For those aiming to enhance their expertise in accounting software, there is a structured path to gain recognition as a skilled user. This journey involves passing a rigorous assessment that evaluates both theoretical knowledge and practical skills, which are crucial for offering expert services to clients. Success in this process unlocks a range of professional benefits, including improved credibility and access to valuable resources.

Understanding the scope of the assessment is key to preparing effectively. The evaluation covers a wide array of topics, focusing on various aspects of financial management tools. By familiarizing yourself with the core subjects, you can develop a deeper understanding of the software’s functionality and improve your ability to manage complex financial tasks.

Preparing for the test requires dedication and the right approach. With a range of materials and practice resources available, it is important to prioritize key areas that are often highlighted in the assessment. The process is designed to ensure that candidates can handle real-world accounting challenges efficiently, reflecting the needs of businesses and their financial operations.

QuickBooks ProAdvisor Certification Exam Overview

For those looking to gain professional recognition in financial management tools, there is a structured process designed to test proficiency. This assessment aims to evaluate a candidate’s ability to effectively use accounting software in various business scenarios. Upon successful completion, individuals receive a formal acknowledgment of their skills, which can enhance their credibility in the industry.

The testing process is comprehensive, covering a wide range of topics related to managing financial operations. It includes both theoretical concepts and practical applications, ensuring that candidates are well-prepared for real-world challenges. This structure helps identify individuals who have a deep understanding of the software and can apply it to optimize business practices.

Preparation for this process requires a strategic approach, focusing on core functionalities and common tasks that users face. With a variety of training materials and resources available, candidates can review critical areas in advance, improving their chances of success. Understanding the format and scope of the assessment is key to passing with confidence and achieving a recognized level of expertise.

Importance of QuickBooks ProAdvisor Certification

Achieving professional recognition in financial software usage offers numerous advantages for accountants and business consultants. By demonstrating a high level of expertise, individuals can distinguish themselves from their peers and gain trust from clients seeking reliable financial management services. The process of earning formal acknowledgment highlights one’s competence in handling complex financial tasks effectively.

Here are some of the key benefits of obtaining this designation:

- Enhanced Professional Credibility: Validates your ability to navigate financial tools and provides assurance to clients about your expertise.

- Increased Marketability: A recognized qualification sets you apart in a competitive job market, opening doors to more opportunities.

- Access to Specialized Resources: Certified professionals gain access to exclusive tools, materials, and ongoing support that improve service delivery.

- Higher Earning Potential: With demonstrated proficiency, individuals are often able to command higher fees and salaries.

- Networking Opportunities: Being part of a professional network provides valuable connections for career growth and collaboration.

In addition to these advantages, becoming certified increases your ability to provide clients with accurate, efficient, and up-to-date financial solutions, making you a trusted advisor in the industry.

What to Expect in the Exam

When preparing for the professional assessment in accounting software, it’s essential to understand the format and content that will be covered. The evaluation is designed to thoroughly test your knowledge and practical skills in using financial management tools. It will assess your ability to handle real-world scenarios and solve problems commonly encountered in the field.

Key Areas Covered

The evaluation will focus on several core areas, ensuring a well-rounded test of your abilities. Below are the main topics you should be familiar with:

- Financial Transaction Management: Understanding how to record, categorize, and reconcile various financial transactions.

- Reporting and Analysis: Ability to generate, interpret, and analyze financial reports for business decision-making.

- Software Features and Tools: Familiarity with advanced features of the software, such as payroll processing, inventory management, and tax calculations.

- Client Management: Knowledge of how to set up and manage client profiles, track billable hours, and communicate effectively with clients.

