Effective execution of any initiative requires a deep understanding of key principles that drive its success. From planning resources to overseeing the allocation of finances, these elements play a crucial role in delivering results within time and budget constraints. Having a clear grasp of these concepts helps individuals navigate the complexities of various challenges while ensuring that all aspects of a venture are aligned towards its goals.

Financial planning is a cornerstone of any endeavor. Whether it’s about determining the resources required, controlling expenditures, or predicting future costs, a comprehensive approach is necessary to ensure efficiency. One must understand how to balance available resources and manage them effectively to avoid disruptions.

Another important aspect is understanding how to measure and track progress throughout a project. This involves continuously assessing how well the allocated resources are being utilized and adjusting strategies when needed. Preparing for assessments that test these skills can be crucial, as it equips individuals to handle real-world challenges with confidence and precision.

Essential Concepts in Project Management

To successfully guide any venture from start to finish, understanding key principles is essential. These principles encompass the careful planning, execution, and monitoring of various tasks to ensure alignment with the overall goals. Achieving success in any complex undertaking requires more than just organizing resources; it involves strategic thinking and the ability to adapt to changing circumstances.

Planning is the first critical element. It involves setting clear objectives, outlining key milestones, and allocating necessary resources. This step is fundamental for ensuring that every task is properly defined and that there is a structured approach to meeting deadlines.

Resource allocation follows closely behind. It involves identifying the right tools, personnel, and materials needed for the initiative. Proper allocation ensures that efforts are maximized, and potential constraints are minimized, helping to avoid costly delays.

Another core concept is risk management. Every undertaking has inherent risks, and identifying, assessing, and mitigating these risks is vital for minimizing potential setbacks. A proactive approach to risk helps safeguard the project from unforeseen challenges.

Finally, performance tracking allows for continuous assessment and adjustment throughout the process. Monitoring progress ensures that objectives are met efficiently, and corrective actions can be taken if necessary, maintaining the focus on achieving the desired outcomes.

Understanding the Role of Budgets

A clear financial plan is essential for ensuring that resources are allocated efficiently throughout the course of any initiative. Proper allocation helps avoid overspending, ensures that priorities are met, and supports decision-making at every stage. Without an effective financial plan, even the most carefully conceived plans can fail due to unforeseen expenses or lack of resources.

One of the primary functions of a financial plan is to establish clear limits on how much can be spent at each phase of a project. This allows for careful control and monitoring of costs, helping to ensure that no area is neglected or underfunded. Through continuous tracking, adjustments can be made to keep things on track.

Additionally, understanding the costs associated with each part of the venture allows for better forecasting and preparation. When financial constraints are well understood, it’s easier to make informed choices about where to invest resources and where to cut back if needed.

Finally, a comprehensive financial plan provides stakeholders with a transparent view of how funds are being used, fostering trust and accountability. This level of visibility is crucial for ensuring that everyone involved is aligned and that potential financial risks are managed effectively.

Key Principles for Managing Projects

Successfully guiding any initiative requires a set of essential principles that help maintain focus and ensure smooth progression towards the intended goals. These principles establish a framework for organizing tasks, optimizing resources, and navigating potential obstacles. By adhering to these guiding factors, teams can maximize efficiency and enhance overall outcomes.

One of the fundamental principles is clear goal setting. Defining specific, measurable, and time-bound objectives is crucial for ensuring that all efforts are aligned and focused on the most important outcomes. Clear goals provide a roadmap for everyone involved and help prioritize tasks effectively.

Effective communication is another core element. Regular updates and transparent information sharing between team members and stakeholders prevent misunderstandings and keep everyone on the same page. Good communication fosters collaboration and ensures that any issues are addressed in a timely manner.

Another important principle is resource optimization. Ensuring that the right tools, skills, and personnel are utilized in the most efficient way possible helps prevent waste and delays. By allocating resources where they are most needed, the likelihood of successful execution is significantly increased.

