Understanding key financial principles is essential for making informed decisions and achieving long-term financial stability. Whether you are aiming to manage your budget effectively, build wealth, or make smart investment choices, grasping the core concepts is crucial for navigating the complexities of money management.

Effective preparation involves focusing on the primary topics that shape our financial lives. These subjects include savings strategies, debt management, investment basics, and understanding credit, all of which contribute to a well-rounded approach to handling finances.

By studying and applying these concepts, individuals can improve their financial literacy and enhance their ability to make sound financial choices, leading to a more secure future. Whether you’re preparing for an assessment or simply seeking to expand your knowledge, mastering these areas will provide a strong foundation for financial success.

Mastering Key Financial Concepts for Assessment Success

Achieving proficiency in essential money management topics is crucial for success in any financial assessment. By understanding key principles and practicing relevant skills, individuals can confidently tackle complex questions related to budgeting, investment strategies, and debt management. A strong grasp of these subjects not only helps in academic evaluations but also in real-life decision-making.

Key Areas to Focus On

When preparing for any financial test, it’s important to prioritize the following areas:

- Budgeting: Understanding how to create and maintain a balanced budget is fundamental. This involves tracking income and expenses, setting financial goals, and managing spending habits.

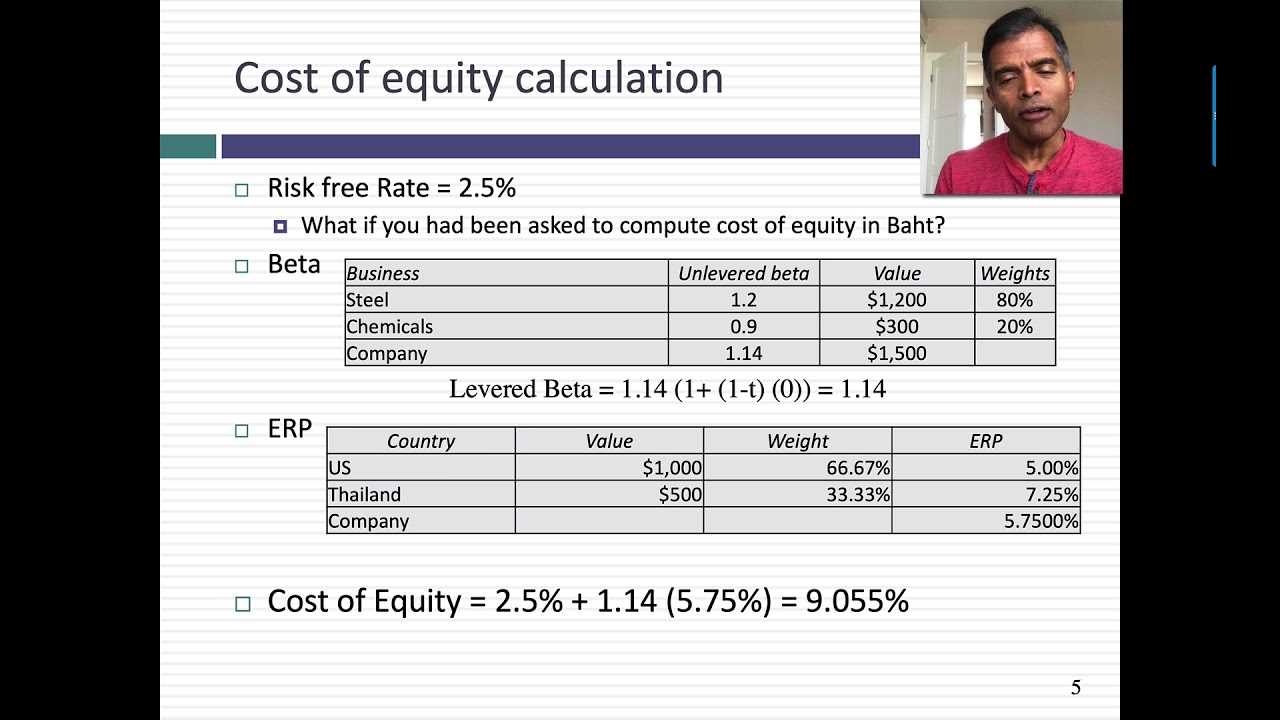

- Investing Basics: Knowing the different types of investments, such as stocks, bonds, and mutual funds, along with risk management strategies, is vital for long-term wealth building.

- Credit Management: Familiarity with how credit works, including credit scores, loans, and interest rates, plays a major role in maintaining financial health.

- Debt Reduction: Learning strategies for paying off debt efficiently can improve financial stability and help avoid financial pitfalls.

- Retirement Planning: Preparing for retirement by understanding various plans and the importance of early savings is a crucial topic to cover.

