Achieving a strong performance in economics assessments requires a clear understanding of key principles and concepts. Whether you’re tackling theoretical questions or applying practical knowledge to problem-solving, mastering the material is essential. By focusing on critical topics and honing your ability to think analytically, you can increase your confidence and readiness.

Effective preparation involves familiarizing yourself with economic models, key theories, and common problem-solving techniques. Understanding the relationship between variables, interpreting data correctly, and applying economic principles to various scenarios are all crucial aspects of success. Equally important is knowing how to structure your responses clearly and logically, demonstrating a deep grasp of the subject matter.

Mastering the foundational elements can also provide a strong advantage in your ability to tackle more complex topics. Developing a systematic approach to studying will help you identify and prioritize the most relevant areas, ensuring you’re well-equipped for a range of questions. This approach fosters both efficiency and precision in your response strategy.

Economics Assessment Preparation

When preparing for any assessment in this field, it’s essential to focus on grasping the core principles and applying them accurately to various scenarios. The ability to analyze data, understand key relationships, and solve complex problems is critical to demonstrating your knowledge effectively. Preparation goes beyond memorization; it involves developing a deep understanding of the underlying concepts and how they interconnect.

For optimal performance, it’s important to break down difficult topics into manageable parts. This includes identifying essential models, theories, and formulas, as well as practicing the application of these elements in different contexts. Gaining proficiency in interpreting graphs, understanding market structures, and evaluating economic behavior will help you tackle a broad range of questions with confidence.

By focusing on these key areas and refining your analytical skills, you can approach any question with a structured response. Practicing problem-solving techniques and reviewing common question formats will also help build confidence and speed during the assessment. This thorough preparation ensures that you can demonstrate a comprehensive understanding of the material.

Key Concepts for Economics Assessment Success

Success in economics assessments hinges on a solid grasp of fundamental principles. Understanding core concepts, such as supply and demand, elasticity, and market structures, is crucial to navigating a variety of topics. Mastering these areas not only enhances your problem-solving abilities but also enables you to apply theoretical knowledge to real-world scenarios effectively.

Essential Economic Principles

Several foundational principles serve as the building blocks for any assessment in this field. These principles are not only vital for answering specific questions but also provide a broader framework for understanding economic behavior. Here are some of the most important concepts:

- Supply and Demand: The basic interaction that determines the price and quantity of goods in any market.

- Elasticity: The sensitivity of quantity demanded or supplied to changes in price.

- Marginal Analysis: The examination of the additional benefits and costs of economic decisions.

- Market Equilibrium: The point where supply equals demand, ensuring efficient allocation of resources.

Practical Application of Key Theories

Being able to apply economic theories to practical situations is as important as understanding the concepts themselves. The ability to work through problems involving cost-benefit analysis, profit maximization, and consumer behavior is essential. Focus on the following areas to build your application skills:

- Identifying optimal production levels using marginal cost and marginal revenue.

- Analyzing consumer choices and utility maximization.

- Understanding how external factors such as taxes or subsidies impact market behavior.

- Recognizing the differences between various market structures and their implications for pricing and output decisions.

Understanding Supply and Demand Curves

The relationship between the availability of goods and consumer desire for those goods is fundamental to economic theory. These relationships are visually represented through curves that show how price and quantity interact within a market. Grasping how these curves work helps in analyzing how markets reach equilibrium and how external factors, like changes in price or external shocks, influence economic outcomes.

At the heart of supply and demand analysis are two primary curves: the supply curve, which shows the quantity of a good producers are willing to sell at different prices, and the demand curve, which shows the quantity consumers are willing to buy. The intersection of these two curves determines the market price and quantity, known as the equilibrium.

Key Elements of the Supply Curve

The supply curve slopes upward, reflecting the idea that as prices rise, producers are willing to supply more of a good. This is because higher prices typically lead to higher profits, incentivizing producers to increase production. Key points to understand include:

- Law of Supply: As price increases, the quantity supplied also increases.

- Shifts in the Supply Curve: Changes in factors like production costs or technology can shift the supply curve to the left (decrease) or right (increase).

Key Elements of the Demand Curve

In contrast, the demand curve typically slopes downward. As the price of a good decreases, consumers are willing to purchase more of it. This inverse relationship between price and quantity demanded is a central concept in understanding market behavior. Important aspects of the demand curve include:

- Law of Demand: As price decreases, the quantity demanded increases.

