Navigating the process of obtaining and using medical coverage can raise many uncertainties. Whether you’re applying for benefits or trying to understand your entitlements, it’s important to have clear information on hand. This section aims to clarify various aspects of obtaining medical services through official systems.

Many individuals face challenges when it comes to understanding eligibility, required documentation, or how to make the most of their benefits. In this guide, you’ll find essential details to address these concerns, ensuring you can make informed decisions when accessing health services.

Common issues such as registration, usage, or troubleshooting potential complications are addressed here, helping you stay up to date with the rules and requirements. With the right information, you can confidently manage your medical coverage and ensure that you’re properly equipped for any situation.

Health Coverage Inquiries

When seeking medical assistance or services, individuals often have concerns regarding the procedures, eligibility, and usage of their benefits. This section provides clarification on common issues faced by those navigating the system, ensuring smooth access to needed care and support.

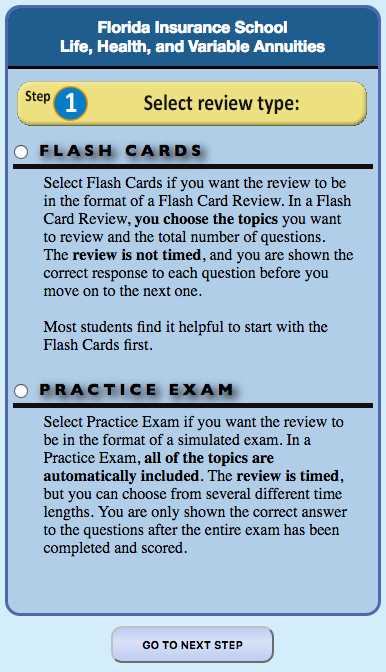

How to Register for Medical Services

Understanding the steps to register for medical coverage is essential for receiving timely care. The process typically involves filling out application forms and submitting required documents. Here are the general steps:

- Provide proof of identity and residence.

- Complete an online or in-person registration form.

- Submit relevant documents to verify eligibility.

- Receive confirmation of registration approval.

Common Issues with Registration

Sometimes, complications arise during the registration process. Here are some of the most frequent issues and their solutions:

- Delayed processing: Ensure all necessary documents are submitted correctly and check the expected timelines for approval.

- Ineligibility: Double-check that you meet the basic criteria for coverage.

- Lost or missing documents: If documents are lost, request duplicates from the relevant authorities.

What is a Health Card

An official document that provides access to medical services is essential for anyone seeking to receive covered healthcare. It serves as proof of eligibility for certain benefits, allowing individuals to access a range of treatments, consultations, and emergency care under the established system. This document ensures that those who qualify are able to receive the necessary support without additional financial burden at the point of care.

Why is it Important?

Having this document is crucial for individuals who wish to avoid high out-of-pocket expenses. It provides a means to access necessary medical services and helps ensure that you are covered for routine visits, emergency care, and long-term treatments when needed.

Who is Eligible?

Eligibility for this document typically depends on residency status, income level, and sometimes employment situation. In most cases, residents of a specific region or country are entitled to it, with some exceptions based on age, medical conditions, or financial standing.

How to Apply for a Health Card

Applying for access to medical services requires completing a straightforward process that ensures you are eligible for the benefits available. The application procedure usually involves submitting personal information, proving your eligibility, and providing any necessary documentation that supports your claim. This section outlines the essential steps to get started and receive approval for your medical coverage.

The application process can vary depending on the region or system you are applying to, but the general steps remain similar. It is important to be aware of deadlines, required documents, and where to submit your application to avoid any delays.

Eligibility Requirements for Health Cards

To access certain medical services, individuals must meet specific criteria to qualify for the benefits provided. These requirements ensure that only eligible residents can receive coverage and assistance through the system. The conditions can vary depending on factors such as residency status, age, income, and other relevant details.

Basic Eligibility Criteria

The primary factors influencing eligibility include the following:

- Residency Status: Applicants must typically reside within the designated area for a certain period.

- Age: Some programs have age restrictions, either providing coverage for minors or senior citizens.

- Income Level: Financial status may impact eligibility, with certain programs targeting low-income individuals or families.

- Employment Status: Those employed by qualifying organizations may also be eligible for coverage.