Effective Study Tips

To improve performance and achieve the best results, follow these study strategies:

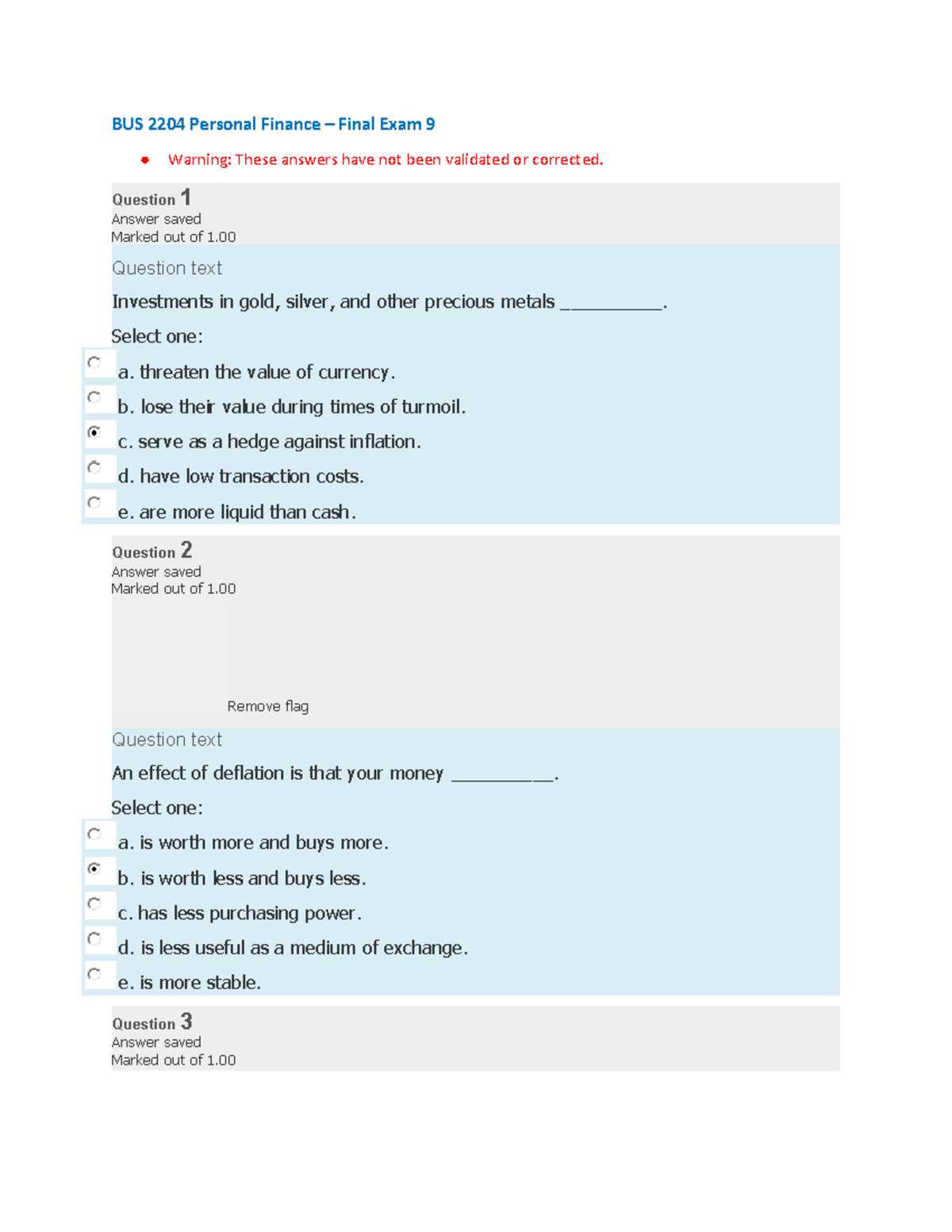

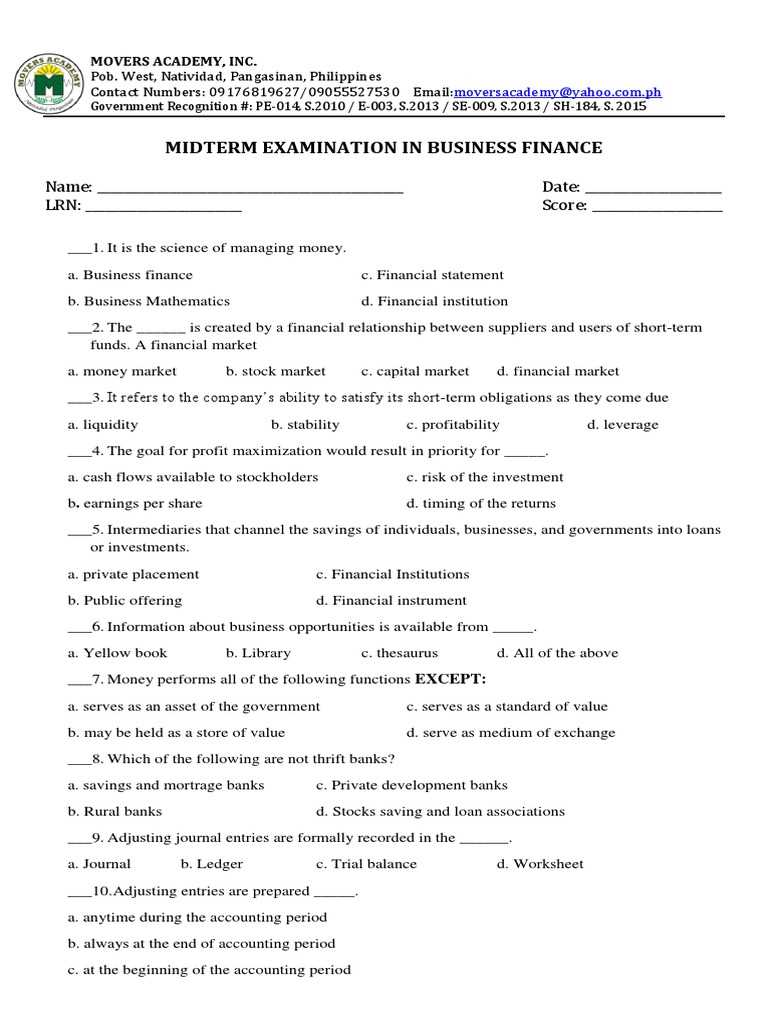

- Practice with Sample Questions: Familiarize yourself with common question types to build confidence and identify areas that need further study.