Finally, monitoring and adaptation play a critical role. Continuously assessing progress allows for adjustments to be made as needed. Whether it’s adjusting timelines, reallocating resources, or reevaluating objectives, staying flexible and responsive ensures that the initiative remains on track despite any challenges that may arise.

How to Approach Project Budgets

Handling finances effectively is a critical component of any venture. A well-thought-out financial plan serves as the foundation for successful execution by ensuring that resources are used wisely and that financial constraints are adhered to. Approaching the financial aspect of a project requires a methodical approach that involves planning, tracking, and adjusting as necessary to stay within allocated limits.

Creating a Financial Plan

The first step is to carefully outline all expected costs. This includes direct expenses such as materials and labor, as well as indirect costs like administrative support and unforeseen contingencies. By forecasting these expenses upfront, you can establish a clear financial framework to guide all subsequent actions.

Monitoring and Adjusting Spending

Once the plan is in place, it’s important to regularly monitor expenditures to ensure they align with the initial estimates. If discrepancies arise, timely adjustments are necessary to keep spending within limits. Regular reviews help to identify potential savings or areas where funds may be overspent.

| Expense Type | Initial Estimate | Actual Spending | Variance |

|---|---|---|---|

| Materials | $5,000 | $4,800 | -$200 |

| Labor | $8,000 | $8,200 | +$200 |

| Contingency | $1,000 | $950 | -$50 |

Through regular updates and revisions, a financial plan can stay flexible and responsive to the evolving needs of the initiative, ensuring a balanced approach to cost control and efficient resource utilization.

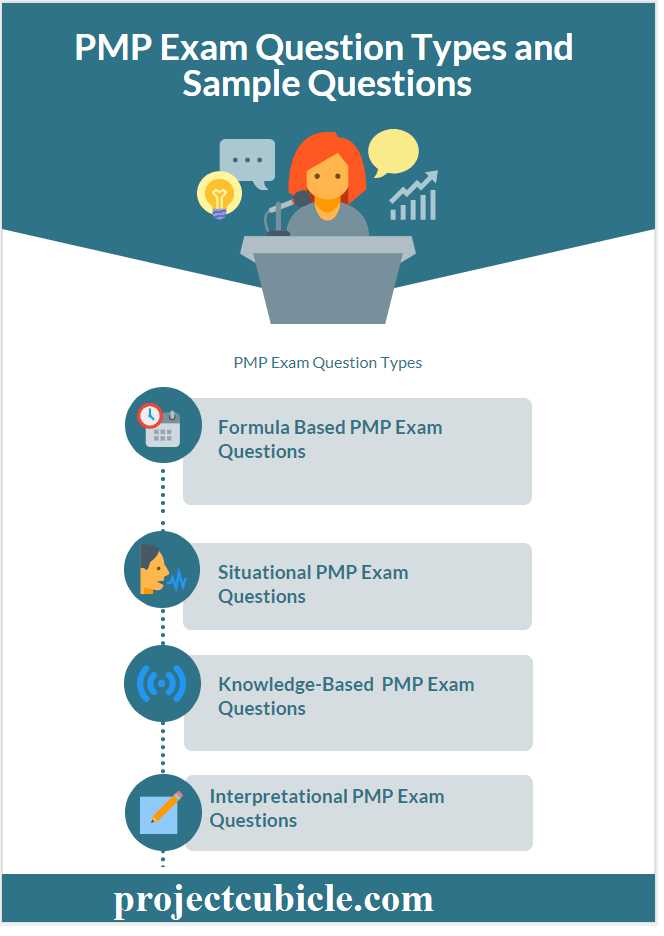

Common Exam Topics in Project Management

When preparing for assessments related to overseeing ventures, it’s important to focus on key concepts that are frequently tested. These topics cover a range of areas that are essential for the successful execution of any initiative. Understanding these subjects thoroughly can help you perform better by showcasing your ability to manage resources, timelines, and unforeseen challenges effectively.

