Preparing for a professional financial qualification requires a well-structured approach. Understanding the exam’s content, format, and the types of tasks you will encounter is key to success. It is not just about memorizing information but about learning how to apply knowledge under timed conditions.

Strategic practice is essential. Focusing on key topics and practicing with sample tests will help familiarize you with the exam’s structure. By doing so, you’ll be better equipped to tackle any challenge that arises. Familiarity with the format reduces anxiety and increases your ability to think critically when under pressure.

To maximize your chances of success, it’s important to focus on the most frequently tested concepts. As you work through practice materials, aim to understand the reasoning behind each question and solution. This method will provide a deeper understanding and greater confidence when facing the real challenge.

Understanding Financial Qualification Structure

To successfully navigate any professional financial assessment, it is important to first grasp the overall framework. The structure typically involves multiple sections that test different skill sets. These sections are designed to evaluate both theoretical knowledge and practical application in real-world scenarios. The format of each section varies, so understanding the specific requirements of each is crucial for effective preparation.

Section Breakdown

Each section of the evaluation is focused on specific areas of expertise. The first part often includes a range of basic principles, requiring candidates to demonstrate understanding of key concepts and financial models. The following sections may delve into more complex topics, including financial analysis, risk management, and investment strategies. Depending on the level, the questions may vary from general knowledge to highly detailed calculations or theoretical applications.

Time Constraints and Organization

Time management plays a crucial role in performing well on any professional financial assessment. The limited time frame for each section requires candidates to prioritize tasks and answer efficiently. Practicing under timed conditions can help improve speed and accuracy, ensuring that candidates can complete all sections without feeling rushed. The structure is designed to challenge both the depth of knowledge and the ability to perform under pressure.

How to Approach Financial Assessment Tasks

When facing any professional financial qualification, it’s essential to develop a systematic approach to the tasks at hand. Rather than rushing through, a strategic mindset can significantly improve performance. Taking the time to carefully analyze each item before jumping into the solution allows for more accurate and thoughtful responses. Understanding how to prioritize tasks and manage time efficiently is critical in such evaluations.

Step-by-Step Approach

To tackle financial evaluation tasks effectively, consider the following steps:

- Read Instructions Carefully: Ensure you understand what is being asked before attempting any calculations or decisions.

- Identify Key Information: Highlight essential facts or data points that are critical to solving the problem.

- Break Down Complex Problems: Divide difficult tasks into smaller, manageable components to avoid confusion.

- Eliminate Irrelevant Data: Focus only on the information that directly impacts the solution, ignoring unnecessary details.

Time Management Tips

Efficient time management is vital for ensuring that all sections are completed within the given timeframe. Use these strategies to help manage time:

- Allocate Time to Each Task: Assign a specific time limit to each section based on its complexity and importance.

- Don’t Get Stuck: If you’re struggling with a task, move on and come back to it later if time permits.

- Keep Track of Time: Monitor how much time you have left and adjust your pace as needed.

Key Topics in Financial Qualification

Successful preparation for a professional financial qualification requires a deep understanding of the core concepts and areas that are regularly tested. Each section is designed to assess different facets of financial knowledge, from basic principles to complex applications. Focusing on the most important areas can significantly enhance performance and boost confidence.

Core Areas to Focus On

Several topics are commonly featured and carry significant weight in the overall evaluation. These key areas are essential for a well-rounded understanding of financial principles:

- Financial Reporting and Analysis: Understanding financial statements, ratios, and accounting principles is foundational to most financial qualifications.