- Shifts in the Demand Curve: Changes in consumer income, preferences, or the prices of related goods can shift the demand curve to the left (decrease) or right (increase).

Understanding these curves is essential for predicting how markets react to various changes, from price fluctuations to shifts in external factors. By mastering this concept, you can better analyze how market forces determine the pricing and availability of goods in an economy.

Important Economic Theories You Should Know

To effectively navigate through any economic assessment, it’s essential to understand several key theories that form the backbone of economic analysis. These theories provide the framework for understanding how markets operate, how consumers make decisions, and how producers respond to changes in the economic environment. Familiarizing yourself with these fundamental ideas will help you build a solid foundation for tackling more complex problems.

Some of the most influential theories highlight how different factors such as price, production costs, and consumer behavior shape economic outcomes. Mastering these theories will allow you to critically analyze various market scenarios and predict outcomes with greater accuracy.

Theory of Consumer Behavior

One of the core concepts in economics is understanding how individuals make purchasing decisions. The theory of consumer behavior explains how consumers allocate their resources (income) to maximize satisfaction or utility. Key aspects include:

- Utility Maximization: Consumers seek to get the most value or satisfaction from their income.

- Budget Constraints: Consumers make choices based on their limited financial resources.

- Indifference Curves: These curves represent various combinations of goods that give consumers the same level of satisfaction.

Production and Cost Theory

Understanding how businesses produce goods and the costs involved is crucial for analyzing market behavior. The theory of production and costs explains the relationship between inputs and outputs and how firms decide the optimal amount of resources to employ. Important elements include:

- Law of Diminishing Returns: As more units of a variable input are added to a fixed input, the additional output produced eventually decreases.

- Short-Run and Long-Run Costs: In the short run, some inputs are fixed, while in the long run, all inputs can be adjusted.

- Economies of Scale: Firms experience lower per-unit costs as they increase their level of production.

By understanding these and other key theories, you can gain deeper insights into the mechanisms that drive economic systems and apply them effectively in problem-solving scenarios.

Elasticity and Its Role in Economics

Elasticity is a fundamental concept in economics that measures the responsiveness of one variable to changes in another. It plays a critical role in understanding how price changes impact the quantity demanded or supplied in the market. By analyzing elasticity, economists can predict consumer behavior, the effects of price changes, and how different market forces influence the economy.

The concept of elasticity is essential for businesses and policymakers, as it helps them make informed decisions regarding pricing, taxation, and subsidies. For instance, understanding the elasticity of demand can guide firms in setting optimal prices, while governments can use this knowledge to assess the impact of taxes or price controls on market behavior.

Types of Elasticity

There are several types of elasticity, each focusing on a different aspect of the relationship between price and quantity. The most commonly analyzed types are price elasticity of demand, price elasticity of supply, and income elasticity of demand.

| Type of Elasticity | Definition | Formula | Impact on Market |

|---|---|---|---|

| Price Elasticity of Demand | Measures how much the quantity demanded of a good changes in response to a change in its price. | Ed = % Change in Quantity Demanded / % Change in Price | Higher elasticity means consumers are more responsive to price changes. |

| Price Elasticity of Supply | Measures how much the quantity supplied of a good changes in response to a change in its price. | Es = % Change in Quantity Supplied / % Change in Price | Higher elasticity indicates that producers can easily adjust their supply in response to price changes. |

| Income Elasticity of Demand | Measures how the quantity demanded of a good changes in response to a change in consumer income. | Yed = % Change in Quantity Demanded / % Change in Income | Helps identify whether a good is a necessity, luxury, or inferior. |

Understanding these types of elasticity allows for more accurate predictions about market dynamics and the effects of various economic changes on consumer and producer behavior.

How to Solve Profit Maximization Problems

Profit maximization is a fundamental goal for businesses, and solving these problems involves understanding the relationship between costs, revenue, and output levels. By determining the point where a firm’s total profit is at its highest, you can provide insights into how businesses should set their production levels and pricing strategies. The process involves both analytical techniques and a clear understanding of key economic principles.

To solve profit maximization problems, it is essential to focus on the following key steps:

Steps to Solve Profit Maximization Problems

- Determine the Total Revenue (TR): Total revenue is the amount of money a firm receives from selling its goods or services. It is calculated by multiplying the price per unit by the quantity sold.

