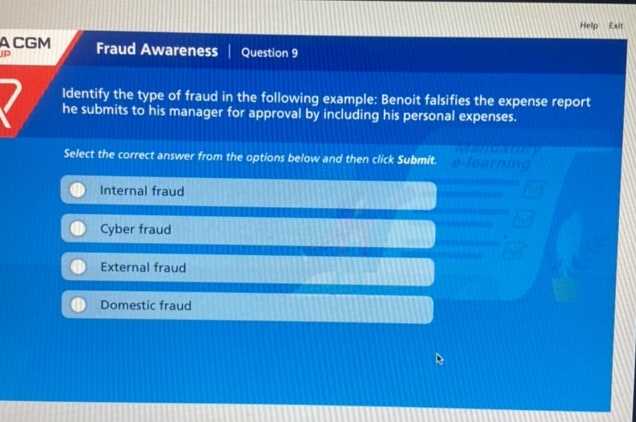

In today’s world, understanding the risks of financial manipulation is more crucial than ever. As technology evolves, so do the methods used by individuals with harmful intent. Knowing how to identify these deceptive practices is vital for maintaining security in both personal and professional settings.

It’s essential to learn how to spot potential threats and respond accordingly. Effective methods for countering these dangers are not only helpful in safeguarding sensitive information but also in fostering trust within organizations. A proactive approach can significantly reduce the likelihood of falling victim to unethical actions.

By equipping yourself with the right knowledge and tools, you can become an active defender against malicious activities. Recognizing the warning signs early on can make all the difference in preventing costly consequences. This guide will help you understand the key concepts needed to navigate the complexities of securing against various forms of deceit.

Final Exam IS-0038 Fraud Awareness Guide

Understanding the principles of recognizing and addressing dishonest actions is critical for anyone working in environments where trust and integrity are paramount. This section provides a comprehensive overview of the key concepts that will help you identify risky situations and respond effectively. The ability to protect yourself and others from harmful activities is a skill that can prevent significant losses and ensure long-term security.

Key Concepts for Identifying Deceptive Practices

One of the first steps in building an effective defense against unethical behavior is knowing how to spot the early warning signs. These might include unusual financial transactions, inconsistent behavior, or suspicious interactions. Being familiar with these red flags can help you detect threats before they escalate. The more informed you are, the better equipped you’ll be to handle potential risks when they arise.

Effective Strategies for Mitigating Risk

Once you’ve identified potential threats, it’s important to know the best ways to address them. Establishing clear protocols, fostering a culture of vigilance, and promoting open communication within teams can create a secure environment where unethical actions are less likely to thrive. Additionally, technology plays a crucial role in detecting and reporting malicious behavior, helping safeguard both personal and organizational resources.

Understanding Fraud and Its Impact

Dishonest activities aimed at deceiving individuals or organizations can have wide-ranging consequences, both immediate and long-term. These unethical actions not only undermine trust but also lead to significant financial losses, reputational damage, and legal challenges. Whether in personal finance, business operations, or government processes, the ripple effects of such behavior can be felt across multiple sectors, creating instability and eroding confidence.

The true impact extends beyond the initial victim. Once these deceptive actions occur, they can trigger a chain of events that affect various stakeholders, including employees, customers, and shareholders. The overall environment becomes one where security is questioned, and the effort to rebuild trust can take years. Understanding how these harmful practices operate is the first step in mitigating their influence and ensuring a more secure future.

Key Concepts in Fraud Prevention

To effectively safeguard against harmful activities, it’s essential to understand the fundamental practices that help identify and stop malicious acts before they cause damage. Implementing solid protective measures requires a blend of awareness, vigilance, and technology. By building a strong defense strategy, individuals and organizations can significantly reduce the likelihood of falling victim to unethical behavior.

Key Elements of an Effective Strategy

There are several critical components that contribute to a robust defense system:

- Education: Ensuring that all stakeholders are well-informed about potential threats and the signs of suspicious behavior.

- Security Measures: Employing the latest technology and systems to monitor activities and detect anomalies.

