In the field of commercial law, understanding the relationship between a borrower and a lender is crucial. This often involves complex agreements that dictate the terms under which assets are used to secure obligations. The importance of such agreements cannot be overstated, as they form the foundation of many financial arrangements and dispute resolutions.

Familiarity with key principles in this area is essential for anyone looking to navigate the legal landscape effectively. This guide provides a structured approach to mastering the key concepts, ensuring that you are well-equipped to handle related scenarios. From the establishment of a security interest to the various methods of enforcement, knowing these details can significantly impact outcomes in legal matters.

By exploring a variety of typical scenarios and legal frameworks, we aim to clarify important aspects of this field. Whether you are preparing for a professional certification or enhancing your general knowledge, this content will offer valuable insights that are practical and easy to understand.

Secured Transactions Exam Questions and Answers

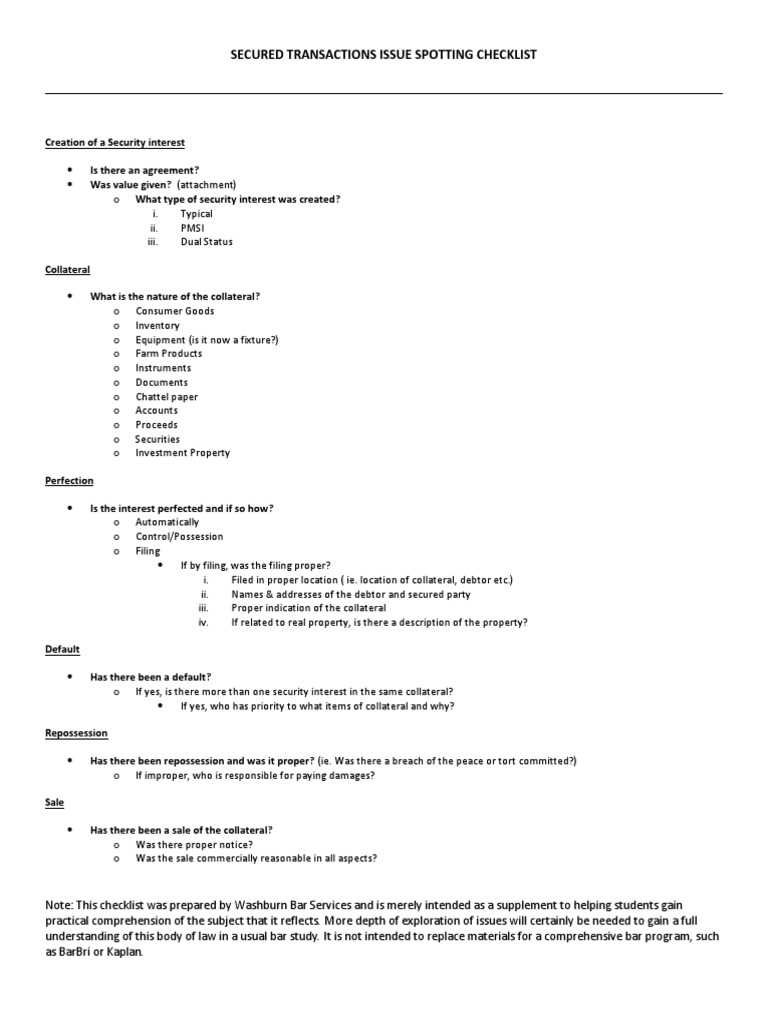

In this section, we will explore key topics that frequently appear in legal assessments related to asset-backed lending. These subjects are critical for understanding the core principles of how financial obligations are supported by collateral. By reviewing different scenarios, you can sharpen your ability to address common situations and challenges that arise in this area of law.

Key Areas to Focus On

- Establishing a legal relationship between borrower and lender

- Defining types of collateral used to secure obligations

- Understanding the process of perfecting an interest

- Analyzing priority rules and their application in case of default

- Examining enforcement rights and remedies available to lenders

Commonly Asked Scenarios

- How do priority rules determine who gets paid first in a default situation?