- Calculate Total Costs (TC): Total costs include both fixed and variable costs. Fixed costs remain constant regardless of output, while variable costs change with the level of production.

- Find Profit Function: Profit is calculated by subtracting total costs from total revenue: Profit = TR – TC.

- Maximize Profit: To find the output level that maximizes profit, take the derivative of the profit function with respect to quantity and set it equal to zero. This will give you the point where profit is maximized.

Key Considerations for Maximizing Profit

While the mathematical approach is essential, it’s also important to consider the practical aspects of business operations that impact profitability:

- Marginal Revenue (MR) and Marginal Cost (MC): The point where MR = MC indicates the optimal production level. If MR exceeds MC, increasing production will increase profit; if MC exceeds MR, reducing production will increase profit.

- Market Conditions: Consider factors like competition, demand elasticity, and input costs. These variables can shift the relationship between price, quantity, and profit.

- Long-Term Strategy: Profit maximization often requires balancing short-term objectives with long-term goals, such as investment in technology or market expansion.

By following these steps and considering the broader context, businesses can determine the optimal output and pricing strategies to maximize their profits in both competitive and monopoly markets.

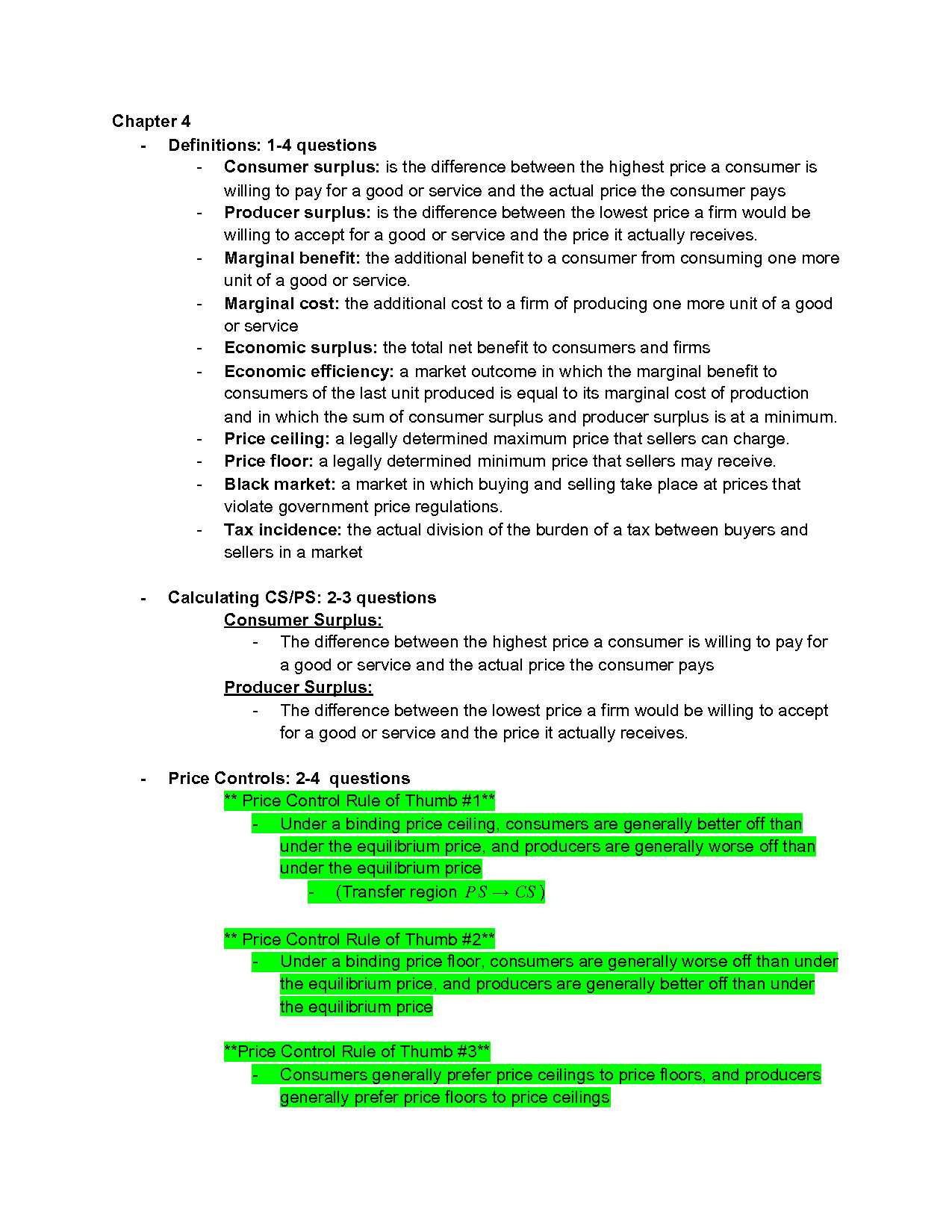

Understanding Consumer and Producer Surplus

Consumer and producer surplus are important concepts that represent the benefits that consumers and producers receive from participating in a market. These surpluses reflect the difference between what consumers are willing to pay for a good or service and what they actually pay, as well as the difference between the price at which producers are willing to sell a good and the price they actually receive. Together, these surpluses help to measure the efficiency of markets and the overall welfare of participants.

In a well-functioning market, both consumers and producers benefit from trade. Consumers gain surplus when they are able to purchase goods for less than their maximum willingness to pay, while producers gain surplus when they can sell goods for a price higher than their minimum acceptable price. Understanding these surpluses provides insights into market efficiency and can help guide policy decisions.

Consumer Surplus

Consumer surplus occurs when consumers are able to purchase a good or service for less than the maximum price they are willing to pay. It is the area between the demand curve and the price line, representing the net benefit to consumers. The larger the difference between the market price and the price consumers are willing to pay, the greater the consumer surplus.

Producer Surplus

Producer surplus, on the other hand, is the benefit producers receive when they sell goods at a price higher than their minimum acceptable price. This is represented by the area between the supply curve and the price line. The larger the difference between the market price and the price at which producers are willing to sell, the greater the producer surplus.

Both surpluses combined indicate the total welfare or benefit derived from market transactions. These concepts are used to evaluate market efficiency, with a greater surplus suggesting a more efficient allocation of resources in the economy.

