Preparing for an assessment in property and investment management can be challenging, especially with complex topics that require both understanding and application. This section is designed to guide you through the critical areas of study, offering essential insights to help you succeed. Whether you are looking for practical knowledge or theoretical foundations, a strong grasp of the core principles is crucial.

Success in this field relies on being able to navigate through financial structures, market evaluations, and investment strategies. By breaking down the most common topics and providing targeted strategies, this guide aims to simplify the learning process. With the right approach, you can confidently tackle even the most difficult questions and demonstrate your expertise.

Key areas of focus include understanding key calculations, evaluating market dynamics, and mastering financial models. These are the building blocks of any in-depth assessment. Our goal is to equip you with the tools you need to approach your study and assessment with confidence and clarity.

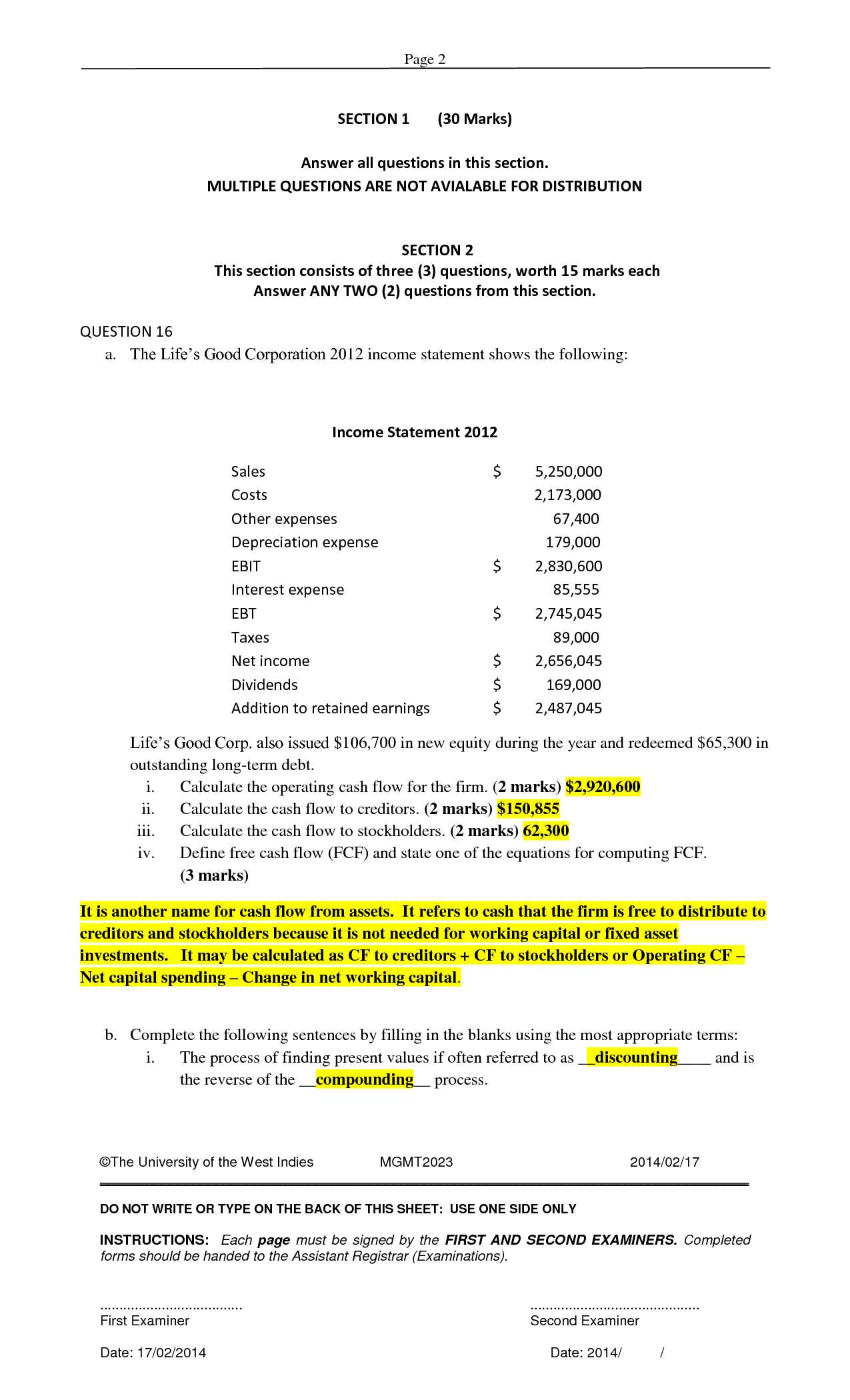

Real Estate Finance Final Exam Answers

This section provides valuable insights to help you navigate through the most critical topics covered in property investment assessments. Understanding the fundamentals, such as market analysis, risk management, and capital structures, is essential for tackling complex scenarios and demonstrating your proficiency in this field. By focusing on core concepts and practical application, you can ensure a comprehensive approach to the test material.

Key Areas to Master

To perform well in any property-related assessment, it is crucial to have a solid grasp of essential financial principles. These include investment strategies, valuation techniques, and the intricacies of financing options. Mastering these areas allows you to answer complex questions with clarity and accuracy. A deep understanding of these core topics also helps in solving case studies, where practical application is key.

Effective Strategies for Success

Focusing on strategy and time management is just as important as understanding the theoretical aspects of the subject. Preparing for property assessments involves practicing calculations, familiarizing yourself with key terms, and staying current with industry trends. Through targeted practice and careful review, you can sharpen your ability to analyze scenarios and provide well-reasoned responses under exam conditions.

Understanding Key Concepts in Real Estate Finance

Grasping the fundamental principles of property investment is essential for success in any related assessment. It is not only about memorizing formulas or terms but about developing a deeper understanding of how various elements interact in the context of property transactions. These core ideas form the foundation upon which more complex strategies and calculations are built.

