Preparing for a professional financial assessment can be a daunting task. It requires a deep understanding of key concepts, critical thinking, and the ability to apply knowledge in real-world scenarios. Achieving success in this type of evaluation depends not only on thorough study but also on mastering specific strategies that will enhance your performance under pressure.

Effective preparation involves a combination of reviewing theoretical material, practicing problem-solving, and becoming familiar with the test structure. Knowing what to expect can help reduce anxiety and improve focus during the actual test. In this guide, we will explore the essential techniques and approaches that can lead to successful outcomes in any financial certification exam.

By breaking down the exam into manageable sections and focusing on key areas, candidates can optimize their study time and increase their chances of achieving a high score. Whether it’s understanding complex financial models or perfecting time management skills, this guide provides the necessary tools to excel.

Essential Insights into Financial Certification Assessments

Understanding the key elements of a financial certification test is crucial for effective preparation. These evaluations are designed to assess both theoretical knowledge and practical skills, requiring a candidate to demonstrate competence in applying financial concepts to real-world scenarios. Knowing the structure, content, and focus areas of the assessment can provide a significant advantage when preparing for the challenge ahead.

There are several core areas that candidates should focus on to increase their likelihood of success. These areas typically cover financial analysis, risk management, and understanding complex economic models. It is important to not only study the materials but also practice applying these concepts to problem-solving exercises to strengthen both theoretical and practical skills.

| Key Area | Focus Points | Study Recommendations |

|---|---|---|

| Financial Analysis | Balance sheets, income statements, cash flow analysis | Review case studies, practice financial calculations |

| Risk Management | Risk types, risk assessment models, mitigation strategies | Understand common risk scenarios, apply risk models |

| Economic Models | Market behavior, forecasting, valuation techniques | Study real-world examples, test application of models |

Familiarizing yourself with the structure and content of the test will help streamline your study plan. By focusing on these key areas and practicing regularly, candidates can approach the assessment with confidence and improve their chances of a successful outcome.

Understanding Financial Certification Test Format

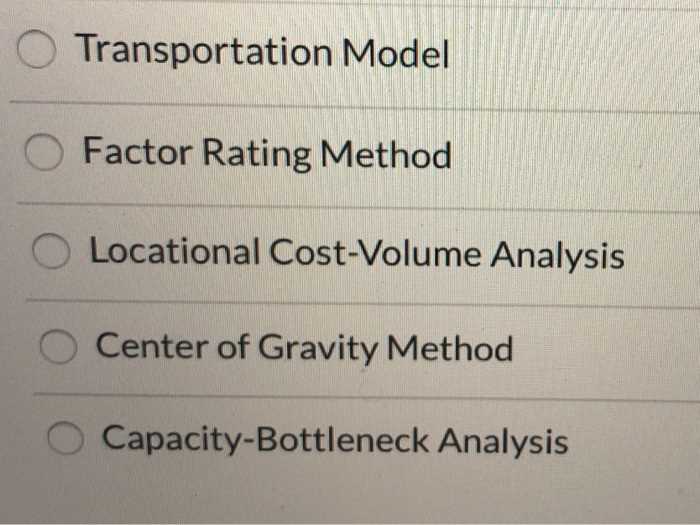

Familiarity with the format of a professional financial assessment is essential for strategic preparation. These evaluations are designed to test both theoretical knowledge and practical skills, and they typically consist of multiple sections, each focusing on different aspects of financial analysis. Understanding how the test is structured allows candidates to allocate study time more effectively and approach each part with confidence.

The format generally includes a combination of multiple-choice questions, case studies, and open-ended problems. Multiple-choice questions assess the candidate’s ability to recall and apply core concepts, while case studies require deeper analysis and the application of financial models to real-world situations. Open-ended problems test critical thinking, requiring well-supported written responses.

Knowing the time limits for each section is equally important, as it helps with time management during the assessment. Practicing with sample questions that mirror the actual format is highly recommended to ensure that candidates can work efficiently under pressure.

Key Concepts Tested in Financial Assessments

Professional financial evaluations focus on several critical concepts that candidates must master to demonstrate their competence. These concepts span a wide range of topics, from financial analysis to risk management, and are designed to test both theoretical understanding and the ability to apply this knowledge in practical situations. Grasping these core principles is essential for success in any financial certification process.