Market Structures: From Perfect to Monopoly

Different market environments shape how businesses operate and interact with consumers. These environments can range from highly competitive, where multiple firms sell identical goods, to highly concentrated, where one firm controls the entire market. Understanding these structures is crucial for grasping how prices are set, how firms behave, and how resources are distributed within the economy.

At one extreme, markets function with perfect competition, where numerous sellers offer identical products, leading to efficient outcomes. On the other end, a monopoly exists when a single company dominates, often resulting in higher prices and restricted choice for consumers. Between these extremes are various market forms, each with its own characteristics, advantages, and disadvantages.

Perfect Competition

In perfectly competitive markets, there are many firms that sell identical products, and no single firm has enough influence to control prices. This structure leads to efficient outcomes, where the forces of supply and demand determine the market price. Some of the key features include:

- Numerous sellers: There are many small firms in the market, none of which can influence the price.

- Homogeneous products: All products offered by firms are identical, with no differentiation.

- Free entry and exit: Firms can easily enter and exit the market without significant barriers.

- Price takers: Firms accept the prevailing market price as determined by supply and demand forces.

Monopolistic Competition

Monopolistic competition exists when there are many firms in the market, but each firm offers a product that is slightly differentiated from its competitors. While firms have some control over prices, the market remains relatively competitive. Features of monopolistic competition include:

- Differentiated products: Each firm offers a unique product that differs in some way from others.

- Many competitors: Although firms have some control over their prices, they still face competition.

- Low barriers to entry: New firms can enter the market with relative ease, provided they can differentiate their product.

Oligopoly

An oligopoly is a market structure where a small number of large firms dominate. These firms hold significant market power, often making strategic decisions based on the actions of competitors. In oligopolistic markets, firms may engage in collusion or price leadership to maximize profits. The defining features include:

- Few dominant firms: A small number of firms hold most of the market share.

- Barriers to entry: High startup costs or other factors prevent new competitors from entering the market easily.

- Strategic behavior: Firms make decisions based on the anticipated actions of their competitors.

Monopoly

A monopoly exists when one firm is the sole provider of a good or service, with no close substitutes available. The monopolist has significant control over pricing and can restrict output to maximize profits. Features of a monopoly include:

- Single seller: The entire market is controlled by one firm.

- High barriers to entry: Legal, technological, or economic factors prevent other firms from entering the market.

- Price maker: The monopolist sets prices rather than accepting market prices.