- Clear Policies: Establishing transparent rules and protocols that make it difficult for unethical actions to go undetected.

- Regular Audits: Conducting thorough reviews of operations and financial activities to ensure everything is in order.

Building a Culture of Integrity

Another key concept in protecting against harmful actions is fostering an organizational culture that values honesty and integrity. When individuals are committed to doing the right thing, the overall risk of deceit is lowered. This includes:

- Encouraging open communication about concerns and potential risks.

- Providing training to help employees identify unethical behavior and report it safely.

- Rewarding transparency and accountability within the organization.

Examining the IS-0038 Curriculum

Understanding the structure and content of a training program is essential for anyone preparing to tackle a comprehensive assessment in the field of security and ethics. The curriculum provides an in-depth exploration of the key principles, tactics, and best practices needed to identify and combat harmful actions. It is designed to equip individuals with the knowledge to recognize risks and implement strategies to protect both personal and organizational interests.

Core Topics Covered

The curriculum is structured around several critical topics that form the foundation of ethical conduct and security measures:

- Understanding Threats: A deep dive into various deceptive practices, how they operate, and their potential impact on systems and individuals.

- Identifying Warning Signs: Key indicators that can help individuals spot suspicious behavior before it escalates into a larger issue.

- Mitigation Techniques: Proven methods to reduce risks and prevent harmful actions from affecting systems or organizations.

- Reporting and Responding: Proper channels and strategies for reporting unethical behavior and ensuring timely intervention.

Practical Applications of the Curriculum

Beyond theory, the curriculum emphasizes real-world scenarios to help participants apply their knowledge. Practical exercises and case studies are included to illustrate how these principles can be used effectively in everyday situations. By applying the lessons learned, individuals are better prepared to navigate complex situations and contribute to a secure environment.

Common Fraud Schemes and Tactics

Deceptive practices are constantly evolving, making it essential to stay informed about the various methods used by individuals with harmful intentions. These schemes can take many forms, but they all aim to exploit vulnerabilities for financial or personal gain. Recognizing the most common tactics allows individuals and organizations to identify potential risks and take action before significant damage occurs.

Types of Common Deceptive Practices

Several common methods used to deceive individuals or organizations include:

- Phishing: Fraudsters use emails or messages that appear to be from trusted sources to trick victims into revealing sensitive information, such as passwords or credit card details.

- Impersonation: This involves criminals pretending to be legitimate employees or authorities to gain access to confidential information or funds.

- Online Scams: Fraudulent websites or advertisements lure victims into making false purchases or providing personal data under the guise of legitimate transactions.

- Investment Schemes: Criminals offer fake or exaggerated investment opportunities to convince individuals to part with their money under false pretenses.

Recognizing Deceptive Techniques

Awareness of the tactics used in these schemes is the first step toward protection. Fraudsters often rely on psychological manipulation, creating a sense of urgency or offering “too good to be true” deals to lower their victim’s defenses. Learning to recognize these patterns and take cautious steps when faced with unusual offers or requests can prevent falling prey to such practices.

How to Recognize Fraudulent Behavior

Recognizing deceptive actions is crucial to protecting yourself and others from harmful outcomes. The first step in preventing these activities is to identify the warning signs early. Fraudulent behavior often shares common characteristics that can be spotted through careful observation and critical thinking. By learning to spot these patterns, you can take appropriate steps to avoid falling victim to scams or unethical conduct.

Warning Signs of Deceptive Activities

Fraudulent behavior often exhibits certain traits that are worth noting. These can range from inconsistencies in communication to suspicious financial actions:

- Unusual Requests: A sudden, unexpected demand for personal information or money, especially under pressure or with a sense of urgency.

- Too Good to Be True Offers: Promises of high rewards with little to no risk or effort are common red flags. If something seems too perfect, it often is.

- Lack of Transparency: Individuals or organizations that are unwilling to provide clear information about their identity or processes should be approached with caution.

- Inconsistencies in Information: Fraudsters often change details or make conflicting statements. Pay attention to discrepancies in what is being said or requested.

