Preparing for important assessments in the world of business can be a challenging yet rewarding task. The key to success lies in mastering the core concepts that are most commonly tested, along with understanding how to apply theoretical knowledge to real-world scenarios. By focusing on the critical areas that appear most often, students can build a solid foundation for answering complex problems with confidence.

In this guide, we explore the primary topics that typically emerge in high-level financial evaluations. We highlight the most important theories, formulas, and techniques that are essential for excelling in these tests. Whether you are revising for the first time or looking to reinforce your knowledge, having a clear grasp of the fundamental principles will ensure that you’re fully prepared.

Key strategies for effective preparation include mastering the art of breaking down problems, understanding the core concepts behind financial decision-making, and practicing with mock problems that replicate the difficulty and format of actual assessments. With consistent practice and focused study, success in these evaluations becomes much more attainable.

Corporate Finance Final Exam Questions and Answers

When preparing for high-level business assessments, understanding key concepts and applying them to practical situations is essential. This section will guide you through the types of problems most frequently encountered during these evaluations, providing a strategic approach to mastering the content. By focusing on fundamental principles and practicing a variety of scenarios, you can strengthen your ability to tackle the most challenging material with confidence.

Essential Topics to Master

Some of the most critical areas for these evaluations include risk management, valuation techniques, capital budgeting, and the analysis of financial statements. Understanding the time value of money, investment decisions, and the relationship between risk and return are often the cornerstones of the assessments. A strong grasp of these subjects will allow you to navigate complex problems with greater ease, ensuring that you can approach any question with a structured and thoughtful solution.

Practice Problems for Better Preparedness

Working through practice problems is one of the most effective methods for reinforcing your understanding of key concepts. By simulating real test conditions and solving a range of problems, you can refine your problem-solving skills and improve your time management. The more you practice, the more confident you’ll become in handling different question formats, helping you perform at your best when it matters most.

Understanding Key Concepts in Corporate Finance

Mastering the core principles of business decision-making is essential for success in advanced assessments. These foundational ideas help individuals make informed decisions about investments, risk management, and company strategies. A solid understanding of these concepts not only aids in solving complex problems but also supports the application of knowledge to real-world situations. Key topics to focus on include valuation, budgeting, capital structure, and financial performance analysis.

Time Value of Money

One of the most crucial concepts in business management is the time value of money. This principle asserts that money available today is worth more than the same amount in the future due to its earning potential. Understanding how to calculate present and future values is vital for evaluating investment opportunities and making informed financial decisions. The use of discount rates and interest rates are fundamental tools in applying this concept to practical problems.

Risk and Return

The relationship between risk and return is central to many financial strategies. Investors typically seek a higher return for taking on more risk, but understanding this trade-off is key to making sound choices. The ability to evaluate the level of risk associated with different investments and compare expected returns is fundamental in financial decision-making. Concepts like diversification and portfolio management further help in balancing risks effectively.

Common Topics in Finance Exams

Understanding the most commonly tested subjects is crucial for preparing effectively for business assessments. Certain areas consistently appear in evaluations due to their importance in real-world financial decision-making. By focusing on these key topics, students can maximize their chances of success, as they form the foundation for many practical financial analyses and strategies.

Valuation Methods

Valuation is a critical component in many financial evaluations, especially when determining the worth of assets or companies. Methods like discounted cash flow (DCF) analysis, price-to-earnings ratios, and market comparables are frequently tested. These techniques help assess whether an investment is worth pursuing or if a company is over or undervalued, which is a key aspect of financial decision-making.

Capital Budgeting Techniques

Capital budgeting is another core topic in these assessments. The process involves evaluating potential investment projects and determining their long-term profitability. Techniques such as net present value (NPV), internal rate of return (IRR), and payback period are essential for making informed decisions about which projects to pursue. These tools allow individuals to assess whether an investment will create value over time, making them indispensable in financial analysis.