The primary areas tested typically include financial statements, market analysis, and valuation techniques. Candidates are expected to have a deep understanding of how to interpret balance sheets, income statements, and cash flow reports. Furthermore, a strong foundation in risk management and economic forecasting is necessary to tackle more advanced sections of the test.

Additionally, proficiency in financial modeling, portfolio management, and asset valuation plays a significant role in the evaluation process. These areas often require candidates to analyze case studies and apply theoretical knowledge to real-world scenarios.

Effective Study Strategies for Financial Assessments

Achieving success in a professional financial certification requires more than just reading through study materials. A well-structured approach to studying can make a significant difference in performance. Effective study strategies involve not only reviewing the necessary content but also practicing problem-solving, time management, and applying theoretical knowledge to practical situations.

Active learning techniques, such as taking notes, summarizing key concepts, and teaching others, can help reinforce understanding. Additionally, regularly testing yourself with sample questions or practice tests is essential for becoming familiar with the format and improving recall under time constraints. Focus should be placed on both individual study and group discussions to clarify difficult topics.

Time management plays a crucial role in preparation. Creating a study schedule that allocates specific time blocks to each topic ensures that all areas are covered thoroughly. It’s also important to allow for breaks and review sessions to maintain focus and prevent burnout.

Common Mistakes to Avoid During the Test

When taking a professional financial assessment, it’s easy to fall into traps that can negatively impact your performance. Recognizing and avoiding these common errors is crucial for improving your chances of success. Many candidates make mistakes due to lack of preparation, poor time management, or misunderstanding key concepts, which can all be easily mitigated with careful attention and practice.

Neglecting Time Management

One of the most common mistakes is failing to manage time effectively. Without a clear plan, candidates may spend too much time on difficult questions and not leave enough time to answer the easier ones. This can lead to incomplete responses and missed opportunities for scoring. Practicing under timed conditions can help simulate the real test environment and build confidence in managing time efficiently.

Overlooking Question Details

Another mistake is rushing through questions without fully understanding what is being asked. Financial assessments often include complex scenarios that require careful analysis before selecting an answer. Skimming the questions or misinterpreting key details can lead to incorrect responses. Taking the time to read each question thoroughly and ensuring you understand the context can significantly improve accuracy.

Time Management Tips for Financial Assessments

Effective time management is a key factor in achieving success during a professional financial evaluation. With multiple sections and a limited timeframe, it’s essential to prioritize tasks and work efficiently to ensure all questions are answered. Without a clear strategy, candidates may find themselves overwhelmed or running out of time before completing the test.

Allocate Time Wisely – Before starting the test, divide the total time available among different sections based on their complexity and your familiarity with the content. Prioritize sections that are more challenging, but ensure you leave enough time for the easier sections that may require less thought but still contribute to your overall score.

Practice Under Time Constraints – Simulating exam conditions during practice sessions is one of the most effective ways to build speed and accuracy. Set timers when working through practice questions to get used to working under pressure. This will help you gauge how much time to spend on each question and adjust accordingly during the actual test.

How to Approach Multiple-Choice Questions

Multiple-choice questions are a common feature in professional financial assessments, designed to test both your knowledge and ability to apply concepts quickly and accurately. The key to succeeding in these types of questions is a systematic approach, combining preparation, careful analysis, and strategic elimination of incorrect answers.

Read the Question Carefully

Before jumping to the options, take a moment to read the question thoroughly. This will help you understand what is being asked and what information is required. Often, the question contains important clues that can guide you toward the correct answer. Make sure you’re clear on whether the question is asking for a specific fact, an application of knowledge, or an analysis of a situation.

Use the Process of Elimination

One of the most effective strategies for multiple-choice questions is the process of elimination. If you’re unsure about the correct answer, rule out the most obviously incorrect options first. This will increase your chances of selecting the right answer from the remaining choices.

- Eliminate extremes: Answers that are too broad or too specific are often incorrect.

- Look for qualifiers: Words like “always” or “never” can indicate that the option is likely wrong.

- Check for consistency: Ensure that the selected option aligns with the concepts you’ve studied.

By using these strategies, you can improve your accuracy and avoid falling into common traps while answering multiple-choice questions. Remember, practice is key to mastering this approach.