Behavioral Red Flags

Beyond actions, certain behaviors can also indicate fraudulent intent. Some of the most common signs include:

- Avoiding Direct Communication: Individuals who avoid direct conversations, especially in writing, may be trying to hide their intentions or avoid accountability.

- Emotional Manipulation: Fraudsters often use guilt or fear to influence decisions, making victims feel like they must act quickly or risk missing out.

- Reluctance to Provide Documentation: A refusal to provide official paperwork or supporting evidence for claims is another major indicator of dishonest intent.

Fraud Prevention Strategies for Organizations

For any organization, protecting against unethical behavior and malicious actions is critical to maintaining trust, reputation, and financial stability. Developing a solid defense strategy involves a combination of internal policies, employee training, technology, and proactive measures that can detect and mitigate risks. Organizations must adopt a comprehensive approach that addresses vulnerabilities and reinforces ethical conduct at every level.

Key Strategies for Mitigating Risk

Organizations can implement several effective strategies to reduce the risk of dishonest activities:

- Strong Internal Controls: Establishing clear policies, procedures, and checks ensures that operations run smoothly and without irregularities. This includes regular audits, transparent reporting, and clear approval processes for financial transactions.

- Employee Training: Educating staff on identifying suspicious behavior and understanding the company’s ethical standards helps create a culture of vigilance. Regular workshops and seminars can keep employees informed about current risks.

- Clear Reporting Channels: Providing secure, anonymous channels for reporting concerns enables employees to act without fear of retaliation. Encouraging openness fosters trust and accountability throughout the organization.

- Use of Technology: Advanced tools such as data analytics and automated monitoring systems can help identify irregular activities quickly, allowing for swift action before damage is done.

Building a Culture of Integrity

Beyond rules and regulations, the foundation of an organization’s security lies in its culture. Leaders should model ethical behavior and prioritize integrity in every decision. When integrity is ingrained in the company’s values, it becomes harder for harmful actions to take root. Fostering a transparent environment where employees feel valued and trusted strengthens the organization’s ability to prevent misconduct.

Role of Technology in Fraud Detection

In today’s digital age, technological advancements play a crucial role in identifying and addressing deceptive activities. Automated systems, data analysis tools, and artificial intelligence have revolutionized how organizations monitor, detect, and respond to unethical practices. By leveraging these technologies, businesses can proactively identify risks and prevent potential damage before it occurs.

Technological Tools for Identifying Deceptive Behavior

Several technological tools are commonly used to detect suspicious behavior and mitigate potential risks:

- Data Analytics: Advanced analytics allows for the examination of large volumes of data in real time, identifying patterns, anomalies, and trends that may indicate irregular or dishonest actions.

- Machine Learning: By using algorithms that learn from historical data, machine learning systems can predict and detect fraudulent activities with increasing accuracy over time.

- Biometric Authentication: Technologies such as fingerprint recognition or facial recognition offer secure methods of verifying identities and preventing unauthorized access.

- Transaction Monitoring Software: These systems track financial transactions and flag unusual activities, helping organizations quickly spot irregular spending, abnormal account access, or other suspicious transactions.

Benefits of Technology in Risk Management

By integrating technology into risk management strategies, businesses can benefit in numerous ways:

- Improved Accuracy: Automated systems reduce human error, ensuring that risks are identified accurately and consistently.

- Real-Time Detection: With continuous monitoring, technology allows organizations to detect suspicious activities as they happen, minimizing potential damage.

- Cost Efficiency: Technology can automate many processes, reducing the need for extensive manual oversight while maintaining a high level of security.

- Scalability: As organizations grow, technological tools can easily scale to accommodate increased data and activity without compromising security.

Identifying Red Flags in Fraudulent Activities

Recognizing warning signs early is essential to minimizing the impact of dishonest actions. Certain behaviors, patterns, or inconsistencies often signal that something may not be as it appears. By understanding these red flags, individuals and organizations can take proactive steps to address potential threats before they escalate. These indicators are not always immediately obvious but can be uncovered with careful attention and critical analysis.

