Understanding the intricacies of financial practices is essential for anyone pursuing a career in business or finance. This section dives into the fundamental elements that drive decision-making and reporting within organizations. By breaking down complex topics, you’ll gain the tools needed to navigate real-world financial scenarios effectively.

Whether you’re preparing for an exam or simply looking to strengthen your knowledge, focusing on the most critical aspects of financial management will lay a strong foundation. From interpreting statements to mastering key calculations, this content is designed to provide clarity and precision in each concept.

Grasping core principles and applying them in various contexts will help you approach problems confidently. With a structured breakdown of topics, you’ll develop a deeper understanding of how financial data impacts business operations and strategic choices.

Understanding Key Concepts for Financial Analysis

In this section, we focus on clarifying essential financial principles and techniques that are fundamental for any aspiring professional in the field. By reviewing various scenarios and examples, you’ll be better equipped to apply the knowledge gained to real-world financial tasks. Each key area is broken down for a deeper understanding of how financial data impacts overall business strategies and decisions.

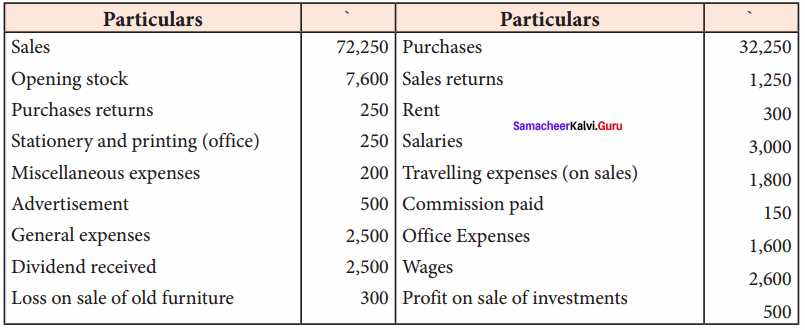

The following table summarizes the most important concepts covered and their practical applications, offering a helpful overview for quick reference:

| Topic | Explanation | Application |

|---|---|---|

| Financial Statements | Overview of key documents that summarize an organization’s financial performance. | Used to assess profitability, liquidity, and overall business health. |

| Cost Analysis | Understanding how various costs affect an organization’s financial position. | Helps in pricing decisions and profit margin optimization. |

| Depreciation Methods | Different approaches to allocating the cost of tangible assets over time. | Essential for tax planning and long-term financial forecasting. |

| Break-even Analysis | Calculating the point at which total revenue equals total costs. | Critical for understanding when a business becomes profitable. |

| Budgeting Techniques | Planning for future financial activity based on anticipated income and expenditures. | Supports effective financial planning and resource allocation. |

By studying and practicing these fundamental topics, you will gain a comprehensive understanding of how financial decisions are made and how to approach complex scenarios with confidence and accuracy.

Overview of Key Financial Concepts

This section provides an essential overview of the foundational principles that guide decision-making and analysis in the field of finance. It covers a wide range of topics that are crucial for understanding how financial information is structured, interpreted, and used in various business contexts. The following areas are explored in-depth to give a clearer understanding of their role and application:

- Understanding the structure of financial records

- Identifying the most important financial metrics

- Exploring methods of assessing financial performance

- Key calculations for evaluating a company’s standing

Throughout this section, you’ll learn how to connect theoretical knowledge to practical application. The goal is to equip you with the tools needed to make informed decisions based on financial reports and analyses.

To help further solidify your understanding, we will cover essential areas like:

- Income statements and their components

- Balance sheets and understanding assets and liabilities

- Cash flow analysis and its importance for business liquidity

- Cost analysis and its impact on profitability

By the end of this section, you will have a comprehensive overview of how key financial data is interpreted and applied in various decision-making scenarios.

Key Concepts in Financial Analysis

This section highlights the core principles that are essential for understanding financial decision-making and analysis. These concepts provide the foundation for interpreting financial data, identifying trends, and making informed business decisions. Mastering these principles will help you confidently approach a wide range of scenarios in the business world.

