Preparing for competitive assessments requires more than just an understanding of core subjects. A solid grasp of various topics, including current events and key concepts, plays a critical role in achieving success. Mastering this broad range of material can significantly boost performance and enhance your chances of excelling in a variety of tests.

It’s essential to focus not only on theoretical knowledge but also on practical application. The ability to recall facts quickly and accurately, along with being aware of recent developments, is invaluable. By dedicating time to practice and review, you can sharpen your skills and improve your efficiency during the evaluation process.

Success in these assessments depends on your preparedness and confidence. While specific subjects are important, it’s the ability to think critically and adapt to different formats that truly sets top performers apart. Stay focused, stay informed, and keep refining your techniques to achieve the best possible outcome.

Banking Exam General Knowledge Questions with Answers

When preparing for competitive assessments in the finance sector, it is crucial to have a solid foundation in a wide range of topics. This includes understanding concepts related to economics, current affairs, and key policies that affect the financial industry. A well-rounded approach helps you stay sharp and confident while tackling diverse challenges during the evaluation process.

Essential Areas to Focus On

Key subject areas often tested include monetary policy, international trade, and financial institutions. Being aware of global trends and government regulations is equally important. These topics are typically covered in various formats, from multiple-choice items to case studies, demanding both recall and analytical skills. By regularly practicing, you ensure a strong grasp of these critical areas, enabling you to respond quickly and accurately when needed.

Improving Your Performance

Regularly reviewing material and practicing sample scenarios can significantly improve your ability to handle complex queries. Creating a study plan that covers all important topics while focusing on areas where you feel less confident can provide a more balanced approach. Don’t forget to pay attention to recent news and developments, as they often form the basis of several questions. Consistency and preparation are the keys to performing at your best during any evaluation.

Understanding Key Concepts in Banking

To succeed in assessments related to financial systems, it is essential to grasp several fundamental principles. These concepts form the basis of many questions and help develop a deeper understanding of how financial institutions and markets operate. Mastering these areas will enhance your ability to answer complex problems and analyze real-world scenarios efficiently.

Core Areas of Focus

Several important areas should be covered when studying for financial assessments. These include:

- Monetary Systems: Understanding the role of currency, central banks, and monetary policy.

- Financial Instruments: Familiarity with various assets such as stocks, bonds, and derivatives.

- Economic Indicators: Knowledge of GDP, inflation rates, and unemployment statistics.

- Market Structures: Grasping how different markets like equities, commodities, and forex operate.

- Financial Regulations: Awareness of key laws and regulations that govern financial institutions.

Key Terms to Master

Being familiar with critical terms can help in both understanding concepts and answering questions accurately. Some of the most important terms include:

- Liquidity

- Capital Markets

- Risk Management

- Asset Allocation

- Credit Ratings

By thoroughly studying these concepts, you will build a strong foundation that will not only help in assessments but also in understanding the broader financial landscape.

Importance of General Knowledge for Exams

Being well-versed in a wide range of subjects plays a crucial role in preparing for competitive assessments. A comprehensive understanding of current events, important policies, and industry-specific details can significantly boost your chances of success. The ability to recall relevant facts quickly and apply them effectively can make a substantial difference during the testing process.

General awareness is not just about memorizing facts; it’s about staying informed and understanding the context in which those facts apply. This helps not only in answering direct questions but also in analyzing complex situations that may arise during assessments. In many cases, such knowledge is essential for solving problems and making decisions that demonstrate a deeper understanding of the field.

| Area | Importance |

|---|---|

| Current Affairs | Helps in answering questions related to global trends and news. |

| Economic Policies | Provides insight into how governments manage economies and influence markets. |

| Regulatory Frameworks | Understanding the rules that govern industries ensures accurate responses. |

| Financial History | Knowledge of past events can offer context for present-day developments. |

| Technological Advancements | Awareness of innovations helps in answering questions related to modern industry changes. |

By expanding your awareness and staying updated on diverse topics, you are better equipped to handle the wide variety of subjects that may arise during an assessment. This proactive approach ultimately strengthens your performance and prepares you for success.

