Passing a certification related to financial services requires focused preparation and understanding of key concepts. This process involves studying essential principles, familiarizing oneself with various types of inquiries, and practicing with realistic scenarios. Success depends on recognizing patterns in questions and knowing the material inside out.

To achieve a strong performance, it is vital to explore both theoretical knowledge and practical applications. By focusing on the most common topics covered in the evaluation, candidates can boost their confidence and readiness. Using study aids and practicing with mock tests can help reinforce important information.

Whether you are new to the field or revisiting the content, staying organized and strategic in your approach can make all the difference. Building your skill set through careful review and thorough practice will lead to a smoother path toward certification success.

Overview of Financial Services Certification

Achieving certification in the field of financial services requires a thorough understanding of key principles, regulations, and the core aspects of the profession. The process is designed to assess both knowledge and practical skills, ensuring candidates are equipped to meet industry standards. Preparation involves familiarizing oneself with the subjects most commonly tested and practicing the application of these concepts in real-world scenarios.

Structure of the Assessment

The assessment consists of multiple sections, each targeting different areas of expertise. From general principles of financial products to regulatory practices, every segment tests your ability to interpret and apply what you’ve learned. By breaking down these components and reviewing relevant study materials, you can gain a better grasp of what to expect and focus your efforts on the most critical topics.

Importance of Understanding Key Concepts

A strong focus on foundational knowledge is essential for success. Topics such as customer needs analysis, product details, and legal requirements form the backbone of the material covered. Candidates should focus not only on memorizing facts but also on developing a deeper understanding of how these concepts interact and impact decision-making in real financial situations.

Understanding the Financial Services Certification Process

Gaining certification in the financial services sector is a critical step for individuals aiming to prove their expertise and competence. The process is designed to test your knowledge of essential concepts, legal standards, and best practices within the industry. It requires not only an understanding of theoretical principles but also the ability to apply them in practical scenarios.

Key Areas Covered in the Assessment

The evaluation is structured to cover a broad range of topics that reflect the core aspects of the profession. From customer evaluation and risk management to product offerings and regulatory compliance, each section is aimed at ensuring that candidates are well-versed in the necessary skills. Understanding how these areas interconnect is crucial to performing well on the assessment.

Effective Preparation Strategies

Preparing for this certification requires a strategic approach. Focusing on practice materials and simulated tests will help familiarize you with the format and the types of challenges you may face. Moreover, reviewing the most common concepts in depth and utilizing study resources can significantly increase your chances of success, providing the confidence needed on the day of the evaluation.

Key Topics Covered in the Evaluation

The assessment for certification in the financial services field is designed to test a wide range of important concepts. Candidates must have a solid understanding of both foundational theories and practical applications related to various financial products, services, and regulatory requirements. Focusing on the most common subjects covered in the test will help ensure thorough preparation.

Some of the core topics include risk analysis, customer assessment, compliance with industry regulations, and product features. Candidates should also be prepared to handle complex scenarios that require critical thinking and the ability to apply knowledge in real-world contexts. A well-rounded understanding of these areas is essential for performing well on the assessment.

How to Prepare for the Test

Effective preparation is key to success when aiming for certification in the financial services field. By organizing your study materials, focusing on core subjects, and practicing regularly, you can greatly improve your chances of performing well. A well-structured approach will help you feel confident and ready when the time comes to take the test.

Begin by reviewing the most commonly tested topics and understanding the key principles associated with each area. It’s also important to familiarize yourself with the structure of the test and practice with mock versions to gauge your readiness. Additionally, using study guides and taking practice quizzes will help reinforce your understanding and highlight areas that may need more attention.

| Preparation Step | Action |

|---|---|

| Review Core Concepts | Study fundamental principles such as risk management, financial products, and customer analysis. |

| Practice with Mock Tests | Use sample tests to familiarize yourself with the format and time constraints. |

| Utilize Study Resources | Make use of textbooks, online courses, and study guides tailored to the test. |

| Time Management | Practice answering questions under timed conditions to improve efficiency. |

By following these preparation strategies and committing to regular study, you will improve your ability to perform well and demonstrate your expertise when taking the assessment.

