Preparing for a financial assessment can be a challenging yet rewarding task. To perform well, it’s crucial to focus on mastering the essential concepts, techniques, and strategies that are commonly evaluated. Proper preparation requires not only knowing the material but also understanding how to approach different types of inquiries effectively.

In this section, we will explore the most important themes and areas that often appear in such evaluations. Whether you are studying for a certification or testing your knowledge, understanding the core topics will give you an edge. By reviewing sample items, learning key principles, and practicing different types of scenarios, you can build confidence and increase your chances of success.

Mastering the fundamentals and refining your problem-solving skills will be essential to excel. Stay focused on the underlying theories and practice consistently to improve your performance.

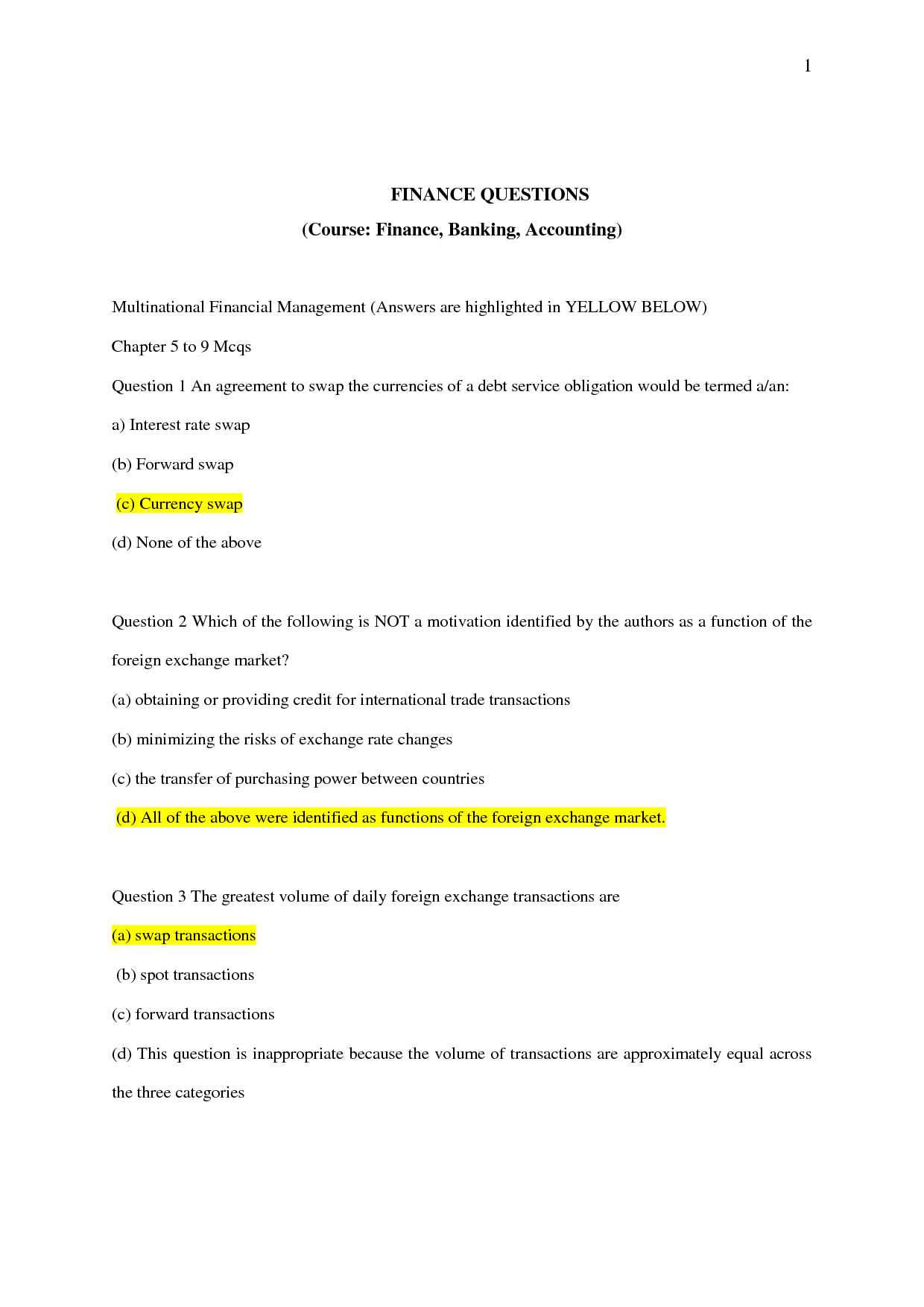

Foreign Exchange Exam Questions and Answers

Preparing for financial assessments requires a deep understanding of various principles and concepts that are regularly tested. Whether you are focusing on market dynamics, risk management, or analytical methods, it’s essential to familiarize yourself with the most commonly encountered types of queries. Each test often includes different formats designed to evaluate both theoretical knowledge and practical application.

