Preparing for a key assessment in any subject can feel overwhelming, especially when it involves complex topics and intricate problem-solving. The process requires not only knowledge of core principles but also the ability to apply them in a structured and efficient way. This section aims to help you navigate through these challenges with a clear approach that enhances both understanding and performance.

Mastering the key concepts is crucial for success. It is essential to grasp the underlying ideas and their real-world applications to answer questions effectively. In addition, practical tips and techniques can make a significant difference when it comes to tackling various types of questions, from theoretical inquiries to detailed calculations.

By focusing on the right strategies and practicing regularly, you can feel more confident when the time comes to demonstrate your knowledge. Whether you’re dealing with time management or refining your answer structure, preparation plays a critical role in achieving the best results.

Effective Techniques for Solving Complex Assessments

In any challenging assessment, the ability to apply knowledge in a practical manner is what truly sets top performers apart. While understanding the theory is important, knowing how to break down problems and approach them systematically is equally crucial. This section explores various strategies for tackling complex questions and offering clear solutions.

The key to success lies in identifying the relevant information and using it efficiently. Whether it’s performing calculations, interpreting data, or explaining concepts, each task requires a specific method. Mastering these methods allows you to present well-organized responses that highlight your grasp of the subject.

Additionally, practicing with sample problems and reviewing past materials is an excellent way to strengthen your skills. By recognizing common question formats and familiarizing yourself with the types of challenges you may face, you can enhance your problem-solving abilities and improve your performance under pressure.

Key Concepts in Financial Management

Understanding the fundamental principles behind financial decision-making is essential for tackling assessments in this field. These core ideas form the foundation of more advanced topics, and a solid grasp of them can significantly enhance your ability to solve complex problems. By mastering these concepts, you build the tools necessary for interpreting data, evaluating performance, and making informed business choices.

