Preparing for a professional qualification in taxation requires a deep understanding of complex principles and regulations. For those aiming to excel in their studies, mastering the essential topics is crucial for success. Whether you’re new to the field or seeking to refine your knowledge, tackling these subjects effectively can make a significant difference in your performance.

Practice plays a pivotal role in reinforcing your understanding. By engaging with practical scenarios and analyzing common patterns in previous assessments, you can enhance your problem-solving skills. Focusing on the core topics ensures you’re well-equipped to handle the variety of challenges that may arise during testing.

Additionally, familiarizing yourself with key laws, rules, and calculations is fundamental. With a structured approach to preparation, you can boost your confidence and be ready to tackle any situation that might come your way. Make sure to study both theoretical concepts and practical applications to achieve the best possible outcome in your assessment journey.

Essential Assessment Preparation Tips

Successfully navigating a challenging evaluation requires more than just theoretical knowledge. To perform at your best, it is important to focus on key preparation strategies that will help you understand the material deeply and approach the assessment with confidence. Here are some essential tips for effective preparation:

- Understand Core Principles: Make sure you have a strong grasp of fundamental concepts. Review the main rules, frameworks, and calculations to build a solid foundation.

- Practice with Real-Life Scenarios: Apply your knowledge to practical examples. This helps in solidifying your understanding and improves your ability to handle various situations.

- Use Past Material: Going through previous assessments allows you to familiarize yourself with the question structure and the types of topics that frequently appear.

- Stay Organized: Keep track of important dates, materials, and progress. Plan your study sessions to focus on the areas that need the most attention.

- Work on Time Management: Developing a strategy for managing your time during the assessment is essential. Practice under timed conditions to improve your speed and accuracy.

Incorporating these strategies into your study routine will provide a structured approach to preparation and improve your chances of success. Focus on refining both your theoretical knowledge and practical application skills to tackle the challenge effectively.

Understanding the Basics of Taxation

Grasping the foundational concepts of indirect taxation is essential for anyone pursuing a career in finance or accounting. This area of taxation involves understanding how certain taxes are applied to goods and services at different stages of the production and distribution process. Mastering the core principles is critical to handling more complex scenarios in the future.