By focusing on concepts such as market analysis, valuation techniques, and the role of financing, you can better navigate through various scenarios. These topics allow you to assess investment potential, understand risk, and evaluate the financial viability of projects. A strong grasp of these basics will help you solve complex problems and make informed decisions under time constraints.

| Concept | Description | Importance |

|---|---|---|

| Market Analysis | Evaluating market conditions to determine the potential for investment success. | Helps in predicting trends and making informed decisions. |

| Property Valuation | Determining the current value of a property based on various factors. | Crucial for assessing the financial worth of an investment. |

| Risk Management | Identifying and mitigating financial risks in investment decisions. | Prevents significant losses and ensures long-term profitability. |

| Capital Structure | Understanding the mix of debt and equity financing for property projects. | Vital for evaluating how a project is funded and its financial stability. |

These key concepts are the cornerstone of any property-related assessment. Understanding their application is critical for successfully navigating complex situations and answering related questions with confidence.

Common Questions in Real Estate Finance Exams

In any assessment related to property investment, certain types of questions are commonly encountered. These questions often test both theoretical knowledge and practical application of key principles. A strong understanding of these areas is necessary to perform well, as they form the core of what is being evaluated in such tests.

Many questions focus on fundamental topics such as investment analysis, property valuation, and financing structures. These areas are essential for making informed decisions in real estate transactions. Additionally, scenarios requiring the application of calculations, such as loan amortization or cash flow analysis, frequently appear. Recognizing the pattern of such questions can significantly aid in preparing for assessments.

For example: You might be asked to calculate the net present value (NPV) of a property investment or determine the best financing option based on certain criteria. Other typical questions may involve explaining the implications of different risk factors or assessing the value of a property under changing market conditions.

Understanding these recurring topics and practicing the methods to solve them will help you navigate any related questions effectively. Familiarizing yourself with common question formats allows for quicker, more accurate responses during the actual assessment.

