The process of evaluating one’s proficiency in advanced financial analysis requires thorough preparation and a strategic approach. Success in this kind of assessment is determined not only by knowledge but also by the ability to apply that knowledge under pressure. Candidates must demonstrate competence in a variety of topics ranging from financial modeling to the interpretation of complex data sets.

To excel, it is crucial to understand the structure and requirements of the test. Knowing the key areas of focus allows for targeted studying, ensuring that you are well-equipped to tackle each question. Being familiar with the types of tasks and the best strategies for solving them can make a significant difference in performance.

Through consistent practice and review of past material, you can increase your chances of performing at your best. It is also important to build confidence in handling time-sensitive scenarios, as the ability to manage your time effectively during the assessment is often just as important as your technical knowledge.

FMVA Final Exam Overview

The evaluation process designed to test one’s proficiency in financial analysis and modeling is structured to challenge candidates on a variety of important skills. This includes the application of complex financial concepts, the ability to use data effectively, and problem-solving in high-pressure scenarios. The assessment consists of several sections, each targeting a key area of knowledge, from accounting basics to advanced valuation techniques.

Understanding the layout of the test is crucial to ensuring effective preparation. Each section is weighted differently, allowing candidates to focus their efforts according to the importance of each topic. Below is an overview of the main sections included in the assessment:

| Section | Topics Covered | Weight |

|---|---|---|

| Financial Modeling | Creating and interpreting financial models, valuations | 40% |

| Accounting | Understanding and analyzing financial statements | 20% |

| Excel Skills | Advanced formulas, functions, and data manipulation | 15% |

| Corporate Finance | Capital budgeting, investment strategies | 15% |

| Valuation Techniques | Discounted cash flow, comparable company analysis | 10% |

Each section tests different facets of financial expertise, requiring a balance of theoretical knowledge and practical application. A thorough understanding of the concepts and techniques in these areas will be key to achieving a successful outcome.

FMVA Final Exam Overview

The evaluation process designed to test one’s proficiency in financial analysis and modeling is structured to challenge candidates on a variety of important skills. This includes the application of complex financial concepts, the ability to use data effectively, and problem-solving in high-pressure scenarios. The assessment consists of several sections, each targeting a key area of knowledge, from accounting basics to advanced valuation techniques.

Understanding the layout of the test is crucial to ensuring effective preparation. Each section is weighted differently, allowing candidates to focus their efforts according to the importance of each topic. Below is an overview of the main sections included in the assessment:

| Section | Topics Covered | Weight |

|---|---|---|

| Financial Modeling | Creating and interpreting financial models, valuations | 40% |

| Accounting | Understanding and analyzing financial statements | 20% |

| Excel Skills | Advanced formulas, functions, and data manipulation | 15% |

| Corporate Finance | Capital budgeting, investment strategies | 15% |

| Valuation Techniques | Discounted cash flow, comparable company analysis | 10% |

Each section tests different facets of financial expertise, requiring a balance of theoretical knowledge and practical application. A thorough understanding of the concepts and techniques in these areas will be key to achieving a successful outcome.

Key Topics Covered in FMVA

The assessment designed to evaluate expertise in financial analysis covers a wide array of topics, each focusing on essential skills required for advanced financial work. From building financial models to mastering valuation techniques, candidates will need a comprehensive understanding of core concepts in corporate finance, accounting, and data analysis. Preparation for this assessment involves not only theoretical knowledge but also practical application of these concepts in various scenarios.

Key areas of focus typically include financial modeling, valuation methods, investment strategies, and advanced Excel functions. A solid grasp of accounting principles is also crucial, as understanding financial statements is a foundation for many of the more complex tasks. The ability to apply this knowledge in a time-sensitive environment is central to success in the assessment.

Time Management Tips for Success

Effective time management is a critical factor in achieving success during any rigorous assessment. With multiple sections to complete in a limited time frame, it is essential to approach each task strategically to ensure that you can complete everything accurately and efficiently. The key to managing your time effectively is to stay organized and prioritize tasks based on their complexity and importance.

- Start with a Plan: Before you begin, quickly assess the sections and estimate how much time you will need for each. Prioritize areas that require more attention and allocate time accordingly.

- Set Time Limits for Each Section: Break down the time allocated to each section and set a specific limit for each task. Try to stick to these limits to avoid spending too much time on any one part.

- Use a Timer: Use a timer or clock to track how much time has passed and keep yourself on schedule. This will help prevent any surprises at the end of the assessment.