The Taxable Process

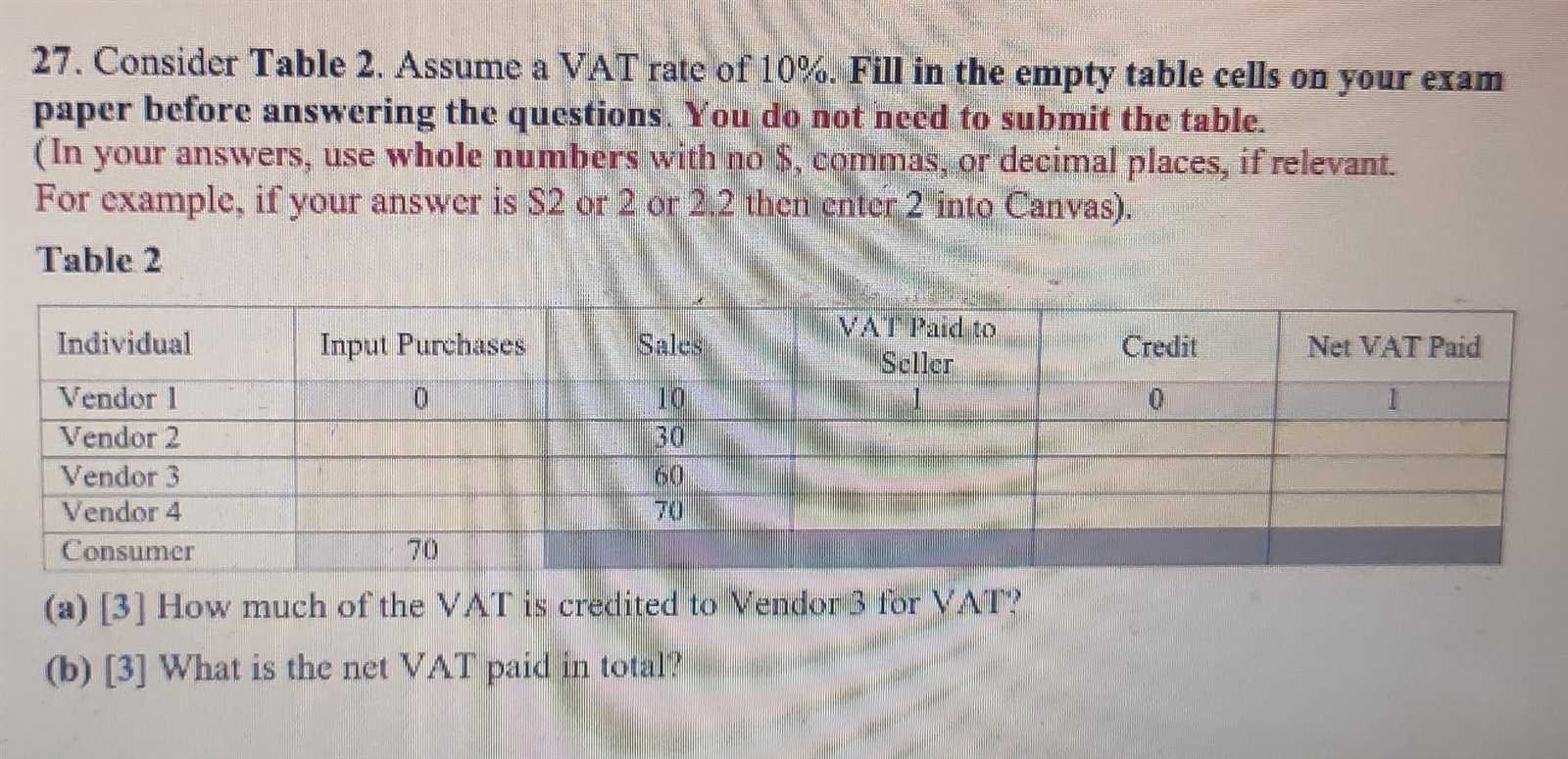

In simple terms, taxes are levied on the value added at each step of production or sale. This means businesses collect a portion of the tax from their customers and remit it to the government. The amount owed depends on the value added at each stage, creating a cumulative effect as goods or services move through the supply chain.

Key Elements to Focus On

To build a strong understanding, focus on the following areas: tax rates, exemptions, and how to calculate the amount due. Knowing the different categories and classifications of goods, along with the relevant tax rates, will ensure you can apply the right calculations in various situations. Understanding the process of compliance and filing is equally important for ensuring accuracy and avoiding errors.

Common Tax Assessment Topics to Focus On

Focusing on the most relevant areas is crucial when preparing for a professional qualification in taxation. Understanding the key subjects that are often tested will help you prioritize your studies and increase your chances of success. Here are some common topics that frequently appear in assessments:

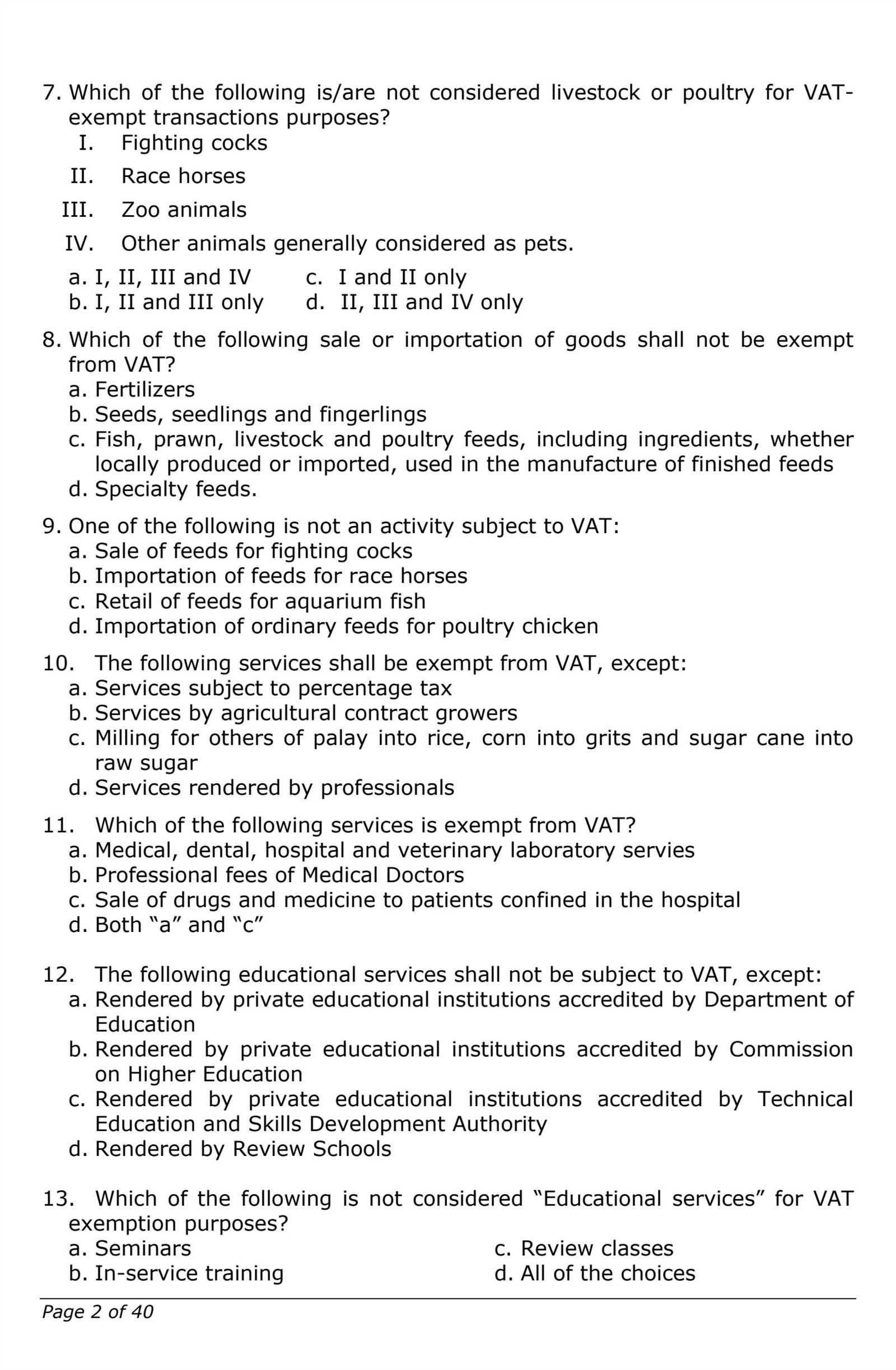

- Taxable Transactions: Understand the different types of transactions subject to taxation, including sales, purchases, and exchanges of goods and services.