Additional Considerations

In some cases, additional factors such as medical condition or disability status may also play a role in determining eligibility. It is important to consult with the relevant authorities to understand any special conditions or exceptions that may apply to specific circumstances.

Benefits of Having a Health Card

Having access to medical coverage offers numerous advantages, especially when it comes to managing healthcare costs and ensuring timely treatments. This document allows individuals to take advantage of a variety of services that would otherwise be costly or inaccessible, providing both peace of mind and financial relief. Below are some key benefits that come with being enrolled in the medical assistance program.

| Benefit | Description |

|---|---|

| Cost Savings | Subsidized or fully covered treatments reduce out-of-pocket expenses for routine visits, hospital stays, and emergency care. |

| Access to Specialists | Enables you to consult medical specialists without high consultation fees, ensuring comprehensive care. |

| Timely Medical Attention | Facilitates faster access to treatments and healthcare services, reducing wait times for necessary care. |

| Preventive Services | Coverage often includes preventative care, such as screenings and checkups, which help detect health issues early. |

| Emergency Support | Gives access to emergency services without the concern of exorbitant costs, offering quick medical intervention when needed. |

Common Health Card Misconceptions

Many individuals hold misconceptions about medical coverage and the related documentation, which can lead to confusion and misinformed decisions. These misunderstandings can result in unnecessary delays, incorrect assumptions about eligibility, or missed opportunities for assistance. This section aims to clarify some of the most common myths and provide accurate information to help individuals better navigate the system.

Myth 1: Coverage is Available Immediately

One of the most common misconceptions is that medical assistance is available right after registration. In reality, there is often a waiting period before benefits can be fully utilized. It’s important to verify timelines and understand that processing times can vary depending on the system or region.

Myth 2: All Services Are Fully Covered

While many services are subsidized or covered, not all treatments and consultations are included. Some medical procedures, specialized services, or elective treatments may require out-of-pocket payments or separate insurance. Always check the details of the specific benefits offered to avoid surprises.

How Long Does it Take to Receive a Health Card

After completing the application process for medical benefits, many individuals wonder about the time it will take to receive official documentation that grants access to services. The processing time can vary based on factors such as the region, the volume of applications, and the type of program you are applying to. Understanding these timelines will help you manage your expectations and plan accordingly.

Typical Processing Time

In most cases, you can expect to receive your approval within a few weeks after submitting the necessary documentation. However, this period may be shorter or longer depending on the specific circumstances surrounding your application. It’s recommended to check with the relevant authorities for an estimated timeline.

What Affects Processing Time?

Factors such as:

- Volume of applications being processed at the time of submission.

- Completeness and accuracy of your application and supporting documents.

- Specific eligibility requirements for the region or program.

These factors can all influence how quickly your request is processed. Ensure that all documentation is correct and submitted promptly to avoid delays.