- Move On If Stuck: If you encounter a particularly challenging question, don’t dwell on it for too long. Mark it and move on, returning to it if time allows.

- Leave Time for Review: Make sure to reserve the last few minutes for reviewing your answers. This will allow you to catch any mistakes or missed questions.

By implementing these time management strategies, you can ensure that you are able to complete each task with accuracy and confidence, ultimately increasing your chances of success.

Common Mistakes to Avoid During the Test

During any rigorous assessment, it’s easy to fall into common traps that can affect performance. Whether it’s rushing through questions or overlooking critical details, these mistakes can significantly lower your score. By understanding the most frequent errors and learning how to avoid them, you can ensure a smoother and more successful experience.

Overlooking Instructions

One of the most common mistakes is failing to carefully read the instructions. Each section may have specific guidelines on how to approach the questions or allocate time. Skipping these instructions can lead to mistakes or missed opportunities to maximize your score. Always take a moment to understand exactly what is being asked before jumping into the task.

Underestimating Time for Complex Sections

It is crucial to manage your time effectively throughout the entire assessment. Many candidates tend to rush through simpler questions, leaving insufficient time for more complex tasks. It’s important to balance your time by allocating enough attention to challenging sections that may require more thought or calculation.

By staying focused, reading instructions carefully, and managing your time well, you can avoid these common mistakes and perform to the best of your ability.

Common Mistakes to Avoid During the Test

During any rigorous assessment, it’s easy to fall into common traps that can affect performance. Whether it’s rushing through questions or overlooking critical details, these mistakes can significantly lower your score. By understanding the most frequent errors and learning how to avoid them, you can ensure a smoother and more successful experience.

Overlooking Instructions

One of the most common mistakes is failing to carefully read the instructions. Each section may have specific guidelines on how to approach the questions or allocate time. Skipping these instructions can lead to mistakes or missed opportunities to maximize your score. Always take a moment to understand exactly what is being asked before jumping into the task.

Underestimating Time for Complex Sections

It is crucial to manage your time effectively throughout the entire assessment. Many candidates tend to rush through simpler questions, leaving insufficient time for more complex tasks. It’s important to balance your time by allocating enough attention to challenging sections that may require more thought or calculation.

By staying focused, reading instructions carefully, and managing your time well, you can avoid these common mistakes and perform to the best of your ability.

Essential Study Materials for FMVA

To succeed in an advanced financial analysis assessment, it’s important to have the right study materials. These resources should provide comprehensive coverage of key concepts, practical techniques, and real-world applications. By using high-quality materials, you can build a strong foundation in financial modeling, valuation, and accounting, all of which are essential for excelling in the test.

Recommended Resources

- Study Guides: Comprehensive guides that outline the key concepts and formulas needed for the test are invaluable. These materials often include summaries, practice questions, and tips for understanding difficult topics.

- Practice Tests: Simulated tests are a great way to assess your readiness. By practicing under timed conditions, you can familiarize yourself with the format and refine your ability to manage time during the real assessment.

- Online Courses: Interactive courses offer in-depth lessons on financial topics, including video tutorials and quizzes. These courses often provide step-by-step guidance on creating financial models and performing valuations.

- Textbooks and Reference Books: Books focused on financial analysis and modeling offer detailed explanations of theories, methodologies, and industry practices. Look for textbooks with practical examples and exercises.

Additional Tools

- Excel Templates: Since Excel is essential for modeling and analysis, having pre-built templates for financial models can be incredibly helpful. These templates allow you to practice quickly and efficiently.

- Financial News and Case Studies: Staying updated with industry trends and reviewing case studies can deepen your understanding of how financial concepts are applied in real-world situations.

By using these essential study materials, you can ensure that you are well-prepared to tackle the assessment with confidence and competence.

How to Prepare for Case Studies

Case studies are an essential component of assessments in financial analysis. They require you to apply your theoretical knowledge to real-world business scenarios, testing your ability to analyze data, make decisions, and communicate your findings effectively. Preparation for case studies involves practicing problem-solving techniques, understanding key financial metrics, and developing a clear approach to structuring your analysis.