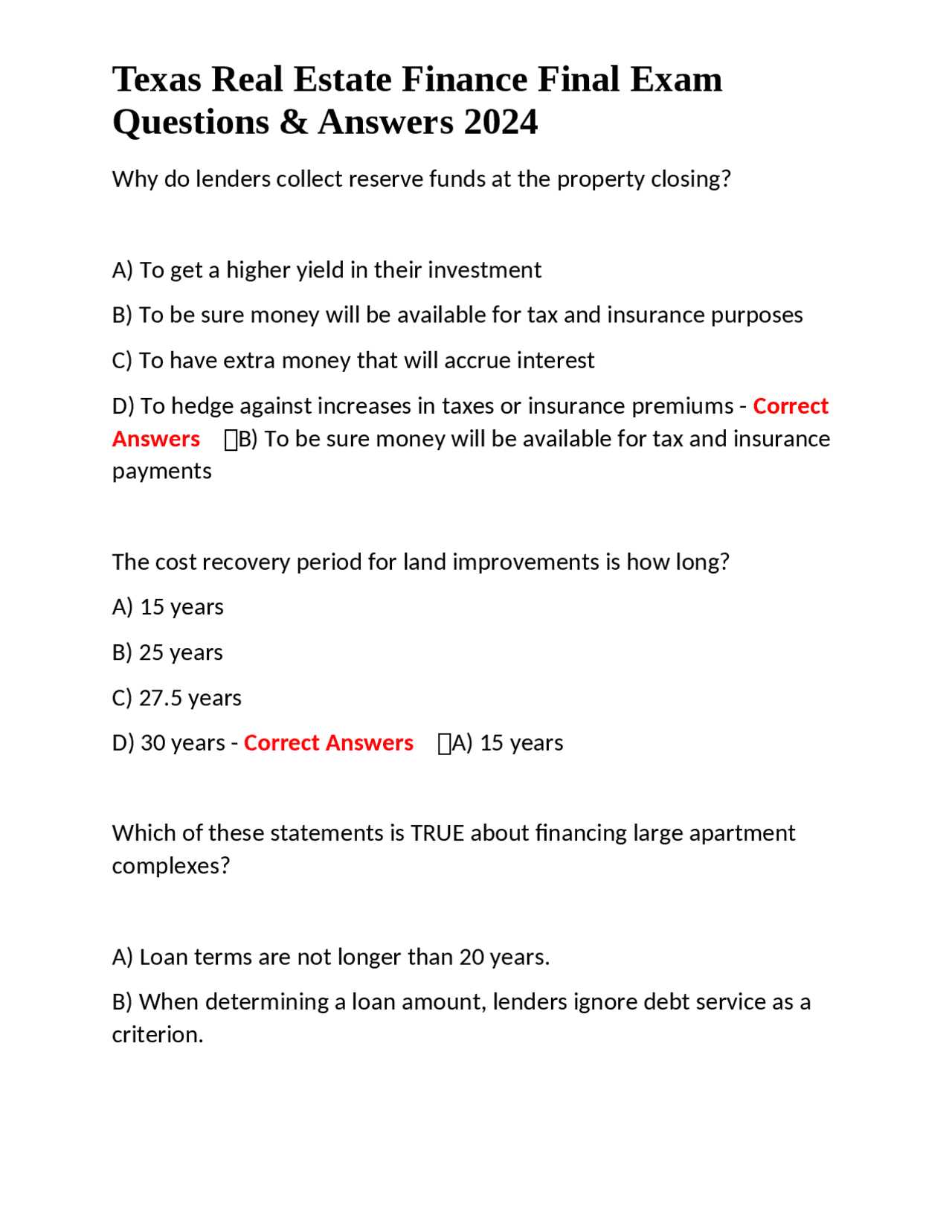

Important Formulas for Real Estate Finance

In property investment assessments, certain mathematical formulas are essential for solving key problems. These formulas help in evaluating financial viability, estimating returns, and making informed decisions based on quantitative data. Understanding and applying these calculations is crucial for successfully navigating complex scenarios presented in assessments.

Among the most important formulas are those that calculate investment returns, financing structures, and risk factors. Whether you’re determining cash flow, assessing property values, or calculating loan payments, knowing these formulas inside and out will give you a significant advantage. Below are some of the key formulas that are frequently used in property-related financial evaluations.

