Mastering financial concepts and mathematical techniques is crucial for those pursuing a career in finance or actuarial science. This section will help you understand the key areas and strategies to succeed in your upcoming certification process. By focusing on the core principles, you can build a solid foundation and improve your performance.

Preparation for this certification involves understanding a wide range of topics, from time value of money to risk assessment. Emphasis is placed on problem-solving skills and the ability to apply theory to real-world scenarios. Proper guidance and consistent practice will enable you to approach each topic with confidence.

Whether you’re just beginning your studies or looking to refine your knowledge, the right resources and techniques can significantly enhance your readiness. With a structured study plan, you can tackle complex mathematical problems and improve your overall understanding of financial principles.

Preparing for the TIA Exam FM

Achieving success in financial mathematics certification requires a well-thought-out approach and dedicated study. Whether you’re starting your preparation or refining your knowledge, it’s essential to focus on understanding the core concepts and practicing consistently. A strategic study plan will help you stay on track and manage the vast array of material effectively.

Developing a Study Plan

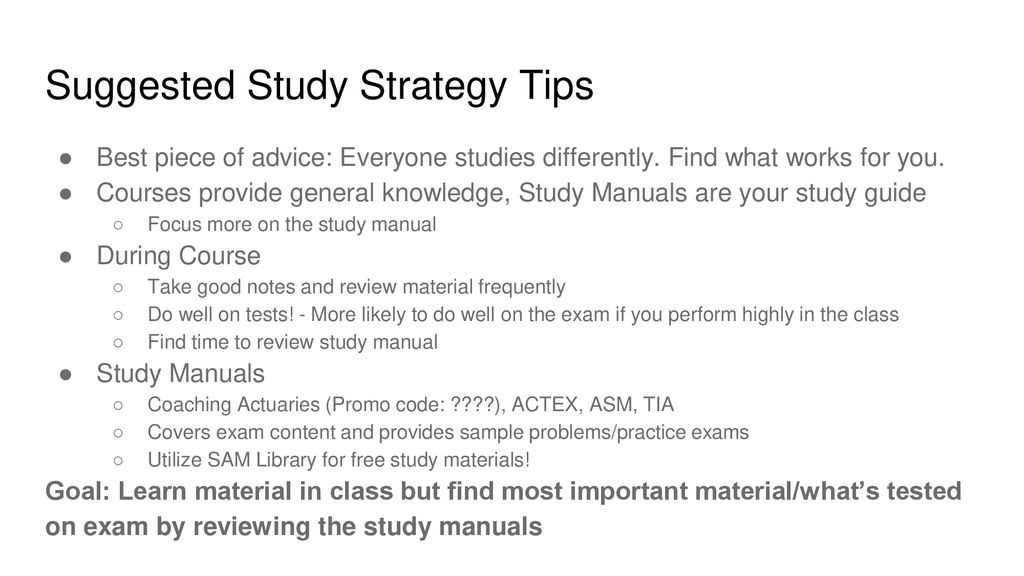

Creating a study schedule that breaks down topics into manageable sections is key. Focus on mastering fundamental principles before moving on to more complex concepts. Set aside dedicated time each day or week to study, ensuring you give adequate attention to each area. Don’t forget to include time for practice problems, as applying what you’ve learned is essential for reinforcing your understanding.

Utilizing Effective Resources

Make use of various study materials, such as textbooks, practice questions, and online courses. Some resources focus on theory, while others are problem-based, helping you build both your understanding and problem-solving abilities. Look for practice exams to familiarize yourself with the format and timing of the certification. These tools will provide valuable insights and help you identify areas that require more focus.

Understanding the TIA FM Exam Format

Familiarity with the structure of the certification process is crucial for efficient preparation. Knowing what to expect in terms of question types, time limits, and the overall layout can help reduce anxiety and improve performance. In this section, we will break down the key elements of the assessment and guide you through the format to ensure you’re fully prepared on the day of the test.