In this section, we will examine typical inquiries that assess candidates’ grasp of key topics. These may include understanding market trends, interpreting charts, or analyzing economic indicators. The goal is to help you identify areas where you need to strengthen your knowledge and practice solving problems in real-world scenarios.

By reviewing these typical examples, you can gain insight into what to expect and refine your approach to each challenge. Mastering the various formats and types of assessments will make you more confident and prepared for any testing situation that comes your way.

Understanding Key Concepts in Forex

Grasping the fundamental principles of financial markets is crucial for success in any related assessment. A solid understanding of core concepts lays the foundation for tackling various types of tasks and challenges. This section focuses on the essential topics that will help you build a comprehensive knowledge base, ensuring that you’re well-prepared for practical applications and theoretical inquiries alike.

Market Mechanisms and Terminology

The first step in mastering any assessment is understanding the mechanisms that govern the market. Key terminology such as “currency pairs”, “pips”, “lot sizes”, and “spread” is often tested, and a deep knowledge of these terms allows you to approach problems with greater clarity. These fundamental concepts are the building blocks for understanding how markets function and how to interpret real-time data.

Risk Management and Strategy

Another vital area of focus is the ability to manage risks effectively. Many assessments will test your understanding of various risk management strategies such as stop-loss orders, leverage, and margin. Knowing how to balance potential rewards with risks is an essential skill, and a thorough understanding of these concepts will enhance your decision-making process in any practical scenario.

Types of Questions in Forex Exams

In any financial assessment, understanding the variety of problem formats is crucial. These evaluations typically feature different types of inquiries designed to test your grasp of key concepts, market understanding, and practical skills. Knowing what to expect helps you focus on the most relevant areas and improve your performance.