- Exemptions and Reduced Rates: Familiarize yourself with which goods or services are exempt from taxation or subject to reduced rates. These can vary depending on jurisdiction and context.

- Registration Requirements: Know the criteria for when businesses must register for tax purposes, as well as the implications of non-registration.

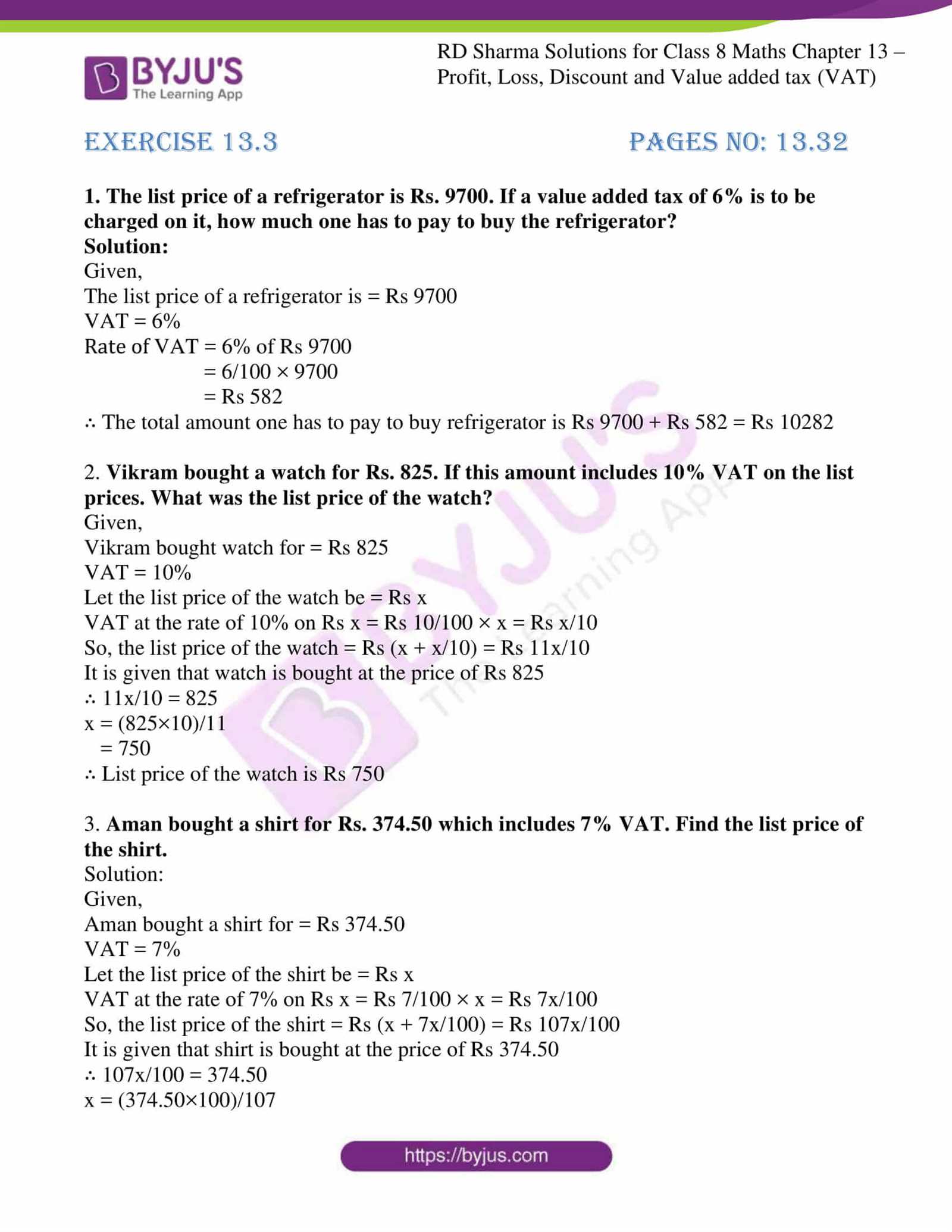

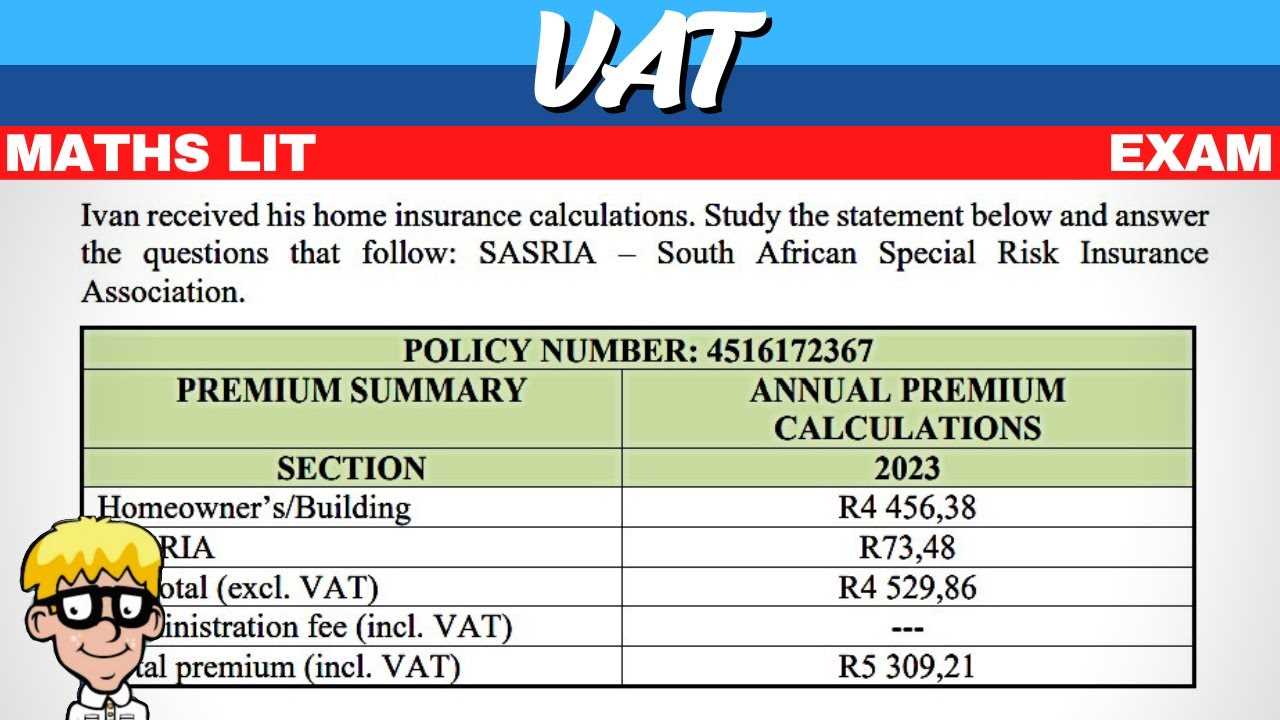

- Tax Calculation Methods: Master the formulas used to calculate the amount due at each stage of the process, including the application of tax rates to taxable amounts.

- Compliance and Reporting: Understand the necessary procedures for filing returns, making payments, and maintaining proper records in accordance with regulations.

By focusing on these core subjects, you can ensure a comprehensive understanding of the material and approach your study sessions with confidence. Prioritizing these topics will also help you apply the principles in real-world scenarios effectively.

Effective Strategies for Answering Tax Queries

To succeed in professional assessments, having a clear strategy for tackling questions is crucial. Approaching problems in a structured way ensures you address all aspects thoroughly and minimize errors. Here are some effective strategies that can help you perform at your best:

Read the Instructions Carefully

Before jumping into any solution, take a moment to fully understand the task. Carefully read through the prompt to identify what is being asked. Pay close attention to specific instructions such as required calculations, important details, or any exemptions that may apply. Missing even a small part of the instruction can lead to incomplete or incorrect responses.

Break Down Complex Scenarios

In many cases, problems can seem overwhelming due to their complexity. Break down each scenario step-by-step, identifying the key components that need to be addressed. Start with the basics and gradually work through the problem, ensuring each calculation is accurate and that you understand how it fits within the broader context. Don’t hesitate to simplify complex questions into smaller, manageable parts.

Stay Calm and Organized throughout the process. Maintain focus and ensure your work is methodical. Whether you are calculating values or applying laws, keep your steps clear to avoid confusion. Effective time management and organized thought processes are essential for presenting clear and precise solutions.