Structure of the Assessment

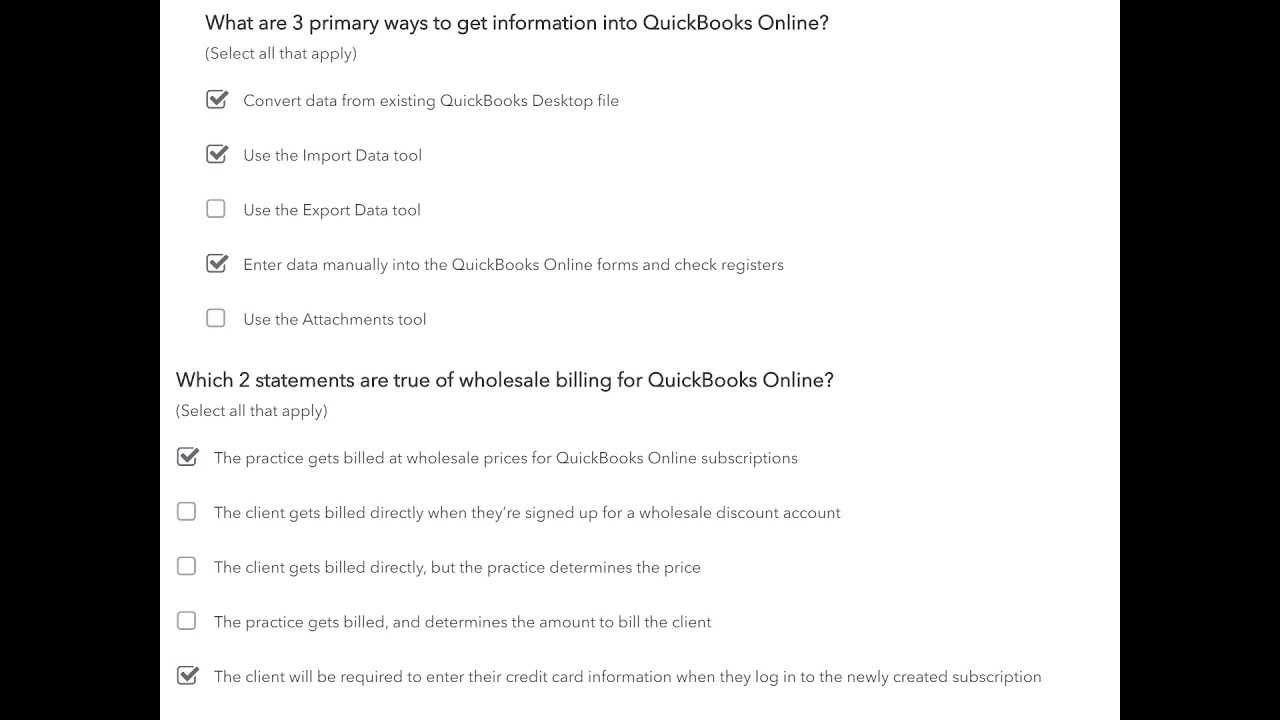

Expect a mix of multiple-choice and scenario-based questions that test both theoretical understanding and practical problem-solving skills. The questions will vary in difficulty, with some focusing on basic concepts and others on more advanced functionalities. You may also be asked to complete tasks within the software environment itself to demonstrate your hands-on expertise.

Being well-prepared for this type of assessment will ensure that you can confidently tackle the questions and manage the time constraints effectively.

Key Topics Covered in the Test

The professional assessment evaluates a candidate’s proficiency in a wide range of accounting software features and financial management concepts. A deep understanding of the following topics is essential for success. These areas are designed to test both theoretical knowledge and practical application, ensuring candidates are well-equipped for real-world tasks.

- Managing Financial Transactions: This includes recording purchases, sales, payments, and receipts, as well as understanding the flow of money within the business.

- Creating and Customizing Reports: Candidates should be able to generate accurate financial reports, such as profit and loss statements, balance sheets, and cash flow reports, tailored to specific business needs.

- Tax Calculation and Compliance: Understanding how to calculate taxes, set up tax rates, and ensure compliance with tax laws is a critical component of the assessment.

- Client Account Management: Knowledge of managing client profiles, tracking invoicing, payments, and accounts payable/receivable is tested.

