Understanding the fundamental principles of economics is crucial for anyone preparing for a foundational assessment in this field. By mastering core ideas such as market forces, production, and pricing mechanisms, students can build a strong foundation for tackling questions that require both theoretical knowledge and practical application.

Grasping critical topics like demand and supply, cost structures, and economic efficiency will not only help in approaching typical questions but also enhance your ability to analyze real-world scenarios. In this guide, we break down these concepts into manageable sections, focusing on their relevance and practical implications.

By focusing on specific topics and practicing application techniques, you’ll be able to answer questions confidently. This resource aims to simplify complex topics and offer clear insights that will improve your understanding and performance.

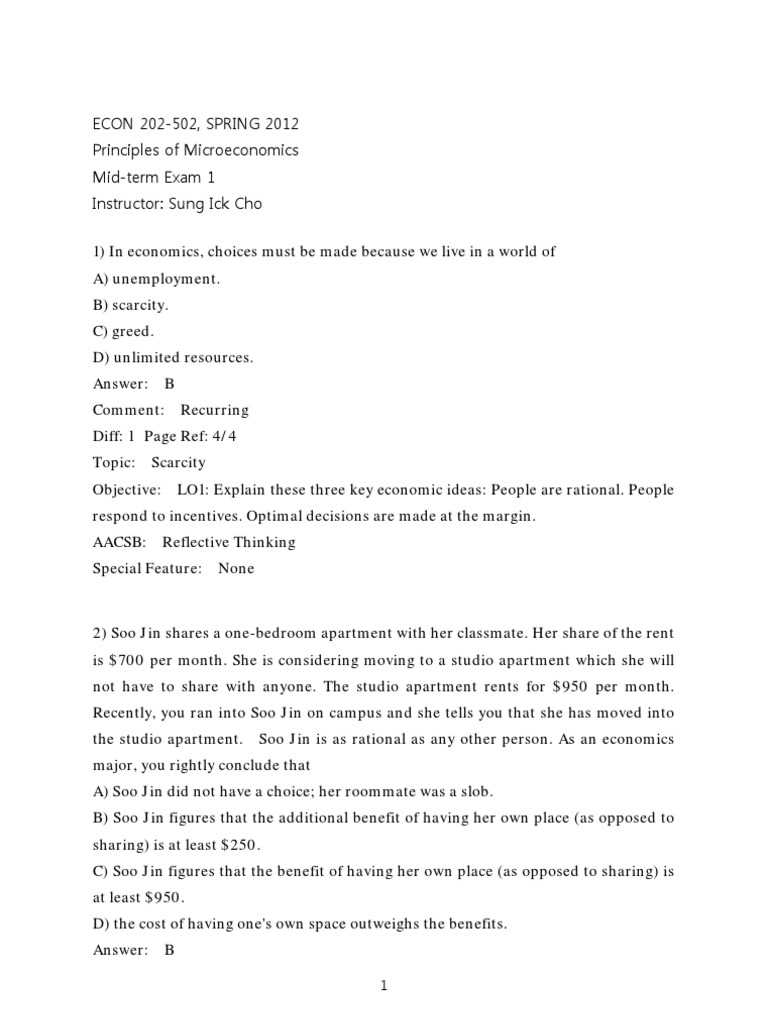

Microeconomics Exam 1 Answers

In this section, we explore the key topics and strategies necessary for tackling the initial set of questions related to economic principles. The goal is to provide a structured approach to understanding the fundamental concepts that are frequently tested. By breaking down each topic into clear, actionable points, you can improve both your understanding and your ability to perform well in the assessment.

Core Topics to Focus On

- Supply and Demand: Understanding the relationship between price and quantity in various market conditions.