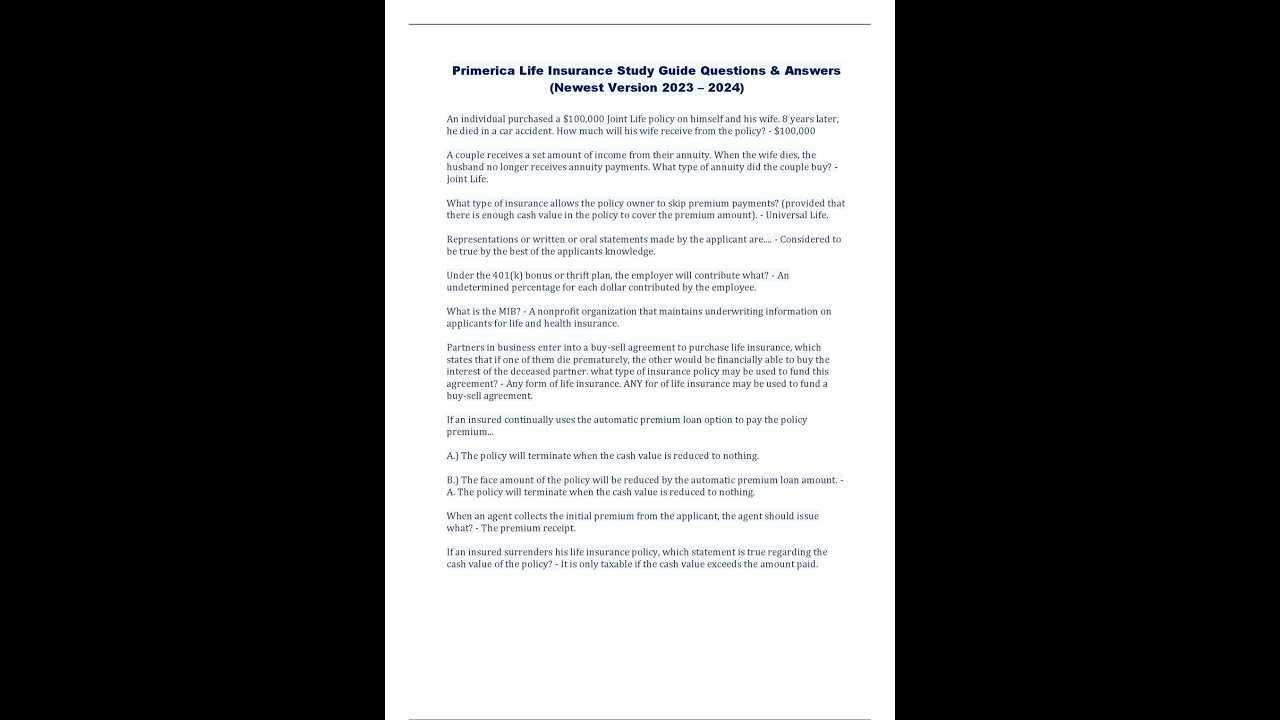

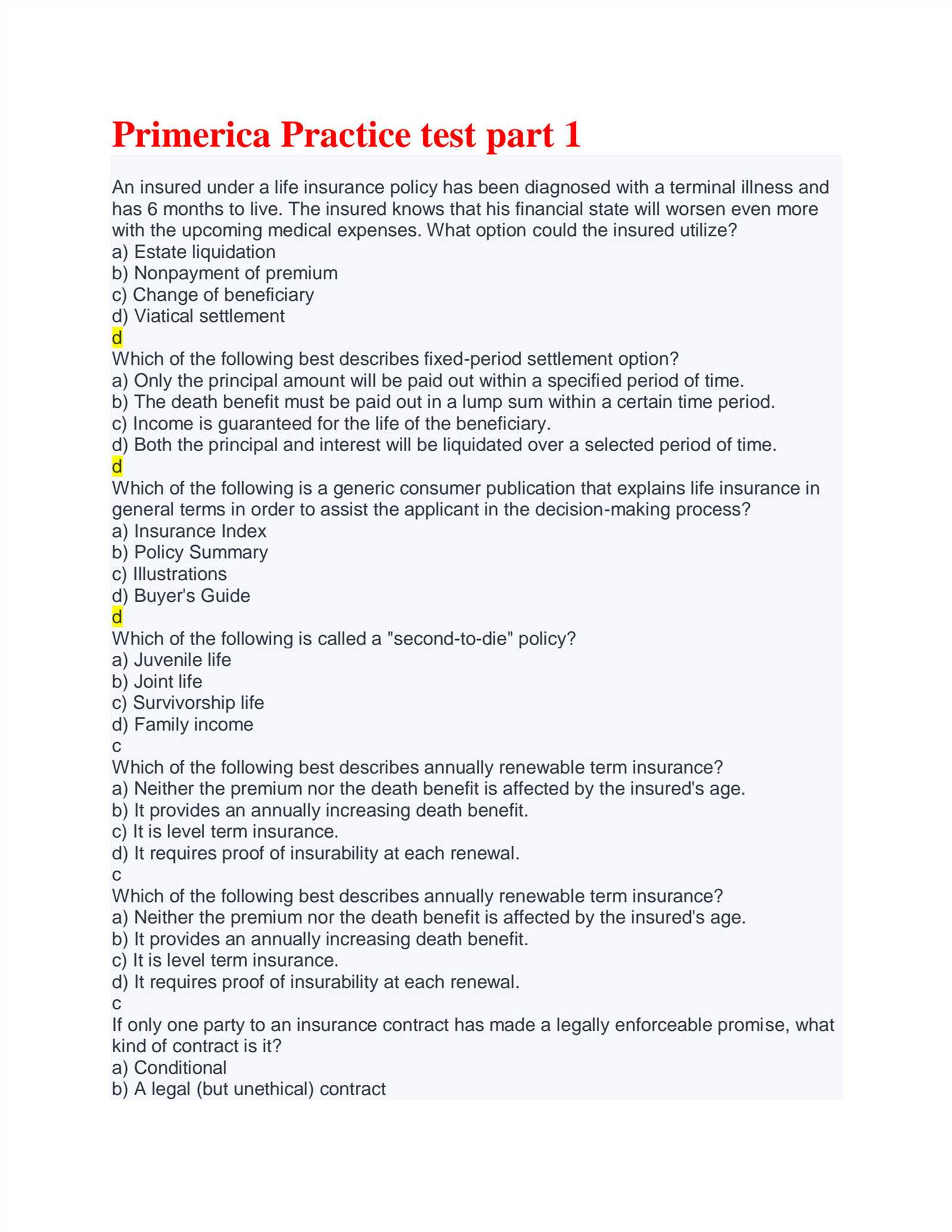

Common Assessment Inquiries

During the evaluation process for financial services certification, candidates are often faced with a variety of questions that assess their understanding of essential topics. These inquiries are designed to test both theoretical knowledge and practical application of concepts. Understanding the types of questions most commonly presented can help individuals better prepare and focus their study efforts.

Types of Questions You Will Encounter

Questions typically focus on a wide range of subjects, including financial products, customer evaluation, and regulatory compliance. Some questions may involve scenario-based problems where you are asked to apply knowledge to real-life situations. Others may test your understanding of technical terms or ask you to define specific concepts.

| Topic | Common Question Type |

|---|---|

| Customer Risk Assessment | Identify the most suitable financial solution for a given scenario. |

| Financial Products | Explain the benefits and limitations of a specific product. |

| Legal and Regulatory Standards | Define industry-specific terms and standards. |

| Ethical Practices | Determine the best course of action in a situation involving conflict of interest. |

How to Approach These Inquiries

When approaching these types of questions, it is crucial to read each question carefully and fully understand the scenario presented. In many cases, the correct answer will rely on both the theory behind the subject matter and the practical application of that theory. Practicing with mock assessments will help you recognize the patterns and types of inquiries that are most likely to appear.