Understanding Financial Metrics

One of the most crucial aspects of financial analysis is knowing how to evaluate the health of an organization. Key metrics, such as profitability, liquidity, and solvency, provide critical insights into business performance. These indicators help assess whether a company is meeting its financial goals and if adjustments are needed.

Analyzing Profitability and Efficiency

In any business, evaluating profitability and efficiency is vital for long-term success. By looking at various financial measures, such as gross margin, operating income, and net profit, you can assess how well a company is utilizing its resources to generate profit. Efficiency metrics, like return on assets (ROA) and return on equity (ROE), further shed light on the company’s operational effectiveness.

The table below provides a summary of the key metrics and their significance in assessing business performance:

| Metric | Description | Importance |

|---|---|---|

| Gross Margin | Measures the difference between revenue and the cost of goods sold (COGS). | Indicates the basic profitability of a company’s products or services. |

| Operating Income | Represents earnings from core business operations, excluding other sources. | Reflects the effectiveness of operational management. |

| Net Profit | The final earnings after all expenses, taxes, and interest have been deducted. | Shows the overall profitability of the company. |

| Return on Assets (ROA) | Shows how efficiently a company uses its assets to generate profits. | Helps determine asset utilization and operational efficiency. |

| Return on Equity (ROE) | Measures profitability relative to shareholders’ equity. | Indicates how well the company uses equity investments to generate earnings. |

By gaining a deep understanding of these concepts and metrics, you’ll be able to assess financial data with greater precision and apply your knowledge in decision-making scenarios effectively.

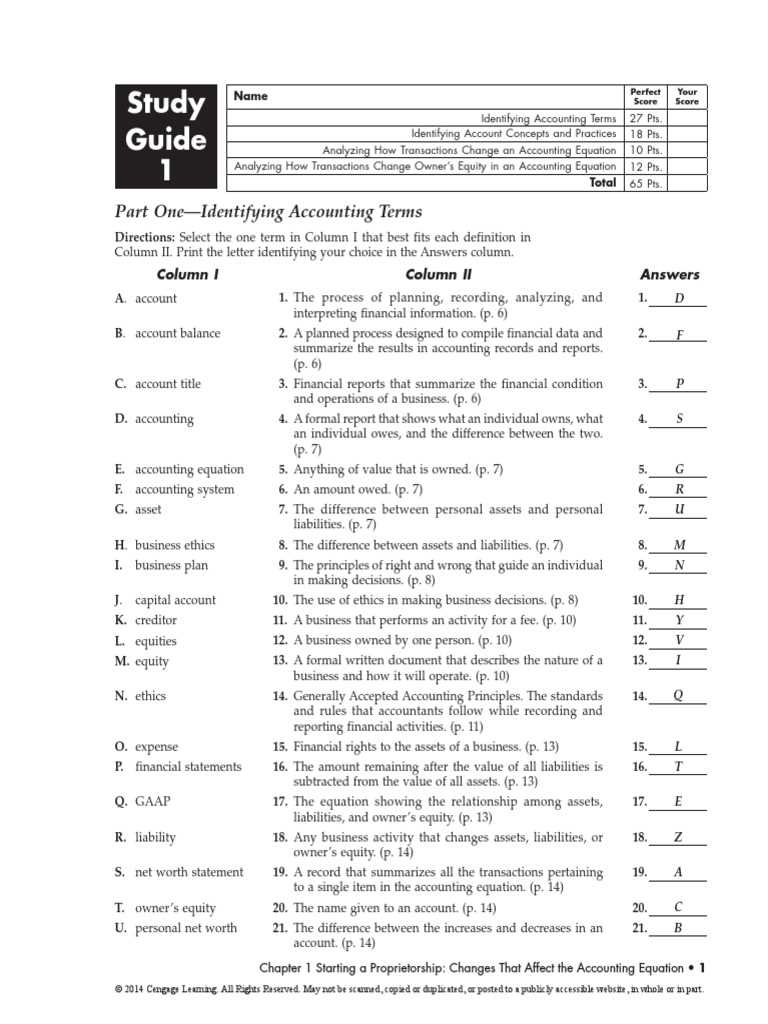

Important Definitions to Remember

Understanding the fundamental terminology used in financial management is essential for accurately interpreting data and making sound decisions. These terms form the building blocks for a comprehensive understanding of how financial systems operate. Below are key terms that every individual working with financial data should be familiar with to ensure clarity and precision in their analysis.