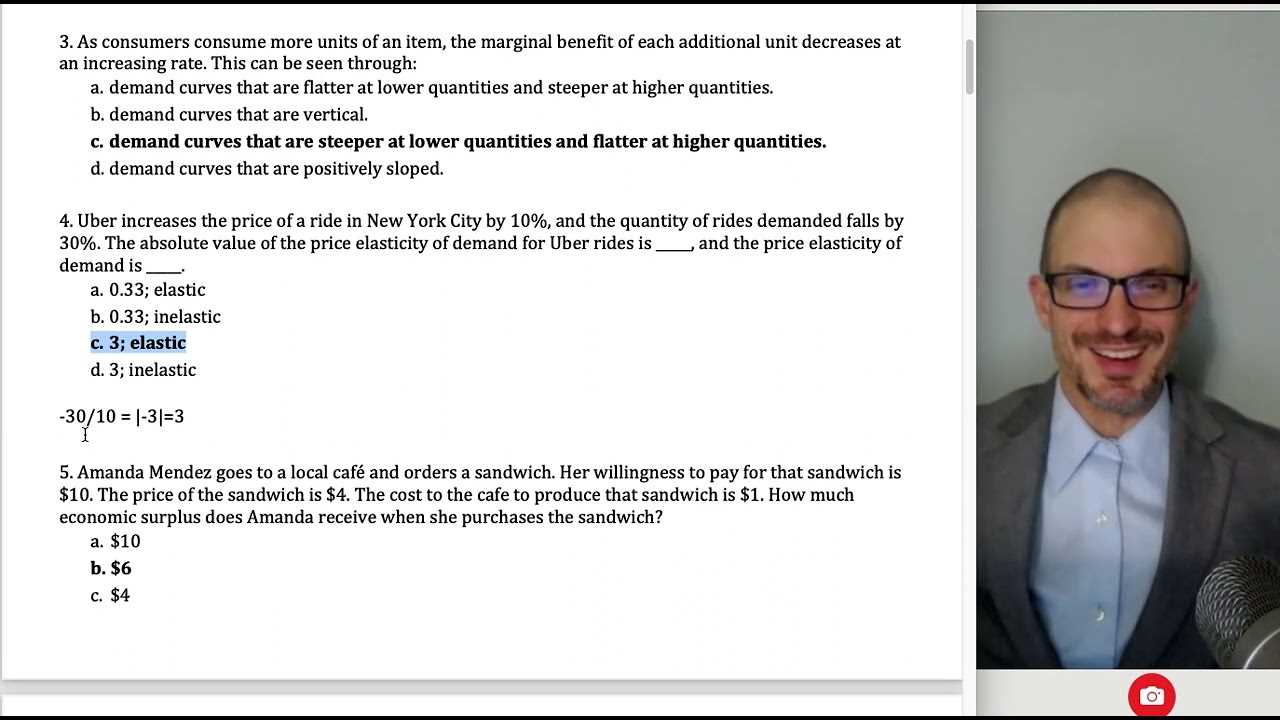

- Elasticity: Analyzing how changes in price affect the quantity demanded or supplied.

- Market Structures: Differentiating between perfect competition, monopolies, and oligopolies.

- Consumer Behavior: Examining how individuals make purchasing decisions and allocate their resources.

- Cost Analysis: Understanding the various types of costs firms face and how they influence production decisions.

Tips for Successful Preparation

- Review and understand the main models and their assumptions.

- Practice applying theoretical concepts to real-life examples.

- Focus on the most commonly tested topics like pricing, market equilibrium, and cost structures.

- Work through practice questions to familiarize yourself with typical question formats.

- Ensure you can explain concepts both qualitatively and quantitatively.

By focusing on these areas and employing the strategies mentioned, you’ll be well-equipped to address a wide variety of questions. Success lies in clear comprehension and the ability to apply economic reasoning effectively.

Key Concepts for Microeconomics Exam

This section focuses on the fundamental ideas that form the basis of economic theory. A solid understanding of these key concepts will provide the foundation needed to answer a wide range of questions effectively. These principles explain how markets operate, how individuals make decisions, and how firms respond to economic forces.

Essential Economic Principles

- Supply and Demand: The core concept that drives market outcomes. Changes in supply or demand affect prices and quantities exchanged in the market.

