Understanding how to determine the value of fixed-income securities is essential for anyone studying finance or preparing for related assessments. This area requires a solid grasp of several core concepts, mathematical formulas, and the factors that influence the pricing of these investment vehicles. Gaining proficiency in these topics will allow you to confidently navigate complex problems and make informed decisions in real-world scenarios.

Key concepts such as interest rate effects, time value, and market conditions play a crucial role in determining the fair value of these instruments. By applying relevant principles, one can solve problems related to the relationship between price and yield, as well as the risk factors that impact performance. Through regular practice and study, you’ll gain the skills needed to tackle the most challenging tasks in this field.

In this section, we’ll explore essential strategies and techniques, providing practical examples and explanations. You’ll also find tips for efficiently approaching complex problems to ensure better results in your academic or professional pursuits.

Bond Valuation Exam Questions and Answers

In this section, we will address some of the most common challenges faced when dealing with the process of determining the value of fixed-income securities. These tasks often involve a variety of concepts, such as calculating yields, understanding market fluctuations, and determining the relationship between price and future payments. Mastering these techniques is essential for success in related assessments.

Practice problems are a key part of preparation. They allow you to apply theoretical knowledge to practical scenarios, reinforcing your understanding of key principles. Each problem presents an opportunity to refine your skills, from the simplest calculations to more complex issues involving multiple variables. By tackling a wide range of examples, you will develop a deeper comprehension of the subject.

As you work through problems, be mindful of the strategies used to approach each one. This can help streamline your process and avoid unnecessary errors. Whether it’s breaking down the formula or understanding the implications of changing variables, practicing regularly is vital to boosting your confidence and readiness for any challenge.

Understanding the Basics of Bond Valuation

To successfully navigate the process of pricing fixed-income instruments, it’s essential to grasp a few foundational concepts. These financial tools are typically issued with a promise to pay periodic interest and repay the principal amount at maturity. The challenge lies in determining how much these instruments are worth at any given moment based on the present value of those future cash flows.

Key Factors Affecting Price

The price of a financial instrument depends on several key factors, such as the interest rate environment, the creditworthiness of the issuer, and the timing of future payments. A simple principle to keep in mind is that as interest rates rise, the value of these instruments tends to fall, as newer issues may offer more attractive returns. Similarly, the longer the maturity, the more sensitive the price is to fluctuations in interest rates.

Time Value of Money

The concept of time value is fundamental when evaluating fixed-income securities. Money received today is more valuable than the same amount received in the future. This is because of the opportunity cost of capital, which is reflected in discounting future payments back to their present value. By applying this principle, you can calculate the present worth of future interest payments and principal repayment, forming the basis for determining the current price of these instruments.

Key Concepts in Bond Pricing

When determining the worth of fixed-income securities, several essential concepts need to be understood. These concepts are fundamental to the calculation of their price and help evaluate their performance in the market. Understanding these principles will enable you to make more informed decisions about these financial instruments.

- Yield to Maturity (YTM): This represents the total return expected from a security if held until it matures. It is a crucial measure for comparing different investments.

- Coupon Rate: The interest rate paid by the issuer on the face value of the security, typically expressed as a percentage.

- Current Yield: This measures the annual return based on the annual coupon payment and the current market price of the security.

- Discounting Future Payments: The process of determining the present value of future cash flows, accounting for the time value of money.

- Duration: A measure of the sensitivity of the price to interest rate changes, which helps assess the risk associated with price fluctuations.

Each of these concepts plays a critical role in pricing decisions and investment strategies. By understanding how they interact, you can better analyze the market and make more accurate predictions regarding the performance of these instruments.

Types of Bonds and Their Features

There are various types of debt securities, each with unique characteristics that determine their pricing, returns, and risk profiles. Understanding the different categories helps investors choose the right instruments based on their financial goals, risk tolerance, and market conditions. Each type has its own set of features that influence its performance and appeal to different investors.

- Government Issued Securities: These are issued by national governments and typically offer lower risk due to the backing of the government’s credit. They include treasury bills, notes, and bonds.

- Corporate Debt: Issued by companies to raise capital, these securities often offer higher yields to compensate for increased risk compared to government-issued instruments.