Mastering Essay Questions in Financial Assessments

Essay questions in financial assessments are designed to evaluate your ability to think critically, organize your thoughts clearly, and apply your knowledge to complex scenarios. These questions typically require detailed responses and an in-depth understanding of the material. Mastering this type of question involves more than just recalling facts; it requires strong writing skills and the ability to structure your answer effectively.

Structuring Your Answer

When approaching an essay question, it is essential to organize your response logically to ensure clarity and coherence. A well-structured answer not only demonstrates your understanding but also makes it easier for the examiner to follow your reasoning.

- Introduction: Start with a brief introduction that outlines the main points you will address in your answer. This helps the reader know what to expect.

- Main Body: Divide the body of your answer into clear, concise paragraphs. Each paragraph should address a specific point, supported by evidence or examples. Use bullet points if appropriate for listing facts or arguments.

- Conclusion: End with a concise conclusion that summarizes your key points and offers a final analysis or recommendation.

Tips for Writing Strong Essay Responses

- Stay focused: Ensure each paragraph directly addresses the question and avoids unnecessary tangents.

- Use examples: Illustrate your points with real-world examples or case studies to strengthen your arguments.

- Be clear and concise: Avoid overly complex language. Make your points clearly and directly to demonstrate your understanding.

- Proofread: Take the time to review your answer for any errors or areas that could be improved. A well-polished response makes a stronger impression.

By following these strategies, you can approach essay questions with confidence and provide detailed, well-organized responses that showcase your knowledge and critical thinking abilities.

Resources to Help You Prepare

Preparation for a professional financial certification requires access to the right materials and tools. The right resources can make a significant difference in your understanding of key concepts and your ability to apply them during the assessment. There are a variety of materials available, ranging from textbooks and online courses to practice tests and study groups. Utilizing these resources effectively can streamline your study process and increase your chances of success.

Books and Study Guides

Comprehensive study guides and textbooks are fundamental resources that provide in-depth explanations of the material covered in the assessment. Many guides also offer practice questions and sample cases to help reinforce your understanding.

- Official Study Guides: These materials are often tailored specifically to the certification and are created by experts in the field.

- Textbooks: Consider using textbooks that cover foundational concepts such as finance, economics, and risk management.

- Practice Question Books: Books that include practice questions can help familiarize you with the test format and common question types.

Online Learning Platforms

Online platforms offer flexible learning opportunities and a variety of courses designed to help you prepare efficiently. Many platforms provide video tutorials, interactive lessons, and practice tests that mimic real assessment conditions.

- Interactive Courses: Platforms like Coursera, Udemy, and LinkedIn Learning offer courses on topics relevant to the certification, often led by experienced professionals.

- Webinars and Tutorials: Look for live webinars and recorded tutorials that dive deeper into complex topics and provide opportunities to ask questions.

- Practice Tests: Many online resources offer practice exams that can help you assess your readiness and pinpoint areas for improvement.

Study Groups and Forums

Joining a study group or online forum can be a valuable way to gain insights from others who are preparing for the same certification. Group discussions often allow you to clarify doubts, share study strategies, and learn from different perspectives.

- Online Forums: Websites like Reddit or dedicated professional forums often feature discussion threads where candidates share experiences and tips.

- Study Groups: Forming or joining a study group can provide structure and accountability, as well as offer different viewpoints on challenging topics.

- Mentorship: Seek out mentors who have completed the certification for advice and guidance on the preparation process.

By leveraging these resources effectively, you can build a solid foundation of knowledge, improve your test-taking skills, and approach the certification process with confidence.

Preparing for the Financial Analysis Section

The financial analysis portion of a professional certification is designed to assess your ability to analyze and interpret financial statements, evaluate performance metrics, and understand financial health. To succeed in this section, you must be proficient in various financial concepts, including ratio analysis, cash flow management, and financial forecasting. A thorough understanding of how to apply these concepts in real-world situations is crucial for accurate assessment and decision-making.

Key Areas to Focus On

When preparing for this section, it’s important to familiarize yourself with the core concepts and analytical methods used to evaluate financial performance. Here are the key areas you should focus on:

- Ratio Analysis: Understand various financial ratios (e.g., profitability, liquidity, leverage, and efficiency ratios) and how to interpret them to assess a company’s performance.

