Mastering the fundamentals of financial management in the public realm is essential for anyone pursuing a career in government finance. The ability to interpret and manage financial data is crucial in ensuring that public resources are allocated efficiently and transparently. This section provides a comprehensive guide to the most important topics that will appear in any related evaluations.

Preparation is key to success in these assessments. Understanding the core principles, legal frameworks, and financial reporting standards will help candidates tackle complex scenarios. Through focused practice and a clear understanding of the material, one can navigate through various challenges that arise in these types of evaluations.

Developing a strong foundation in these subjects will not only assist in passing assessments but also build the necessary skills to excel in managing public finances. Whether you’re looking to advance your knowledge or preparing for a test, the information provided here is designed to support your journey towards success.

Public Sector Accounting Exam Questions and Answers

To succeed in evaluations related to financial management in government organizations, it’s essential to focus on both theoretical knowledge and practical problem-solving skills. This section offers valuable insights into how you can prepare effectively for these assessments. By understanding the core principles of financial control, budgeting, and reporting, candidates can better approach the variety of scenarios typically presented in these tests.

Key Areas to Focus On

The subjects covered in these assessments usually involve a mix of theoretical concepts and real-life situations. Focus on areas such as financial oversight, resource allocation, and fiscal transparency. Having a thorough understanding of the rules governing these activities will give you a competitive edge. Practical exercises often simulate real challenges, testing your ability to apply knowledge in decision-making processes.

Approaching Practice Problems

Working through practice scenarios is one of the most effective ways to prepare. These exercises help familiarize you with the types of problems you will encounter. They also allow you to develop strategies for tackling complex situations. Systematic review of previous test content can help identify common patterns and recurring themes, ensuring you are well-equipped for a range of potential topics.

Key Concepts in Public Sector Accounting

Understanding the foundational principles of financial management in government organizations is essential for navigating assessments. These principles guide the efficient use of public resources, ensuring that funds are properly allocated and spent in line with established regulations. Familiarizing yourself with the core concepts will prepare you to tackle any financial situation presented in related evaluations.

Here are some critical topics to focus on:

- Budgeting Processes: Understanding how budgets are created, approved, and monitored is fundamental in any government finance system.

- Financial Reporting: Knowing how to prepare and interpret financial statements is crucial for assessing the health of an organization.

- Fund Management: Effective management of public funds ensures that resources are used appropriately for their intended purposes.

- Compliance with Legal Standards: Adhering to legal frameworks and regulations ensures that financial practices meet governmental requirements.

- Auditing and Oversight: Regular audits help identify discrepancies and improve financial transparency.

By mastering these concepts, candidates can approach the related tasks with confidence, demonstrating a deep understanding of the challenges in managing government finances.

Understanding Government Financial Statements

Financial statements in government organizations provide a comprehensive view of fiscal health and resource distribution. These documents serve as essential tools for decision-makers, auditors, and stakeholders to assess how funds are managed and allocated across various public programs. A solid understanding of these reports is necessary for interpreting their content and making informed judgments about financial performance.

Types of Government Financial Reports

There are several key reports that serve as the foundation for financial analysis within government entities:

- Balance Sheet: Displays the financial position, including assets, liabilities, and equity, at a specific point in time.

- Income Statement: Shows the revenues and expenditures over a period, highlighting the net financial result.

- Cash Flow Statement: Tracks the flow of cash in and out of the organization, indicating liquidity and operational effectiveness.

- Budgetary Compliance Report: Compares actual financial performance to planned budgets, ensuring that spending aligns with approved allocations.

Interpreting Financial Data

Being able to read and understand these statements is vital. Key aspects to focus on include:

- Revenue Recognition: Understanding when income is recognized and how it impacts the overall financial health of the entity.

- Expenditure Patterns: Analyzing where funds are spent and whether they are in line with policy objectives.

- Liabilities and Debt: Evaluating the level of debt and obligations the organization holds and their implications on long-term sustainability.

By mastering the interpretation of these documents, individuals can gain insights into the financial stability and operational efficiency of government bodies, making informed decisions based on factual data.

Common Challenges in Public Sector Exams

Individuals preparing for assessments related to government finance often face a range of challenges. These hurdles can stem from the complexity of the subject matter, the breadth of topics covered, and the specific nature of the problems encountered. Being aware of these obstacles in advance can help candidates devise effective strategies for overcoming them.