- Inventory and Asset Tracking: The ability to manage inventory levels, purchase orders, and track assets is also assessed, particularly for businesses that deal with physical goods.

- Payroll Processing: Handling payroll functions, including employee setup, salary calculations, tax withholdings, and benefits management, is a key area of focus.

- Bank Reconciliation: Candidates are expected to reconcile business bank accounts with internal financial records, ensuring accuracy and consistency.

- Software Navigation and Efficiency: Mastery of the software interface and using shortcuts and advanced features to work efficiently is also tested.

Familiarity with these critical areas will significantly enhance your preparation, ensuring you can tackle all components of the evaluation with confidence and competence.

Preparing for the QuickBooks Exam

Success in the professional assessment requires thorough preparation and a strategic approach. To ensure you are fully equipped to handle the challenges of the test, it’s important to focus on understanding the core topics, practicing key tasks, and becoming familiar with the format. A well-structured preparation plan can significantly increase your chances of achieving a positive outcome.

Study Resources and Materials

Start by gathering study materials that cover the essential topics. There are a variety of resources available, including online courses, tutorials, books, and practice tools. Make sure to choose those that are up-to-date and specifically tailored to the content you will encounter. Consider utilizing:

- Official training guides and resources from recognized sources.

- Practice software or simulations to gain hands-on experience.

- Online forums and communities where professionals share tips and insights.

Practical Tips for Success

To ensure effective preparation, here are a few key strategies:

- Set a Study Schedule: Create a timeline that breaks down each topic, allocating sufficient time for practice and review.

- Focus on Weak Areas: Identify areas where you need improvement and concentrate your efforts on mastering those skills.

- Take Practice Tests: Simulate the test environment with practice exams to assess your readiness and adjust your study plan as needed.

- Stay Calm and Confident: Ensure that you are well-rested and focused on the day of the test to maximize performance.

By following these steps, you will build the knowledge and confidence required to succeed in the assessment and demonstrate your proficiency in financial management tools.

How to Access Study Materials

To effectively prepare for any professional assessment, it is crucial to have access to high-quality study materials. These resources will provide you with the knowledge and practice you need to succeed. There are a variety of options available, ranging from official documentation to online courses and community-driven content. Choosing the right mix of resources will allow you to cover all necessary topics and strengthen your understanding.

Here are some key types of study materials and where you can find them:

| Resource Type | Where to Access | Benefits |

|---|---|---|

| Official Guides | Official websites and platforms | Comprehensive, up-to-date, and aligned with test content. |

| Online Courses | Learning platforms like Udemy, Coursera | Interactive and structured learning, often with video tutorials. |

| Practice Tests | Test prep websites, forums | Helps assess your readiness and identify weak areas. |

| Community Forums | Discussion boards, social media groups | Real-world tips, study advice, and experiences from others. |

| Books & eBooks | Amazon, local libraries, online bookshops | In-depth coverage of the topics with step-by-step explanations. |

Using a combination of these resources will help you prepare efficiently and effectively, ensuring you gain the knowledge needed to perform well in the assessment.

Top QuickBooks ProAdvisor Exam Tips

Preparing for a professional assessment in financial management software can be challenging, but with the right strategies, you can boost your chances of success. A focused approach to studying, combined with effective test-taking strategies, can make a significant difference in your performance. Here are some essential tips that will help you navigate the process with confidence and ease.

Preparation Strategies

Effective preparation is the foundation of success. To ensure you’re fully ready for the assessment, focus on these key areas:

- Create a Study Schedule: Break down the content into manageable sections, setting specific goals for each study session. Consistent, structured study time is more effective than cramming.

- Master Key Features: Make sure you are comfortable with all essential functions of the software, especially the tools that are frequently tested in the assessment.

- Use Practice Resources: Engage with mock tests and simulations to familiarize yourself with the test format. This will help you become comfortable with the pacing and structure of the assessment.