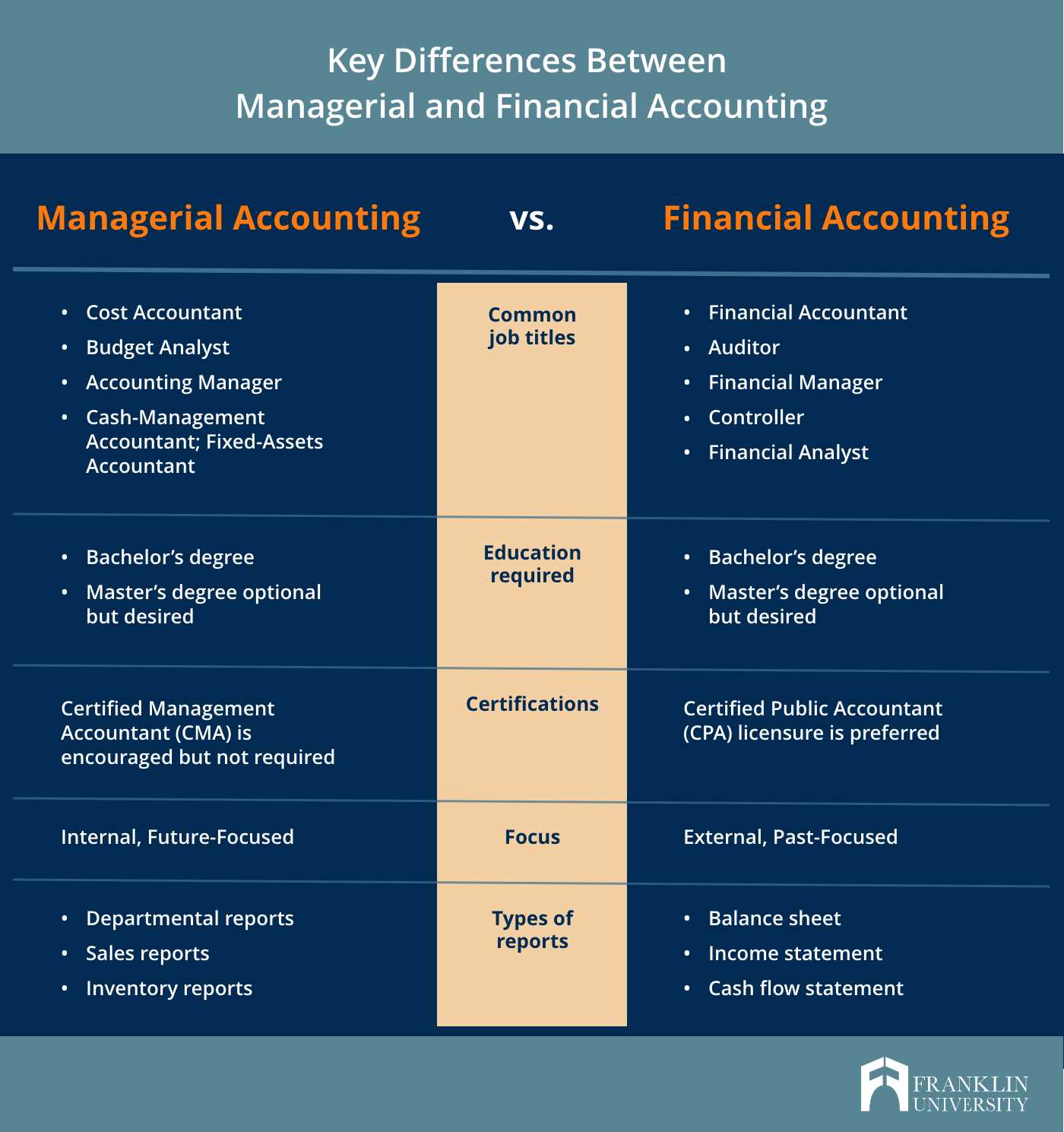

Cost Structure and Allocation

One of the most important concepts is how costs are classified and allocated within an organization. Fixed and variable costs play a crucial role in understanding how expenses impact overall performance. Knowing how to allocate these costs to products or departments is key for accurate reporting and analysis.

Budgeting and Forecasting

Another vital area is the preparation and management of financial plans. Budgets help set targets and guide decision-making, while forecasting allows businesses to predict future financial conditions. These tools are indispensable for maintaining control over resources and ensuring the sustainability of an organization.

How to Prepare for the Assessment

Effective preparation is the key to success when facing an important evaluation. By organizing your study sessions and focusing on the right materials, you can maximize your understanding of the subject and approach the test with confidence. Strategic planning and consistent practice are essential to ensure that you’re well-equipped to tackle any challenge that comes your way.

Start by identifying the most critical areas of the subject that are likely to be tested. Prioritize core concepts and make sure you understand the underlying principles behind each one. Reviewing past exercises and sample problems will also help you get familiar with the format and difficulty level of potential questions.

Time management is equally important. Break down your study time into manageable chunks, and allocate time for both review and practice. Make sure to include short breaks to maintain focus and avoid burnout. Regular self-assessment, through quizzes or mock tests, will give you an idea of where you stand and help refine your approach.

Common Mistakes in Financial Assessments

When preparing for a key evaluation in this subject, it’s easy to fall into certain traps that can hinder performance. Often, mistakes are made when key concepts are misunderstood or overlooked, affecting the overall quality of responses. Recognizing these common errors can help you avoid them and ensure you approach each question with clarity and precision.

Misinterpreting Questions

A frequent issue is the misinterpretation of the question itself. Many candidates rush through reading the prompt and fail to fully understand what is being asked. This leads to irrelevant or incomplete answers. Here are some common pitfalls:

- Overlooking key instructions or requirements.

- Assuming the question is asking for a simple calculation, when a detailed explanation is required.

- Failing to identify the main focus of the problem, leading to misapplied methods.

Incorrect Application of Concepts

Another common mistake is the improper application of learned principles. It’s essential to not only memorize formulas but to understand when and how to use them. Common errors include:

- Using the wrong cost behavior classification in calculations.

- Confusing different methods for allocating expenses.

- Misapplying formulas due to a lack of understanding of their underlying logic.

By carefully reviewing and practicing the application of core concepts, you can minimize these mistakes and improve your accuracy and confidence when solving problems.

Essential Formulas for the Assessment

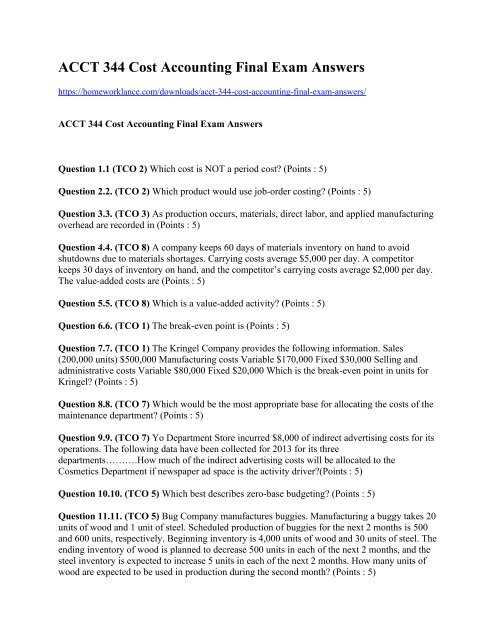

To perform well in any evaluation, it’s crucial to have a solid understanding of the key formulas that drive problem-solving in this field. These formulas provide the foundation for performing accurate calculations and analyzing financial data. Mastering these equations not only helps with efficiency but also ensures you can apply the correct method to different scenarios.

Cost and Profit Formulas

One of the fundamental areas involves calculating costs and profitability. Here are some essential formulas:

- Break-even Point: Determines the level of sales at which total revenues equal total costs.