Key Areas of Focus

One of the primary areas typically covered in assessments is resource allocation. This involves the distribution of both human and material resources to ensure tasks are completed on time and within the established parameters. Questions may revolve around how to optimize resource use and avoid waste or shortages.

Another important topic is risk assessment and mitigation. This involves identifying potential risks early and developing strategies to address them before they escalate. Assessments often test how well you can predict risks and implement preventive measures to minimize their impact on the overall process.

Measuring Progress and Performance

Understanding how to track progress and evaluate performance is another critical component. This includes the use of performance indicators and metrics to ensure that the project remains on schedule and meets quality standards. Exam questions often focus on how to interpret data and take corrective actions when necessary.

| Topic | Key Focus | Example Question |

|---|---|---|

| Resource Allocation | Effective use of resources | How do you allocate limited resources efficiently? |

| Risk Management | Identifying and managing risks | What steps can you take to reduce project risks? |

| Progress Tracking | Monitoring project performance | How would you adjust if a task is delayed? |

These topics represent just a few of the core areas you can expect in assessments, and being well-prepared in each of them will help you succeed in demonstrating your skills in overseeing initiatives.

Mastering Budget Estimation Techniques

Accurate estimation of financial needs is one of the most vital skills for ensuring the success of any endeavor. A solid understanding of how to forecast costs enables efficient resource allocation, prevents overspending, and helps maintain a clear financial direction. Mastering various estimation techniques allows you to plan for both predictable and unforeseen expenses effectively.

Common Estimation Methods

There are several widely used techniques for estimating costs, each with its own strengths depending on the project’s complexity and available information. Here are a few of the most common approaches:

- Analogous Estimating: This method involves using historical data from similar projects to predict future costs. It’s quick and often used in the early stages when there is limited information available.

- Parametric Estimating: This technique relies on statistical data and mathematical models to estimate costs based on specific variables, such as cost per unit of output or cost per hour of labor.

- Bottom-Up Estimating: In this approach, individual components of the project are broken down, and costs for each segment are estimated in detail. These are then aggregated to form the overall budget.

- Three-Point Estimating: This method considers three different scenarios–optimistic, pessimistic, and most likely–to provide a range of estimates. It helps account for uncertainty and variations in costs.

Improving Accuracy in Estimations

To enhance the accuracy of your estimates, consider the following strategies:

- Gather Detailed Information: The more information you have about each aspect of the venture, the more precise your estimates will be. Incomplete or vague data often leads to unrealistic financial projections.

- Factor in Contingencies: Always include a margin for unexpected costs. It’s essential to anticipate potential risks that could lead to higher expenses, such as changes in scope or unforeseen delays.

- Review and Update Regularly: Estimations should not be static. Revisit your financial forecasts as the project progresses and as new information becomes available.

By mastering these techniques and consistently applying them, you can greatly improve your ability to accurately forecast and control the financial aspects of any initiative.

Top Strategies for Project Cost Control

Effectively controlling expenses is crucial to ensuring that an initiative stays within financial constraints and achieves its goals. Cost control involves implementing practices that prevent overspending, optimize resource use, and allow for adjustments when unexpected costs arise. Adopting key strategies helps ensure financial efficiency and contributes to the overall success of the endeavor.

Proactive Planning and Monitoring

One of the most effective ways to control costs is by establishing a detailed financial plan from the outset. This plan should account for all anticipated expenses, both direct and indirect. Proactive planning includes identifying potential risks and setting aside contingency funds to address any unforeseen challenges that may emerge.

Regular monitoring is equally important. Continuously tracking expenses and comparing them to the forecasted amounts allows for early identification of discrepancies. If costs are rising faster than expected, corrective measures can be taken immediately to prevent overspending.

