In the world of finance, the ability to identify and address mistakes is crucial for ensuring the accuracy of calculations and records. Whether it’s handling documents, statements, or balance sheets, having a structured approach to correcting missteps is essential for success. Strengthening this skill can significantly enhance both efficiency and confidence when tackling complex tasks.

Recognizing discrepancies quickly and resolving them with clarity is a valuable asset. This process not only saves time but also leads to a deeper understanding of financial principles. By following practical strategies and applying effective techniques, individuals can navigate through challenging scenarios with greater ease.

Precision in resolving issues is key, and developing the right mindset for it will help achieve consistent results. Whether you are preparing for a certification or working in a professional setting, learning how to tackle such challenges is an ongoing journey that leads to mastery over time.

Mastering Correction of Accounting Errors Exam Answers

In financial problem-solving, being able to pinpoint and resolve mistakes is essential for achieving accurate and reliable outcomes. This skill is particularly important when dealing with complex numerical tasks where precision is paramount. Developing a systematic approach to spotting and addressing discrepancies ensures that the final result reflects true financial positions, allowing for more informed decisions.

By understanding common missteps and knowing how to address them, individuals can enhance their ability to work through complicated situations with greater confidence. This process involves not just recognizing where things went wrong but also applying the correct methods to rectify them efficiently. The key to success lies in building a solid foundation of problem-solving strategies and learning how to adjust quickly when mistakes occur.

Whether preparing for a professional assessment or improving daily practice, this ability to analyze and fix inaccuracies is crucial for long-term success. Mastering this skill requires both practice and attention to detail, enabling individuals to tackle even the most challenging financial tasks with ease and accuracy.

Understanding Common Accounting Mistakes

In the field of financial record-keeping, mistakes are not only common but often inevitable. Whether it’s through simple oversight or more complex miscalculations, understanding the nature of these mistakes is the first step toward preventing them. By familiarizing yourself with frequent issues, you can develop strategies to avoid them and enhance your overall precision when working with numbers.

Common issues often arise from misinterpretation of data, incorrect entries, or mathematical mistakes. These can lead to inaccurate reports, which in turn may affect the decision-making process. Recognizing where these discrepancies typically occur and addressing them proactively is crucial for anyone looking to refine their financial handling skills.

| Common Mistake | Cause | Impact |

|---|---|---|

| Transposition Errors | Switching digits during manual entries | Results in incorrect balances or amounts |

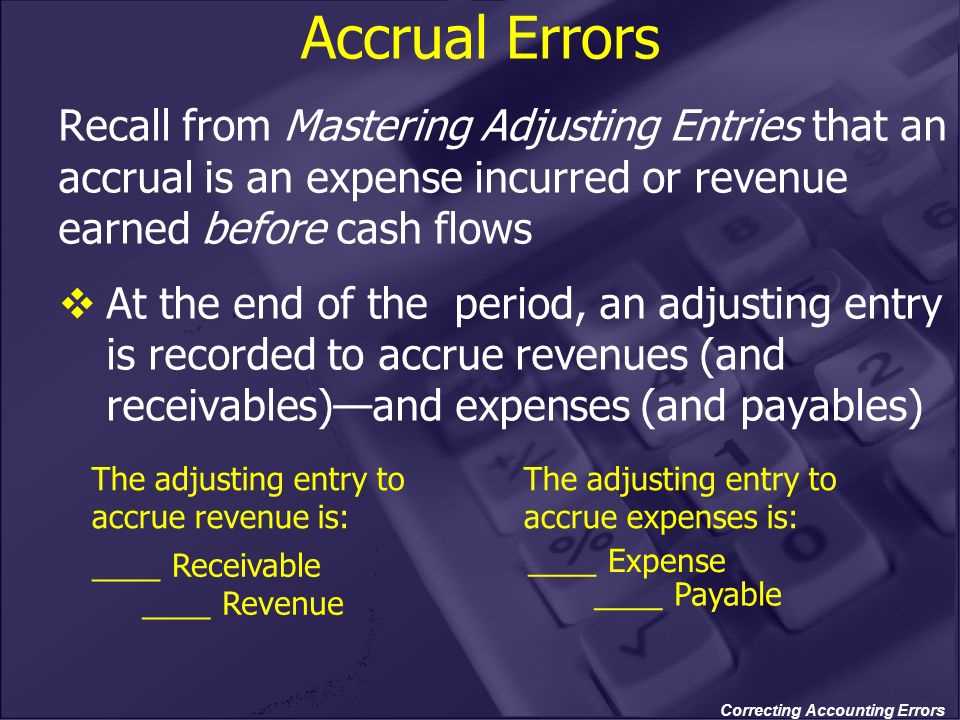

| Failure to Adjust Entries | Not updating records to reflect changes | Leads to discrepancies in final reports |