When preparing for case studies, focus on strengthening your ability to break down complex scenarios, identify critical information, and develop actionable recommendations. Familiarity with common case structures and the most important financial concepts will help you respond with clarity and precision under time constraints.

| Key Areas for Case Study Preparation | Description |

|---|---|

| Data Analysis | Practice analyzing financial statements, ratios, and other relevant data to identify key trends and insights. |

| Problem Identification | Learn to quickly pinpoint the main issues in a case study and focus your analysis on addressing them directly. |

| Structured Approach | Develop a consistent method for approaching each case study, including creating financial models, performing valuations, and presenting findings. |

| Time Management | Practice solving case studies within a set time limit to enhance your ability to think and respond quickly during the actual assessment. |

By focusing on these areas, you will be well-equipped to approach case studies with confidence, making informed decisions and presenting your analysis clearly and effectively.

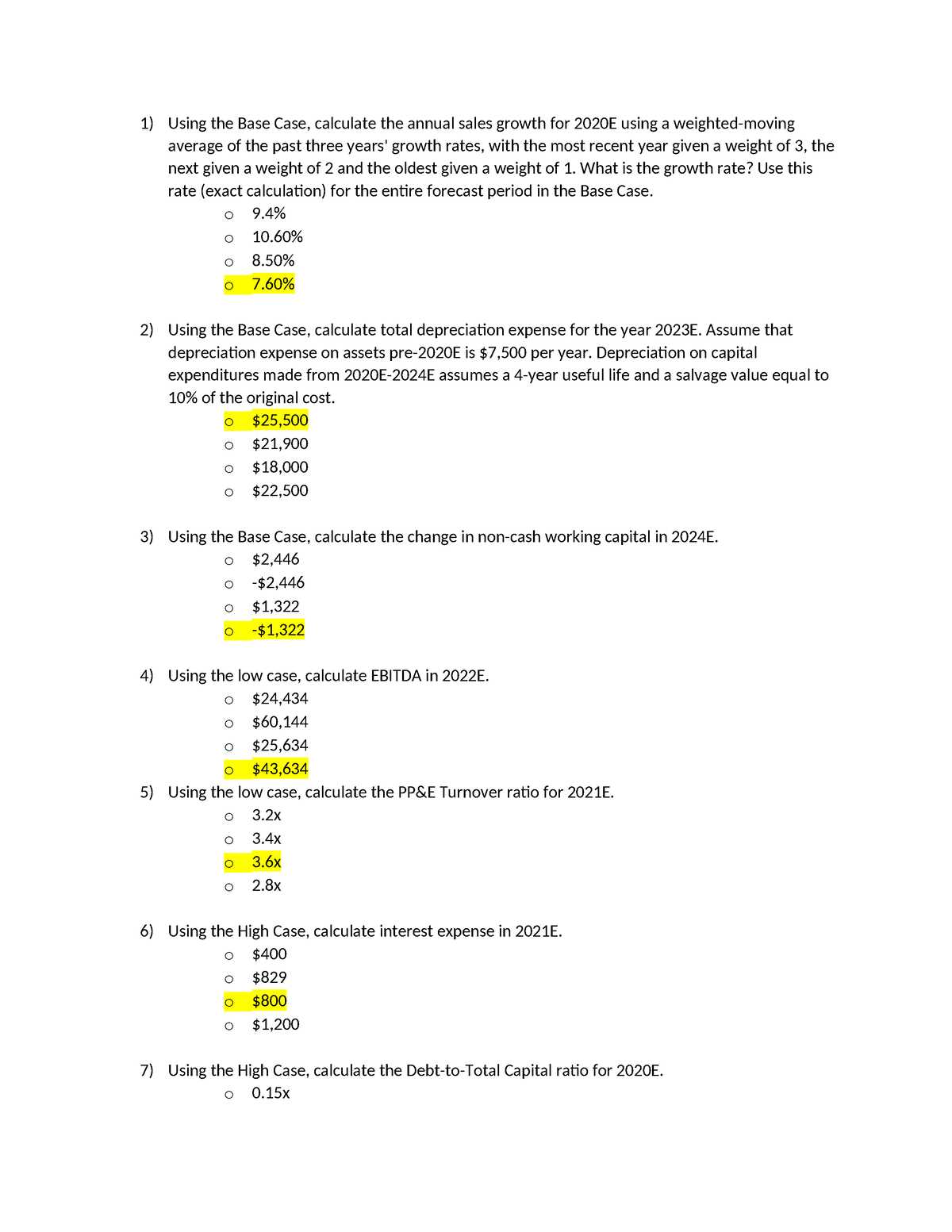

Practice Questions and Sample Tests

To build confidence and reinforce your knowledge, practicing with sample questions and mock tests is essential. These resources simulate the types of questions and problems you will encounter during the actual assessment, allowing you to familiarize yourself with the format and identify areas that require further study. By regularly testing yourself, you can measure your progress and improve your time management skills.