- Municipal Instruments: Issued by local government entities, these often come with tax advantages for investors, making them an attractive option for certain income tax brackets.

- Zero-Coupon Securities: These instruments do not make periodic interest payments. Instead, they are issued at a discount to their face value and pay the full principal amount at maturity.

- Convertible Securities: These allow the holder to convert the debt into equity shares of the issuer, providing the potential for capital appreciation in addition to fixed income.

- High-Yield Instruments: Often referred to as junk debt, these securities are issued by companies with lower credit ratings, offering higher returns to attract investors willing to take on more risk.

Each type has its advantages and drawbacks, depending on the investor’s specific needs, market conditions, and financial strategies. Understanding these features is key to making informed decisions in the world of fixed-income investing.

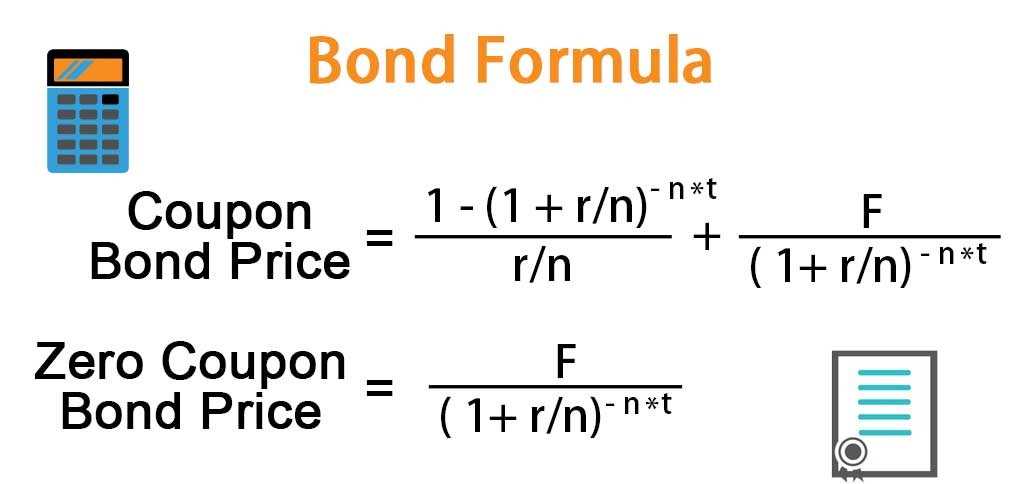

Important Bond Valuation Formulas

To assess the price of debt instruments accurately, several formulas are essential for determining the present value of future cash flows. These calculations take into account factors like interest payments, maturity periods, and the time value of money. Mastering these formulas is crucial for anyone involved in financial analysis, investment strategy, or risk management.

Present Value of Future Payments

The most fundamental formula involves calculating the present value (PV) of future cash flows, which include both interest payments and the face value that will be paid at maturity. The formula for PV is:

PV = C / (1 + r)^t + F / (1 + r)^n

- C: The coupon payment

- r: The discount rate (or market interest rate)

- t: The time period for the coupon payment

- F: The face value (principal repayment)

- n: The total number of periods until maturity

Yield to Maturity (YTM)

YTM is a critical measure of the total return an investor can expect if the security is held until maturity. It considers both the current market price and the future cash flows. The YTM formula involves solving for the discount rate that equates the present value of all future payments to the current price:

Current Price = Σ (C / (1 + YTM)^t) + F / (1 + YTM)^n

Where the sum (Σ) represents the sum of all coupon payments over the security’s life. The YTM formula can be complex, often requiring iterative methods or a financial calculator to solve.

Understanding these formulas is key to accurately assessing the value of debt instruments in various market conditions. By applying them, you can derive essential information that guides investment decisions and portfolio management.

How Interest Rates Affect Bond Prices

The relationship between interest rates and the price of fixed-income securities is fundamental to understanding how the financial markets operate. When market interest rates change, the present value of future payments also fluctuates, which in turn affects the price of these instruments. This dynamic is a key factor in assessing investment opportunities and managing risks.

When interest rates rise, the price of existing securities tends to fall. This happens because newly issued securities offer higher yields, making the older, lower-yielding securities less attractive. Investors demand a discount on the older securities to match the returns available in the current market. Conversely, when interest rates fall, the price of existing securities tends to rise, as their relatively higher yields become more appealing in comparison to newly issued, lower-yielding alternatives.