Revenue refers to the total income generated from business activities before any expenses are subtracted. It is the starting point for assessing the financial health of an organization.

Expenses are the costs incurred during the process of generating revenue, such as salaries, utilities, and raw materials. Understanding the nature and breakdown of expenses is crucial for evaluating profitability.

Assets are resources owned by a business that are expected to provide future economic benefits. These can be both tangible, like equipment, and intangible, such as intellectual property.

Liabilities represent financial obligations or debts that a company owes to others. Proper management of liabilities is critical for maintaining solvency and managing cash flow.

Equity refers to the ownership interest in a business, calculated by subtracting liabilities from assets. It indicates the value of the shareholders’ stake in the company.

Liquidity measures a company’s ability to meet short-term obligations with its most liquid assets. It is often assessed using ratios such as the current ratio and quick ratio.

Solvency indicates a company’s ability to meet long-term debts and obligations. It is a key indicator of financial stability and is commonly measured through ratios like debt-to-equity.

Depreciation is the process of allocating the cost of tangible assets over their useful life. It helps reflect the reduction in value of assets over time and is important for tax and financial reporting.

By mastering these definitions, you will be better equipped to navigate financial reports, make informed decisions, and communicate effectively within any business or financial context.

Common Mistakes in Financial Practices

In the world of financial management, even small errors can lead to significant consequences. Understanding and avoiding these common pitfalls is crucial for maintaining accurate records and making informed decisions. Below are some of the most frequent mistakes that can occur in the process of managing financial information:

- Misclassifying Expenses: Incorrectly categorizing costs can lead to inaccurate financial statements, impacting the evaluation of profitability.

- Failing to Reconcile Accounts: Not regularly reconciling bank accounts or other financial records can result in overlooked discrepancies, affecting the overall accuracy of financial reporting.

- Overlooking Depreciation: Ignoring or underestimating the depreciation of assets can lead to inflated asset values and inaccurate expense reporting.

- Inaccurate Tax Calculations: Mistakes in calculating taxes can lead to penalties, fines, and unnecessary financial burdens on the business.

- Not Tracking Cash Flow Properly: Failing to monitor cash flow consistently can result in liquidity problems, making it difficult to meet financial obligations on time.

By being aware of these common mistakes, you can take proactive measures to ensure the accuracy and reliability of your financial records. Proper training, attention to detail, and regular reviews are key to avoiding these pitfalls and maintaining strong financial health.

Step-by-Step Guide to Solutions

This section walks you through the process of solving common financial problems, offering clear steps to follow for accurate and efficient results. By understanding the methodology behind each solution, you will be able to confidently apply these techniques to various scenarios. The following is a structured approach to help you tackle complex financial challenges with ease.

Step 1: Identify the Problem

The first step in solving any financial issue is identifying the core problem. This involves reviewing the data and understanding the context to ensure that the issue is accurately defined. Whether you’re dealing with cash flow issues or assessing profitability, pinpointing the exact problem will guide your approach.

Step 2: Apply Relevant Formulas

Once the problem is clearly defined, the next step is to apply the appropriate formulas and financial metrics. This could include calculating key ratios, determining depreciation, or working with income and expense statements. Using the right tools is crucial for obtaining accurate results.

| Formula | Explanation | Application |

|---|---|---|

| Profit Margin = Net Profit / Revenue | Measures the percentage of profit relative to revenue. | Used to assess the overall profitability of the business. |

| Current Ratio = Current Assets / Current Liabilities | Shows the ability to cover short-term liabilities with short-term assets. | Used to evaluate liquidity and financial health. |

| Return on Equity (ROE) = Net Income / Shareholder Equity | Measures how effectively the business generates profit from shareholders’ investments. | Helps assess the efficiency of equity utilization. |

By applying these formulas and adjusting based on the data provided, you’ll arrive at a solution that accurately reflects the financial situation at hand.

Understanding Journal Entries

Journal entries are the fundamental building blocks of any financial record-keeping system. They serve as the detailed documentation of every transaction that a business undergoes, ensuring that all financial activities are properly captured and reflected in the overall financial statements. This process provides a clear trail of each action and helps maintain the integrity of the financial data.