Efficient Resource Allocation

Maximizing the value of available resources is another key strategy for controlling costs. Ensure that the right resources are allocated to the right tasks, and avoid inefficiencies such as underutilizing personnel or over-committing to unnecessary services or materials. By optimizing how resources are distributed, the overall financial burden can be significantly reduced.

Additionally, fostering a culture of cost-consciousness among team members helps ensure that everyone is focused on delivering value without waste. This collective awareness often leads to innovative solutions for keeping expenses in check.

Importance of Time Management in Projects

Effectively allocating time is one of the most vital components for ensuring the success of any initiative. Time constraints can often be the deciding factor between the success and failure of a task, and the ability to manage it efficiently is crucial. Proper time management allows for better resource utilization, ensures deadlines are met, and helps mitigate risks associated with delays.

Key Benefits of Time Management

Properly managing time can have several positive impacts on an undertaking:

- Increased Productivity: Effective time management enables teams to focus on essential tasks without distractions, leading to higher overall output.

- Reduced Stress: By planning ahead and allocating sufficient time for each task, pressure is minimized, and the likelihood of last-minute rushes is reduced.

- Improved Quality: Time management allows for more thoughtful work and provides the opportunity for reviewing and refining tasks, which leads to better outcomes.

Strategies for Effective Time Management

There are several techniques that can help individuals and teams stay on track and meet deadlines:

- Prioritizing Tasks: Assess the importance and urgency of each task and allocate time accordingly. Focus on high-priority items that contribute most to the overall objective.

- Setting Realistic Deadlines: Ensure that deadlines are achievable based on available resources. Overly ambitious timelines can lead to burnout and subpar results.