- Break-even Point (in units) = Fixed Costs / (Price per Unit – Variable Cost per Unit)

- Contribution Margin: Measures the profitability of a product or service.

- Contribution Margin = Sales – Variable Costs

Financial Ratios

Another important aspect of financial evaluations involves analyzing key financial ratios. These ratios offer insights into an organization’s performance and health. Here are a few commonly used formulas:

- Current Ratio: Assesses an entity’s ability to pay short-term liabilities with short-term assets.

- Current Ratio = Current Assets / Current Liabilities

- Return on Investment (ROI): Measures the efficiency of an investment.

- ROI = (Net Profit / Cost of Investment) × 100

Familiarizing yourself with these and other relevant formulas ensures you are prepared to handle a wide range of problems effectively and efficiently during the assessment.

Understanding Cost Behavior and Allocation

A key aspect of financial decision-making is understanding how costs behave and how they should be allocated to various products or services. Different types of costs can vary depending on the level of activity or production, and recognizing these patterns is essential for accurate budgeting, forecasting, and performance evaluation. This section explores the key principles behind cost behavior and allocation methods.

Types of Costs and Their Behavior

Costs can be categorized based on their behavior in relation to production levels. Recognizing how each type of cost behaves is critical for effective management. Here are the primary categories:

- Fixed Costs: These costs remain constant regardless of the level of activity. Examples include rent, salaries, and insurance.

- Variable Costs: These costs change in direct proportion to the level of production or sales. Common examples are raw materials and direct labor.

- Mixed Costs: These contain both fixed and variable components, such as utilities or maintenance costs.

Methods of Cost Allocation

Allocating costs accurately ensures that each product, department, or service is assigned a fair share of the total expenses. Various allocation methods can be used depending on the situation:

- Direct Allocation: Costs are directly assigned to a specific product or service based on actual usage or consumption.

- Activity-Based Allocation: Costs are allocated based on the activities that drive costs, rather than just volume. This method is especially useful for businesses with diverse products or services.

- Step-Down Allocation: A method that assigns costs to departments or products in a sequential order, recognizing the flow of services and resources.

Understanding these categories and methods is crucial for ensuring that costs are allocated properly and that financial decisions are made based on accurate data.

Case Study Analysis in Financial Management

Case study analysis is a critical exercise that allows individuals to apply theoretical knowledge to real-world business scenarios. By analyzing a case, students or professionals can assess how various financial decisions affect an organization’s overall performance and make informed recommendations. This method not only tests comprehension but also enhances problem-solving abilities and strategic thinking.

In this section, we explore the steps involved in analyzing a financial case study, focusing on how to identify key issues, gather relevant data, and develop actionable insights.

Steps for Analyzing a Case Study

The process of case study analysis requires a systematic approach to ensure that all relevant aspects are considered. Here are the key steps:

- Identify the Core Issue: Start by understanding the primary problem the organization is facing, whether it’s related to cost management, profitability, or resource allocation.

- Analyze the Data: Review the financial statements, budgets, and other relevant documents provided in the case. Look for trends, anomalies, or patterns that can provide insight into the issue.

- Evaluate Possible Solutions: Based on the data, explore different approaches the organization could take to address the problem. Consider the financial implications of each option.

- Make Recommendations: Conclude by recommending the most effective course of action. Justify your decision with solid reasoning and quantitative analysis.

Common Challenges in Case Study Analysis

While case study analysis is an invaluable tool, it is not without its challenges. Some common obstacles include:

- Incomplete Data: In many cases, key financial information may be missing or incomplete, which makes it harder to form accurate conclusions.

- Overlooking Long-Term Impact: Focusing too heavily on short-term solutions without considering long-term consequences can lead to suboptimal decisions.

- Bias in Interpretation: Personal biases or preconceived notions about a company or industry can cloud judgment and affect the objectivity of the analysis.

By following a structured approach and avoiding these common mistakes, you can conduct a thorough analysis that leads to practical and well-supported recommendations.

Budgeting Techniques for Financial Planning

Effective budgeting is crucial for the financial health of any organization. It helps in planning and controlling financial resources, ensuring that the company remains on track to meet its goals. Different budgeting techniques offer unique advantages, and understanding these methods allows managers to choose the most suitable approach for their specific needs. In this section, we will explore several key budgeting methods and their applications.