Structure of a Journal Entry

A journal entry typically consists of several key components, including the date of the transaction, the accounts involved, the amounts debited or credited, and a brief description of the transaction. Each entry must follow the principle of dual entry, where for every debit, there must be a corresponding credit, ensuring that the books remain balanced.

Here’s a basic example of a journal entry:

| Date | Account | Debit | Credit | Description |

|---|---|---|---|---|

| 2024-11-22 | Cash | $1,000 | Received cash from a customer for services rendered | |

| 2024-11-22 | Revenue | $1,000 | Revenue earned from services rendered |

Importance of Accuracy

Ensuring accuracy in journal entries is critical, as errors can distort financial reports and lead to incorrect conclusions about a business’s financial position. Regular reviews and reconciliations are essential to verify that every transaction is recorded correctly and in accordance with accounting principles. By maintaining precise records, businesses can generate reliable financial statements that serve as the basis for strategic decision-making.

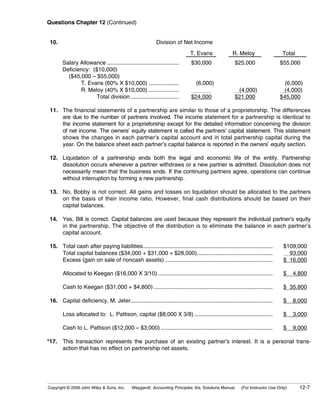

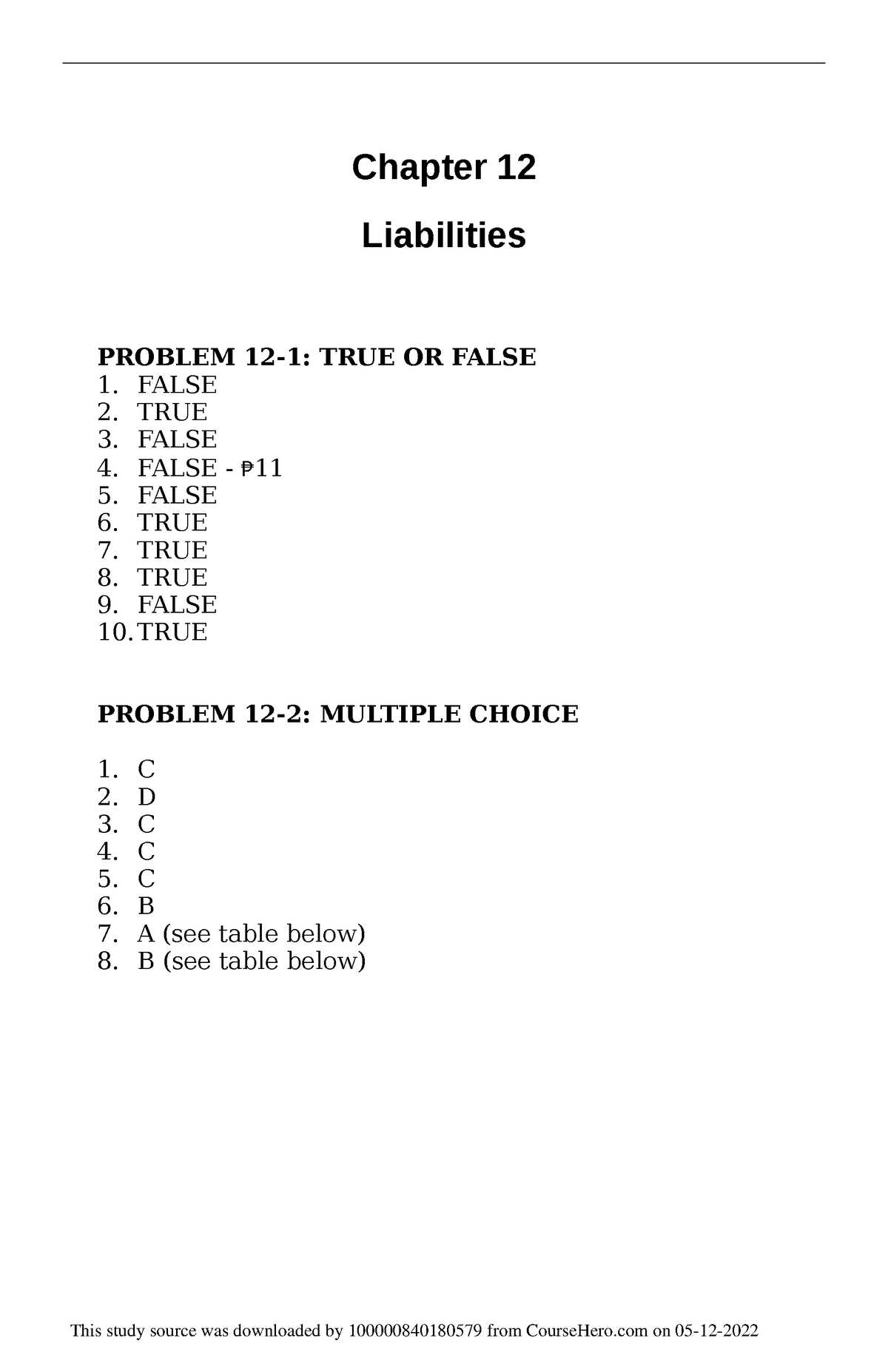

Commonly Tested Topics in Chapter 12

When preparing for assessments related to financial management, certain concepts are frequently tested. Understanding these areas is essential for mastering the material and performing well in evaluations. Below are some of the most commonly covered topics that you should focus on in your study sessions.

- Financial Ratios: These are key metrics used to analyze a company’s performance, including profitability, liquidity, and solvency. Common ratios include return on equity (ROE), current ratio, and quick ratio.

- Asset Valuation: Properly determining the value of assets is critical for accurate financial reporting. Topics often involve depreciation methods, such as straight-line and declining balance depreciation.

- Cash Flow Management: Cash flow analysis helps assess the company’s ability to meet its financial obligations. Expect questions on cash flow statements and cash flow ratios.

- Cost Allocation: Understanding how costs are allocated between different departments or products is vital. Be prepared to calculate overhead rates and other allocation methods.

- Income Statement Preparation: The structure and components of an income statement are commonly tested. This includes identifying and calculating revenues, expenses, and profits.