Here are some common challenges:

| Challenge | Potential Solutions |

|---|---|

| Complex Terminology | Familiarize yourself with key terms through study guides and practical examples. |

| Broad Range of Topics | Create a study plan that covers all critical areas, focusing on weak points. |

| Time Management | Practice under timed conditions to develop speed and efficiency. |

| Understanding Practical Scenarios | Work through case studies and past examples to build real-world application skills. |

| Adherence to Regulations | Study the relevant legal frameworks and ensure compliance with rules in every solution. |

By preparing for these challenges, candidates can improve their chances of success and approach their evaluations with greater confidence.

Top Exam Preparation Strategies

Effective preparation for assessments related to financial management in government entities requires a strategic approach. It’s not just about studying the material; it’s about understanding key concepts, practicing application, and managing time effectively. These strategies can help ensure that candidates approach their tests with confidence and the skills necessary to succeed.

Here are some of the most effective preparation methods:

- Create a Study Schedule: Plan your study sessions in advance, breaking down the material into manageable sections and allocating time for review.

- Focus on Key Areas: Identify the most important topics, such as financial reporting and budgeting, and dedicate more time to them.

- Practice with Past Content: Reviewing past materials and test content can help familiarize you with the format and common types of challenges.

- Utilize Study Groups: Discussing complex topics with peers can enhance understanding and offer new perspectives on difficult material.

- Take Regular Breaks: Avoid burnout by taking short breaks during study sessions to refresh and maintain focus.

- Simulate Test Conditions: Practice under timed conditions to improve speed and accuracy when solving problems.

By following these strategies, individuals can approach their preparation in an organized and effective manner, ensuring they are well-prepared for any challenges that may arise during their assessments.

Essential Accounting Principles to Master

Mastering the core principles of financial management is crucial for success in any evaluation related to managing public finances. These principles provide the foundation for making informed decisions, ensuring that funds are utilized effectively and in compliance with relevant regulations. A strong grasp of these concepts is vital for anyone seeking to navigate the complexities of governmental financial systems.

Key Principles to Focus On

Here are some of the most important principles to master:

- Accrual Basis of Accounting: Recognizing revenues and expenses when they are incurred, rather than when cash is received or paid, is a fundamental principle in managing financial records.

- Consistency: Consistently applying accounting methods ensures that financial statements are comparable across periods, making it easier to track performance.

- Transparency: Clear and accurate reporting ensures that stakeholders can easily understand the financial position of an organization, fostering trust and accountability.

- Materiality: Focusing on significant financial information that could influence decision-making is critical in ensuring relevant data is prioritized.

- Compliance: Adhering to legal and regulatory standards ensures that financial practices align with required guidelines and prevents errors in reporting.

Application in Real-World Scenarios

Understanding how to apply these principles in real-life situations is key. Practicing with examples and case studies will help you gain the ability to interpret complex financial data, ensuring that you can make sound decisions under various circumstances. By mastering these concepts, individuals can enhance their ability to manage finances effectively, ensuring that public resources are used responsibly.

How to Interpret Public Sector Reports

Interpreting financial documents from government entities requires a deep understanding of the various components that make up these reports. These documents are not just numbers; they tell the story of how resources are allocated, managed, and utilized. Being able to read and understand these reports is critical for making informed decisions and ensuring accountability in managing public resources.

Here are key steps to effectively interpret government financial reports:

- Understand the Structure: Familiarize yourself with the layout of the report. Typically, it includes a balance sheet, income statement, cash flow statement, and budget comparisons. Each section provides different insights into the financial health of the organization.

- Analyze Revenue Streams: Look at where the funds are coming from, whether through taxes, grants, or other sources. Understanding revenue helps assess sustainability.

- Review Expenditures: Focus on how the money is being spent, particularly in areas like public services, infrastructure, and social programs. This reveals how efficiently resources are being utilized.

- Check for Compliance: Ensure that the organization is adhering to financial regulations and laws. Non-compliance could signal potential issues or inefficiencies.

- Assess Debt Levels: High levels of debt could indicate financial instability, so it’s important to analyze the organization’s liabilities and compare them against assets.

By understanding these key areas, you can gain a clear picture of the financial standing of a government organization, ensuring transparency and better decision-making for future resource allocation.

Important Topics for Public Sector Exams

When preparing for evaluations related to managing governmental finances, certain topics tend to appear frequently and require focused study. These subjects form the foundation of financial management in public entities, covering areas that influence decision-making, budget management, and resource allocation. Mastery of these concepts is essential for success in the assessments.