Each market structure presents different challenges and opportunities for firms, affecting how they price products, compete, and allocate resources. Understanding these structures helps to analyze economic efficiency and the role of competition in shaping consumer and business behavior.

Application of Marginal Analysis in Economics

Marginal analysis is a fundamental tool in economics, helping to evaluate the impact of small changes in variables on overall outcomes. By comparing the additional benefits and costs of incremental decisions, this approach guides individuals and firms in optimizing their resource allocation. Whether determining how much more to produce, consume, or invest, understanding marginal changes is essential for making efficient economic decisions.

The principle behind marginal analysis is simple: decisions are made based on the additional or marginal value that an action will bring. This concept is widely used in various economic fields, including production, consumption, and market pricing. For example, businesses can assess whether increasing production will lead to higher profits, while consumers use marginal utility to determine their spending behavior.

Marginal Cost and Marginal Benefit

Two key concepts in marginal analysis are marginal cost and marginal benefit. Marginal cost refers to the extra cost incurred when producing one more unit of a good or service, while marginal benefit is the additional satisfaction or profit gained from consuming or producing that extra unit.

- Marginal cost: The change in total cost when the quantity of a good or service is increased by one unit. It is crucial for firms to understand this to avoid overproduction.

- Marginal benefit: The additional benefit received from consuming one more unit of a product. This helps consumers determine the value of their purchases.

When the marginal benefit equals the marginal cost, the economy is in an optimal state, as no additional units should be produced or consumed beyond this point. This equilibrium ensures that resources are used efficiently, with no wastage of capital or effort.

Practical Applications of Marginal Analysis

Marginal analysis is applied across many economic decisions, from everyday consumer choices to large-scale business operations. Some practical examples include:

- Production decisions: Firms decide how much of a good to produce by comparing the marginal cost of production to the marginal revenue it will generate.

- Consumption choices: Consumers allocate their budget by comparing the marginal utility of different goods and services to maximize satisfaction.

- Investment strategies: Investors assess the marginal return on capital to decide how to allocate funds across various opportunities.

By understanding and applying marginal analysis, both businesses and individuals can make more informed and efficient decisions, ensuring the optimal use of available resources and maximizing potential benefits.

How to Approach Cost-Benefit Analysis

Cost-benefit analysis is a systematic approach to evaluating the potential gains and losses associated with a decision or investment. It involves comparing the total expected costs of an action against its total expected benefits to determine whether the decision is worth pursuing. This process helps decision-makers prioritize projects, allocate resources efficiently, and make informed choices that maximize overall value.

The key to effective cost-benefit analysis lies in accurately estimating both costs and benefits, as well as considering all relevant factors. Often, this process requires a detailed examination of both tangible and intangible outcomes. A successful analysis helps to ensure that resources are directed toward opportunities that offer the greatest return relative to their costs.

Step-by-Step Guide to Conducting a Cost-Benefit Analysis

To properly conduct a cost-benefit analysis, follow these general steps:

- Identify the decision or project: Clearly define the scope and objectives of the decision you are analyzing.

- List all costs: Enumerate both direct and indirect costs, including initial investment, operating expenses, and any potential risks or downsides.

- Identify potential benefits: Assess both monetary and non-monetary benefits, such as increased revenue, improved efficiency, or enhanced customer satisfaction.

- Quantify costs and benefits: Assign measurable values to each cost and benefit where possible, even if some are subjective or based on estimates.

- Compare and analyze: Subtract the total costs from the total benefits. If the benefits outweigh the costs, the project may be a good investment.

Considerations for Accurate Analysis

While conducting a cost-benefit analysis, it is important to consider several key factors:

- Timeframe: Be sure to account for both short-term and long-term costs and benefits, as some effects may not be immediately visible.

- Risk and uncertainty: Incorporate the potential for unexpected events or changes in assumptions that could alter the outcome of the analysis.

- Opportunity cost: Consider the potential value of alternative investments or actions that may be sacrificed by pursuing a particular option.

By carefully following these steps and considering all relevant factors, decision-makers can make well-informed, rational choices that align with their objectives and optimize outcomes.

Key Formulas for Success in Economic Assessments

Understanding the essential mathematical formulas is critical for success when approaching economic evaluations. These formulas provide a structured way to calculate various economic concepts such as costs, revenues, and efficiencies. Mastering these equations not only aids in solving problems more efficiently but also ensures a deeper understanding of economic theory and its practical applications.

