Preparing for a professional certification can be a challenging yet rewarding process. To succeed, it is crucial to understand both the scope of the test and the most efficient study methods. Whether you’re new to the field or refining your skills, focusing on the right areas will significantly increase your chances of success.

Familiarizing yourself with the key concepts is the first step. Understanding the rules, regulations, and guidelines relevant to your field is essential. The knowledge you gain will not only help you pass the certification process but also equip you for future success in your career.

By taking a structured approach and using the right study materials, you can enhance your chances of achieving the certification. Time management, practice questions, and reviewing core topics are effective techniques for ensuring you are fully prepared when the time comes to take the test.

Certification Preparation Guide for Tax Experts

Achieving success in any professional qualification requires a clear understanding of what to expect and how to approach the process. This section provides a comprehensive guide to help you navigate the various stages of certification. By focusing on the most relevant areas of knowledge and honing your skills, you can increase your confidence and performance.

Essential Concepts to Master

In order to excel, it’s crucial to familiarize yourself with the core principles that are central to the assessment. Focusing on eligibility rules, policy guidelines, and the regulations that govern the profession will give you a solid foundation. A deep understanding of these areas ensures you can address practical scenarios effectively.

Study Methods and Resources

Effective preparation goes beyond simply reading materials. The best way to get ready is through consistent practice and applying your knowledge to sample questions. Utilize available resources such as study guides, online courses, and review materials to ensure you are fully prepared. Planning your study time and staying organized is key to mastering the content efficiently.

Overview of the Certification Process for Tax Experts

Understanding the structure and purpose of the professional qualification is crucial for success. This section provides a detailed overview of the assessment process, highlighting what candidates can expect, the areas of focus, and how the test is organized. A clear grasp of these elements will help in effectively preparing for the challenge.

The assessment is designed to evaluate a candidate’s knowledge and practical application of rules, regulations, and guidelines relevant to the profession. It tests both theoretical understanding and the ability to apply this knowledge to real-world situations.

| Section | Focus Area | Key Topics |

|---|---|---|

| Part 1 | Regulations and Policies | Eligibility criteria, legal requirements, compliance |

| Part 2 | Practical Application | Case studies, scenarios, problem-solving |

| Part 3 | Technical Knowledge | Calculation methods, policy interpretation, auditing |

Each section of the qualification is focused on different aspects of the profession, and understanding the key topics within each will be critical to passing. Preparing for each section through practice and study will improve performance and ensure readiness for the certification process.

Key Topics Covered in the Certification Process

The professional qualification assesses a range of critical knowledge areas that are essential for success in the field. Each topic is designed to test your understanding of the rules, regulations, and practical applications that professionals must be familiar with. Mastering these topics will help you approach the process with confidence and increase your chances of passing.

Eligibility criteria and legal standards are central to the qualification. Understanding the guidelines that define eligibility, along with the legal frameworks that govern the industry, will help you answer foundational questions. Additionally, technical skills related to calculations and policy interpretation are also evaluated to ensure that candidates can apply theoretical knowledge in real-world scenarios.

Another key area of focus includes auditing procedures and compliance checks. Candidates will need to demonstrate their ability to audit cases, spot discrepancies, and understand compliance regulations in various settings. Familiarity with documentation and reporting standards is also essential for success.

Common Mistakes to Avoid During the Test

When preparing for a professional qualification, being aware of common pitfalls can significantly improve your performance. Many candidates make mistakes that can be easily avoided with proper preparation and focus. By understanding these missteps, you can ensure that your test-taking experience is more effective and productive.

Top Mistakes to Watch Out For

- Rushing Through Questions – Taking your time is essential to avoid careless errors. Don’t rush through questions without fully understanding them.

- Skipping Review – Skipping the review of answers can lead to missing simple mistakes. Always allocate time to go over your responses before submitting them.

- Panic During Difficult Questions – When faced with tough questions, it’s important to stay calm. Panicking can cloud your judgment and hinder your ability to recall important information.

- Ignoring Instructions – Always read the instructions carefully. Overlooking key details in the instructions can lead to misinterpretation of the questions.