- Elasticity: Measures how responsive the quantity demanded or supplied is to changes in price. This concept helps explain consumer behavior and producer decisions.

- Market Equilibrium: Occurs when the quantity supplied equals the quantity demanded at a particular price. It represents a balanced market condition.

- Opportunity Cost: The cost of forgoing the next best alternative when making a decision. It plays a critical role in decision-making for both consumers and firms.

Understanding Market Structures

- Perfect Competition: A market structure where numerous small firms sell identical products, leading to no single firm having control over the price.

- Monopoly: A market dominated by a single firm that controls the entire supply of a good or service, allowing them to set prices without competition.

- Oligopoly: A market structure dominated by a few large firms, where each firm’s decisions impact the others.

- Monopolistic Competition: A market with many firms selling similar but not identical products, where firms have some control over prices.

Mastering these key concepts will help you analyze how various factors affect the market and make it easier to approach questions related to economic behavior and market dynamics.

Understanding Supply and Demand

At the heart of economic theory lies the relationship between the availability of goods and services and the desire for them. This fundamental interaction shapes how markets function and determine prices. The forces of supply and demand work together to balance what is produced with what consumers are willing to purchase, affecting both price levels and quantity traded.

When supply increases and demand remains constant, prices tend to fall, as sellers compete to attract buyers. Conversely, if demand rises while supply remains stable, prices usually increase. Understanding this dynamic is essential for analyzing market behavior and predicting how changes in one factor will influence the other.

Grasping this relationship allows for better decision-making, whether for businesses setting prices, governments crafting policy, or individuals making purchasing choices. It forms the foundation for understanding various economic outcomes and the flow of resources in a market economy.

Perfect Competition Explained

In a perfectly competitive market, numerous small firms operate under conditions that lead to an efficient allocation of resources. The primary characteristic of this market structure is the presence of many buyers and sellers offering identical products, resulting in no single firm having the ability to influence market prices.

Key Features of Perfect Competition

- Homogeneous Products: All firms sell identical goods, meaning consumers have no preference between different sellers.

- Free Entry and Exit: New firms can easily enter the market, and existing firms can exit without significant barriers or costs.

- Price Takers: Individual firms cannot set prices; instead, they accept the market price determined by overall supply and demand.

- Perfect Information: Buyers and sellers have access to all relevant information about prices and products, ensuring transparency and efficiency.

Implications for Firms and Consumers

In a perfectly competitive market, firms are highly efficient as they operate at the lowest possible cost, driven by competition. Consumers benefit from lower prices and the assurance that they are getting the best value for their money. However, in reality, perfect competition is rare, and many markets display characteristics that deviate from this ideal model.

Monopoly vs Perfect Competition

Markets can take on various forms depending on the number of firms, the level of competition, and the control over pricing. In one extreme, a single firm dominates the entire market, while in the other, many firms compete, offering identical products. These two market structures, monopoly and perfect competition, represent opposite ends of the spectrum, each with distinct characteristics and implications for both producers and consumers.

Monopoly Characteristics

- Single Seller: A monopoly exists when one firm controls the entire supply of a particular good or service, giving it significant market power.

- Price Maker: Unlike firms in perfect competition, a monopolist can set prices due to the lack of competition.

- Barriers to Entry: High entry barriers, such as control over essential resources or government regulation, prevent other firms from entering the market.

- Less Consumer Choice: Since only one firm provides the product, consumers have limited options.

Perfect Competition Characteristics

- Many Sellers: In perfect competition, numerous firms produce identical products, leading to no single firm controlling the market.

- Price Taker: Firms in perfect competition must accept the market price, as they have no power to influence it.

- Free Market Entry: Firms can easily enter or exit the market without significant barriers, fostering competition.

- Consumer Benefit: Consumers enjoy a wide variety of choices at competitive prices due to the abundance of firms.

The main difference between monopoly and perfect competition lies in the level of control firms have over pricing. While a monopoly can dictate prices and limit choices, perfect competition ensures efficiency and a wide array of options at market-determined prices. Both structures have distinct advantages and drawbacks, which influence the overall functioning of the market economy.