Investment Return Calculations

One of the most common calculations involves determining the return on investment (ROI). This formula helps evaluate the profitability of a property or project:

ROI = (Net Profit / Total Investment) × 100

This formula allows investors to determine the percentage of profit relative to the amount of money invested, which is essential for assessing financial performance.

Loan Payment Calculation

Another critical formula involves calculating loan payments, particularly when dealing with mortgages or other debt financing options:

Monthly Payment = [Loan Amount × Interest Rate × (1 + Interest Rate)^n] / [(1 + Interest Rate)^n – 1]

This formula helps in determining how much will be paid monthly based on the loan amount, interest rate, and the loan term (n), a crucial aspect when assessing financing options for property investments.

By mastering these formulas, you can solve a wide range of problems related to property investment and financing, ensuring that you’re well-prepared for any related question or scenario.

How to Prepare for Real Estate Finance Tests

Success in any property investment assessment depends on a combination of focused study, practical application, and effective time management. Preparing for such tests involves more than just reviewing notes; it requires a deep understanding of key concepts, formulas, and strategies. By breaking down your preparation into manageable steps, you can approach your study with confidence and efficiency.

Study Techniques for Mastery

To ensure thorough preparation, it’s essential to use a variety of study methods. These methods not only help you retain information but also allow you to apply knowledge in real-world scenarios:

- Review Key Concepts: Focus on understanding the core principles and terms related to property investments, risk management, and financial modeling.

- Practice Problem-Solving: Regularly solve practice questions and case studies to reinforce your understanding of financial calculations and decision-making processes.

- Study Group Sessions: Collaborating with peers can help you grasp difficult concepts and gain new insights through discussion and debate.

- Utilize Flashcards: Use flashcards for memorizing important formulas, terms, and definitions to improve recall under timed conditions.

Effective Time Management Strategies

Efficient time management during the preparation phase is just as crucial as understanding the material. To optimize your study time:

- Create a Study Schedule: Break down your study plan into daily or weekly goals, prioritizing areas where you feel less confident.

- Simulate Test Conditions: Practice solving questions within a set time limit to familiarize yourself with the pace required during the actual assessment.

- Take Breaks: Avoid burnout by scheduling regular breaks to rest and recharge your mind, helping maintain focus throughout your study sessions.

By following these strategies, you can prepare thoroughly and approach your assessment with a sense of readiness and control.

Strategies for Answering Finance Questions Effectively

When tackling financial-related questions in assessments, it’s crucial to approach each problem strategically. Success lies not only in knowing the material but in how you apply that knowledge to answer questions accurately and efficiently. By following specific methods and techniques, you can maximize your performance and reduce the risk of making common mistakes.

Key Approaches to Answering Questions

Effective answering involves breaking down the question, applying the right formulas, and ensuring clarity in your response. Below are key strategies that can help you achieve this:

- Understand the Question: Carefully read each question to identify what is being asked. Look for keywords that indicate the required calculation or concept.

- Organize Your Thoughts: Before diving into calculations, take a moment to outline the steps you’ll need to solve the problem. This helps you avoid confusion.

- Show Your Work: Clearly write out each step in your calculations. This ensures that you won’t miss critical components and makes it easier to identify errors if they occur.

- Check Your Units: Be mindful of units (e.g., dollars, percentage rates) and ensure consistency across all steps of the problem.

Managing Time and Stress

Time management is vital in any test, especially when dealing with financial calculations. Here are some strategies to help you manage your time effectively:

| Strategy | Description |

|---|---|

| Prioritize Questions | Start with questions you feel most confident about to build momentum and reduce anxiety. |

| Skip and Return | If a question feels too difficult, skip it and return later with fresh eyes to avoid wasting time. |

| Allocate Time per Question | Estimate how much time to spend on each question and stick to it, ensuring all questions are addressed. |

By adopting these strategies, you’ll improve your ability to handle financial questions with accuracy and efficiency, ultimately enhancing your performance under timed conditions.