- Financial Statements: Be able to analyze and draw conclusions from income statements, balance sheets, and cash flow statements. Focus on understanding how these statements interconnect.

- Cash Flow Analysis: Learn how to evaluate cash flow statements to assess the liquidity and operational efficiency of a business.

- Forecasting and Budgeting: Understand how to create and interpret financial forecasts and budgets, and how they inform business strategy and planning.

Practical Tips for Success

Beyond theoretical knowledge, applying that knowledge in practical scenarios is essential for success in the financial analysis section. Here are some tips to improve your performance:

- Practice with Real-World Data: Use financial reports from actual companies to practice your analysis. This will help you become familiar with different formats and real-world complexities.

- Use Financial Calculators: Get comfortable with financial calculators or spreadsheet software like Excel to quickly compute ratios and other financial metrics.

- Understand Context: Learn to interpret financial data within the context of industry trends, economic conditions, and company-specific factors.

- Time Management: During your preparation, practice working under timed conditions. Efficiently managing time during the assessment is crucial to completing all sections thoroughly.

By mastering these concepts and strategies, you can approach the financial analysis section with confidence and a clear understanding of what is expected in this crucial part of the assessment.

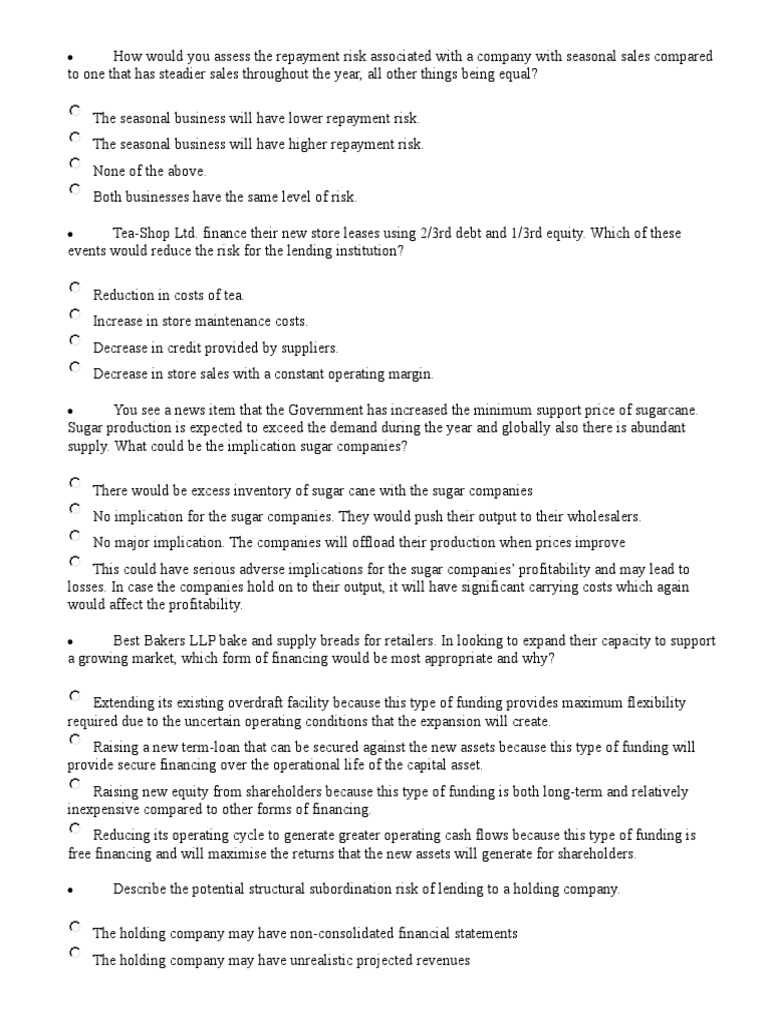

Understanding the Rating System

The rating system used to assess the creditworthiness of entities plays a crucial role in determining the risk level of investments. It provides investors, analysts, and institutions with a standardized method for evaluating the financial stability of companies, governments, and other organizations. These ratings offer a snapshot of an entity’s ability to meet its debt obligations, serving as an essential tool for making informed financial decisions.