Key Areas to Focus On

Below are some of the critical topics to prioritize in your preparation:

| Topic | Description |

|---|---|

| Financial Reporting | Understand the structure and purpose of financial statements, including balance sheets and income statements. |

| Budgeting Processes | Learn how budgets are prepared, approved, and monitored within governmental organizations. |

| Fund Accounting | Explore the concept of fund-based accounting, which is essential for managing different revenue sources and expenditures. |

| Regulatory Compliance | Familiarize yourself with the laws and regulations governing public financial management and reporting. |

| Audit Practices | Understand the role of audits in ensuring accountability and transparency in financial reporting. |

Strategic Importance of These Topics

Focusing on these topics will not only enhance your understanding of how financial management works within government organizations but will also improve your ability to interpret data and make well-informed decisions. By mastering these areas, you’ll be better prepared for any challenges that arise during the evaluation process.

Difference Between Public and Private Sector

Understanding the differences between government organizations and private businesses is fundamental to grasping how financial management works in each domain. While both operate with financial resources, their goals, structures, and regulatory environments differ significantly. These distinctions impact how they are governed, funded, and how they operate on a day-to-day basis.

Key Differences in Operations

Here are some important contrasts between these two areas:

- Goals and Objectives: Government organizations are focused on serving the public good, whereas private businesses aim to generate profit for their owners and shareholders.

- Funding Sources: Government entities typically rely on taxpayer funding, grants, and other public revenue streams, while private businesses are funded through investments, sales, and loans.

- Accountability: Public organizations are held accountable to the public and must follow strict regulatory frameworks, whereas private businesses are accountable to owners or shareholders.

- Decision-Making Processes: Decisions in the government sector are often influenced by political factors and public interest, while private sector decisions are driven by profitability and competition.

Impact on Financial Management

These differences have a direct impact on how financial decisions are made and how resources are managed in each environment. While private companies have more flexibility and focus on efficiency and profitability, governmental organizations must balance financial constraints with the responsibility of serving the public interest. Understanding these distinctions is essential for navigating financial frameworks within both domains.