Real Estate Finance Case Studies Explained

Case studies are an invaluable tool for understanding complex concepts related to property investment and financial decision-making. They provide real-world scenarios where theoretical knowledge is applied to solve practical problems. By studying these examples, one can gain insight into the challenges and strategies involved in making investment decisions and managing risks.

Each case study typically highlights a specific situation where various financial methods are tested, such as property valuation, loan structuring, and investment return calculations. Analyzing these case studies helps to develop a deeper understanding of the financial principles that guide real estate transactions, allowing individuals to approach similar problems with confidence in the future.

For instance: A case study might explore the financial challenges faced by an investor purchasing a multi-family property. By evaluating the cash flow, financing options, and expected return on investment (ROI), students can learn how to apply formulas and strategies in practice.

Additionally, case studies often present multiple perspectives by including alternative approaches to solving a financial problem. This diversity encourages critical thinking and offers a broader view of the different strategies investors might use in real-world scenarios.

Types of Mortgages on the Exam

Understanding the various types of mortgage loans is essential for solving questions related to property financing. These loans are fundamental in assessing the costs, risks, and terms of a property investment. Different loan types come with distinct structures, interest rates, and repayment schedules, each influencing the financial outcome of an investment. Familiarity with these loan options will help you navigate assessment questions more effectively.

Common Mortgage Types

There are several key types of mortgages that are frequently covered in financial assessments. These include:

- Fixed-Rate Mortgages: The interest rate remains the same throughout the loan term, ensuring predictable monthly payments.

- Adjustable-Rate Mortgages (ARMs): The interest rate can change periodically based on market conditions, which can lead to varying monthly payments.

- Interest-Only Mortgages: During the initial period, borrowers only pay interest on the loan, with the principal balance remaining unchanged until the end of the term.

- Balloon Mortgages: This loan requires smaller monthly payments over the term, with a large “balloon” payment due at the end to pay off the remaining balance.

Considerations for Each Mortgage Type

Each mortgage type comes with its own advantages and risks, and understanding these differences is crucial for making informed financial decisions. For example:

- Fixed-Rate Mortgages: These loans provide stability and predictability but may have higher initial interest rates.

- ARMs: These loans can be more affordable in the short term but carry the risk of rising interest rates in the future.

- Interest-Only Mortgages: While offering lower initial payments, these loans can result in a larger principal balance at the end of the term.

- Balloon Mortgages: These loans offer lower monthly payments but require a substantial lump sum payment at the end of the term, which can be a financial challenge.

By understanding the characteristics of each mortgage type, you’ll be better equipped to approach questions that test your knowledge of loan structures and their impact on financial outcomes.

Risk Assessment in Real Estate Transactions

Evaluating risk is an essential part of property deals, as it helps investors and professionals determine the potential challenges and rewards associated with a transaction. Identifying various risks before making decisions can significantly affect the profitability and success of an investment. Proper risk assessment involves examining several factors that might influence the outcome of a deal, such as market conditions, property valuation, and external economic forces.

Types of Risks in Property Deals

In any property-related transaction, there are various risks to consider. These risks can come from different sources and have varying degrees of impact on the overall investment. Understanding these risks is crucial for making informed decisions. Below are some common types of risks:

| Risk Type | Description |

|---|---|

| Market Risk | Fluctuations in market conditions, such as changes in property demand, interest rates, or economic downturns. |

| Credit Risk | The potential that a borrower may fail to repay a loan, leading to financial losses for the lender or investor. |

| Liquidity Risk | The difficulty in quickly selling or liquidating a property without significant losses. |

| Legal Risk | Uncertainties arising from legal complications, such as zoning issues or disputes over ownership or property rights. |

Managing and Mitigating Risks

Effective risk management is key to protecting investments and ensuring long-term profitability. Below are several methods used to manage these risks:

- Diversification: Spreading investments across different property types or markets to reduce the impact of any single risk.

- Due Diligence: Thoroughly researching and analyzing the property, market conditions, and potential legal issues before making decisions.

- Insurance: Purchasing insurance policies to protect against unexpected events, such as natural disasters or structural damage.

- Risk Spreading: Partnering with other investors to share the financial burden and reduce individual exposure to risk.