Key Tax Laws You Must Know

To navigate the complexities of taxation, it is essential to understand the key regulations that govern the system. Knowledge of these laws not only ensures compliance but also enables accurate application of the rules in various scenarios. Here are the most important tax laws that you should be familiar with:

- Registration Requirements: Understand when and how a business must register with the relevant authorities. This includes knowing the thresholds for mandatory registration and the process involved.

- Taxable Events: Familiarize yourself with the circumstances under which tax becomes due. This includes understanding the distinction between taxable and exempt transactions.

- Rates of Tax: Be aware of the different tax rates applied to various goods and services. Some items may be subject to standard rates, while others may qualify for reduced or zero rates.

- Exemptions and Exceptions: Know which goods or services are exempt from taxation, as well as any special exceptions that may apply to certain industries or sectors.

- Compliance Obligations: Learn about the filing and reporting requirements, including deadlines for submission of returns and payment of dues. Familiarity with these deadlines is critical for avoiding penalties.

Mastering these laws is essential for both theoretical understanding and practical application. They form the foundation for making informed decisions and handling various financial situations accurately.

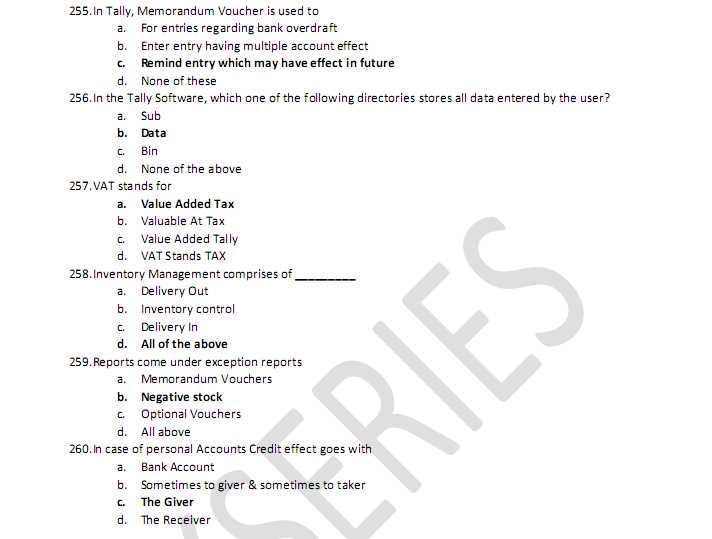

Types of Inquiries in Tax Assessments

When preparing for a professional qualification, understanding the various types of inquiries you may encounter is essential. Different formats test your ability to apply your knowledge in practical scenarios. Recognizing the types of problems can help you approach each task effectively and confidently. Here are the main types of tasks you may face:

Conceptual Understanding

These types of tasks assess your grasp of fundamental concepts. They may ask you to explain key principles, identify correct definitions, or apply theoretical knowledge to basic situations. The goal is to test your ability to recall important rules and apply them accurately.