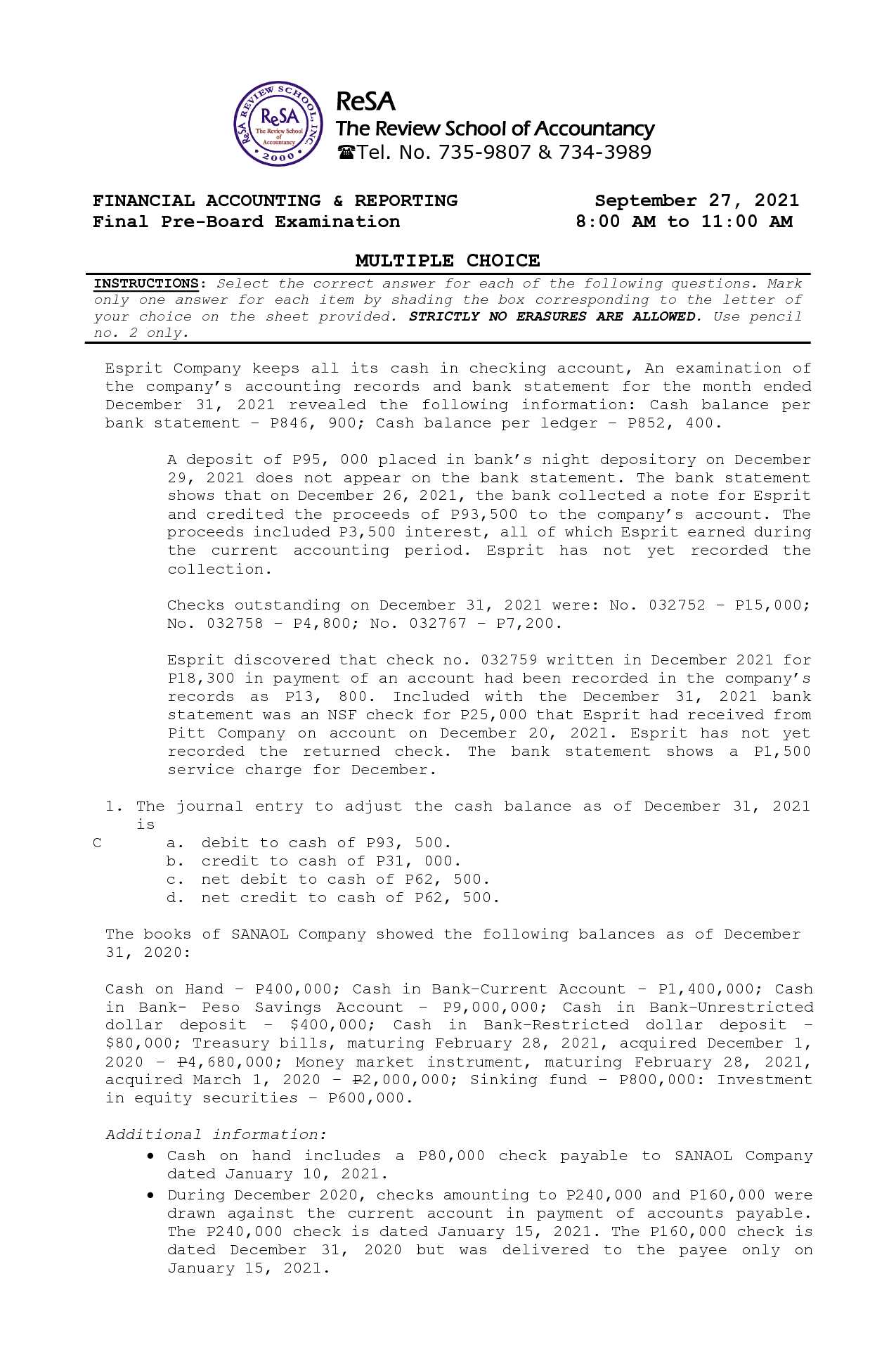

Practical Examples of Public Accounting

Real-world examples can provide valuable insights into how financial principles are applied within government organizations. These practical scenarios help to clarify how financial data is handled, reported, and used to make critical decisions. Understanding these applications is essential for mastering the complexities of managing funds and resources in the public domain.

Budget Allocation and Oversight

A common example of financial management in the government involves the annual budget. Governments allocate funds to various sectors, such as healthcare, education, and infrastructure. The budget must be carefully monitored to ensure that funds are spent according to plan, and any deviations need to be addressed promptly. Financial professionals in this field are responsible for tracking expenditures, preparing reports, and ensuring that taxpayer money is used effectively.

Grant Management and Reporting

Another example of how financial management is applied is in the administration of grants. Governments often provide financial support to local organizations, nonprofits, and businesses. Managing these grants involves ensuring that the recipients use the funds for the intended purpose and submit accurate reports on how the money was spent. Financial oversight is crucial in ensuring that these funds are accounted for properly, preventing fraud or misuse.

Critical Formulas for Exam Success

Mastering key formulas and concepts is essential for achieving success in assessments related to financial management within government organizations. These formulas help you quickly solve problems, analyze financial data, and apply theoretical knowledge in practical scenarios. Understanding the right formulas can make a significant difference in the efficiency and accuracy of your responses during evaluations.

Key Financial Formulas to Remember

Here are some of the essential formulas that are often used to solve complex financial problems:

- Budget Variance Formula:

Budgeted Amount – Actual Amount = Variance

This formula helps to analyze the difference between projected and actual financial performance, which is crucial for financial reporting and decision-making.

- Cost of Goods Sold (COGS):

Opening Stock + Purchases – Closing Stock = COGS

Understanding the cost of goods sold is critical for evaluating the efficiency of resource use and inventory management.

- Return on Investment (ROI):

Net Profit / Cost of Investment × 100 = ROI

Calculating ROI is essential for measuring the profitability and success of investments, especially in projects funded by public resources.

- Debt-to-Equity Ratio:

Total Debt / Total Equity = Debt-to-Equity Ratio

This ratio helps to assess the financial leverage of an organization, particularly useful in understanding how much of its operations are funded by borrowed money versus owner investment.

Applying Formulas in Real Situations

Mastering these formulas not only helps in answering theoretical questions but also aids in interpreting financial statements, creating budgets, and conducting financial analysis. Consistent practice with these calculations will improve your speed and confidence, ensuring you are well-prepared for any challenges during assessments.

How to Manage Your Exam Time

Effective time management is a crucial skill for success in any evaluation. Whether you’re facing theoretical challenges or practical applications, organizing your time ensures that you can address each task thoroughly without rushing. Developing a strategy for allocating time based on question difficulty and importance is key to achieving the best results.

Steps to Optimize Your Time

Here are some strategies to help you manage your time during an evaluation:

- Read Instructions Carefully: Before starting, read through all the instructions to understand the requirements. This helps you avoid making mistakes that could waste valuable time later.

- Survey the Entire Test: Quickly glance over the whole assessment. Identify the easier questions that you can complete quickly and tackle them first to gain momentum.