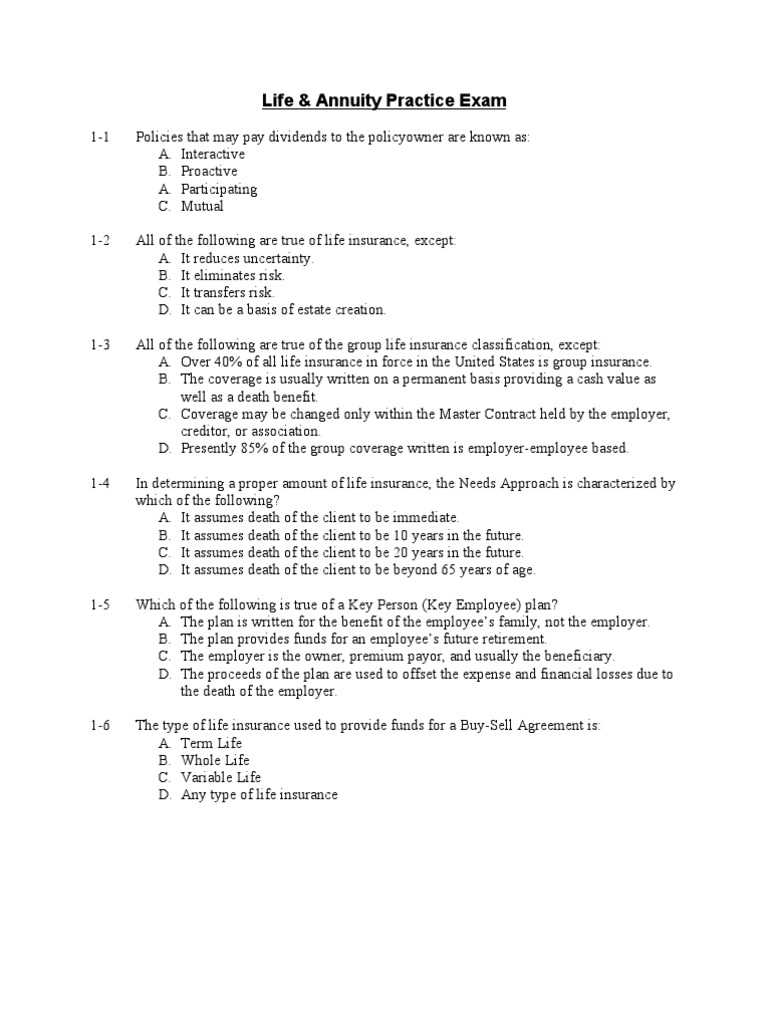

Types of Questions You’ll Encounter

During the assessment process for financial services certification, you will come across various types of questions that assess your knowledge and problem-solving abilities. These questions are designed to test both theoretical understanding and practical application in real-world scenarios. Familiarizing yourself with the common question types will help you approach the test with confidence and efficiency.

Common Formats of Questions

The assessment may include several formats that require different approaches. Some questions are straightforward and factual, while others involve critical thinking or scenario-based analysis. Below are the most common types you can expect:

- Multiple Choice: These questions present several options, and you must select the correct answer based on your knowledge.

- True/False: You will be asked to determine whether a given statement is correct or incorrect.

- Scenario-Based: In these questions, you will be given a situation or case study and asked to choose the best course of action based on your understanding of the concepts.

- Fill-in-the-Blank: These questions require you to complete sentences with the correct term or phrase.

Approaching Scenario-Based Questions

Scenario-based questions often appear in assessments as they test your ability to apply what you’ve learned in a real-world context. These questions present a situation, and you must select the best solution or decision based on the information provided. It’s important to carefully analyze the details, identify the relevant principles, and choose the answer that aligns with industry standards.

- Read the scenario carefully.

- Identify the key factors and principles involved.

- Eliminate obviously incorrect answers.

- Choose the most appropriate response based on your understanding.

Study Materials for Success

Preparing for a certification test in the financial services field requires the right tools and resources. Utilizing high-quality study materials can significantly improve your understanding of the topics covered and increase your chances of success. A variety of resources are available, from textbooks and practice guides to online platforms and interactive tools. The key is to find materials that align with the test’s focus areas and help reinforce your knowledge.

Textbooks and study guides are great starting points for building a solid foundation in essential concepts. These resources often break down complex topics into manageable sections, making it easier to digest the material. In addition to these, online practice tests and quizzes can help you assess your progress and become familiar with the format of the questions you’ll encounter.

Supplementing your studies with video tutorials, flashcards, or group study sessions can also be beneficial. These tools provide different learning styles and allow for a more interactive approach to preparation. By mixing traditional study methods with modern tools, you can enhance your ability to retain information and apply it effectively during the assessment.

What to Expect on Test Day

The day of the certification assessment can be both exciting and nerve-wracking. Knowing what to expect beforehand will help you feel more prepared and confident. On the day of the test, you will need to arrive at the testing center with plenty of time to spare. Make sure you have all the necessary documents and identification required to begin the process.

Once you arrive, you will be checked in and given instructions on how the test will be administered. This may include information on the time limit, the types of questions you’ll face, and how to navigate through the test. The atmosphere at the testing center is typically quiet, and there will likely be other candidates taking the same or similar assessments.

During the test, it’s important to stay calm and focused. Take your time to read each question carefully, and don’t rush your responses. If you’re unsure about an answer, it’s often best to move on and come back to it later. Remember, the test is designed to assess your understanding, so ensure that you’re applying your knowledge accurately in each scenario.

Once you’ve completed the test, you’ll submit your answers and await the results. While the length of the test may vary, the most important thing is to maintain a steady pace and stay positive throughout the process.

Time Management During the Exam

Efficient time management is one of the most crucial aspects of performing well during a certification assessment. With a set time limit and a series of questions to answer, balancing speed and accuracy becomes essential. The ability to pace yourself throughout the test ensures that you can answer all questions without feeling rushed, giving you the best chance to demonstrate your knowledge.

Before starting, take a moment to assess the total time available and estimate how long you can afford to spend on each question. This will help you stay on track and avoid getting stuck on difficult questions for too long. If a question feels challenging, it’s wise to move on and return to it later, ensuring that you don’t lose valuable time on a single item.

During the test, consider dividing the time evenly across sections or question types, if applicable. For example, if the assessment is broken into multiple sections, allocate a specific time to each part based on its weight or complexity. Keep an eye on the clock, but don’t let it cause stress. Adjust your strategy if you find yourself falling behind in any section.

As you approach the end of the test, leave yourself some time to review your answers, especially if there were any questions you had to skip earlier. A final review can help catch any mistakes or incomplete responses, giving you a chance to make improvements before submitting.