This inverse relationship is a critical concept for anyone involved in financial analysis or investment strategy. Understanding how fluctuations in the interest rate environment impact the value of these instruments is essential for making informed decisions in both the short and long term.

Yield to Maturity and Its Significance

Yield to maturity (YTM) is one of the most important metrics used to assess the total return an investor can expect from a fixed-income investment if held until its maturity. It represents the rate of return that equates the present value of all future cash flows to the current market price. Understanding YTM is crucial for investors looking to evaluate the attractiveness of an investment in comparison to other opportunities.

How YTM Is Calculated

YTM is calculated by solving for the discount rate that makes the present value of all future payments, including both interest and principal repayment, equal to the current price of the security. The calculation takes into account the purchase price, the coupon payments, and the time remaining until maturity. While the formula can be complex, financial calculators and spreadsheet tools are commonly used to perform this calculation efficiently.

Significance of Yield to Maturity

YTM serves as a comprehensive measure of a security’s return potential, factoring in both income and capital gain or loss over the life of the instrument. It is particularly useful when comparing different investment options, as it provides a single figure that incorporates all relevant factors. For investors seeking to hold an investment until maturity, YTM offers a reliable estimate of what the return will be, assuming no changes in market conditions or default risk.

Explaining Duration in Bond Valuation

Duration is a key concept used to measure the sensitivity of a fixed-income security’s price to changes in interest rates. It provides an indication of how much the price of a security will fluctuate when there are changes in the market interest rates. Understanding duration is essential for managing risk and for making informed investment decisions in fixed-income markets.

How Duration Is Calculated

Duration is calculated as the weighted average time it takes for the cash flows (both interest payments and principal repayment) to be received. The longer the duration, the more sensitive the price of the instrument is to changes in interest rates. To calculate duration, each cash flow is multiplied by the time period in which it occurs, and the sum of these weighted values is divided by the total price of the security.

Why Duration Matters

Duration is an essential tool for assessing risk. The higher the duration, the more volatile the price of the security is likely to be in response to interest rate movements. A shorter duration typically indicates a lower price sensitivity, making the security less risky in terms of price fluctuation. By understanding duration, investors can better align their portfolios with their risk tolerance and interest rate outlook.

Understanding the Time Value of Money

The concept of time value is fundamental to understanding financial decision-making. It asserts that the value of money changes over time due to factors such as inflation, interest rates, and opportunity costs. Essentially, a dollar today is worth more than a dollar in the future because it can be invested or used to generate returns. Grasping this principle is critical for evaluating investments, pricing financial instruments, and making informed decisions about resource allocation.

The Core Principle

The core idea behind the time value of money is that the purchasing power of money diminishes over time. This occurs because money can earn interest or be invested in other ways to generate returns. Therefore, a fixed amount of money received today can be reinvested, whereas the same amount received in the future would forgo potential earnings. The time value of money helps quantify the opportunity cost associated with waiting to receive payments or returns.

Present Value vs. Future Value

Two key components in the time value of money are present value (PV) and future value (FV). Present value refers to the current worth of a future sum of money, discounted by the interest rate over time. Future value, on the other hand, calculates how much a sum of money today will be worth in the future, considering interest or growth. These concepts are essential for financial analysis, as they help compare the value of cash flows received or paid at different points in time.

Calculating Bond Price Sensitivity

The sensitivity of a fixed-income security’s price to changes in market interest rates is a crucial factor for investors. This sensitivity helps determine how much the price of an instrument will fluctuate when interest rates rise or fall. Calculating this sensitivity is essential for managing risk, optimizing investment strategies, and making informed decisions in volatile markets.

Price sensitivity is often measured by the concept of duration, which indicates how long it takes, on average, for an investor to receive the present value of all future cash flows. The higher the duration, the more sensitive the security is to interest rate changes. This relationship is inverse, meaning that as interest rates increase, the price of the security typically decreases, and vice versa.

To calculate price sensitivity, investors use duration and convexity. Duration measures the first-order price change for a given change in interest rates, while convexity helps to account for the more complex, non-linear aspects of price changes. By incorporating both metrics, investors can estimate the impact of interest rate shifts on the security’s price with greater accuracy, allowing for more effective risk management.