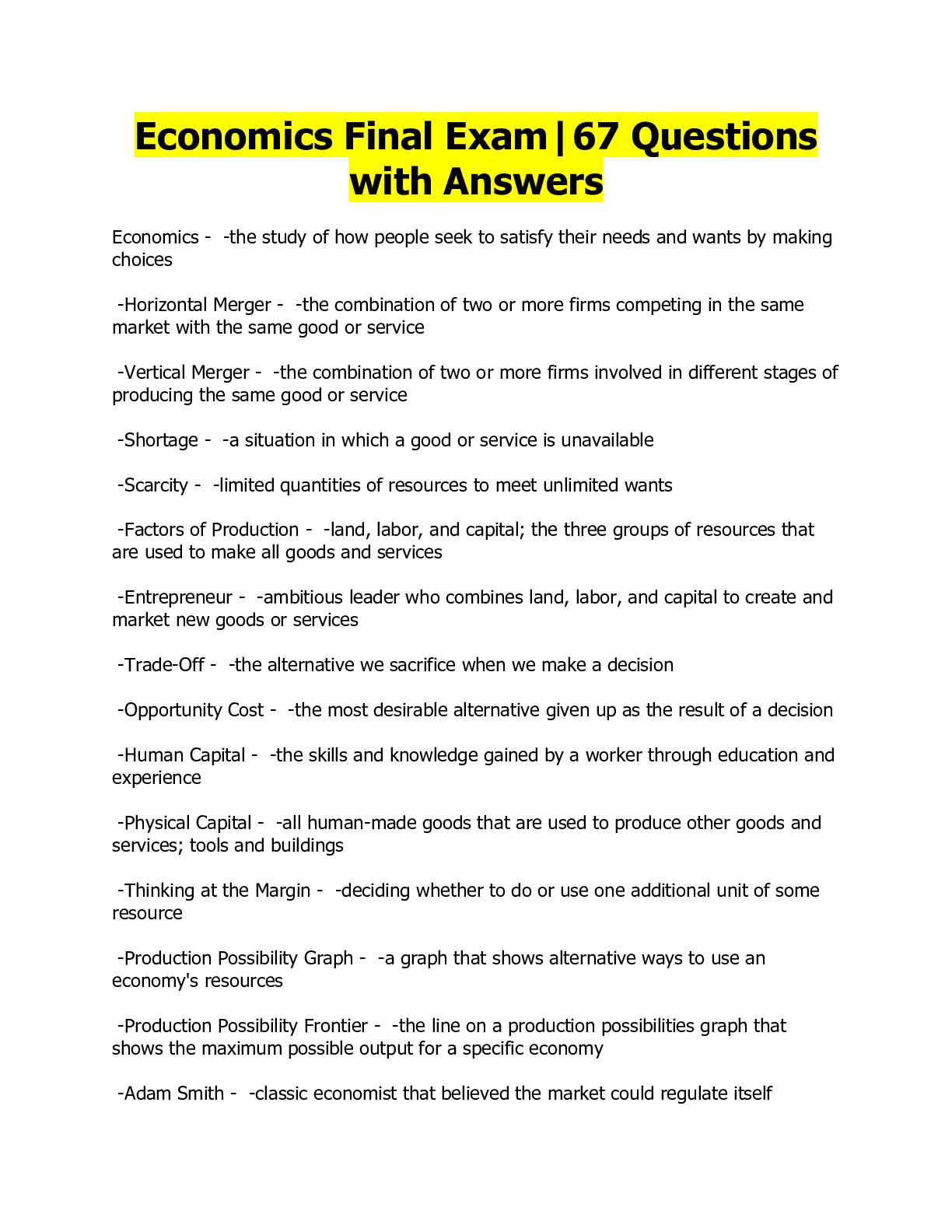

- Understand Key Formulas: Many financial concepts rely on specific calculations, so understanding how to use formulas for budgeting, interest rates, and investment returns is essential.

- Review Real-World Scenarios: Applying theory to practical situations can enhance understanding and make abstract concepts more tangible.

- Join Study Groups: Collaborating with others allows for diverse perspectives and can help clarify complex topics.

- Use Study Aids: Leverage textbooks, online resources, and financial tools to reinforce learning and ensure a comprehensive understanding.

Mastering these concepts and preparing efficiently will ensure you are ready to tackle any financial assessment with confidence and success.

Understanding Essential Money Management Concepts

Grasping key concepts of handling money is fundamental for achieving long-term stability and making informed decisions. These basic principles are the building blocks for managing one’s wealth, from budgeting and saving to understanding credit and investing. A solid understanding of these areas enables individuals to navigate the complexities of their financial lives with confidence and clarity.

Key Areas to Focus On

- Budgeting: The ability to track income and expenditures is essential. A clear budget helps allocate funds effectively, prioritize spending, and avoid unnecessary debt.