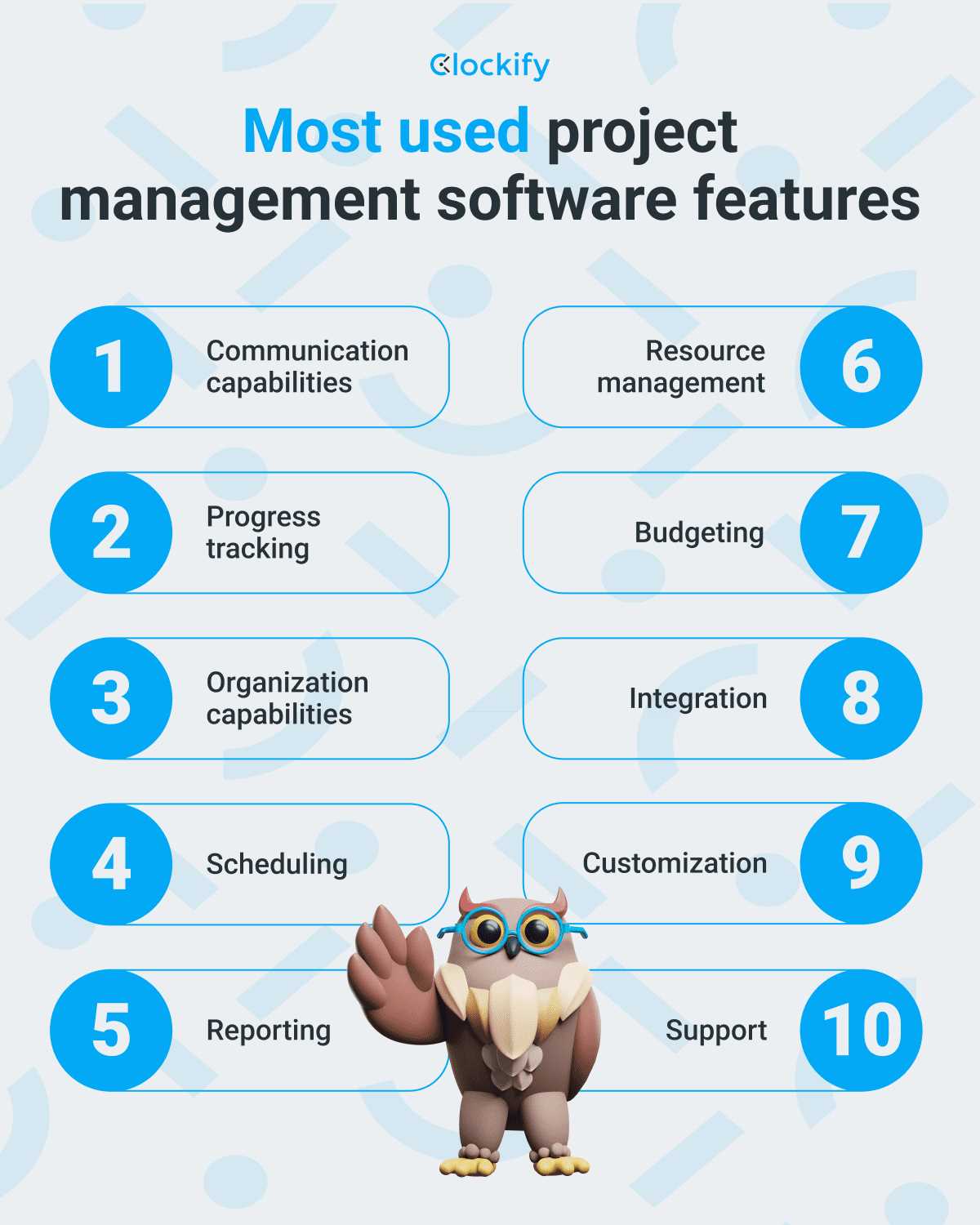

- Utilizing Time-Tracking Tools: Leverage tools that help track time spent on tasks and monitor progress in real-time. These tools can provide valuable insights into efficiency and help adjust plans when necessary.

By mastering these time management strategies, teams can stay focused, avoid delays, and consistently meet goals within the desired timeframe.

How to Organize Project Deliverables

Effective organization of outcomes is essential for ensuring a smooth workflow and achieving the desired objectives. Clear planning and structure allow all stakeholders to understand the expected results, maintain focus, and track progress efficiently. Properly organizing deliverables minimizes confusion, ensures deadlines are met, and helps with resource allocation.

Key Steps for Organizing Deliverables

To efficiently organize expected results, follow these important steps:

- Define Clear Milestones: Break down the overall goal into smaller, manageable chunks. Clearly defined milestones make it easier to track progress and ensure that each part of the task is on schedule.

- Assign Responsibilities: Clearly delegate tasks to team members based on their expertise and availability. Each person should know exactly what is expected of them to prevent overlap or gaps in work.

- Set Realistic Deadlines: Establish achievable timelines for each deliverable. Consider the complexity of each task and the resources available to avoid setting unrealistic expectations.

Tools for Streamlining Deliverable Organization

There are various tools and techniques available to streamline the organization of outcomes:

- Project Management Software: Use tools like task management applications to create, assign, and track deliverables. These platforms often include timelines, communication channels, and progress tracking features.

- Document Templates: Create standardized templates for tracking deliverables. This ensures consistency and makes it easier to manage multiple tasks at once.

By adhering to these strategies, you can ensure that all outcomes are well-organized, tracked efficiently, and completed on time.

Common Pitfalls in Budget Planning

Effective financial planning is crucial for the success of any initiative. However, it is easy to fall into common traps that can lead to overspending or financial shortfalls. By recognizing these pitfalls in advance, you can avoid costly mistakes and ensure that resources are used efficiently throughout the process.

Frequent Mistakes in Financial Planning

Several key mistakes are often made during the planning phase that can negatively impact the financial outcome:

- Underestimating Costs: One of the most common mistakes is failing to accurately estimate the full scope of expenses. This can lead to unexpected costs that strain available resources.

- Neglecting Contingency Planning: Not setting aside funds for unexpected situations is a significant risk. Without a financial cushion, even minor setbacks can result in larger budget issues.