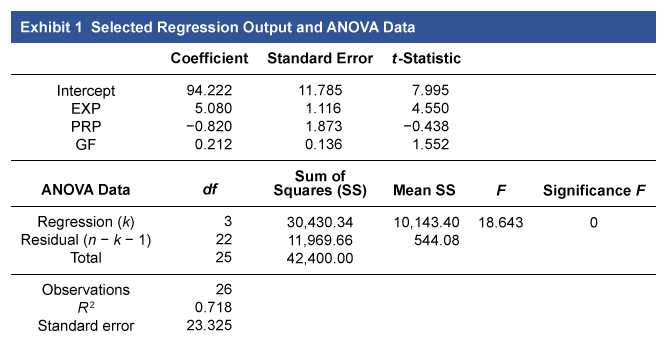

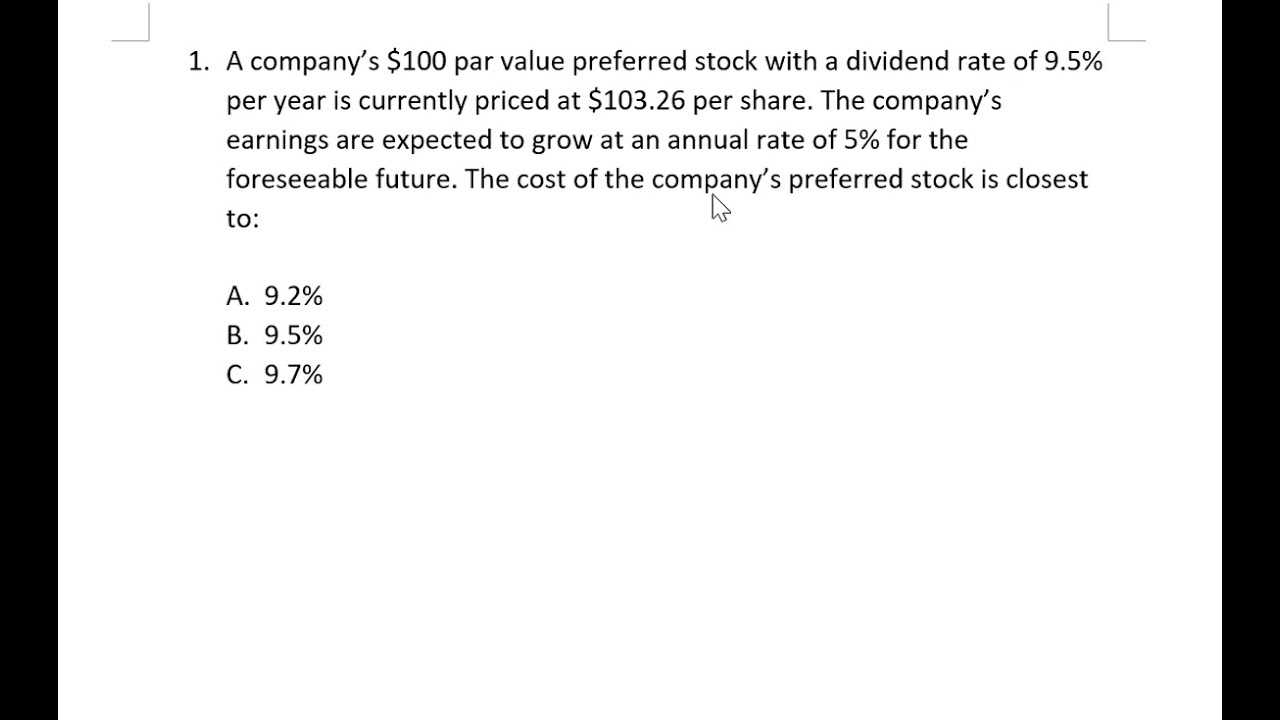

- Quantitative Methods: Mastering statistical methods, financial modeling, and data analysis tools is critical for solving complex problems.

- Corporate Finance: This topic covers the fundamentals of capital budgeting, financing, and corporate governance.

- Equity Investments: A deep understanding of market analysis, valuation methods, and asset management is key to success in this area.

- Fixed Income: Knowledge of bond valuation, interest rates, and debt instruments plays a critical role in many evaluations.

Additional Focus Areas

While the above topics are central to the evaluation, other areas also require attention to ensure a comprehensive understanding:

- Portfolio Management: Understanding asset allocation, portfolio theory, and risk management strategies is essential for this subject.

- Ethical and Professional Standards: This area ensures candidates are familiar with industry norms, ethical conduct, and best practices.

- Alternative Investments: Familiarity with non-traditional investment assets, such as real estate and hedge funds, is increasingly important.

- Derivatives: A strong grasp of derivative instruments, pricing models, and risk management techniques is crucial for advanced financial analysis.

Mastering Financial Assessment Formats

Successfully navigating a professional financial evaluation requires familiarity with the various types of tasks that may appear. Understanding the format of each section is essential for effective preparation. Each type of task is designed to test different skills, ranging from basic concept application to complex problem-solving under time constraints. Mastery of these formats helps candidates approach the assessment with confidence and efficiency.