- Equity and Debt Financing: Understanding the difference between equity financing (issuing stocks) and debt financing (issuing bonds) is essential for financial strategy discussions.

Focusing on these topics will not only help you prepare for tests but also build a solid foundation in understanding the broader principles of financial management. Mastering these areas ensures that you’re equipped to tackle a wide range of questions and scenarios that may arise during assessments.

How to Approach Chapter 12 Problems

Solving financial problems requires a systematic approach to ensure accuracy and clarity. Whether you’re working through calculations or conceptual questions, a step-by-step method will help you stay organized and avoid common mistakes. Below are the strategies you can use to effectively tackle problems in this section.

Step 1: Understand the Question

Before jumping into the numbers, take a moment to carefully read the problem. Identify key information and determine what is being asked. Look for clues about which formulas or methods should be used, as well as any assumptions you may need to make.

Step 2: Break Down the Problem

Once you have a clear understanding, break the problem into manageable parts. This could involve isolating variables, setting up equations, or categorizing data. A step-by-step breakdown allows you to focus on one piece at a time and helps prevent feeling overwhelmed.

- Identify Given Data: Write down all the known variables from the problem.

- Determine What Needs to Be Found: Clearly define the unknown values you need to calculate.

- Select Relevant Formulas: Choose the right equations or techniques based on the information provided.

Step 3: Execute the Calculations

Now that you’ve outlined the problem, proceed with the calculations. Ensure you use the correct units and double-check each step. If applicable, simplify equations and round numbers appropriately. Pay attention to signs (positive or negative), as they can impact your final result.

Step 4: Review Your Solution

Once you’ve completed the problem, review your solution to confirm it makes sense. Check your calculations, ensure you’ve answered the original question, and verify that all assumptions were properly addressed. A final check will help identify any errors before you submit your work.

By following these steps, you can confidently approach each problem, ensuring that your answers are accurate and well-supported by logical reasoning.