- Saving: Developing a habit of saving regularly is vital for building a safety net and preparing for future financial goals, such as emergencies or large purchases.

- Understanding Debt: Knowing how loans, credit cards, and other forms of debt work allows individuals to manage their liabilities wisely, ensuring they don’t accumulate unmanageable interest payments.

- Investing: Gaining a basic understanding of investment options and their potential returns can help grow wealth over time and make informed decisions for the future.

- Credit Management: A clear understanding of how credit scores and reports work is important for maintaining financial health and qualifying for favorable borrowing terms.

Practical Tips for Managing Finances

Applying these concepts in daily life can lead to better control over your financial situation:

- Track Your Spending: Keep an eye on where your money goes each month to identify areas for improvement and potential savings.

- Set Financial Goals: Define clear objectives, whether short-term, like saving for a vacation, or long-term, such as buying a home or preparing for retirement.

- Build an Emergency Fund: Saving a portion of your income for unexpected events will help you manage emergencies without resorting to credit or loans.

- Pay Off High-Interest Debt: Focus on eliminating high-interest debts first, as they can quickly spiral out of control if left unchecked.

Mastering these basic principles is the first step towards achieving financial well-being and security. By implementing these strategies, individuals can take charge of their finances and lay a solid foundation for future financial success.

Key Topics Covered in the Assessment

When preparing for any financial assessment, it’s important to focus on the primary areas that will be tested. These topics are designed to evaluate your understanding of crucial money management principles that are essential for achieving financial stability and making sound decisions. The core subjects range from budgeting to investing, each contributing to a holistic approach to managing one’s resources effectively.

Core Concepts to Study

- Budgeting and Money Management: This involves understanding how to create and maintain a balanced budget, allocate resources wisely, and avoid overspending.

- Saving Strategies: Learning about the different types of savings accounts, interest rates, and long-term savings goals, such as building an emergency fund or saving for retirement.

- Understanding Debt: The assessment will test your knowledge of different forms of debt, such as credit cards, loans, and mortgages, as well as strategies for managing and reducing them.

- Credit and Its Impact: Analyzing how credit works, how to build and maintain a healthy credit score, and understanding the implications of poor credit.

- Investment Basics: Understanding the fundamentals of investing, including stocks, bonds, and mutual funds, and how to evaluate risk versus reward.

Important Financial Tools and Calculations

The test may also include questions about specific financial tools and calculations that help in making informed financial decisions:

- Compound Interest: How interest grows over time and the importance of early saving.

- Loan Repayment Plans: Understanding different types of loans, their repayment schedules, and how interest accumulates.

- Investment Returns: Calculating potential returns on various investments and evaluating their long-term growth potential.

Familiarity with these core topics will help you perform well in the assessment, giving you the knowledge needed to make informed financial decisions in the future.

How to Prepare for the Test

Effective preparation for any financial assessment requires a clear strategy and focused study. To succeed, it’s essential to understand the key concepts that will be evaluated and practice applying them in different scenarios. A structured approach will help you retain important information and feel confident when facing the assessment.

Study Tips for Success

- Review Key Concepts: Focus on the main areas of study such as budgeting, saving, debt management, and investing. Ensure you understand the definitions, formulas, and real-world applications of these topics.

- Use Practice Tests: Taking practice tests will help you familiarize yourself with the types of questions likely to appear, improve your time management skills, and identify areas that need further review.

- Focus on Weak Areas: After reviewing practice tests, concentrate on subjects that you find challenging. This targeted review will ensure you’re well-prepared for every topic.

- Stay Organized: Create a study schedule that allocates time to each subject based on its importance and complexity. Break your study sessions into manageable blocks and stick to the plan.

- Use Study Guides: Refer to textbooks, online resources, and financial tools to clarify concepts and deepen your understanding.

Test-Taking Strategies

In addition to preparing the content, it’s important to have effective strategies for taking the assessment:

- Manage Your Time: Allocate a specific amount of time to each section of the test to ensure you can answer all questions without rushing.

- Read Questions Carefully: Take your time to read each question thoroughly, ensuring you understand what is being asked before answering.

- Answer What You Know First: Begin with the questions you are most confident in to build momentum and save difficult questions for later.

- Stay Calm and Focused: Maintain a positive attitude and focus on the task at hand. If you encounter a challenging question, move on and return to it later.

By following these preparation and test-taking strategies, you’ll be well-equipped to perform at your best and successfully tackle the assessment.

Common Mistakes to Avoid in the Test

When preparing for a financial assessment, it’s important to be aware of common pitfalls that can hinder your performance. These mistakes often stem from a lack of preparation, poor time management, or misunderstanding key concepts. Avoiding these errors will increase your chances of success and help you navigate the test more effectively.

Common Pitfalls to Watch Out For

- Rushing Through Questions: One of the most common mistakes is rushing through questions without fully reading or understanding them. Taking time to carefully consider each question ensures you don’t miss critical details.

- Ignoring Instructions: Always read the instructions at the beginning of each section. Not following specific guidelines can lead to unnecessary mistakes, especially when dealing with complex calculations or multi-part questions.

- Skipping Difficult Questions: It’s tempting to leave the hardest questions for later, but this can lead to incomplete answers. Instead, attempt to tackle the easier questions first, then return to the difficult ones with a clear mind.