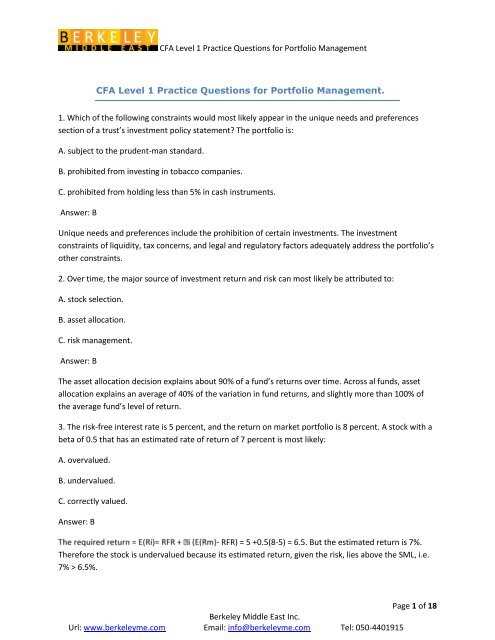

Multiple-Choice Format

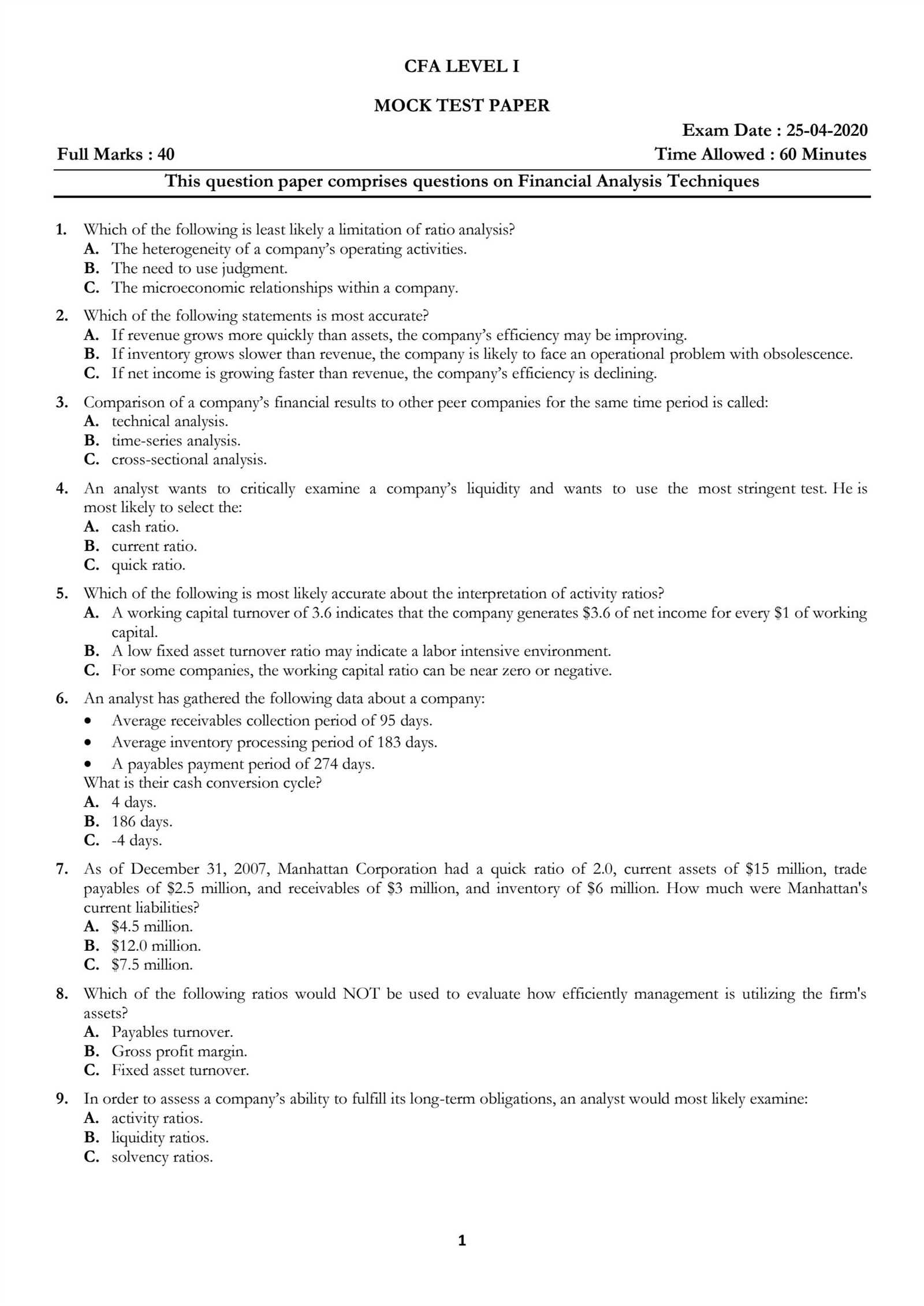

The multiple-choice format is one of the most common structures in financial assessments. Candidates are presented with a question followed by several possible answers, only one of which is correct. To excel in this format, strategic elimination is key. By narrowing down the choices, you can improve your chances of selecting the correct response even if you’re uncertain. Additionally, timing is crucial; ensure you don’t spend too much time on any one item.