Using Accounting Ratios for Analysis

Financial ratios are powerful tools used to evaluate a company’s performance and financial health. By comparing different metrics from financial statements, these ratios provide insights into key aspects such as profitability, liquidity, and overall efficiency. Understanding how to use these ratios is essential for interpreting the financial condition of any business.

Ratios are typically categorized into several groups, each focusing on a different area of financial performance:

- Profitability Ratios: These ratios measure a company’s ability to generate profit relative to its revenue, assets, or equity. Common examples include the return on equity (ROE) and gross profit margin.

- Liquidity Ratios: These ratios assess a company’s ability to meet short-term obligations. The current ratio and quick ratio are frequently used to determine financial stability.

- Leverage Ratios: These ratios evaluate the level of debt used by a company in relation to its equity or assets. The debt-to-equity ratio is a common example.

- Efficiency Ratios: These ratios assess how effectively a company is utilizing its assets. The asset turnover ratio and inventory turnover ratio are commonly analyzed metrics.

By applying these ratios, analysts can spot trends, compare performance across different periods, and benchmark against industry standards. They are also invaluable for identifying potential financial risks or opportunities for growth. Whether you’re a business owner, investor, or financial analyst, mastering ratio analysis is an essential skill for making informed decisions based on reliable data.

Review of Financial Statements

Financial statements provide a snapshot of a company’s financial performance and position. They are essential tools for assessing the financial health of an organization and making informed decisions. These statements typically include key reports such as the balance sheet, income statement, and cash flow statement, each offering unique insights into different aspects of business operations.

The balance sheet outlines the company’s assets, liabilities, and equity at a specific point in time, offering a clear picture of its financial standing. It helps evaluate liquidity and financial stability by highlighting how resources are financed–either through debt or equity.

The income statement shows a company’s profitability over a period by detailing revenue, expenses, and net income. It is crucial for understanding operational efficiency and identifying areas for cost reduction or revenue growth.

Finally, the cash flow statement tracks the flow of cash in and out of the business, categorizing activities into operations, investing, and financing. This report is vital for assessing a company’s ability to generate cash and maintain liquidity to cover its obligations.

When reviewed together, these statements offer a comprehensive overview of a company’s financial situation, helping stakeholders–whether investors, management, or creditors–make well-informed judgments about the organization’s future potential and stability.

Explaining Cash Flow Statements

A cash flow statement is a crucial financial document that tracks the movement of cash into and out of a business over a specific period. It provides essential insights into a company’s ability to generate cash from its core operations, as well as how it manages its cash to fund investments, meet obligations, and return value to shareholders.

The statement is typically divided into three main sections: operating activities, investing activities, and financing activities. Each section focuses on different aspects of cash flow and helps stakeholders understand the sources and uses of cash within the business.

Operating activities reflect the cash generated or used in the day-to-day functions of the business, such as sales, expenses, and working capital changes. This section is a key indicator of a company’s ability to sustain operations and generate profits over time.

Investing activities involve cash flows related to the purchase or sale of long-term assets, such as property, equipment, or investments. Analyzing this section helps assess how the company is allocating its resources for future growth.

Financing activities show cash flows from borrowing or repaying debt, issuing equity, or paying dividends. These transactions indicate how the company is funding its operations and whether it is relying on external sources of capital to support growth.

By reviewing the cash flow statement, investors, managers, and other stakeholders can gauge the company’s financial health, its capacity to manage short-term obligations, and its strategy for long-term sustainability. Understanding cash flow is vital for making informed decisions about potential risks and opportunities in the business.

Breakdown of Depreciation Methods

Depreciation is the process of allocating the cost of a long-term asset over its useful life. This accounting concept helps businesses match expenses with the revenue generated by using the asset. Different methods are available for calculating depreciation, and the choice of method can impact the financial statements and tax obligations of a company. Understanding the different approaches is essential for accurate financial reporting and decision-making.

There are several methods used to calculate depreciation, each with its own advantages and applications. Below are the most commonly used approaches:

- Straight-Line Depreciation: This is the simplest and most widely used method, where the same amount of depreciation is expensed each year over the asset’s useful life. It assumes the asset loses value evenly over time.