The system categorizes entities based on their ability to repay debt, with higher ratings reflecting lower risk and greater financial stability. A strong understanding of how these ratings are assigned and what they signify is essential for anyone involved in financial analysis or investment strategy.

Rating Scale Overview

The rating scale typically ranges from the highest possible rating, indicating minimal risk, to the lowest, signaling significant risk. Here’s an overview of the common categories:

- Investment Grade: These ratings signify a low likelihood of default, making these entities a safer investment option. They are typically used for stable governments and large, financially secure corporations.

- Non-Investment Grade (Junk): These ratings are assigned to entities with higher risk, indicating a greater chance of default. These investments offer higher returns to compensate for the increased risk.

- Creditwatch: Some entities may have a “Creditwatch” status, indicating that their ratings are under review due to potential significant changes in their financial position.

Factors Influencing Ratings

The assignment of a rating involves a detailed analysis of various factors that can affect the financial health of the entity. These include:

- Economic Conditions: The broader economic environment, such as recession risks or inflation, can significantly impact an entity’s financial stability.

- Financial Performance: Metrics such as profitability, liquidity, debt levels, and cash flow are carefully examined to assess financial health.

- Management and Strategy: The ability of the entity’s leadership to effectively manage operations, mitigate risks, and adapt to market changes plays a critical role in determining the rating.

Having a clear understanding of the rating system allows analysts and investors to make better judgments about the relative risk of different financial instruments, enhancing their decision-making process and helping them avoid unnecessary exposure to high-risk investments.

Commonly Asked Questions on the Certification Process

As you prepare for a professional assessment, you may encounter a variety of questions regarding the structure, content, and expectations of the certification. Understanding the most frequently asked questions can help ease any uncertainties and provide you with the necessary tools to succeed. These questions cover a range of topics, from the best ways to prepare to how to approach specific sections of the test.

What Is the Best Way to Prepare?

The most effective preparation for the assessment involves a combination of studying the core topics, practicing with sample materials, and managing your time efficiently. It’s essential to review all relevant areas, including financial analysis, risk evaluation, and strategic management. Additionally, make use of practice tests to familiarize yourself with the format and types of questions you’ll encounter.

How Much Time Should I Spend on Each Section?

Time management is crucial for success. It’s recommended to allocate a set amount of time to each section of the assessment based on its complexity and weight. Some sections may require more in-depth analysis, while others may be more straightforward. Be sure to leave enough time to review your answers, especially for the more challenging questions.

Are There Any Recommended Resources for Studying?

Yes, there are several resources available to assist in your preparation. Textbooks, online courses, practice exams, and official guides from the certifying body are all excellent tools. Joining study groups or seeking out tutoring can also provide additional support if needed.

How Do I Know If I’m Ready for the Test?

Self-assessment is key. If you can comfortably answer most practice questions, understand the material in depth, and manage your time effectively during mock tests, you’re likely ready. It’s also helpful to review any feedback from previous attempts or assessments to identify areas for improvement.

By addressing these common questions, you can approach the certification with greater confidence and clarity, knowing that you are well-prepared for what lies ahead.

Test Day Tips for Success

The day of the assessment can be stressful, but with the right strategies and preparation, you can maximize your chances of success. It’s important to approach the day with a calm and focused mindset. By following some simple tips, you can ensure that you are fully prepared to perform at your best and handle any challenges that arise during the test.

1. Get a Good Night’s Sleep

One of the most important things you can do before test day is to rest well. A good night’s sleep helps improve memory, focus, and cognitive function. Try to avoid last-minute cramming, as this can cause unnecessary stress. Aim to sleep for at least 7-8 hours the night before the test.

2. Eat a Healthy Breakfast

Eating a balanced meal before the test is essential to keep your energy levels up. Opt for a meal with protein, complex carbohydrates, and healthy fats, such as eggs, oatmeal, or whole-grain toast. Avoid sugary or heavy foods, as they can cause a sugar crash and leave you feeling sluggish.

3. Arrive Early and Be Prepared

Give yourself plenty of time to get to the test center. Arriving early helps reduce anxiety and gives you time to settle in. Ensure you have all necessary documents and materials, such as identification, a calculator (if allowed), and any other items specified by the test organizers.