- Overlooking Hidden Expenses: Many plans fail to account for indirect costs or unforeseen fees, such as taxes, shipping, or unforeseen legal requirements. These can quickly add up and create financial strain.

Strategies to Avoid Financial Pitfalls

To steer clear of these common errors, consider these strategies:

- Conduct Thorough Research: Ensure you have all the information needed to estimate costs accurately. Include input from experts and review historical data to make well-informed projections.

- Include a Buffer: Set aside additional funds for unexpected challenges. A contingency fund is essential for covering unforeseen expenses without derailing the plan.

- Review Regularly: Monitor expenses frequently and adjust the plan as needed. Early detection of discrepancies allows for timely interventions to keep finances on track.

By being mindful of these common mistakes and implementing effective strategies, you can create a financial plan that supports the long-term success of the initiative while minimizing the risk of unexpected financial challenges.

Using Tools for Budget Management

Efficient financial tracking and control are essential to ensuring that resources are allocated wisely and that costs stay within expected limits. With the right tools, individuals and teams can streamline processes, gain real-time insights, and improve decision-making. These tools help in tracking expenses, forecasting future costs, and making adjustments when necessary, ensuring financial health throughout the process.

Many digital platforms and tools are available to assist with financial oversight. These tools range from basic spreadsheets to advanced software solutions that offer detailed tracking, reporting, and analysis features. By utilizing such tools, it becomes easier to manage finances, reduce errors, and improve overall efficiency.

Some popular categories of tools for financial oversight include:

- Spreadsheets: Basic yet highly effective, spreadsheets allow for easy customization and the ability to create detailed financial records and projections. They are ideal for smaller-scale tracking and budgeting.

- Cloud-Based Software: These tools offer real-time collaboration, cloud storage, and integration with other platforms. They are suitable for larger initiatives and teams that require seamless communication and up-to-date financial data.

- Specialized Financial Platforms: Dedicated software designed specifically for financial planning offers advanced features such as forecasting, scenario analysis, and detailed reporting. These platforms are often used by larger organizations to track and optimize expenses on a granular level.

By selecting the right tools based on needs and scale, it’s possible to greatly enhance control over finances, identify discrepancies early, and ensure that all resources are used effectively.

Risk Management in Project Budgets

Financial plans are never immune to uncertainties and potential setbacks. Recognizing and mitigating risks before they affect the bottom line is essential for maintaining financial control. Identifying possible challenges early on, assessing their impact, and preparing appropriate responses can help minimize financial disruptions and keep resources on track.

Risk management involves a systematic approach to identifying, evaluating, and addressing potential threats that could negatively influence financial plans. This process allows for the creation of strategies to either reduce the likelihood of these risks or limit their impact should they occur. By anticipating issues, teams can proactively put measures in place to safeguard the overall financial health of an initiative.

Key strategies for managing risks in financial planning include:

- Risk Identification: The first step in managing risks is to identify potential threats, including external factors such as market volatility or internal factors like resource misallocation. Early identification helps in prioritizing actions to mitigate these risks.

- Risk Assessment: Once risks are identified, it’s crucial to assess their potential impact on the financial plan. This involves estimating the likelihood of the risk occurring and the severity of its impact on available resources.

- Contingency Planning: Preparing for unexpected events by setting aside funds or creating backup plans ensures that the initiative can continue even if risks materialize. A well-defined contingency plan can help cushion the financial impact of unforeseen issues.

- Continuous Monitoring: Financial risks are not static, so continuous monitoring of key metrics and external factors is necessary to detect any emerging threats. Regularly reviewing the financial status allows for quick adjustments to keep things on track.

By incorporating these strategies, organizations can enhance their ability to predict and address financial challenges, ensuring a more resilient and sustainable approach to resource allocation and financial planning.