| Omitting Transactions | Missing or forgetting to record financial events | Creates imbalances in financial statements |

| Misclassifying Accounts | Incorrectly categorizing financial data | Affects overall financial analysis and budgeting |

Addressing these and other common issues requires attention to detail and a methodical approach. With practice, it’s possible to minimize mistakes and ensure that the financial process remains accurate and reliable.

How to Identify Calculation Errors

Accurate calculations are essential in financial tasks, yet miscalculations can easily occur due to oversight, misapplication of formulas, or incorrect data entry. Recognizing these mistakes promptly is key to maintaining the integrity of your work. By developing a systematic approach to reviewing your results, you can spot issues before they lead to larger discrepancies.

Double-Check Your Work

A simple yet effective method for identifying calculation mistakes is to revisit your figures after completing the task. Verify each step of your process to ensure the calculations align with your expectations. Cross-referencing with previous entries or utilizing alternative approaches can help pinpoint inconsistencies.

Use Digital Tools for Accuracy

Leveraging technology is another way to minimize miscalculations. Accounting software and spreadsheet programs can automate much of the work, reducing the likelihood of human error. Utilizing built-in functions and formulas can help verify the accuracy of your calculations quickly, making it easier to detect issues early on.

Strategies for Correcting Journal Entries

Making adjustments to financial records is an integral part of ensuring that transactions are accurately reflected in the books. When mistakes are found in journal entries, it’s important to address them promptly and effectively. The key to successfully managing these adjustments lies in a systematic approach that includes identifying the mistake, documenting the changes, and ensuring that all entries are in balance.

One effective strategy involves reversing the incorrect entry and posting a new, correct one. This method ensures that the original error is completely removed from the records, maintaining clarity and preventing any confusion down the line. Another approach is using adjusting entries to modify the existing records without fully reversing the transaction.

| Strategy | Benefit | Considerations |

|---|---|---|

| Reversing Entries | Completely removes the incorrect transaction | May require additional documentation |

| Adjusting Entries | Allows for partial correction without reversal | Requires careful tracking to ensure accuracy |

| Consolidating Multiple Entries | Streamlines the correction process | Can be time-consuming if not tracked properly |

Each approach has its advantages depending on the complexity of the mistake. The best method is often determined by the nature of the error and the overall structure of the financial statements. Regularly reviewing and maintaining detailed records will make the correction process smoother and more efficient.

Improving Accuracy in Financial Statements

Ensuring that financial reports are precise and reliable is crucial for any organization. Small inaccuracies can have significant consequences, affecting business decisions and compliance. Improving the accuracy of these documents requires a thorough understanding of best practices, regular checks, and attention to detail throughout the reporting process.

To enhance the reliability of financial statements, it is important to follow these key steps:

- Consistency in Data Entry: Regularly review data inputs to ensure all figures are entered correctly and consistently across all documents.

- Use of Automated Tools: Leveraging accounting software can help minimize manual mistakes, automate calculations, and reduce the risk of human error.

- Cross-Verification: Cross-checking reports with source documents and previous entries helps identify any discrepancies early on.

- Double-Check Calculations: Recalculating totals and subtotals ensures that the numbers align properly, preventing errors from going unnoticed.

Regular training for staff involved in financial reporting is also essential for maintaining high standards of accuracy. Keeping abreast of the latest tools and techniques will ensure that the team can handle complex tasks with confidence and precision.

By integrating these practices into daily routines, the chances of making mistakes in financial statements are greatly reduced, leading to more reliable and transparent reporting.