How to Avoid These Mistakes

- Time Management – Practice managing your time efficiently during preparation to ensure that you can pace yourself properly during the test.

- Practice with Sample Questions – Regularly take practice tests to get used to the format and the types of questions, helping you avoid surprises on the actual test day.

- Stay Focused – Keep your attention on each question and avoid distractions. Mental clarity is essential for success.

Study Resources for Tax Experts

Accessing the right study materials is essential for successful preparation. The wealth of resources available can help you focus on the most important topics, build a deep understanding of key concepts, and practice the skills needed to succeed. Choosing the right tools can make all the difference in achieving your goals.

Recommended Study Materials

- Official Study Guides – These guides provide comprehensive coverage of the required topics and are tailored to the structure of the qualification process.

- Online Courses – Interactive online courses offer flexibility and often include video lectures, quizzes, and practice exams to reinforce your knowledge.

- Practice Tests – Regularly taking practice exams can help you familiarize yourself with the question formats and improve your time management skills.

- Books and Reference Materials – Use textbooks and reference books that explain the key regulations and policies in depth.

Additional Learning Tools

- Forums and Discussion Groups – Joining forums or online groups allows you to engage with other candidates, share tips, and clarify difficult concepts.

- Study Apps – There are several apps available that provide on-the-go study materials, flashcards, and quizzes.

- Workshops and Webinars – Attending workshops or webinars can offer expert guidance and allow you to interact directly with instructors or experienced professionals.

How to Prepare for the Certification Effectively

Effective preparation is key to achieving success in any professional qualification. It’s not just about studying hard, but about studying smart. By focusing on the right areas, practicing consistently, and staying organized, you can optimize your chances of passing the test with confidence.

Steps to Organize Your Study Plan

Breaking your preparation into manageable steps is essential. Create a study plan that covers all the key topics and leaves time for review. Stick to your schedule and adjust as necessary to ensure you’re progressing steadily.

| Study Phase | Focus Area | Suggested Time |

|---|---|---|

| Initial Review | Overview of core concepts and guidelines | 2-3 days |

| In-Depth Study | Diving deeper into regulations, policies, and technical details | 1-2 weeks |

| Practice and Simulations | Complete practice questions and mock tests | 1 week |

| Final Review | Review weak areas and focus on key concepts | 2-3 days |

Effective Study Methods

- Active Recall – Regularly test your memory by trying to recall information without referring to your notes.

- Spaced Repetition – Review materials at spaced intervals to reinforce retention.

- Time Practice – Simulate test conditions by practicing under time constraints to improve your pace and focus.

- Group Study – Collaborating with peers can help clarify complex topics and deepen understanding through discussion.

Understanding Eligibility Criteria for Financial Assistance Programs

Eligibility requirements are fundamental to determining whether an individual or business can receive financial support under various programs. This section delves into the essential criteria that must be met to qualify for these benefits. Understanding these rules is crucial for both applicants and professionals who advise on such matters.

Key Eligibility Factors

- Income Limits – Many programs have specific income thresholds that must be met. Applicants must prove that their earnings fall within the prescribed range to qualify.

- Residency Requirements – Some benefits are only available to individuals residing in specific regions or countries. Applicants may need to provide proof of residence.

- Filing Status – Your tax filing status, whether single, married, or head of household, can significantly affect your eligibility for certain programs.

- Age or Dependents – Certain programs may have age restrictions or require applicants to have dependents, which can influence the eligibility decision.

Additional Considerations

- Documentation – Proper documentation is essential when applying for benefits. This may include income statements, tax returns, and proof of residency.

- Special Circumstances – Some applicants may qualify due to special circumstances, such as disability or military service.

- Program-Specific Rules – Each program has its own set of eligibility rules, which can include time limitations, exceptions, and other specific requirements.

Time Management Tips for Test Success

Proper time management is a key factor in ensuring you can efficiently tackle all parts of the test. Without a clear strategy, it’s easy to spend too much time on one section and run out of time for others. In this section, we’ll explore proven techniques that can help you organize your study schedule and manage your time during the actual test.

Effective Study Time Allocation

Creating a study plan is crucial for balancing all the material you need to cover. Allocate specific amounts of time to each topic based on its complexity and importance, ensuring you give yourself enough time to revisit challenging sections.