Important Formulas to Memorize

For anyone preparing for business-related evaluations, understanding key formulas is essential. These mathematical tools are fundamental for solving complex problems and making informed decisions. Memorizing the most frequently used equations allows you to quickly apply them during tests and real-world scenarios, ensuring accurate calculations and analyses.

Time Value of Money

The time value of money is a crucial concept that involves calculating the present and future value of cash flows. One of the most common formulas used is:

Future Value (FV) = Present Value (PV) × (1 + r)^n

Where r is the interest rate, and n is the number of periods. This formula helps determine how much an investment today will be worth in the future, factoring in the rate of return.

Net Present Value

Net present value (NPV) is a method used to evaluate investment opportunities by comparing the value of future cash flows to the initial investment. The formula for NPV is:

NPV = Σ [Cash Flow / (1 + r)^t] – Initial Investment

Where r is the discount rate, t is the time period, and the sum is calculated for all future cash flows. This equation is used to assess whether an investment will add value to the company over time.

Time Value of Money in Practice

Understanding the time value of money is vital for making informed financial decisions. This concept highlights that the value of money changes over time due to its potential earning capacity. Whether you’re evaluating investment opportunities, loan payments, or the cost of capital, this principle plays a central role in assessing the true value of cash flows occurring at different points in time. In practical terms, this concept is used to compare the worth of amounts received or paid in the future to their value today.

Applications of Time Value of Money

Real-world situations often require the application of time value of money to make decisions about investments, loans, and budgeting. Here are a few common scenarios where this principle is used:

- Investment Valuation: Determining how much an investment is worth today, given its future cash flows.

- Loan Amortization: Calculating monthly payments for loans and determining how much of each payment goes toward interest versus principal.

- Capital Budgeting: Evaluating long-term projects by comparing the present value of expected future returns to the initial cost.

- Retirement Planning: Assessing how much you need to save today to meet future retirement goals, considering interest rates and time.

Practical Example: Future Value of an Investment

Consider an example where you invest $1,000 today at an annual interest rate of 5% for 3 years. To calculate the future value of this investment, use the formula:

Future Value (FV) = Present Value (PV) × (1 + r)^n

Where:

- PV = $1,000 (the initial investment)

- r = 5% (the annual interest rate)

- n = 3 (the number of years)

Using the formula, the future value is:

FV = $1,000 × (1 + 0.05)^3 = $1,000 × 1.157625 = $1,157.63

This means that after 3 years, your $1,000 investment will grow to $1,157.63, reflecting the time value of money in action.

Risk and Return Analysis for Exams

Assessing the relationship between risk and potential return is a crucial component in evaluating investment opportunities. In real-world decision-making, higher risk is often associated with higher potential returns, but understanding how to quantify and manage this trade-off is essential for making informed choices. This concept is especially important when analyzing investments, as it helps determine whether the expected returns justify the risks involved. Mastering this analysis is key to succeeding in assessments that focus on investment strategies and financial planning.

Key Metrics for Risk and Return

Several metrics are used to evaluate the risk-return profile of investments. The most common ones include:

- Expected Return: The anticipated return on an investment, calculated based on historical data or projected performance.

- Standard Deviation: A measure of the volatility or risk associated with an investment’s returns.

- Beta: A metric that gauges an asset’s risk in relation to the broader market.

- Sharpe Ratio: A measure that evaluates the return of an investment relative to its risk.

Risk-Return Example

Below is a simple example comparing two investment options with different levels of risk and expected return:

| Investment | Expected Return (%) | Risk (Standard Deviation) | Beta |

|---|---|---|---|

| Stock A | 8% | 15% | 1.2 |

| Stock B | 6% | 10% | 0.8 |

In this case, Stock A has a higher expected return, but also greater volatility (higher standard deviation) and a higher beta, meaning it is more sensitive to market movements. Stock B, while offering a lower return, is less volatile and more stable in comparison. These differences highlight the trade-off between risk and return that investors must consider when making decisions.