In this section, we will explore some of the most important formulas used in evaluating economic decisions and scenarios. These formulas are essential tools that every student should be familiar with in order to navigate complex calculations with ease and precision.

1. Total Revenue (TR)

The total revenue is the total amount of money a business earns from selling goods or services. It can be calculated using the following formula:

TR = Price x Quantity

This formula is crucial for analyzing a company’s income and is often used to assess pricing strategies and market performance.

2. Marginal Cost (MC)

Marginal cost is the additional cost incurred from producing one more unit of a good or service. It helps businesses decide how much to produce in order to maximize profits. The formula for marginal cost is:

MC = ΔTotal Cost / ΔQuantity

Where Δ (Delta) represents a change in cost or quantity. Understanding marginal cost is vital for pricing and production decisions.

3. Profit Maximization

Profit maximization occurs when a firm produces at a level where marginal revenue equals marginal cost. This concept is fundamental in microeconomic analysis. The equation used to find the profit-maximizing quantity is:

MR = MC

Where MR is marginal revenue and MC is marginal cost. The point where these two are equal is where the firm achieves maximum profit.

4. Price Elasticity of Demand (PED)

The price elasticity of demand measures how much the quantity demanded of a good changes in response to a change in its price. It is an essential concept in understanding market behavior and consumer response:

PED = (% Change in Quantity Demanded) / (% Change in Price)

This formula helps businesses and policymakers understand the sensitivity of demand to price changes, guiding pricing and taxation strategies.

5. Average Total Cost (ATC)

Average total cost represents the per-unit cost of production and is used to evaluate a firm’s cost structure. The formula is:

ATC = Total Cost / Quantity

This formula is important for assessing efficiency and determining pricing strategies that cover costs and generate profit.

6. Consumer Surplus

Consumer surplus is the difference between what consumers are willing to pay for a good or service and what they actually pay. It can be calculated as:

Consumer Surplus = Willingness to Pay – Price Paid

It is an indicator of consumer welfare and is used in evaluating the impact of market changes on consumers.

7. Producer Surplus

Producer surplus refers to the difference between the amount producers receive for a good or service and the minimum amount they are willing to accept. It is calculated as:

Producer Surplus = Price Received – Minimum Acceptable Price

This formula is important for understanding the benefits producers gain from market transactions.

By mastering these key formulas, students can confidently approach any problem in economics, ensuring they have the necessary tools to analyze and solve various economic scenarios effectively.

Common Mistakes in Economic Problem Solving

When approaching economic assessments, students often fall into certain traps that hinder their ability to provide accurate and complete solutions. These common missteps, ranging from misunderstanding core concepts to misapplying formulas, can lead to significant errors. Identifying and addressing these mistakes can help improve overall performance and understanding of key principles.

In this section, we’ll highlight some of the most frequent errors students make when tackling economic problems. Understanding these pitfalls will help you avoid them and approach each question with greater clarity and precision.

1. Misunderstanding Key Concepts

A major challenge in solving economic problems is grasping the underlying principles correctly. For instance, confusing the concepts of marginal cost and average cost can lead to incorrect calculations. Often, students may use one formula where the other is required, which can distort the analysis. It’s crucial to carefully read the question to ensure that you are applying the right concept at the right time.

2. Incorrect Application of Formulas

Another common mistake is misapplying formulas or using them incorrectly. Whether it’s calculating price elasticity of demand, total revenue, or profit maximization, students sometimes make simple errors such as switching variables or misinterpreting symbols. Always double-check that the formula is being used in its correct context and that all values are correctly inputted.

Additionally, failing to recognize when to use approximations or rounding errors can impact the precision of the results. It’s important to be meticulous when applying formulas to ensure accuracy in your calculations.

3. Ignoring Graphical Interpretation

Graphs and charts are crucial in many economic problems, especially when interpreting supply and demand curves, cost structures, or profit maximization points. A common mistake is either misreading these graphs or failing to interpret the relationship between variables. Always take time to review the graph carefully before making conclusions. Ensure that you understand the labels, axes, and what each curve or line represents.

Being familiar with graphical tools such as shifts in curves or equilibrium points is essential for providing a comprehensive solution to many problems.

4. Overlooking the Role of Assumptions

Many economic models rely on assumptions such as perfect competition or rational behavior. Ignoring these assumptions or misunderstanding their role in the model can lead to inaccurate answers. Always take note of any assumptions mentioned in the problem, as they guide how to approach the analysis. Failing to consider these underlying assumptions can lead to flawed conclusions.