Exam Structure and Timing

The certification consists of multiple-choice questions, typically organized by topics in financial mathematics. The exam is timed, and candidates must complete it within a set duration. Here’s an overview of the structure:

- Total number of questions: 100-150

- Duration: 3-4 hours

- Multiple-choice format

- Each question carries one mark

Topic Coverage and Question Distribution

Different areas of financial mathematics are tested in varying proportions. Understanding the focus areas will help you allocate your study time effectively. The main topics include:

- Time Value of Money

- Interest Rate Models

- Financial Instruments and Risk

- Cash Flow Analysis

- Mathematical Probability and Statistics

Being aware of these areas and how they relate to the question distribution can aid in focusing your efforts on the most critical topics.

Key Topics to Focus on for Success

To perform well in the financial mathematics certification, it’s essential to prioritize the most important areas of study. Understanding the core concepts and being able to apply them to solve problems is critical for success. Here, we will highlight the key topics that are frequently tested and should be at the center of your preparation efforts.

Core Areas of Focus

These are the primary topics you should dedicate time to in order to perform at your best:

- Time Value of Money: Understand how money changes value over time, including concepts like discounting, compounding, and present/future value calculations.

- Risk Management and Analysis: Study methods for assessing and managing financial risks, including risk-free rates, portfolio management, and derivatives.

- Interest Rate Models: Get familiar with models that explain how interest rates behave and affect financial products, such as bonds and loans.

- Financial Instruments: Learn about various financial products, including bonds, stocks, and options, and how they are priced and traded.

Mathematical and Statistical Foundations

A solid understanding of mathematical and statistical principles is essential. Key areas to focus on include:

- Probability Theory: Brush up on probability concepts like distributions, expected value, and variance, which are essential for decision-making under uncertainty.

- Statistical Analysis: Learn the basics of statistical testing and data interpretation to help you understand trends and patterns in financial data.

- Financial Calculations: Practice the mathematical techniques needed to solve common financial problems, such as loan amortization, annuities, and bond valuation.

Study Resources for the TIA Exam

Having access to the right study materials is crucial for mastering the concepts needed for financial mathematics certification. Whether you’re looking for textbooks, online courses, or practice exams, the right resources can significantly enhance your understanding and problem-solving abilities. In this section, we’ll explore various tools and materials that can help you prepare effectively.

Books and Textbooks

Books provide in-depth explanations of key topics and offer a structured approach to learning. Here are some highly recommended resources:

- Financial Mathematics: A Practical Guide for Actuaries – This book covers all major areas of the syllabus and is especially useful for grasping complex topics.

- Introduction to Financial Mathematics – A comprehensive guide that offers both theoretical explanations and practical examples.

- Principles of Financial Engineering – Ideal for those looking to understand the mathematical foundation of financial instruments.

Online Courses and Practice Tools

Online platforms offer flexible learning options with interactive content and practice exams. Some of the best resources include:

- Coursera: Financial Mathematics Specialization – Offers video lectures, quizzes, and assignments to reinforce learning.

- Actuarial Science Review – Provides practice exams and tutorial videos that simulate the actual certification process.

- Khan Academy: Financial Math Lessons – A free resource that covers the basics of finance, ideal for building a solid foundation.

Time Management Strategies During the Exam

Effective time management is one of the most critical factors for success in a financial mathematics certification. Knowing how to allocate your time wisely during the test can help you answer more questions accurately and reduce the stress of running out of time. In this section, we will explore strategies to ensure you make the most of the available time.