- What are the steps involved in perfecting a financial interest?

- What happens if a party fails to file the necessary legal documents?

- How are conflicting claims between secured parties resolved?

- What legal steps can a lender take when collateral is in default?

Reviewing these fundamental concepts will ensure you’re prepared to analyze similar legal situations effectively. Mastery of the material covered here will also help in identifying key issues and formulating appropriate legal solutions when faced with related challenges.

Understanding Secured Transactions Basics

In the realm of finance, lending agreements often involve a promise from a borrower to offer certain assets as assurance for repayment. These legal arrangements ensure that, should the borrower fail to meet their obligations, the lender has a claim to specific property to satisfy the debt. Understanding the foundation of such agreements is vital for navigating both the creation and enforcement of these legal relationships.

Key Components of Asset-Backed Financing

- Security Interest: A legal claim that a lender holds over a specific asset to ensure loan repayment.

- Collateral: The asset or property pledged to secure a debt, which can be seized if the borrower defaults.

- Debtor and Creditor Relationship: The parties involved in the agreement, where the debtor promises to repay and the creditor holds the interest in collateral.

Important Considerations

- Attachment: This is the process by which the lender’s claim attaches to

Key Terms in Secured Transactions

In the context of lending agreements backed by collateral, there are several important terms that define the legal framework of such arrangements. Understanding these terms is crucial for navigating both the creation of these agreements and the enforcement of rights in case of default. These terms establish the rights, obligations, and protections for both parties involved in the financial arrangement.

Core Concepts

- Collateral: An asset pledged by the borrower to guarantee repayment of the debt, which the lender can seize if the borrower defaults.

- Debtor: The borrower who pledges assets as security for the loan and is responsible for repaying the debt.

- Creditor: The lender or financial institution providing the loan, holding the claim to the collateral until the debt is paid off.

Legal Principles

- Attachment: The process by which a lender’s right to the collateral becomes legally enforceable once certain conditions are met, such as a signed agreement.

- Perfection: The act of legally formalizing the claim to the collateral, often through registration or public notice, to protect the lender’s interest.

- Priority: The order in which creditors’ claims to the same collateral will be honored in the event of default, often determined by the timing of perfection.

Grasping these key terms provides a strong foundation for understanding the mechanics of asset-backed lending and the associated legal processes. These concepts are central to managing risks, ensuring compliance, and resolving disputes effectively.

Types of Security Interests Explained

When a borrower pledges an asset to ensure the repayment of a debt, various types of legal claims may be established depending on the nature of the agreement. These claims, known as security interests, differ in how they are created, perfected, and enforced. Understanding these different types is essential for both lenders and borrowers to navigate the complexities of asset-backed lending.

Common Types of Claims

- Possessory Interest: This type of claim is created when the lender physically takes possession of the collateral. The lender holds the asset until the debt is repaid.

- Non-Possessory Interest: In this arrangement, the borrower retains possession of the collateral, but the lender still holds a legal claim on it in the event of default.

- Floating Charge: This is a type of interest that allows the borrower to use the asset in question (often inventory or accounts receivable) while the debt remains outstanding. The lender’s claim becomes fixed if certain conditions are met, such as default or liquidation.

How Interests Are Structured

- Fixed Interest: A fixed interest is tied to a specific asset and gives the lender rights to that particular property, such as real estate or equipment, for the duration of the loan.

- Floating Interest: A floating interest allows the borrower to continue using the asset, but the lender’s claim becomes active under specific circumstances, such as default or insolvency.

Each of these types provides different levels of control and flexibility to the lender and borrower. By understanding the distinctions between these interests, one can better manage the risks associated with asset-backed lending and navigate the legal landscape effectively.