By understanding and addressing potential risks, investors can make more informed decisions and increase their chances of success in the competitive property market.

Evaluating Property Value in Finance Exams

Determining the value of a property is a crucial skill in any financial assessment. This process involves analyzing multiple factors that influence how much a property is worth in the market. Understanding these evaluation methods is essential for answering questions effectively, as they test your ability to apply theoretical concepts in practical scenarios. Property value assessments are often based on several key approaches that can be used to estimate fair market value.

In exams, you’ll likely encounter questions that require you to calculate property value using different methods. These techniques help determine the worth of real estate based on income generation, comparable sales, or replacement costs. It is important to be familiar with these methods and understand when to apply each one, depending on the context provided in the problem.

Common Methods for Property Valuation

Below are the most widely recognized approaches used to evaluate property value:

- Sales Comparison Approach: This method involves comparing the property in question with similar properties that have recently sold. Adjustments are made based on differences in features and location to arrive at a market value.

- Income Approach: Used primarily for income-producing properties, this method calculates value based on the property’s ability to generate income. Common formulas include the capitalization rate and gross rent multiplier.

- Cost Approach: This approach estimates the cost to replace or reproduce the property, factoring in depreciation and land value. It’s often used for new or unique properties.

Key Factors to Consider in Property Valuation

When performing a property valuation, several factors influence the final result. It’s crucial to understand these elements, as they can affect the calculation and interpretation of the property’s worth:

- Location: The neighborhood and surrounding infrastructure play a significant role in determining property value. Proximity to amenities, schools, and public transport can increase appeal and value.

- Condition of the Property: The physical state of the property, including its age, design, and any recent improvements or renovations, influences its overall value.

- Market Trends: Fluctuations in supply and demand, interest rates, and the broader economic environment can affect property values. Understanding current market conditions is essential for accurate assessments.

Mastering these valuation methods and factors will enable you to confidently tackle questions in financial assessments related to property evaluation.

Time Value of Money in Real Estate

The concept of time value of money is essential in property-related investments, as it helps evaluate the impact of time on the value of money. Essentially, the value of money changes over time due to factors like interest rates, inflation, and opportunity cost. Understanding this concept allows investors and financial professionals to make informed decisions about the best way to allocate capital, whether in purchasing, leasing, or financing property.

In property investments, money available today is generally considered more valuable than the same amount in the future. This principle influences many financial calculations, such as loan repayments, investment returns, and property valuations. By applying time value of money principles, one can assess the potential profitability of a deal or investment over time.

Key Formulas Used in Property Valuation

Several important formulas are employed to assess the time value of money in property investments. Below are some commonly used calculations:

- Present Value (PV): The current value of a future sum of money, discounted by an interest rate over a specific time period. It helps determine how much a future cash flow is worth today.

- Future Value (FV): The value of an amount of money at a specific point in the future, considering the interest rate and the number of periods over which it grows.

- Net Present Value (NPV): A calculation used to evaluate the profitability of an investment by subtracting the present value of costs from the present value of benefits.

- Internal Rate of Return (IRR): The interest rate that makes the net present value of all cash flows from an investment equal to zero. It’s used to assess the profitability of an investment.

Applications of Time Value of Money in Property

Time value of money principles play a vital role in various aspects of property transactions and investments:

- Mortgage Repayments: Calculating the cost of a loan involves understanding how the principal amount decreases over time with interest. This impacts both the total cost of borrowing and the monthly payments.

- Investment Returns: Investors use time value of money to determine the profitability of long-term property investments, considering rental income, capital appreciation, and other cash flows.

- Valuation of Income-Producing Properties: Investors use discounted cash flow analysis to estimate the value of a property based on the income it will generate over time.

By integrating the concept of time value of money, professionals can more accurately evaluate the financial implications of property investments, helping them make better decisions and optimize returns.

Financial Statements in Real Estate Finance

Financial statements are essential tools for evaluating the performance and financial health of property-related ventures. These documents provide a clear picture of an entity’s financial position, including its income, expenses, assets, liabilities, and overall profitability. By analyzing these reports, investors, lenders, and managers can make informed decisions about investments, loans, and operational strategies.