Common Warning Signs of Deceptive Behavior

There are several key behaviors or circumstances that can raise suspicion and warrant further investigation:

| Red Flag | Possible Implication |

|---|---|

| Urgency and Pressure | Attempting to rush decisions or requests, especially involving sensitive information, may indicate an attempt to manipulate or control the situation. |

| Lack of Documentation | Refusing to provide necessary paperwork or evidence for transactions often suggests that something is being concealed. |

| Unexplained Wealth | Sudden or unexplained financial gains without clear justification can signal illegal activities or dishonest means of earning. |

| Inconsistent Stories | Contradictions in statements or changes in details over time suggest that the person is not being truthful. |

| Unusual Financial Activity | Frequent or large-scale financial transactions that don’t align with the person’s known activities or account history may indicate improper conduct. |

Behavioral Cues to Watch For

In addition to the above, some behaviors may raise additional concerns:

- Avoidance of Direct Communication: Individuals who refuse face-to-face or written communication could be trying to hide their actions or avoid accountability.

- Overconfidence: An individual who is excessively confident or dismissive of concerns may be trying to deflect attention from irregularities.

- Emotional Manipulation: Using guilt, fear, or sympathy to influence decisions can be a tactic employed by someone seeking to deceive or manipulate others.

Reporting Fraud: Steps to Follow

When unethical or illegal activities are suspected, it is crucial to report them in a timely and organized manner. By following a clear process, individuals can ensure that the situation is addressed appropriately while minimizing further risks. Reporting not only helps stop the deceptive actions but also safeguards others from potential harm. Knowing the proper steps to take can make a significant difference in the outcome of an investigation.

Key Steps in Reporting Suspicious Activities

The following steps can guide individuals through the process of reporting questionable actions effectively:

| Step | Description |

|---|---|

| Step 1: Document Everything | Gather all relevant information, including dates, times, names, and descriptions of the suspicious activities. Keep records of any communications related to the issue. |

| Step 2: Evaluate the Situation | Consider the potential impact of the activity and whether it poses a serious threat. If possible, consult with a colleague or supervisor before taking action. |

| Step 3: Report to the Right Authority | Identify the appropriate department or organization responsible for handling the issue. This may include your employer, a regulatory body, or law enforcement. |

| Step 4: Provide Detailed Information | Present the facts clearly, including all supporting documentation. Be specific about the nature of the activity and any individuals involved. |

| Step 5: Follow Up | Ensure that your report is being reviewed and ask for updates on the investigation. Stay engaged while respecting the confidentiality of the process. |

Important Considerations When Reporting

While reporting is crucial, there are several important considerations to keep in mind:

- Confidentiality: Maintain confidentiality throughout the process to avoid retaliation or further complications. Always report through the proper channels.

- Stay Objective: Focus on the facts and avoid making assumptions or jumping to conclusions. Present evidence rather than personal opinions.

- Legal Protection: Be aware of any legal protections available to whistleblowers, ensuring that you are not at risk for retaliation.

Legal Consequences of Fraudulent Actions

Engaging in deceptive practices can lead to serious legal repercussions. Such actions not only violate ethical standards but can also breach laws that protect individuals, businesses, and society as a whole. Understanding the potential legal consequences of these behaviors is crucial for both individuals and organizations. Legal penalties can vary based on the severity of the act and the jurisdiction in which it occurs, but they often involve significant financial loss, criminal charges, or even imprisonment.

Individuals who engage in dishonest activities may face a wide range of legal actions, including civil suits, fines, or imprisonment. Businesses that fail to detect or address such conduct could also be held accountable, leading to regulatory fines, damage to reputation, and financial instability. The legal framework surrounding these offenses is designed to deter misconduct and provide justice for those affected by unethical actions.

Some of the most common legal consequences of deceptive practices include:

- Criminal Charges: Those found guilty of engaging in dishonest activities may face criminal prosecution, with penalties ranging from fines to lengthy prison sentences.