Elasticity of Demand and Supply

Elasticity refers to the degree of responsiveness in both consumers’ purchasing decisions and producers’ supply decisions when prices change. Understanding this concept is essential for analyzing how price fluctuations influence the overall market behavior. It helps businesses and policymakers predict how changes in price can affect demand and supply, influencing strategies and decisions.

The elasticity of demand measures how much the quantity demanded changes in response to a price change, while the elasticity of supply looks at how much the quantity supplied changes. The two concepts are critical for understanding market equilibrium, pricing strategies, and the effects of external factors such as taxes and subsidies.

| Type of Elasticity | Elastic | Inelastic |

|---|---|---|

| Demand | Consumers significantly change their quantity demanded with a price change. | Consumers’ purchasing behavior remains largely unaffected by price changes. |

| Supply | Producers can quickly increase or decrease supply with price changes. | Producers have limited ability to change the quantity supplied when prices change. |

Elasticity plays a key role in shaping pricing and market dynamics. When demand or supply is elastic, small changes in price can lead to larger changes in quantity demanded or supplied. Conversely, inelastic demand or supply suggests that price changes will have minimal effect on the amount bought or sold. Understanding these patterns is crucial for making informed economic decisions and anticipating market shifts.

Price Controls and Market Effects

Price controls are government-imposed limits on the prices of goods and services within a market. These regulations are often designed to protect consumers from excessively high prices or to ensure that essential goods remain affordable. However, while price controls may seem beneficial in the short term, they can lead to various unintended consequences that distort market equilibrium and disrupt the natural flow of supply and demand.

Types of Price Controls

- Price Ceilings: A maximum price that can be charged for a product, often set below the equilibrium price to make goods more affordable for consumers. Examples include rent controls or price caps on essential commodities.

- Price Floors: A minimum price set above the market equilibrium to prevent prices from falling too low. Minimum wage laws and agricultural price supports are common examples of price floors.

Market Impacts of Price Controls

When price controls are set, they can lead to shortages or surpluses, depending on whether they are ceilings or floors. Price ceilings, if set below the equilibrium price, typically result in shortages, as the demand exceeds the supply at the lower price. Price floors, on the other hand, often create surpluses because producers are willing to supply more at higher prices, but consumers may not be willing to buy at those prices.

| Price Control Type | Effect on Market | Example |

|---|---|---|

| Price Ceiling | Leads to shortages, as demand exceeds supply at the controlled price. | Rent controls in cities |

| Price Floor | Leads to surpluses, as supply exceeds demand at the minimum price. | Minimum wage laws, agricultural subsidies |

Although price controls may achieve certain social or economic objectives, they can create inefficiencies in the market, leading to misallocation of resources and potential long-term negative effects. Understanding the balance between regulatory interventions and market dynamics is crucial for assessing their impact on both consumers and producers.

Consumer and Producer Surplus

In every market, both consumers and producers derive benefits from their participation. These benefits can be measured in terms of surplus, which represents the difference between what consumers are willing to pay for a good or service and what they actually pay, and similarly, the difference between what producers are willing to accept for a product and the price they actually receive. The concept of surplus helps us understand the gains created by market transactions and the efficiency of resource allocation.

Consumer Surplus

Consumer surplus is the area of benefit that consumers receive when they are able to purchase a product for less than the maximum price they are willing to pay. It reflects the extra satisfaction or value consumers receive from paying a lower price than expected.

- It occurs when consumers are willing to pay more than the market price for a good or service.

- Consumer surplus is represented graphically as the area between the demand curve and the market price, up to the quantity purchased.

- Higher consumer surplus indicates that consumers are receiving good value for their purchases.

Producer Surplus

Producer surplus refers to the benefit producers receive when they are able to sell a good or service for more than the minimum amount they are willing to accept. It represents the difference between the price producers receive for a good and the lowest price they would be willing to accept for it.

- It occurs when producers receive more than the cost of producing a good, generating a profit.