Types of Budgeting Methods

Various budgeting methods are used depending on the nature of the business and the specific goals to be achieved. Each method has its strengths and weaknesses, and selecting the right one can significantly impact an organization’s financial success. The following are some of the most common budgeting techniques:

| Budgeting Method | Description | Advantages | Disadvantages |

|---|---|---|---|

| Zero-Based Budgeting (ZBB) | Starts from scratch, with all expenses needing to be justified for each new period. | Ensures efficient allocation of resources, prevents unnecessary spending. | Time-consuming, requires detailed analysis of all activities. |

| Incremental Budgeting | Uses the previous period’s budget as a base and makes adjustments for the new period. | Simple and easy to implement, good for stable environments. | May not address inefficiencies, encourages “spending to the budget”. |

| Flexible Budgeting | Adjusts the budget based on actual performance, allowing for more accurate forecasts. | Responsive to changes in business conditions, improves accuracy. | Requires regular monitoring, can be complex to manage. |

| Rolling Forecast | Uses updated data to revise the budget regularly, often quarterly or monthly. | Allows for continuous adjustments, provides more up-to-date information. | Requires frequent updates and can be resource-intensive. |

Choosing the Right Budgeting Technique

When selecting a budgeting technique, it’s important to consider the specific circumstances and objectives of the organization. Factors such as industry, size, and the level of financial control needed can influence the decision. By using the right approach, businesses can enhance their financial planning, control costs, and achieve long-term success.

Cost-Volume-Profit Analysis Explained

Cost-volume-profit (CVP) analysis is a powerful tool used to understand the relationship between costs, sales volume, and profit. By examining how different levels of sales and production affect a company’s profitability, businesses can make more informed decisions about pricing, production levels, and cost management. This analysis is crucial for setting financial targets, evaluating the feasibility of new projects, and assessing risks.

At its core, CVP analysis helps organizations predict how changes in costs and sales volumes will impact their overall financial performance. It focuses on understanding fixed and variable costs, and how these costs behave as production and sales fluctuate.

Key Components of CVP Analysis

The main components of CVP analysis are:

- Fixed Costs: These costs remain constant regardless of production or sales volume, such as rent and salaries.

- Variable Costs: These costs change in direct proportion to production or sales volume, including materials and direct labor.

- Sales Price: The price at which a product or service is sold, which directly affects revenue.

- Contribution Margin: The difference between sales and variable costs. This amount contributes to covering fixed costs and generating profit.

Application of CVP Analysis

CVP analysis can be applied in several areas of financial decision-making:

- Break-Even Analysis: This is the point where total revenue equals total costs, resulting in no profit or loss. Understanding the break-even point helps businesses determine the minimum sales required to cover costs.

- Profit Planning: By understanding how different levels of sales impact profitability, companies can set realistic financial goals and determine the necessary sales volume to achieve desired profit levels.

- Pricing Decisions: CVP analysis helps businesses assess the impact of price changes on profitability and find the optimal price point for their products or services.

Overall, cost-volume-profit analysis offers a clear picture of the financial dynamics within a business, enabling better strategic planning and more effective management of costs and revenues.