Theoretical Questions

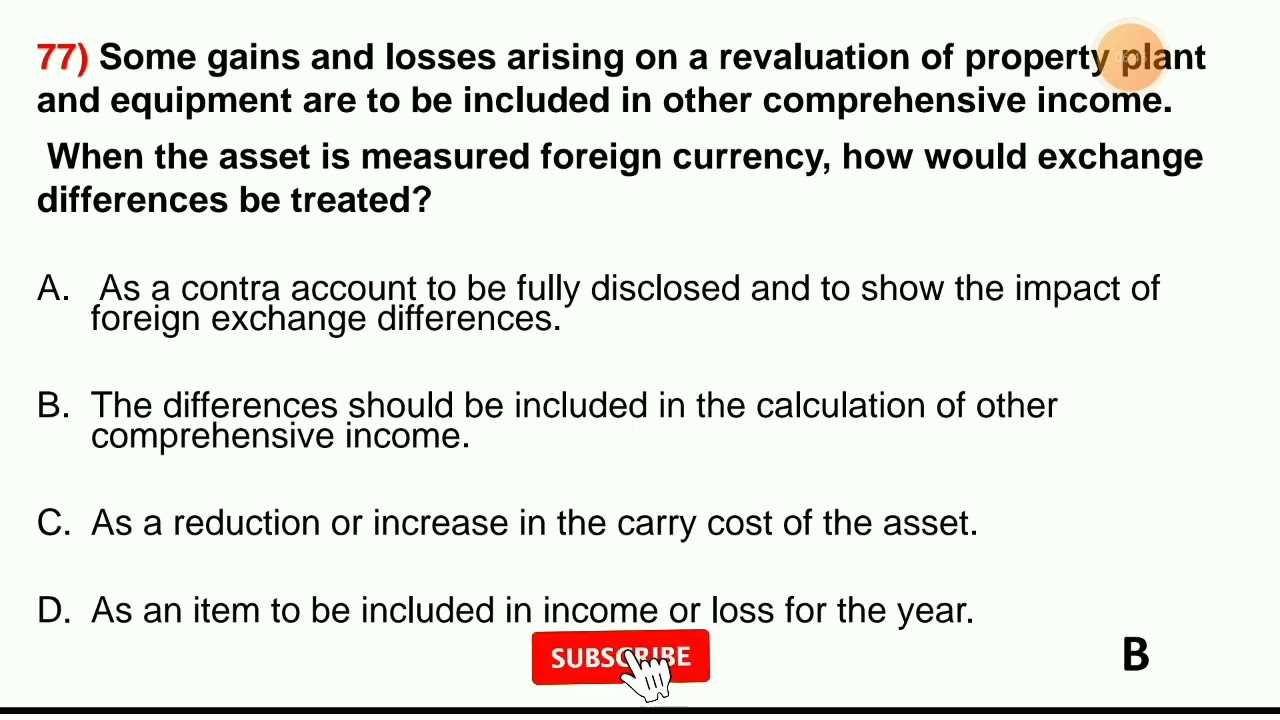

Theoretical questions often focus on testing your knowledge of core principles and concepts. These may include definitions, explanations, or scenario-based inquiries that require you to apply your understanding of market structures, trading strategies, or economic factors. Mastering these questions requires a solid foundation in the theoretical aspects of the subject, allowing you to articulate concepts clearly and accurately.

Practical Application Scenarios

Practical application questions assess your ability to make informed decisions based on real-world market situations. These might involve interpreting market data, analyzing trends, or making decisions about trading strategies based on hypothetical conditions. Strong analytical skills are essential for tackling these types of inquiries effectively, as they simulate real-life situations where quick, informed decisions are necessary.

Commonly Tested Forex Terminology

Understanding the key terminology used in the market is essential for performing well in assessments. These terms form the foundation for analyzing market conditions, evaluating strategies, and interpreting data. Familiarity with these terms ensures that you can approach any problem with confidence and clarity.

Important Terms to Know

Below is a table of frequently tested terminology, including definitions and examples:

| Term | Definition | Example |

|---|---|---|

| Spread | The difference between the bid and ask price of a currency pair. | If the bid price is 1.1000 and the ask price is 1.1003, the spread is 3 pips. |

| Pip | The smallest price movement in a currency pair. | A movement from 1.1000 to 1.1001 is a 1 pip change. |

| Leverage | The ability to control a large position with a relatively small amount of capital. | A 50:1 leverage allows you to control a $50,000 position with just $1,000. |

| Lot Size | The quantity of a currency being traded. | A standard lot size is 100,000 units of the base currency in a pair. |

Advanced Terminology

As you advance in your study, you will encounter more complex terms related to market analysis and strategy development. These terms often refer to specific tools or theories used to predict market movements or manage risks effectively. Mastering this advanced terminology will provide you with a deeper understanding of how to navigate financial environments.

How to Approach Forex Exam Questions

Successfully tackling financial assessments requires more than just knowledge of the material. It’s equally important to approach the challenges strategically, understanding how to manage time, interpret scenarios, and apply concepts effectively. With the right approach, even the most complex questions become manageable.

Breaking Down the Problem

The first step is to carefully read each inquiry and identify what is being asked. Often, a question will present multiple components or require you to analyze different aspects of the market. By breaking down the task into smaller parts, you can focus on each one individually, making it easier to formulate a response.

Time Management Strategies

Time is always a limiting factor in assessments, so managing it effectively is crucial. Allocate time based on the complexity of each question. For example, questions requiring in-depth analysis should be given more time than simple definitional ones. Keep an eye on the clock and move on to the next if you find yourself stuck on a particularly challenging item.

Studying Strategies for Forex Exams

Effective preparation is essential for excelling in any financial assessment. To maximize your performance, it’s important to use focused study methods that cover both theoretical knowledge and practical skills. By adopting the right strategies, you can improve your retention, understanding, and application of key concepts.

Organizing Your Study Plan

One of the first steps in preparing is creating a structured study plan. This ensures that all topics are covered and that time is used efficiently. Here’s how to organize your study approach:

- Prioritize Key Areas: Focus on the areas that are most commonly tested and those where you feel less confident.

- Set Realistic Goals: Break down your study sessions into manageable tasks, such as reviewing a specific topic or practicing a set of problems.

- Use a Variety of Resources: Supplement your study with books, online tutorials, practice tests, and study groups to gain diverse perspectives.

Effective Study Techniques

Once you’ve organized your study schedule, it’s crucial to use techniques that enhance understanding and retention. Consider incorporating the following strategies:

- Active Learning: Engage with the material by solving problems, discussing concepts, and testing your understanding through quizzes.