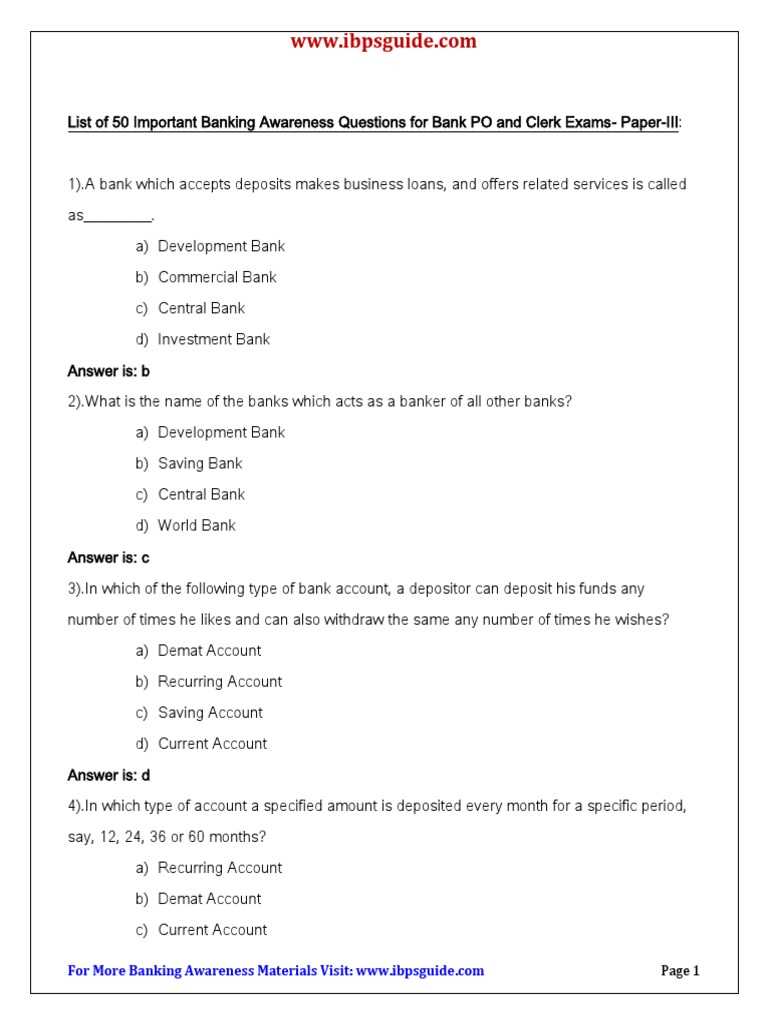

Top 10 Banking GK Questions

When preparing for assessments in the financial sector, it’s essential to focus on the most relevant and frequently tested topics. Understanding key concepts and practicing common scenarios can help you perform confidently. Below are some of the most commonly asked topics, which will provide a strong foundation for your preparation.

Most Frequently Asked Topics

Here are some examples of widely tested subjects that often appear in evaluations:

- Central Banking Role: What are the primary responsibilities of central banks in regulating national economies?

- Interest Rates: How do changes in interest rates affect inflation and growth?

- Fiscal vs. Monetary Policy: How do these policies differ in their impact on financial markets?

- Capital Markets: What are the different types of securities traded in the capital markets?

- Global Financial Institutions: Which organizations regulate international monetary policies?

- Financial Crisis History: What were the causes and effects of major financial crises in recent decades?

- Currency Exchange: How do fluctuations in exchange rates impact trade and investments?

- Inflation Measurement: What are the key indicators used to measure inflation rates?

- International Trade Agreements: How do global trade agreements impact the financial system?

- Digital Currencies: What are the potential effects of digital currencies on traditional financial systems?

Preparing for Success

Familiarizing yourself with these topics will provide a well-rounded understanding of the core issues. To excel, ensure that you review and practice these subjects regularly. This knowledge will help you approach any topic confidently and answer even the most complex queries with ease.

Types of Banking Exams and Their Structure

There are various assessments designed to evaluate individuals’ understanding of finance, economics, and related fields. These tests differ in their structure, focus, and complexity depending on the role or position being applied for. Understanding the format of these evaluations is essential for preparing effectively and ensuring success during the process.

Common Types of Assessments

Different types of evaluations serve different purposes in the financial sector. Below are some of the common formats you may encounter:

- Recruitment Tests: Typically used for hiring in financial institutions, these assessments evaluate a candidate’s general aptitude, logical reasoning, and sector-specific knowledge.

- Promotion Evaluations: Conducted for current employees, these tests often focus on advanced concepts and practical knowledge relevant to higher-level positions.