Key Strategies for Efficient Time Use

Proper planning and pacing are essential to maximize your performance. Here are some techniques that can help you manage your time effectively:

| Strategy | Description |

|---|---|

| Start with Easy Questions | Begin by answering the questions you find easiest, as this will boost your confidence and ensure you gain early marks. |

| Allocate Time per Section | Divide your total time by sections or question types, setting a specific time limit for each. This prevents spending too much time on difficult questions. |

| Use Process of Elimination | For multiple-choice questions, eliminate clearly incorrect answers first. This speeds up your decision-making process. |

| Don’t Get Stuck | If you’re unsure about a question, move on and come back to it later. It’s better to leave a tough question temporarily than risk wasting too much time on it. |

| Review Your Answers | If time permits, go back to check your answers. Ensure that you’ve not missed any questions and verify your calculations. |

Example Time Allocation

Here’s a suggested time breakdown for a typical test:

| Section | Time Allocation |

|---|---|

| Introduction & Instructions | 5 minutes |

| Easy Questions | 40 minutes |

| Moderate Difficulty Questions | 60 minutes |

| Reviewing and Remaining Questions | 15 minutes |

By following these time management strategies, you’ll be better prepared to complete the certification with confidence and accuracy.

How to Approach Exam Questions Effectively

Having a systematic approach to answering questions is essential for maximizing your performance in a financial mathematics assessment. The way you tackle each question can significantly impact your ability to solve problems accurately and efficiently. In this section, we will explore proven strategies for addressing questions in a clear, logical, and time-efficient manner.

Steps to Follow When Answering Questions

To ensure that you’re addressing each question effectively, it’s important to follow a structured process. Below are some strategies that can help you approach questions with confidence:

| Step | Action |

|---|---|

| Read the Question Carefully | Before attempting to solve the problem, make sure you fully understand what is being asked. Pay attention to key terms and conditions provided in the question. |

| Identify the Core Concept | Determine which financial principle or formula applies to the question. This will guide your approach and help avoid irrelevant calculations. |

| Break Down the Problem | For complex problems, break the question into smaller parts. Solve each part step-by-step to make the process more manageable. |

| Perform Calculations Carefully | Take your time with calculations, ensuring that each step is correct. Double-check formulas and values to avoid simple errors. |

| Check Your Answer | Once you’ve completed the question, review your answer to confirm that it aligns with the problem’s requirements and makes logical sense. |

Tips for Different Question Types

There are different types of questions you may encounter. Here’s a breakdown of how to approach some of the most common formats:

| Question Type | Approach |

|---|---|

| Multiple Choice | Use the process of elimination. Eliminate the clearly incorrect options first and then choose the most likely answer from the remaining options. |

| Problem-Solving | Write out all relevant steps. Ensure you have all necessary information before proceeding with calculations, and show each step clearly to avoid confusion. |

| Conceptual Questions | Refer back to the core principles you’ve studied. Relate the question to the key concepts and think about how they apply in a real-world context. |

By following these strategies, you will be better equipped to answer questions effectively, maximizing your chances for success.

Common Mistakes to Avoid in the TIA Exam

Even with thorough preparation, it’s easy to make mistakes during a financial mathematics assessment. These errors can be costly, reducing your chances of success. In this section, we’ll highlight some of the most common mistakes that candidates make and provide tips on how to avoid them. Recognizing these pitfalls will help you approach the test with more confidence and precision.

Overlooking Key Details in the Questions

One of the most frequent mistakes is failing to read the question carefully. Small details, such as the units of measurement or specific conditions, can completely change the way a problem should be solved. Avoid rushing through the questions; take a moment to ensure you understand every part of what’s being asked.

- Tip: Always underline or highlight keywords in the question to remind yourself of critical information.

Incorrect Application of Formulas

Many candidates make the mistake of using the wrong formula or applying a formula incorrectly. This often happens when students try to memorize formulas without fully understanding when and how they should be used. The proper application of formulas is crucial, as even a small mistake in the formula can lead to an incorrect answer.

- Tip: Make sure you understand the logic behind each formula and practice applying it in different scenarios to reinforce your understanding.

Rushing Through the Test

It’s common to feel pressured to complete the test quickly, but rushing through questions can lead to avoidable mistakes. Skipping steps, making calculation errors, and failing to check your work are all more likely when you’re in a hurry.

- Tip: Set a pace for yourself and stick to it. Make sure you allocate enough time for each question and leave time for review at the end.

By avoiding these common mistakes, you can increase your chances of performing well in the assessment. Focus on understanding the questions, applying the right formulas, and managing your time effectively for the best results.