- Prioritize Key Topics – Focus on areas where you need the most improvement, but don’t neglect less difficult sections completely.

- Break Sessions into Chunks – Use the Pomodoro technique or similar methods to break your study sessions into manageable 25-30 minute intervals, followed by short breaks.

- Set Realistic Goals – Set achievable goals for each study session to maintain motivation and track your progress.

Strategies During the Test

- Read Through the Entire Test First – Before starting, take a few minutes to quickly glance through all the questions. This helps you prioritize and plan how much time to allocate for each section.

- Keep Track of Time – Use a watch or clock to ensure you don’t spend too long on any one question. It’s important to pace yourself to answer all questions.

- Skip and Return – If a question is taking too long, skip it and return to it later. This allows you to focus on easier questions first, which boosts your confidence.

Best Study Practices for Financial Certification

Mastering the content required for a certification requires more than just reading through materials. It’s about adopting effective study strategies that ensure comprehensive understanding and retention. In this section, we will explore the best practices for preparing thoroughly, staying focused, and approaching the material in a way that maximizes learning efficiency.

One key aspect of studying effectively is organizing your time and resources to create a balanced and sustainable study routine. It’s essential to break down complex topics into smaller, manageable chunks and focus on mastering one concept at a time. Active learning methods, such as practicing with real-world examples and regularly testing your knowledge, are also crucial for reinforcing your understanding and identifying areas that need more attention.

Consistency is another important factor. Setting aside dedicated time for study every day, even if it’s just for a short period, can help maintain a steady learning pace. It’s also helpful to review materials regularly, rather than cramming all at once, to strengthen memory retention and comprehension.

Essential Concepts to Master Before the Test

Before attempting any professional certification, it’s crucial to have a solid grasp of the fundamental concepts that are likely to appear in the assessment. This section highlights the key areas you should focus on to ensure you’re well-prepared and able to apply your knowledge effectively. Mastering these concepts will build a strong foundation and boost your confidence when facing the test.

Key Areas of Focus

- Understanding of Regulations – Be sure to familiarize yourself with the rules and policies that govern the field. A deep understanding of these regulations is essential for accurate decision-making.

- Financial Documentation – Knowing how to interpret and manage different types of financial documents is crucial. This includes understanding forms, statements, and the relevant supporting materials.

- Eligibility Criteria – Understanding who qualifies for various programs, along with the specific eligibility requirements, is a key component of the field.

- Calculation Techniques – Master the techniques required for performing various calculations, whether they involve percentages, deductions, or other financial metrics.

Strategies for Mastery

- Active Learning – Engage with the material by applying it to real-world scenarios, rather than passively reading. Practice with examples to solidify your understanding.

- Frequent Review – Regularly revisit key concepts and revisit any areas where you feel less confident. Repetition is a powerful tool for retention.

- Time Management Skills – Ensure you’re able to work through questions efficiently. Practice answering questions under time constraints to improve your pace.

How to Interpret Financial Regulations

Interpreting financial regulations can be a complex process, but mastering the key principles is essential for anyone working in this field. A clear understanding of the rules and their application ensures that decisions are made accurately and in compliance with legal standards. This section will guide you through the steps necessary to interpret these regulations effectively, helping you to apply them to real-world situations with confidence.

The first step is to become familiar with the language of the regulations. Legal and financial documents often use precise language, which can be difficult to understand at first glance. Breaking down these terms into simpler language can help clarify their meaning. Pay special attention to definitions, as they set the context for the entire regulation. Knowing the core principles and their implications is vital for accurate interpretation.

| Regulation Aspect | Key Considerations |

|---|---|

| Definitions | Understand the terminology and how it applies to different scenarios. Key terms are often defined within the regulation itself. |

| Eligibility Criteria | Identify who qualifies for certain benefits or programs. Regulations often specify the conditions required to be eligible. |

| Calculation Methods | Know how to apply formulas or calculations that are specified in the regulation to determine outcomes. |

| Exemptions | Recognize any exceptions or special conditions that may apply in specific circumstances. |

By breaking down the regulation into its key components and understanding the meaning behind each section, you can more easily apply these principles in practice. Regularly reviewing and keeping updated with any changes in the regulations will further enhance your ability to interpret and utilize them effectively.