Types of Risks in Bond Investments

Investing in fixed-income instruments carries various types of risks that can impact returns and the overall stability of an investment portfolio. Understanding these risks is essential for investors to effectively manage and mitigate potential losses. While some risks are inherent in the structure of these investments, others are influenced by broader market and economic factors.

Key Risks in Fixed-Income Investments

Several risks are common to fixed-income investments. Each of these risks affects the price, yield, or the ability of the issuer to meet its obligations. Here are the primary risks that investors face:

| Risk Type | Description |

|---|---|

| Interest Rate Risk | The risk that changes in interest rates will negatively affect the price of the investment. When rates rise, the price of existing instruments typically falls. |

| Credit Risk | The risk that the issuer may fail to meet its payment obligations, leading to default or downgrade. |

| Inflation Risk | The risk that inflation erodes the purchasing power of future interest payments and principal repayments. |

| Liquidity Risk | The risk of being unable to sell the investment quickly at a reasonable price due to a lack of market participants. |

| Reinvestment Risk | The risk that interest payments or principal repayments will be reinvested at lower rates than the original investment. |

Managing Risk in Fixed-Income Investments

To effectively manage these risks, investors can diversify their portfolios, carefully assess the creditworthiness of issuers, and use various financial instruments to hedge against potential losses. Understanding the impact of market conditions, issuer stability, and economic factors is crucial in mitigating risk exposure and maximizing returns over time.

Bond Ratings and Their Impact on Valuation

The creditworthiness of an issuer plays a crucial role in determining the risk associated with fixed-income investments. Ratings provided by credit agencies are essential for assessing the likelihood that an issuer will meet its financial obligations. These ratings influence the attractiveness and pricing of fixed-income instruments, as they reflect the potential for default or the overall financial health of the issuer.

How Ratings Affect Investment Decisions

Credit ratings are typically issued by agencies like Moody’s, S&P, and Fitch. These ratings give investors a clear indication of the risk involved in holding an instrument issued by a specific entity. The higher the rating, the lower the risk, and typically the lower the yield required by investors. Conversely, lower-rated securities often offer higher yields to compensate for the increased risk.

- Investment-Grade: Securities rated BBB- or higher are considered relatively safe, with lower yields due to their reduced risk of default.

- Speculative-Grade: Ratings below BBB- indicate higher default risk and generally require higher yields to attract investors.

- Junk: These securities have very low ratings and are considered highly risky, but offer the potential for high returns to compensate for the added risk.

Impact on Pricing and Returns

The rating assigned to a fixed-income instrument directly affects its market price. When a rating is upgraded, the price tends to rise as the perceived risk decreases, making the investment more attractive to investors. On the other hand, a downgrade signals higher risk, often leading to a decrease in the price and an increase in yield as investors demand a premium for taking on additional risk.

Investors closely monitor rating changes as they can have significant implications for returns, especially in volatile markets. By considering ratings, investors can make more informed decisions and adjust their portfolios accordingly to align with their risk tolerance and investment goals.

How to Handle Bond Coupons in Exams

When dealing with fixed-income investments during assessments, it’s important to understand how interest payments, commonly known as coupons, factor into calculations. These payments are a key element in determining the overall return of the instrument. In an academic setting, handling these correctly is crucial for achieving accurate results and demonstrating your understanding of investment principles.