- Flashcards: Use flashcards to reinforce key terms and definitions, helping you memorize important terminology.

- Practice with Mock Tests: Simulate the testing environment by taking practice assessments under timed conditions to build familiarity and confidence.

Practice Questions for Forex Exams

To enhance your preparation, practicing with realistic scenarios is key to understanding the types of challenges you’ll encounter. By working through sample items, you can test your knowledge, improve your problem-solving abilities, and build confidence. This section will introduce several practice problems that cover the essential concepts needed for success.

Example Problems to Work Through

The following list includes sample problems that reflect the common themes and formats in assessments:

- Scenario 1: Given a currency pair’s bid and ask prices, calculate the spread and determine the cost of trading a standard lot.

- Scenario 2: Interpret a set of economic indicators and predict their potential effect on the market.

- Scenario 3: Based on a given market trend, suggest an appropriate strategy for minimizing risk while maximizing potential returns.

- Scenario 4: Identify the impact of leverage on a trade and calculate the required margin for a given position size.

Solving Practical Problems

By practicing with these types of problems, you can improve both your theoretical knowledge and your ability to apply it in real-world situations. Regular practice will help you recognize patterns, improve decision-making speed, and gain the experience necessary for tackling complex scenarios effectively.

Exam Preparation Tips for Forex Students

Effective preparation is essential for mastering the material and performing well in any assessment. To excel, students need a combination of strategic study techniques, time management, and stress reduction methods. This section provides valuable tips to help students prepare efficiently and confidently for their upcoming evaluations.

Building a Solid Study Routine

One of the most important steps in preparation is developing a consistent study routine. The key to retaining complex material is regular review and practice. To establish a solid routine:

- Schedule Regular Sessions: Consistency is crucial. Set aside dedicated time each day to focus on different topics, such as trading strategies, market analysis, and risk management.

- Focus on Key Areas: Prioritize subjects that are most commonly tested or where you feel least confident.

- Review Past Tests: Going over previous assessments helps identify common themes and question types, giving you insight into what to expect.

Maximizing Retention with Active Techniques

Passive reading alone won’t lead to long-term retention. Instead, incorporate active learning techniques that engage your brain and reinforce knowledge. Consider:

- Practice with Mock Assessments: Simulating test conditions helps improve time management and builds confidence.

- Use Visual Aids: Diagrams, charts, and tables can simplify complex concepts, making them easier to understand.

- Teach Others: Explaining what you’ve learned to peers is a great way to reinforce your own understanding.