- Not Managing Time Wisely: Failing to allocate enough time for each section can leave you rushing at the end. Prioritize your time by allotting a set amount for each part of the test and sticking to it.

- Overlooking Key Formulas: Forgetting important formulas or concepts can result in errors in calculations. Make sure you understand all the necessary formulas and practice applying them before the test.

How to Avoid These Mistakes

- Practice Under Time Constraints: Simulating test conditions during your study sessions can help you become accustomed to time limitations and manage your pace effectively during the actual assessment.

- Review Key Concepts Thoroughly: Make sure you have a deep understanding of the core principles, formulas, and methods needed for the test. This will give you the confidence to tackle any question.

- Stay Calm and Focused: Staying composed is key to avoiding mistakes caused by stress or panic. Take deep breaths and remain focused on each question as it comes.

By recognizing and avoiding these common mistakes, you’ll be better prepared to perform well and approach the test with confidence.

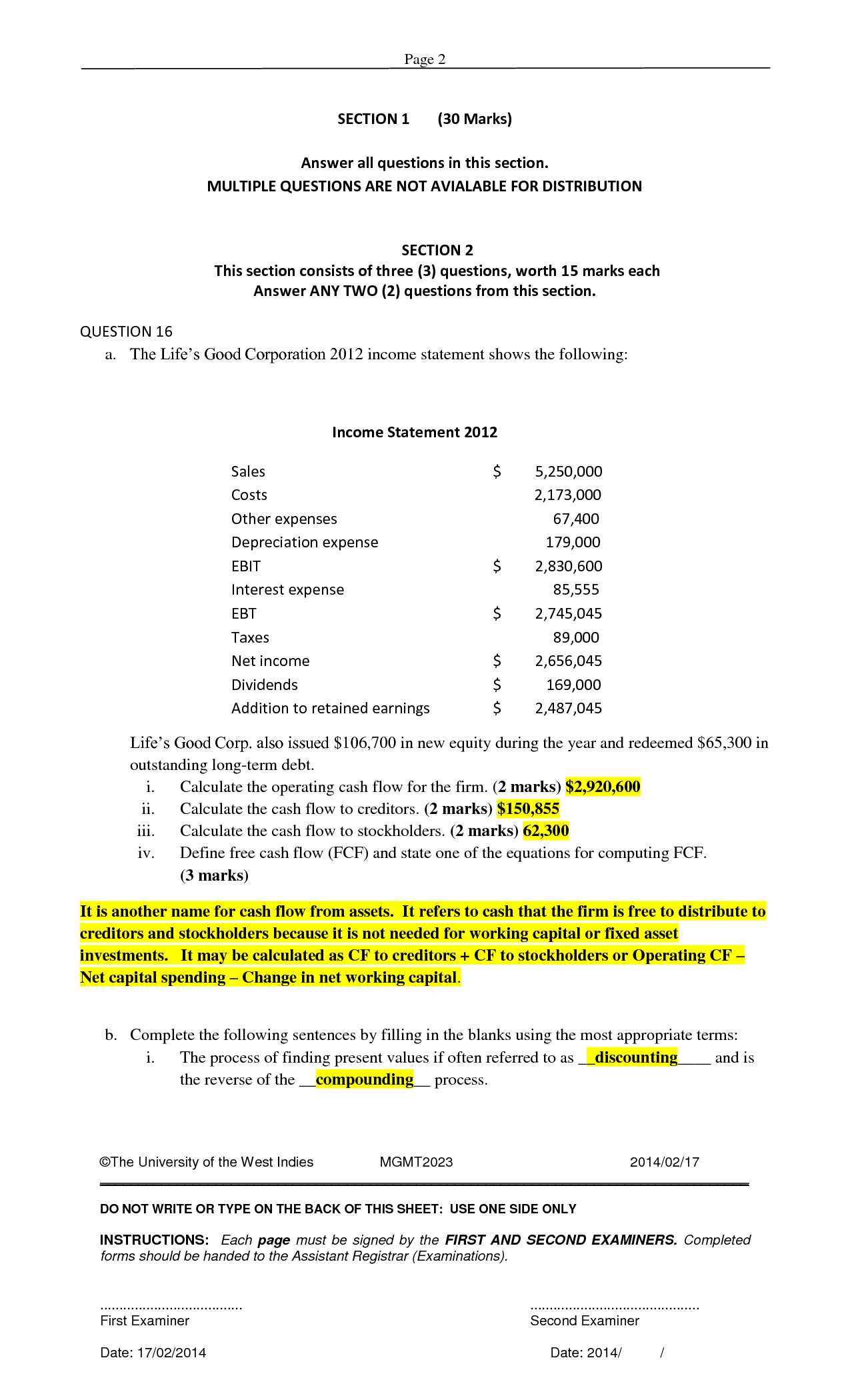

Understanding Financial Statements

Financial statements are essential tools for assessing the health of an individual or business’s finances. They provide detailed insights into how money is being managed, where it is coming from, and where it is being spent. Understanding these documents is crucial for making informed financial decisions, whether you’re managing personal funds or overseeing a business’s financial activities.