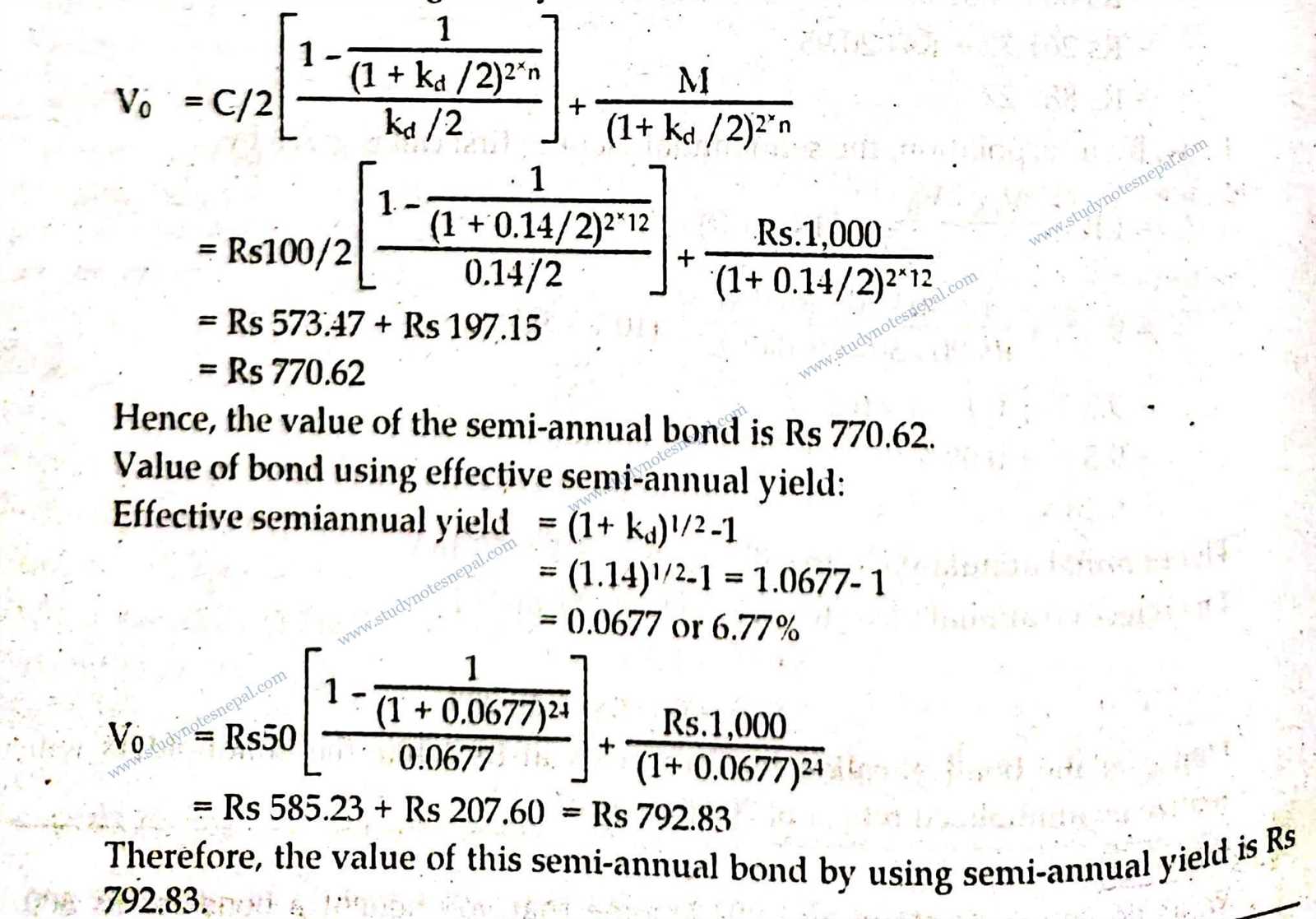

Coupon payments typically occur on a regular basis, such as annually or semi-annually, and must be incorporated into any calculations involving the total yield or present value. During assessments, students must be familiar with how to calculate the present value of future payments, considering both the coupon rate and the time until maturity.

| Step | Description |

|---|---|

| Step 1: Identify Coupon Rate | Determine the rate at which the issuer pays interest on the principal, often expressed as a percentage of the face value. |

| Step 2: Calculate Payment Amount | Multiply the face value of the instrument by the coupon rate to find the periodic payment amount. |

| Step 3: Determine Payment Frequency | Identify how often the payments are made, whether annually, semi-annually, or quarterly, as this will impact the calculation. |

| Step 4: Discount Future Payments | Use the appropriate discount rate to calculate the present value of the coupon payments, based on the time until they are received. |

Mastering the proper treatment of coupon payments will help you efficiently calculate key metrics such as the total return and yield to maturity. Understanding how these payments contribute to the overall value of a fixed-income instrument is an essential skill for academic success in this area.