Importance of Practice Exams for Preparation

One of the most effective ways to prepare for any financial mathematics assessment is through consistent practice. Simulated tests that replicate the real assessment environment allow you to apply the knowledge you’ve gained and familiarize yourself with the types of questions you’ll face. In this section, we’ll discuss the advantages of using practice exams to improve your preparation and boost your confidence.

Building Confidence and Reducing Anxiety

Taking practice exams helps you get comfortable with the format and timing of the test. By simulating the actual test experience, you can reduce the anxiety that often accompanies real assessments. As you become more familiar with the structure and pacing, you’ll feel more confident going into the actual test.

- Tip: Start with untimed practice sessions to focus on understanding the material, then gradually introduce time limits to improve your speed.

Identifying Weak Areas for Improvement

Practice exams provide valuable insights into your strengths and weaknesses. After completing a practice test, review your incorrect answers to identify areas where you need to focus more. This targeted approach helps you allocate your study time more effectively, ensuring you spend more time on topics that need improvement.

- Tip: Use incorrect answers as learning opportunities. Reread the relevant chapters or seek additional resources to strengthen those areas.

Incorporating practice exams into your study routine not only reinforces what you’ve learned but also ensures that you’re fully prepared for the real test, both mentally and academically.

Tips for Staying Calm During the Exam

Maintaining a calm and focused mindset during a high-pressure assessment is crucial for performing at your best. Stress and anxiety can cloud your judgment and affect your ability to think clearly. In this section, we’ll explore some strategies to help you stay calm and composed, allowing you to approach the test with confidence and clarity.

Practice Relaxation Techniques

Before and during the assessment, relaxation techniques can be a powerful tool for reducing stress. Deep breathing exercises, mindfulness, and visualization can help you relax and refocus. These techniques allow you to clear your mind, regain composure, and approach each question with a calm demeanor.

- Tip: Try the “4-7-8” breathing technique: inhale for 4 seconds, hold for 7 seconds, and exhale for 8 seconds to reduce anxiety and calm your nerves.

Stay Positive and Focused

A positive mindset is key to staying calm under pressure. Rather than focusing on potential mistakes, remind yourself of the preparation you’ve done and trust in your abilities. A positive, focused attitude will help you tackle each question methodically, rather than succumbing to feelings of panic.

- Tip: If you feel yourself getting anxious, take a short break, close your eyes, and reset your mindset before continuing.

By using these techniques, you can create a calm environment for yourself, allowing you to perform at your highest potential and face the assessment with confidence.

What to Do After Completing the TIA Exam

Once you’ve completed your financial assessment, it’s important to take certain steps to ensure you’re fully prepared for what comes next. Whether it’s reviewing your performance or awaiting results, how you handle this period can influence your overall success. This section covers essential actions to take after finishing the test to help you manage your next steps effectively.

Relax and Reflect

After finishing the test, it’s crucial to take a moment to relax and decompress. Constantly worrying about your performance can heighten stress levels and reduce your ability to focus on the next task. Take a break, go for a walk, or engage in a calming activity to give your mind some rest. Reflection is also helpful–consider how you approached the test and what could be improved for future assessments.

- Tip: Avoid overanalyzing each question immediately after the test. Trust that you did your best and allow yourself a mental break.

Prepare for the Next Steps

After taking a test, it’s important to plan for the next stages. Whether it’s waiting for your results or preparing for another challenge, having a strategy for your next move will help you stay focused. You can begin revisiting areas where you felt unsure or start preparing for further steps in your learning journey.

- Tip: If you’re unsure about your performance, take notes on the areas where you struggled and seek additional practice or support in those areas.

By taking these steps after completing the assessment, you will be able to maintain a balanced mindset and stay focused on your goals, regardless of the outcome.

How to Review Your Performance Post-Exam

After completing any assessment, it’s essential to review your performance in order to learn from the experience and identify areas for improvement. This reflective process allows you to better understand your strengths and weaknesses, ultimately helping you perform better in the future. In this section, we will outline effective strategies for evaluating your performance after an assessment.