Item Set Format

In this format, candidates are given a set of related items that require analysis and problem-solving. Each set is followed by a series of questions that must be answered based on the provided data. The key to succeeding in item sets is to identify patterns and focus on the most relevant information. Make sure to read the case study or data carefully before answering, as each piece of information contributes to the overall solution.

Constructed Response Format

This format requires candidates to generate their own responses to open-ended problems. It typically involves calculations, detailed explanations, or both. Success in this format relies on clear, logical thinking and the ability to show your work. Always structure your response step-by-step, demonstrating the rationale behind your approach. Practicing this format helps develop the skills necessary to tackle more complex tasks under pressure.

Effective Study Strategies for Financial Qualification

Achieving success in a professional financial qualification requires more than just passive learning. A focused, organized approach to studying ensures that candidates are well-prepared for every aspect of the assessment. By adopting effective study techniques, candidates can build a strong foundation and boost their confidence as they approach the testing day.

Active Learning Techniques

Instead of just reading through materials, engage with the content actively. Practice solving problems, summarizing key concepts in your own words, and teaching the material to someone else. Active recall is a powerful method that strengthens long-term memory retention. Using this technique regularly helps reinforce knowledge and increases the ability to recall information under pressure.

Utilize Practice Tests

Simulating real testing conditions is one of the most effective ways to prepare. Take as many practice tests as possible to familiarize yourself with the format, timing, and the type of material that will be covered. Practice exams also help identify weak areas that need more attention. Focused practice on these areas can greatly improve performance and reduce stress during the actual evaluation.

Time Management

Managing study time effectively is crucial. Create a study schedule that allocates sufficient time to cover all topics, allowing for regular review sessions. Break larger sections into smaller, manageable tasks to avoid feeling overwhelmed. Consistent study habits and sticking to a schedule will help ensure steady progress towards your goal.

Common Mistakes in Financial Assessments

During a professional financial qualification, candidates often make certain mistakes that can hinder their performance. These errors are typically a result of inadequate preparation, poor time management, or overlooking critical details. By recognizing these common pitfalls, candidates can take proactive steps to avoid them and improve their chances of success.

Underestimating the Importance of Time Management

One of the most frequent mistakes is poor time management. Many candidates spend too much time on difficult tasks, leaving insufficient time for easier ones. To avoid this, it’s crucial to allocate time appropriately to each section. Practice with timed mock assessments will help develop a sense of pacing and ensure that all areas are covered within the given timeframe. Staying mindful of time throughout the process is key to a balanced performance.

Neglecting Review and Revision

Another common error is failing to regularly review and revise the material. Simply going through the content once is not enough for long-term retention. Without consistent revision, it’s easy to forget important concepts or details. Frequent review sessions help reinforce learning and ensure that knowledge is fresh and ready for application when needed. Regularly revisiting the material helps identify weak points and solidifies understanding.

Overlooking the Application of Knowledge

Many candidates focus solely on memorizing theory without understanding how to apply it in practical scenarios. Financial assessments often require candidates to apply concepts to solve real-world problems, and memorization alone is insufficient. Practical application should be emphasized alongside theoretical learning to ensure readiness for complex, real-world questions.

Practicing with Mock Assessments

One of the most effective ways to prepare for a professional financial qualification is through regular practice with mock tests. These simulated assessments closely mirror the format and difficulty level of the actual evaluation. By engaging in mock sessions, candidates can familiarize themselves with the test structure, manage their time more effectively, and identify areas that need improvement.

Benefits of Mock Assessments

Mock tests offer numerous advantages, including:

- Time Management Practice: They help candidates develop a strategy for pacing themselves during the real assessment.

- Stress Reduction: Familiarity with the testing environment reduces anxiety and builds confidence.

- Concept Reinforcement: Regular practice helps reinforce learned material and ensures better retention.

- Realistic Assessment Experience: They provide insight into the types of challenges and problem-solving scenarios likely to be encountered.

