Preparing for professional certification in the field of risk management and protection can be a challenging yet rewarding experience. This section aims to provide essential insights and key topics that will help you navigate the process efficiently. Whether you are new to the industry or seeking to refine your knowledge, understanding the core principles and details is crucial for success.

Focus on understanding concepts that cover various policies, legal frameworks, and practical applications. Grasping these will not only assist in clearing the required tests but also lay a solid foundation for your future career in the field.

Comprehensive review of practical scenarios and key concepts allows you to approach challenges with confidence. Effective study strategies, practical examples, and clarity in subject matter are key components of excelling in this domain.

Certification Preparation for Protection Plans

Mastering the essential topics in the field of personal coverage is crucial for passing the required assessments. By familiarizing yourself with the core concepts, regulations, and operational procedures, you can ensure a thorough understanding that will help you succeed in your certification. It’s not just about memorizing facts, but understanding how these concepts apply to real-world situations and scenarios.

Understanding Policy Types and Benefits

Different types of coverage offer various benefits depending on individual needs. Knowing the specific characteristics of each plan is vital for both answering test inquiries and working within the industry. From basic protection to more comprehensive options, each plan addresses a unique set of needs and risks. The ability to distinguish between these plans is essential for both practical and theoretical assessments.

Regulatory Frameworks and Industry Standards

Another critical area for assessment involves understanding the regulatory bodies and legal requirements that govern protection services. Comprehending industry standards helps you not only navigate the certification process but also ensures compliance once you enter the workforce. You should focus on key regulations, eligibility criteria, and claim handling procedures, as these are often highlighted in the assessments.

Key Topics for Insurance Exam Preparation

Focusing on the most important areas will significantly increase your chances of success in certification assessments. To ensure thorough preparation, it is essential to understand the various elements that make up the protection industry. By grasping the core concepts and knowing what to expect, you can effectively navigate the assessment process and perform confidently on test day.

Essential Areas to Study

- Policy Structures: Understand the different types of coverage and their specific features.

- Eligibility Requirements: Know the criteria for qualifying for different protection plans.

- Regulatory Knowledge: Familiarize yourself with the legal frameworks that govern the industry.

- Claims Process: Learn how to handle claims and the procedures involved.

Preparation Tips

- Review sample scenarios to better understand real-world applications.

- Focus on key definitions and terminology that are often tested.

- Use practice tests to assess your knowledge and identify weak areas.

- Study the rules and regulations that impact eligibility and compliance.

Understanding Insurance Policy Terms

Grasping the terminology used in coverage plans is essential for effective comprehension and navigating related assessments. These terms define the rights, obligations, and coverage scope for policyholders. A clear understanding of these definitions is crucial not only for passing evaluations but also for making informed decisions about various protection options available.

Key Terms to Know

- Premium: The amount paid regularly for a policy.

- Deductible: The amount the policyholder must pay before benefits kick in.

- Beneficiary: The individual or entity entitled to receive the policy’s benefits.

- Exclusion: Specific conditions or circumstances not covered by the plan.

- Underwriting: The process of assessing the risk before approving coverage.

Commonly Tested Concepts

- Ensure familiarity with policy clauses and their meanings.

- Understand how terms affect premiums and coverage limits.

- Review common exclusions to avoid misunderstandings in scenarios.

- Know how underwriting practices influence policy acceptance.