4. Stay Calm and Manage Your Time

During the test, it’s easy to become overwhelmed, but maintaining a calm demeanor is essential. Focus on one question at a time, and don’t dwell on difficult questions for too long. Manage your time wisely, ensuring that you allocate enough time to complete each section and review your work if possible.

5. Read Instructions Carefully

Before starting the test, make sure you fully understand the instructions for each section. Misunderstanding a question or section requirement can lead to unnecessary mistakes. If you are unsure about any instructions, don’t hesitate to ask for clarification before proceeding.

6. Take Breaks When Needed

Some assessments allow short breaks between sections. Use these moments to relax and recharge. Step away from your test materials for a few minutes, stretch, or take deep breaths to refocus and reduce stress levels.

7. Stay Positive and Confident

A positive mindset is key to maintaining focus throughout the test. Stay confident in your preparation and abilities. If you encounter a difficult question, move on and come back to it later–don’t let it derail your entire performance.

| Tip | Why It Helps |

|---|---|

| Get a good night’s sleep | Improves focus and cognitive function |

| Eat a healthy breakfast | Maintains energy levels and concentration |

| Arrive early | Reduces stress and allows for preparation |

| Stay calm and manage your time | Helps reduce anxiety and ensures all questions are addressed |

| Read instructions carefully | Prevents confusion and mistakes |

| Take breaks when needed | Recharges your mind and body |

| Stay positive and confident | Boosts performance and reduces stress |

By following these simple tips, you can ensure that you are in the best possible position to succeed on test day. Focus, preparation, and a calm mindset will help you navigate the challenges ahead and perform to the best of your ability.

How to Improve Your Test Score

Achieving a higher score on an assessment requires focused effort and effective strategies. Whether you are preparing for a comprehensive test or a specific section, there are proven methods to enhance your performance. By implementing the right study habits, time management skills, and test-taking techniques, you can boost your score and increase your chances of success.

1. Organize Your Study Schedule

Creating a study plan is crucial for staying on track and covering all necessary material. Break down your study sessions into manageable chunks, allowing time for review and practice. Consistency is key–set aside specific hours each day dedicated to studying, and stick to the schedule as much as possible.

2. Practice with Past Questions

One of the most effective ways to prepare for any assessment is by practicing with past questions or sample papers. This helps you familiarize yourself with the format, style, and types of questions you will encounter. It also allows you to identify patterns and focus on areas that may require more attention.

| Strategy | Benefit |

|---|---|

| Organize study schedule | Ensures systematic learning and reduces stress |

| Practice with past questions | Familiarizes you with the test format and builds confidence |

| Review mistakes | Helps identify weak points and correct them |

| Focus on key topics | Maximizes study efficiency by prioritizing important areas |

| Stay positive and confident | Maintains motivation and mental clarity during the test |

3. Review Your Mistakes

After completing practice questions or mock tests, take the time to thoroughly review your mistakes. Understanding why you got a question wrong will help you avoid similar errors in the future. Focus on the areas where you struggled the most and dedicate extra time to reinforcing these concepts.

4. Focus on Key Topics

Rather than trying to memorize every detail, prioritize the key topics that are most likely to appear on the test. These are typically the areas that carry the most weight or are emphasized in the guidelines. By mastering these core topics, you’ll be able to tackle a larger portion of the test more confidently.

With a structured approach, consistent practice, and a focus on your weak points, you can significantly improve your test score. Remember that preparation is not just about studying harder, but studying smarter. The more prepared and focused you are, the more successful you will be in achieving your desired outcome.

Real-World Applications of Financial Assessments

Understanding and mastering financial assessments can significantly impact various sectors in the real world. The ability to analyze financial data, interpret trends, and make informed decisions is highly valued in industries such as banking, investment, and corporate finance. Preparing for and succeeding in these types of evaluations equips individuals with the skills necessary to assess risk, manage portfolios, and evaluate market conditions, making them invaluable assets to their organizations.

1. Investment and Portfolio Management

In the world of investment, professionals who are proficient in financial evaluations can better manage risk and optimize portfolio returns. These assessments provide a deep understanding of how market forces influence investment performance, helping analysts make sound decisions that can lead to substantial financial gains. This skill set is essential for those working in hedge funds, private equity, and wealth management.