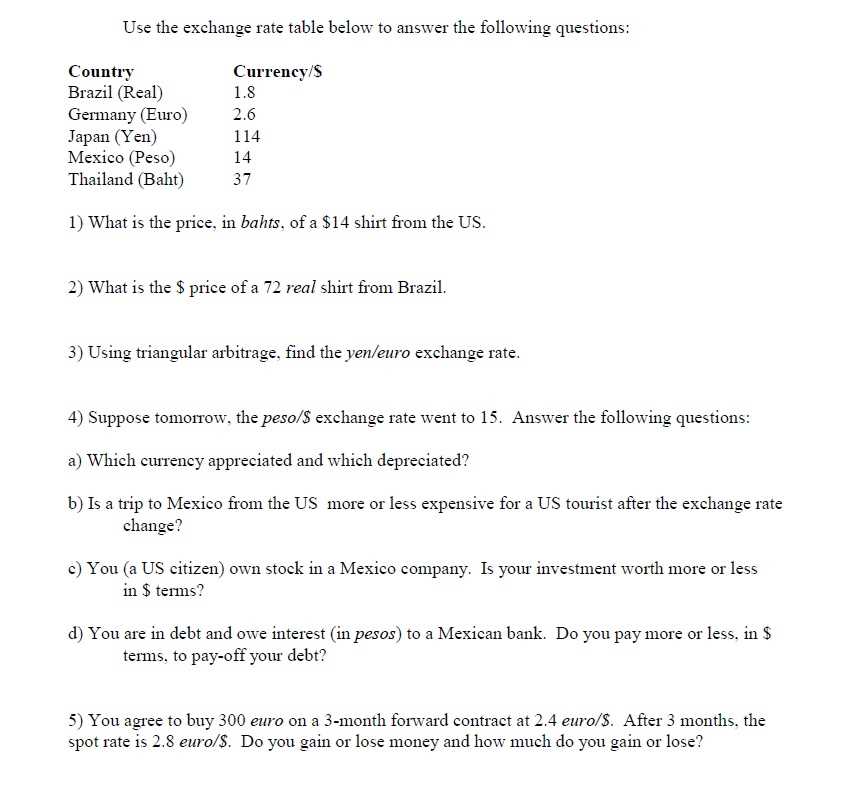

Understanding Currency Pairs in Forex

In the world of global markets, currencies are always traded in pairs. These pairs represent the value of one currency relative to another and are essential for anyone looking to succeed in market activities. Understanding the structure and mechanics of these pairs is fundamental to navigating the financial landscape effectively.

Types of Currency Pairs

Currency pairs are typically categorized into different types based on their liquidity and market involvement. Below is a breakdown of the most commonly traded categories:

| Category | Examples | Characteristics |

|---|---|---|

| Major Pairs | EUR/USD, GBP/USD, USD/JPY | Highly liquid, most traded in the market |

| Minor Pairs | EUR/GBP, EUR/AUD, GBP/JPY | Less liquid, but still actively traded |

| Exotic Pairs | USD/TRY, EUR/ZAR, GBP/SGD | Lower liquidity, higher volatility |

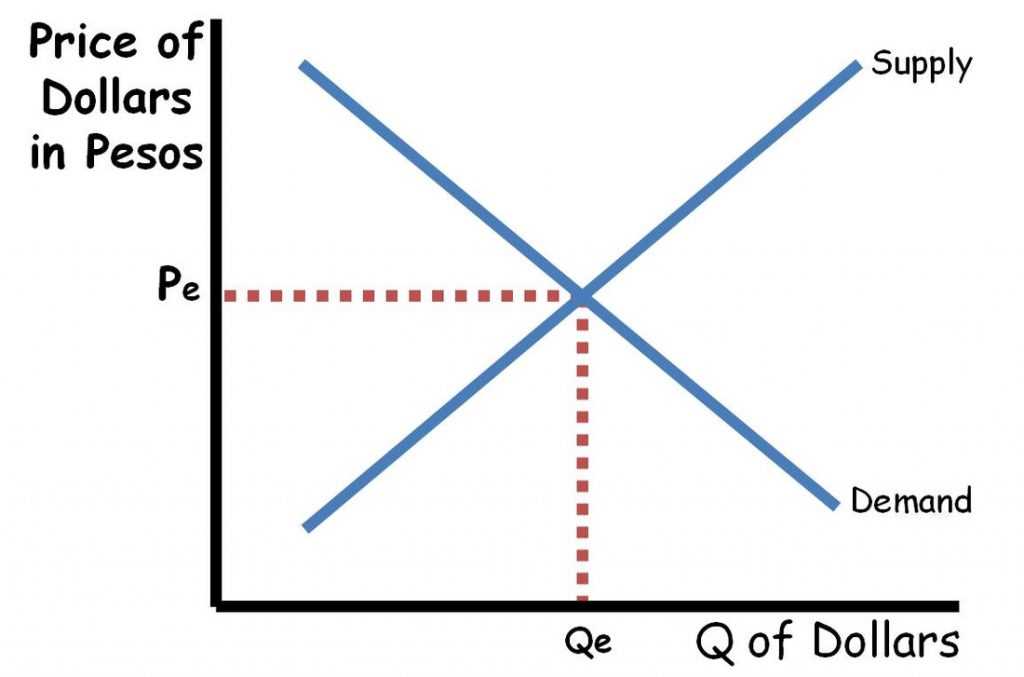

Interpreting Currency Pair Quotes

When examining currency pairs, it’s crucial to understand the quote system. The first currency in a pair is known as the “base” currency, while the second is the “quote” currency. The exchange rate tells you how much of the quote currency is needed to buy one unit of the base currency. For example, in the pair EUR/USD = 1.2000, 1 Euro costs 1.20 US Dollars.

Risk Management Questions in Forex Exams

Risk management is an essential part of any successful trading strategy. Understanding how to identify, assess, and mitigate risks is crucial for making informed decisions and protecting investments. In assessments related to trading, risk management scenarios often test your ability to apply theoretical knowledge to real-world situations.

Key Topics in Risk Management

The following topics are commonly tested when it comes to risk management in trading:

- Position Sizing: Determining the appropriate amount of capital to allocate to each trade based on risk tolerance.