- Declining Balance Method: This approach accelerates the depreciation expense, allowing a larger portion of the asset’s cost to be deducted in the earlier years. It is based on a fixed percentage of the asset’s book value at the beginning of each year.

- Units of Production Method: This method ties depreciation to the actual usage of the asset. The more the asset is used, the greater the depreciation expense, making it ideal for assets whose value declines with usage rather than time.

- Sum-of-the-Years’-Digits Method: Another accelerated method, where depreciation is based on a sum of years. It charges a larger expense in the earlier years of an asset’s life and decreases over time.

Choosing the appropriate depreciation method depends on the nature of the asset and how it is expected to be used. For instance, assets that lose value quickly may benefit from an accelerated method, while assets with steady usage patterns might be better suited to the straight-line method. The method chosen can have a significant impact on the financial performance and tax liabilities of the business.

Inventory Valuation Techniques

Inventory valuation is a critical process for businesses that deal with physical goods. It determines the value of unsold stock and impacts financial reporting, profit margins, and taxation. There are several methods used to calculate the cost of inventory, each influencing the financial outcomes in different ways. The choice of valuation method can significantly affect a company’s balance sheet and income statement, making it essential for businesses to select the right approach based on their operations and market conditions.

Here are the most commonly used inventory valuation methods:

- First-In, First-Out (FIFO): Under FIFO, the earliest purchased or produced items are assumed to be sold first. This method is beneficial during times of rising prices, as it results in lower cost of goods sold and higher inventory value, leading to a higher reported profit.

- Last-In, First-Out (LIFO): LIFO assumes that the most recently acquired items are sold first. This method tends to be more advantageous in periods of inflation, as it matches the latest, higher costs against current revenues, resulting in lower taxable income and thus lower taxes.

- Weighted Average Cost: This method calculates the average cost of all inventory items available for sale during the period. The cost of goods sold and ending inventory are both based on this average cost, making it simpler to apply than FIFO or LIFO.

- Specific Identification: This method tracks the actual cost of each individual item of inventory. It is best suited for businesses dealing with unique or high-value items, such as cars, real estate, or expensive machinery, where each item can be specifically identified and valued.

Each of these techniques offers distinct advantages depending on market conditions and the nature of the inventory. The choice between FIFO, LIFO, and other methods can affect profitability, tax liabilities, and cash flow, so businesses must carefully consider their financial strategy when selecting an inventory valuation approach.

Exploring Cost-Volume-Profit Analysis

Cost-Volume-Profit (CVP) analysis is a powerful tool used by businesses to understand the relationship between costs, sales volume, and profits. It helps in determining how changes in various factors, such as sales price, production costs, and sales volume, impact profitability. By utilizing CVP analysis, organizations can make more informed decisions regarding pricing strategies, product lines, and cost management.

The analysis focuses on several key components that influence overall business performance:

- Fixed Costs: These are costs that do not change with the level of production or sales, such as rent or salaried employee wages. Understanding fixed costs helps businesses identify the baseline expenses that must be covered before generating a profit.

- Variable Costs: These costs fluctuate in direct proportion to the level of production or sales, such as raw materials or hourly labor. The ability to manage variable costs is crucial for maximizing profit margins as production scales up or down.

- Sales Price: The price at which goods or services are sold plays a vital role in determining profitability. CVP analysis evaluates how changes in pricing affect the break-even point and profit potential.

- Sales Volume: The quantity of products or services sold is central to CVP analysis. By understanding the volume required to break even and start generating profit, businesses can set realistic sales targets.

- Contribution Margin: This is the difference between sales revenue and variable costs, representing the amount available to cover fixed costs and generate profits. The contribution margin ratio is a crucial metric in CVP analysis, as it helps assess the impact of changes in sales volume on profitability.

CVP analysis is often summarized in a break-even analysis, which identifies the point at which total revenue equals total costs, resulting in neither profit nor loss. Additionally, it helps in setting sales targets, determining optimal product pricing, and analyzing the effects of cost changes on profitability.

By applying CVP principles, businesses can make strategic decisions that align their cost structure with their revenue goals, ensuring sustainable profitability even in fluctuating market conditions.