- Specialized Skill Assessments: These are designed to evaluate proficiency in a specific area, such as financial analysis, risk management, or investment strategies.

- Certification Exams: Certain certifications require passing exams that demonstrate in-depth expertise in specific financial fields.

Structure of the Tests

Most evaluations share a common structure that typically includes multiple sections aimed at assessing different skills:

- Aptitude Section: Designed to test logical reasoning, mathematical ability, and problem-solving skills.

- Sector-Specific Questions: These test the candidate’s understanding of finance, monetary systems, and related topics.

- Case Studies and Situational Analysis: Used to evaluate decision-making and practical application of theoretical knowledge in real-world scenarios.

- Personal Interviews: A final stage to assess communication skills, professional demeanor, and deeper understanding of the sector.

By familiarizing yourself with these different types and structures, you can tailor your preparation to excel in each aspect of the process.

Tips for Effective Exam Preparation

Preparing for any kind of assessment requires careful planning, dedication, and a strategic approach. The key to success lies in organizing your study routine, staying consistent, and focusing on the right areas. By following a structured plan, you can improve your chances of performing well and tackling even the most challenging topics with confidence.

Essential Preparation Strategies

Below are some proven methods to help you prepare more effectively for your upcoming assessment:

- Create a Study Schedule: Plan your study time wisely, allocating more time to difficult topics while revisiting familiar ones to maintain confidence.

- Practice Regularly: Consistent practice helps solidify concepts and improves recall during assessments.

- Focus on Weak Areas: Identify topics that are challenging and devote extra time to mastering them.

- Simulate Real Conditions: Practice solving problems under timed conditions to prepare yourself for the actual test environment.

Effective Revision Techniques

Incorporating these revision methods will ensure that you retain key information and remain sharp:

| Method | Description |

|---|---|

| Active Recall | Review material by testing yourself instead of passively reading notes. |

| Spaced Repetition | Break your revision into smaller, spaced sessions to improve long-term retention. |

| Mind Mapping | Visualize concepts and their relationships to aid memory and understanding. |

| Group Study | Collaborate with peers to discuss complex topics and gain new insights. |

By applying these strategies, you will build the confidence needed to face any challenge and maximize your potential for success.

Common Mistakes to Avoid in Banking Exams

During assessments, candidates often make certain errors that can negatively impact their performance. These mistakes are usually preventable with careful preparation, focus, and awareness. Understanding these common pitfalls and knowing how to avoid them can significantly enhance your chances of success.

One of the most frequent errors is not managing time effectively. Many candidates spend too much time on difficult questions and fail to complete the test within the allotted time. Another common mistake is neglecting to review instructions carefully, which can lead to misinterpretation of the questions and inaccurate answers.

Furthermore, rushing through the material without understanding the concepts can be detrimental. It’s important to focus on comprehending the key ideas rather than merely memorizing facts. Relying solely on rote learning often leads to confusion, especially when faced with unfamiliar scenarios during the assessment.

Another critical mistake is neglecting to practice under real test conditions. Simulating actual testing scenarios allows you to become accustomed to the pressure and time constraints, which are often quite different from casual study sessions. Regular practice will help you build the speed and accuracy needed to perform well.

By recognizing these common mistakes and preparing accordingly, you can approach the assessment confidently and avoid unnecessary setbacks.

How to Improve Your GK Skills

Enhancing your awareness of current events, financial systems, and key concepts in your field requires continuous learning and practice. Strengthening your understanding and retaining essential information will allow you to tackle any challenge with confidence. Below are some effective strategies to improve your skills.

Effective Strategies for Improvement

- Read Daily News: Stay updated on current events and global affairs, especially those that impact the financial world.

- Study Regularly: Consistency is key. Set aside time each day to read relevant materials and revise important concepts.

- Use Flashcards: Create flashcards with key terms and their definitions to improve memory retention.

- Join Study Groups: Collaborating with peers can help you gain new perspectives and clarify doubts.

- Take Practice Tests: Simulate real-world conditions by taking practice tests, which will improve both speed and accuracy.

Additional Techniques for Success

- Watch Documentaries and Webinars: Engaging with expert discussions will help you better understand complex topics.

- Follow Experts and Analysts: Keep track of insights and opinions from professionals in your area of interest.

- Stay Organized: Create summaries or mind maps to connect various ideas and concepts for easier recall.