Analyze Your Incorrect Answers

One of the most productive ways to review your performance is by carefully analyzing the questions you got wrong. Focus on the reasoning behind each mistake and identify any gaps in your understanding. Did you misinterpret the question, or was it a lack of knowledge? This analysis will help you target specific areas for improvement.

- Tip: Create a list of the topics that caused confusion, and prioritize them in your future study sessions.

Identify Patterns and Trends

Look for recurring themes or patterns in your incorrect answers. For example, do you consistently struggle with certain types of questions or concepts? Identifying these trends will allow you to focus your efforts more effectively in your next study phase, making it easier to address your weak points and build stronger skills in those areas.

- Tip: Keep a log of common errors and revisit them during your next round of preparation to ensure steady improvement.

By taking the time to thoroughly assess your performance and identify areas of improvement, you’ll be able to refine your skills and increase your chances of success in future assessments.

Benefits of Passing the TIA FM Exam

Successfully completing a financial assessment opens up numerous opportunities for both professional and personal growth. It not only validates your expertise but also enhances your career prospects in various industries. In this section, we will explore the key benefits of passing such a test and how it can positively impact your future endeavors.

Career Advancement

One of the most significant advantages of passing the assessment is the potential for career growth. With the credentials gained, you can distinguish yourself from others in your field, showing potential employers that you have the knowledge and skills to excel in complex financial environments. Many industries value these qualifications as a benchmark of expertise, making you a more competitive candidate for promotions and higher-paying roles.

- Tip: Employers often look for candidates who have successfully passed specialized tests, as it demonstrates dedication and a solid understanding of the subject matter.

Increased Confidence and Knowledge

Passing a comprehensive financial test not only boosts your confidence but also deepens your knowledge in the field. You will gain a more thorough understanding of core concepts, which can be directly applied to real-world scenarios. This increased expertise can make you more effective in your current role, improve decision-making skills, and help you navigate complex financial challenges more successfully.

- Tip: The process of preparation itself helps you sharpen your problem-solving abilities, making you more adept at handling future tasks with ease.

By passing the assessment, you open the door to many professional and personal benefits, including career advancement and a deeper understanding of your field.

Overview of Financial Mathematics Concepts

Financial mathematics is a branch of applied mathematics that deals with the modeling and analysis of financial markets, investments, and risk management. This field focuses on understanding the quantitative methods used in evaluating financial products and making informed decisions in various financial situations. Mastering these concepts is crucial for anyone pursuing a career in finance or economics.

Time Value of Money

One of the fundamental concepts in financial mathematics is the time value of money (TVM), which states that a sum of money today is worth more than the same sum in the future due to its potential earning capacity. This principle forms the basis for discounting future cash flows and evaluating investments. TVM is essential when calculating present and future values of cash flows, as well as when determining the appropriate discount rates for financial decision-making.

- Key formula: The present value (PV) is calculated using the formula: PV = FV / (1 + r)^n, where FV is the future value, r is the rate of return, and n is the number of periods.

Risk and Return

Another core concept is the relationship between risk and return. In financial mathematics, risk is often quantified using statistical measures such as standard deviation and variance. Understanding the trade-off between risk and return helps investors make choices that align with their risk tolerance and financial goals. This concept is particularly important when constructing portfolios and evaluating investment opportunities.

- Important note: A higher potential return usually comes with higher risk, and vice versa. Proper analysis helps in balancing this risk-return relationship.

These concepts are foundational to financial analysis and provide the tools needed for effective decision-making in various financial contexts.

Understanding Key Formulas for the Exam

Mastering essential formulas is crucial for anyone preparing for a financial assessment. These formulas provide the framework for solving problems related to time value of money, risk analysis, and investment valuation. Familiarity with these key equations will help streamline calculations and ensure accuracy during the evaluation process.