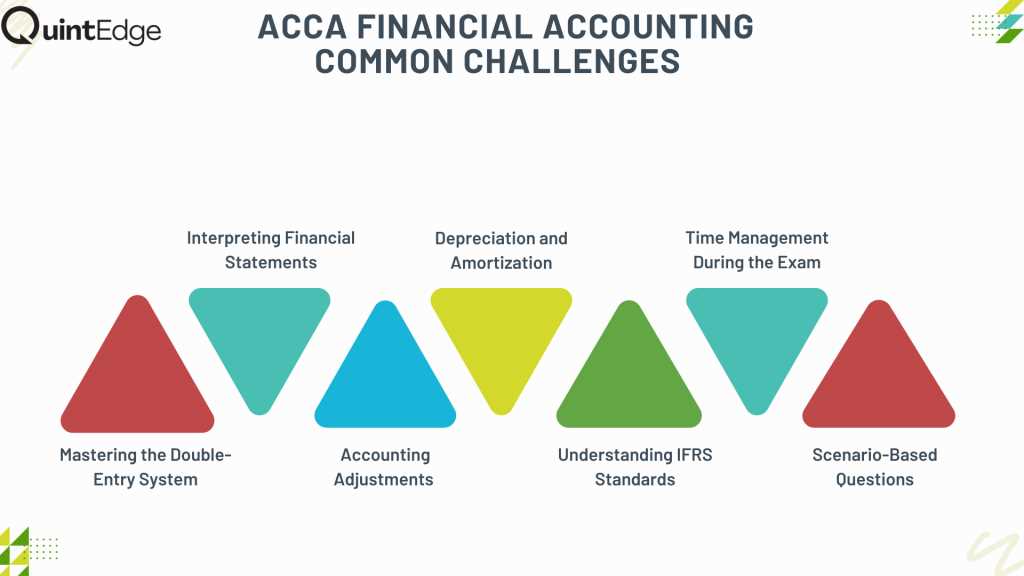

Common Pitfalls in Accounting Exams

When faced with financial problem-solving tasks, many candidates encounter challenges that can lead to mistakes and missed points. These challenges often stem from misunderstandings of key concepts, poor time management, or overlooking small yet crucial details. Recognizing these common pitfalls and knowing how to avoid them can greatly improve performance and confidence during assessments.

Typical Mistakes and Misunderstandings

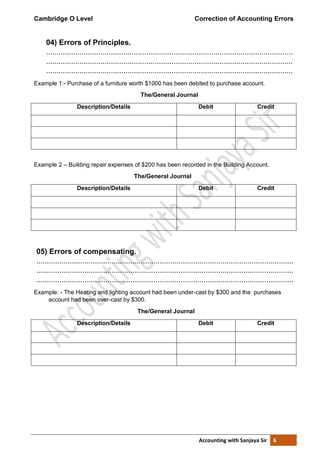

One of the most frequent mistakes is misinterpreting the instructions or misapplying formulas. This can lead to incorrect calculations or missing essential steps in the process. It’s important to thoroughly read the instructions and ensure a clear understanding of the task before proceeding.

- Misunderstanding the Problem: Failure to grasp the full scope of a question can lead to irrelevant calculations and incomplete answers.

- Ignoring Assumptions: Not accounting for certain assumptions, such as tax rates or depreciation methods, can result in incomplete or inaccurate solutions.

- Inconsistent Formatting: Failure to follow a consistent approach when organizing information can lead to confusion or lost marks.

Time Management Challenges

Another common issue is poor time allocation. Candidates often spend too much time on one question and then rush through others, leading to sloppy work. Effective time management is crucial for completing all sections of the task with the necessary level of detail.

- Spending Too Much Time on One Question: Focus on answering each question effectively without getting bogged down in details that aren’t directly relevant.

- Rushing Through the Last Questions: Allow enough time at the end to review and double-check your work, especially on more complex problems.

By being aware of these pitfalls and developing strategies to address them, candidates can improve their approach, avoid common mistakes, and enhance their performance in financial assessments.

Step-by-Step Guide to Error Analysis

Identifying and analyzing mistakes in financial calculations or records requires a methodical approach. By breaking down the process into clear, manageable steps, you can systematically uncover the root cause of discrepancies and apply the necessary adjustments. This step-by-step guide provides an organized framework to help you pinpoint issues and address them effectively.

Follow these steps to conduct a thorough analysis of any inconsistencies:

- Review the Instructions Carefully: Begin by ensuring that you understand the task or question fully. Misinterpretations at the outset can lead to unnecessary mistakes in the process.

- Re-examine Initial Entries: Check the original entries for accuracy. Verify that all data, such as figures or account names, were input correctly and consistently.