Types of Security Interests Explained

When a borrower pledges an asset to ensure the repayment of a debt, various types of legal claims may be established depending on the nature of the agreement. These claims, known as security interests, differ in how they are created, perfected, and enforced. Understanding these different types is essential for both lenders and borrowers to navigate the complexities of asset-backed lending.

Common Types of Claims

- Possessory Interest: This type of claim is created when the lender physically takes possession of the collateral. The lender holds the asset until the debt is repaid.

- Non-Possessory Interest: In this arrangement, the borrower retains possession of the collateral, but the lender still holds a legal claim on it in the event of default.

- Floating Charge: This is a type of interest that allows the borrower to use the asset in question (often inventory or accounts receivable) while the debt remains outstanding. The lender’s claim becomes fixed if certain conditions are met, such as default or liquidation.

How Interests Are Structured

- Fixed Interest: A fixed interest is tied to a specific asset and gives the lender rights to that particular property, such as real estate or equipment, for the duration of the loan.

- Floating Interest: A floating interest allows the borrower to continue using the asset, but the lender’s claim becomes active under specific circumstances, such as default or insolvency.

Each of these types provides different levels of control and flexibility to the lender and borrower. By understanding the distinctions between these interests, one can better manage the risks associated with asset-backed lending and navigate the legal landscape effectively.

Perfection of Security Interests

To ensure that a lender’s legal claim on an asset is enforceable and prioritized over other claims, it must undergo a process known as perfection. This process solidifies the lender’s rights, making them publicly recognized and legally binding. Without perfection, the lender’s claim may not hold up against competing interests or third parties, which could jeopardize their ability to recover the loan in case of default.

Methods of Perfection

There are several methods available to perfect a claim, depending on the type of asset and the legal requirements involved. Each method is designed to provide notice of the lender’s interest in the property, ensuring that other parties are aware of the claim and that the lender has priority over unsecured creditors.

Method Description Commonly Used For Filing Filing a public notice, often with a government registry, to notify all parties of the lender’s interest in the asset. Personal property, intangible assets Possession The lender physically takes control of the collateral, securing their interest until the debt is repaid. Movable property, tangible goods Control The lender takes control over certain types of assets, such as deposit accounts or investment property, to perfect their claim. Accounts, financial assets The choice of perfection method depends on the nature of the collateral and the legal framework that applies. By selecting the most appropriate method, a lender can protect their interest, ensuring that it remains enforceable and takes precedence over other claims in the event of financial default.

Perfection of Security Interests

To ensure that a lender’s legal claim on an asset is enforceable and prioritized over other claims, it must undergo a process known as perfection. This process solidifies the lender’s rights, making them publicly recognized and legally binding. Without perfection, the lender’s claim may not hold up against competing interests or third parties, which could jeopardize their ability to recover the loan in case of default.

Methods of Perfection

There are several methods available to perfect a claim, depending on the type of asset and the legal requirements involved. Each method is designed to provide notice of the lender’s interest in the property, ensuring that other parties are aware of the claim and that the lender has priority over unsecured creditors.

Method Description Commonly Used For Filing Filing a public notice, often with a government registry, to notify all parties of the lender’s interest in the asset. Personal property, intangible assets Possession The lender physically takes control of the collateral, securing their interest until the debt is repaid. Movable property, tangible goods Control The lender takes control over certain types of assets, such as deposit accounts or investment property, to perfect their claim. Accounts, financial assets The choice of perfection method depends on the nature of the collateral and the legal framework that applies. By selecting the most appropriate method, a lender can protect their interest, ensuring that it remains enforceable and takes precedence over other claims in the event of financial default.

Priority Rules in Secured Transactions

When multiple parties have claims to the same asset, the question of which party has priority in collecting their debt is critical. Priority rules determine the order in which creditors are entitled to be paid from the sale of a debtor’s property in the event of default. These rules help to establish a clear hierarchy of claims, ensuring that the most rightful or earliest claim is honored first. Understanding the factors that influence priority can significantly affect a creditor’s strategy and legal standing.