- Stop-Loss Orders: Using stop-loss levels to limit potential losses on a trade.

- Leverage: Understanding how leverage amplifies both potential gains and risks in trading.

- Risk-to-Reward Ratio: Evaluating the potential reward of a trade relative to the amount of risk involved.

Common Risk Management Scenarios

Below are a few typical risk management scenarios you may encounter in assessments:

- Scenario 1: Calculate the position size for a trade, given a specified risk percentage and the stop-loss distance.

- Scenario 2: Determine the appropriate stop-loss level for a trade based on volatility and market conditions.

- Scenario 3: Analyze the impact of leverage on a trade’s risk and calculate the margin requirements for a given position size.

- Scenario 4: Assess the risk-to-reward ratio for a particular trade setup and determine if it meets your risk tolerance.

Technical Analysis in Forex Exams

In the world of trading, technical analysis is a critical skill for analyzing market trends and making informed decisions. By evaluating past price movements, traders can predict future market behavior and identify profitable opportunities. This section focuses on how technical analysis is assessed, offering insights into the key concepts that are often tested.

Core Concepts in Technical Analysis

When preparing for assessments related to market analysis, it’s important to focus on the foundational concepts and tools that drive technical analysis. These often include:

- Chart Patterns: Recognizing formations such as head and shoulders, double tops, and triangles, which signal potential market reversals or continuations.

- Indicators and Oscillators: Understanding how tools like Moving Averages, RSI, and MACD are used to evaluate market momentum and identify entry or exit points.

- Support and Resistance Levels: Identifying price levels where markets tend to reverse or consolidate, helping to set stop-loss and take-profit targets.

- Volume Analysis: Interpreting changes in trading volume to confirm the strength or weakness of price movements.

Commonly Tested Topics in Technical Analysis

In assessments, you may be asked to apply technical analysis principles to real market data. Common scenarios include:

- Chart Pattern Identification: Recognizing and interpreting key patterns, such as flags or channels, to predict market direction.

- Indicator Interpretation: Using tools like RSI or Moving Averages to analyze overbought or oversold conditions in a market.

- Support and Resistance Analysis: Determining key levels that indicate potential reversal points or breakout zones.

- Volume Confirmation: Analyzing how volume supports or contradicts a price trend to validate trade decisions.

Fundamental Analysis for Forex Exams

Understanding the broader economic forces that influence markets is essential for any trader. Fundamental analysis involves evaluating economic indicators, political events, and other macroeconomic factors that can affect asset prices. In assessments, the focus is on testing your ability to apply these principles to predict market movements and make informed decisions.

Key Concepts in Fundamental Analysis

The following concepts are frequently tested in evaluations focused on market fundamentals:

- Interest Rates: Understanding how central bank policies and changes in interest rates impact currency values.

- Economic Indicators: Analyzing reports such as GDP, inflation rates, unemployment data, and trade balances to assess economic health.

- Geopolitical Events: Evaluating how political decisions, natural disasters, or other global events can affect market sentiment and stability.

- Monetary Policy: Understanding how central banks’ actions, such as quantitative easing or tightening, influence currency markets.

Practical Application of Fundamental Analysis

In practical scenarios, you might be asked to assess how a specific event or economic report impacts a market. Some common scenarios include:

- Interest Rate Decisions: Analyzing the potential impact of a central bank’s rate hike or cut on the value of a currency.

- Economic Reports: Interpreting the release of key reports such as GDP or employment figures and their effect on market direction.

- Geopolitical Risk: Analyzing how political instability or global conflicts can create volatility in the markets.

Time Management During Forex Exams

Effectively managing your time is crucial when tackling assessments that involve financial markets. The ability to allocate time wisely allows you to approach each task systematically and ensure you address all areas of the assessment without rushing. Proper time management not only enhances performance but also reduces anxiety during the process.

Strategies for Efficient Time Allocation

To optimize your time during the test, consider the following techniques:

- Plan Your Approach: Before diving into the test, take a few minutes to scan through the entire assessment to identify the types of tasks you’ll face.

- Prioritize Tasks: Tackle easier or higher-scoring questions first to gain confidence and secure quick points.

- Set Time Limits: Allocate a specific amount of time for each section or question and stick to it. This prevents spending too much time on any single item.

- Leave Time for Review: Always reserve the last few minutes to go back over your responses and check for mistakes or missing information.