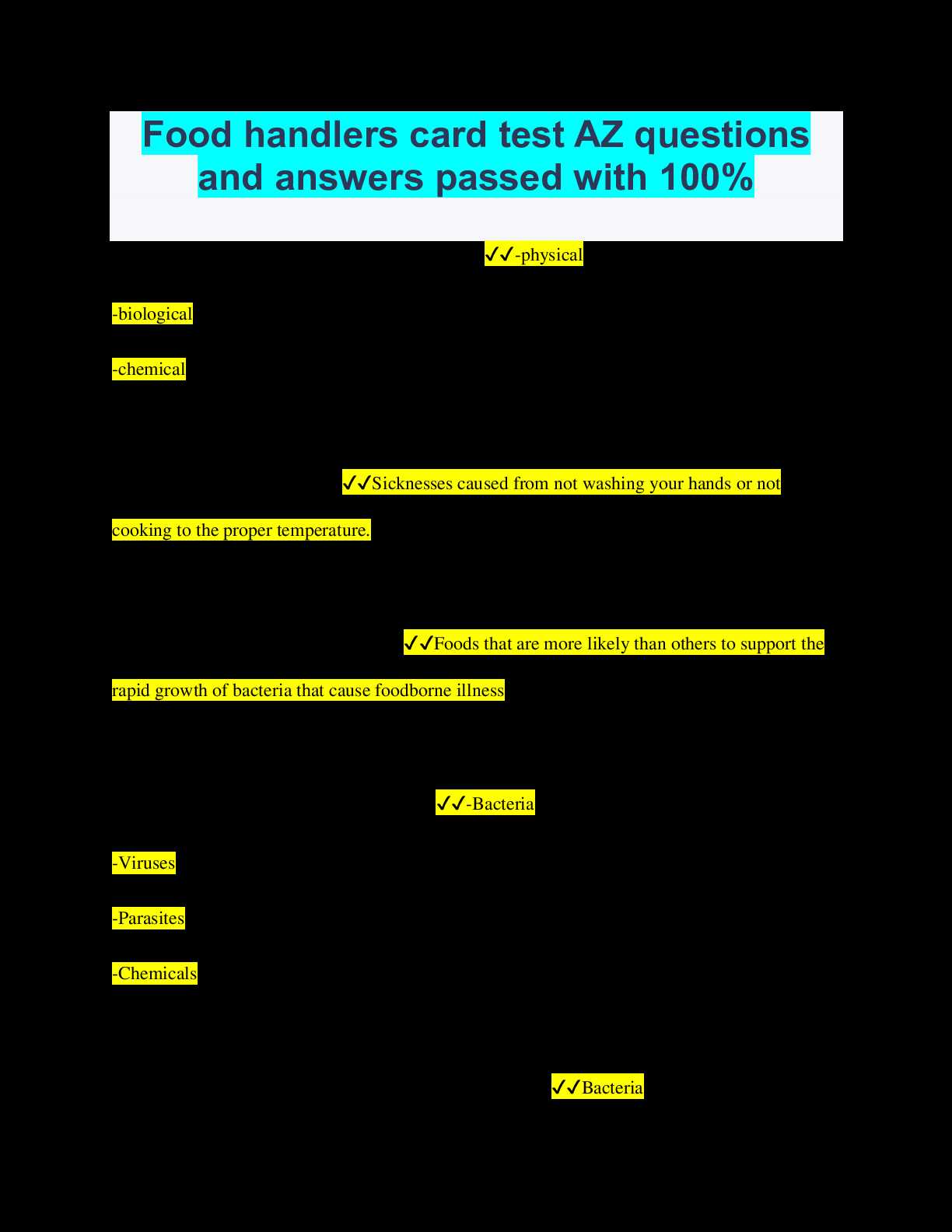

What Documents Are Needed for Health Cards

To apply for medical coverage, applicants must provide certain documents that verify their eligibility and identity. These documents ensure that the application process is smooth and that all the necessary information is available for approval. Below is a list of commonly required paperwork to complete the registration process successfully.

| Document | Description |

|---|---|

| Proof of Identity | Typically, a passport, national ID, or driver’s license is required to confirm your identity. |

| Proof of Residency | A utility bill, lease agreement, or similar document showing your current address is usually required. |

| Income Verification | Pay stubs, tax returns, or financial statements may be needed to confirm your income level for eligibility. |

| Proof of Employment or Student Status | Documents such as a work contract or school enrollment letter may be required for certain applications. |

| Social Security Number or Equivalent | For residents, your Social Security number or an equivalent local identification number will typically be required. |

Ensure that all documents are up-to-date and complete to avoid delays in the processing of your application. In some cases, additional paperwork may be requested depending on your specific circumstances.

Health Card Renewal Process

Renewing your access to medical benefits is an essential step to ensure continuous coverage. The renewal process is typically straightforward, but it requires careful attention to deadlines and required documentation. By following the outlined steps, you can avoid any gaps in your coverage and ensure that you remain eligible for the services provided.

Steps for Renewal

The renewal process generally involves the following steps:

- Check Eligibility: Verify that you are still eligible for the program and that there are no changes in your status that could affect your renewal.

- Submit Necessary Documents: Ensure that all required paperwork is updated and submitted on time. This may include proof of identity, residency, or income.

- Complete the Application: Fill out the renewal application form, either online or in person, depending on the system in place in your region.

- Pay Fees (if applicable): Some systems may require a renewal fee or premium payment as part of the renewal process.

- Wait for Confirmation: After submitting your application, wait for confirmation of approval. In most cases, you will receive a new document or a notification about your renewed eligibility.

Common Issues to Avoid

- Missing deadlines or submitting late applications.