Time Value of Money Formulas

Time value of money is a cornerstone concept in financial analysis. To evaluate the present value or future value of a sum of money, it’s essential to understand the relevant formulas. These calculations allow for assessing how money grows or diminishes over time, depending on interest rates and compounding periods.

- Future Value (FV): FV = PV × (1 + r)^n – This formula calculates the value of an investment at a future date, considering an interest rate (r) and number of periods (n).

- Present Value (PV): PV = FV / (1 + r)^n – This formula calculates the current value of a future cash flow, discounting it by the appropriate interest rate over a given time frame.

Risk and Return Formulas

When analyzing investments or portfolios, understanding the relationship between risk and return is vital. The following formulas help quantify risk and evaluate how it relates to expected returns, guiding decisions in asset allocation and risk management.

- Standard Deviation (σ): σ = √(Σ (x – μ)² / n) – This formula measures the variability or volatility of an investment’s returns over a period of time.

- Expected Return (ER): ER = Σ (probability × return) – This formula calculates the anticipated return on an investment, based on its probabilities and possible outcomes.

These formulas provide the foundation for solving a wide range of financial problems, ensuring you are well-prepared for the challenges of financial analysis.

How to Study for Complex Problem Sets

Approaching complex problem sets requires a structured and focused method to break down difficult concepts into manageable parts. It’s important to develop a strategy that allows for tackling these challenges step-by-step, building confidence along the way. A clear understanding of the core principles and consistent practice is key to mastering these intricate tasks.

Breaking Down the Problem

The first step in solving complex problems is to carefully analyze the question. Identify what is being asked and separate the problem into smaller, more understandable components. This makes the overall task less overwhelming and allows you to focus on one part at a time. Start by recognizing the known variables and determining the unknowns.

- Identify the Key Information: Focus on the relevant data provided in the problem, eliminating distractions and irrelevant details.

- Formulate a Plan: Think through potential methods or formulas that might be useful in solving the problem before jumping into calculations.

Consistent Practice and Review

Consistent practice is critical to mastering complex problems. Working through a variety of practice sets allows you to strengthen your problem-solving skills and gain familiarity with different question formats. Regularly reviewing past solutions helps reinforce your understanding and enables you to spot patterns in problem types.

- Practice Regularly: Set aside time each day to work on problems. Repetition helps to solidify concepts and improve accuracy.

- Review Mistakes: Analyze errors to understand why they occurred and how to avoid them in the future. This reflective process helps you learn from each mistake.

By breaking down problems, practicing regularly, and reviewing past work, you will be better prepared to approach even the most complex problem sets with confidence and clarity.

Building Confidence Before the Exam Day

Preparing for an assessment can often feel daunting, but building confidence in the days leading up to the test is crucial for success. Confidence comes from thorough preparation, understanding key concepts, and practicing consistently. With the right approach, you can reduce anxiety and feel assured in your abilities when the day arrives.

Effective Preparation Strategies

Confidence begins with understanding the material and knowing that you’ve dedicated sufficient time to mastering the core topics. Creating a study schedule and following it diligently ensures you don’t leave anything to chance. As you review, focus on areas that are challenging but avoid overloading yourself with information at the last minute.

- Set a Study Schedule: Allocate time for each topic, balancing difficult and easy sections. Break your study time into manageable blocks.

- Focus on Weak Areas: Spend extra time on topics you find challenging. By mastering these areas, you’ll gain confidence in your overall preparation.

Practice and Review

Another way to build confidence is through regular practice. Solving practice problems and past assessments simulates the real test environment, making it easier to anticipate what to expect. Review your solutions thoroughly to understand where you made mistakes and how to correct them for future reference.

- Simulate Test Conditions: Take practice tests under timed conditions to get comfortable with the pace and pressure of the real assessment.

- Review Mistakes: Identify common mistakes and work on strategies to avoid them in the future. Understanding where you went wrong builds confidence for the actual test.

By focusing on these strategies, you will develop a sense of readiness and assurance that will allow you to approach the assessment with a calm and confident mindset.