- Civil Penalties: Victims of deceitful actions may file lawsuits seeking compensation for damages. Courts may impose financial penalties on the responsible party.

- Loss of Employment: Individuals caught engaging in unethical behavior may be fired or face other workplace consequences, such as professional disbarment or suspension.

- Regulatory Fines: Companies may incur significant fines from regulatory bodies for failing to implement adequate safeguards or for participating in misleading practices.

- Reputational Damage: Both individuals and organizations can suffer lasting reputational harm, making it more difficult to secure future opportunities or relationships.

Case Studies: Fraud Prevention in Action

Understanding how real-world scenarios unfold provides valuable insight into how organizations successfully detect and address deceptive activities. Case studies are powerful tools for showcasing effective strategies used by businesses and individuals to combat dishonesty and safeguard their operations. By analyzing past incidents, we can identify key practices, strategies, and technologies that helped prevent substantial financial loss and protect against risks.

Below are several case studies that highlight the implementation of strong protective measures in various sectors:

Case Study 1: Financial Institution’s Response to Internal Theft

A leading bank faced a situation where an employee was embezzling funds through fraudulent transactions. After noticing irregularities in account reconciliations, the bank launched an internal audit. This action led to the identification of the theft and the immediate dismissal of the employee involved. The case serves as an example of the importance of regular audits and having clear internal controls in place.

- Key Takeaways: Regular audits, monitoring of financial transactions, and a well-defined reporting process can help detect and prevent internal theft.

- Technology Used: Fraud detection software to track suspicious activities.

- Outcome: Prompt detection and corrective actions minimized financial damage.

Case Study 2: E-commerce Platform Tackling Customer Scams

In another instance, a popular e-commerce platform encountered a wave of fake account registrations and credit card chargebacks. The company employed advanced machine learning algorithms to analyze user behavior and identify patterns consistent with fraudulent activity. Once detected, the platform took proactive steps to lock suspicious accounts, notify affected users, and refund the fraudulent transactions.

- Key Takeaways: Machine learning and AI can help detect patterns indicative of scams across large datasets.

- Technology Used: Advanced fraud detection algorithms to monitor transactions in real-time.

- Outcome: The platform significantly reduced the rate of fraudulent transactions and enhanced customer trust.

Case Study 3: Retail Chain Preventing Identity Theft

A retail company noticed an increase in identity theft attempts at its physical stores. To combat this, the retailer implemented an ID verification system at the checkout point. Customers were required to scan their ID cards, which were cross-checked against the details in the payment system. This led to a noticeable reduction in fraudulent activities during transactions.

- Key Takeaways: Implementing identity verification tools can prevent unauthorized use of personal information during transactions.

- Technology Used: ID scanning and cross-checking software integrated with the point of sale system.

- Outcome: The company saw a decline in identity theft and enhanced customer security.

These case studies demonstrate the importance of combining technology, well-defined policies, and employee training to effectively reduce the risk of dishonest activities. By taking proactive measures, organizations can create a robust defense against a wide variety of deceptive practices.

Best Practices for Safeguarding Data

In an increasingly digital world, protecting sensitive information has become a critical concern for businesses and individuals alike. With the rise of cyber threats, data breaches, and unauthorized access, it is essential to adopt comprehensive strategies to secure personal and organizational data. By implementing best practices, organizations can mitigate risks, ensure privacy, and maintain the integrity of valuable information.

1. Strong Authentication Methods

One of the most effective ways to protect sensitive data is through robust authentication measures. By using multifactor authentication (MFA), organizations add an extra layer of security beyond just passwords. This requires users to provide multiple forms of verification, such as a fingerprint or a one-time passcode, in addition to a standard password.

- Key Practices: Implement multifactor authentication for all systems containing sensitive data.

- Benefits: Reduces the likelihood of unauthorized access, even if passwords are compromised.

2. Data Encryption and Storage Security

Encrypting data is crucial in safeguarding information during storage and transmission. Encryption converts readable data into an unreadable format, ensuring that even if data is intercepted, it cannot be accessed or used by unauthorized individuals. In addition to encryption, secure storage practices must be employed to prevent data leaks from physical or digital breaches.