- Incomplete or outdated documentation.

- Failure to inform the authorities about changes in your personal information or eligibility status.

By staying informed about the renewal process and completing each step accurately, you can ensure that there are no interruptions to your coverage and that you remain eligible for medical services when needed.

What to Do if Your Health Card is Lost

Misplacing important documents can be stressful, especially when it affects your ability to access essential services. If you find yourself in the unfortunate situation of losing your medical documentation, it’s important to act quickly to ensure there is no disruption in your coverage. Here are the steps you should take to resolve the issue.

Step 1: Report the Loss

The first thing to do is report the loss to the relevant authorities or your provider. This will help prevent any unauthorized use of your document and ensure that your coverage remains active while you await a replacement.

Step 2: Request a Replacement

Once the loss has been reported, you will need to apply for a replacement. Most systems allow you to request a new document online, by phone, or in person. Make sure to have all the necessary personal information and documentation ready to verify your identity.

Step 3: Monitor Your Account

During the waiting period, check your account regularly for updates on the status of your replacement request. In some cases, you may receive temporary confirmation to continue using the services until the new document arrives.

Step 4: Prevent Future Losses

To avoid future problems, consider keeping your document in a secure, easily accessible place. It may also be helpful to make copies or store important details electronically for quicker reference if necessary.

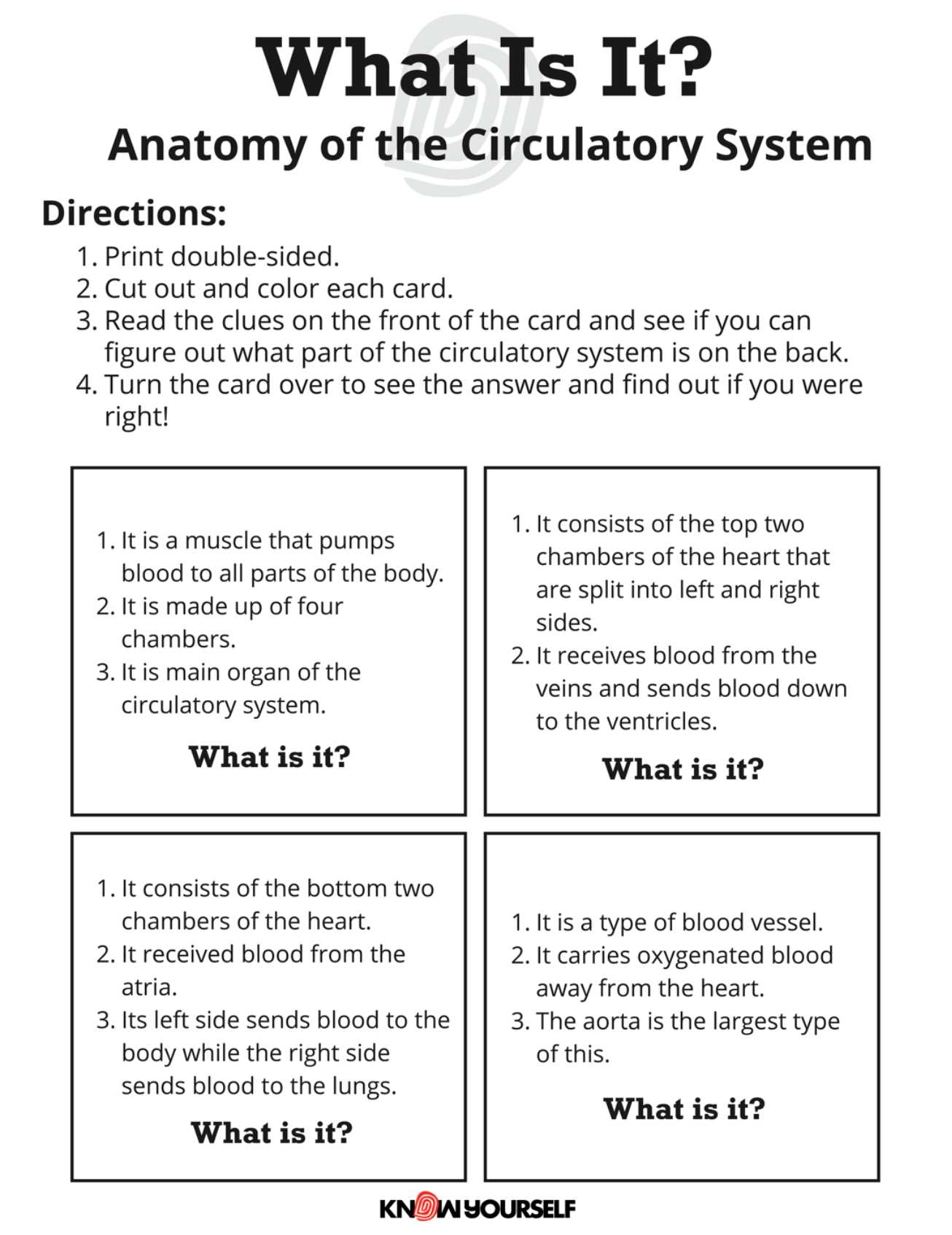

Using a Health Card for Medical Services

Once you have received your official documentation, it becomes your primary tool for accessing medical care and benefits. This document provides proof of your eligibility for various health services, enabling you to receive treatments, consultations, and prescriptions covered by the system. Understanding how to use it properly can help you make the most of your entitlements.

How to Present Your Documentation

When visiting a healthcare provider, make sure to present your document at the time of registration or when you are seeking treatment. This allows the provider to verify your eligibility and process your claim for medical services. Be prepared to show additional identification if requested, as some facilities may require further proof to confirm your identity.

What Services Are Covered

The types of services you can access will depend on the coverage associated with your plan. Generally, this includes:

- Routine medical visits to doctors or specialists.

- Hospital stays, surgeries, and emergency treatments.

- Prescription medications, subject to certain restrictions.

- Preventive care such as vaccinations and screenings.

When to Use Your Documentation

Always bring your document when seeking medical attention, as it helps to streamline the process and ensures that you receive the benefits to which you’re entitled. Whether it’s a visit to a clinic, an emergency room, or a pharmacy, having this proof on hand makes access to services faster and more efficient.