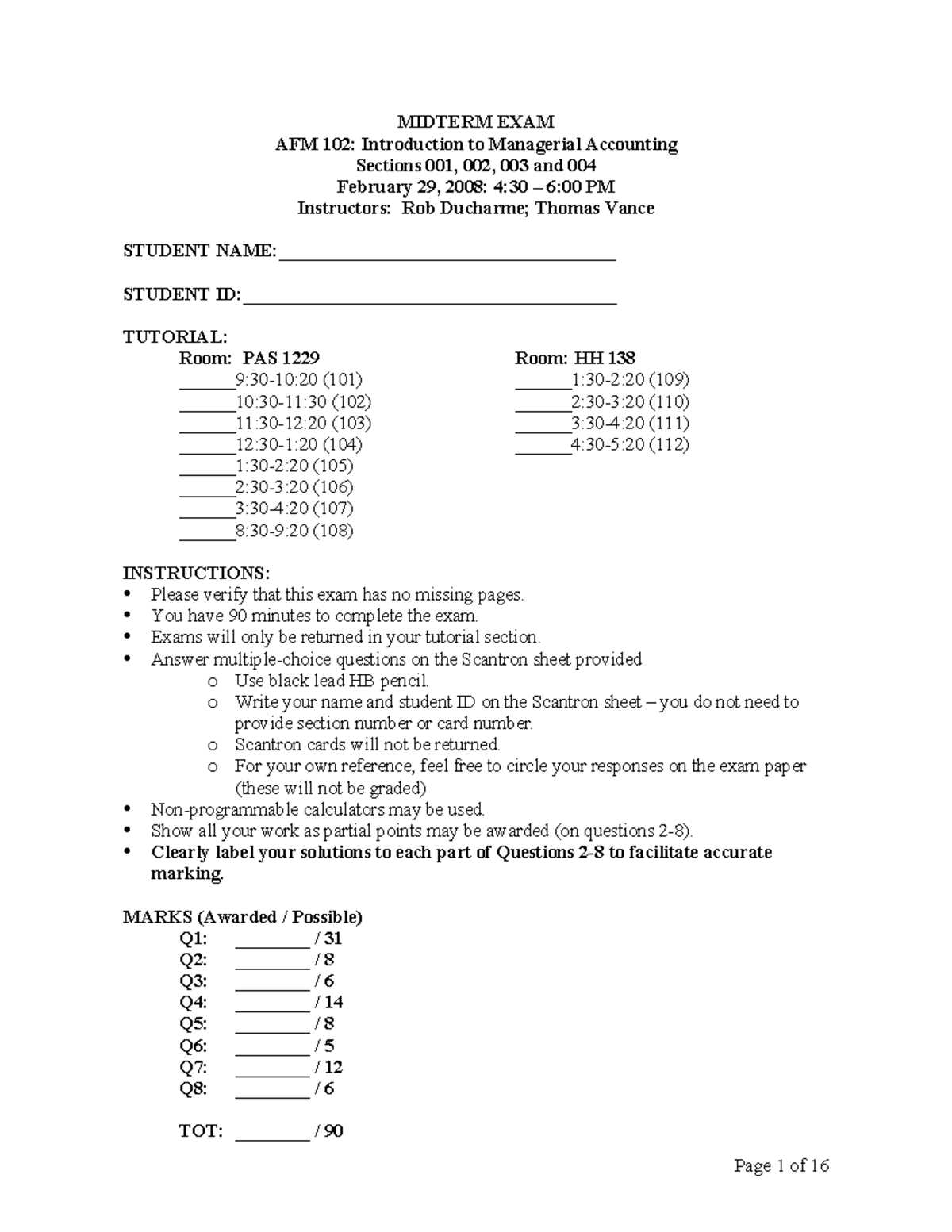

Time Management During the Test

Effective time management is crucial when preparing for and completing any test. Proper allocation of time allows you to approach each question methodically, ensure you answer everything, and avoid rushing through difficult sections. By managing your time well, you can maintain focus, reduce stress, and increase your chances of success.

In any timed assessment, the ability to prioritize tasks and divide your time wisely is key to completing all sections while still maintaining accuracy. It’s essential to have a strategy in place that allows you to stay on track and manage your time effectively throughout the entire process.

Key Strategies for Time Management

- Understand the Test Format: Before starting, familiarize yourself with the structure of the test, including the number of questions, types of tasks, and time allocated. This helps you plan your time accordingly.

- Allocate Time Per Section: Divide your total time by the number of sections or questions. Allow more time for questions that require deeper analysis or calculation, and keep a quick pace for simpler ones.

- Start with Easy Questions: Answer the questions you find easiest first. This ensures you gather points quickly and helps build confidence as you move through the test.

- Leave Tough Questions for Later: If you encounter difficult questions, don’t dwell on them for too long. Skip them and move on to the next section. You can always come back to them with a clearer mind later.

- Monitor the Clock: Keep an eye on the time throughout the test. This helps prevent spending too long on any one part and ensures you complete the assessment on time.

- Review Your Answers: If time allows, reserve the last few minutes to go over your answers. This gives you the opportunity to catch any mistakes and make sure you’ve answered every question fully.

Tips for Staying Calm and Focused

- Stay Calm: Anxiety can waste time and reduce focus. Practice deep breathing or visualization techniques to stay relaxed.

- Breaks and Stretching: During longer assessments, if breaks are allowed, use them to stretch and clear your mind. A brief mental reset can improve focus for the next section.

- Stay Positive: Keep a positive mindset throughout the test. Confidence boosts efficiency and helps you stay on task without feeling overwhelmed.

By implementing these time management strategies, you can optimize your performance and ensure that you complete your test efficiently and effectively.

Reviewing Financial Statements for the Test

When preparing for a test that involves financial analysis, reviewing key financial documents is essential. Understanding how to read and interpret balance sheets, income statements, and cash flow statements can significantly improve your ability to answer related questions efficiently. A thorough review of these statements helps you recognize the most important figures and their relationships, which is vital for applying concepts correctly under timed conditions.

By practicing how to identify trends, ratios, and financial health indicators from these documents, you can better analyze given data and draw meaningful conclusions. It’s important to familiarize yourself with the structure and terminology commonly used in financial statements, as well as how to interpret them in the context of various scenarios.

Key areas to focus on when reviewing financial statements include:

- Income Statement: Understand how revenue, expenses, and profits are reported. Pay attention to operating profit and net income, as these often relate directly to questions regarding business performance.

- Balance Sheet: Focus on assets, liabilities, and equity. Be sure you can calculate key metrics such as the debt-to-equity ratio and working capital, which help assess a company’s financial position.

- Cash Flow Statement: Know the different types of cash flow–operating, investing, and financing–and how they reflect the business’s financial activities. This is important for questions about liquidity and financial stability.

In addition to the documents themselves, it is essential to practice working with financial ratios. Commonly used ratios such as return on equity, current ratio, and profit margin provide deeper insights into a company’s performance and can be useful when analyzing case studies or problem sets during your preparation.