- Allocate Time for Each Section: Divide your total available time by the number of sections or questions, and allocate a specific amount of time for each one. Stick to this limit to avoid spending too long on any single task.

- Prioritize Based on Difficulty: If you’re unsure about a question, move on to the next one and come back to it later. This allows you to complete the easier questions first, building confidence.

- Monitor Your Time: Keep an eye on the clock and adjust your pace as needed. If you find yourself spending too much time on a particular question, move on to the next and return to it later.

Techniques to Stay Focused

To maintain focus and efficiency, it’s important to avoid distractions. Consider the following tips:

- Stay Calm: Anxiety can slow you down. Take deep breaths, stay positive, and focus on one task at a time.

- Avoid Perfectionism: Don’t strive for perfection on every question. Aim for accuracy and completeness within the time you have.

- Review Your Work: If time permits, leave a few minutes at the end to review your answers. This helps to catch any mistakes or missed details.

By using these strategies, you can maximize your performance, reduce stress, and ensure that you have enough time to address every aspect of the assessment effectively.

Reviewing Past Public Sector Exams

One of the most effective ways to prepare for upcoming assessments is to review past evaluations. By going through previous materials, you can familiarize yourself with the types of challenges that may appear, the structure of the content, and the level of difficulty. This practice not only reinforces knowledge but also helps build confidence for the test day.

Why Review Past Materials?

Going over past evaluations offers several advantages in preparation:

- Identify Common Topics: Certain subjects or themes often reappear in evaluations. By reviewing past materials, you can pinpoint these recurring areas and focus your study efforts on them.

- Understand Question Patterns: Past materials reveal how questions are framed. This helps you understand what examiners look for and how to structure your responses more effectively.

- Gauge Difficulty Level: Reviewing older tests gives you a sense of the difficulty you might encounter. Knowing what to expect can alleviate anxiety and help you approach the test with a calm mindset.

Best Practices for Reviewing Past Materials

To get the most out of your review sessions, follow these strategies:

- Simulate Test Conditions: Try to solve the past papers within the time limits and under similar conditions to those of the actual evaluation. This helps you manage time more effectively and work under pressure.

- Analyze Mistakes: Carefully review any errors you made while solving past materials. Understanding why a particular approach was wrong can help you avoid making the same mistake in the future.

- Mix Past Papers with Current Study: Integrate reviewing older evaluations with ongoing study. This allows you to test the knowledge you’ve gained in real exam scenarios and spot areas that may require additional focus.

By strategically using past evaluations as a tool, you can enhance your preparation, improve your performance, and ensure a greater chance of success on the day of the assessment.

Common Mistakes to Avoid in Exams

When preparing for assessments, there are several common errors that many people make which can significantly impact their performance. Recognizing and avoiding these pitfalls will help you approach your work more effectively, ensuring you maximize your results and avoid unnecessary setbacks.

One of the most frequent mistakes is not carefully reading the instructions. Many candidates rush into answering without fully understanding the requirements of the task. This can lead to incomplete or irrelevant responses. Another mistake is mismanaging time. Without allocating appropriate time to each section or question, it’s easy to spend too much time on one part, leaving others unfinished.

Here are some specific errors you should be mindful of:

- Rushing Through the Instructions: Failing to fully read and comprehend the instructions can lead to misunderstandings. Always take a moment to review what is being asked before starting.

- Skipping Questions: Sometimes, candidates skip difficult questions, hoping to come back to them later. This can be risky, especially if time runs out. It’s better to attempt an answer, even if it’s not perfect, than leave a question blank.

- Overcomplicating Answers: Overthinking or writing unnecessarily complex answers can waste valuable time. Stick to clear, concise responses that directly address the question.

- Not Reviewing Work: Many students neglect to review their answers. Even if you’re confident, always leave time to check for any obvious mistakes or omissions.

- Mismanaging Time: Not allocating time properly can lead to panic towards the end. Plan how much time to spend on each question before you begin.

By being aware of these common mistakes, you can avoid unnecessary errors and increase your chances of achieving your desired results. Focus on precision, time management, and clear understanding of instructions to perform at your best.