International Use of Health Cards

While some documents provide access to medical services within a specific country, others are designed to be used internationally. These documents can facilitate access to necessary healthcare services while traveling or living abroad, but it’s important to understand the extent of their coverage and limitations. Different countries and regions have varying agreements and policies regarding the use of such documents.

Countries with Reciprocal Agreements

Several countries have reciprocal agreements that allow residents to use their local medical documentation when seeking care in another country. These agreements often ensure that individuals can receive medical treatment during travel, subject to certain conditions such as coverage limits or emergency care only. Common examples include:

- Emergency medical care in partner countries.

- Access to public healthcare services in specific nations.

- Reduced costs for medical visits or prescriptions.

Limitations to International Coverage

While international agreements exist, they usually come with restrictions. It’s essential to check the details of your document before traveling to ensure you are aware of any exclusions. For instance:

- Some countries may not cover routine visits or elective procedures.

- There may be limits on the duration or total amount of coverage available.

- Specific medical conditions or treatments might not be included under international agreements.

Steps to Take Before Traveling

Before relying on your documentation abroad, it’s wise to:

- Contact your provider to confirm the extent of coverage in your destination country.

- Consider obtaining travel insurance for additional protection.

- Carry proof of coverage alongside any emergency contact information for international assistance services.

Understanding these factors ensures that you are fully prepared for any medical needs while traveling outside your home country.

Health Card for Dependents

When it comes to family coverage, many individuals may wonder whether their loved ones are eligible for the same healthcare benefits. Dependent family members, such as children or spouses, can often be added to your coverage, ensuring they have access to medical services. Understanding the process of adding dependents and the types of coverage available is essential for managing family health needs effectively.

Who Qualifies as a Dependent

Typically, dependents include individuals who rely on the policyholder for financial support. The eligibility criteria may vary depending on the region or provider, but common categories of dependents include:

- Children under a certain age (usually 18 or 25 if still in full-time education).

- Spouses or common-law partners.

- In some cases, elderly parents or relatives who depend on the policyholder for care.

How to Add Dependents

To include dependents under your plan, you typically need to complete an application or update your existing coverage. The steps usually involve:

- Providing proof of relationship, such as birth certificates or marriage certificates.