- Define key terms: Identify and explain the meaning of specific terminology used in taxation.

- Clarify rules: Describe the main principles governing transactions, exemptions, or calculations.

Practical Problem Solving

These tasks require you to solve real-world scenarios, applying the relevant rules to calculate amounts due, identify exemptions, or determine compliance. The focus is on applying theoretical knowledge to practical situations.

- Calculate amounts: Determine the correct tax payable based on provided figures.

- Assess compliance: Evaluate whether certain actions or transactions meet regulatory standards.

By recognizing these types of tasks, you can tailor your preparation to focus on both understanding the theory and developing your problem-solving skills.

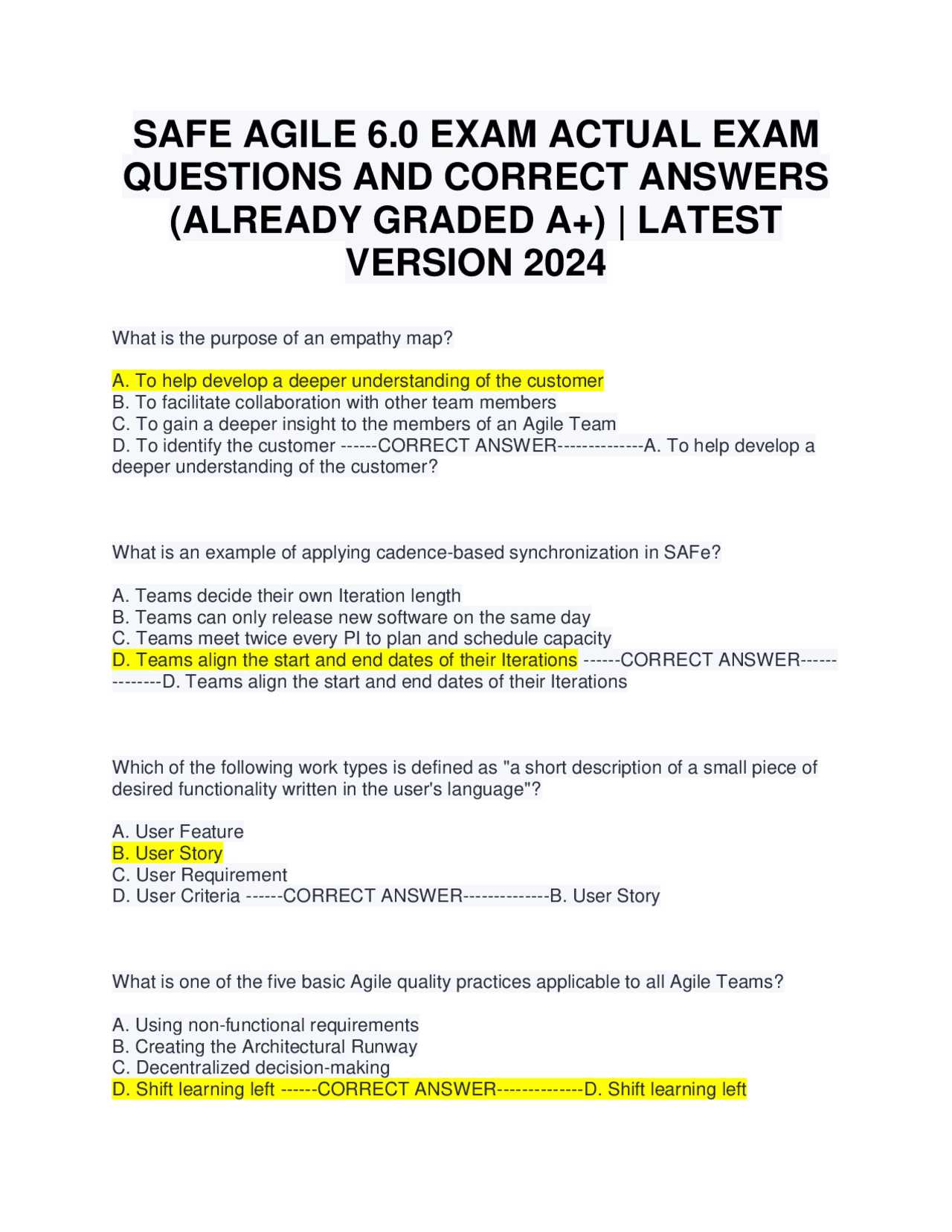

How to Approach Multiple Choice Tax Inquiries

Multiple-choice tasks are common in professional assessments and require a strategic approach to maximize accuracy. These tasks test your ability to identify the correct answer from a set of options, often challenging your understanding of the material. By using effective techniques, you can increase your chances of selecting the right answer.