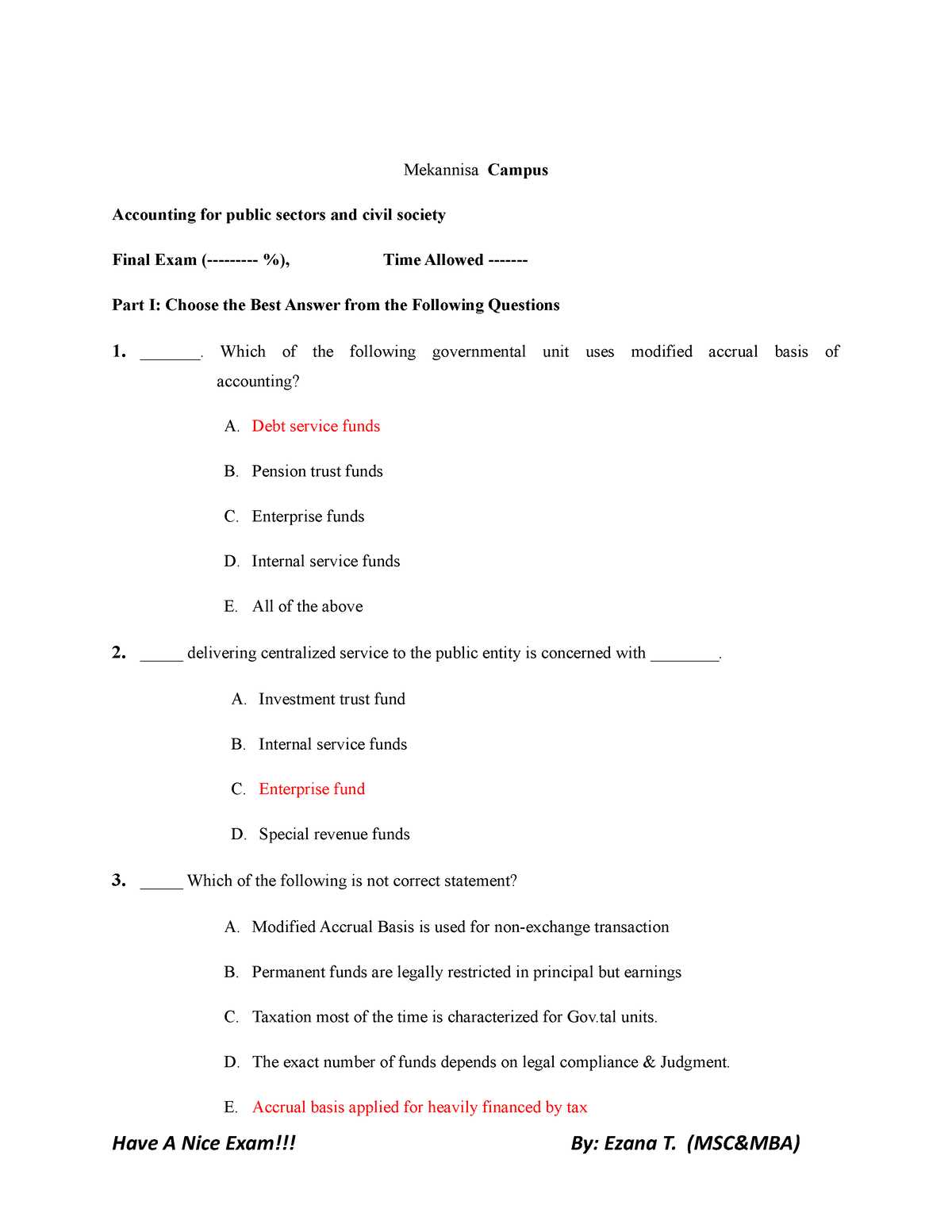

Test Your Knowledge with Practice Questions

One of the most effective ways to gauge your understanding and prepare for assessments is by engaging in regular practice. By attempting a variety of mock scenarios and challenges, you can identify areas where you need improvement, reinforce your strengths, and build confidence. This active approach not only helps solidify your knowledge but also enhances your ability to think critically under pressure.

Simulating the real experience with timed exercises can give you a better idea of how well you’re able to recall and apply what you’ve studied. Additionally, practicing with past scenarios allows you to familiarize yourself with the format and structure of tasks, so you’re less likely to be caught off guard during the actual assessment.