In the context of property investments and management, key financial statements include the income statement, balance sheet, and cash flow statement. Each of these documents serves a specific purpose and provides valuable insights into different aspects of a business’s financial performance.

Understanding how to read and interpret these statements is critical for anyone involved in property-related financial transactions. Properly analyzing financial data can help identify opportunities for growth, assess risks, and ensure long-term success in property management and investment.

Common Mistakes to Avoid During Exams

When preparing for and taking tests related to property management and investment, it is easy to fall into several common traps. These mistakes can negatively impact performance, causing confusion and reducing overall effectiveness. Being aware of these potential pitfalls can help ensure a smoother, more successful testing experience.

One of the most frequent errors is misunderstanding the questions or overlooking important details. This can happen when rushing through the material or misinterpreting what is being asked. Careful reading and thorough analysis of each question are essential to avoid this mistake.

Another common issue is neglecting to manage time properly during the test. Without a clear plan, candidates may spend too much time on difficult questions, leaving little time for others. Time management strategies, such as allocating specific amounts of time for each section, can prevent this problem.

Below is a table outlining other frequent errors to watch out for:

| Mistake | Solution |

|---|---|

| Rushing through questions | Take time to read each question thoroughly and avoid guessing unless necessary |

| Overlooking instructions | Pay close attention to guidelines and requirements for each section |

| Failing to review answers | Leave time to double-check responses and ensure accuracy |

| Skipping difficult questions | Address challenging questions with careful thought or mark them for later review |

By being mindful of these common mistakes and preparing effectively, you can approach the testing process with confidence and maximize your chances of success.

Understanding Real Estate Investment Analysis

Analyzing the financial potential of property investments is essential for making informed decisions. This process involves evaluating various factors that contribute to the profitability of a property. Understanding the key metrics, such as cash flow, return on investment (ROI), and net present value (NPV), is crucial to assessing whether an investment will meet financial goals.

One of the primary steps in investment analysis is understanding the potential risks and rewards associated with the property. Investors need to consider factors such as market trends, location, and economic conditions that can influence property values and rental income. This helps in making an accurate forecast of future returns.

Key Factors in Investment Analysis

- Cash Flow: The net amount of cash generated by the property after expenses. A positive cash flow indicates that the property is earning more than it costs to maintain.

- Return on Investment (ROI): This metric helps investors measure the profitability of the investment relative to its cost.

- Net Present Value (NPV): The calculation of the current value of future cash flows, accounting for the time value of money.

- Cap Rate: The capitalization rate helps investors assess the return on investment relative to the property’s current market value.

Common Analysis Methods

- Comparable Sales Approach: This method involves comparing the property to similar ones that have recently sold in the same market.

- Income Approach: This method focuses on the income-generating potential of a property, particularly relevant for rental properties.

- Cost Approach: This method estimates the cost to replace the property, factoring in depreciation and land value.

By understanding these essential components and analysis techniques, investors can confidently evaluate properties and make sound financial decisions. Proper analysis ensures that the potential investment aligns with long-term financial goals and offers a clear path to profitability.

Debt Financing vs Equity Financing Concepts

When raising capital for a project, two primary methods are commonly used: debt and equity. Both have distinct characteristics that influence how the funding is structured and how the investor or lender is compensated. Understanding the differences between these two types of capital is essential for making informed decisions in any investment or business venture.

Debt financing involves borrowing money that must be repaid with interest over time, typically through regular payments. In contrast, equity financing involves raising funds by selling ownership stakes in the business or project, which means investors share in the profits and risks.

Debt Financing

With debt financing, the borrower receives capital upfront and agrees to pay it back with interest. The key features of debt financing include:

- Fixed Repayment Schedule: The borrower must make regular payments until the loan is fully repaid.

- Ownership Retention: Since the lender does not take ownership in the project, the borrower maintains full control.

- Interest Costs: The borrower must pay interest on the borrowed amount, which adds to the overall cost of capital.