Here are some strategies for approaching multiple-choice inquiries:

| Strategy | Description |

|---|---|

| Read Carefully | Ensure that you understand the question fully before looking at the options. Sometimes the phrasing can be tricky, and paying attention to detail will help avoid mistakes. |

| Eliminate Wrong Options | Start by crossing out the clearly incorrect choices. Narrowing down your options will improve your chances of selecting the right one. |

| Look for Keywords | Identify any key terms or concepts in the options that directly relate to the material you’ve studied. This can help guide you to the most accurate answer. |

| Don’t Overthink | If you’re unsure, trust your first instinct. Often, your initial choice is the correct one, especially when you’ve studied thoroughly. |

| Manage Your Time | Don’t spend too much time on one question. If you’re unsure, move on and come back to it later. |

By following these strategies, you can approach multiple-choice inquiries with greater confidence, ensuring that you make the most of your preparation and answer selection process.

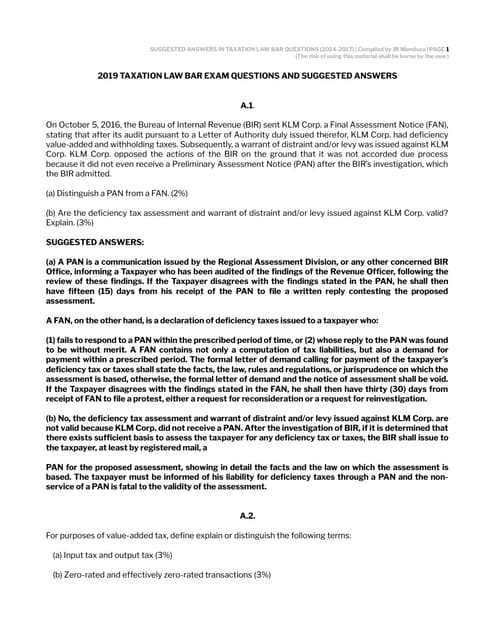

Understanding Tax Returns and Their Importance

Tax returns are essential documents that businesses must submit to the relevant authorities at regular intervals. These filings outline the amount of tax a business owes, ensuring compliance with national regulations. Understanding how to prepare and file these returns accurately is crucial for avoiding penalties and maintaining proper financial records.

The Process of Filing Tax Returns

Filing tax returns involves several key steps, from collecting the necessary data to submitting the forms to the appropriate tax office. It is important to ensure that all information is correct and up-to-date, as errors can lead to costly mistakes.

| Step | Description |

|---|---|

| Data Collection | Gather all relevant financial documents, including sales records, purchase invoices, and previous returns, to ensure accuracy. |

| Calculations | Calculate the amount owed or the amount to be refunded, depending on the transactions within the period. Ensure that tax rates and exemptions are applied correctly. |

| Submission | Submit the completed forms within the specified deadline, either electronically or via paper, depending on the regulations. |

The Importance of Accurate Tax Filing

Accurate filing is critical for businesses to avoid fines, interest charges, or audits. Regular submissions also help maintain transparency, ensuring that the business complies with financial regulations. Proper filing can also affect a company’s ability to recover overpaid taxes or claim any applicable credits or deductions.

Time Management Tips During Tax Assessments

Efficiently managing your time during an assessment is crucial to ensuring that you can complete all tasks thoroughly and accurately. Without a clear strategy, it’s easy to lose focus and waste valuable minutes. Proper planning and organization can significantly boost your performance and help you stay calm under pressure.

Setting Priorities

Before you begin, take a moment to assess the tasks ahead. Prioritize based on difficulty, importance, or familiarity. By tackling the easier or higher-point questions first, you can gain confidence and ensure you don’t run out of time for more challenging tasks.

| Strategy | Benefit |

|---|---|

| Read All Instructions First | Reading the full set of instructions helps you understand what’s required, preventing mistakes later on. |

| Allocate Time for Each Task | Estimate how long each section should take and stick to it. This prevents spending too much time on any one task. |

| Skip Difficult Tasks | If you’re stuck, move on to easier sections and come back later. This ensures you’re making progress rather than wasting time. |

| Double-Check Before Submitting | Leave a few minutes at the end to review your answers and correct any obvious mistakes. |

Staying Focused

Focus is key when managing time effectively. Eliminate distractions and concentrate solely on the task at hand. Maintaining a steady pace and keeping your attention on the current question will help you avoid rushing and making errors later on.

Common Mistakes to Avoid in Tax Assessments

During assessments, it’s easy to make small errors that can have a big impact on your overall performance. By being aware of these common mistakes, you can take steps to avoid them and improve your results. Preparation, focus, and attention to detail are key to minimizing errors and maximizing your accuracy.

Here are some frequent mistakes that candidates often make:

- Misunderstanding the Question – Carefully read each task to ensure that you fully understand what is being asked. Skimming through questions can lead to misinterpretation and incorrect answers.

- Overlooking Instructions – It’s easy to skip over specific instructions that could affect how you approach the task. Always read the instructions thoroughly before starting.

- Rushing Through Calculations – Speed is important, but rushing through calculations can lead to mistakes. Take your time to ensure accuracy, especially in numerical tasks.

- Failing to Check Work – Not reviewing your responses before submitting can result in simple errors being missed. Always leave time at the end for a final check.

- Not Managing Time Properly – Poor time management can cause unnecessary stress and result in incomplete answers. Make sure to allocate enough time to each section and avoid spending too much time on any one part.