- Verify Calculations: Double-check all mathematical operations to ensure that no simple arithmetic mistakes were made. Use different methods or tools to confirm the results.

- Cross-reference with Source Documents: Compare your findings against original source documents, such as invoices or receipts, to ensure that the figures match up.

- Look for Missing or Duplicated Entries: Ensure that no transactions were overlooked or mistakenly entered twice. Missing entries can cause significant discrepancies in the final balance.

- Evaluate for Common Mistakes: Watch for typical issues such as misclassifications or overlooked adjustments that may have led to the imbalance.

By following these steps, you can isolate and understand the specific causes of mistakes in your work. This organized approach not only helps in fixing problems but also in preventing similar issues from arising in the future.

Handling Adjustments and Corrections Efficiently

When discrepancies arise in financial records, it’s crucial to address them quickly and effectively. The process of making changes and updating records can be time-consuming, but with a structured approach, it becomes much more manageable. Efficient handling of modifications not only saves time but also helps maintain the integrity of the data and ensures smooth financial operations.

To manage adjustments and revisions effectively, follow these key strategies:

- Act Quickly: As soon as an issue is identified, make the necessary changes without delay to prevent the problem from escalating or affecting other records.

- Document Every Change: Keep a clear record of all modifications, including the reason for the change and the specific entries adjusted. This ensures transparency and helps track any future inquiries.

- Use Automated Tools: Whenever possible, rely on automated tools and software to streamline the adjustment process. These tools can help minimize human error and speed up corrections.

- Double-Check Modifications: After making adjustments, review the updated records carefully to ensure that the changes have been applied correctly and that no further discrepancies remain.

- Maintain Consistency: Ensure that your adjustments follow a consistent method and align with standard practices. This ensures that the changes are accurate and reliable.

By following these best practices, you can handle modifications efficiently, ensuring that your financial data remains accurate and up-to-date with minimal disruption to ongoing tasks.

Developing a System for Error Detection

Creating a reliable system to identify mistakes in financial records is essential for maintaining accuracy and consistency in any business operation. With a structured approach, detecting discrepancies becomes more manageable, allowing you to address issues before they impact the overall process. An effective detection system can help reduce the likelihood of mistakes and ensure that the records remain up-to-date and reliable.

To develop an efficient error detection system, consider the following strategies:

- Implement Regular Reviews: Schedule periodic reviews of financial data to identify inconsistencies or mistakes. Regular checks allow you to catch problems early, before they accumulate and become harder to resolve.

- Automate Where Possible: Utilize automated software and tools that can flag potential issues such as duplicate entries, unusual figures, or missing transactions. These tools can quickly identify discrepancies that might go unnoticed in manual processes.

- Set Up Cross-Checks: Establish cross-checking procedures where one team member verifies the work of another. This redundancy helps catch errors that may have been overlooked during initial entries or calculations.

- Standardize Procedures: Develop standardized processes for data entry and reporting to reduce the chances of mistakes. When everyone follows the same guidelines, it’s easier to spot deviations from the norm.

- Use Consistent Terminology: Ensure that terminology and account classifications are consistent across all records. Inconsistent naming or categorization can lead to confusion and missed mistakes.

By integrating these practices into your workflow, you can establish a robust error detection system that ensures financial accuracy and enhances overall efficiency. A proactive approach to identifying issues can save time and resources, while preventing potential disruptions down the line.

How to Approach Complex Accounting Problems

Tackling intricate financial tasks requires a clear, methodical approach. When faced with complicated scenarios, breaking down the problem into manageable steps and focusing on each element individually can make it less overwhelming. By systematically analyzing the issue, you can identify the root cause and apply the necessary solutions efficiently.

Here’s a step-by-step strategy to approach complex financial issues:

1. Break Down the Problem

Start by dissecting the problem into smaller components. Understand the different elements involved and how they relate to one another. Isolate each part and analyze it separately before trying to solve the entire problem. This will help you focus on one issue at a time, reducing the complexity.

2. Organize Your Information

Gather all relevant data, ensuring that everything you need is accessible. Organize the information logically, whether by dates, accounts, or transaction types. A well-organized dataset allows you to quickly spot patterns and inconsistencies, making it easier to find solutions.

By following these steps, you can confidently approach even the most challenging financial problems. Taking a methodical approach not only helps you stay organized but also improves your ability to identify and resolve issues more effectively.