Test-Taking Tips

When it’s time for the actual test, apply these strategies to maximize your performance:

- Manage Your Time: Pace yourself throughout the assessment. Spend the appropriate amount of time on each section, and don’t get stuck on difficult questions. Move on and return to them later if needed.

- Read Instructions Carefully: Pay close attention to each instruction and question, ensuring you fully understand what’s being asked before responding.

- Stay Calm: Approach the assessment with confidence. Trust in your preparation and maintain a positive mindset throughout the process.

By following these tips, you will be well-equipped to face the challenge and demonstrate your proficiency in financial management software.

Frequently Asked Questions about the Exam

Many individuals preparing for a professional assessment in financial software often have similar concerns and inquiries. Understanding the process, requirements, and best practices can help ease any uncertainty. Below are some of the most frequently asked questions, along with clear and helpful answers to guide you through your preparation.

Common Inquiries

| Question | Answer |

|---|---|

| How long is the assessment? | The duration typically ranges from 2 to 3 hours, depending on the specific test you are taking. It is advisable to manage your time wisely during the session. |

| Is there a passing score? | Yes, there is a set threshold that you must meet to pass. Generally, a score of 70% or higher is required to achieve a passing result. |

| What happens if I fail the test? | If you do not pass, you can retake the assessment after a waiting period. Most testing platforms allow candidates to retake the test multiple times, typically after a 30-day gap. |

| Can I take the assessment remotely? | Yes, many assessments offer the option to be taken online from the comfort of your home or office. Ensure you meet the technical requirements before attempting the test remotely. |

| Are there any study materials provided? | Yes, official resources, practice tools, and training modules are available to assist with preparation. These materials are a great starting point to guide your studies. |

Additional Clarifications

Feel free to reach out to support teams or consult official websites for further details about the process. Having a clear understanding of what to expect can help you stay focused and confident as you prepare for the assessment.

Understanding the QuickBooks Certification Levels

For professionals aiming to demonstrate their proficiency in financial management tools, different levels of recognition are available. These levels reflect varying degrees of expertise and are designed to help individuals build their skills progressively. Whether you’re just starting or you’re a seasoned user, understanding these levels is essential to choose the right path and achieve your goals in the field.

Typically, there are multiple tiers of qualification, each one corresponding to different skill sets and responsibilities. These levels allow professionals to showcase their growing knowledge and gain access to a range of opportunities. From beginner-level users to advanced experts, each level is designed to match specific roles and tasks within the accounting and finance industry.

Achieving higher levels not only boosts professional credibility but also increases marketability, as advanced certifications often signal deeper expertise and a broader understanding of complex financial systems. These distinctions can open doors to new roles, higher salaries, and expanded client bases, making them a valuable asset for any professional in the field.

Time Management During the Exam

Effective time management is a crucial skill for any assessment. With limited time and a wide range of topics to cover, it’s important to approach the process strategically. Properly allocating your time during the test ensures that you can address all sections without feeling rushed or overwhelmed. By managing your time wisely, you can maximize your performance and improve your chances of success.

Strategic Approaches

Here are some strategies to help you manage your time efficiently during the test:

- Familiarize Yourself with the Time Limit: Before starting, be aware of the overall time limit and how much time you should ideally spend on each section. Having a clear understanding of time constraints will help you pace yourself.

- Prioritize Easy Questions: Start with the questions you find easiest to answer. This will boost your confidence and help you save time for more challenging sections.

- Don’t Get Stuck: If you encounter a difficult question, move on and return to it later if time permits. Spending too much time on one question can negatively impact your ability to complete others.

- Use Time Blocks: Allocate specific time blocks to different sections or types of tasks. For example, spend the first 10 minutes reviewing the instructions, the next 30 minutes on easier sections, and reserve the final 15 minutes for tougher parts.

Final Review

It’s essential to leave time at the end to review your answers. Check for any mistakes, incomplete responses, or areas that might need revision. If time allows, go back and ensure that you’ve addressed all aspects of each question thoroughly.