By avoiding these common pitfalls, you can approach each task with more confidence and achieve better results.

How to Interpret Tax Legislation Effectively

Interpreting legal texts, especially those related to taxation, requires a structured approach. Understanding the language, context, and application of regulations is crucial for making informed decisions. It’s essential to not only focus on the literal meaning of terms but also understand their practical implications and how they relate to specific scenarios.

Key Steps for Interpreting Legal Texts

Following a clear process can help break down complex legal language and make it easier to apply the rules correctly. Here are the main steps to take when interpreting tax legislation:

- Understand the Purpose – Before diving into specific clauses, understand the purpose of the legislation. This context helps clarify why certain provisions are included.

- Identify Key Definitions – Legal documents often define terms that might not be immediately clear. Make sure to check the definitions section to avoid misunderstandings.

- Pay Attention to Exceptions – Many tax rules come with exceptions or special conditions. Identifying these exceptions is critical for applying the rules accurately.

- Analyze Recent Amendments – Tax laws evolve over time. Always review the most recent updates or amendments to ensure compliance with the latest requirements.

- Look for Judicial Interpretations – Court rulings or official interpretations can clarify ambiguous parts of the legislation, offering further guidance on how to apply the rules in real-world situations.

Practical Tips for Effective Interpretation

In addition to understanding the text itself, it’s helpful to apply the rules to practical situations. Testing your interpretation through case studies or hypothetical scenarios can reinforce your understanding and help prevent misapplication of the law.

- Consult with Experts – When in doubt, consult legal professionals or specialists in taxation. Their expertise can provide clarity and ensure that you’re interpreting the legislation correctly.

- Practice Regularly – The more you familiarize yourself with legal texts, the easier it becomes to interpret them. Regular practice and review help reinforce your knowledge.

Practice Exercises for Tax Assessment Success

One of the most effective ways to prepare for any assessment is by practicing with sample tasks. This approach helps you familiarize yourself with the format, identify the most important concepts, and develop the skills needed to answer questions confidently. Regular practice can also help pinpoint areas that need further attention, ensuring a well-rounded preparation.

Here are some examples of practice exercises to help you succeed:

- Scenario-Based Problems: Create hypothetical situations that reflect real-world tax challenges. Work through these examples to apply your knowledge and test your problem-solving abilities.

- Multiple-Choice Tests: Use multiple-choice formats to test your knowledge quickly. These can help assess your ability to recall key facts and make quick, accurate decisions.

- Short-Answer Tasks: Practice responding to brief prompts. This will help you refine your ability to explain concepts concisely and accurately.

- Time-Constrained Simulations: Set a time limit when practicing tasks. This will help you build speed and efficiency under pressure, a key skill for any assessment.

- Mock Reviews: After completing exercises, review your work critically. This process of self-assessment allows you to identify mistakes and refine your approach.

By regularly engaging in these practice exercises, you’ll develop a deeper understanding of the material and improve your readiness for the real assessment.

Reviewing Past Tax Assessment Papers

Going through previous assessments is an invaluable way to enhance your preparation. By analyzing past papers, you not only become familiar with the structure of the tasks but also gain insights into recurring themes and topics. This process helps to sharpen your understanding of what is most likely to appear and what areas require more attention.

Benefits of Reviewing Past Papers

Reviewing past assessments offers multiple advantages for anyone preparing for a tax-related test:

- Understanding the Format: Familiarity with the types of tasks and how they are structured makes it easier to navigate the assessment process with confidence.

- Identifying Common Topics: Certain topics tend to appear regularly, so reviewing past papers can help you pinpoint the most important areas to focus on.

- Improving Time Management: Practicing with real past papers under time constraints helps you build the ability to manage your time effectively during the actual test.

- Learning from Mistakes: By reviewing the correct answers and solutions, you can learn from your previous mistakes and avoid repeating them in the future.

How to Effectively Review Past Papers

To get the most out of reviewing past papers, consider these strategies:

- Take Notes: While reviewing, make sure to note down important concepts, tricky areas, or any patterns you notice across different papers.

- Recreate the Conditions: Try solving past papers in a timed setting to simulate the pressure of the actual test.

- Discuss with Peers: If possible, join a study group where you can discuss your findings and get different perspectives on the questions and solutions.

By actively engaging with past assessments, you will not only improve your performance but also develop a deeper, more practical understanding of the material. This process is key to building both confidence and competence for the real test.

What to Do Before Your Tax Assessment

Proper preparation before any important evaluation can significantly impact your performance. The hours leading up to the test are crucial for reinforcing knowledge, managing stress, and ensuring readiness. By following a few strategic steps, you can approach your assessment with greater confidence and clarity.

Last-Minute Preparation Strategies

In the days and hours before your assessment, consider implementing these helpful practices to maximize your success:

- Review Key Concepts: Go over the most critical topics that have been consistently covered in your study materials. Focus on concepts you may have found challenging during your practice sessions.

- Practice with Simulations: Complete a few practice tasks under timed conditions. This will help you build speed and identify areas where you might still need improvement.

- Organize Your Materials: Ensure that all the materials you need for the assessment are ready. Whether it’s your identification, pens, or any other essentials, gather them the night before.

- Stay Calm and Focused: Avoid last-minute cramming, as it can increase anxiety and confusion. Instead, take time to relax and trust in your preparation.