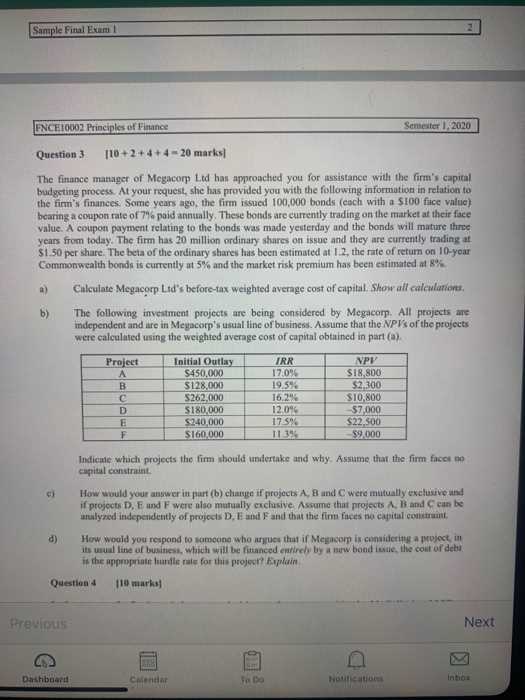

Capital Budgeting Questions Explained

When evaluating long-term investment opportunities, understanding the various methods and tools used to assess potential projects is essential. Capital budgeting involves determining the viability of investment decisions by comparing future cash flows against initial costs. The primary goal is to identify projects that will add value and enhance the financial position of the company. This process typically involves various analytical techniques that help quantify both the potential return and the risks associated with the investment.

Common Techniques in Capital Budgeting

Several approaches are commonly used to evaluate potential investments. These methods provide different perspectives on the financial implications of a project, helping decision-makers choose the most profitable option:

- Net Present Value (NPV): The sum of present values of future cash flows minus the initial investment. A positive NPV indicates a project will add value.

- Internal Rate of Return (IRR): The discount rate at which the NPV of a project equals zero. Projects with higher IRR values are generally more desirable.

- Payback Period: The time it takes for a project to recoup its initial investment. Shorter payback periods are preferred for quicker returns.

- Profitability Index (PI): The ratio of the present value of future cash flows to the initial investment. A ratio greater than 1 indicates a profitable project.

Example of Capital Budgeting Analysis

Let’s consider a scenario where a company is deciding whether to invest in a new project. The initial investment is $100,000, and the expected future cash flows over the next five years are as follows:

- Year 1: $30,000

- Year 2: $40,000

- Year 3: $35,000

- Year 4: $25,000

- Year 5: $20,000

To calculate the NPV, the company will use a discount rate of 10%. The formula for NPV is:

NPV = Σ [Cash Flow / (1 + r)^t] – Initial Investment

Where:

- r = discount rate (10%)

- t = time period (1, 2, 3, 4, 5)

- Cash Flow = expected future cash flow in each period

By calculating the present value of each cash flow and subtracting the initial investment, the company can determine if the project will yield a positive return or not.

Financial Statement Analysis Techniques

Evaluating the financial health of an organization requires a thorough analysis of its financial statements. These documents provide insights into the company’s profitability, liquidity, solvency, and overall financial position. By applying various techniques, stakeholders can better understand a company’s performance, assess risks, and make informed decisions regarding investments, lending, or business operations. These techniques often involve the use of ratios, trends, and comparisons to industry standards or competitors.

Key Techniques for Financial Analysis

There are several methods commonly employed to analyze financial statements. These techniques help break down complex information into more digestible metrics that reveal underlying trends and performance indicators:

- Ratio Analysis: A tool for evaluating relationships between different financial variables, such as profitability, liquidity, and leverage.

- Trend Analysis: Analyzing financial data over multiple periods to identify patterns and forecast future performance.

- Common-Size Statements: These statements standardize financial information by converting all figures into percentages, allowing for easier comparisons across companies and time periods.