By integrating these methods into your study routine, you will steadily improve your understanding and be better prepared for any challenge that comes your way.

Best Resources for Banking GK Practice

Improving your understanding of financial concepts and staying informed about current events is crucial for performing well in any assessment. Utilizing the right resources can make a significant difference in how efficiently you grasp essential topics. Below are some top resources that will help you practice and enhance your skills.

Top Practice Materials

- Online Mock Tests: Platforms offering simulated tests allow you to practice under timed conditions, helping you get used to the pressure of real assessments.

- Books and Study Guides: There are many well-structured books available that focus on the fundamentals, providing both theory and practice exercises.

- Mobile Apps: Various apps are designed for on-the-go learning, offering quizzes and daily challenges that help improve recall and understanding.

- Government Websites: Official government portals and financial institutions often provide practice material based on real-life scenarios.

- Online Forums and Discussion Groups: Engaging in discussions with peers or experts in online forums can help clarify doubts and gain different perspectives on challenging topics.

Additional Learning Tools

- YouTube Channels: Educational channels provide video tutorials, expert discussions, and walkthroughs on complex topics, offering a more visual way to understand the material.

- Podcasts and Webinars: Listening to professionals and industry experts discuss key concepts helps you stay up-to-date and deepen your understanding.

- Flashcards: Digital or physical flashcards are a great tool for memorizing important terms, definitions, and concepts.

By regularly utilizing these resources, you can strengthen your understanding, improve your skills, and enhance your performance in any related assessment.

Understanding Banking Terms and Definitions

Mastering the terminology used in the financial sector is crucial for anyone looking to gain a deeper understanding of the field. Being familiar with key terms and their meanings enables you to communicate effectively and make informed decisions. Whether you’re preparing for a professional evaluation or simply enhancing your knowledge, knowing the definitions of fundamental concepts is essential.

Key Terms You Should Know

- Interest Rate: The percentage at which interest is charged or paid on a loan or deposit.

- Assets: Resources owned by an institution or individual that are expected to bring future economic benefits.

- Liabilities: Financial obligations or debts that a company or individual is responsible for paying.

- Credit Score: A numerical representation of a person’s creditworthiness, often used by lenders to assess risk.

- Equity: The value of ownership interest in a firm, calculated by subtracting liabilities from assets.

How to Master Financial Terminology

- Consistent Revision: Make reviewing key terms a regular part of your study routine to improve recall and understanding.

- Use Real-World Examples: Relate the terms to real-life scenarios or news events to see how they apply in practice.

- Stay Updated: The financial sector is constantly evolving, so it’s important to keep learning about new terms and concepts.

- Practice Using Terms: Incorporate the terms into your daily conversations or writing to solidify your understanding.

By familiarizing yourself with these critical terms and regularly revising them, you can build a solid foundation for a deeper understanding of financial concepts and improve your overall expertise in the field.

Role of Current Affairs in Banking Exams

Staying informed about current events is essential for anyone involved in the financial sector, as it shapes the broader landscape of economic decisions. Awareness of ongoing developments not only keeps individuals up to date but also enhances their decision-making abilities. In assessments related to the field, questions related to recent events and their impact are often included to test the candidate’s awareness and ability to think critically about real-world issues.

Importance of Following Current Developments

- Economic Impact: Global events like market crashes, political decisions, and technological advancements can significantly affect financial systems.

- Policy Changes: Understanding the latest policies introduced by governments or central banks is vital for interpreting their implications on financial institutions.

- Trends and Innovations: Staying updated on emerging trends, such as digital currencies or financial regulations, is crucial for staying competitive in the industry.

How Current Affairs Influence Assessments

Many evaluations include questions based on recent news, economic shifts, or significant changes within the financial world. To prepare effectively, it is crucial to follow:

| Source | Type of Information |

|---|---|

| News Websites | Updates on major financial events and developments |

| Government Publications | New policies, reports, and economic strategies |

| Financial Magazines | Analysis of market trends and expert opinions |

| Webinars and Conferences | In-depth discussions on sector-specific changes |

By integrating current events into your study routine and understanding their implications, you will improve your readiness for any related assessment and gain a deeper understanding of the financial environment.