Interpreting Budget Variances

Understanding budget variances is crucial for evaluating a business’s financial performance. Variances arise when there is a difference between the budgeted (planned) figures and the actual figures. These differences can be either favorable or unfavorable and provide valuable insights into how well a company is managing its resources. By analyzing these variances, organizations can identify areas where performance deviates from expectations and take corrective actions when necessary.

Types of Budget Variances

There are two primary types of variances to consider when evaluating financial performance:

- Favorable Variance: A favorable variance occurs when actual revenues exceed budgeted revenues, or when actual expenses are less than budgeted expenses. This indicates better-than-expected performance, contributing positively to profitability.

- Unfavorable Variance: An unfavorable variance occurs when actual revenues fall short of budgeted revenues, or when actual expenses exceed budgeted expenses. This highlights areas of concern that may require management’s attention to avoid further negative impacts on profitability.

Causes of Budget Variances

Budget variances can stem from various factors, including but not limited to:

- Changes in market conditions: External factors such as shifts in demand, economic conditions, or competition can impact actual performance, leading to variances from the budget.

- Operational inefficiencies: Internal factors, such as mismanagement, production delays, or higher-than-expected labor costs, can result in unfavorable variances.

- Pricing adjustments: Changes in the selling price of goods or services can also lead to variances, especially when actual sales are higher or lower than anticipated.

- Underestimation or overestimation of expenses: Budgeting errors in estimating fixed or variable costs can lead to significant variances, impacting the overall financial outcome.

Analyzing budget variances is essential for ongoing financial health. When variances are unfavorable, organizations must investigate the root causes and determine whether corrective measures, such as cost-cutting initiatives or adjusting sales strategies, are necessary to bring performance back in line with expectations.

Applying Managerial Accounting in Practice

In the dynamic world of business, making informed decisions is essential to ensuring long-term success. One of the most effective ways to support decision-making is through the application of specialized financial tools and techniques. These methods help managers understand costs, evaluate performance, and strategize effectively. By leveraging these techniques, organizations can enhance their operational efficiency, profitability, and overall sustainability.

Strategic Decision-Making

Effective decision-making relies heavily on accurate and timely information. In practice, managers use various financial reports and metrics to evaluate different business scenarios, such as:

- Cost behavior analysis: Understanding how different costs behave in relation to production levels helps managers predict and control expenses.

- Break-even analysis: This tool helps determine the minimum sales needed to cover all fixed and variable costs, which is essential for pricing and profit forecasting.

- Budgeting: By comparing actual performance to budgeted figures, managers can spot variances and take corrective actions where necessary.

Improving Operational Efficiency

In the real world, businesses often face challenges related to resource management and cost control. Managerial tools can help identify areas where improvements can be made. For example, activity-based costing helps businesses allocate overhead costs more accurately, while variance analysis highlights discrepancies between planned and actual outcomes. By regularly applying these techniques, managers can fine-tune operations to increase productivity and reduce waste.

By incorporating these approaches into daily operations, organizations gain a better understanding of financial performance and can make more informed choices that align with their strategic goals.

Test Tips for Chapter 12 Success

Preparing for an upcoming exam requires more than just reading through materials–effective strategies are key to mastering the concepts. Whether it’s understanding financial metrics or interpreting performance reports, a structured approach to studying can greatly enhance your chances of success. This section provides practical tips to help you effectively approach the material and excel in the test.

Organize Your Study Material

Begin by breaking down the content into manageable sections. Focus on understanding core principles and their real-world applications. Highlight key formulas, definitions, and concepts that are frequently tested. Create concise notes or flashcards to help reinforce important points. These tools can be invaluable when reviewing before the exam.

Practice with Sample Questions

One of the most effective ways to prepare for a test is by practicing with sample questions or past exam papers. This allows you to familiarize yourself with the format and types of questions that may appear. Pay close attention to the reasoning behind each answer. Practice will help you improve time management during the exam and increase your confidence.

Additionally, reviewing mistakes from practice tests can provide valuable insights. Identifying areas where you need improvement ensures that you focus your revision efforts on the most challenging topics. This approach helps turn weaknesses into strengths, making you more prepared for the test.