Why Practice Questions Matter

Working through practice questions helps you gain a deeper understanding of the material and develop the ability to apply theoretical knowledge in real-world scenarios. These exercises also provide an opportunity to refine your critical thinking skills, improve your analytical abilities, and perfect your approach to solving problems under time pressure. Practicing regularly will ensure that you are comfortable with the various question types and can approach the assessment with confidence.

Using Sample Tests Effectively

Sample tests are an invaluable tool for preparing for the actual assessment. They offer a realistic experience, helping you to simulate the test environment and practice under timed conditions. Completing full-length practice tests allows you to identify any gaps in your knowledge, test your understanding of key concepts, and work on improving your speed. Aim to take several sample tests during your preparation to build endurance and improve your accuracy.

By incorporating practice questions and sample tests into your study routine, you can maximize your readiness and ensure that you approach the assessment with the skills and confidence necessary for success.

Practice Questions and Sample Tests

To build confidence and reinforce your knowledge, practicing with sample questions and mock tests is essential. These resources simulate the types of questions and problems you will encounter during the actual assessment, allowing you to familiarize yourself with the format and identify areas that require further study. By regularly testing yourself, you can measure your progress and improve your time management skills.

Why Practice Questions Matter

Working through practice questions helps you gain a deeper understanding of the material and develop the ability to apply theoretical knowledge in real-world scenarios. These exercises also provide an opportunity to refine your critical thinking skills, improve your analytical abilities, and perfect your approach to solving problems under time pressure. Practicing regularly will ensure that you are comfortable with the various question types and can approach the assessment with confidence.

Using Sample Tests Effectively

Sample tests are an invaluable tool for preparing for the actual assessment. They offer a realistic experience, helping you to simulate the test environment and practice under timed conditions. Completing full-length practice tests allows you to identify any gaps in your knowledge, test your understanding of key concepts, and work on improving your speed. Aim to take several sample tests during your preparation to build endurance and improve your accuracy.

By incorporating practice questions and sample tests into your study routine, you can maximize your readiness and ensure that you approach the assessment with the skills and confidence necessary for success.