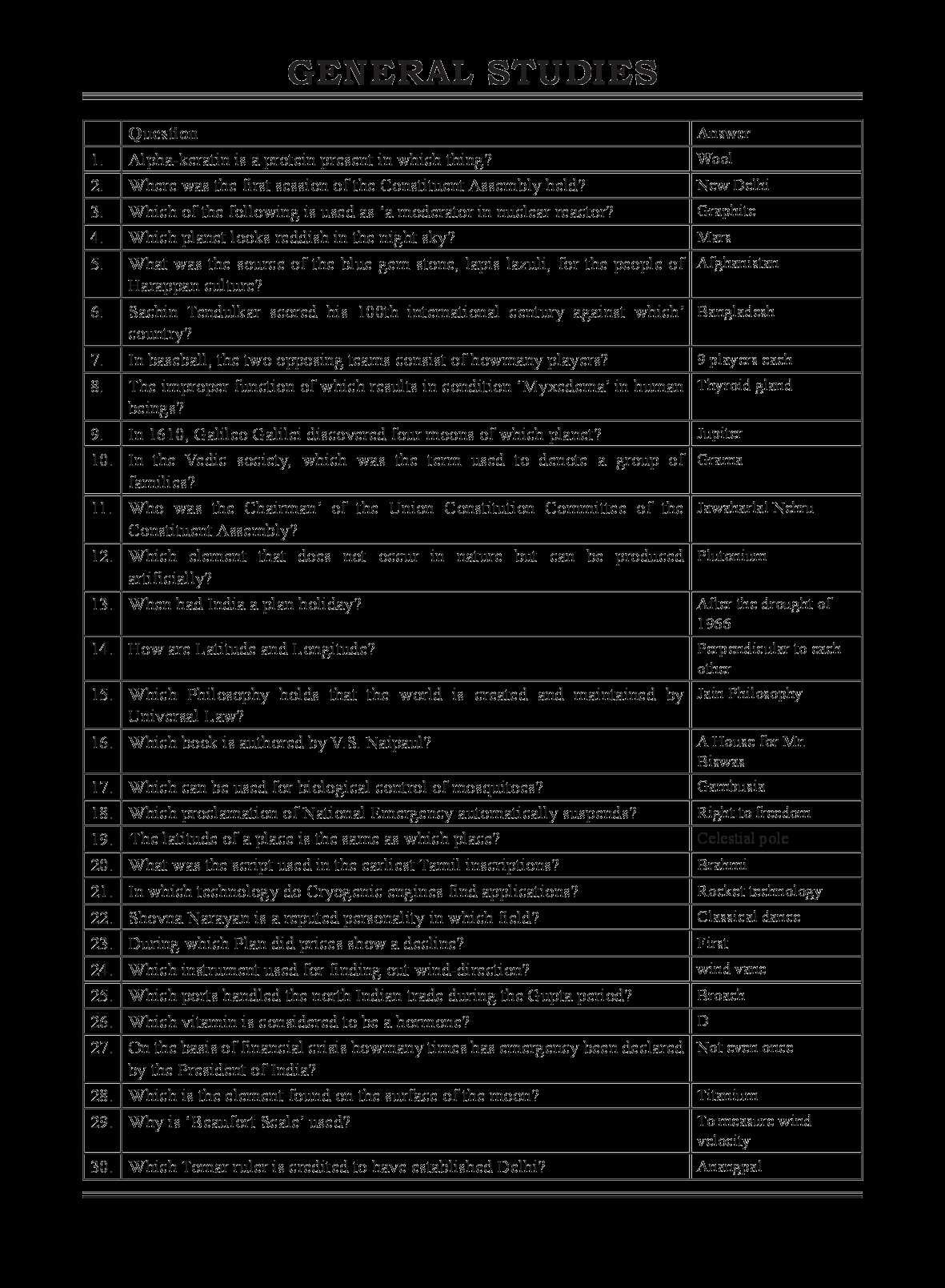

Popular GK Topics in Banking Exams

To succeed in assessments focused on the financial sector, it is essential to familiarize yourself with a range of topics that frequently appear. These areas are critical for understanding how the economy operates, how institutions function, and how global events impact financial systems. Whether you’re aiming to enhance your preparation or simply want to stay informed, knowing the most common subjects can help you focus your study efforts effectively.