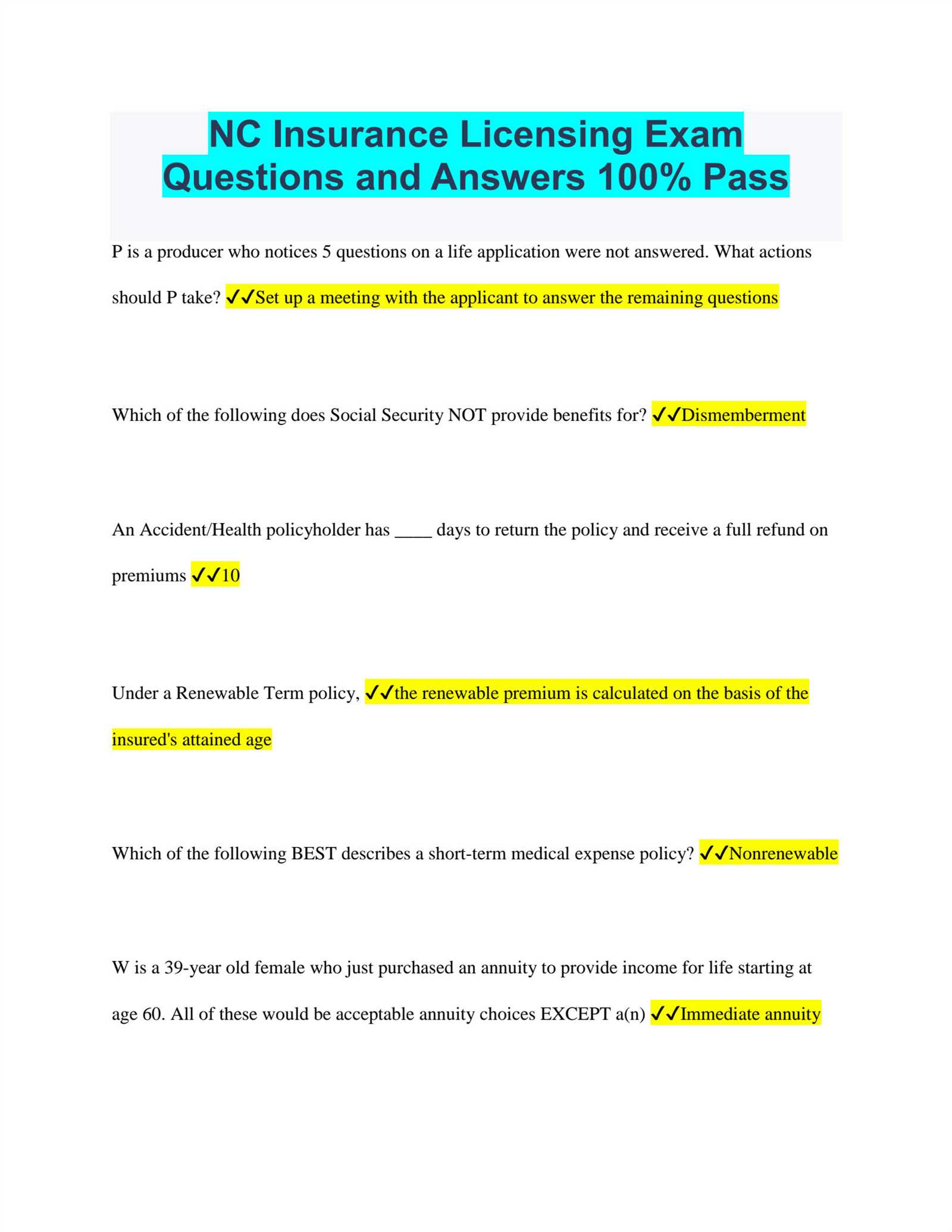

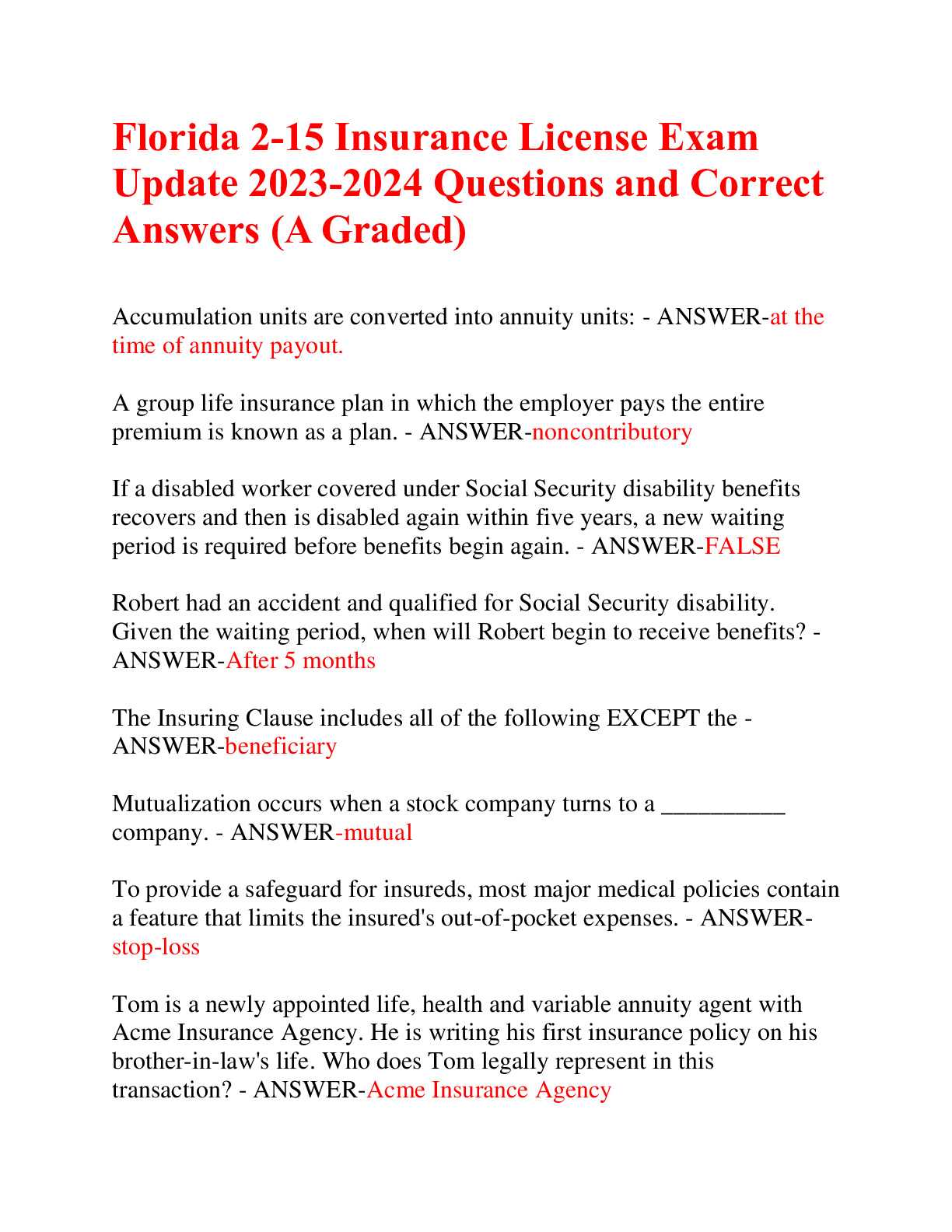

Common Questions on Life Insurance

When preparing for assessments in the field of personal protection, it’s important to understand the most commonly asked topics regarding coverage plans. These key concepts often form the foundation of many questions and help in evaluating knowledge of basic principles. By addressing these common points, you can confidently approach tests and better understand the intricacies of the subject matter.

Frequently Asked Concepts

- What factors influence premiums? Premium rates are determined by age, health, coverage amount, and policy type.

- How are benefits paid out? Benefits are typically paid as a lump sum or annuity, depending on the policy terms.

- What are riders? Riders are additional provisions that modify the coverage or offer extra benefits.

- How do claims work? Claims are processed after the policyholder’s death or upon the occurrence of a specified event, following specific procedures.

Important Considerations

- What exclusions exist in most plans? Common exclusions include suicide within the first two years or death caused by criminal activities.

- How does underwriting impact acceptance? Underwriting evaluates the risk level of the applicant, affecting their eligibility and premium rates.

Health Insurance Coverage Explained

Understanding the details of coverage options is essential for making informed decisions about protection plans. These policies offer varying levels of support, depending on the individual’s needs and circumstances. By knowing the types of services included, as well as limitations and exclusions, you can navigate these plans with clarity and confidence.

Coverage typically includes a wide range of medical services, from routine checkups to emergency care. It’s important to understand the distinctions between different tiers of protection, such as basic and comprehensive options. Additionally, knowing what is covered under each plan, such as hospital stays, doctor visits, or prescription medications, helps you make an informed choice when selecting a plan.