- Vertical and Horizontal Analysis: Vertical analysis involves looking at each line item as a percentage of total sales, while horizontal analysis compares financial statements across periods to assess growth or decline.

Example of Ratio Analysis

One of the most common approaches in financial analysis is ratio analysis. It helps assess various aspects of a company’s operations. Below is an example of key financial ratios derived from the balance sheet and income statement of a hypothetical company:

| Ratio | Formula | Result |

|---|---|---|

| Current Ratio | Current Assets / Current Liabilities | 1.5 |

| Return on Equity (ROE) | Net Income / Shareholder’s Equity | 12% |

| Debt-to-Equity Ratio | Total Debt / Total Equity | 0.5 |

In this example, the current ratio of 1.5 indicates that the company has sufficient short-term assets to cover its short-term liabilities. The return on equity of 12% suggests that the company is generating a relatively strong return on shareholders’ investment, while the debt-to-equity ratio of 0.5 implies a conservative approach to leveraging debt in relation to equity.

Leverage and Capital Structure Insights

The ability of a company to use borrowed funds for investment purposes plays a critical role in its financial strategy. The balance between debt and equity is a fundamental aspect of a company’s capital structure. By adjusting this mix, companies can influence their risk levels, potential returns, and overall financial stability. Understanding leverage and its impact on returns, costs, and financial performance is key for managers and investors alike.

Leverage, in its simplest form, refers to the use of debt to amplify potential returns on investment. A higher proportion of debt can lead to greater profits when investments perform well, but it also increases the risk if the company faces challenges in generating returns or servicing debt. On the other hand, equity financing offers a lower-risk alternative but can dilute ownership and return on equity.

The optimal capital structure is one that strikes a balance between these two funding sources, minimizing the cost of capital while maintaining financial flexibility and managing risk effectively. Understanding how leverage affects both profitability and risk is crucial in decision-making processes, especially for long-term growth and stability.