Several key subjects often emerge as important in tests related to the field, reflecting the current dynamics of the financial world and the need for candidates to stay updated on various topics.

| Topic | Description |

|---|---|

| Economic Policies | Government decisions that influence market operations, inflation rates, and currency stability. |

| Financial Markets | Understanding how stock, bond, and commodities markets work, along with key market trends. |

| International Trade | Trade agreements, tariffs, and their impact on global financial flows and national economies. |

| Banking Institutions | Roles of central banks, commercial banks, and financial regulators in shaping financial systems. |

| Technological Advancements | The role of innovations like blockchain, cryptocurrencies, and digital banking in transforming the industry. |

| Legal and Regulatory Frameworks | Key laws and regulations that govern financial activities, including anti-money laundering measures and capital requirements. |

By dedicating time to mastering these important subjects, you will not only improve your readiness for related assessments but also develop a deeper understanding of the evolving financial landscape.

Analyzing Previous Year’s Exam Questions

Reviewing past assessments can provide invaluable insights into the format, structure, and types of topics that are likely to appear in upcoming evaluations. By examining previous years’ papers, candidates can identify recurring patterns, common themes, and the level of difficulty expected. This practice not only improves familiarity with the test format but also helps in creating a focused study plan.

Focusing on previously asked topics allows for a targeted approach to learning, ensuring that you are well-prepared for the content most likely to appear. This method of preparation can help pinpoint areas that need further attention and increase overall confidence.

Key Benefits of Analyzing Past Assessments:

- Identify Trends: Spot recurring themes and types of questions to focus your preparation on.

- Improve Time Management: Practice under real-time conditions to improve speed and accuracy during the actual test.

- Understand Question Formats: Gain familiarity with the wording and structure of questions, which can help reduce confusion during the test.

- Evaluate Difficulty Level: Assess the complexity of past questions to gauge your own level of readiness.

Incorporating this strategy into your study routine ensures a more strategic and efficient approach, ultimately leading to improved performance on test day.

Commonly Asked Banking GK Questions

In various assessments related to the financial sector, certain topics are frequently highlighted, and certain queries are often asked. These questions typically cover a wide range of areas, from financial institutions and their functioning to national and global economic concepts. Understanding these subjects and being well-prepared for them can significantly enhance performance in any evaluation process.

Here are some commonly addressed themes and topics you might encounter:

- Financial Institutions: Understanding the roles and structures of various financial entities such as banks, credit unions, and insurance companies.

- Economic Indicators: Questions related to inflation rates, GDP, interest rates, and their effects on the economy.

- Currency and Monetary Policy: Knowledge about different currencies, central banking systems, and monetary regulations.

- Financial Products: Familiarity with different types of loans, investment products, and savings instruments.

- Global Financial Markets: Key knowledge about the stock market, forex, commodities, and related concepts.

- National Financial Policies: Questions on government fiscal policies, budgetary concepts, and public debt management.

To ensure thorough preparation, it is advisable to stay updated on current financial trends and developments. This knowledge will not only help you answer specific questions but also provide a better understanding of the broader financial landscape.

Strategies for Quick Recall During Exams

During a high-pressure assessment, being able to recall information quickly and accurately is crucial for success. Developing effective strategies for mental clarity and quick retrieval of facts can make a significant difference in performance. With the right techniques, it’s possible to organize your thoughts and recollections, helping you answer confidently and efficiently.

Here are some effective techniques for improving recall during an assessment:

- Active Review: Regularly test yourself on the material you’ve studied. This helps reinforce concepts and boosts memory retention.

- Mnemonic Devices: Use acronyms, rhymes, or visualization techniques to associate complex information with something easier to remember.

- Mind Mapping: Create diagrams or flowcharts to visually organize information, making it easier to recall during the test.

- Chunking: Break down larger sets of information into smaller, more manageable chunks to make it easier to memorize.

- Practice Under Pressure: Simulate the test environment by practicing questions under timed conditions to get used to working within a time limit.

- Stay Calm and Focused: Anxiety can cloud memory. Practicing relaxation techniques like deep breathing or visualization can help maintain focus and clarity during the assessment.

By incorporating these strategies into your preparation, you can enhance your ability to recall critical details quickly and perform at your best when it matters most.

Exam Day Tips for Success

The day of an assessment can be filled with both excitement and anxiety. To perform your best, it’s essential to approach the day with a clear and focused mindset. Proper planning and maintaining a calm demeanor can ensure you’re ready to tackle any challenge that comes your way. By following these strategies, you can make the most of your preparation and stay confident throughout the process.