Tips for Answering Multiple Choice Questions

Multiple choice questions are a common format in many assessments, designed to evaluate both your knowledge and decision-making skills. While these types of questions may seem straightforward, there are strategies you can use to maximize your performance and minimize mistakes. By using a systematic approach, you can navigate through the options with more confidence and accuracy.

Key Strategies to Consider

When faced with multiple choice questions, consider the following tips to improve your chances of selecting the correct response:

- Read the question carefully: Ensure that you fully understand what is being asked before looking at the available choices. Sometimes, questions contain clues that help you eliminate incorrect options.

- Eliminate obvious incorrect options: If you can immediately identify one or two answers that are clearly wrong, cross them out. This will increase your chances of choosing the correct one from the remaining options.

- Consider all options before choosing: Don’t settle for the first option that seems correct. Carefully evaluate each choice, as sometimes the correct answer is more detailed or nuanced than it appears at first glance.

- Look for keywords: Keywords or phrases within the question may indicate the right answer. Pay attention to qualifiers like “always”, “never”, “most”, or “least”, which can help you narrow down the choices.

Dealing with Uncertainty

If you’re unsure about a question, don’t let uncertainty affect your overall strategy. Consider these additional tips:

- Skip and return: If you’re stuck, move on to the next question and come back to the difficult one later. You might find that the answer becomes clearer after answering other questions.

- Use logic: If you have to guess, try to use logic based on what you know. Often, the most detailed or well-rounded option is the correct one.

- Trust your first instinct: In many cases, your initial choice is the correct one. If you decide to change your answer, make sure you have a clear reason for doing so.

Understanding Life Insurance Basics

Having a fundamental understanding of how financial protection products work is crucial for anyone pursuing a career in the related field. These products are designed to provide security for loved ones in the event of a policyholder’s passing. Familiarity with the core principles can help individuals make informed decisions when selecting or discussing different coverage options. Grasping these concepts is essential for both personal financial planning and professional development in the industry.

Key Elements of Coverage

Before diving deeper, it’s important to recognize the core components of such protection plans. These typically include the coverage amount, premiums, and beneficiaries. Understanding these factors will help ensure that the right policies are chosen based on specific needs.

- Coverage Amount: This is the sum that will be paid to the designated beneficiary upon the policyholder’s death. It is important to choose an amount that adequately addresses the financial needs of the dependents.

- Premiums: The regular payments made to maintain the policy. The frequency and amount of premiums can vary depending on the terms of the policy and the individual’s financial situation.

- Beneficiaries: The individuals or entities designated to receive the benefits. It’s crucial to keep beneficiary information up to date, as life circumstances can change over time.

Types of Financial Protection Products

There are different categories of these products, each offering various benefits. These types differ in their duration, cost, and the level of protection they provide. Below are some of the most commonly used options:

- Term Coverage: Provides coverage for a specific period of time, such as 10, 20, or 30 years. It is typically less expensive but offers no payout if the policyholder survives the term.

- Permanent Coverage: Offers lifelong protection, as long as the premiums are paid. This type of plan may accumulate cash value over time and often comes at a higher cost.

- Universal Protection: A flexible plan that allows policyholders to adjust the premium and coverage amount over time. It combines elements of both term and permanent coverage.