Avoiding Common Pitfalls

While it’s important to stay focused, some common mistakes can derail your time management:

- Overthinking: Don’t get caught up in trying to find the perfect answer. Trust your knowledge and move on if you’re stuck.

- Skipping Questions: Avoid leaving questions blank. If you don’t know the answer, make an educated guess based on the options available.

- Misreading Instructions: Ensure that you understand the instructions for each section, as misunderstanding them can lead to wasting time on the wrong task.

Common Mistakes in Forex Exams

When participating in assessments related to financial markets, it’s easy to make errors that can hinder performance. These mistakes often arise from a lack of preparation, misunderstanding of concepts, or simply mismanaging time. By recognizing and avoiding these common pitfalls, you can significantly improve your chances of success in evaluations.

Frequent Errors to Avoid

Here are some of the most common mistakes students make during assessments:

- Misinterpreting Questions: Sometimes, test-takers focus too much on the terminology and miss the true intent of the question. Make sure to read each prompt carefully to understand what is being asked.

- Overthinking Answers: Overcomplicating a simple question can lead to confusion. Stick to your initial thoughts unless you’re certain the first answer was incorrect.

- Skipping Key Steps: In complex scenarios, it’s easy to skip over crucial steps, leading to incomplete or incorrect solutions. Break down each problem methodically to avoid missing any important details.

- Neglecting Time Limits: Failing to manage time effectively often results in leaving questions unanswered. Be sure to allocate a specific amount of time for each section to avoid rushing at the end.

How to Prevent These Mistakes

To enhance your chances of success, here are some strategies to minimize errors during an assessment:

- Practice Regularly: Regular practice helps reinforce key concepts and reduce the likelihood of making basic mistakes.

- Double Check Your Work: If time permits, always review your responses to ensure accuracy before submitting your answers.

- Stay Calm Under Pressure: Test anxiety can lead to hasty decisions. Maintain a calm, focused mindset to think through each question logically.

How to Improve Forex Exam Scores

Improving your performance in assessments related to financial markets requires a strategic approach. Success doesn’t just depend on raw knowledge, but also on how well you manage your preparation, time, and test-taking strategies. By focusing on key areas of improvement, you can boost your overall score and increase your chances of achieving your goals.

Start by refining your understanding of critical concepts. A deep grasp of fundamental and technical ideas will allow you to answer questions more effectively and quickly. In addition, practicing regularly with mock scenarios or past evaluations will help familiarize you with the format and the types of problems you’ll encounter. Consistent practice leads to better confidence and faster problem-solving abilities.

Another essential factor is time management. During the assessment, ensure you allocate sufficient time to each section based on its weight and difficulty. Avoid spending too much time on a single question; this can compromise your ability to finish the test within the allocated time. Working on your speed without sacrificing accuracy is key to boosting your score.

Lastly, test-taking strategies play a huge role in improving performance. Before starting, scan through the entire assessment to get an overview. Tackle the easier questions first to build confidence and then move on to the more challenging ones. Additionally, if time permits, review your answers to ensure no mistakes were made in the rush to finish.

Resources for Forex Exam Preparation

Preparing for assessments related to financial markets requires utilizing a variety of tools and resources. Whether you’re studying concepts or practicing problem-solving techniques, the right materials can significantly enhance your understanding and readiness. By accessing a diverse range of resources, you can ensure a comprehensive preparation process.

Various books, online platforms, and video tutorials offer detailed explanations and examples. Additionally, joining discussion forums or study groups allows you to collaborate with others and share insights. These interactions can deepen your knowledge and help you discover new approaches to solving market-related scenarios.

Below is a list of resources that can help you prepare effectively:

| Resource Type | Description | Recommended Platform |

|---|---|---|

| Books | Comprehensive guides that cover essential theories and practices in financial markets. | Amazon, Goodreads |

| Online Courses | Interactive lessons designed to break down complex topics into manageable modules. | Udemy, Coursera |

| Forums | Engage with other learners, exchange knowledge, and discuss topics related to the assessment. | Reddit, Trade2Win |

| Practice Tests | Simulated assessments that allow you to familiarize yourself with the format and test conditions. | Investopedia, BabyPips |

| Video Tutorials | Step-by-step videos that demonstrate key concepts and problem-solving strategies. | YouTube, Khan Academy |

By utilizing these resources, you can build a strong foundation and improve your performance in assessments. Remember, consistency and practice are crucial to achieving success.