Prepare in the Morning

Starting your day with a clear routine can set a positive tone for the rest of the day. Here are some tips to consider before you head to the test:

- Get Plenty of Rest: A good night’s sleep ensures that you’re alert and ready to think clearly. Avoid cramming the night before; rest is just as important as studying.

- Eat a Balanced Breakfast: Opt for a light but nutritious meal that provides long-lasting energy, such as fruits, whole grains, or protein-rich foods.

- Stay Hydrated: Drinking water can help keep your mind sharp and prevent dehydration, which can negatively affect concentration.

- Arrive Early: Aim to arrive at the venue with enough time to settle in, relax, and get mentally prepared. Rushing can increase anxiety.

During the Assessment

Once you’re in the test setting, staying calm and organized is key. Here are a few tips for managing your time and energy during the test:

- Read Instructions Carefully: Ensure you fully understand the guidelines for each section. Misinterpreting directions can lead to mistakes.

- Manage Your Time Wisely: Allocate time to each section based on its weight. If you get stuck on a difficult question, move on and come back to it later.

- Stay Positive: Keep a positive attitude throughout the process. If you encounter challenges, remind yourself that you’ve prepared well.

- Check Your Work: If time allows, review your answers for any mistakes or omissions. Small errors can be easily caught upon second review.

By following these guidelines, you can maximize your chances for success and approach your test with confidence and clarity.

How to Stay Motivated While Studying

Maintaining focus and drive during preparation can be challenging, especially when the material feels overwhelming or tedious. However, staying motivated is key to successful learning. By employing a few simple strategies, you can build momentum, stay on track, and keep your energy levels high throughout the process.

Create a Clear Plan

Having a structured plan can provide a sense of direction and accomplishment. When you know exactly what you need to study and when, it’s easier to stay focused. Here are a few ways to organize your approach:

- Set Specific Goals: Break down your study material into manageable sections and set daily or weekly objectives.

- Track Your Progress: Keep a checklist or journal of what you’ve accomplished. Marking off tasks as you complete them gives a sense of achievement.

- Prioritize Key Areas: Identify the most important topics and allocate more time to mastering them. Focusing on your weakest areas can help you feel more confident as you progress.

Make the Process Enjoyable

Studying doesn’t have to feel like a chore. Finding ways to make the process enjoyable can help you stay engaged. Here are some ideas to incorporate into your routine:

- Use Different Study Methods: Mix up your approach by using flashcards, quizzes, or educational videos to break up the monotony.

- Reward Yourself: After reaching a milestone, reward yourself with a small treat, break, or activity you enjoy.

- Study with Friends: If possible, join a study group. Sharing knowledge and learning together can make the process more enjoyable and motivating.

By staying organized and finding ways to enjoy your preparation, you can maintain motivation and work effectively towards your goals.

Improving Accuracy in Banking Knowledge Tests

Achieving high accuracy in assessments requires more than just rote memorization; it involves honing your ability to think critically and recall information precisely. Whether you are preparing for a professional certification or a competitive evaluation, enhancing your precision can make a significant difference in your performance. Below are some strategies to help you boost your accuracy during these tests.

Master Key Concepts

Understanding the core principles behind various topics is essential for minimizing errors. Rather than memorizing isolated facts, focus on grasping the underlying concepts that connect the material. This deep comprehension allows you to apply your knowledge in various scenarios, improving your chances of answering accurately. Some effective techniques include:

- Build a Strong Foundation: Focus on mastering the basics first before advancing to more complex topics.

- Use Active Recall: Test yourself frequently on the material to enhance retention and recall speed.

- Link Related Concepts: Connect new information to what you already know. This method enhances long-term memory and accuracy under pressure.

Practice Under Realistic Conditions

Simulating the conditions of an actual test is one of the most effective ways to improve accuracy. Regular practice in a timed, focused environment helps to familiarize yourself with the pace and pressure of the real assessment. Here’s how to make the most of your practice sessions:

- Take Timed Quizzes: Set a timer while completing practice tests to get accustomed to working within time constraints.

- Review Mistakes Thoroughly: After completing a practice session, carefully analyze any errors to understand where your thinking went wrong.

- Focus on Weak Areas: Identify and revisit the topics that you struggle with most. Spend additional time on these areas to improve your accuracy over time.

By mastering core concepts and practicing under realistic conditions, you can significantly improve your performance and ensure a higher degree of precision in your results.