Ultimately, reviewing financial statements prepares you to not only recognize key numbers but also understand their implications. This knowledge will help you apply concepts correctly and think critically during your test.

Ethics and Best Practices in Financial Management

When dealing with financial data and decision-making processes, it is crucial to adhere to a strong ethical framework and follow best practices. Ethical behavior ensures the integrity of financial information, promotes transparency, and fosters trust with stakeholders. Understanding and applying ethical principles in financial management helps avoid manipulation of data and ensures that decisions align with both legal requirements and organizational goals.

Best practices, on the other hand, provide guidelines for efficient and accurate management of financial tasks. They help professionals navigate complex financial environments while ensuring consistency and reliability. By adhering to these practices, financial professionals can minimize risks, enhance decision-making, and ensure the sustainability of their organizations.

Key Ethical Principles

- Integrity: Always provide honest and accurate financial information, ensuring that reports reflect the true financial health of the organization.

- Objectivity: Avoid conflicts of interest and remain impartial when analyzing financial data or making decisions that affect the organization.

- Confidentiality: Safeguard sensitive financial data and avoid sharing confidential information without proper authorization.

- Compliance: Adhere to legal standards, regulations, and company policies while making financial decisions or reporting financial results.

Best Practices for Financial Management

| Best Practice | Description |

|---|---|

| Accurate Reporting | Ensure that all financial statements and reports are accurate, comprehensive, and free from errors. |

| Regular Auditing | Conduct periodic audits to assess the accuracy and reliability of financial information and ensure compliance with accounting standards. |

| Financial Forecasting | Use financial data to predict future trends, enabling proactive decision-making and risk management. |

| Effective Communication | Ensure clear and transparent communication with stakeholders about the financial health and decisions of the organization. |

By implementing these ethical guidelines and best practices, professionals in financial management can contribute to the long-term success and ethical integrity of their organizations. Following these standards not only supports effective decision-making but also helps build a reputation for trustworthiness and responsibility in financial operations.

Important Ratios to Remember

Financial ratios are essential tools for analyzing the health and performance of a business. By understanding and applying these ratios, you can gain insights into liquidity, profitability, efficiency, and leverage. These ratios are critical for interpreting financial data and making informed decisions, especially when managing resources or evaluating business performance over time.

Below are some of the most important ratios to remember, each serving a unique purpose in assessing different aspects of financial health.

| Ratio | Formula | Purpose |

|---|---|---|

| Current Ratio | Current Assets / Current Liabilities | Measures the company’s ability to pay short-term obligations with its most liquid assets. |

| Quick Ratio | (Current Assets – Inventory) / Current Liabilities | Assesses the ability to meet short-term liabilities with liquid assets, excluding inventory. |

| Debt-to-Equity Ratio | Total Liabilities / Shareholders’ Equity | Indicates the proportion of debt used in financing the company’s operations relative to equity. |

| Return on Equity (ROE) | Net Income / Shareholders’ Equity | Measures profitability by revealing how much profit is generated from shareholders’ investments. |

| Gross Profit Margin | (Revenue – Cost of Goods Sold) / Revenue | Indicates the percentage of revenue that exceeds the cost of goods sold, showing the efficiency of production. |

| Net Profit Margin | Net Income / Revenue | Shows the percentage of profit generated from total sales, reflecting overall efficiency and profitability. |

| Inventory Turnover | Cost of Goods Sold / Average Inventory | Measures how quickly inventory is sold and replaced over a period. |

Each of these ratios provides valuable insights into different aspects of a company’s financial health. Understanding and applying these ratios can help businesses make more informed decisions, optimize operations, and effectively manage risk. When preparing for any financial analysis or assessment, keeping these ratios in mind will aid in evaluating performance and identifying areas for improvement.

Top Resources for Exam Preparation

Preparation is key to success in any assessment, and utilizing the right materials can make a significant difference. The resources listed below provide a mix of study tools, practice exercises, and reference materials that can help reinforce your understanding and boost confidence during the process.

- Textbooks and Study Guides: Comprehensive textbooks cover all fundamental topics and serve as an excellent reference. Study guides often condense critical concepts and provide focused revision, offering practice problems and examples.

- Online Learning Platforms: Websites like Coursera, Udemy, and LinkedIn Learning offer courses from experts, providing in-depth lectures and interactive content on various subjects. These platforms also offer quizzes and assessments for self-evaluation.

- Practice Tests and Quizzes: Taking practice tests helps familiarize you with the format of questions and time constraints. Resources like Quizlet or other test preparation websites offer customizable practice sets.

- Flashcards: Flashcards are an effective way to memorize formulas, definitions, and key concepts. Tools like Anki or Quizlet allow for easy creation and review of digital flashcards.

- Study Groups: Joining or forming a study group can provide a collaborative environment where you can discuss difficult topics, share study strategies, and quiz each other. Group discussions help solidify knowledge and uncover new perspectives.