- Filling out necessary forms or online updates with your provider.

- Submitting required documentation, such as student status for children in school.

Benefits for Dependents

Once added, dependents can access the same healthcare services as the policyholder, such as:

- General medical appointments and specialist consultations.

- Emergency treatment and hospital stays.

- Prescription medications and preventive care.

Ensuring that all eligible family members are covered helps provide peace of mind and ensures timely medical care for everyone in the household.

How to Update Your Health Card Information

It’s important to keep your personal and contact details up to date with your provider. This ensures you continue to receive the full range of benefits and services available. Whether you’ve moved, changed your name, or altered any other personal details, updating this information is a simple process that helps avoid delays or confusion in the future.

Reasons to Update Your Information

Several life changes might require you to update your data. Common reasons include:

- Change of address or phone number.

- Change in your name due to marriage or other personal reasons.

- Change in dependent status (e.g., adding or removing family members).

- Changes in your status, such as becoming eligible for additional coverage or benefits.

Steps to Update Your Information

Updating your information is generally straightforward. Follow these steps to ensure your details are correct:

- Log in to your provider’s online portal, or visit their office if they don’t offer digital services.

- Find the section for updating personal details or contact information.

- Submit any necessary documents, such as proof of address or name change.

- Review your changes and submit the update request.

In some cases, the process may require additional verification or documentation, depending on the changes you are making. Always keep a copy of your updated details for reference.

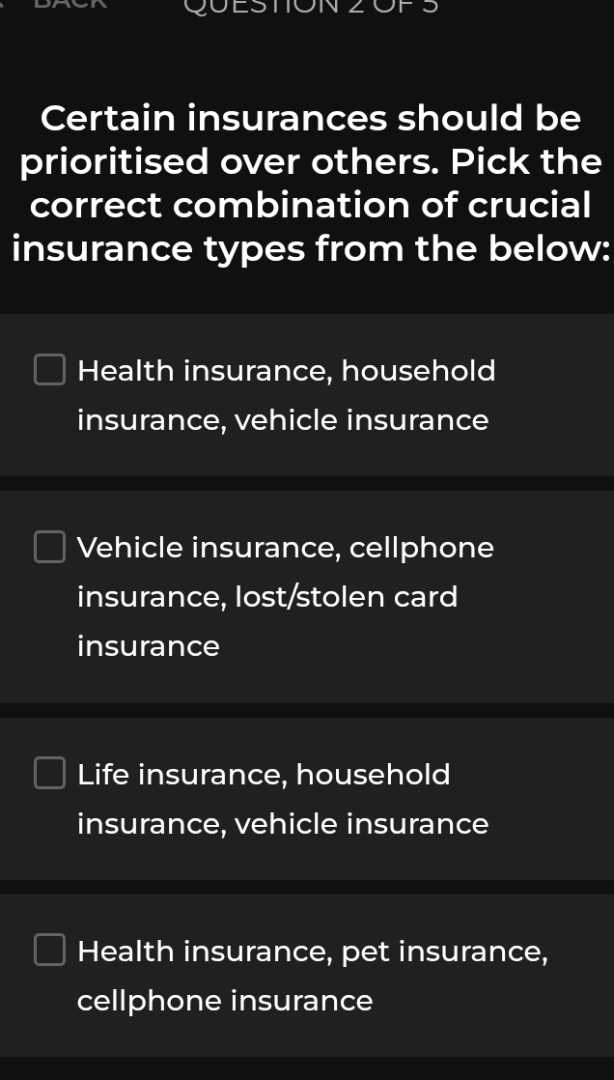

Health Card and Private Insurance

In many countries, residents have access to basic medical coverage through public systems. However, some individuals opt to enhance their protection with additional private coverage. The combination of both options can provide a more comprehensive healthcare experience, offering both essential services and additional benefits that the public system might not fully cover. Understanding the interaction between these two forms of protection is crucial for optimizing healthcare access and minimizing personal expenses.

Public insurance generally covers a range of necessary medical treatments, including hospital visits, emergency care, and some outpatient services. On the other hand, private insurance plans typically cover areas not included in the public system, such as dental care, vision correction, and certain elective procedures. By having both types of coverage, individuals can ensure a more robust healthcare safety net.