- Producer surplus is represented graphically as the area between the supply curve and the market price, up to the quantity sold.

- A higher producer surplus suggests greater profitability and incentives for production.

In a competitive market, both consumer and producer surpluses indicate the level of efficiency and mutual benefit that result from trade. The greater the surpluses for both parties, the more efficient the market is in allocating resources, leading to an overall increase in economic welfare.

Production Costs and Efficiency

Understanding production costs and how they impact overall efficiency is essential for both businesses and economists. The cost of producing goods or services influences the supply decisions of firms and determines their profitability. Additionally, the efficiency of production plays a significant role in how well resources are allocated and utilized within an economy. By analyzing costs and efficiency, businesses can optimize their operations, and policymakers can identify strategies to improve economic performance.

Types of Production Costs

Production costs can be divided into several categories, each reflecting different aspects of the production process. These costs are crucial for determining the profitability of a firm and its competitive position in the market.

- Fixed Costs: Costs that do not change with the level of output, such as rent, salaries, and equipment depreciation.

- Variable Costs: Costs that vary directly with the level of production, such as raw materials, energy, and labor costs.

- Total Costs: The sum of both fixed and variable costs at any given level of production.

- Marginal Cost: The additional cost of producing one more unit of output. This is critical for decision-making in pricing and production levels.

Efficiency in Production

Production efficiency occurs when a firm maximizes output while minimizing the input costs. The more efficient a firm is in utilizing its resources, the lower its average costs will be, which increases its competitive advantage.

- Allocative Efficiency: This occurs when the resources in an economy are distributed in such a way that they provide the maximum benefit to society. It is achieved when goods and services are produced according to consumer preferences.

- Productive Efficiency: This is achieved when a firm produces goods at the lowest possible cost. It happens when firms operate on the production possibility frontier, using the least amount of resources for the greatest output.

In competitive markets, firms strive for both allocative and productive efficiency to maximize profits and meet consumer demand. A firm that can produce goods at a lower cost without sacrificing quality can offer lower prices, increasing its market share and long-term sustainability.

Market Failures and Government Intervention

Markets are typically efficient in allocating resources, but there are situations where they fail to produce the optimal outcome for society. These failures can result from a variety of factors, such as externalities, imperfect competition, or the lack of public goods. When markets fail to achieve optimal outcomes, government intervention can help correct inefficiencies and ensure that resources are allocated in a way that maximizes societal welfare.

Causes of Market Failures

There are several common reasons why markets may fail to operate efficiently. These failures can lead to an underproduction or overproduction of goods, misallocation of resources, or inequities in society.

- Externalities: When the costs or benefits of a transaction affect third parties who are not involved in the transaction itself. For example, pollution from a factory imposes costs on society that the producer does not account for in the price of their product.

- Imperfect Competition: This occurs when a market is dominated by a single firm or a few firms, which can lead to higher prices and reduced output compared to a perfectly competitive market.

- Public Goods: These are goods that are non-excludable and non-rivalrous, meaning that individuals cannot be excluded from using them, and one person’s use does not reduce their availability to others. Examples include national defense and clean air.

- Information Asymmetry: When one party in a transaction has more or better information than the other, leading to imbalances in decision-making, such as in the case of used car sales or healthcare services.

Government Intervention Methods

To address market failures, governments may implement various policies designed to correct inefficiencies and improve overall welfare. These interventions can take many forms, depending on the specific issue at hand.

- Taxes and Subsidies: Governments may impose taxes on goods that produce negative externalities, such as carbon taxes on pollution, or provide subsidies for goods that generate positive externalities, like education or clean energy.

- Regulations: Laws and regulations can be enacted to limit the negative effects of market failures, such as environmental regulations to control pollution or antitrust laws to prevent monopolies.

- Public Provision of Goods: In cases where markets fail to provide public goods, the government may step in to provide them directly, such as funding public health systems or building infrastructure like roads and bridges.

- Price Controls: Governments may set price ceilings (maximum prices) or price floors (minimum prices) to protect consumers and producers from extreme market outcomes, such as rent controls or minimum wage laws.