Many plans also offer supplementary benefits, such as dental or vision care, which can be added based on individual preferences or requirements. Recognizing the scope of protection and any out-of-pocket costs is key to maximizing the benefits of the plan.

Eligibility and Enrollment Exam Questions

Understanding the requirements for joining coverage programs is critical when preparing for related assessments. These topics often focus on the criteria that determine who can qualify for various plans and the processes involved in applying. Mastering these concepts will help you navigate the eligibility rules and procedures, which are essential to many tests in this field.

Key Eligibility Factors

| Factor | Description |

|---|---|

| Age | Minimum and maximum age limits for eligibility. |

| Income | Income thresholds that determine eligibility for certain plans. |

| Residency | Location requirements for qualifying for specific options. |

| Employment Status | Whether you need to be employed or self-employed to qualify for a program. |

Enrollment Procedures

Once eligibility is determined, understanding the steps required for enrollment is essential. Procedures can vary depending on the type of coverage being applied for, and may involve completing forms, submitting necessary documentation, or meeting deadlines. It’s important to be aware of these steps to ensure smooth enrollment.

Types of Life Insurance Policies

There are various types of coverage plans designed to provide financial support in the event of an individual’s passing. Each plan is structured differently to meet specific needs, whether for temporary protection or long-term financial security. Understanding the differences between these options is crucial for selecting the right policy that aligns with both personal preferences and financial goals.

Some options provide fixed premiums and coverage for a set period, while others offer lifelong protection with the potential to accumulate cash value over time. Additionally, certain plans allow policyholders to adjust their coverage as life circumstances change. Exploring the key types of these plans will help you navigate the available choices and understand which may be most suitable based on various factors such as age, financial goals, and coverage needs.

Insurance Regulations and Compliance

Regulations play a crucial role in ensuring that all policies adhere to specific standards, protecting both consumers and providers. These rules help to maintain fairness, transparency, and consistency within the industry. Compliance with legal requirements ensures that coverage providers operate ethically, meet the needs of policyholders, and uphold industry standards.

In this field, understanding the regulations surrounding eligibility, claims processing, and the sale of coverage is essential. Each region may have its own set of laws that govern how providers must operate, what they must disclose, and how they should handle claims. Being well-versed in these laws ensures that professionals can effectively navigate the complexities of the field while remaining compliant with legal standards.

Exam Tips for Life Insurance Candidates

Preparing for assessments in the field of coverage requires both strategic planning and a clear understanding of key concepts. Effective preparation involves knowing what areas to focus on, practicing time management, and developing a methodical approach to studying. By honing specific skills and techniques, candidates can feel more confident and ready to face the challenges of their evaluation.

Study Techniques

- Focus on Core Concepts: Prioritize the most common topics that are typically tested.

- Use Practice Tests: Take multiple mock tests to assess your knowledge and identify weak areas.

- Review Key Terms: Make sure you’re familiar with essential terminology and definitions.

- Break Down Study Sessions: Study in manageable chunks, avoiding long, exhaustive sessions that can lead to burnout.

Time Management Tips

- Allocate specific time blocks for each topic, ensuring thorough coverage.

- Practice under timed conditions to simulate the real test environment.

- Leave time at the end of your study for review and reinforcement of key points.

- Ensure regular breaks to avoid fatigue and keep focus sharp.

Health Insurance Plans and Benefits

Understanding the variety of available coverage options is essential when considering protection for medical expenses. Different plans offer a range of benefits designed to address individual needs, from routine care to more specialized treatments. The selection process should be guided by personal health requirements, budget, and coverage preferences, ensuring a comprehensive understanding of what each plan offers.

Types of Coverage Options

- Basic Coverage: Typically includes essential services like doctor visits and hospital stays.

- Comprehensive Plans: Offers a wider range of services, including prescriptions, preventive care, and specialist consultations.

- Catastrophic Coverage: Designed to protect against major health emergencies or long-term conditions.

- Short-Term Plans: Temporary coverage options for those in transition or between more permanent plans.

Key Benefits of Coverage

- Access to a network of healthcare providers, ensuring cost-effective treatments.

- Prevention and wellness programs that help in early diagnosis and maintaining health.

- Coverage for both inpatient and outpatient services, reducing financial strain in case of illness.