Acknowledging and addressing assumptions in your responses shows that you understand the model and how it applies to the specific scenario at hand.

By being mindful of these common mistakes, you can improve your problem-solving skills and approach each economic scenario with greater accuracy and confidence.

How to Interpret Economic Graphs Correctly

Interpreting graphs is a crucial skill in economics, as they visually represent key relationships between variables. Whether you’re analyzing supply and demand curves, cost structures, or market equilibrium, understanding how to read these visual tools accurately is essential for drawing the right conclusions. Graphs often provide a clearer and quicker understanding of economic trends and can highlight important patterns that might not be immediately obvious from text alone.

In this section, we’ll explore how to approach economic graphs systematically, focusing on identifying key elements, understanding their significance, and avoiding common misinterpretations.

1. Identifying Key Variables

The first step in interpreting any graph is to identify the variables represented on the axes. The horizontal axis typically shows the independent variable, while the vertical axis shows the dependent variable. For example, in a supply and demand graph, the horizontal axis often represents quantity, and the vertical axis represents price. Understanding which variables are being compared is crucial to making sense of the graph.

2. Recognizing the Shape and Slope of Curves

Economic graphs often contain curves that represent relationships between variables. The shape and slope of these curves convey important information. For instance, in a supply curve, an upward slope indicates that as price increases, suppliers are willing to produce more. Similarly, a downward-sloping demand curve indicates that as price decreases, consumers are more willing to buy a product. It’s important to understand the significance of the curve’s direction and steepness, as they can indicate elasticity, efficiency, or other economic behaviors.

3. Analyzing Equilibrium and Shifts

One of the most important features to identify in economic graphs is the point of equilibrium, where supply and demand meet. At this point, the quantity supplied equals the quantity demanded, and the market is said to be in balance. Understanding this concept is key to analyzing price and quantity changes. Additionally, shifts in the curves, whether they are to the left or right, reflect changes in market conditions such as consumer preferences, production costs, or technological advancements.

4. Interpreting the Area Under the Curve

The area under a curve can often represent key economic measures, such as total revenue or consumer surplus. For example, in a demand curve, the area under the curve can indicate the total value consumers place on a product. In a cost curve, the area under it may represent total costs. Understanding what these areas represent can help you better interpret the graph’s implications.

5. Avoiding Common Mistakes

Common errors in graph interpretation include misreading the axes, confusing shifts in curves with movements along curves, and failing to account for changes in other variables. Always make sure that you are clear on what each axis represents and that you understand the context of any shifts in the graph. Double-check your interpretation of the data to avoid drawing incorrect conclusions.

By following these steps, you can develop a strong ability to interpret economic graphs accurately, which will greatly enhance your ability to analyze economic situations and solve related problems effectively.

Optimal Decision-Making Under Constraints

Making the best possible decisions in situations with limited resources is a fundamental aspect of economic analysis. Individuals, businesses, and governments often face constraints that prevent them from pursuing all possible options. These limitations might include budget restrictions, time constraints, or scarce resources. Understanding how to maximize utility or profit within these boundaries is key to effective decision-making.

This section explores the principles and strategies for making optimal choices when faced with such constraints. It discusses how to evaluate different alternatives and allocate resources efficiently to achieve the best possible outcome.

1. Recognizing Constraints

The first step in optimal decision-making is identifying the constraints at play. Constraints can take many forms, including:

- Budgetary limitations: Financial constraints that restrict the amount of money available for consumption or investment.

- Time constraints: Limited time to accomplish tasks or make decisions.

- Resource limitations: Limited access to raw materials, labor, or technology that affect production or consumption choices.

- Legal and regulatory constraints: Restrictions imposed by laws or regulations that shape possible decisions and behaviors.

2. Maximizing Utility or Profit

Once the constraints are understood, the next step is to optimize decision-making by maximizing the desired outcome, such as utility or profit. Here are some methods used to achieve this:

- Marginal analysis: Comparing the additional benefits of a decision with the additional costs involved. This helps to identify when the marginal benefit equals the marginal cost, which is the point of optimal decision-making.

- Cost-benefit analysis: Evaluating the total costs of a decision against the total benefits to determine the most profitable or beneficial option.

- Opportunity cost: Considering the value of the next best alternative that must be forgone when making a choice. This concept helps in understanding the trade-offs involved in decision-making.