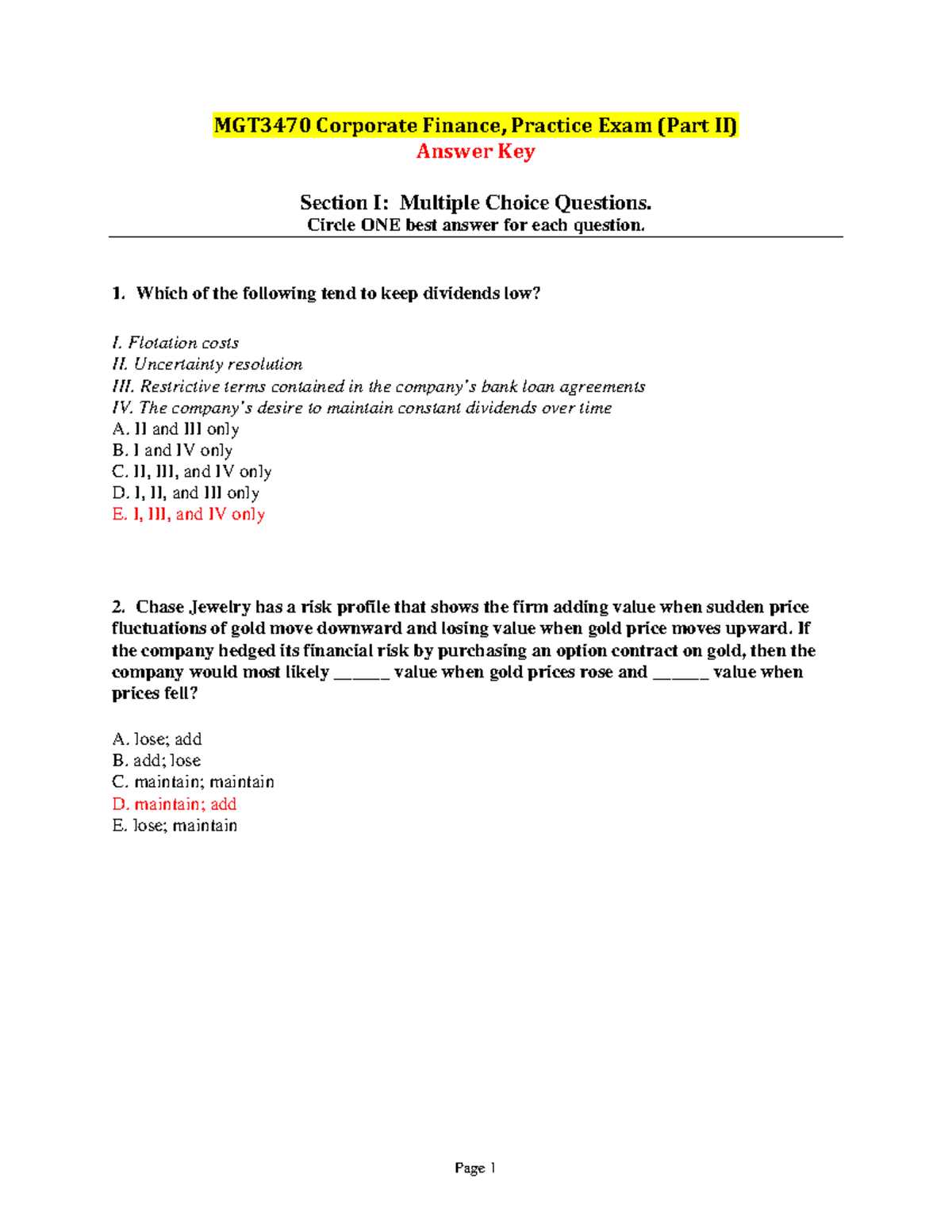

Dividend Policy Questions in Exams

The decision regarding how much of a company’s earnings should be returned to shareholders in the form of dividends is a critical aspect of its financial strategy. This decision influences both the company’s long-term growth prospects and its appeal to investors. Understanding the underlying factors that drive dividend policy is essential for assessing a company’s approach to managing profit distribution while balancing the need for reinvestment in operations.

Factors Influencing Dividend Policy

Several elements play a role in determining the dividend distribution strategy of a company. These factors include:

- Profitability: A company’s ability to generate consistent profits affects its capacity to pay dividends. Strong earnings often lead to higher payouts, while periods of low profitability may result in reduced or suspended dividends.

- Cash Flow: Even profitable companies must ensure they have sufficient liquidity to meet dividend commitments. Cash flow is essential in ensuring that dividends can be paid without compromising the company’s ability to meet other financial obligations.

- Growth Opportunities: Companies that are in a high-growth phase may prefer to reinvest their earnings back into the business rather than paying out dividends, as this could provide a higher return in the long run.

- Tax Considerations: Tax policies affect the attractiveness of dividend payments for shareholders, as dividends may be taxed at different rates compared to capital gains.

Types of Dividend Policies

Different companies adopt various dividend policies based on their financial position and strategic goals. Some common types of policies include:

- Stable Dividend Policy: A company aims to maintain a steady or gradually increasing dividend payout, even during times of fluctuating earnings.

- Residual Dividend Policy: Dividends are paid out based on the remaining profits after investment needs have been met. This policy ensures that funding for growth is prioritized before shareholder returns.

- Constant Payout Ratio: A fixed percentage of earnings is paid as dividends, which fluctuates as earnings change.

Cost of Capital and Valuation Basics

Understanding the cost of obtaining capital is essential for evaluating investment opportunities and determining the value of a company or project. This concept reflects the return a business must earn on its investments to satisfy the expectations of investors, whether they are debt holders or equity holders. A proper assessment of the cost of capital helps ensure that the company is using its resources efficiently and is in a position to generate value for its shareholders.

Determining the Cost of Capital

The cost of capital is typically calculated by considering both debt and equity components. Each source of capital carries its own cost, which must be factored into investment decisions:

- Cost of Debt: This refers to the interest rate the company must pay on its borrowings. It is adjusted for tax effects since interest expenses are tax-deductible.