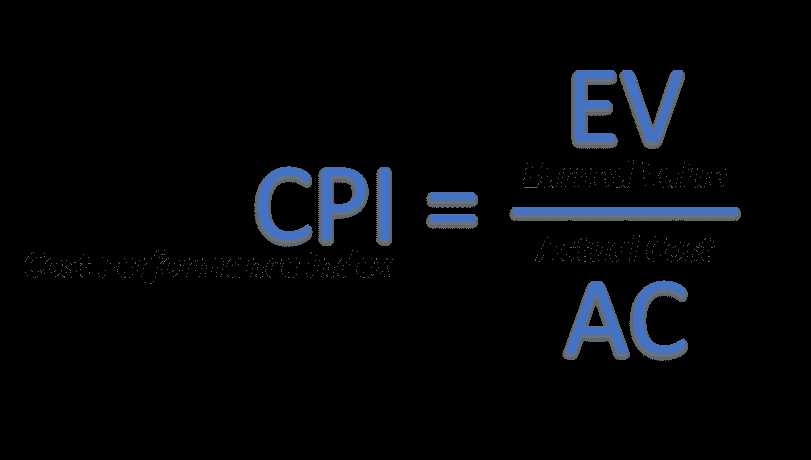

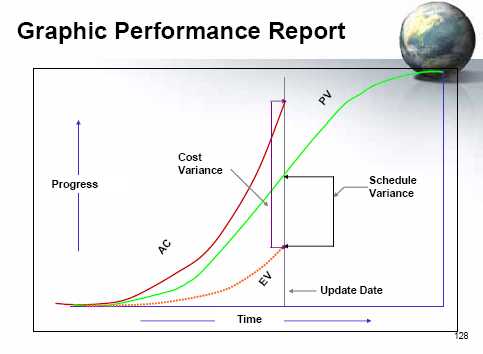

Evaluating Project Performance Metrics

Assessing the effectiveness of any initiative requires a clear understanding of how well resources are being utilized and whether objectives are being met within the planned constraints. By tracking specific performance indicators, it becomes possible to measure progress, identify areas needing improvement, and make data-driven decisions to ensure the initiative stays on course. Regular evaluation helps ensure that goals are achieved efficiently and within scope.

Performance metrics provide tangible benchmarks that reflect the health and trajectory of an initiative. These metrics serve as a tool for evaluating not just progress but also the efficiency of processes and the allocation of resources. By examining these indicators, stakeholders can gain valuable insights into both strengths and weaknesses, allowing for timely adjustments and optimizations.

Some essential performance metrics include:

- Cost Efficiency: This metric evaluates how well the available financial resources are being spent compared to initial estimates. It helps in identifying cost overruns or areas where funds may be underutilized.

- Time Adherence: Time performance measures how closely actual timelines align with the original schedule. Delays or early completions are important signals that can help assess overall performance.

- Quality of Deliverables: This metric measures how closely the final output matches the required quality standards. It includes assessing the functionality, usability, and compliance of the work completed.

- Resource Utilization: This metric looks at how effectively resources–whether human, financial, or technological–are being allocated and utilized throughout the process. Over or underuse of resources can signal areas of inefficiency.

By regularly reviewing these performance metrics, it becomes easier to identify trends, address challenges early, and improve overall results. Continuous performance evaluation helps keep initiatives on track, ensuring that all objectives are met effectively and efficiently.

How to Prepare for Project Management Exams

Preparing for any certification or evaluation requires a methodical approach to mastering essential concepts and applying them effectively under timed conditions. It’s important to focus not only on understanding the theory but also on practicing with real-world scenarios to enhance problem-solving abilities. By breaking down key areas of knowledge and regularly testing yourself, you can improve both your confidence and performance.

Key Areas to Focus On

Focus your preparation on the most critical elements of the subject. This includes understanding processes, frameworks, and essential tools that drive successful outcomes. Key areas often include:

- Resource Allocation: Understanding how to distribute available assets efficiently is vital for ensuring success in any initiative.