While government intervention can help correct market failures, it must be done carefully to avoid unintended consequences. Excessive regulation or poorly designed policies can lead to inefficiency or create new problems, which is why policymakers must consider the potential effects of their actions on the market and society as a whole.

Short-Run vs Long-Run Decisions

In business and economics, firms face different decision-making scenarios depending on the time frame in which they operate. Short-term decisions typically involve adjustments to existing resources and capabilities, while long-term decisions allow firms to plan for changes that can affect their entire structure, operations, and strategies. Understanding the difference between these two types of decisions is crucial for optimizing business performance and achieving sustainable growth.

In the short run, companies often work within certain constraints, such as fixed capital or limited workforce capacity. This means that their decisions are generally focused on making the best use of existing resources, adjusting production levels, and maximizing profitability without making major changes to their operations. In contrast, long-run decisions involve strategic planning that may include expanding production capacity, investing in new technology, or entering new markets. These decisions are based on long-term forecasts and are more flexible, as firms can adjust all of their resources over time.

Both short-run and long-run decisions have their own unique challenges and advantages. The short run typically requires quick, efficient responses to market conditions, while the long run allows for more thoughtful, long-term planning. However, both types of decisions must align with the overall goals of the firm and the external market environment to ensure success and growth.

Income Distribution and Inequality

Income distribution refers to the way in which the total income of a society is shared among its population. While some individuals earn much more than others, others may receive only a small portion of the total income. This disparity is a key factor in understanding the broader issue of economic inequality. How income is distributed across different groups within a society has significant implications for social stability, economic growth, and quality of life.

Inequality in income distribution is a common challenge faced by many economies. It arises from various factors, including differences in education, skills, access to opportunities, and even inheritance. As the gap between the rich and the poor widens, social mobility can decrease, and the ability for individuals to improve their economic standing becomes more difficult. This can lead to further divisions in society and create long-term economic challenges.

Addressing inequality often involves government intervention, such as progressive taxation, social welfare programs, and policies aimed at improving access to education and healthcare. These measures seek to reduce disparities in income and create a more balanced economic environment where all individuals have the opportunity to succeed. However, finding the right balance between promoting economic growth and reducing inequality remains a complex issue for policymakers.

Externalities and Public Goods

In economics, the concept of externalities refers to the unintended side effects that the actions of individuals or businesses can have on others, either positive or negative. These effects are not reflected in market prices and can lead to inefficiencies. Public goods, on the other hand, are resources that are available to everyone and are often subject to issues like overuse or underproduction, as they are not easily excluded from consumption. Both externalities and public goods can significantly affect the well-being of society, requiring thoughtful intervention and regulation.

Negative and Positive Externalities

Negative externalities occur when the actions of individuals or firms have harmful effects on others that are not accounted for in the cost of goods or services. For example, pollution from factories or second-hand smoke can harm public health and the environment without the producers or consumers bearing the full cost. On the other hand, positive externalities happen when individuals or firms create benefits for others without receiving compensation. A classic example is education, where an educated population can benefit society by contributing to economic growth and reducing crime.

Public Goods and Their Challenges

Public goods are unique because they are non-excludable and non-rivalrous. This means that no one can be excluded from using the good, and one person’s use does not diminish its availability to others. Examples include clean air, national defense, and public parks. However, because public goods are freely available to all, there is often little incentive for private businesses to produce them, leading to the “free rider” problem. This situation calls for government intervention to ensure that such goods are adequately provided and maintained for the benefit of society.

Market Structures Overview

Market structures define the competitive environment in which businesses operate. These structures influence how products are produced, priced, and sold to consumers. The characteristics of each market structure, such as the number of firms, the level of competition, and the ease of entry into the market, affect the overall efficiency and outcomes of the economy. Understanding these differences helps in analyzing economic behavior and the impact of business decisions on prices and output.