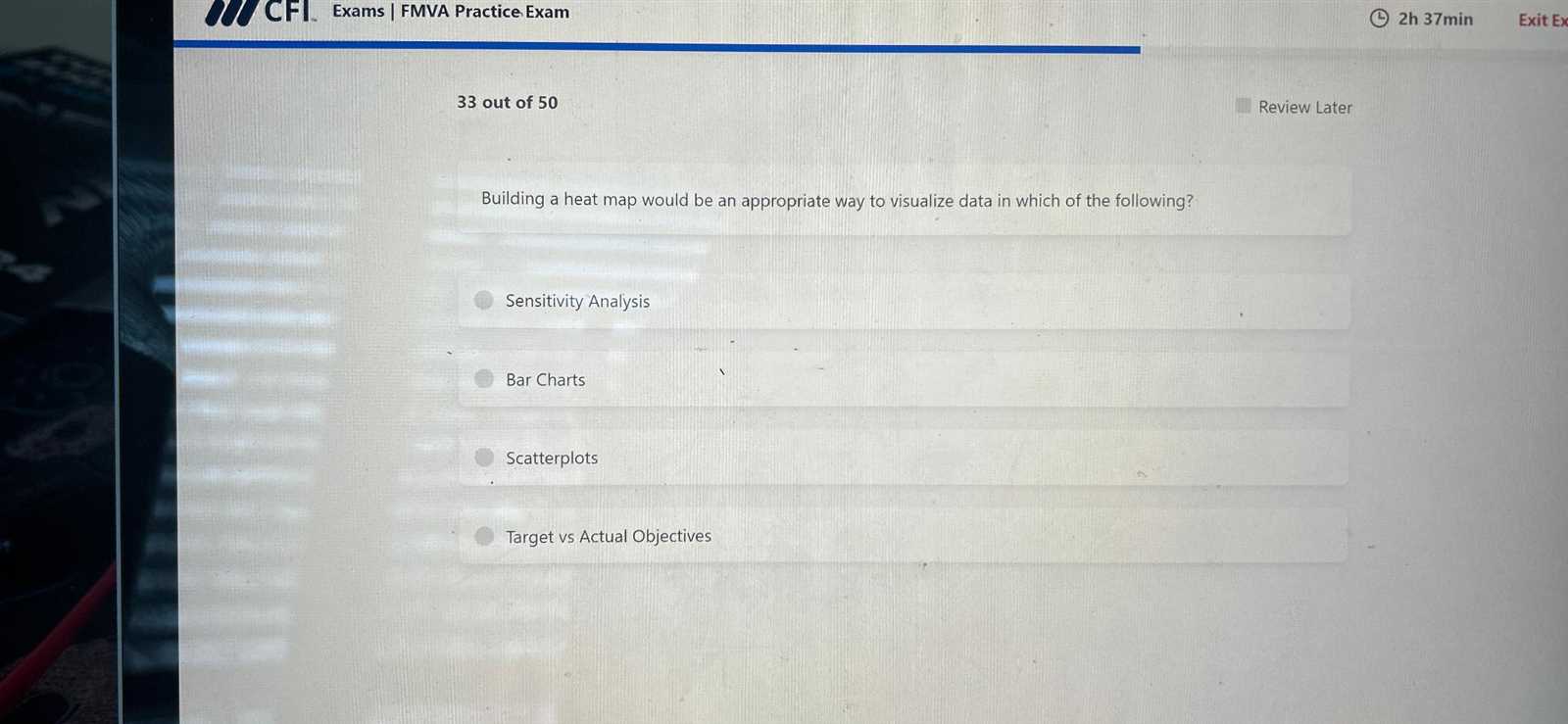

Tips for Answering Multiple Choice Questions

Multiple choice questions can be tricky, but with the right strategies, you can maximize your chances of selecting the correct response. These types of questions often test both your knowledge of the material and your ability to think critically. Understanding the structure of these questions and applying effective techniques can help you navigate through them with confidence and accuracy.

Read Each Question Carefully

The first step in answering multiple choice questions is to read each question thoroughly. Sometimes, questions include important details or qualifiers that can significantly impact your choice. Pay attention to keywords like “not,” “always,” or “except,” which can completely alter the meaning of the question. By carefully analyzing the wording, you can avoid making common mistakes caused by misinterpretation.

Use the Process of Elimination

If you’re unsure of the correct answer, using the process of elimination is a highly effective strategy. Start by eliminating the most obviously incorrect options. Often, at least one or two answers can be dismissed quickly because they don’t align with the question’s context or are factually incorrect. Once you narrow down the choices, you increase the probability of selecting the right answer, even if you’re not entirely certain.

Additional Tips:

- Don’t rush: Take the time to think through each question, especially if you’re faced with difficult options.

- Look for patterns: If you notice that some answers seem similar, there’s a good chance one of them is correct.

- Be cautious with “all of the above” or “none of the above”: These options can be tempting, but make sure all the other statements are correct before selecting them.

By employing these strategies, you can approach multiple choice questions with greater precision and increase your chances of success during your assessment.