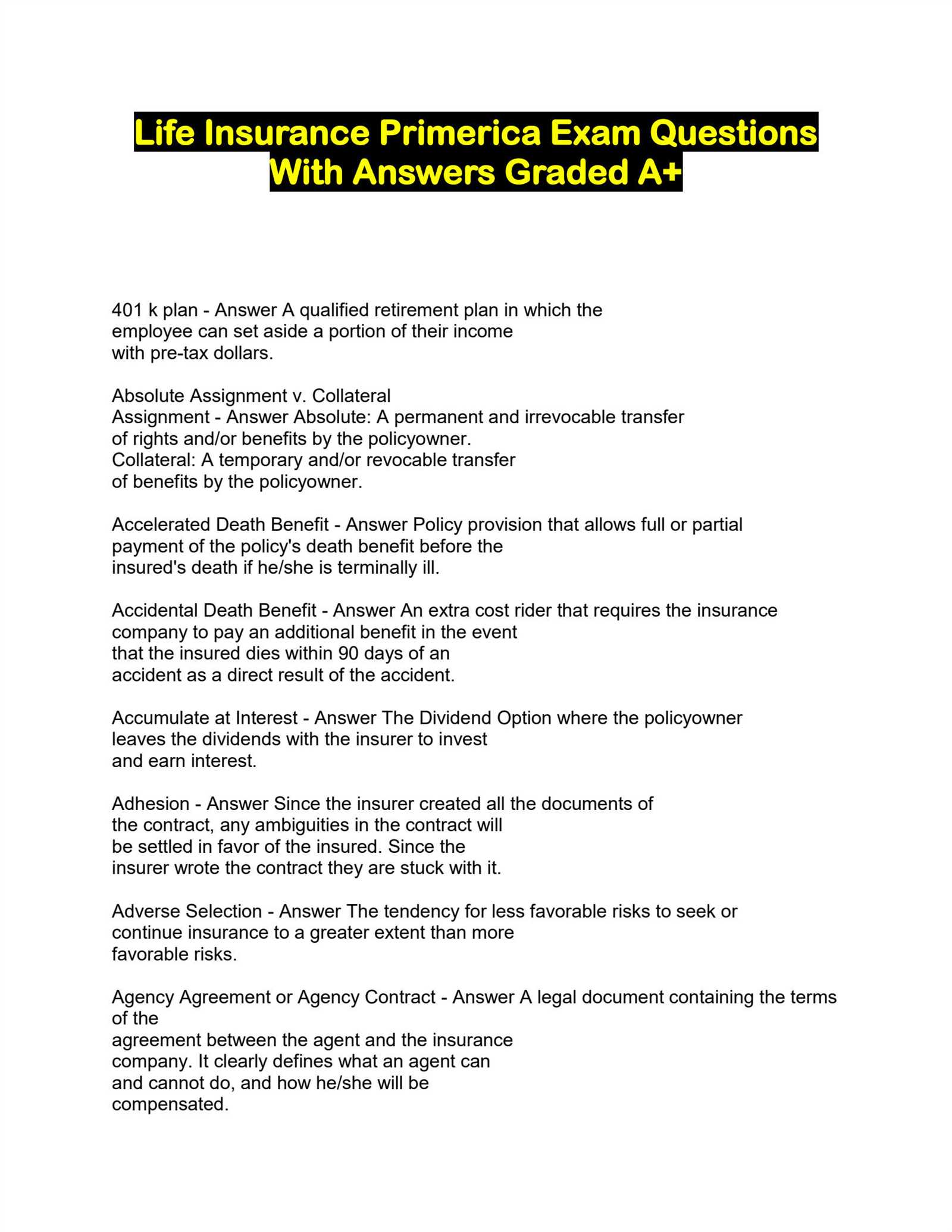

Key Terminology You Should Know

In the field of financial protection, understanding the key terms is essential for anyone involved in providing or discussing these services. Familiarity with the terminology not only helps in navigating discussions but also ensures that you are equipped to make informed decisions when choosing or explaining different plans. Here are some of the most important terms you should know to get a solid grasp of the subject.

Important Terms to Understand

Grasping the following terminology will help you understand the core concepts and assist in offering the right advice or making informed decisions:

- Premium: The amount a policyholder must pay to maintain their coverage, typically paid monthly, quarterly, or annually.

- Beneficiary: The person or entity designated to receive the benefits from a policy in the event of the policyholder’s death.

- Coverage Amount: The total sum of money paid out to the beneficiary upon the policyholder’s passing. This amount is determined when the policy is taken out.

- Underwriting: The process used by insurers to assess the risks associated with a potential policyholder, which helps in determining premiums and coverage options.

- Term Length: The duration for which a specific policy provides protection. This can vary widely depending on the type of plan chosen.

Additional Important Terms

To further strengthen your understanding, here are some additional terms to consider when exploring different protection options:

- Cash Value: A feature of permanent plans where a portion of the premium payments accumulates over time, potentially offering a loan or withdrawal option to the policyholder.

- Exclusion: Specific conditions or situations that are not covered under a policy, often mentioned in the fine print of the contract.

- Policyholder: The individual or entity that owns the policy and is responsible for paying the premiums.

- Riders: Optional add-ons to a standard policy that provide additional coverage or benefits tailored to the policyholder’s needs.

- Renewability: The ability to extend the policy for additional terms, often without the need for a new health assessment or underwriting.

How to Review Practice Tests

Reviewing practice tests is an essential step in preparing for any certification or assessment process. By thoroughly analyzing the results of these tests, you can identify areas of strength and those that require further attention. A thoughtful review can significantly enhance your understanding and performance when facing the real challenge. Here’s how you can effectively review practice tests to improve your readiness.

Step 1: Identify Mistakes and Understand Why

The first step in reviewing is to go over the questions you answered incorrectly. It’s important to not just memorize the correct answers but to understand the reasoning behind them. This will help you internalize the concepts and avoid making the same mistakes in the future.

- Read each question carefully to ensure that you grasp the underlying concept being tested.

- For each incorrect answer, analyze why your choice was wrong. Was it due to a lack of knowledge, a misunderstanding, or simple oversight?