By implementing these time management techniques, you can approach the assessment with a calm, focused mindset, giving you the best chance to perform at your highest level.

Common Mistakes to Avoid in the Exam

While preparing for a professional assessment, it’s easy to make mistakes that can negatively impact your performance. Recognizing these common errors in advance allows you to avoid them and approach the test with confidence. Small oversights can lead to missed opportunities for success, so it’s important to be aware of these pitfalls and plan accordingly.

Common Pitfalls

- Skipping Instructions: Failing to read the instructions thoroughly can lead to misunderstandings about what is being asked. Always take a moment to carefully review the guidelines before beginning each section.

- Rushing Through Questions: Speeding through questions without fully considering your answers may result in careless mistakes. It’s important to take your time and think through each task, even if you’re on a tight schedule.

- Overlooking Details: Pay close attention to details, such as specific numbers, names, or steps involved in a process. Overlooking a small but important element can lead to incorrect responses.

- Focusing Only on Difficult Tasks: Spending too much time on challenging sections can cause you to neglect easier questions. Prioritize based on difficulty to ensure that all areas are covered.

- Mismanaging Time: Poor time allocation can leave you rushing toward the end. Plan your time effectively to ensure that you have enough moments to address each section without pressure.

How to Avoid These Mistakes

- Take Your Time to Read: Always read each instruction and question carefully to avoid missing key details.

- Practice Time Management: Develop a strategy for pacing yourself throughout the assessment, so you don’t get stuck on one section.

- Stay Calm and Focused: If you feel stressed or anxious, take a brief pause to reset your thoughts. Staying calm helps you think more clearly and avoid errors.

- Review Your Answers: If time allows, go back and review your responses before submitting, ensuring everything is accurate and complete.

By being mindful of these common mistakes, you can avoid unnecessary setbacks and improve your performance, ensuring that you complete the assessment to the best of your ability.

How to Register for the Certification Exam

Registering for a professional assessment in financial management software is a straightforward process, but it requires attention to detail. Ensuring that you follow the correct steps is crucial for securing your spot and getting prepared. This guide walks you through the steps involved in signing up for the test and outlines key considerations to ensure a smooth registration experience.

Step-by-Step Registration Process

To register for the assessment, follow these simple steps:

- Visit the Official Registration Portal: The first step is to access the official website where the registration process takes place. Make sure to use the correct platform to avoid any issues with your application.

- Create an Account: If you don’t already have one, you’ll need to create an account on the website. This will involve providing your contact information, professional details, and possibly agreeing to terms and conditions.

- Select the Assessment Type: Choose the specific assessment that aligns with your goals. Depending on your skill level or area of interest, there may be different tests available.

- Choose a Date and Location: Once you’ve selected the type of test, you’ll be prompted to choose a date and location. Many assessments offer both in-person and online options, so select the most convenient one for you.

- Complete Payment: Most professional tests require a fee. Ensure that you make the payment through the secure methods provided on the registration site.

- Confirmation: After completing the registration process, you should receive a confirmation email. This email will include all the details you need, such as your test date, location (if applicable), and any additional instructions.

Important Considerations

Before registering, keep the following in mind:

- Eligibility Requirements: Check any prerequisites or eligibility criteria to ensure that you meet all the necessary qualifications for the assessment.

- Technical Requirements (For Online Tests): If you are opting for an online test, verify that your computer meets the technical specifications and that you have a stable internet connection.

- Cancellation Policy: Review the cancellation or rescheduling policy in case of unforeseen circumstances that might prevent you from attending the test.

By following these steps and tips, you’ll be well on your way to successfully registering for your professional assessment, setting the stage for effective preparation and a rewarding experience.

Practice Tests for QuickBooks ProAdvisor

Preparing for a professional assessment in financial software can be challenging, but practice is one of the most effective ways to ensure success. Practice tests provide an opportunity to familiarize yourself with the types of tasks you’ll encounter, refine your problem-solving skills, and manage your time more effectively. These mock tests simulate the actual experience, helping you build confidence and reduce anxiety before the real assessment.