There are several key financial statements you should be familiar with, each serving a unique purpose:

| Statement | Purpose | Key Components |

|---|---|---|

| Income Statement | Shows the company’s or individual’s earnings over a period. | Revenue, expenses, profits or losses |

| Balance Sheet | Details assets, liabilities, and equity at a specific point in time. | Assets, liabilities, owner’s equity |

| Cash Flow Statement | Reveals how cash is flowing in and out of the business or personal accounts. | Operating activities, investing activities, financing activities |

Each of these statements provides a different perspective on financial performance, and together, they offer a comprehensive overview. By analyzing these documents, you can gain a clearer understanding of where financial decisions should be made to improve or maintain a healthy balance between income, expenses, and savings.

Budgeting Strategies for Success

Creating a clear and effective budget is essential for managing finances and achieving long-term financial goals. By setting realistic limits on spending, tracking expenses, and adjusting as needed, you can maintain control over your money. A well-thought-out budget helps ensure you’re saving enough for future needs while avoiding unnecessary debt.

Effective Budgeting Methods

There are several approaches to budgeting that can help you achieve financial success. Each method caters to different needs, so it’s important to choose one that aligns with your financial goals and lifestyle.

| Method | Overview | Best For |

|---|---|---|

| Zero-Based Budgeting | Every dollar is assigned a purpose, ensuring that income minus expenses equals zero. | People who want to allocate every penny efficiently |

| 50/30/20 Rule | Allocates 50% of income to needs, 30% to wants, and 20% to savings and debt repayment. | Those who want a simple, easy-to-follow approach |

| Envelope System | Cash is divided into envelopes for each spending category to limit overspending. | Individuals who prefer cash-based management |

Tips for Staying on Track

- Set Clear Goals: Having specific short-term and long-term financial goals will keep you motivated and focused.

- Track Spending Regularly: Monitor your spending on a weekly or monthly basis to ensure you’re staying within budget.

- Adjust as Needed: Life changes, and so should your budget. Don’t be afraid to modify your plan as your financial situation evolves.

- Build an Emergency Fund: Allocate a portion of your budget for unexpected expenses to avoid derailing your plan when emergencies arise.

By adopting one or more of these strategies, you can establish a sustainable financial plan that helps you meet your financial goals while maintaining peace of mind.

Managing Debt for Financial Stability

Effectively managing debt is a key element of achieving financial stability. It involves understanding how much you owe, making consistent payments, and developing strategies to reduce outstanding balances over time. When handled well, debt can be used to leverage financial opportunities, but poor debt management can lead to financial strain and unnecessary stress. Establishing a clear plan is essential for regaining control and securing long-term financial health.

Debt Management Strategies

There are various strategies for managing and reducing debt. Choosing the right approach depends on your financial goals and the type of debt you have. Here are some common methods:

| Strategy | Description | Best For |

|---|---|---|

| The Debt Snowball | Paying off smaller debts first to build momentum, then applying the savings to larger balances. | People who need quick wins to stay motivated |

| The Debt Avalanche | Focusing on paying off the highest-interest debt first to save on interest payments. | Those aiming to reduce overall interest costs |

| Consolidation Loans | Combining multiple debts into one loan with a lower interest rate for easier management. | Individuals with several high-interest loans |

Tips for Maintaining Financial Stability

- Pay More Than the Minimum: Always try to pay more than the minimum required amount, especially on high-interest debts.

- Prioritize High-Interest Debt: Start by eliminating the debts with the highest interest rates, as they cost you more in the long run.

- Stay Consistent: Make regular, scheduled payments to avoid late fees and damage to your credit score.

- Avoid Taking on New Debt: Focus on paying down existing debts before taking on additional obligations, unless it’s for a necessary expense.

- Review Your Budget Regularly: Adjust your budget as needed to allocate more funds towards paying off debt, ensuring faster progress.

By implementing these strategies and sticking to a well-thought-out plan, you can successfully manage your debt, build a solid financial foundation, and pave the way toward long-term financial security.

Importance of Credit Scores Explained

Your credit score is one of the most significant factors that lenders consider when assessing your financial reliability. It is a numerical representation of your creditworthiness, reflecting how well you manage debt and make payments over time. A strong credit score can unlock better loan terms, lower interest rates, and even influence your ability to rent a home or secure a job. Understanding this metric is essential for making informed financial decisions and maintaining long-term stability.

Credit scores are typically calculated based on several factors, including payment history, amounts owed, length of credit history, types of credit used, and recent inquiries. These elements provide a snapshot of your financial behavior and help lenders predict your likelihood of repaying borrowed funds. A higher score signals lower risk, while a lower score can indicate potential issues with debt management.

Maintaining a good credit score requires consistent, responsible financial habits, such as paying bills on time, keeping credit balances low, and regularly checking your credit report for errors. Understanding how credit works and the impact of your score can guide you in making better choices to improve your financial future.

Investing Basics for Beginners

Investing is an essential tool for building wealth and securing your financial future. It involves putting your money into assets or ventures with the expectation of earning a return over time. While the process can seem complex, understanding the basics can help you make informed decisions and grow your wealth strategically. With careful planning and knowledge, anyone can begin investing, even with limited funds.

There are various types of investments, each with its own level of risk and potential for return. Common options include stocks, bonds, mutual funds, and real estate. The key to successful investing lies in balancing risk and reward, diversifying your portfolio, and having a long-term perspective. It is crucial to start by understanding your financial goals, risk tolerance, and time horizon before choosing the right investment strategy.

Whether you’re looking to grow your savings for retirement, build wealth, or achieve specific financial objectives, a clear understanding of investment basics will provide the foundation for making smart choices in the future. By starting early and staying informed, you can take advantage of the power of compounding and build a more secure financial future.