- Timeline Management: Learn how to create and adjust schedules, accounting for potential risks and delays.

- Risk Identification: Being able to identify, assess, and mitigate potential risks ensures smoother execution and fewer unexpected setbacks.

- Performance Metrics: Familiarize yourself with the various metrics used to assess progress and success.

Effective Study Strategies

Using a combination of study techniques can enhance retention and comprehension. Some effective methods include:

- Practice Tests: Regularly take practice tests to familiarize yourself with the types of questions and improve your ability to recall information under pressure.

- Flashcards: Create flashcards for key terms, definitions, and formulas that you can easily review in short sessions.

- Study Groups: Joining a study group allows you to share insights and learn from others’ perspectives on complex topics.

- Simulate Real Scenarios: Work through case studies or hypothetical scenarios to develop your ability to apply theoretical knowledge to practical situations.

With these preparation strategies, you’ll be well-equipped to face any evaluation and demonstrate your proficiency in the subject matter. Consistent practice, focused study, and proper time management are the key components of successful preparation.

Budget Allocation Best Practices

Effective distribution of resources is a critical aspect of ensuring any endeavor’s success. Proper allocation involves prioritizing expenses, ensuring efficiency, and aligning financial decisions with overarching goals. The process demands foresight, precision, and an understanding of potential risks and opportunities. By adhering to best practices, you can avoid common pitfalls and ensure that funds are used in the most impactful way possible.

Prioritizing Critical Areas

When allocating resources, focus on areas that will have the most significant impact on success. Prioritize critical tasks and essential components, ensuring that the most valuable activities receive adequate funding. For example:

- Core Operations: Allocate a significant portion to areas directly linked to the initiative’s core objectives.

- Contingencies: Always allocate funds for unforeseen issues to mitigate risks effectively.

- Technology and Tools: Ensure that the necessary tools and technologies are adequately funded to support efficiency and innovation.

Monitoring and Adjusting Allocations

Budget distribution should not be static. It’s essential to continuously monitor spending and adjust allocations based on evolving needs or challenges. Regularly assessing the performance of allocated funds ensures that they continue to align with objectives. Consider these strategies:

- Track Spending: Implement a system to regularly track and evaluate expenditure.

- Review and Adapt: Make adjustments to allocations based on performance reviews and changing circumstances.

- Feedback Loops: Gather input from team members to understand the effectiveness of resource distribution.

By following these best practices, you can make informed decisions that maximize resource use and contribute to overall success. Consistent review, strategic prioritization, and flexibility are key to ensuring the best outcomes in any initiative.

Key Takeaways for Successful Project Budgeting

Mastering the financial aspect of any initiative requires a strategic approach to resource allocation, continuous monitoring, and a solid understanding of financial principles. Successful planning is not just about creating a plan, but also about being adaptable to changes, managing risks, and making informed decisions. The following insights offer a roadmap for navigating the financial complexities of any venture.

- Accurate Forecasting: A reliable estimate of costs is crucial to avoid unexpected shortfalls. Understand every aspect of the work involved and consider hidden costs that may arise along the way.

- Prioritize Financial Flexibility: The ability to adjust allocations as needed is key. Always allow room for unforeseen circumstances that could alter the course of the plan.

- Regular Monitoring: Continuous tracking of expenditures ensures that the financial resources are being used effectively and that any deviations from the plan are detected early.

- Risk Mitigation: Set aside contingency funds for managing unforeseen events. This helps ensure that the initiative can continue without financial disruption, even when unexpected challenges arise.

- Transparent Communication: Clear communication with stakeholders about financial status and adjustments helps keep everyone aligned and supports better decision-making throughout the process.

By focusing on these core principles, you can create a financial plan that supports the initiative’s goals while minimizing risks and maximizing efficiency. A disciplined, yet flexible approach to handling financial resources leads to more successful outcomes and helps avoid common financial pitfalls.