- Key Practices: Use encryption for sensitive data both in transit and at rest.

- Benefits: Enhances confidentiality and prevents data from being accessed without proper authorization.

3. Regular Software Updates and Patching

Keeping software up-to-date is an essential component of any data protection strategy. Cybercriminals often exploit vulnerabilities in outdated systems to gain unauthorized access. Regularly updating software and applying patches ensures that security weaknesses are addressed promptly, reducing the risk of exploitation.

- Key Practices: Schedule routine software updates and ensure that all security patches are promptly applied.

- Benefits: Keeps systems secure and reduces the chances of vulnerabilities being exploited.

4. Employee Training and Awareness

Humans are often the weakest link in security systems, as they may fall victim to phishing scams or inadvertently expose sensitive information. Regular training sessions on security best practices can empower employees to recognize threats and handle data responsibly. It is also essential to educate staff about the importance of strong passwords, secure file sharing, and safe browsing habits.

- Key Practices: Conduct regular cybersecurity training for all employees.

- Benefits: Reduces human error and helps staff recognize potential threats.

5. Data Access Controls

Limiting access to sensitive data is one of the most effective ways to reduce the chances of unauthorized use. Access should be granted only to individuals who require it for their specific job roles. Role-based access control (RBAC) is a strategy where users are assigned specific permissions based on their roles, ensuring that they only access the data necessary for their work.

- Key Practices: Implement role-based access control (RBAC) and ensure that employees only have access to the data they need.

- Benefits: Limits exposure and minimizes the risk of internal breaches.

6. Regular Data Backups

Backing up data regularly is crucial to prevent data loss in case of a cyberattack, system failure, or accidental deletion. Backup data should be stored securely and tested periodically to ensure it can be restored when needed. Additionally, it’s important to ensure that backup copies are encrypted to maintain data confidentiality.

- Key Practices: Regularly back up critical data and store backups in secure locations.

- Benefits: Ensures business continuity in case of data loss or security breaches.

7. Secure Data Disposal

Properly disposing of outdated or unnecessary data is an often-overlooked aspect of data security. Simply deleting files may not remove them permanently. Instead, organizations should use secure methods such as data wiping or physical destruction of storage devices to ensure that sensitive information cannot be retrieved once it is no longer needed.

- Key Practices: Use secure data destruction methods, including data wiping and shredding physical media.

- Benefits: Prevents data recovery and protects against potential breaches from discarded storage devices.

Data Security Best Practices Summary

| Practice | Benefits | Key Technology/Methods |

|---|---|---|

| Strong Authentication | Reduces unauthorized access | Multifactor Authentication (MFA) |

| Data Encryption | Enhances confidentiality | Encryption protocols |

| Software Updates | Prevents exploitation of vulnerabilities | Automatic patching tools |

| Employee Training | Reduces human error | Security awareness programs |

| Access Control | Limits exposure to sensitive data | Role-based Access Control (RBAC) |

| Data Backups | Ensures data recovery | Cloud storage, secure backup software |

| Data Disposal | Prevents unauthorized data recovery | Data wiping, physical destruction |

By incorporating these best practices, businesses can significantly reduce the risk of data breaches and ensure that sensitive information remains secure. Constant vigilance and the adoption of security innovations will help protect data from evolving threats.

Building a Fraud Awareness Culture

Establishing a strong organizational culture focused on the prevention of deceptive activities is crucial for maintaining trust, security, and integrity. It involves fostering an environment where all employees are equipped with the knowledge, tools, and motivation to identify and address unethical behaviors. When individuals at every level of an organization understand the risks, consequences, and preventive measures, they are better prepared to act responsibly and make informed decisions.

Key Steps to Cultivate a Culture of Integrity

- 1. Leadership Commitment: Senior leadership must demonstrate an unwavering commitment to ethical standards. Their actions set the tone for the entire organization.

- 2. Regular Training: Conducting regular educational sessions ensures that employees remain informed about the latest risks and preventive measures.