Retirement Planning and its Importance

Planning for retirement is a crucial part of securing your long-term financial well-being. It involves preparing for a future where you are no longer working full-time but still need a steady income to cover living expenses. The earlier you start, the more time your money has to grow, allowing you to enjoy a comfortable and stress-free retirement. Having a clear strategy in place ensures you are ready to meet your financial needs when the time comes to stop working.

Why Retirement Planning Matters

There are several reasons why retirement planning should be a priority. Here are a few key points:

- Financial Independence: Planning ahead allows you to build enough savings to support yourself without relying on others.

- Inflation Protection: Inflation can erode the value of money over time. By planning, you can ensure your savings grow faster than inflation.

- Healthcare Costs: As you age, healthcare costs typically rise. Planning helps you set aside funds for medical expenses in retirement.

- Quality of Life: A solid retirement plan ensures that you can continue enjoying activities and experiences, even after you retire.

Steps to Start Planning

There are several steps you can take to begin planning for retirement:

- Set a Retirement Goal: Determine the lifestyle you want to have and estimate the amount of money you will need to achieve it.

- Save Consistently: Start saving early and contribute regularly to retirement accounts, such as a 401(k) or IRA.

- Invest Wisely: Choose investments that match your risk tolerance and time horizon. Diversify your portfolio to minimize risk.

- Review and Adjust: Regularly review your plan and make adjustments as necessary based on changes in your financial situation or goals.

Starting retirement planning early can make a significant difference in the quality of life during your retirement years. By taking the time to save and invest, you are setting yourself up for a more secure and fulfilling future.

Risk Management in Personal Finance

Managing risks is a crucial aspect of securing your financial future. Life is unpredictable, and unexpected events can have a significant impact on your wealth and well-being. Whether it’s health issues, job loss, or market fluctuations, having strategies in place to mitigate these risks helps protect your assets and ensures financial stability. By identifying potential risks and taking proactive measures, you can minimize their impact and avoid devastating consequences.

Types of Financial Risks

There are various types of risks that individuals face when managing their money. Here are some common ones:

- Market Risk: This type of risk refers to the possibility of losing money due to fluctuations in investment markets. It can affect stocks, bonds, or other investments.

- Health Risk: Unforeseen medical expenses can quickly deplete savings. Without proper health coverage or emergency savings, this risk can be devastating.

- Income Risk: This occurs when there is uncertainty regarding future income, such as job loss or reduced working hours, which can impact one’s ability to meet financial obligations.

- Inflation Risk: Inflation can erode purchasing power over time, which means that today’s savings may not be sufficient to meet future expenses.

Strategies for Managing Risks

There are several effective strategies for managing financial risks and safeguarding your wealth:

- Diversify Your Investments: Spread your investments across various asset classes (stocks, bonds, real estate) to reduce the impact of market volatility on your overall portfolio.

- Maintain Adequate Insurance: Ensure that you have the right coverage for health, life, and disability. Insurance can protect you from financial loss in case of unexpected events.

- Build an Emergency Fund: Set aside enough savings to cover 3-6 months of living expenses to protect against income disruptions or unforeseen emergencies.

- Plan for Inflation: Invest in assets that tend to outperform inflation, such as stocks or real estate, to preserve the value of your money over time.

By incorporating these strategies into your financial plan, you can reduce the impact of risk and create a more secure and resilient financial future. Risk management is not about avoiding risks entirely, but rather about controlling and mitigating them in a way that protects your long-term objectives.

Understanding Taxes and Their Impact

Taxes play a crucial role in the economy and can have a significant effect on an individual’s financial situation. From income to property, understanding the various types of taxes and how they affect your overall wealth is essential for managing your finances effectively. Whether it’s understanding the deductions you qualify for or learning how tax rates change based on income, being informed allows you to make better decisions and reduce your tax burden.

Types of Taxes

There are several types of taxes that individuals encounter in their daily lives. Here’s a breakdown of the most common ones:

- Income Tax: This is a tax levied on the money you earn, including wages, salaries, and bonuses. The tax rate can vary depending on your income bracket and location.

- Sales Tax: Imposed on goods and services you purchase, this tax is typically added at the point of sale. The rate can differ based on the state or country where the transaction occurs.

- Property Tax: Property owners are subject to this tax, which is based on the value of their property, whether it’s land or buildings. Local governments typically collect this tax.

- Capital Gains Tax: This tax applies to profits made from the sale of investments such as stocks, bonds, or real estate. The rate varies depending on how long you held the asset before selling it.

How Taxes Affect Financial Planning

Understanding how taxes affect your financial strategy is essential for optimizing your wealth-building efforts. Here are a few ways taxes can impact your financial decisions:

- Retirement Planning: Contributions to retirement accounts like IRAs or 401(k)s may be tax-deferred, which can help reduce your current taxable income and allow your savings to grow tax-free until withdrawal.

- Investment Decisions: Taxes on capital gains can influence investment strategies. For instance, holding investments for over a year may result in a lower tax rate on gains, encouraging long-term investing.

- Cash Flow Management: The amount you owe in taxes directly affects your available cash flow. It’s important to plan for tax payments to avoid cash shortages or penalties.