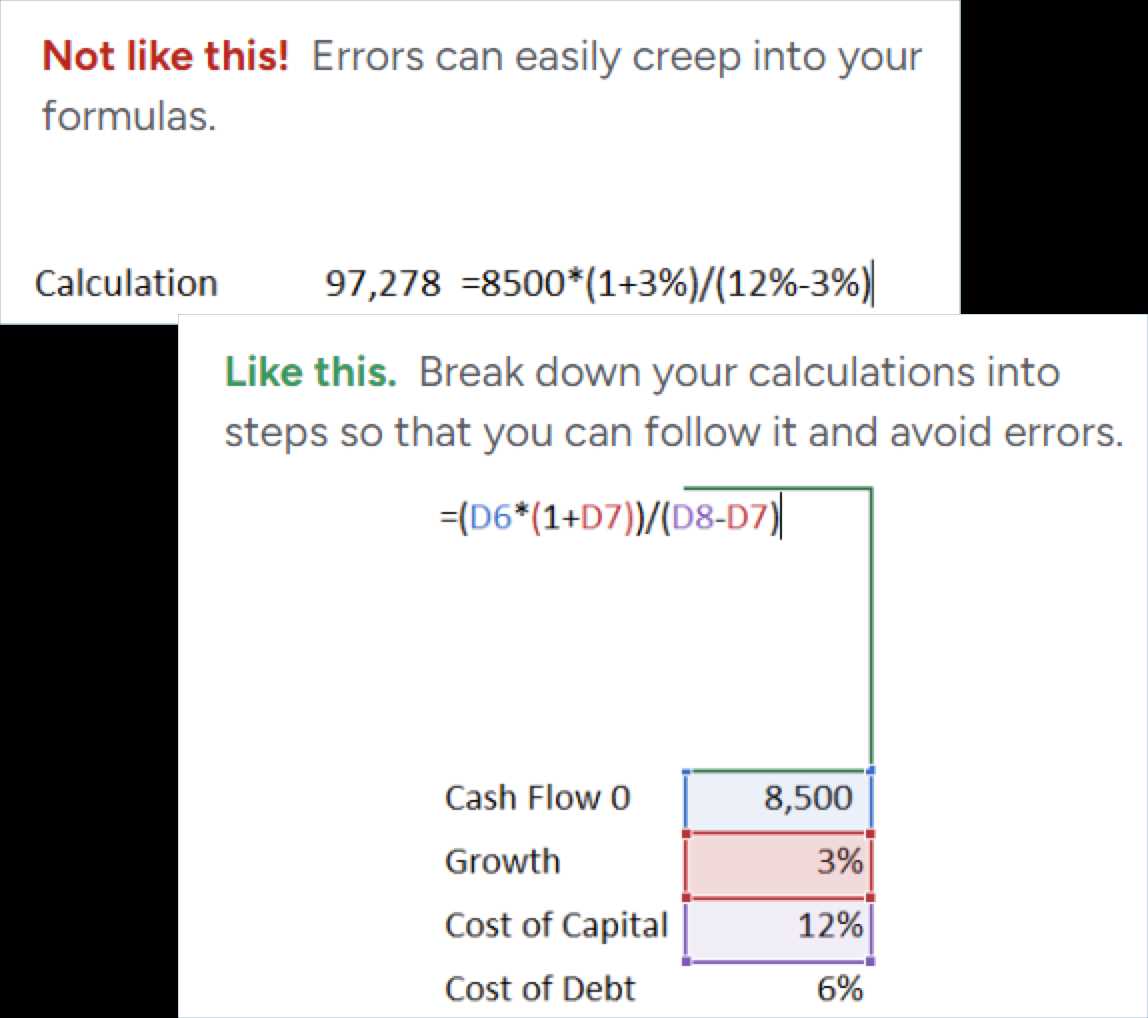

How to Improve Financial Modelling Skills

Developing strong financial modelling skills is crucial for success in many areas of finance. Whether you’re working with budgets, forecasting, or valuation models, having the ability to build and manipulate accurate models can significantly enhance your decision-making capabilities. Improving these skills involves a combination of practice, theoretical knowledge, and hands-on experience. Below are several strategies to help you refine your financial modelling expertise.

Focus on Core Concepts

Before diving into complex models, it’s important to have a solid understanding of the fundamental concepts that underpin financial modelling. These include:

- Accounting principles: A deep knowledge of financial statements and accounting standards is essential for building accurate models.

- Time value of money: Understanding discounting, compounding, and the relationship between risk and return is crucial for many financial models.

- Financial ratios: Familiarity with key ratios, such as liquidity, profitability, and solvency, helps in interpreting and constructing models effectively.

Practice Building Different Types of Models

Financial modelling is a skill that improves with consistent practice. To enhance your proficiency, try building various types of models, such as:

- Forecasting models: Create projections for revenue, expenses, and cash flow based on historical data and assumptions.

- Valuation models: Practice methods like discounted cash flow (DCF), comparable company analysis, and precedent transactions.

- Budgeting models: Learn to create models that track company expenditures and help manage resources effectively.

By building diverse models, you will gain a deeper understanding of the application of different techniques and improve your overall modelling skills.

Leverage Online Resources and Tools

There are numerous online courses, tutorials, and software tools designed to improve financial modelling skills. Take advantage of these resources to enhance your knowledge and gain access to advanced techniques. Some of the tools you can explore include:

- Excel: Mastering Excel is essential for financial modelling, as it’s the most widely used software for building models.

- Online courses: Platforms like Coursera, LinkedIn Learning, and Udemy offer courses specifically aimed at improving financial modelling skills.

- Financial modelling software: Tools like FactSet, Bloomberg Terminal, and others can help you explore more complex modelling techniques and real-time data analysis.

Utilizing these resources will provide valuable insights into best practices and help you stay current with industry standards.