- 3. Open Communication Channels: Encouraging transparency and providing safe avenues for reporting suspicious activities fosters a sense of trust and accountability.

- 4. Reward Ethical Behavior: Recognizing and rewarding individuals who exemplify ethical behavior reinforces the importance of maintaining integrity.

- 5. Clear Policies: Having clear and concise policies in place that outline acceptable behaviors and consequences for violations is essential for guiding employees.

Measuring the Success of a Strong Ethical Culture

Creating a culture focused on preventing unethical conduct is not just about implementing policies–it also requires continuous evaluation to ensure its effectiveness. Regular assessments help identify areas for improvement, measure employee engagement with the initiatives, and track the overall success of the organization’s efforts.

| Strategy | Impact | Key Metrics |

|---|---|---|

| Leadership Commitment | Sets the ethical tone for the organization | Employee feedback, leadership behavior consistency |

| Regular Training | Increases knowledge and understanding of ethical standards | Training participation rates, employee understanding assessments |

| Open Communication Channels | Encourages transparency and trust | Reports of suspicious activities, employee surveys |

| Reward Ethical Behavior | Motivates employees to uphold ethical standards | Number of recognitions, employee morale surveys |

| Clear Policies | Provides a framework for acceptable conduct | Policy understanding surveys, compliance rates |

Ultimately, building a culture centered on ethical practices requires consistent effort, engagement, and a clear strategy. By focusing on continuous improvement and holding individuals accountable, organizations can establish a workplace where integrity and responsibility thrive.

Preparing for the IS-0038 Final Exam

Success in any assessment requires a strategic approach, proper understanding of the material, and the right preparation techniques. Whether you’re preparing for an important certification or a crucial evaluation, it is essential to focus on mastering key concepts and practicing effective study methods. This section will guide you on how to best prepare for the upcoming test, highlighting useful strategies and tips that can help you perform at your best.

Study Techniques for Effective Preparation

To excel in any assessment, you need to approach your study routine with a clear plan. Start by reviewing the course materials thoroughly, taking note of any key areas where you may need additional practice. Use a variety of study methods to engage with the content more effectively.

- Active Learning: Engage with the material by summarizing key points, teaching concepts to others, or applying scenarios to real-life situations.

- Practice Tests: Completing practice exams or quizzes can help familiarize you with the format and identify areas that need improvement.

- Group Study: Collaborating with peers can enhance your understanding by discussing challenging topics and sharing insights.

- Time Management: Set aside specific time blocks for studying each topic, and make sure to take regular breaks to stay focused.

Reviewing Key Areas for Success

Identify the critical concepts that are central to the evaluation. This often includes understanding the core principles, common tactics, and methods that can be applied in real-world scenarios. Make sure to focus on the sections that will likely carry the most weight in the assessment.

| Key Areas | Tips for Mastery |

|---|---|

| Ethical Standards | Review examples of ethical dilemmas and the proper actions to take in each case. |

| Risk Management | Understand the various risk mitigation strategies and their applications in different environments. |

| Identification Techniques | Focus on methods used to identify suspicious behaviors or activities. |

| Organizational Protocols | Learn the proper procedures for reporting unethical behaviors and addressing issues within an organization. |

Consistent preparation, along with strategic review of critical topics, will provide you with the knowledge and confidence needed to succeed. Stay organized, manage your time effectively, and focus on understanding the key principles that will be tested. With these strategies, you’ll be well-equipped to excel in your evaluation.

Common Mistakes in Fraud Prevention Exams

When preparing for an important assessment in any field, it’s easy to overlook certain areas that can affect performance. Even the most diligent students can fall victim to common errors that can easily be avoided. Understanding these frequent mistakes can help ensure that you’re better prepared and able to approach the assessment with confidence. This section highlights some of the most typical pitfalls and offers advice on how to avoid them.

Common Mistakes to Avoid

Many people make errors that can significantly impact their success in evaluations. Being aware of these can help you focus on the right strategies and avoid simple missteps.