Utilizing practice tests is an essential part of your preparation strategy. They allow you to identify areas where you need improvement and reinforce your understanding of core concepts. Below, we discuss the benefits of using practice tests and provide guidance on how to make the most of them during your preparation.

| Benefit | Description |

|---|---|

| Simulate Real Conditions | Mock tests replicate the format and time constraints of the actual test, giving you a realistic sense of what to expect. |

| Improve Time Management | Practice tests help you learn how to pace yourself, ensuring that you don’t run out of time during the actual assessment. |

| Identify Knowledge Gaps | By taking practice tests, you can pinpoint areas where you need further study or clarification, allowing you to focus your efforts on weak spots. |

| Boost Confidence | Repeated exposure to practice tests helps reduce anxiety, allowing you to feel more confident when facing the real assessment. |

While practice tests are invaluable, it’s important to use them strategically. Don’t rely solely on them; complement your practice with a solid study routine that includes reading materials, review guides, and hands-on exercises. By combining practice with other resources, you’ll be well-prepared to succeed.

What Happens After Passing the Exam

Once you’ve successfully completed the professional assessment, the next steps involve more than just receiving a certificate. Passing the test opens up new opportunities and offers recognition of your skills in financial management tools. This achievement not only enhances your professional credibility but also provides access to various resources and benefits that can help advance your career.

Recognition and Credentials

After successfully completing the test, you will receive official acknowledgment of your accomplishment. This often comes in the form of a badge, certificate, or digital credential that you can proudly display on your resume or online profiles. The recognition helps set you apart from others in the industry, demonstrating your expertise and commitment to professional growth.

New Opportunities

With the qualification in hand, you open the door to various career advancements and business opportunities. Many professionals find that their marketability increases, leading to better job prospects, promotions, or the ability to take on more complex roles. For freelancers or business owners, having this recognition can help attract new clients and expand your service offerings.

In addition to these professional benefits, passing the assessment may grant you access to exclusive resources, such as continued education, advanced training, and networking opportunities with other qualified professionals. These additional resources can help you stay updated with industry trends and enhance your skills even further.

Ultimately, passing the test is just the beginning of a long-term commitment to professional excellence. As the industry evolves, staying engaged and pursuing further development ensures you remain competitive and continue to build on your success.

How to Maintain Your Certification

Once you’ve earned a professional credential, it’s essential to keep it current to ensure your expertise remains recognized in your field. Maintaining your qualification involves ongoing education, skills development, and staying informed about any updates or changes in industry standards. Below are key steps to help you retain your professional status and continue demonstrating your competency.

Steps to Keep Your Credential Active

- Stay Updated with Changes: Regularly review any updates or new features in the financial management software you are certified in. Staying informed helps you remain proficient with the latest tools and functionalities.

- Engage in Continuing Education: Many certifications require ongoing education or professional development courses. Participate in relevant workshops, webinars, or training sessions to keep your knowledge up to date.

- Renew Your Qualification Periodically: Some certifications require renewal after a set period, usually every 1-3 years. This may involve retaking part of the assessment or demonstrating continued expertise in the field.

- Stay Active in the Community: Engage with other professionals in your field through online forums, industry events, or networking groups. Being involved in the community can help you stay ahead of trends and maintain a strong professional reputation.

- Document Your Progress: Keep a record of any professional development activities you complete, including courses, certifications, or special projects. This documentation may be necessary for renewal or for demonstrating your continuous improvement.

Why Ongoing Maintenance is Important

- Credibility: Ongoing maintenance of your credential ensures that you are seen as a trusted expert in your field, making you more valuable to employers or clients.

- Competitiveness: The industry is constantly evolving, and staying up to date with the latest tools and best practices helps you stay competitive in the job market.

- Career Growth: Continuing education and certification maintenance open doors to new opportunities, promotions, or more complex projects.