- Debt Covenant Restrictions: Lenders may impose certain conditions or restrictions on the borrower to ensure repayment.

Equity Financing

In equity financing, capital is raised by offering a share of ownership in the business or project. Investors provide funding in exchange for a stake in the profits and potential future returns. The main features of equity financing include:

- Profit Sharing: Investors receive a portion of the profits based on their equity stake.

- No Repayment Obligation: There is no requirement to repay the invested capital, which can reduce financial strain on the company.

- Shared Risk: Investors bear the risks of the venture, as their returns are tied to the performance of the business or project.

- Loss of Control: By selling equity, the original owners may lose some control over decision-making, depending on the ownership structure.

Each financing method has its advantages and disadvantages. Debt financing allows for maintaining control and can be more predictable due to fixed payments, but it introduces the risk of over-leveraging. On the other hand, equity financing reduces the financial burden but involves sharing ownership and profits. The choice between debt and equity financing depends on the specific goals, risk tolerance, and financial situation of the business or investor.

Key Terms Every Finance Student Should Know

In the world of financial analysis and decision-making, there are several key concepts that every student must familiarize themselves with to build a strong foundation. Understanding these terms will enable you to better grasp complex topics and effectively navigate through financial challenges. Below are some of the most important terms to understand for anyone studying the subject.

Basic Financial Terminology

These fundamental terms form the backbone of financial theory and practice. Without them, it would be difficult to analyze, interpret, or manage financial data.

- Capital: The money or assets used to fund investments or operations.

- Liquidity: The ability of an asset to be quickly converted into cash without significant loss of value.

- Return on Investment (ROI): A measure of the profitability of an investment, calculated as the gain or loss relative to the initial investment.

- Leverage: The use of borrowed capital to increase the potential return of an investment.

- Risk: The likelihood of a financial outcome differing from expectations, typically involving the possibility of a loss.

Advanced Concepts in Financial Analysis

For those looking to delve deeper into the world of finance, understanding these more advanced terms is essential for making informed decisions in a variety of financial scenarios.

- Net Present Value (NPV): The value of future cash flows discounted to their present value, used to assess the profitability of an investment.

- Internal Rate of Return (IRR): The discount rate that makes the net present value of all cash flows equal to zero; used to evaluate the attractiveness of an investment.

- Debt-to-Equity Ratio: A measure of the proportion of debt used in financing relative to equity, indicating the level of financial leverage.

- Amortization: The gradual repayment of a debt over time through regular payments, typically involving both principal and interest.

- Cash Flow: The total amount of money being transferred into and out of a business or investment, indicating liquidity and financial health.

By mastering these key terms, finance students will be well-equipped to navigate the complexities of financial markets, investment strategies, and business decision-making. A strong grasp of these concepts is essential for anyone pursuing a career in finance or investment management.

Tips for Managing Exam Time Efficiently

Effective time management is crucial during assessments, especially when you are dealing with complex material and tight deadlines. By planning your approach and staying organized, you can make the most of your time and increase your chances of success. Below are strategies to help you manage your time effectively during an assessment.

Prioritize Tasks and Questions

Before diving into the test, take a few moments to scan through all the questions. This will help you assess the difficulty level and prioritize your approach. Focus on the questions you are most comfortable with first, ensuring that you secure the points you’re confident about. Leave more challenging questions for later, giving yourself the opportunity to think more carefully.

- Start with familiar questions to build confidence.

- Identify questions with higher point values and allocate more time to them.

- Set aside difficult questions for the end, so you don’t waste time on them early on.

Use a Time Allocation Strategy

Allocate specific amounts of time to each section or question, ensuring you don’t spend too long on any one task. This prevents you from getting stuck and running out of time for other parts of the assessment. Use a watch or a timer to keep track of your progress and stay on schedule. If you find yourself spending too much time on one question, move on and come back to it later if necessary.

- Set a time limit for each question or section.

- Don’t linger too long on any one question – keep moving forward.

- Review your work only after completing all sections, unless you have spare time.

By managing your time carefully and applying these strategies, you can maximize your efficiency, reduce stress, and increase your performance during assessments.