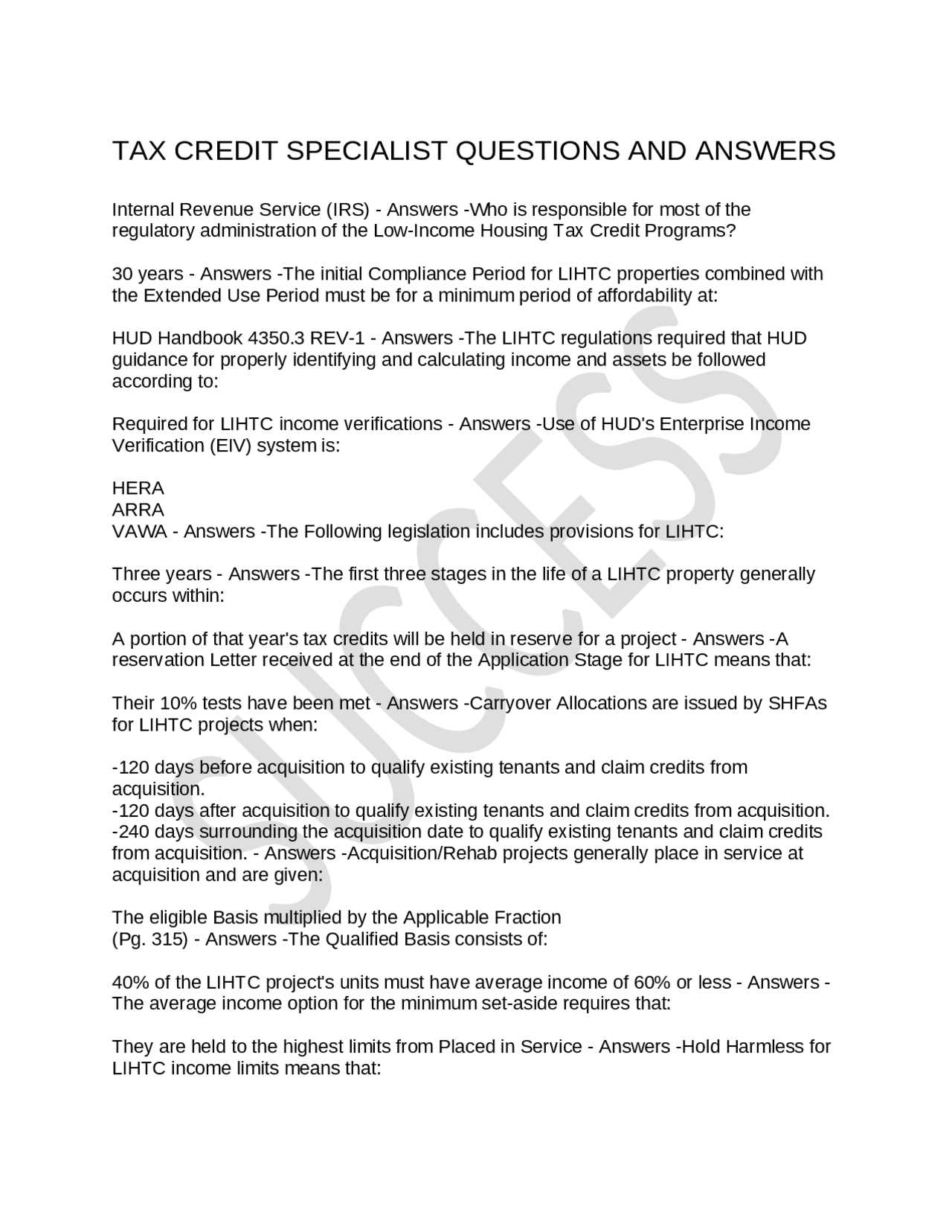

Questions You Should Expect

When preparing for a professional assessment, it’s important to understand the types of questions you are likely to encounter. These questions are designed to test your knowledge of key concepts and your ability to apply them in practical situations. In this section, we will explore the types of questions that commonly appear in the test, allowing you to focus your studies on the areas that matter most.