Factors Affecting Priority

The ranking of competing claims is primarily governed by the timing of actions taken by the parties involved. Several key factors come into play when determining the priority order:

- Filing Date: Generally, the creditor who files first or perfects their interest first takes priority over other creditors. This is a fundamental principle of most legal systems regarding property claims.

- Possession or Control: In some cases, a creditor who physically takes possession or gains control over specific assets may secure a higher priority, even if other creditors filed earlier.

- Purchase Money Interests: Creditors who provide funds for the purchase of certain assets may be granted priority over other claims, even if their interest is perfected later than others.

Special Considerations for Priority

While the general rule favors the earliest filing or perfection, certain exceptions exist that can alter the order of priority:

- Super-Priority Claims: Certain claims, such as those for unpaid wages or tax liabilities, may be granted superior priority under the law, overriding other perfected claims.

- Unsecured vs. Secured Claims: Unsecured creditors typically rank behind secured creditors, who have rights to specific assets in case of liquidation or default.

By understanding these rules, parties can strategically position their interests to ensure they are in the best possible position to recover outstanding debts. Properly navigating priority rules is essential for both lenders and borrowers in managing legal rights and obligations effectively.

Default and Enforcement Mechanisms

When a borrower fails to meet their obligations, it triggers a process known as default. In such situations, creditors must rely on enforcement mechanisms to recover the value owed. These mechanisms are legal tools that allow a creditor to take action against the borrower and secure payment from the collateral. The methods available depend on the terms of the agreement, the type of property involved, and the legal framework within which the parties operate.

Common Default Triggers

Defaults can occur for various reasons, but they are generally defined by a failure to make timely payments or meet other contractual obligations. Some of the most common triggers include:

- Non-payment of Debt: The most straightforward form of default, occurring when a borrower fails to make a required payment by the due date.

- Breach of Terms: Default may also result from a failure to comply with other terms of the agreement, such as providing accurate financial reports or maintaining adequate insurance on collateral.

- Bankruptcy: If a borrower declares bankruptcy, it typically results in a default, triggering creditor rights to collect from any available assets.

Enforcement Actions Available

Once a default occurs, creditors can pursue various enforcement actions depending on the circumstances. These actions are aimed at recovering the owed amounts, either through liquidation or other means. Common enforcement mechanisms include:

- Repossession: A creditor may take possession of collateral to either sell it or liquidate it in order to recover the debt.

- Foreclosure: In cases where real property is involved, a creditor may initiate foreclosure proceedings to take control of the property and sell it.

- Judgment Collection: If a creditor is unable to recover through other means, they may seek a court judgment, which allows them to garnish wages or seize assets directly from the borrower.

Understanding the different default triggers and enforcement options is essential for both creditors and borrowers. Creditors must be aware of their rights and available mechanisms, while borrowers should recognize the potential consequences of failing to meet their obligations.

Default and Enforcement Mechanisms

When a borrower fails to meet their obligations, it triggers a process known as default. In such situations, creditors must rely on enforcement mechanisms to recover the value owed. These mechanisms are legal tools that allow a creditor to take action against the borrower and secure payment from the collateral. The methods available depend on the terms of the agreement, the type of property involved, and the legal framework within which the parties operate.

Common Default Triggers

Defaults can occur for various reasons, but they are generally defined by a failure to make timely payments or meet other contractual obligations. Some of the most common triggers include:

- Non-payment of Debt: The most straightforward form of default, occurring when a borrower fails to make a required payment by the due date.

- Breach of Terms: Default may also result from a failure to comply with other terms of the agreement, such as providing accurate financial reports or maintaining adequate insurance on collateral.

- Bankruptcy: If a borrower declares bankruptcy, it typically results in a default, triggering creditor rights to collect from any available assets.