Mock Test Scoring and Analysis

After completing a mock assessment, it’s crucial to thoroughly review your performance. Analyzing your results allows you to pinpoint weak areas that require further focus. Below is an example of how to track progress after taking a practice test:

| Section | Total Questions | Correct Answers | Incorrect Answers | Score (%) |

|---|---|---|---|---|

| Financial Reporting | 40 | 35 | 5 | 87.5% |

| Corporate Finance | 30 | 25 | 5 | 83.3% |

| Equity Investments | 25 | 22 | 3 | 88.0% |

By regularly assessing your performance in mock tests and tracking progress, you can ensure continuous improvement and better prepare for the actual assessment day.

Time Management for Financial Qualification Candidates

Efficient time management is crucial for anyone preparing for a professional financial assessment. Without a structured approach, candidates may find themselves overwhelmed by the volume of material, or worse, unable to complete all sections within the allotted time. Proper planning allows individuals to allocate sufficient time for each topic, practice solving problems, and revise key concepts before the actual evaluation.

Developing a study plan that balances all areas of the assessment is essential. Dividing your preparation into manageable tasks ensures that each section is given the attention it deserves. Regular practice under timed conditions can also help improve speed and accuracy, making it easier to manage the pressure during the real evaluation.

Furthermore, it’s important to recognize your own strengths and weaknesses. Allocating more time to areas where you feel less confident, while ensuring that you maintain a good pace in subjects you excel in, is a key component of a successful strategy. With the right time management techniques, candidates can maximize their potential and feel more in control as they approach their goal.

Tips for Answering Multiple-Choice Questions

Multiple-choice questions often form a large part of any professional assessment. They require not only knowledge but also strategy and careful consideration of each option. Understanding how to approach these types of tasks can significantly improve performance, as well as minimize the chances of making avoidable mistakes under time pressure.

First, always read the question thoroughly before considering the options. Sometimes, the phrasing of the question itself provides valuable hints that help narrow down the choices. When reviewing the available options, eliminate the clearly incorrect ones first to improve the likelihood of selecting the correct answer. This process of elimination can significantly enhance your chances of success, especially when you’re uncertain about a particular question.

Another useful strategy is to manage your time wisely. Don’t linger too long on any one question. If you find yourself stuck, make a best guess, mark the question, and move on. You can always come back to it later if time allows. Prioritize questions that you find easier and more familiar, as this will help you build confidence and avoid unnecessary stress.

Resources for Exam Preparation

Preparing for a professional financial assessment requires access to the right tools and resources. Whether you’re just starting your study journey or looking to refine your knowledge, having high-quality materials can make all the difference. From textbooks to online courses, these resources will help you cover all necessary topics and gain a deeper understanding of complex concepts.

Key Resources to Utilize

There are several types of resources available to help candidates prepare effectively:

- Study Guides: Comprehensive guides covering all major topics, often structured to align with the format of the evaluation.

- Online Courses: Interactive learning platforms that offer video lessons, practice quizzes, and live discussions.

- Practice Tests: Simulated assessments that help you familiarize yourself with the question format and pacing.

- Forums and Discussion Groups: Community-driven platforms where candidates can discuss difficult topics, share tips, and support one another.

Choosing the Right Materials

It’s important to choose resources that match your learning style and study goals. Some candidates prefer in-depth reading materials, while others may benefit from interactive tools or live sessions. Here’s a comparison of a few popular resources:

| Resource | Advantages | Best For |

|---|---|---|

| Official Study Guides | Structured content, clear explanations | Self-learners who prefer comprehensive study |

| Online Courses | Interactive, flexible learning schedule | Visual learners or those needing structured schedules |

| Practice Tests | Realistic practice, time management skills | Candidates looking to improve test-taking speed |

By combining different resources, you can ensure a well-rounded approach to your preparation. Always ensure that the materials you choose are up-to-date and align with the current assessment standards.