Questions typically fall into a few broad categories, each assessing a different skill set. Some will challenge your understanding of fundamental concepts, while others may require you to analyze real-world scenarios or solve specific problems. Being familiar with the format and structure of these questions will help you respond confidently and accurately when the time comes.

Here are some of the most common question types you can expect:

- Multiple Choice Questions – These questions test your knowledge of basic facts and concepts. You will be asked to select the correct answer from a list of options, requiring quick recall and accuracy.

- Scenario-Based Questions – These questions present a scenario and ask you to apply your knowledge to solve a problem or make a decision. They are designed to test your ability to interpret real-world situations.

- Calculation Problems – Expect questions that involve mathematical computations. These will test your ability to perform calculations accurately and efficiently.

- True or False – These questions assess your understanding of specific statements. You will need to determine if the statement is correct or incorrect based on your knowledge.

By preparing for these types of questions and practicing with similar examples, you can improve your test-taking strategy and increase your chances of success. Be sure to focus on mastering the core concepts and applying them to various question formats, as this will allow you to tackle any question with confidence.

Expert Tips for Passing the Assessment

Successfully navigating a professional assessment requires more than just knowledge; it also involves strategy, focus, and preparation. In this section, we’ll share expert tips to help you approach the test confidently and efficiently. These insights will guide you through the key steps you should take to ensure you’re fully prepared and ready to succeed.

The right approach can make a significant difference in your performance. By focusing on the areas that matter most and utilizing proven strategies, you can maximize your chances of success. Here are a few expert tips to keep in mind:

Preparation is Key

- Start Early: Begin your preparation well in advance to avoid last-minute stress. Give yourself enough time to cover all the necessary material and to revisit complex concepts.

- Use Reliable Study Resources: Rely on reputable textbooks, guides, and practice tests that reflect the content of the assessment. Choose materials that offer clear explanations and practical examples.

- Understand the Format: Familiarize yourself with the format of the test. Knowing what types of questions to expect will help you feel more confident and reduce anxiety.

Test-Taking Strategies

- Stay Calm: Take deep breaths and stay focused throughout the assessment. Maintaining a calm demeanor can help you think more clearly and answer questions more effectively.

- Manage Your Time: Keep track of time during the test. Don’t linger too long on any single question. If you’re unsure about an answer, move on and come back to it later.

- Review Your Work: If time permits, go back and review your answers. Double-check calculations and ensure that you haven’t overlooked important details.

By following these expert tips, you’ll be well-equipped to approach the test with confidence and tackle the questions efficiently. A solid study routine, along with strategic test-taking, is the key to passing with flying colors.

How to Deal with Assessment Stress

Stress is a natural response when preparing for a significant evaluation, but managing it effectively can make all the difference in your performance. Understanding how to cope with pressure is just as important as mastering the material itself. In this section, we’ll explore practical strategies to help you stay calm, focused, and in control throughout the entire process.

Whether you’re dealing with nervousness, anxiety, or the overwhelming feeling of being unprepared, it’s essential to recognize that stress is common and manageable. By adopting the right techniques and maintaining a balanced approach, you can reduce stress and boost your confidence as you approach the assessment.

Effective Stress Management Techniques

- Practice Relaxation Techniques: Deep breathing exercises, meditation, or mindfulness can help calm your nerves and clear your mind before and during the assessment.

- Get Enough Rest: Adequate sleep is crucial for mental clarity and focus. Avoid staying up late studying the night before the test–this can increase stress and reduce performance.

- Take Breaks: Don’t study continuously without breaks. Give your mind time to rest and recharge. Regular short breaks during study sessions can help you retain more information and reduce feelings of being overwhelmed.

Maintaining a Positive Mindset

- Focus on the Process: Instead of stressing over the outcome, focus on doing your best at each step. Break your study plan into smaller, manageable tasks to avoid feeling overwhelmed.

- Visualize Success: Picture yourself confidently completing the assessment. Positive visualization can help reduce anxiety and increase your overall sense of self-assurance.