Enforcement Actions Available

Once a default occurs, creditors can pursue various enforcement actions depending on the circumstances. These actions are aimed at recovering the owed amounts, either through liquidation or other means. Common enforcement mechanisms include:

- Repossession: A creditor may take possession of collateral to either sell it or liquidate it in order to recover the debt.

- Foreclosure: In cases where real property is involved, a creditor may initiate foreclosure proceedings to take control of the property and sell it.

- Judgment Collection: If a creditor is unable to recover through other means, they may seek a court judgment, which allows them to garnish wages or seize assets directly from the borrower.

Understanding the different default triggers and enforcement options is essential for both creditors and borrowers. Creditors must be aware of their rights and available mechanisms, while borrowers should recognize the potential consequences of failing to meet their obligations.

Repossession Procedures and Legalities

When a borrower defaults on a loan agreement, creditors often exercise their right to reclaim the property used as collateral. This process, known as repossession, involves specific legal procedures that must be followed to ensure fairness and compliance with the law. Understanding the steps involved and the legal framework is crucial for both creditors and borrowers to avoid disputes and potential legal issues.

Steps in Repossession

The repossession process generally follows a structured series of steps, each designed to protect the rights of all parties involved. Key steps include:

- Notification: The creditor must inform the borrower of their default and intention to reclaim the property. This notice is often required by law to ensure the borrower is aware of the situation.

- Reclaiming the Property: Once the notification is given, the creditor has the right to retrieve the collateral. This must be done without breaching the peace, meaning no force or intimidation can be used.

- Inventory and Documentation: After repossession, the creditor must document the condition of the property and its value to avoid future disputes. This documentation is vital for the next stages, such as the sale of the property.

Legal Considerations in Repossession

Repossession is not a simple matter of reclaiming the property; several legal rules govern how and when repossession can occur. Understanding these regulations is crucial to avoid violating the borrower’s rights and risking legal action. Some important legal considerations include:

- Right to Cure: Many jurisdictions allow borrowers a period to cure the default by paying off the debt or bringing the account current before repossession can take place.

- Prohibition of Breach of Peace: Creditors are prohibited from using force, threats, or entering the borrower’s property without consent when reclaiming the property.

- Deficiency Judgment: If the sale of the repossessed property does not cover the full amount owed, creditors may seek a deficiency judgment, which allows them to pursue the remaining balance from the borrower.

By following proper procedures and adhering to legal standards, both creditors and borrowers can navigate the repossession process smoothly, ensuring that the process is fair and in line with the law.

UCC Article 9 Overview for Exams

UCC Article 9 is a critical section of the Uniform Commercial Code that governs various aspects of credit and personal property lending. It focuses on the creation, perfection, and enforcement of rights related to personal property pledged as security for a loan or debt. For students preparing for assessments, understanding the key concepts and provisions of this article is essential for success. This article outlines the legal framework that ensures both lenders and borrowers understand their rights and obligations when property is used as collateral.

Key Concepts in UCC Article 9

UCC Article 9 encompasses several key provisions that are vital for understanding how secured interests are created and managed. The main concepts include:

- Attachment: This refers to the process by which a lender gains a legal claim over the debtor’s property. Attachment occurs when there is an agreement between the parties, the debtor has rights to the property, and value is given.

- Perfection: Perfection involves steps taken to give public notice of a lender’s claim on the property. This typically involves filing a financing statement or taking possession of the collateral.

- Priority Rules: UCC Article 9 establishes a system to determine which lender has priority in cases of default or competing claims. Generally, the first to perfect their interest will have priority over other creditors.

Common Issues Covered in UCC Article 9

Some common issues and scenarios that are addressed under UCC Article 9 include:

- Default and Remedies: The article outlines the rights of creditors if a borrower defaults on their obligation, including the process of reclaiming collateral and enforcing the terms of the agreement.

- Filing Requirements: Properly filing a financing statement is critical to ensuring that a lender’s interest in the collateral is legally recognized and enforceable.