- Misunderstanding Key Terminology: Many individuals confuse similar terms or fail to grasp the subtle differences between them. Ensure you fully understand the terminology used in the course material before taking the assessment.

- Relying Too Much on Memorization: While memorizing facts can be helpful, understanding the concepts behind them is more important. Focus on how different elements are interrelated rather than simply memorizing isolated pieces of information.

- Overlooking Practice Questions: Skipping practice questions or sample scenarios may result in poor performance. These exercises simulate the test environment and help reinforce your knowledge while also improving your test-taking skills.

- Not Managing Time Effectively: Poor time management is a common issue. Allocate time to each section of the test and stick to it, avoiding the temptation to spend too long on a single question.

- Failing to Review Mistakes: After completing practice tests, many individuals fail to analyze their mistakes. Review each incorrect response to understand why you missed it and learn how to avoid similar errors in the future.

- Not Paying Attention to Instructions: It’s easy to overlook important details in the instructions. Read all instructions carefully to ensure you’re following the right approach and answering questions correctly.

How to Improve Performance

Now that you’re aware of the common mistakes, here are some strategies to enhance your preparation and performance.

- Active Learning: Engage with the material by discussing it with peers, teaching others, or applying the concepts in real-world scenarios.

- Time Practice: Set aside specific periods for practice tests and time yourself to get accustomed to the pressure of answering questions under time constraints.

- Use Flashcards: Flashcards can be an effective tool for memorization, especially for terminology and key concepts.

- Stay Organized: Keep your study materials organized, and break down complex topics into manageable sections for easier review.

By being mindful of these common mistakes and adopting effective study strategies, you can greatly improve your chances of success in the assessment. Proper preparation and a focused approach are key to overcoming obstacles and excelling in any evaluation.

Tips for Passing the Final Exam

Preparing for a challenging assessment requires a combination of effective strategies, time management, and a strong understanding of the material. Success is not just about cramming information but developing a deep comprehension and applying that knowledge during the test. In this section, we’ll explore helpful tips that can improve your chances of performing well and achieving the desired results.

1. Understand the Key Concepts

Make sure you’re familiar with the core topics covered in the course. This includes not just memorizing facts but understanding how different concepts are interconnected. Focus on grasping the “why” behind the information rather than just the “what.” This approach will help you tackle more complex questions that test your overall comprehension.

2. Practice Regularly

Repetition is one of the most effective ways to reinforce your knowledge. Use practice questions, quizzes, or even mock assessments to simulate the real testing environment. This will help you become comfortable with the format, improve your speed, and identify areas that need more focus.

3. Manage Your Time Wisely

Effective time management is essential when preparing for a test. Set aside specific periods for studying each subject and stick to the schedule. During the test, allocate a fixed amount of time for each section and avoid getting stuck on any single question for too long. This will help you complete all parts of the assessment.

4. Take Care of Your Mental and Physical Health

Your well-being plays a critical role in your performance. Ensure you’re getting enough sleep, eating properly, and exercising to stay energized and focused. Mental fatigue can undermine your ability to think clearly and recall information, so it’s important to take breaks when studying and rest well before the test.

5. Stay Calm and Confident

Confidence can make a significant difference in how you perform under pressure. Trust in the preparation you’ve done and avoid panicking. Read each question carefully, and if you’re unsure about something, move on and return to it later. Stay calm, think critically, and give yourself time to consider all possible answers.

6. Review Your Mistakes

After taking practice tests or quizzes, always review the answers, especially the ones you got wrong. Understand why your answer was incorrect, and make sure to learn from it. This helps solidify your understanding and prevents similar mistakes on the actual assessment.

7. Stay Organized

Keep your study materials well-organized, whether it’s notes, textbooks, or online resources. A cluttered study environment can make it difficult to focus. Having your materials in order allows you to quickly access the information you need and reduces unnecessary stress.

By following these tips and dedicating enough time and energy to preparation, you’ll be in a strong position to achieve success. Remember, consistent effort and smart strategies are key to passing any challenge with confidence.