Practice Example 1: Financial Analysis

Below is an example of a practice exercise where you analyze a fictional scenario to test your understanding of financial statements.

| Scenario | Action Required |

|---|---|

| XYZ Corporation is facing cash flow problems. Their balance sheet shows rising liabilities with little growth in assets. What steps should they take to improve their situation? | List the potential actions to address cash flow challenges, considering methods like cost reduction, restructuring, or securing additional funding. |

| The company has large operational expenses that are disproportionate to its income. How would you address this issue from a financial management perspective? | Suggest strategies for balancing expenditures and income, such as cutting non-essential costs or increasing revenue sources. |

Practice Example 2: Budgeting and Forecasting

Here’s another example where you will test your skills in budgeting and forecasting for an organization.

| Scenario | Action Required |

|---|---|

| Your organization is planning a budget for the next fiscal year. How would you estimate the expected revenue based on historical data? | Use past financial performance data to predict future revenue, taking into account market trends and potential growth opportunities. |

| The organization plans to introduce a new project with high upfront costs. How would you forecast the project’s return on investment over the next five years? | Discuss methods for calculating ROI, including net present value and internal rate of return, considering both short-term and long-term benefits. |

These practice exercises are designed to test your ability to apply knowledge in real-world contexts. By repeating such exercises regularly, you will be better prepared to handle complex challenges and improve your overall performance.

Understanding Budgeting in Public Sector

Effective financial management in governmental organizations involves the allocation of resources to meet the needs of the community. Budgeting plays a key role in this process, ensuring that funds are distributed efficiently to achieve the desired outcomes. This process includes both short-term and long-term planning, where priorities are set, expenses are projected, and revenue is forecasted to support various initiatives.

The budget serves as a tool for financial control, helping to track and measure the performance of programs, projects, and services. It also provides a framework for decision-making, guiding leaders in determining where to allocate resources for maximum benefit. Properly constructed, it helps maintain transparency, accountability, and sustainability in the use of financial resources.

Key Components of a Budget

The budget in this context typically consists of several key components, which are outlined below:

- Revenue Forecasting: Estimating the income expected from various sources, such as taxes, grants, or service fees.

- Expenditure Planning: Identifying the costs required for delivering services, maintaining infrastructure, and supporting operations.

- Deficit/Surplus Management: Analyzing the difference between expected revenues and planned expenditures, aiming for balance.

- Capital Budgeting: Allocating funds for large, long-term projects like infrastructure development or technology upgrades.

- Monitoring and Reporting: Establishing mechanisms to track progress and ensure adherence to financial plans.

Types of Budgeting Approaches

Various approaches can be employed when preparing financial plans, each serving a distinct purpose depending on the goals and structure of the organization. Here are a few common approaches:

- Incremental Budgeting: A method where the previous year’s budget serves as a base, with adjustments made for inflation or changes in priorities.

- Zero-Based Budgeting: Each item in the budget is evaluated from scratch, with no assumptions made based on previous budgets.

- Performance-Based Budgeting: A focus on aligning financial resources with specific program outcomes, ensuring accountability for results.

- Program Budgeting: Organizing expenditures by specific programs, allowing for more detailed allocation of resources toward particular goals.

By understanding the principles and strategies behind budgeting, organizations can ensure the responsible and effective management of funds, allowing them to achieve their objectives while remaining accountable to stakeholders. This knowledge is crucial for both financial officers and decision-makers working to maintain the fiscal health of governmental entities.

Legal and Ethical Aspects in Accounting

The integrity and credibility of financial information depend on adherence to legal regulations and ethical standards. In any financial practice, it is essential to ensure compliance with laws that govern financial transactions and reporting, while also maintaining high moral standards. The intersection of these two areas plays a significant role in establishing trust between financial professionals, stakeholders, and the public.

Legal obligations often include following regulations set by government bodies or industry standards, while ethical considerations ensure that decisions are made with honesty, transparency, and fairness. Both factors are crucial in preventing fraud, conflicts of interest, and financial misstatements that can lead to legal penalties and damage to an organization’s reputation.

Key Legal Considerations

Financial professionals must adhere to various legal requirements, including the following:

- Compliance with Laws: Ensuring that all financial statements and reports meet the legal standards set by local and international authorities.

- Taxation Laws: Understanding and following tax regulations to avoid penalties and fines related to improper reporting or non-compliance.

- Regulatory Oversight: Adhering to the guidelines provided by regulatory agencies that monitor financial practices, such as the Securities and Exchange Commission (SEC) in the U.S.

- Contractual Obligations: Upholding the terms and conditions of financial agreements, ensuring that all transactions are legal and binding.

Ethical Standards in Financial Practices

Ethics play a vital role in decision-making processes, guiding professionals in making choices that are in the best interest of all stakeholders. Common ethical principles include:

- Honesty and Integrity: Providing truthful, accurate, and clear financial information, without falsifying records or concealing material facts.

- Confidentiality: Protecting sensitive information and ensuring that it is not disclosed to unauthorized parties.