Seek Feedback and Collaboration

One of the best ways to improve is by seeking feedback from experienced professionals. Share your models with mentors or colleagues and ask for constructive criticism. Collaborating with others can also provide new perspectives and ideas, helping you refine your approach. By continuously reviewing and refining your models, you will ensure that they are not only accurate but also efficient and user-friendly.

Improving your financial modelling skills is an ongoing process that requires dedication and consistent effort. By focusing on core principles, practicing regularly, leveraging resources, and collaborating with others, you can enhance your proficiency and become an expert financial modeller.

Building Confidence Before the Exam

Confidence plays a critical role in achieving success, especially when it comes to assessments that test your knowledge and skills. Proper preparation and the right mindset are essential in boosting your self-assurance and ensuring that you approach the task with clarity and focus. In this section, we will explore several effective strategies to help you build the confidence needed to perform your best under pressure.

1. Master the Material

One of the most effective ways to build confidence is to thoroughly understand the content that will be assessed. If you are clear on the key concepts, methods, and problem-solving techniques, you will feel more prepared and less anxious when faced with complex questions. Here are some ways to ensure you have a strong grasp on the material:

- Review key concepts: Focus on the most important topics and ensure you have a deep understanding of each area.

- Practice regularly: Consistent practice will not only improve your skills but also make you feel more comfortable with the types of questions you may face.

- Work through sample problems: Solving a variety of problems will help you understand the application of concepts in different scenarios.

2. Simulate the Testing Environment

Simulating the testing environment is another excellent way to boost confidence. By recreating the conditions of the actual assessment, you can familiarize yourself with the process and reduce anxiety. Here’s how to do it:

- Take practice tests: Use mock tests or sample papers to practice answering questions under time constraints.

- Replicate the exam format: Ensure the practice test mimics the actual assessment format, whether it’s multiple choice, case studies, or calculations.

- Review your performance: After completing a practice test, assess your mistakes and use them as opportunities to improve.

3. Develop a Positive Mindset

Building confidence isn’t just about mastering the material, it’s also about maintaining a positive attitude towards the assessment process. A positive mindset will help you stay calm, focused, and resilient throughout the process. Consider the following tips:

- Visualize success: Imagine yourself performing well during the assessment. This mental exercise can help reduce anxiety and increase your motivation.

- Stay organized: Creating a study schedule and sticking to it can reduce the feeling of being overwhelmed.

- Celebrate small victories: Every time you master a difficult concept or complete a practice test, take a moment to acknowledge your progress.

With preparation, practice, and a positive mindset, you can significantly increase your confidence and approach the assessment with a sense of calm and readiness. By focusing on building your confidence, you will be more likely to perform at your highest potential and achieve success in the task ahead.

Exam Day Preparation Checklist

The day of the assessment is critical in determining your overall performance. To ensure you’re fully prepared and can approach the task with confidence, it’s essential to follow a well-structured checklist. Proper planning the night before and on the day of the assessment will minimize stress and help you stay focused. Below is a checklist that can guide your preparation process.

1. Prepare Your Materials

Ensure that you have all the necessary materials and tools ready ahead of time. This will save you from rushing around on the day of the assessment and reduce unnecessary stress.

- Review Required Tools: Check that you have everything you need, such as a calculator, writing instruments, and any other specific items required for the assessment.

- Gather Documents: Ensure you have any identification, confirmation emails, or login credentials for online assessments.

- Prepare Snacks and Water: Bring water and light snacks to stay energized, especially for longer sessions.

2. Review Your Strategy

Go over your preparation plan and reinforce your strategy for tackling the assessment. This will help you feel more confident and mentally prepared.

- Go Over Key Topics: Quickly review the most important concepts or areas that you’re likely to be tested on.

- Familiarize Yourself with the Format: Be clear on the structure of the assessment and understand how different sections are weighted.

- Set Time Limits: If you’re taking practice tests or reviewing questions, be mindful of time constraints to simulate actual conditions.

3. Mental and Physical Preparation

Preparing your mind and body is just as important as reviewing content. A calm, focused mindset will help you perform at your best.

- Get Adequate Rest: Make sure you get a good night’s sleep the night before the assessment to ensure you’re alert and well-rested.

- Eat a Balanced Breakfast: A nutritious meal will help maintain your energy levels throughout the session.

- Practice Relaxation Techniques: Consider breathing exercises or meditation to calm any pre-assessment nerves.

By following this checklist, you can enter the assessment day with a clear mind, knowing you’re fully prepared and ready to tackle the challenge ahead. Preparation in the days leading up to the assessment, combined with a calm, organized approach on the day itself, will set you up for success.