- YouTube Channels: Many educational YouTube channels, such as Khan Academy or specific subject-focused channels, offer free video tutorials on complex topics, breaking them down into digestible pieces for better understanding.

- Past Papers: Reviewing past assessment papers gives insight into the types of questions typically asked. This is crucial for understanding the depth of knowledge required and practicing time management under exam conditions.

Using a combination of these resources can maximize your preparation, giving you a well-rounded understanding of the material. It’s important to start early, set a study schedule, and stay consistent with your review to ensure success in the assessment process.

Managing Exam Stress and Anxiety

Feeling stressed or anxious before a major assessment is common, but it can hinder performance if not properly managed. Recognizing the symptoms of stress and taking proactive steps to calm the mind can help you maintain focus and perform at your best. It’s important to develop strategies to stay calm and collected during this challenging time.

Effective Stress-Reduction Techniques

There are various techniques to manage stress and reduce anxiety leading up to and during the assessment. Practicing these methods regularly can help you build resilience and stay in control of your emotions.

- Breathing Exercises: Deep breathing exercises, such as inhaling for a count of four and exhaling for a count of four, can help activate the body’s relaxation response. Focused breathing reduces tension and clears the mind.

- Mindfulness and Meditation: Taking short breaks for mindfulness or guided meditation can help reset your mental state. This allows you to refocus and prevent your thoughts from spiraling into negativity.

- Physical Activity: Engaging in regular physical activity, even short walks, helps release endorphins, which are natural stress relievers. Exercise also promotes better sleep, which is essential for clear thinking.

- Progressive Muscle Relaxation: This involves systematically tensing and then relaxing muscle groups throughout your body. It helps you become more aware of physical tension and effectively release it.

Time Management for Reducing Stress

Effective time management reduces anxiety by allowing you to feel more in control. By planning ahead and organizing your study sessions, you can avoid last-minute cramming, which often leads to stress.

| Strategy | Benefit |

|---|---|

| Break study time into blocks | Prevents burnout by maintaining focus and energy. |

| Prioritize tasks | Helps you focus on the most important material first. |

| Set realistic goals | Ensures you don’t feel overwhelmed by an unrealistic workload. |

| Include breaks | Regular breaks refresh the mind and prevent fatigue. |

By adopting these strategies and incorporating stress-relief practices into your routine, you can reduce anxiety and improve your performance. Remember, managing stress is a skill that improves with time and practice, and it can make a significant difference in your overall success.