Using Accounting Software to Prevent Errors

Technology has revolutionized financial management by providing powerful tools to streamline processes and minimize the risk of mistakes. Leveraging software designed for financial tasks can significantly enhance accuracy by automating calculations, flagging inconsistencies, and providing real-time feedback. By incorporating such tools into daily operations, businesses can prevent common mistakes before they occur.

Here are some ways accounting software can help reduce the risk of mistakes:

1. Automation of Calculations

One of the primary benefits of using financial software is its ability to automate repetitive calculations. Whether it’s balancing ledgers, reconciling transactions, or calculating taxes, automated features reduce the likelihood of manual calculation mistakes. This not only saves time but also ensures more accurate results.

2. Real-Time Error Detection

Modern software solutions offer built-in checks and validations that identify discrepancies as they happen. For instance, they can alert users to unusual patterns or conflicting entries, allowing for immediate adjustments. This proactive approach helps maintain the integrity of financial data and ensures that problems are addressed before they become significant.

By adopting the right accounting tools, businesses can significantly reduce the potential for mistakes and improve overall efficiency. Integrating software into your workflow not only supports accuracy but also enhances productivity, allowing for quicker decision-making and better financial oversight.

Best Practices for Exam Preparation

Effective preparation is key to success in any assessment, especially when it involves complex topics. A structured approach to reviewing material, practicing key concepts, and managing time can make all the difference. By adopting efficient study strategies, you can improve your performance and reduce stress during the process.

Here are some best practices for preparing for assessments:

1. Develop a Study Plan

Creating a study schedule is essential to ensure you cover all necessary topics. Break down the material into manageable chunks and allocate specific time slots for each. Be realistic about how much time you can dedicate to each section and focus on areas where you need the most improvement.

2. Practice Regularly

Repetition is crucial for reinforcing key concepts. Set aside time for regular practice, including mock tests or sample questions. Practicing under timed conditions can help you become familiar with the format and manage your time effectively during the actual assessment.

- Use Flashcards: Create flashcards for key terms and formulas to test your recall.

- Work Through Problems: Solve practice problems to deepen your understanding of how to apply theoretical knowledge.

- Review Past Materials: Go over notes, textbooks, and any previous work to refresh your memory and ensure comprehensive understanding.

3. Stay Organized

Being organized can improve your ability to focus and retain information. Keep all study materials in one place, and make sure they are easily accessible. This organization extends to your physical space–study in a clean, quiet environment free from distractions.

By following these best practices, you can approach any assessment with confidence. Consistent effort, thorough preparation, and effective time management will help you achieve better results and reduce last-minute stress.

Mastering Time Management in Accounting Exams

Efficient time management is crucial to performing well in any assessment, especially when dealing with complex financial problems. Properly allocating time for each section allows for a balanced approach, ensuring that all parts of the test are addressed without rushing through important tasks. By developing strategic time-management skills, candidates can improve both their accuracy and confidence during assessments.

Here are some key strategies to enhance time management during assessments:

1. Prioritize Tasks

Start by reviewing the entire test to get a sense of the time required for each section. Identify questions or sections that may take longer to complete and allocate extra time to them. At the same time, quickly answer the simpler questions first to build momentum and gain confidence.

2. Allocate Time per Question

Set a specific time limit for each question or problem, based on its complexity. For example, reserve more time for multi-step problems and less for direct questions. This approach ensures that you don’t spend too much time on any one task, leaving enough time for the rest of the assessment.

- Use a Timer: Set a timer for each section to stay on track and ensure you don’t exceed the allotted time.

- Keep Track of Time: Periodically check the clock to assess whether you’re adhering to your planned schedule.

3. Practice Under Time Constraints

To build your ability to manage time efficiently, practice completing similar tasks or sample assessments under strict time limits. This will help you become accustomed to pacing yourself and recognizing where you can improve.

By following these strategies, you can ensure that you approach any assessment with a calm, organized mindset, allowing for optimal performance and reduced stress. Effective time management will not only help you complete your tasks efficiently but also improve the overall quality of your work during the assessment.

How to Spot and Correct Errors Quickly

Recognizing and addressing mistakes in your work efficiently can save valuable time, especially when you’re under pressure. Developing strategies to quickly identify inconsistencies or miscalculations can improve the quality of your output and reduce the need for major revisions later. This skill is essential, not only for improving accuracy but also for boosting confidence when reviewing your work.