- Note any recurring patterns in your mistakes–are there particular topics or question types that you consistently struggle with?

Step 2: Reinforce Your Knowledge

Once you’ve identified the gaps in your understanding, it’s time to focus on reinforcing those areas. Return to the study materials and review the topics that you found challenging. This will help ensure that you retain the necessary information and are fully prepared for the actual assessment.

- Use different learning resources such as textbooks, online courses, or discussion groups to deepen your knowledge.

- Practice similar questions to build confidence and improve your response time.

- Consider breaking down complex concepts into smaller, more manageable parts for easier understanding.

Step 3: Take Multiple Practice Tests

One review session might not be enough to fully gauge your readiness. To truly master the material, it’s essential to take multiple practice tests. Each new test will provide a fresh perspective and help you track your progress over time.

- Set a regular schedule to take practice tests, making sure to simulate the real testing environment as closely as possible.

- After each test, perform a comprehensive review as outlined above, and aim for continuous improvement with every attempt.

- Use the results to track your development, ensuring that you’re gradually covering all aspects of the content.

By systematically reviewing practice tests, reinforcing weak areas, and consistently testing yourself, you’ll be able to build confidence and increase your chances of success on the real assessment.

What Happens After You Pass the Exam

Once you’ve successfully completed the assessment, a series of important steps follow. Passing the test marks the beginning of a new phase in your professional journey. You will now enter the stage where you can begin applying your newly gained knowledge and skills in a practical setting. Here’s what you can expect after achieving success.

Step 1: Receiving Your Certification

After passing, the first thing you will likely receive is your official certification or qualification. This formal recognition serves as proof of your ability and readiness to work in the relevant field. The process may vary slightly depending on the rules set by the governing body or institution, but generally, you will receive:

- Official documentation or a certificate confirming your success.

- Details about how to access or download your digital certificate, if applicable.

- Information on how to update your professional records and credentials.

Step 2: Starting Your Career or New Role

Once certified, you are officially eligible to begin your career in the relevant field or pursue the next step in your professional development. Depending on your goals, you might explore a variety of opportunities:

- Begin applying for positions in your desired industry.

- Join a company or organization that aligns with your qualifications.

- Start working as a contractor or independent consultant, if applicable.

Step 3: Continuing Education and Ongoing Development

Achieving certification doesn’t mark the end of your professional growth. In fact, many fields require continued learning and development. You may need to:

- Complete additional courses or training to stay up-to-date with industry standards.

- Engage in networking opportunities and attend conferences to expand your professional connections.

- Seek mentorship or coaching to help you navigate your career path.

By embracing these opportunities, you ensure that you maintain a competitive edge and continue to excel in your field. Passing the assessment is just the first step toward a fulfilling career, and ongoing development is key to long-term success.

How to Retake the Test

If you find that your first attempt did not yield the desired result, don’t be discouraged. Retaking the assessment is a common part of the learning journey. In this section, we will walk you through the steps you need to follow to retake the test and increase your chances of success the next time.

Step 1: Analyze the Areas of Weakness

Before scheduling another attempt, take time to reflect on where you struggled. Review the areas where you encountered difficulties and identify the key topics that need more attention. This analysis is essential for focusing your efforts on improving your understanding and knowledge. Consider:

- Reviewing your previous results and pinpointing questions that were challenging.

- Seeking additional resources or support on specific topics that need improvement.

- Using study guides or practice tests to reinforce your knowledge in weak areas.

Step 2: Register for a New Test

Once you’re ready, you’ll need to complete the registration process for your next attempt. This may involve submitting a new application or paying a retake fee, depending on the testing rules. Be sure to:

- Check the retake policy for the test to see if there is a waiting period between attempts.

- Make sure that all necessary fees or documentation are completed before your new attempt.

- Choose an appropriate test date and time that gives you enough preparation time.

Step 3: Prepare Effectively

As with your first attempt, thorough preparation is key. This time, focus on addressing the areas that gave you trouble previously. Consider engaging in study groups or finding a mentor to guide you. Some helpful preparation tips include:

- Studying consistently and breaking down your review sessions into manageable segments.

- Taking practice tests to familiarize yourself with the format and improve time management.

- Utilizing various study materials, such as textbooks, online courses, and tutorial videos.

Step 4: Stay Positive and Confident

It’s essential to maintain a positive mindset throughout the process. Remember, many individuals need more than one attempt to succeed. Stay motivated, keep a steady focus on your goals, and trust in the effort you put into your preparation. With persistence and a clear strategy, you’re more likely to succeed on your second attempt.

Common Mistakes to Avoid on the Test

As you prepare for your assessment, it’s essential to be aware of common pitfalls that many individuals face. These mistakes can not only hinder your performance but may also cause unnecessary stress. In this section, we will highlight the typical errors people make and offer advice on how to avoid them to ensure you’re fully prepared for success.