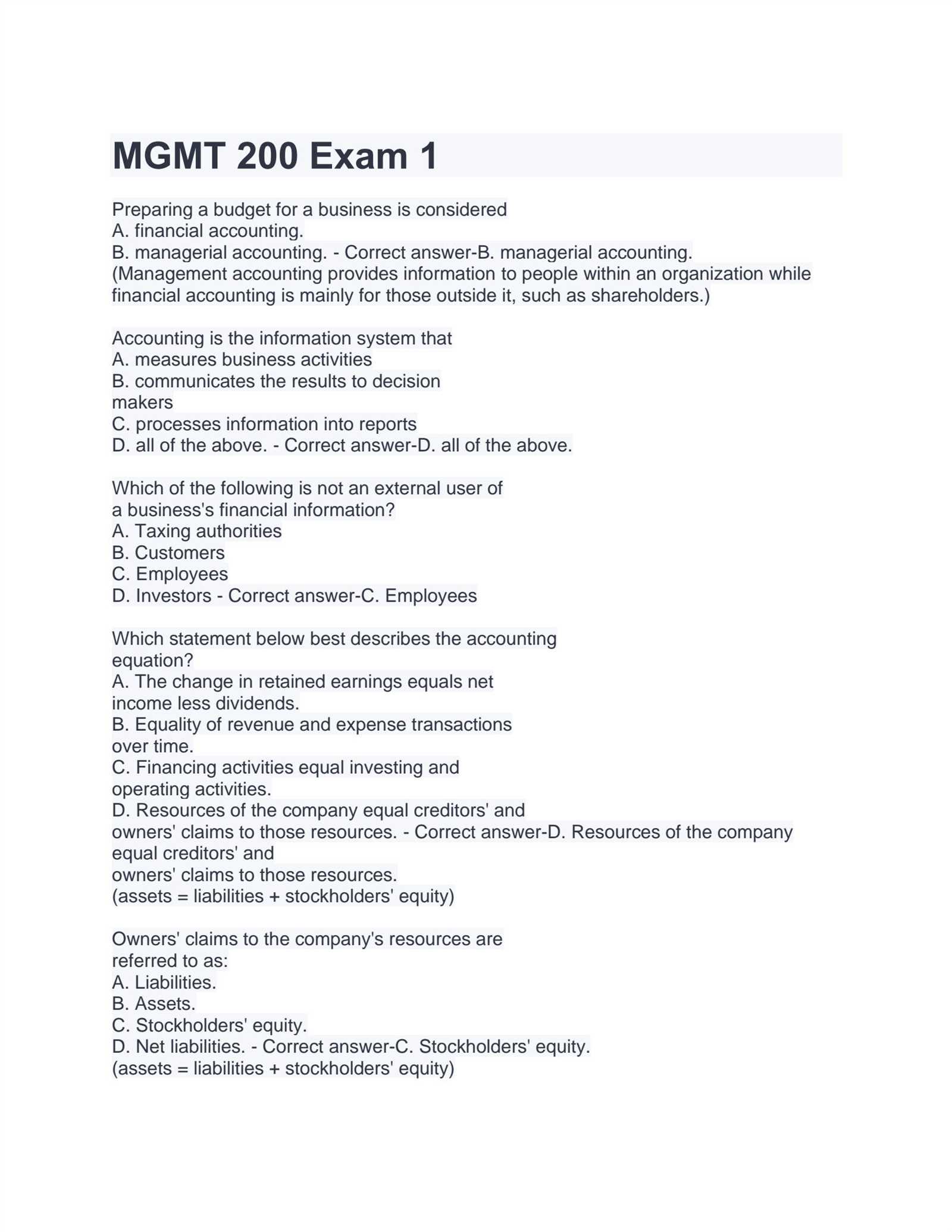

How to Tackle Multiple Choice Questions

Multiple choice questions are a common part of assessments and can sometimes feel overwhelming due to the variety of answer options. However, with the right approach, they can be an opportunity to demonstrate your understanding and critical thinking skills. The key is to read each question carefully, eliminate obviously incorrect choices, and apply logical reasoning to select the best answer.

Step-by-Step Approach to Multiple Choice Questions

To efficiently tackle multiple choice questions, follow these strategies to increase your chances of choosing the correct answer:

- Read the question thoroughly: Before looking at the answer options, make sure you understand what the question is asking. Pay close attention to keywords like “except,” “most,” or “always” that can change the meaning of the question.

- Eliminate obviously incorrect options: Cross out any answers that are clearly wrong. This narrows down your choices and improves the odds of selecting the right one.

- Consider all options: Even if one answer looks promising, review all the choices before making a final decision. Sometimes, there may be subtle differences between options that make one the most accurate.

- Look for clues in the question: Frequently, the wording of the question itself contains hints that can help you determine the right answer. If you’re unsure, check if the question includes terms or concepts from your studies that could point you in the right direction.

- Don’t overthink: Trust your first instincts. Overanalyzing the question and answers can lead to confusion. If you’re stuck, move on and come back later if time allows.

Tips for Improving Performance on Multiple Choice Questions

Here are some additional tips that can help improve your performance on multiple choice questions:

- Practice with sample questions: The more you practice answering similar questions, the more familiar you will become with the format and the types of answers that are likely to be correct.

- Manage your time: Don’t spend too long on one question. If you’re unsure about an answer, make your best guess and move on. You can always come back to it later if time permits.

- Watch for negative phrasing: Questions with words like “not,” “none,” or “never” can change the meaning significantly. Be especially cautious with these, as the correct answer is often the one that contradicts the expectation.

By employing these strategies, you’ll be better prepared to handle multiple choice questions confidently and efficiently, ensuring that you can demonstrate your knowledge and make the most of each question.

Tips for Writing Clear and Concise Responses

Providing clear and concise responses is essential in assessments. Being able to express your thoughts effectively ensures that you convey your knowledge without unnecessary details. A well-structured answer not only demonstrates your understanding but also allows you to address the key points directly, making it easier for the reader to follow your argument.

Here are some tips to help you write clear and concise responses:

- Understand the question: Before you begin writing, take a moment to fully comprehend what is being asked. This helps you stay focused and ensures that your answer directly addresses the key aspects of the question.

- Get to the point: Start your response with a clear and direct statement that answers the question. Avoid unnecessary introductions or filler sentences. Your goal is to provide the necessary information without over-explaining.

- Use simple language: Clear communication relies on simple, straightforward language. Avoid using overly complex words or jargon unless it is necessary for the context. The simpler and more direct your language, the easier it is for your answer to be understood.

- Stay focused on the main ideas: Stick to the key points and avoid going off on tangents. If a detail doesn’t support your main argument or answer, leave it out. This ensures your response remains concise and relevant.

- Use bullet points or numbered lists: When you need to outline multiple points, using bullet points or numbers can help structure your answer clearly. This allows the reader to easily follow your logic and quickly understand the key takeaways.

- Review and edit: After writing your response, take a moment to read it over. Eliminate any repetitive or redundant information. Tighten your language where possible to ensure that every word serves a purpose.

By applying these tips, you’ll be able to write answers that are not only clear and concise but also impactful, making it easier for others to understand and appreciate your knowledge.