- Cost of Equity: The return required by shareholders based on the risk associated with owning the company’s stock. This is often estimated using models such as the Capital Asset Pricing Model (CAPM).

- Weighted Average Cost of Capital (WACC): A combined measure of the cost of debt and equity, weighted by their respective proportions in the company’s capital structure. WACC is widely used in evaluating investment projects.

Valuation Techniques for Investments

Valuation involves estimating the value of a business or asset based on various financial metrics. The most commonly used methods include:

- Discounted Cash Flow (DCF) Method: This method involves forecasting the future cash flows of a business and discounting them back to present value using the cost of capital. DCF is widely used for its comprehensive nature, as it considers both the timing and magnitude of cash flows.

- Comparable Company Analysis: This technique values a company by comparing it to similar firms in the industry. Common multiples such as Price-to-Earnings (P/E) ratio or Enterprise Value-to-EBITDA are used to estimate value.

Effective Study Tips for Exam Success

Preparing for a challenging assessment requires a strategic approach to ensure thorough understanding and retention of key concepts. Successful study habits not only improve performance but also reduce anxiety and increase confidence. A focused and organized plan, combined with active learning techniques, can make all the difference when it comes to achieving desired results.

Key Strategies for Efficient Learning

There are several techniques that can enhance the effectiveness of your study sessions:

- Active Recall: Instead of passively reading notes, actively test yourself on the material. This can help reinforce your memory and identify areas that need further attention.

- Spaced Repetition: Review material multiple times over increasing intervals. This technique helps improve long-term retention of information.

- Study Groups: Collaborating with peers can provide new perspectives and help clarify complex topics. Group discussions often lead to a deeper understanding of concepts.

- Breaks and Rest: Take regular breaks during study sessions to avoid burnout. Short intervals of rest allow your brain to process and retain information more effectively.

Organizing Your Study Schedule

Planning your study time is crucial for covering all topics without feeling overwhelmed. Consider the following tips:

- Prioritize Topics: Identify the most important areas that are likely to be tested and spend more time on them. Focus on weak spots but also ensure to review familiar material to reinforce your knowledge.

- Time Management: Break study sessions into manageable chunks. Set specific goals for each session to stay on track and avoid cramming.

- Simulate Test Conditions: Practice with mock tests or timed quizzes to get comfortable with the format and pace. This helps you manage time effectively during the actual assessment.

Common Mistakes in Assessments

During assessments, students often make several key mistakes that can negatively impact their overall performance. These errors are typically a result of misunderstandings, poor time management, or overlooking important details. Recognizing these pitfalls in advance can help improve preparation and boost confidence on test day.

Failure to Understand Key Concepts

One of the most frequent mistakes is not fully grasping fundamental principles. While memorization can help in some cases, truly understanding the underlying concepts is crucial. Some common issues include:

- Relying on Memorization: Focusing only on rote learning without understanding the “why” behind the formulas and principles can lead to confusion during problem-solving.

- Misinterpreting Questions: Misunderstanding what is being asked can cause errors in both calculations and reasoning. Carefully reading each question and identifying the key components is vital.

Poor Time Management

Another common mistake is ineffective use of time during the assessment. Many students spend too much time on a single question or leave themselves insufficient time to complete the entire test. Effective time management can help avoid these issues:

- Not Allocating Enough Time: Spending too long on one problem can cause you to rush through others, resulting in missed opportunities to score points.

- Skipping Practice with Timed Tests: Not simulating real test conditions can lead to poor time management during the actual assessment. Practicing under timed conditions helps develop a better sense of pacing.

Ethical Considerations in Assessments

In any academic assessment, maintaining ethical standards is crucial to ensure fairness and integrity. The way students approach their studies and handle assessment tasks can have a significant impact on the credibility of the evaluation process. Understanding the ethical boundaries and the importance of honesty in assessments helps uphold the value of the results and contributes to a trustworthy learning environment.