In conclusion, taxes are an unavoidable part of financial life, but by understanding their impact, you can make smarter decisions, optimize your savings, and ensure that your financial goals are not derailed by unexpected tax liabilities. Having a comprehensive understanding of the tax system is key to achieving long-term financial stability.

Building an Emergency Fund

Having a financial cushion for unexpected situations is an essential part of maintaining stability in your life. An emergency fund provides security in case of job loss, medical expenses, or other unplanned events. Setting aside a portion of your income for emergencies allows you to handle these challenges without derailing your long-term financial goals. Building this fund gradually is the key to ensuring you are prepared for life’s unpredictable moments.

How Much Should You Save?

The amount you should aim to save depends on your personal circumstances. However, financial experts often recommend saving enough to cover three to six months’ worth of living expenses. This provides a solid buffer to weather unexpected disruptions without having to rely on credit cards or loans.

- Three months’ expenses: Ideal for those with a stable job and no dependents.

- Six months’ expenses: Recommended for those with fluctuating income, dependents, or those seeking extra peace of mind.

Steps to Build Your Fund

Building your emergency fund doesn’t need to happen overnight. Here are some practical steps to help you get started:

- Start Small: Begin by saving small amounts regularly. Setting up automatic transfers to a separate savings account can make this process easier and more consistent.

- Cut Unnecessary Expenses: Review your spending and eliminate or reduce non-essential costs. Redirect that money toward your emergency savings.

- Prioritize Your Fund: Consider your emergency savings a top priority. Focus on building it up before taking on additional financial goals like investing or large purchases.

By building a robust emergency fund, you can gain peace of mind knowing that you’re prepared for whatever life throws your way. This safety net is a crucial step in achieving financial resilience and maintaining control over your financial future.

Personal Finance Myths and Facts

There are many misconceptions surrounding money management and wealth-building. These myths can mislead individuals and hinder their financial success. It’s essential to separate the myths from the facts in order to make informed and effective financial decisions. In this section, we will examine some of the most common beliefs and clarify the truths behind them.

Common Myths and the Truth Behind Them

- Myth: You need a high income to save money

Fact: Saving money is about managing expenses, not just earning more. Anyone, regardless of income level, can build savings by reducing unnecessary costs and living within their means. - Myth: Debt is always bad

Fact: Not all debt is harmful. Using credit wisely for things like education or a mortgage can be a sound financial strategy. It’s only when debt becomes unmanageable that it becomes a problem. - Myth: The more you invest, the better your returns

Fact: Investing is about strategy and risk tolerance, not just putting more money in. Diversifying investments and understanding your goals are key to maximizing returns, not simply increasing the amount invested. - Myth: Rent is throwing money away

Fact: Renting can be a smart financial choice depending on your circumstances. It provides flexibility and frees up capital for other investments or savings, while owning a home comes with long-term financial responsibilities.

Understanding the Facts

- Fact: Budgeting is essential for financial health

Creating a detailed budget allows you to track spending, set goals, and ensure you’re saving for the future. It’s one of the most powerful tools for gaining control over your money. - Fact: Compound interest is a powerful wealth-building tool

By starting to save and invest early, your money grows exponentially over time due to compound interest. The earlier you begin, the more wealth you can accumulate over time. - Fact: Financial planning is about setting realistic goals

Establishing clear, achievable financial goals helps you focus your efforts and make better decisions. Whether saving for retirement or a major purchase, goal-setting is a cornerstone of sound financial planning.

By debunking these myths and understanding the facts, you can make better choices and take more control over your financial future. Knowledge and awareness are crucial in navigating the complexities of money management and achieving long-term stability.

Final Tips for Success on Test Day

As the test approaches, it’s essential to be fully prepared, both mentally and physically. Success comes from a combination of effective study strategies, time management, and maintaining a calm mindset during the actual test. The following tips will help you approach the day with confidence and maximize your performance.

- Get Enough Rest the Night Before

Ensure you get a full night’s sleep before the test. A well-rested mind performs better, is more focused, and retains information more effectively. Avoid cramming the night before, as it can lead to unnecessary stress. - Review Key Concepts, Not Everything

Focus on reviewing the most important topics and key concepts that are likely to be on the test. Going over summaries, flashcards, and main ideas can help reinforce what you’ve learned, without overwhelming yourself with details. - Eat a Healthy Breakfast

Start the day with a balanced meal that includes protein and complex carbs to fuel your brain and maintain focus. Avoid heavy or sugary foods that can lead to energy crashes. - Arrive Early

Plan to arrive at the test location early to avoid any last-minute rush. This will give you time to settle in, relax, and ensure you have everything you need, such as ID, pens, and any other required materials. - Stay Calm and Manage Stress

It’s normal to feel some anxiety, but don’t let it overwhelm you. Take deep breaths and remember that you’ve prepared for this moment. Staying calm will help you think clearly and recall the material more effectively. - Read Instructions Carefully

Before diving into the test, take a moment to read all instructions thoroughly. This will ensure you understand what is being asked and avoid unnecessary mistakes. - Manage Your Time Wisely

Keep an eye on the clock and allocate time appropriately for each section. Don’t spend too much time on one question. If you’re stuck, move on and come back to it later if necessary. - Review Your Work

If time permits, review your answers before submitting the test. Double-check calculations, read through your written responses, and make sure you didn’t overlook any questions.

By following these strategies, you’ll be able to approach the test with confidence, stay focused, and perform at your best. Preparation is key, and with the right mindset, success is within reach.