- Transfer of Collateral: UCC Article 9 also addresses situations where the debtor transfers or sells the collateral, including the conditions under which the lender’s rights may be affected.

Mastering the principles of UCC Article 9 will equip students with the necessary knowledge to address legal scenarios involving secured lending. Understanding these provisions is crucial for both practical legal applications and assessments related to this area of law.

Common Secured Transactions Pitfalls

While navigating the complexities of credit agreements and collateral, certain challenges can arise that complicate the legal process and reduce the effectiveness of a lender’s protections. These common obstacles can impact the priority of claims, the ability to recover assets, or even the validity of an agreement. Being aware of these issues allows parties to take proactive measures to avoid legal disputes or financial losses.

1. Failure to Perfect a Claim

One of the most significant errors in lending arrangements involves failing to properly perfect a claim. Perfection ensures that a lender’s interest in the pledged property is legally recognized and enforceable against third parties. Common pitfalls in perfection include:

- Incorrect Filing: Filing a financing statement with incomplete or incorrect details can lead to disputes over the priority of claims.

- Failure to File: In some cases, a lender may neglect to file a financing statement, making it difficult to establish a valid claim over the collateral in the event of default.

- Improper Method of Perfection: Using an incorrect method for perfection, such as failing to take possession when necessary, may jeopardize the lender’s interest.

2. Inadequate Documentation

Another frequent problem is the lack of proper documentation supporting the agreement. This includes missing signatures, incomplete descriptions of the collateral, or vague language in the agreement itself. Without clear, well-documented terms, it can be difficult to enforce rights in a legal context. Some common issues include:

- Vague Collateral Descriptions: Failing to provide a specific description of the collateral can make it challenging to identify or reclaim the property in the future.

- Incomplete Agreements: If the agreement does not clearly outline the rights and obligations of each party, it may lead to confusion or disputes over interpretation.

3. Ignoring Priority Rules

Priority issues can complicate matters when multiple parties hold interests in the same property. Understanding and following the proper rules regarding priority can prevent costly legal battles. Common missteps include:

- Neglecting to Consider Other Claims: Failing to investigate and account for other potential claims on the property can result in a lower priority status for a lender.

- Late Perfection: If a lender perfects their interest after another party has already done so, they may lose their priority, even if they were the original lender.

By understanding these common pitfalls, individuals can take the necessary steps to safeguard their interests and reduce the risk of legal complications. Being proactive in addressing these issues can enhance the security of an agreement and ensure its enforceability in court.

Secured Transactions vs. Unsecured Loans

When borrowing money, individuals and businesses often face a choice between two primary lending options: loans that require collateral and those that are based solely on the borrower’s creditworthiness. Each option carries its own set of implications for both the lender and the borrower, influencing terms like interest rates, risk, and the potential consequences of default. Understanding these key distinctions is essential for making informed financial decisions.

Key Distinctions Between Collateralized and Non-Collateralized Lending

The main difference between these two types of agreements lies in the requirement for collateral. A collateralized loan involves the borrower pledging an asset as security for the loan, whereas in a non-collateralized loan, the lender relies entirely on the borrower’s promise to repay. Below is a detailed comparison of both types of loans:

Factor Collateralized Lending Non-Collateralized Lending Collateral Requirement Requires assets to be pledged by the borrower No collateral required Risk to Lender Lower risk for lender due to the asset backing Higher risk for lender due to the lack of collateral Interest Rates Generally lower because of reduced lender risk Typically higher due to increased lender risk Impact of Default Lender can take possession of the collateral Lender must pursue legal action to recover funds Eligibility Requires the borrower to have valuable assets Available to individuals with limited assets Advantages and Disadvantages of Each Option

Both collateralized and non-collateralized lending options have their own benefits and limitations depending on the borrower’s needs and financial situation. Below are some of the main advantages and disadvantages of each approach:

- Collateralized Lending: Provides a sense of security for lenders, which often results in lower interest rates for borrowers. However, there is a risk of losing the pledged assets if the loan is not repaid as agreed.