Here are a few strategies to spot and fix mistakes in a timely manner:

1. Review Key Principles

Before diving into the details, ensure you have a solid understanding of the basic principles and formulas relevant to the task. Misunderstanding the foundation can lead to errors in calculations or logic. Having a quick mental checklist of key rules helps you spot inconsistencies faster.

2. Double-Check Calculations

When working with numbers, take a moment to double-check your calculations. A simple mistake in arithmetic can lead to significant discrepancies in your results. Use a calculator or spreadsheet to verify your calculations, and don’t hesitate to redo a complex step if something feels off.

- Check for consistency: Ensure that the results align with expectations or known values, such as balances or totals.

- Look for unusual patterns: If one value seems too high or too low compared to others, it’s likely worth revisiting.

3. Work in Chunks

Break down complex tasks into smaller, manageable sections. This allows you to focus on one part at a time, making it easier to spot errors as they arise. When you’re working on a larger project, completing it in stages also makes it easier to review and correct each section individually before moving forward.

By applying these techniques, you can reduce the amount of time spent identifying and fixing mistakes, making your work more efficient and accurate. The more you practice, the quicker and more effective you’ll become at spotting and addressing issues, leading to better results in less time.

Common Errors in Depreciation Calculations

Depreciation is an essential concept in financial management, but it is easy to make mistakes during its calculation. These mistakes can lead to inaccurate financial statements and affect business decisions. Identifying common missteps in the process can help avoid costly mistakes and ensure that depreciation is calculated correctly.

One frequent issue occurs when the useful life of an asset is misestimated. If the asset’s lifespan is overestimated, depreciation expenses may be too low, leading to inflated profits. On the other hand, underestimating the useful life can cause depreciation to be higher than necessary, which can distort financial performance.

Incorrect Method Selection

There are various methods to calculate depreciation, such as straight-line, declining balance, and sum-of-the-years’-digits. Using the wrong method for a given asset or situation can lead to significant inaccuracies. For example, applying the straight-line method to an asset that has irregular usage or wear can overestimate its value in later years.

Failure to Account for Residual Value

Many calculations omit the consideration of residual or salvage value, which is the expected value of the asset at the end of its useful life. Failing to subtract this value before calculating depreciation can lead to overstatement of depreciation expense, affecting the financial statements and tax obligations.

- Use the correct formula: Always ensure the formula aligns with the method selected, and include residual value where applicable.

- Adjust for changes: If the asset is impaired or has a significant change in its estimated life or residual value, make sure to update the calculation accordingly.

By recognizing and addressing these common mistakes, individuals and businesses can ensure that depreciation is calculated accurately and in compliance with financial reporting standards. Regular reviews and updates to depreciation schedules will also help maintain accuracy and reliability in financial reports.