By carefully considering these factors and weighing the available alternatives, individuals and organizations can make informed decisions that lead to the most efficient use of resources within the given constraints.

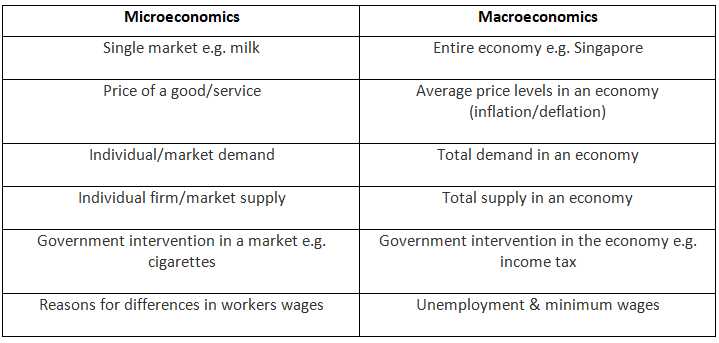

Microeconomic Models You Need to Master

Understanding the key frameworks that explain how individuals, firms, and markets operate is essential for effective decision-making and analysis. These models serve as simplified representations of complex economic behaviors, allowing us to predict and explain outcomes under different scenarios. Mastery of these models is crucial for grasping how various factors influence choices and the overall functioning of economies.

This section highlights some of the fundamental models you should be familiar with. Each of these models offers valuable insights into economic interactions and helps build a foundation for more advanced concepts and real-world applications.

1. The Supply and Demand Model

One of the most basic and widely used frameworks is the supply and demand model. It explains how the price and quantity of goods and services are determined in a market. This model is based on the interaction between consumers (demand) and producers (supply), with prices acting as signals for resource allocation.

- Market equilibrium: The point at which the quantity demanded equals the quantity supplied, resulting in a stable price.

- Shifts in curves: Changes in factors like income, technology, or preferences that cause the supply or demand curve to shift, leading to changes in price and quantity.

2. The Production Possibility Frontier (PPF)

The production possibility frontier (PPF) is a graphical representation of the maximum possible output combinations of two goods or services that an economy can produce, given its resources and technology. This model helps illustrate the trade-offs between different production choices and highlights the concept of opportunity cost.

- Efficiency: Points on the curve represent efficient production combinations, while points inside the curve indicate underutilization of resources.

- Opportunity cost: The PPF shows the cost of forgoing the production of one good in favor of another.

By mastering these models, you can develop a deeper understanding of how markets operate and the trade-offs involved in resource allocation, setting a solid foundation for more complex economic analysis.

Time Management Tips for Microeconomics Exams

Efficient use of time is key to performing well in any assessment. Proper planning allows you to cover all topics, tackle problems effectively, and avoid unnecessary stress. By developing a strategy that aligns with your strengths and addresses potential challenges, you can maximize your performance and confidence when facing time-sensitive tasks.

This section outlines practical strategies to manage your time effectively during preparation and on the day of the test. A thoughtful approach ensures that you stay organized and make the most of the available time.

1. Develop a Study Schedule

A well-organized study schedule helps distribute your time efficiently across all subjects and topics. It ensures that you can dedicate enough time to each area without feeling overwhelmed.

- Set priorities: Focus on high-yield topics first, especially those that carry more weight in the assessment.

- Break down tasks: Divide large topics into manageable sections and set specific goals for each study session.

- Be realistic: Allocate sufficient time for review, practice questions, and rest.

2. Practice with Timed Mock Tests

Simulating test conditions through timed practice can help you gauge how long you take to answer different types of questions and identify areas that need improvement. This also boosts your ability to work under pressure and improves time efficiency during the actual assessment.

| Time Allocation | Task | Strategy |

|---|---|---|

| 10-15 minutes | Quick Review of Instructions | Read through all instructions to ensure clarity on requirements before starting. |

| 30-40 minutes | Answering High-Weight Questions | Focus first on questions that are more complex but carry more points. |

| 10-20 minutes | Quick Responses to Short Questions | Answer the simpler questions quickly, ensuring no time is wasted. |

| 5-10 minutes | Final Review | Double-check answers for clarity and accuracy before submission. |

By implementing these strategies, you will improve your time management and increase your chances of success. A focused and efficient approach is crucial when dealing with the complexity of various topics, and a well-executed time plan can make a significant difference in your performance.