- Accept Imperfection: Remember that no one is perfect. Even if you don’t get every question right, trust that your preparation and effort will be enough to achieve your goals.

By using these stress-management strategies, you can approach your assessment with a clear, calm mind. The key is not to let stress control you, but to use it as a motivator to stay focused and perform at your best.

Understanding the Tax Code for the Assessment

One of the most crucial aspects of preparing for an evaluation in this field is understanding the rules and regulations that govern it. These legal guidelines can often be complex and detailed, but having a clear understanding of them is essential for performing well. In this section, we will explore the key concepts you need to grasp in order to confidently navigate the principles that are frequently tested during the process.

While it may seem overwhelming at first, breaking down the material into manageable sections will allow you to build a solid foundation. You’ll need to familiarize yourself with various rules and provisions, and understand how they apply in different scenarios. Mastering these principles will give you the confidence to tackle any question that may arise in the evaluation.

Key Areas of Focus

- Eligibility Requirements: Understand the conditions that must be met for specific benefits or deductions to apply. Knowing the eligibility criteria is fundamental in answering questions correctly.

- Filing and Documentation: Familiarize yourself with the required forms and documents. The process can vary, so knowing which forms are used in different cases is important.

- Calculations and Limits: Pay attention to how limits, percentages, and other numerical values are applied. These are often tested in practical scenarios where precise calculations are needed.

In-depth knowledge of these areas will not only help you succeed but also ensure that you approach each question with clarity and precision. Preparing effectively will allow you to interpret the regulations accurately and apply them to real-world situations during the evaluation.

Post-Assessment Strategies for Tax Credit Professionals

Once you have completed your assessment, the next step is to reflect on your performance and prepare for the future. The period following the assessment is crucial for growth, whether you pass or need to retake the evaluation. By following the right strategies, you can turn your experience into an opportunity for improvement and success in the field. This section outlines essential steps to take after completing the process, from analyzing your results to planning your next steps.

One of the most important actions is reviewing the areas where you may have faced challenges. Identify the sections where you struggled, and dedicate time to strengthening those skills. This will not only help you in future assessments but also improve your practical understanding of the concepts. Don’t forget to celebrate your achievements, as every step forward is progress.

Key Steps to Take After the Assessment

- Review Your Results: Carefully go through your score or feedback to identify any weaknesses or areas where you can improve. Understanding your mistakes will allow you to focus on the right areas for your next attempt.

- Seek Additional Resources: If certain topics proved difficult, consider additional study materials or professional training to deepen your knowledge.

- Stay Updated: Regulations and guidelines can change frequently. Staying up to date with the latest information ensures that you are always prepared for the next challenge.

- Plan Your Next Steps: Whether you’re moving forward with your career or planning for a retake, setting clear goals will keep you focused and motivated.

Taking these steps seriously and remaining proactive will help you not only improve your future performance but also elevate your career and skillset in the long run.

Post-Assessment Strategies for Tax Credit Professionals

Once you have completed your assessment, the next step is to reflect on your performance and prepare for the future. The period following the assessment is crucial for growth, whether you pass or need to retake the evaluation. By following the right strategies, you can turn your experience into an opportunity for improvement and success in the field. This section outlines essential steps to take after completing the process, from analyzing your results to planning your next steps.

One of the most important actions is reviewing the areas where you may have faced challenges. Identify the sections where you struggled, and dedicate time to strengthening those skills. This will not only help you in future assessments but also improve your practical understanding of the concepts. Don’t forget to celebrate your achievements, as every step forward is progress.

Key Steps to Take After the Assessment

- Review Your Results: Carefully go through your score or feedback to identify any weaknesses or areas where you can improve. Understanding your mistakes will allow you to focus on the right areas for your next attempt.

- Seek Additional Resources: If certain topics proved difficult, consider additional study materials or professional training to deepen your knowledge.

- Stay Updated: Regulations and guidelines can change frequently. Staying up to date with the latest information ensures that you are always prepared for the next challenge.

- Plan Your Next Steps: Whether you’re moving forward with your career or planning for a retake, setting clear goals will keep you focused and motivated.

Taking these steps seriously and remaining proactive will help you not only improve your future performance but also elevate your career and skillset in the long run.