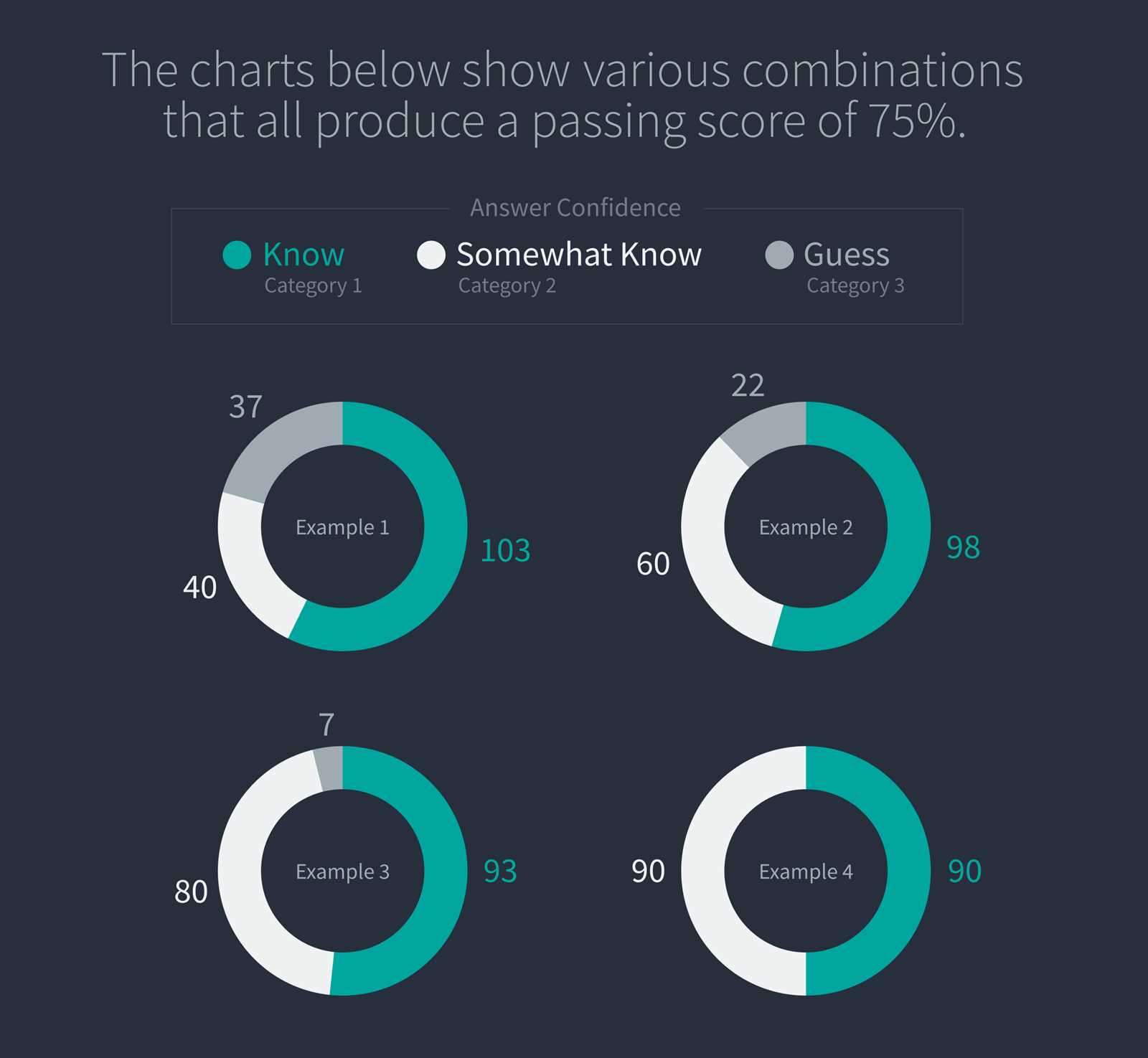

Understanding Scoring for Professional Assessments

Understanding how scoring works is essential for candidates preparing for any professional evaluation. Knowing how your performance is measured allows you to approach the assessment with a clearer strategy. Scoring systems typically involve a combination of correct answers, time management, and the ability to apply knowledge under pressure.

The scoring for these evaluations usually includes a mix of multiple-choice questions and constructed responses. Each type of question contributes to the overall score differently, and understanding this balance can help you prioritize your efforts during preparation.

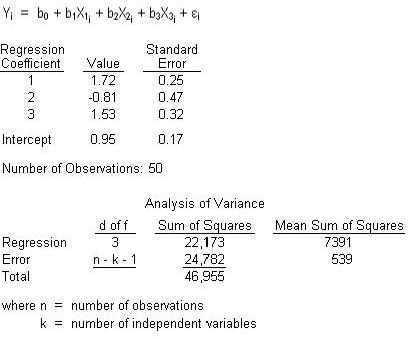

Components of the Scoring System

The scoring system is designed to assess not only knowledge but also how well candidates can manage the pressure of timed conditions. Here’s a general breakdown of how scoring is typically calculated:

- Multiple-Choice Questions: These questions usually have a fixed scoring system, where each correct answer adds a specific number of points to your total score.

- Constructed Responses: These are often graded based on the depth of analysis, structure, and clarity. Scoring for these responses can vary, and partial credit may be awarded for well-constructed arguments, even if not entirely correct.