One of the most critical ethical issues is academic dishonesty, which can manifest in various forms, such as cheating, plagiarism, or unauthorized collaboration. These actions undermine the effort of others and distort the purpose of the assessment, which is to evaluate an individual’s understanding and skills. To avoid such mistakes, students should:

- Avoid Plagiarism: Ensure that all work submitted is original and properly referenced, giving credit to sources where necessary.

- Refrain from Unauthorized Assistance: Working with others in a way that violates assessment rules not only disrespects the learning process but also risks severe academic penalties.

Additionally, students should be aware of the ethical responsibility of honesty in self-assessment. Accurately reflecting on one’s own strengths and weaknesses without exaggeration or self-deception is key to personal growth. Students who understand and embrace these principles foster a positive academic culture and demonstrate their commitment to learning with integrity.

How to Tackle Complex Case Studies

Approaching intricate case studies requires a structured method and a clear understanding of the problem at hand. These tasks often involve multiple components, such as analyzing data, assessing alternatives, and drawing conclusions. Without a methodical approach, it can be easy to become overwhelmed. By breaking down the case into manageable steps, students can develop a comprehensive understanding of the situation and provide well-supported solutions.

Steps to Effectively Solve Case Studies

When dealing with complex case studies, a logical and systematic approach is essential. Here are some key strategies:

- Understand the Problem: Thoroughly read through the case study to grasp the core issue. Identify the main challenge and its underlying factors.

- Gather Relevant Information: Collect all data, financials, or other key details that are provided. Organize this information in a way that makes it easy to refer back to.

- Analyze the Situation: Break down the case into smaller segments. Look for patterns, relationships, or inconsistencies in the data that may provide insight into potential solutions.

- Explore Possible Solutions: Evaluate the various alternatives based on their feasibility, pros, and cons. Consider any risks or potential outcomes that may arise from each option.

- Formulate Recommendations: Based on your analysis, recommend the most suitable course of action. Ensure that your recommendations are well-supported by facts and logical reasoning.

Common Pitfalls to Avoid

While solving case studies, some common mistakes can hinder your ability to craft an effective solution:

- Ignoring Key Details: Sometimes, minor details in the case study can provide crucial insights. Be sure not to overlook any important information.

- Overcomplicating the Problem: It’s easy to get caught up in unnecessary complexity. Stick to the facts and focus on the most important aspects of the case.

- Failing to Address All Stakeholders: Often, a case will involve multiple parties with differing perspectives. Consider all viewpoints before making recommendations.

By following a structured approach and being mindful of potential pitfalls, students can confidently tackle complex case studies and develop effective solutions that demonstrate a deep understanding of the issue at hand.

Exam Strategies for Time Management

Effective time management is essential for success during high-pressure assessments. With limited hours to showcase your knowledge, managing your time wisely ensures that you allocate enough focus to each task while maintaining a steady pace throughout the session. A well-planned approach allows you to cover all required material, avoid unnecessary stress, and maximize your performance.

Planning Your Approach

Before diving into the questions, it’s important to set up a clear strategy that will guide you throughout the entire process. Here are some key steps:

- Familiarize Yourself with the Format: Understand the structure of the test. Whether it’s multiple-choice, long-form, or a mix of both, knowing the format helps you allocate your time more effectively.

- Allocate Time for Each Section: Based on the weight of each section, assign specific time slots. This ensures that you don’t spend too much time on a single part, leaving insufficient time for others.

- Prioritize Simpler Tasks: Start with the questions or tasks that you can answer quickly and confidently. This helps build momentum and boosts your confidence for more challenging sections.

- Leave Time for Review: Reserve the last few minutes to review your answers. Double-check for any mistakes or missed questions, ensuring that everything is addressed before submitting your work.

During the Assessment

While taking the assessment, staying mindful of the clock and adjusting your strategy as necessary is key. Here are some tips for managing your time effectively during the test:

- Stay Calm and Focused: If you encounter a difficult question, don’t panic. Move on to other tasks and come back to it later with a fresh perspective.