What Happens After the Assessment

After completing the assessment, many individuals wonder what the next steps will be. The process typically involves a review of the results, feedback, and sometimes, further actions or requirements to be met before receiving official confirmation. Understanding what follows can help you stay informed and manage expectations as you await your outcome.

1. Result Processing and Evaluation

Once you have submitted your responses, the next step is the evaluation of your performance. This process may take some time, depending on the nature of the assessment. Here’s what to expect:

- Automated Scoring: For certain types of assessments, such as multiple-choice or true/false questions, results may be automatically generated and available quickly.

- Manual Review: For open-ended questions or case studies, the review may take longer as evaluators assess the depth of your responses.

- Calculation of Final Scores: Once all responses are evaluated, your overall score will be calculated based on the predefined scoring system.

2. Receiving Results and Feedback

Once your performance has been evaluated, the next step is receiving your results. Depending on the assessment setup, this could happen through an online portal or via email. In addition to your score, you might also receive valuable feedback.

- Results Announcement: You will be notified about when and how your results will be made available. Some assessments provide immediate results, while others may take a few days.

- Feedback Report: Many assessments offer detailed feedback, highlighting areas where you performed well and areas where improvement is needed. This feedback can be invaluable for future development.

- Further Steps: If you pass, you may be granted certification or next steps for advancing in the program. If additional actions are required, such as retaking certain portions, you will be informed of those requirements.

Understanding the process after completing the assessment allows you to be prepared for any follow-up actions. Whether you receive immediate results or need to wait for more detailed feedback, knowing what to expect will help you manage the transition and plan accordingly.

Post-Assessment Resources for Candidates

After completing your assessment, it is essential to know what resources are available to you for further learning and support. Whether you are looking to deepen your knowledge, enhance your skills, or simply stay updated on the latest industry practices, there are various materials that can help you continue your professional journey.

Here are some valuable resources that can support your growth after completing the assessment:

- Official Study Materials: Many programs provide access to additional study materials after the assessment. These can include advanced topics, case studies, and other resources that help reinforce key concepts.

- Industry Webinars and Workshops: Participating in webinars and workshops led by industry experts can provide deeper insights into complex topics and practical applications. These events also offer opportunities for networking with peers and professionals.

- Professional Communities: Join online forums, discussion groups, or LinkedIn communities where candidates and professionals share insights, advice, and resources. These networks can be valuable for ongoing learning and staying updated on the latest trends.

- Advanced Certifications: After the assessment, you may consider pursuing additional certifications or specializations in areas related to your field. This can help you stand out in the job market and demonstrate your commitment to continuous improvement.

By leveraging these post-assessment resources, you can continue to develop your expertise and remain competitive in your industry. These tools not only help you refine your skills but also keep you connected to the broader professional community.

Certification and Career Opportunities

Obtaining a financial modeling certification can open numerous doors in the finance and business sectors. This credential is recognized globally and signifies a strong understanding of financial analysis, modeling, and valuation. For those seeking to advance their careers, completing the certification program not only enhances technical skills but also strengthens professional credibility.

After earning your certification, a wide array of career opportunities may be available to you. These opportunities span various industries, offering roles in investment banking, corporate finance, consulting, and more. Below are some key career paths that individuals with this qualification often pursue:

- Investment Banking: A common career choice for those with expertise in financial modeling, investment banking involves analyzing financial data, performing valuations, and supporting mergers and acquisitions.

- Corporate Finance: Corporate finance professionals are responsible for managing a company’s finances, including budgeting, financial planning, and risk management.

- Private Equity and Venture Capital: These roles involve analyzing potential investment opportunities, conducting due diligence, and helping firms manage their portfolios of investments.

- Financial Analyst: Financial analysts use their modeling skills to assess company performance, create financial reports, and support decision-making processes within firms.

- Consulting: Many financial modeling professionals pursue careers in consulting, providing expert advice on business strategies, financial operations, and mergers and acquisitions.

Furthermore, professionals who earn the certification can command higher salaries, enjoy better job security, and gain the flexibility to move into senior roles faster. Many companies value this certification because it demonstrates an individual’s commitment to excellence and their ability to deliver results in high-pressure environments.

Overall, a certification in financial modeling is a powerful tool that can provide a competitive edge in a dynamic and competitive job market. With the knowledge and skills acquired, you will be well-positioned to seize career opportunities and make meaningful contributions to your field.