- Weighted Sections: Some sections may be weighted more heavily than others, meaning that performing well in these areas can have a larger impact on your final score.

Understanding Passing Criteria

While understanding the scoring system is important, it’s also essential to know the passing criteria. Most assessments have a minimum score threshold, which varies by level and session. Here are some key factors to keep in mind:

- Each section or subject area is typically assigned a passing mark. Ensure you focus on all areas to meet these requirements.

- In some cases, you may need to achieve a certain aggregate score across all sections, even if individual sections vary in difficulty.

- Some assessments use a relative scoring system, where your performance is compared to other candidates. In such cases, achieving a high score is crucial to securing a passing grade.

Being aware of how your responses will be evaluated allows you to focus on improving specific areas, whether it’s increasing speed or ensuring the accuracy of your answers. Understanding scoring helps build confidence and lets you approach the process strategically.

How to Review Practice Tests

Reviewing practice assessments is a crucial part of preparation. The process of analyzing your performance on mock tests provides valuable insights into your strengths and areas for improvement. It allows you to fine-tune your strategies, ensuring that you’re ready for the actual evaluation. Effective review techniques help you gain a deeper understanding of concepts and improve your overall approach.

Steps for Effective Test Review

When reviewing your practice tests, it’s important to take a structured approach. Here are some key steps to follow:

- Identify Mistakes: After completing a mock test, immediately review the incorrect responses. Understand why you made each mistake and identify the root cause–was it a lack of knowledge, a misunderstanding of the question, or a misinterpretation of the answer choices?

- Analyze Patterns: Look for patterns in the mistakes you make. Are there certain topics or concepts that you struggle with more than others? Identifying these areas allows you to focus your study efforts on the most challenging subjects.

- Understand the Correct Answers: Simply marking the correct answers is not enough. Take time to understand why the correct answer is right, and why other options are incorrect. This will deepen your understanding of the material and help you avoid making the same mistakes in the future.

- Time Management Review: Assess whether you spent too much time on certain questions or sections. Effective time management during practice tests is just as important as knowledge. Make sure you’re pacing yourself appropriately for the real assessment.

Using Review Results for Improvement

The ultimate goal of reviewing practice tests is to continuously improve. By reflecting on your mistakes and analyzing your performance, you can refine your approach. Here are some strategies to implement after each review session:

- Target Weak Areas: Focus on the topics where you made the most mistakes. Use additional resources, such as textbooks or online materials, to reinforce your understanding of these areas.

- Practice Regularly: Regular practice will help you build confidence and familiarity with the test format. The more tests you review, the more you will understand the types of questions and the areas that require the most attention.

- Track Progress: Keep track of your performance across multiple practice tests. This will help you see if you’re improving in weak areas and give you an indication of your readiness.

By following these review techniques, you can make the most out of your practice assessments and feel more confident in your preparation for the actual evaluation.

Focus Areas for Level I

Level I assessment primarily emphasizes fundamental concepts and quantitative techniques. This stage requires a broad understanding of basic principles that serve as the foundation for more advanced topics in later levels. The material covered at this stage is extensive and touches on various areas such as ethics, financial analysis, and portfolio management. Mastery of these areas is essential for progressing further in the program.

Key Topics to Focus On

Below are some critical areas that candidates should pay particular attention to when preparing for the first level of evaluation:

| Topic | Importance | Study Tips |

|---|---|---|

| Ethics and Professional Standards | High – Core to all levels | Review the Code of Ethics and Standards of Professional Conduct thoroughly. Understand ethical decision-making in finance. |

| Quantitative Methods | High – Foundation for financial analysis | Master statistics, probability, and time value of money concepts. Practice calculations regularly. |

| Financial Reporting and Analysis | High – Key for financial statement understanding | Focus on interpreting income statements, balance sheets, and cash flow statements. Practice problem-solving. |

| Corporate Finance | Medium – Business and investment decision-making | Understand corporate financial policies, cost of capital, and capital budgeting techniques. |

| Equity Investments | Medium – Essential for portfolio building | Understand stock valuation techniques and basic market structures. |

| Fixed Income | Medium – Bond market basics | Learn bond pricing, yield curves, and basic fixed-income calculations. |

| Economics | Medium – Macroeconomics and microeconomics basics | Understand key economic concepts like inflation, GDP, and interest rates. |

| Portfolio Management | Medium – Asset allocation basics | Familiarize yourself with risk, return, and portfolio diversification principles. |

Study Strategy for Success

To succeed at Level I, candidates need a systematic approach to their preparation. Here are some study strategies:

- Plan Ahead: Create a study schedule that covers all key topics. Allocate more time to areas where you feel less confident.