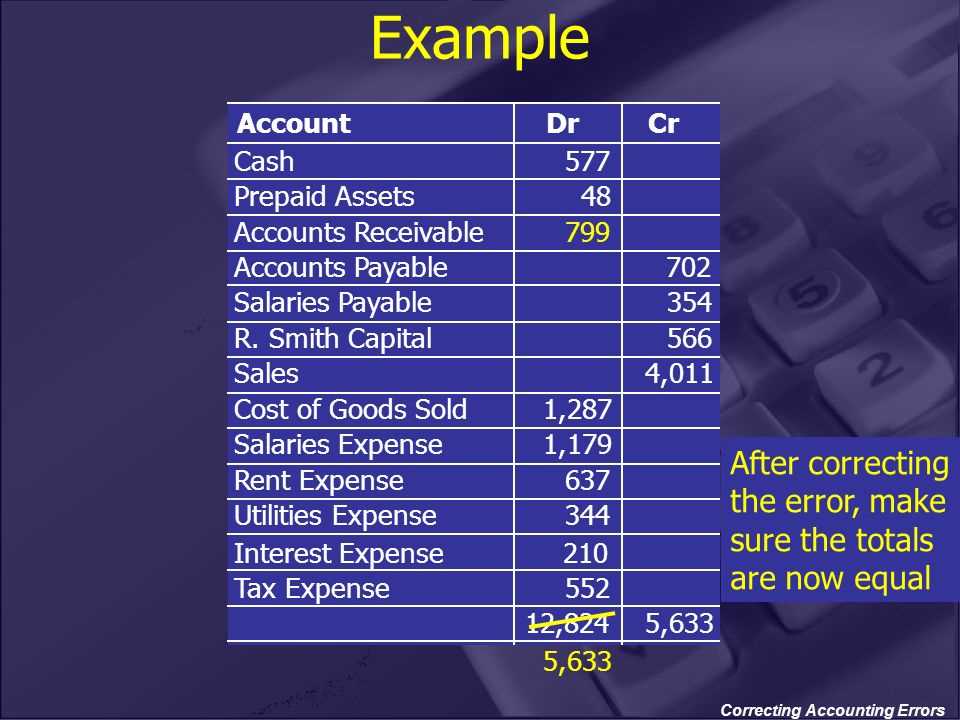

Working with Trial Balances Effectively

Trial balances are a key step in the process of financial statement preparation. They serve as a checkpoint to ensure that all the accounts in the ledger are balanced and that the totals of debit and credit entries match. Efficiently working with trial balances is crucial to identify discrepancies and streamline the process of finalizing financial records.

To work with trial balances effectively, it’s essential to carefully review the balance sheet accounts, ensuring that each account is categorized correctly and that no entries have been overlooked. A thorough check helps identify discrepancies early, making it easier to resolve issues before they compound into larger, more complex problems.

Ensuring Proper Classification of Accounts

One common mistake when working with trial balances is misclassifying accounts. For example, a revenue account may accidentally be listed under liabilities, or an expense could be mistakenly grouped with assets. Such errors can cause the trial balance to appear balanced when, in fact, the financial data is distorted. To avoid this, ensure that each account is placed in the correct category, based on its nature and function within the organization’s financial structure.

Reconcile Discrepancies Promptly

Even with meticulous attention to detail, discrepancies can still arise during the preparation of trial balances. When this occurs, it’s vital to investigate and reconcile them promptly. Start by reviewing the individual ledger entries to ensure that all debits and credits have been entered accurately. If the discrepancy remains, consider whether there may have been a duplication or omission of entries, or if an account was incorrectly carried forward.

- Double-check totals: Compare the totals for both the debit and credit columns to ensure they match.

- Look for rounding mistakes: Rounding errors are subtle but can impact the final balance.

- Verify account balances: Cross-reference account balances with the general ledger to ensure accuracy.

By following a methodical approach to reviewing and reconciling trial balances, businesses can ensure their financial statements reflect an accurate picture of their financial health. Consistency in this process also contributes to more efficient closing procedures at the end of each period, helping to avoid costly delays or inaccuracies in reporting.

Revising and Reviewing for Accounting Success

Thorough revision and review are essential steps for achieving proficiency in financial practices. The process not only helps reinforce concepts but also ensures a deeper understanding of key principles. A structured approach to reviewing material can enhance retention, improve problem-solving abilities, and ensure that every aspect of the topic is well-understood before application in real-world scenarios.

To succeed in this field, it’s important to regularly revisit both foundational and advanced concepts, refining your understanding with each review session. Focusing on core techniques and strategies, as well as identifying areas of weakness, will help streamline your efforts and make your learning more effective.

Break Down Complex Concepts

When tackling complex topics, breaking them down into smaller, more manageable parts is a helpful strategy. Start by reviewing the basic components and principles before attempting to solve advanced problems. This approach allows you to gradually build up your knowledge and gives you a clearer perspective on how different concepts interconnect. Revising this way ensures you aren’t overwhelmed by the material and can retain information more easily.

Practice Regularly and Consistently

Consistent practice is a key factor in retaining information and honing your skills. Make time for regular practice sessions to apply what you’ve learned. Work through a variety of practice problems, as this helps reinforce concepts and exposes you to different scenarios. The more you practice, the more comfortable you will become with applying your knowledge efficiently, which is crucial for success in practical situations.

- Focus on problem-solving: Regularly solve problems to enhance your critical thinking and analytical skills.

- Track progress: Keep a record of your performance during practice sessions to identify areas needing improvement.

- Review mistakes: Analyze past mistakes and understand the reasoning behind correct solutions.

By revisiting material regularly, breaking down complex problems, and practicing consistently, you will build a strong foundation for long-term success. This approach not only strengthens your expertise but also fosters the confidence needed to excel in applying your skills in practical settings.