Common Mistakes in Bond Valuation

When working with fixed-income instruments, there are several common errors that can lead to incorrect results, especially when calculating yields or determining present values. These mistakes often stem from misunderstandings about how certain variables interact, or from overlooking key details in the process. Identifying and avoiding these errors is crucial for ensuring that calculations are accurate and reliable.

Some of the most frequent mistakes include incorrect assumptions about payment frequency, failing to account for compounding, and miscalculating the discount rate. Additionally, not properly adjusting for time to maturity or overlooking the impact of interest rate changes can lead to significant miscalculations.

- Ignoring Payment Frequency: Not adjusting for whether payments are annual, semi-annual, or quarterly can lead to an incorrect valuation of the investment.

- Misunderstanding Discount Rates: Using the wrong discount rate or failing to apply it correctly to future cash flows is a common error.

- Overlooking Compounding: Not accounting for the compounding effect, especially with semi-annual or quarterly payments, can result in incorrect calculations of returns.

- Incorrect Time-to-Maturity Assumptions: Failing to properly account for the number of periods until maturity, especially in long-term instruments, can skew results.

- Neglecting Interest Rate Sensitivity: Not factoring in how changes in market rates can affect the present value and yield of a fixed-income investment.

Avoiding these mistakes requires a careful and systematic approach to each calculation. By paying attention to the details, ensuring that all assumptions are clearly defined, and using the correct formulas, one can avoid these pitfalls and arrive at a more accurate assessment of the investment’s worth.

Exam Strategies for Bond Valuation Questions

Successfully tackling fixed-income calculations during assessments requires a strategic approach that ensures accuracy and efficiency. To maximize your performance, it’s important to focus on key areas that are commonly tested, while also managing your time effectively. Understanding the core concepts and developing a systematic approach to solving problems will significantly improve your chances of success.

1. Familiarize Yourself with Core Formulas

Before attempting any problems, make sure you’re comfortable with the essential formulas. Practice applying these equations under different scenarios so that you can recognize when to use each one. Key formulas for calculating present value, yield to maturity, and coupon rates should become second nature.

2. Break Down the Problem Step-by-Step

When presented with a complex problem, don’t try to solve it all at once. Instead, break the problem into smaller, more manageable parts. Start by identifying the known variables (e.g., interest rates, payment amounts, maturity dates) and determine what the question is asking for. Then, methodically work through each part of the calculation, ensuring that you’re not missing any crucial steps.

- Read the Problem Carefully: Pay attention to payment frequency, interest rates, and time to maturity.

- Check for Missing Information: If a key variable is missing, think about how you might be able to estimate or calculate it using available data.

- Double-Check Units: Ensure that all units (e.g., years, months, percentage rates) are consistent throughout the problem.

By approaching the task in a logical and structured way, you can avoid common errors and reduce the risk of overlooking important details. With enough practice, these strategies will help you handle even the most complex scenarios with confidence.

Practicing with Real-World Scenarios

One of the most effective ways to strengthen your understanding of fixed-income instruments is by practicing with real-world situations. These scenarios often involve more complex data and varying conditions, which can challenge your ability to apply theoretical knowledge in practical contexts. By working through actual cases, you can enhance your skills in analyzing and interpreting market information, making informed decisions, and solving problems efficiently.

1. Analyzing Corporate Debt Issuances

When companies issue debt, they offer a range of terms, including different interest rates, maturities, and payment structures. Practicing with such corporate debt issuances can give you insights into how market conditions influence pricing and yields. Real examples, such as evaluating the attractiveness of different corporate bonds in varying economic environments, will test your ability to adjust assumptions and calculations accordingly.

2. Evaluating Government Debt Instruments

Government debt securities, such as treasury bonds, are often seen as benchmarks in the fixed-income market. Understanding how these instruments are priced in different interest rate environments, alongside the impact of inflation and fiscal policies, is crucial. Working with such examples helps you recognize the importance of macroeconomic factors when assessing the value of a security over time.

- Understand Interest Rate Movements: Practice with scenarios where interest rates fluctuate, affecting the value of fixed-income securities.

- Consider Economic Factors: Analyze how inflation expectations and monetary policy impact the pricing and yields of these instruments.

By practicing with a diverse set of real-world examples, you can refine your ability to assess different types of debt in various financial contexts, preparing you for challenges in both academic and professional settings.