How Private Insurance Works with Public Coverage

When combining public coverage with a private insurance plan, individuals may find that private insurance acts as a supplement to fill gaps or reduce out-of-pocket costs. For instance:

- Public insurance may cover essential doctor visits, while private plans may reduce waiting times for appointments.

- Public coverage may pay for emergency hospital stays, whereas private insurance may help with additional treatment costs or specialized services.

- Some elective procedures, such as cosmetic surgery or dental care, may only be covered by private plans.

Coordinating Benefits Between Public and Private Coverage

It’s important to understand how benefits are coordinated between public and private insurance. In general, public coverage is billed first, and private insurance steps in to cover any remaining eligible expenses. Here’s how the coverage typically works in different scenarios:

| Medical Service | Public Insurance | Private Insurance |

|---|---|---|

| Routine Check-up | Covered in full or partially | May cover additional services or faster access |

| Emergency Treatment | Generally fully covered | May cover additional services, such as private rooms |

| Prescription Medications | Partially covered or not covered | May cover full cost or provide discounts |

| Dental and Vision Care | Rarely covered | May fully or partially cover treatments |

To make the most of both options, it’s essential to review the details of each policy. By understanding the extent of your public and private insurance coverage, you can ensure you receive the maximum benefits while avoiding unnecessary costs.

Understanding Health Card Expiration Dates

Every official identification used for accessing medical services typically comes with an expiration date. This is an important detail that ensures the document remains current and valid for the individual’s coverage. When the expiration date passes, the individual may lose access to benefits and services, potentially causing interruptions in healthcare. Understanding how these dates work, why they exist, and how to manage them is crucial for maintaining continuous access to medical services.

The expiration date on such documents often corresponds to a set period of validity, after which it must be renewed. In most systems, this renewal process is straightforward but requires timely action to avoid any lapse in coverage. If the renewal is missed, there could be a delay in receiving necessary medical treatments or services.

Why Expiration Dates Are Important

Expiration dates serve several functions in a healthcare system:

- They ensure that the information associated with the document is up-to-date.

- They help prevent fraud or misuse by ensuring that only valid documents are used.

- They provide a clear timeframe for when the renewal process should take place, helping individuals plan ahead.

How to Handle Expiration Dates

To avoid complications, it is important to track the expiration of your medical identification. Here are steps to help manage the process:

- Know the Expiration Date: Regularly check your document for the listed expiration date.

- Start the Renewal Process Early: Begin the renewal process well before the expiration to avoid any lapses.

- Submit Necessary Documents: Ensure that all required paperwork is submitted to avoid delays in processing.

- Monitor the Renewal Status: Follow up with the issuing authority to confirm the renewal status.

By staying on top of expiration dates, individuals can ensure they maintain uninterrupted access to essential services and avoid unnecessary complications with their healthcare providers.

Health Card for Emergency Situations

In critical moments, having access to medical services quickly can be a matter of life or death. This is where an official identification used to access healthcare services becomes essential. In emergency situations, the document allows healthcare providers to verify your eligibility for treatment, ensuring that you receive the necessary care without unnecessary delays.

During emergencies, medical teams rely on the information provided by such documents to access important personal details, such as medical history, insurance coverage, or current medications. This can help healthcare professionals make faster decisions, administer appropriate treatments, and ensure your safety when you may not be able to communicate important information yourself.

Importance in Emergency Situations

Here are several reasons why this official document plays a crucial role in urgent scenarios:

- Immediate Access: It facilitates quick verification of eligibility for medical services.

- Accurate Medical History: Helps doctors access critical information about previous health conditions, allergies, or ongoing treatments.

- Insurance Validation: Ensures that your treatment is covered by the relevant health insurance plans, reducing financial burdens.

What to Do in an Emergency

In case of an emergency, ensure that you carry your identification or have it easily accessible. Here are key steps to take:

- Carry It With You: Always have your document on hand, especially when traveling or engaging in high-risk activities.

- Notify Medical Professionals: Inform healthcare providers that you have this document available, so they can verify your details quickly.

- Update Information Regularly: Ensure that all personal information, including medical conditions and emergency contacts, is kept up-to-date to avoid complications during critical care.

By keeping your document up-to-date and accessible, you ensure that you can receive timely medical attention when needed the most, regardless of the situation.