2. Corporate Finance and Risk Management

For professionals working in corporate finance, understanding how to evaluate financial stability and assess risks is key to ensuring the long-term success of a business. These skills help executives make critical decisions about capital structure, mergers, acquisitions, and investments. Furthermore, risk management professionals rely on this knowledge to protect companies from financial instability by predicting and mitigating potential threats.

| Application | Benefit |

|---|---|

| Investment Management | Improves portfolio analysis and optimizes investment decisions |

| Corporate Finance | Enhances decision-making in mergers, acquisitions, and capital allocation |

| Risk Management | Mitigates potential financial threats and secures business sustainability |

| Credit Analysis | Helps assess the creditworthiness of borrowers and reduce default risks |

3. Credit and Debt Analysis

Credit analysts use financial evaluation tools to assess the creditworthiness of potential borrowers, whether individuals or organizations. This analysis determines the risk of lending and helps financial institutions avoid losses. It also provides essential information for decision-making in lending, credit ratings, and managing outstanding debts.

Ultimately, mastering these assessments translates directly into real-world applications where professionals apply their analytical skills to make strategic, data-driven decisions. Whether in finance, investment, or corporate risk management, the expertise gained from these evaluations is invaluable in shaping the financial strategies of individuals and organizations alike.

Post-Assessment Review and Results Interpretation

After completing a financial assessment, understanding the results is crucial for identifying strengths and areas for improvement. The review process helps individuals evaluate their performance, recognize patterns in their mistakes, and adjust their study strategies for future success. Interpreting the results allows for a deeper understanding of one’s abilities in financial analysis and decision-making, helping professionals refine their skills in practical scenarios.

1. Analyzing Performance Breakdown

Once the results are available, a detailed performance analysis should be conducted. This includes reviewing both correct and incorrect responses to identify the areas that require further attention. Common steps include:

- Identifying the most challenging topics and questions.

- Understanding why specific answers were incorrect and correcting misconceptions.

- Recognizing patterns in the types of questions answered incorrectly.

By carefully assessing your performance, you can target specific areas for improvement, which is essential for enhancing overall proficiency in future assessments.

2. Interpreting the Results

Once you have reviewed your answers, it’s essential to interpret the results within the context of the skills being assessed. The goal is to understand what each score or category represents and how it reflects your understanding of key financial concepts. Some steps in interpreting the results include:

- Reviewing the scoring criteria to understand what each section of the assessment measures.

- Comparing your results to the benchmark or expected performance standards.

- Assessing areas where additional study or practice may be needed to meet professional standards.

Ultimately, post-assessment review and result interpretation provide critical insights that enable professionals to enhance their capabilities. By recognizing their strengths and addressing weaknesses, individuals can improve their readiness for future challenges and refine their financial decision-making skills.

Next Steps After Passing the Assessment

Successfully completing a rigorous professional assessment marks an important milestone in one’s career development. However, passing the test is just the beginning. The next steps involve applying your knowledge, leveraging your credentials, and continuing your growth. Whether you’re advancing in your current role or pursuing new opportunities, it’s essential to build on the foundation you’ve established. This section will explore practical steps for making the most of your achievement and setting yourself up for continued success.

1. Leverage Your Achievement

Now that you have passed the assessment, it’s time to showcase your accomplishment. The certification or qualification you’ve earned holds significant value, and you should use it strategically. Consider the following:

- Update Your Resume and LinkedIn Profile: Highlight your achievement to demonstrate your expertise and commitment to your profession.

- Share Your Success: Inform your professional network, mentors, and colleagues about your accomplishment to open doors for new opportunities.

- Use Your Credentials: Look for ways to apply your new skills in your current job or take on new responsibilities that will further hone your expertise.

2. Continue Your Professional Development

Passing the assessment is a major achievement, but it’s also important to stay ahead of industry trends and maintain your skills. Here’s how you can continue to grow:

- Seek Additional Learning Opportunities: Explore advanced courses, workshops, or certifications to deepen your knowledge and stay competitive.

- Get Involved in Professional Organizations: Join industry groups and attend conferences to stay connected with peers and thought leaders.

- Set New Career Goals: Use your success as a springboard to define your long-term career path and take strategic steps toward achieving those goals.

By taking these next steps, you can maximize the value of your achievement and position yourself for continued growth and success in your career.