There are several distinct types of market structures, each with unique features that determine the level of competition and pricing strategies. These include perfect competition, monopolistic competition, oligopoly, and monopoly. Each structure has its own set of advantages and challenges, which can vary depending on the industry and the specific market conditions.

Perfect competition represents the idealized market structure, where numerous firms produce identical products, and no single company has control over the price. This creates an environment where prices are determined purely by supply and demand, leading to the most efficient allocation of resources.

Monopolistic competition features many firms selling similar but differentiated products. While companies have some degree of control over prices, competition remains strong, and firms must continuously innovate to retain customers. This structure is common in industries like retail or restaurants.

In an oligopoly, a small number of firms dominate the market. These firms have significant influence over prices and can engage in strategic behavior, such as price collusion or product differentiation, to maintain market power. This structure is typical in industries like telecommunications or automotive manufacturing.

Lastly, a monopoly exists when a single firm controls the entire market for a product or service, often due to barriers to entry or exclusive control over a vital resource. While monopolies can lead to economies of scale, they also pose challenges such as higher prices and reduced innovation due to lack of competition.

Profit Maximization Techniques

In any competitive market, businesses aim to maximize their profits by optimizing their production processes, pricing strategies, and resource allocation. Profit maximization involves balancing costs and revenue in a way that yields the highest possible return. Companies utilize various techniques to achieve this goal, taking into account factors like market demand, competition, and operational efficiency.

One key approach is to focus on cost reduction while maintaining or increasing output. By minimizing variable and fixed costs, businesses can improve their profit margins. This may involve streamlining production methods, using technology to enhance efficiency, or negotiating better deals with suppliers.

Price Optimization

Another technique for maximizing profit is price optimization. Firms carefully analyze customer demand, production costs, and competitor pricing to set the optimal price for their product. The goal is to find a price point that maximizes revenue without losing too many customers. Businesses often use dynamic pricing strategies, adjusting prices based on demand fluctuations, seasonality, or customer segmentation.

Product Differentiation

Product differentiation is a technique where businesses offer unique features or qualities that make their products stand out in the market. This can allow firms to charge a premium price, as customers may be willing to pay more for products they perceive as superior or more tailored to their needs. Successful differentiation requires constant innovation and effective marketing strategies to build brand loyalty and attract repeat customers.

These techniques, when applied correctly, help businesses not only increase profits but also maintain long-term sustainability in a competitive market. By continuously evaluating and adjusting their strategies, firms can stay ahead of the competition and adapt to changing market conditions.

Cost Curves and Economic Efficiency

Understanding the relationship between costs and production is crucial for businesses aiming to maximize their profitability. Cost curves represent the various costs associated with different levels of output, helping firms determine the most efficient production strategies. These curves are essential for analyzing how resources should be allocated to minimize waste and achieve optimal performance in the market.

Economic efficiency refers to the ability of a firm or an economy to produce goods and services at the lowest possible cost, while maximizing output. By examining cost curves, businesses can identify areas where they may be overproducing or underproducing, allowing them to adjust their operations and achieve greater efficiency. The key is to find the balance where marginal cost equals marginal revenue, ensuring that resources are utilized most effectively.

Short-Run Cost Curves

In the short run, businesses face both fixed and variable costs. Fixed costs do not change with the level of production, while variable costs fluctuate as output increases or decreases. Short-run cost curves illustrate how total, average, and marginal costs behave as output levels change. By analyzing these curves, firms can identify the point at which they experience diminishing returns, helping them optimize production and minimize unnecessary expenses.

Long-Run Cost Curves

In contrast to the short run, long-run cost curves reflect the cost structure when all inputs can be varied. The long-run allows businesses to adjust their scale of production and make investments in technology or capacity to reduce costs. These curves show the lowest possible cost of producing a given level of output, often referred to as the “economies of scale” effect. Understanding long-run cost behavior is vital for firms planning long-term investments and growth strategies.

In summary, cost curves play a central role in evaluating a firm’s economic efficiency. By continuously monitoring and adjusting their production processes, businesses can ensure that they operate at the lowest possible cost while maintaining high levels of output and competitiveness in the market.