- Objectivity: Avoiding bias and conflicts of interest when reporting financial data or making decisions that could affect financial statements.

- Transparency: Offering clear and understandable financial information that allows stakeholders to make informed decisions.

Legal vs. Ethical Dilemmas

While legal requirements and ethical guidelines often align, there are situations where they may conflict. Financial professionals may face dilemmas in which adhering to the law could contradict ethical principles, or vice versa. In such cases, it is crucial to prioritize transparency, consult with legal advisors, and act in a manner that reflects the values of integrity and fairness.

| Legal Requirement | Ethical Standard |

|---|---|

| Compliance with tax regulations | Ensuring transparency in financial reporting |

| Adhering to contractual terms | Maintaining fairness in financial transactions |

| Following regulatory guidelines | Making decisions based on objectivity, not personal gain |

By understanding both legal requirements and ethical principles, professionals can ensure that their actions align with both legal standards and the moral expectations of society, contributing to the long-term success and sustainability of the financial industry.

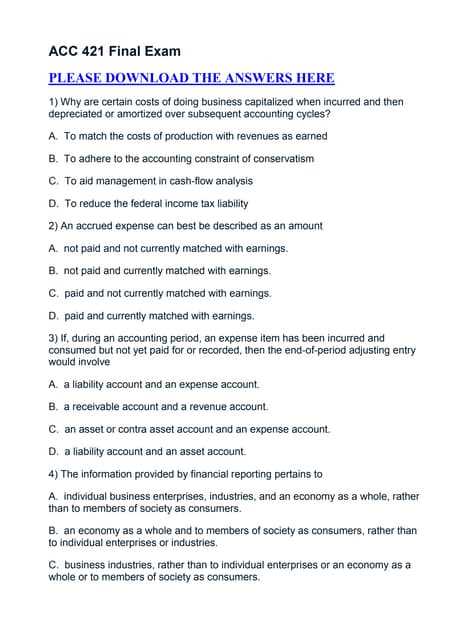

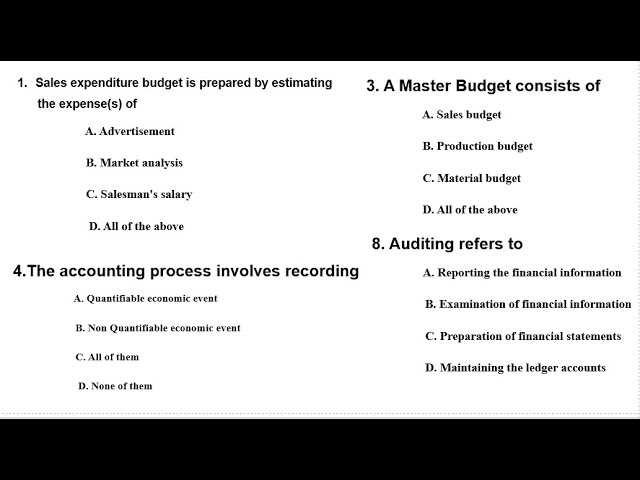

Preparing for Multiple-Choice Questions

Approaching multiple-choice assessments requires a strategic mindset and an understanding of how to effectively analyze and respond to the various answer choices. The key to success lies in careful preparation, mastering the subject matter, and developing techniques to increase accuracy under time constraints. By familiarizing oneself with the format and practicing the right strategies, it becomes easier to eliminate incorrect options and confidently choose the right answer.

Here are some effective methods to prepare for such assessments:

- Understand the Concept: Focus on the core ideas rather than memorizing facts. Multiple-choice questions often test your understanding of key concepts, so having a deep grasp of the material will allow you to apply logic to eliminate incorrect answers.

- Practice Regularly: The more you practice with sample questions, the more comfortable you’ll become with identifying the best responses. Make use of available resources, including past tests, practice quizzes, and mock tests, to familiarize yourself with the types of questions you might face.

- Analyze the Options: Carefully evaluate each option. Often, there will be one choice that is clearly wrong, which you can eliminate right away. Sometimes, answers will contain slight variations, so be sure to read every word and understand what the question is truly asking.

- Use the Process of Elimination: If you are uncertain about the answer, try to eliminate as many wrong answers as possible. This increases your chances of selecting the correct option by narrowing down your choices.

- Don’t Rush: Read each question carefully before answering. Rushed decisions can lead to careless mistakes, so take your time and ensure you fully understand what is being asked.

By applying these strategies, you can increase your chances of success in multiple-choice assessments, ensuring that you approach each question with confidence and accuracy.