- Practice Problems: Regularly practice with sample questions to reinforce your understanding of concepts.

- Review Notes: Review notes and summaries to retain information. Revisit difficult areas multiple times.

- Group Study: Collaborate with peers for discussions on complex topics. Group study can help clarify concepts.

Focusing on these core areas will provide a solid foundation and enhance your readiness for the first level of evaluation. As with all aspects of preparation, consistency and disciplined study habits are key to mastering the material.

Best Tools for Study Preparation

When preparing for a challenging evaluation in the finance field, selecting the right tools can significantly improve efficiency and comprehension. These resources provide interactive practice, detailed explanations, and structured learning paths to guide candidates through their studies. The best tools combine study material with opportunities to test knowledge and track progress. Here, we explore the top resources that can enhance your learning experience.

Essential Study Resources

Below are some of the most effective study tools that can aid in mastering the required concepts:

- Official Study Materials: Many candidates prefer the official curriculum and materials provided by the organization overseeing the assessment. These are designed specifically for the program and provide comprehensive coverage of the necessary topics.

- Practice Tests: Practice exams allow you to simulate the actual test environment and assess your understanding. These tests help identify weak areas, build confidence, and improve time management.

- Study Apps: Apps designed for financial exam preparation can be accessed anywhere, offering flexibility and interactivity. Many apps feature flashcards, quizzes, and study plans to keep you on track.

- Online Courses: Online platforms often provide video lessons, tutorials, and detailed walkthroughs. These courses are led by experts and can offer deeper insights into complex concepts.

- Flashcards: Using flashcards, either physical or digital, is an excellent way to reinforce key terms and concepts. Flashcards are highly effective for quick reviews and active recall.

Supplementary Learning Tools

In addition to core study materials, the following tools can support your study efforts:

- Discussion Forums: Engaging with online communities and discussion boards can provide valuable insights and allow you to clarify doubts with fellow candidates.

- Mobile Flashcards: Digital flashcards, such as those from Quizlet, are portable and allow for frequent revision of key concepts during free moments throughout the day.

- Time Management Tools: Apps that track time, like Toggl or Trello, can help you stay organized and ensure your study sessions are productive and well-paced.

Using these tools in combination with a well-structured study plan will not only help reinforce your understanding but also increase your chances of success. It’s essential to regularly evaluate your progress and adjust your approach using feedback from these tools to ensure comprehensive preparation.

Boosting Confidence for Exam Day

Preparing for a high-stakes test can often bring anxiety and self-doubt. However, building confidence in the days leading up to the test is crucial for achieving your best performance. Confidence is not simply about knowing the material; it’s about managing stress, maintaining focus, and trusting in your preparation. This section provides tips on how to boost your confidence and stay calm on the day of the assessment.

Strategies to Build Confidence

These techniques will help you feel prepared and capable when it’s time to face the challenge:

- Review Key Concepts: In the final days before the assessment, focus on reinforcing the most important concepts. Review notes, summaries, and key formulas to keep essential information fresh in your mind.

- Simulate Test Conditions: Take full-length practice tests under timed conditions. This will help you become comfortable with the format and time constraints, reducing anxiety.

- Stay Positive: Replace negative thoughts with positive affirmations. Visualize yourself performing well, and focus on what you’ve learned instead of what you haven’t.

- Prepare Mentally: Incorporate relaxation techniques such as meditation, deep breathing, or visualization to calm your nerves. A clear mind leads to better performance.

- Trust Your Preparation: Remind yourself that you have been preparing for this moment. Trust the work you’ve put in, and avoid second-guessing yourself on test day.

Test Day Confidence Tips

On the day of the assessment, managing stress and maintaining focus is key to success. Here are a few tips to ensure you are at your best:

- Get Enough Sleep: A well-rested mind is sharper and more focused. Aim for a good night’s sleep before the test to ensure you’re alert and ready.

- Eat a Healthy Breakfast: A balanced breakfast will provide the energy needed for a long day. Avoid heavy meals that may make you feel sluggish.

- Arrive Early: Arriving with plenty of time to spare reduces stress and allows you to settle in before the test begins. This can help you start with a calm, focused mindset.

- Stay Hydrated: Dehydration can impair concentration. Make sure to drink enough water before and during the test.

By employing these strategies, you will increase your confidence and approach the challenge with a positive, focused mindset. Confidence is the key to performing well, so trust your preparation and take the exam with self-assurance.