- Prescription drug benefits to help manage ongoing medical conditions.

Basic Concepts in Risk Management

Risk management involves identifying, assessing, and mitigating potential threats to financial stability and organizational well-being. It is a fundamental practice across various sectors, helping individuals and companies protect themselves against unexpected events that could result in financial losses or other detrimental impacts. Understanding these basic principles is key to navigating risks effectively and minimizing their consequences.

Key Risk Management Strategies

| Strategy | Description |

|---|---|

| Avoidance | Eliminating activities or situations that could introduce risk. |

| Reduction | Implementing measures to reduce the likelihood or severity of a risk. |

| Transfer | Shifting the impact of risk to another party, such as through contracts or partnerships. |

| Retention | Accepting the potential risk and its consequences, often when costs of mitigation are higher than the risk itself. |

Risk Assessment Process

Effective risk management begins with a thorough risk assessment. This involves identifying potential hazards, evaluating their likelihood and impact, and prioritizing them based on their potential threat. Once the risks are identified, strategies can be implemented to either avoid, reduce, transfer, or retain them, depending on the nature of the risk and available resources.

Exam Strategies for Health Insurance Tests

Achieving success in assessments related to medical coverage requires a focused approach and careful preparation. Mastering key concepts, familiarizing oneself with the structure of the assessment, and practicing time management are essential components of an effective strategy. By honing these skills, candidates can improve their chances of performing well and gaining the knowledge required for the field.

Effective Study Techniques

- Understand the Core Material: Prioritize learning the main principles that are most commonly tested.

- Utilize Practice Materials: Regularly take mock assessments to measure progress and identify areas for improvement.

- Break Down Complex Topics: Divide complex subjects into smaller, more manageable chunks for easier retention.

- Review Regularly: Set aside time each week for review to reinforce material and prevent forgetting important concepts.

Time Management During the Test

- Allocate time wisely by giving more attention to questions that are worth more points or are more difficult.

- Answer questions you’re confident about first to gain momentum and save time for the tougher ones.

- Practice pacing with timed mock assessments to build a sense of timing before the actual test.

- Don’t dwell too long on any one question–move on and return to difficult ones later if needed.

Insurance Industry Terminology Explained

The world of risk protection relies on a unique set of terms that define various concepts, processes, and structures. Understanding these terms is essential for anyone involved in this sector, whether for professional knowledge or personal comprehension. Clear definitions of key phrases help navigate contracts, policies, and regulatory frameworks more effectively.

Common Terms in Risk Protection

- Premium: The amount paid regularly to maintain a policy.

- Policyholder: The individual or entity that owns a policy.

- Deductible: The amount that must be paid out-of-pocket by the policyholder before coverage kicks in.

- Beneficiary: The person or entity designated to receive the payout from a policy in the event of a claim.

- Underwriting: The process of evaluating the risk involved in insuring a person or asset, determining the premium, and setting the terms of coverage.

Key Concepts for Understanding Coverage

- Exclusion: Specific situations or events that are not covered by a policy.

- Claim: A formal request made by the policyholder to receive benefits as per the terms of the policy.

- Coverage Limit: The maximum amount a policy will pay for a covered event or loss.

- Rider: An addition to a policy that modifies the terms of the standard coverage.

Life Insurance Claim Process Overview

The process of submitting a claim for a policy payout is a crucial step for beneficiaries to receive the benefits owed to them. Understanding the steps involved helps ensure that all necessary actions are taken promptly, reducing delays and complications. The entire procedure typically involves notifying the provider, submitting required documents, and following through with any additional requests made by the company.

Initial Steps in Filing a Claim

- Notification: The first step is to inform the provider of the policyholder’s passing or the qualifying event as soon as possible.

- Claim Form Submission: A formal request must be filled out, typically provided by the insurance company, detailing the necessary information about the claim.

- Documentation: Key documents, such as the death certificate or proof of incident, must be submitted along with the claim form to verify eligibility for the payout.

Review and Payout Process

- Claim Evaluation: The insurance provider will assess the submitted claim and ensure all terms are met based on the policyholder’s coverage.

- Approval or Denial: Once the claim has been reviewed, a decision is made on whether to approve or deny the payout based on policy guidelines and any exclusions.