- Prepare Mentally: Engage in some light relaxation or mindfulness exercises to clear your mind and ease any tension. A positive mindset can significantly affect your performance.

What to Avoid the Day Before

Avoiding certain actions before the test can help you maintain focus and energy:

- Avoid Stressful Activities: Steer clear of activities that could heighten your anxiety or distract you from your goal, such as trying to learn new information at the last minute.

- Don’t Stay Up Late: Ensure you get enough rest the night before. A well-rested mind is more alert, focused, and capable of retaining key information.

- Resist Overthinking: Don’t overanalyze the material or second-guess yourself. Trust in the effort you’ve already put in and avoid dwelling on minor uncertainties.

Taking these steps before your assessment will set you up for a more organized and confident approach. When you walk into the test feeling prepared and calm, you’re more likely to perform at your best.

Understanding Compliance for Assessments

Mastering the necessary regulations and rules is essential for successfully completing any structured assessment in this field. Compliance with the relevant standards ensures that you can approach your evaluation with the right knowledge and mindset. It’s not just about memorizing facts, but also about understanding the key principles and how to apply them correctly in various scenarios.

Key Aspects of Compliance to Know

Being compliant means you are adhering to both the fundamental laws and any specific guidelines associated with the subject area. Here are some important aspects to consider:

- Understanding Relevant Rules: Familiarize yourself with the specific regulatory framework governing the subject matter. This includes staying updated on any recent changes that may affect your assessment.

- Focusing on Correct Procedures: Practice applying the correct procedures and methods required by the regulations. This is vital for demonstrating your practical understanding and ensuring accurate outcomes in any scenario.

- Identifying Key Requirements: Every assessment has certain key principles that must be followed. Whether it’s about deadlines, documentation, or specific actions, knowing these ahead of time will allow you to perform with confidence.

Common Pitfalls to Avoid

In order to stay compliant and avoid errors, be mindful of common pitfalls that often trip people up during assessments:

- Overlooking Updates: Regulations can change, so staying informed on the latest updates is crucial. Not knowing about recent changes can result in misunderstandings during the assessment.

- Misunderstanding Procedures: Be careful not to skip or misapply any necessary steps. Each stage may be vital to the overall process, and neglecting any part can negatively impact your results.

- Failing to Follow Instructions: Always follow the instructions carefully and precisely. Ignoring details or assuming shortcuts may lead to mistakes that could affect your compliance and performance.

By understanding and adhering to the necessary compliance standards, you will be better equipped to tackle any challenges in your assessment. This approach ensures that you are not just answering questions but demonstrating a deeper understanding of the core principles at play.

How to Improve Your Knowledge in Taxation

Building a solid foundation in taxation principles is essential for anyone aiming to succeed in assessments related to this field. Enhancing your understanding requires a combination of active learning, practical application, and staying updated with the latest developments. It’s about focusing on key concepts, honing your analytical skills, and ensuring you can apply your knowledge effectively in real-world scenarios.

Here are some effective strategies to help deepen your knowledge and improve your overall understanding of the subject:

- Study Core Concepts Thoroughly: Focus on understanding the fundamental principles that govern taxation. Make sure you grasp how taxes work, the key rules that apply, and their impact on various entities.

- Practice Regularly: Consistent practice is key. Work through various case studies, scenarios, and exercises to reinforce your knowledge. The more you apply what you’ve learned, the better prepared you’ll be.

- Engage with Resources: Utilize textbooks, online courses, and official documentation to deepen your knowledge. Seek out reputable sources that provide accurate and up-to-date information.

- Join Study Groups: Collaborating with peers can be incredibly valuable. Group discussions can help clarify difficult concepts, provide alternative viewpoints, and ensure you’re not missing key details.

- Stay Informed on Legal Updates: Tax laws and regulations evolve regularly. Subscribe to newsletters, read legal updates, and participate in webinars to stay on top of changes that may impact your field.

By implementing these strategies and dedicating time to focused learning, you will gradually improve your knowledge, feel more confident in applying your skills, and be better equipped to face challenges in the subject matter.

Top Resources for Taxation Study

To excel in any assessment related to taxation, it’s crucial to rely on high-quality study materials that cover both foundational principles and advanced topics. A diverse selection of resources can provide a well-rounded understanding and offer valuable insights. Whether you’re looking for textbooks, online courses, or practical guides, choosing the right study tools will make your preparation more efficient and comprehensive.

Here are some excellent resources to support your learning journey:

- Official Guides and Handbooks: Start with authoritative books and guides that outline key tax principles, regulations, and case studies. These resources are invaluable for both beginners and advanced learners.

- Online Learning Platforms: Websites offering structured courses on taxation provide video tutorials, quizzes, and practical exercises. Popular platforms like Coursera and Udemy offer a variety of courses designed by experts in the field.

- Taxation Websites and Blogs: Blogs and specialized websites provide up-to-date news, analysis, and discussions on taxation laws. These resources are helpful for staying current with the latest developments and learning from real-world examples.

- Practice Papers and Case Studies: Solving practice papers is an effective way to assess your progress. Many resources provide past papers, mock assessments, and scenario-based questions to help you apply theoretical knowledge in practical situations.

- Interactive Forums and Study Groups: Join forums and study groups where you can ask questions, discuss complex topics, and share resources with fellow learners. Platforms like Reddit or specialized tax forums can offer community support.

By incorporating these resources into your study plan, you can enhance your understanding, stay motivated, and ensure you’re fully prepared for any assessment in the field.