Maintaining your professional credential demonstrates a commitment to personal and professional growth. By staying proactive and following these guidelines, you ensure that your qualification remains a valuable asset throughout your career.

Benefits of Becoming a Certified Professional

Obtaining a professional qualification in financial management software brings numerous advantages that can enhance both your career and your business. Being recognized as an expert in the field boosts your credibility, helps you stand out in a competitive market, and opens doors to new opportunities. This section explores the key benefits of achieving this professional status and how it can positively impact your professional journey.

One of the primary advantages is the increased trust and recognition from clients and employers. With this qualification, you demonstrate a high level of proficiency and a commitment to staying current in a constantly evolving field. Here are some of the top benefits:

- Enhanced Credibility: Holding this qualification shows potential clients and employers that you are a dedicated expert in your field. It signals that you have the knowledge and skills required to manage complex tasks with ease and efficiency.

- Improved Career Prospects: Certification can set you apart in a crowded job market. Many companies prefer to hire professionals with recognized credentials, leading to better job security, higher salaries, and greater career advancement opportunities.

- Increased Earning Potential: Professionals with industry-recognized qualifications often command higher salaries. This credential can be a key factor in negotiating better pay or securing higher-paying positions.

- Access to Exclusive Resources: Certified individuals often gain access to specialized tools, resources, and support networks. These resources can provide ongoing education, professional development, and the opportunity to collaborate with other experts in the field.

- Attracting More Clients: For independent professionals or consultants, certification can help attract more clients. Clients are more likely to trust someone with a recognized qualification, knowing they have the necessary expertise to deliver quality results.

- Professional Growth: Pursuing certification not only validates your current skills but also encourages continuous learning. Staying up to date with new features, tools, and best practices is crucial for remaining competitive and proficient in your work.

In summary, becoming a certified professional in this field is a wise investment for anyone looking to build a successful career. The recognition, opportunities, and growth potential that come with certification are invaluable for both personal development and professional success.

QuickBooks ProAdvisor Certification vs. Other Certifications

When considering professional qualifications, it’s important to evaluate how different credentials compare to each other, particularly in terms of recognition, scope, and practical benefits. While various certifications in financial software and business management exist, some hold more weight in specific industries. This section compares the recognized qualification for financial software expertise with other common certifications, providing insight into their respective strengths and applications.

Industry Recognition and Reputation

One of the major factors in choosing a professional credential is how widely it is recognized across the industry. The qualification for financial software stands out because it’s specifically tailored to a popular tool used by countless businesses worldwide. This credential is known for its rigorous requirements and is highly regarded by employers and clients in need of skilled professionals. In contrast, other certifications may cover broader topics or multiple software systems, potentially making them less specialized but still valuable for a wider range of tasks.

Scope and Specialization

Another key distinction is the level of specialization that comes with each certification. Some credentials focus on general business skills, accounting principles, or software management systems, which can be beneficial for professionals who want to gain a broad understanding of business operations. On the other hand, qualifications specific to one software tool offer deeper, more specialized knowledge, enabling individuals to offer expert-level services in that particular software.

Professionals with the financial software qualification often benefit from focusing on a single, widely-used platform, which can make them more appealing to companies that rely heavily on that software for their operations. However, certifications that cover multiple tools or broader fields, such as project management or general accounting, may appeal to professionals looking to diversify their expertise.

Practical Benefits

In terms of practical benefits, earning a specialized credential often leads to a more direct path to job roles and positions that require proficiency in that specific tool. Certified professionals may find it easier to secure positions in businesses that use the software for their accounting needs. In contrast, broader certifications may open up a wider range of job opportunities, albeit potentially without the same level of technical expertise in a specific tool.

Ultimately, the choice between these qualifications depends on your career goals. If you seek to specialize in a particular software tool or become a subject-matter expert, the specific qualification in financial management software may be the best fit. However, if you prefer a more generalist approach that allows for flexibility across different roles and industries, other certifications might be more advantageous.