- Non-Collateralized Lending: Offers flexibility and does not require the borrower to risk personal or business assets. However, this comes with the downside of higher interest rates and stricter credit requirements due to the lack of collateral.

In conclusion, borrowers should carefully assess their own financial situation, risk tolerance, and repayment ability when choosing between these two options. Understanding the implications of each can help individuals and businesses make the most suitable decision for their needs.

Secured Transactions vs. Unsecured Loans

When borrowing money, individuals and businesses often face a choice between two primary lending options: loans that require collateral and those that are based solely on the borrower’s creditworthiness. Each option carries its own set of implications for both the lender and the borrower, influencing terms like interest rates, risk, and the potential consequences of default. Understanding these key distinctions is essential for making informed financial decisions.

Key Distinctions Between Collateralized and Non-Collateralized Lending

The main difference between these two types of agreements lies in the requirement for collateral. A collateralized loan involves the borrower pledging an asset as security for the loan, whereas in a non-collateralized loan, the lender relies entirely on the borrower’s promise to repay. Below is a detailed comparison of both types of loans:

Factor Collateralized Lending Non-Collateralized Lending Collateral Requirement Requires assets to be pledged by the borrower No collateral required Risk to Lender Lower risk for lender due to the asset backing Higher risk for lender due to the lack of collateral Interest Rates Generally lower because of reduced lender risk Typically higher due to increased lender risk Impact of Default Lender can take possession of the collateral Lender must pursue legal action to recover funds Eligibility Requires the borrower to have valuable assets Available to individuals with limited assets Advantages and Disadvantages of Each Option

Both collateralized and non-collateralized lending options have their own benefits and limitations depending on the borrower’s needs and financial situation. Below are some of the main advantages and disadvantages of each approach:

- Collateralized Lending: Provides a sense of security for lenders, which often results in lower interest rates for borrowers. However, there is a risk of losing the pledged assets if the loan is not repaid as agreed.

- Non-Collateralized Lending: Offers flexibility and does not require the borrower to risk personal or business assets. However, this comes with the downside of higher interest rates and stricter credit requirements due to the lack of collateral.

In conclusion, borrowers should carefully assess their own financial situation, risk tolerance, and repayment ability when choosing between these two options. Understanding the implications of each can help individuals and businesses make the most suitable decision for their needs.

Exam Tips for Secured Transactions

Preparing for an assessment on legal concepts related to collateral and creditor rights requires a focused approach. To perform well, it’s essential to understand core principles, terminology, and scenarios involving financial obligations and asset protection. This section provides key strategies to enhance your performance and ensure success.

One effective method is to review foundational laws and guidelines, focusing on how different types of collateral are used to secure debts. Familiarize yourself with common terms and structures used in such agreements, as well as the various rights and remedies available to parties involved in these arrangements.

Another useful strategy is practicing applying theoretical concepts to practical situations. Consider real-world examples where the protection of interests is at stake, and think critically about how the law governs these interactions. This will help you better interpret any problem scenarios that arise during the test.

Tip Explanation Understand Core Principles Review the basics of asset security, focusing on creditor rights and types of collateral used in financial agreements. Master Relevant Terminology Ensure you’re familiar with key terms such as priority, default, and liquidation, which are central to most issues. Practice Scenario-Based Problems Work through examples of real cases where collateral was in dispute, focusing on how legal concepts are applied. Focus on Procedures Know the steps involved in protecting and enforcing interests under applicable laws and regulations. Use Mnemonics Develop memory aids for remembering processes and critical steps in handling asset disputes. By mastering these strategies, you’ll be well-prepared to handle a variety of scenarios and show your understanding of the material during the assessment. Practicing under timed conditions will also help reduce stress and improve your ability to recall important information when needed.