1. Failing to Manage Time Effectively

Time management is one of the most crucial aspects of any assessment. Many candidates make the mistake of spending too much time on challenging questions and running out of time for easier ones. To avoid this:

- Practice pacing yourself during mock tests to ensure you can allocate time wisely for each section.

- Set a time limit for each question and stick to it. Don’t dwell too long on a single problem.

- If you’re unsure about a question, mark it and come back to it later, rather than wasting valuable time.

2. Overlooking Instructions

Many test-takers overlook the instructions, thinking they know the format or what’s expected. However, not following the directions precisely can lead to errors. To avoid this:

- Always read the instructions thoroughly before starting the test.

- Pay attention to any specific details, such as word limits, required formats, or the number of choices you need to select.

- Double-check the instructions before submitting your answers to ensure everything is in order.

3. Not Reviewing Your Work

It’s easy to rush through the test and assume that everything is correct, but overlooking mistakes can be costly. Many candidates make the error of not reviewing their answers before submitting them. To avoid this:

- Always leave time at the end to review your responses.

- Check for any obvious mistakes, such as misinterpretations of the question or errors in calculations.

- If possible, take a step back and approach your answers with a fresh perspective before submitting.

4. Lack of Preparation

One of the biggest mistakes is not adequately preparing for the assessment. Rushing through your study materials or relying on last-minute cramming can lead to suboptimal results. To prevent this:

- Create a structured study schedule to ensure you cover all essential topics.

- Take time to review practice materials, focusing on your weak areas.

- Stay consistent in your study efforts, avoiding cramming or skipping sessions.

5. Second-Guessing Yourself

After making an initial decision, many candidates second-guess their choices and end up changing correct answers. This can lead to unnecessary errors. To avoid second-guessing:

- Trust your first instinct, especially if you’re familiar with the material.

- If you’re unsure, consider eliminating obviously incorrect options rather than changing your answer multiple times.

- Don’t overthink – the first answer is often the most accurate.

By staying mindful of these common mistakes and preparing thoroughly, you’ll increase your chances of success. Focus on managing your time, following instructions, reviewing your work, and staying confident in your preparation.

Why the Test Is Important

The process of taking this assessment plays a crucial role in ensuring that individuals are fully equipped to handle the responsibilities that come with the position. Successfully passing the test is not only a requirement but also a reflection of your understanding of key concepts and regulations in the field. In this section, we will explore the reasons why the assessment is a vital step in your career journey and how it impacts your future prospects.

1. Legal and Regulatory Requirements

Passing the assessment is often a mandatory step to meet legal and industry-specific requirements. It ensures that individuals are well-versed in the necessary laws, regulations, and ethical standards relevant to their role. This helps to maintain public trust and ensures that professionals adhere to the standards set forth by regulatory bodies. Without this knowledge, one may not be eligible to practice in the field, potentially limiting career advancement.

2. Demonstrating Competence and Professionalism

Successfully completing the assessment demonstrates that you have the necessary skills and expertise to effectively perform in the industry. It acts as proof of your competence and shows your commitment to maintaining high professional standards. For employers and clients, this serves as a reassurance that you are qualified to provide reliable and responsible services.

3. Access to Career Opportunities

Passing the assessment can significantly broaden your career opportunities. It is often a prerequisite for securing roles within certain companies or industries. Moreover, it enhances your credibility and can increase your earning potential. Having this qualification opens doors to various positions and career paths, making it a valuable asset in your professional journey.

4. Personal Growth and Confidence

Preparing for and passing the test is not only about meeting external requirements; it also serves as a benchmark for your personal growth. The process helps you gain confidence in your knowledge and abilities, which can positively impact your career moving forward. It is an opportunity to challenge yourself, build resilience, and validate your expertise in the field.

5. Ongoing Professional Development

The assessment also plays a role in fostering continuous learning and improvement. The knowledge you gain while preparing for the test contributes to your long-term professional development. By staying current with industry trends, regulations, and best practices, you ensure that your skills remain relevant and up to date.

| Reasons for Importance | Benefits |

|---|---|

| Legal and Regulatory Compliance | Ensures eligibility to practice, adherence to industry standards |

| Demonstrating Competence | Builds trust with clients and employers, proves readiness for responsibilities |

| Access to Career Opportunities | Expands job prospects, increases earning potential |

| Personal Growth | Boosts confidence, challenges personal limits |

| Ongoing Development | Ensures continuous learning, maintains industry relevance |

In conclusion, the test serves as a gateway to both professional success and personal growth. It not only enables individuals to meet essential regulatory requirements but also helps them advance in their careers and maintain a competitive edge in the industry.