Government Taxes and Subsidies

Government policies play a significant role in shaping economic activity, with taxes and subsidies being two key instruments used to influence market outcomes. Taxes are typically imposed to generate revenue, but they can also be used to discourage certain behaviors or activities. On the other hand, subsidies are used to encourage production or consumption of specific goods and services, often in areas that are deemed beneficial for society as a whole. These fiscal tools can have a profound impact on both businesses and consumers, affecting prices, production levels, and market efficiency.

Impact of Taxes

Taxes influence both producers and consumers by altering the costs of goods and services. For example, when a government imposes a tax on a product, the price paid by consumers often increases, while the price received by producers may decrease. This creates a shift in the supply and demand equilibrium, leading to changes in market quantities and potentially reducing the overall economic welfare. The extent to which taxes affect the market depends on the price elasticity of demand and supply. The table below summarizes the impact of taxes on market outcomes.

| Tax Type | Impact on Consumers | Impact on Producers | Market Outcome |

|---|---|---|---|

| Sales Tax | Higher prices paid by consumers | Lower effective price received by producers | Reduction in quantity sold |

| Excise Tax | Increased prices for specific goods | Decrease in profit margins | Change in supply curve and equilibrium quantity |

Role of Subsidies

Subsidies are financial incentives provided by the government to encourage the production or consumption of certain goods. By lowering the cost of production or reducing prices for consumers, subsidies can increase the supply and demand for a specific product. This can help correct market failures, promote economic growth, or support social objectives, such as renewable energy or education. However, subsidies also carry the risk of distorting market prices, potentially leading to inefficiencies in resource allocation. The table below illustrates the impact of subsidies on market dynamics.

| Subsidy Type | Impact on Consumers | Impact on Producers | Market Outcome |

|---|---|---|---|

| Production Subsidy | Lower prices for consumers | Higher profit margins and increased output | Increase in quantity supplied and demanded |

| Consumption Subsidy | Reduced prices, higher consumption | Potentially lower production costs | Shift in demand curve and higher consumption |

In conclusion, government taxes and subsidies are powerful tools that influence market behavior and outcomes. While taxes can help regulate consumption and generate government revenue, subsidies provide support for certain industries or social goals. Both instruments, however, need to be carefully designed to avoid negative side effects like inefficiencies or market distortions.

Study Tips for Your Upcoming Test

Preparing for an important test in the field of economics can feel overwhelming, but with the right approach, you can effectively manage your study time and improve your understanding of key concepts. Focusing on fundamental principles and practicing problem-solving strategies will not only help you retain information but also ensure you are able to apply what you’ve learned during the assessment. Below are some strategies to guide you through your preparation process.

1. Understand Key Concepts

Instead of memorizing definitions or formulas, focus on understanding the underlying concepts. This will help you apply knowledge more effectively and handle questions that require critical thinking. Pay special attention to the core principles such as supply and demand, elasticity, market structures, and cost analysis.

2. Use Practice Questions

One of the best ways to prepare is by practicing with past questions or sample problems. This helps you familiarize yourself with the format of the test and the types of questions you might encounter. Working through problems will also improve your ability to apply theoretical knowledge to practical scenarios.

3. Create Study Notes

Condense complex topics into concise study notes that highlight the most important information. Organizing the material in this way will make it easier for you to review key ideas before the test. Focus on summarizing major points and linking concepts together.

4. Review Your Mistakes

If you’ve completed practice problems, be sure to go over your mistakes. Understanding why you made errors and how to correct them is crucial for improving your problem-solving skills. Revisit challenging concepts until you feel confident in your understanding.

5. Take Breaks and Stay Balanced

Studying for long periods without breaks can lead to burnout. Instead, study in short, focused intervals and give yourself time to relax and recharge. A balanced approach to preparation will help you stay energized and focused throughout your study sessions.

By following these strategies, you’ll build a solid foundation and increase your confidence as you approach your test. With consistent effort and careful review, you’ll be well-prepared to succeed.