- Monitor Your Progress: Keep track of time as you progress through the test. If you’re spending too long on one question, adjust your pace to make sure you cover all areas.

- Don’t Overthink: Sometimes, the simplest answer is the correct one. Avoid overanalyzing questions and trust your instincts.

By implementing these time management strategies, you can optimize your approach to assessments and ensure that you have enough time to showcase your knowledge while reducing stress.

Understanding Financial Markets for Exams

Grasping the functioning of financial markets is crucial for success in assessments focused on economic systems and investment practices. These markets are where various assets are bought and sold, and understanding their dynamics helps individuals make informed decisions. Being able to identify the roles of different participants, how prices are set, and the impact of various factors on market performance is essential for achieving a thorough understanding.

Financial markets play a central role in the global economy. They facilitate the movement of capital between those who need it, such as businesses and governments, and those who have it, such as individual and institutional investors. By participating in these markets, investors can gain returns on their investments while businesses can raise the necessary funds for expansion and development. A key aspect of understanding these markets is recognizing the different types of instruments traded, ranging from stocks and bonds to derivatives and commodities.

The Role of Different Market Participants

There are various players within the financial markets, each with distinct roles and responsibilities. Some of the key participants include:

- Investors: Individuals or institutions that buy and sell financial assets to generate returns.

- Borrowers: Entities, such as governments or companies, that issue bonds or other forms of debt to raise capital.

- Market Makers: Firms or individuals that provide liquidity by buying and selling securities to ensure the smooth functioning of the market.

- Regulators: Government bodies that oversee and regulate market activities to ensure fairness and prevent manipulation.

Factors Influencing Market Movements

The performance of financial markets is influenced by a variety of factors. Key elements include:

- Economic Indicators: Data such as GDP growth rates, inflation, and unemployment figures that provide insight into the overall health of an economy.

- Interest Rates: Central bank policies and interest rate adjustments can directly impact the flow of money within financial markets.

- Market Sentiment: The collective mood or perception of investors, often influenced by news, trends, and speculation.

- Political Events: Elections, policy changes, and geopolitical developments can lead to market fluctuations.

By understanding these elements, individuals can gain a clearer picture of how markets operate and how various forces impact asset prices, aiding in effective decision-making and analysis.

Practice Questions for Corporate Finance

Practicing with sample scenarios is an effective way to prepare for any assessment that covers economic principles and investment strategies. By working through various exercises, individuals can refine their understanding and improve problem-solving skills. These exercises often test knowledge of key concepts such as risk management, capital allocation, and asset valuation, allowing one to solidify their grasp of the subject matter.

When preparing for an assessment, it’s important to practice not only straightforward calculations but also to consider the real-world applications of the theories being tested. For example, evaluating different funding options, determining the impact of financial leverage, or assessing the value of an investment can help build a comprehensive understanding of the material.

Sample Problem 1: Investment Valuation

You are considering investing in a project that will generate cash flows of $100,000 per year for the next five years. The required rate of return is 8%. What is the net present value (NPV) of the project?

- Step 1: Use the formula for NPV: NPV = ∑ (Cash Flow / (1 + r)^t) – Initial Investment

- Step 2: Apply the given cash flows and rate of return to the formula.

- Step 3: Interpret the result and determine whether the investment is worthwhile.

Sample Problem 2: Cost of Capital

A company has a debt-to-equity ratio of 0.6 and a cost of debt of 5%. The cost of equity is 10%. What is the company’s weighted average cost of capital (WACC) if the corporate tax rate is 30%?

- Step 1: Use the formula for WACC: WACC = (E/V) * Re + (D/V) * Rd * (1 – Tc)

- Step 2: Substitute the given values into the formula.

- Step 3: Calculate the WACC and analyze the result.

By working through problems like these, one can gain a deeper understanding of the material and better prepare for any assessments that involve similar concepts.