- Payout Distribution: If approved, the payment is processed and sent to the designated beneficiary in accordance with the policy terms.

Common Health Insurance Misconceptions

There are several myths and misunderstandings surrounding coverage plans, which can cause confusion for consumers. Many people hold inaccurate beliefs about what their policies cover, the costs involved, and the processes required to make use of their benefits. Clearing up these misconceptions is essential for individuals to make informed decisions and avoid unexpected issues down the line.

One of the most common misconceptions is the belief that all medical services are fully covered, with no out-of-pocket costs. However, many plans have co-pays, deductibles, and exclusions that can significantly affect the actual expenses a policyholder faces. It’s also widely believed that once you sign up, coverage is immediate and comprehensive, without understanding the fine print or waiting periods that might apply.

Here are some common misconceptions:

- Universal Coverage: Not all treatments are covered by every plan. Policies often have specific conditions for what is included and what is not.

- Full Payment for Medical Bills: Many expect all costs to be covered, but in reality, patients often still need to pay co-pays, deductibles, or a percentage of the bill.

- Immediate Coverage: Some assume benefits start immediately after enrollment, but many plans have waiting periods or require an initial probationary period.

- Family Members Are Automatically Covered: Not all policies automatically cover dependents. In some cases, additional paperwork or separate plans are necessary.

By understanding these common misunderstandings, individuals can better navigate the complexities of their coverage plans and ensure they are making the most of their benefits.

How to Prepare for Difficult Questions

Facing challenging queries during an assessment or interview can be daunting. However, proper preparation can transform a seemingly tough situation into an opportunity for success. Being ready for tricky topics requires both knowledge and strategy. Understanding how to approach these questions effectively is key to performing well.

When tackling difficult questions, it’s essential to stay calm and methodical. Break down each query into smaller, manageable parts to avoid feeling overwhelmed. Many questions are designed to test not only your knowledge but also your problem-solving abilities. Here are some useful techniques for dealing with complex scenarios:

- Understand the Core Concept: Ensure you have a clear grasp of the basic principles before diving into complex questions. Knowing foundational information can help you reason through more difficult inquiries.

- Stay Focused: Maintain composure even if the question seems challenging. Take a deep breath and approach it step by step, ensuring you cover all relevant aspects.

- Use Practice Materials: Familiarize yourself with sample problems and practice regularly. The more exposure you have to potential queries, the better prepared you will be to handle them.

- Eliminate Incorrect Choices: If faced with multiple-choice options, quickly rule out any obviously incorrect answers. This increases your chances of selecting the correct response even when unsure.

With these strategies, individuals can tackle difficult questions with confidence, ensuring that they perform at their best when faced with the toughest challenges.

Understanding Underwriting and Claims

In the world of financial protection, two crucial processes drive the overall functioning of coverage systems: the assessment of risk and the handling of payouts. These stages ensure that both parties involved–whether policyholders or providers–are properly safeguarded. Grasping how these procedures work together can provide invaluable insights into the structure and operations of coverage programs.

The Role of Underwriting

Underwriting involves evaluating the risks associated with a person or entity seeking coverage. This process helps determine the terms, premiums, and eligibility criteria for protection. It is essential to assess an applicant’s profile, including health history, occupation, lifestyle, and other risk factors. The goal is to determine the level of coverage appropriate for the individual or entity, while ensuring the financial stability of the provider.

How Claims Are Processed

Once a claim is made, the provider evaluates the circumstances to determine whether the individual is eligible for a payout. This includes verifying the details, gathering supporting documents, and assessing the incident in question. If all requirements are met, the provider will issue compensation to the policyholder or their beneficiaries. The efficiency and fairness of this process are essential for maintaining trust between clients and companies.

| Step | Process | Details |

|---|---|---|

| Underwriting | Risk Assessment | Evaluating the applicant’s background and determining the coverage terms based on risk factors. |

| Claims Processing | Verification and Payout | Ensuring that the claim is valid and issuing payment or compensation once the claim is approved. |

By understanding the roles of both underwriting and claims, individuals can better navigate the process of securing protection and seeking compensation when necessary.