When preparing for a key assessment in economic theory, it’s crucial to focus on the core principles that define the functioning of economies. Understanding the dynamics that shape national output, inflation, unemployment, and government interventions will help you tackle any question effectively. The key to success lies in grasping the relationships between these economic indicators and their real-world implications.

Mastering the material requires more than memorization. It involves interpreting economic models, analyzing graphs, and applying theoretical concepts to practical situations. Developing a deep understanding of how different policies and market forces interact is essential for solving complex problems and formulating informed responses during your test.

By focusing on critical topics such as supply and demand, government fiscal actions, and monetary systems, you will be equipped to address the variety of questions that may arise. With the right study approach and a clear strategy, you’ll be ready to demonstrate your knowledge and apply it to real-life scenarios.

Macroeconomics Exam 2 Answers

In this section, we will explore the most important concepts you need to understand in order to approach your upcoming test effectively. It’s essential to familiarize yourself with the key economic principles, as well as how to apply these ideas to real-world scenarios. By focusing on critical topics such as market equilibrium, government policies, and economic growth, you can significantly improve your ability to tackle complex questions.

Key areas to concentrate on include the interactions between supply and demand, fiscal and monetary policies, and the factors that influence national income. Understanding these topics at a deeper level will not only help you answer theoretical questions but also enable you to critically analyze and interpret data, which is often required in problem-solving sections.

Preparedness is key when it comes to answering different types of questions, whether they involve theoretical explanations, graphical analysis, or the application of formulas. By practicing regularly and testing your knowledge, you will build the confidence needed to excel under exam conditions.

Key Concepts to Review for the Exam

Before tackling any assessment, it’s crucial to focus on the fundamental principles that shape the functioning of an economy. A solid grasp of these core concepts will provide the foundation needed to understand more complex ideas and effectively solve problems. These topics are not only central to the subject but also essential for interpreting data and analyzing economic trends.

Among the most important ideas to review are the relationships between national output, inflation, unemployment, and government intervention. Understanding how these factors interact will enable you to apply theoretical knowledge to practical questions. Additionally, it’s vital to become familiar with economic models, market structures, and policy effects, as they often form the basis of exam content.

By mastering these critical areas, you’ll be well-equipped to answer a range of questions with confidence and clarity, whether they’re theoretical or data-driven.

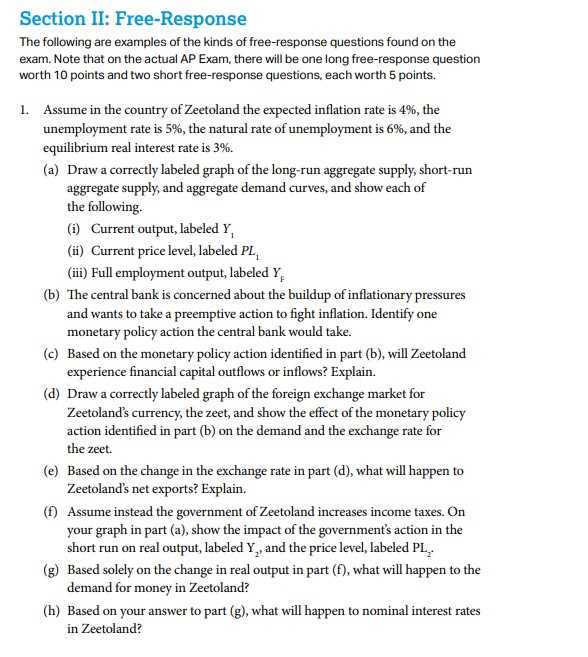

Understanding Aggregate Demand and Supply

One of the key components in studying how economies function is understanding the forces that drive overall economic activity. The total demand for goods and services within an economy, as well as the total output that businesses are willing to produce at various price levels, plays a central role in determining economic health. Grasping these two concepts will help you analyze how shifts in these forces influence inflation, output, and employment.

Aggregate Demand

Aggregate demand represents the total quantity of goods and services demanded in an economy at different price levels, considering factors like consumer spending, investment, government purchases, and net exports. A decrease in any of these components can lead to a reduction in overall demand, impacting economic growth.

Aggregate Supply

On the other hand, aggregate supply reflects the total output of goods and services that producers are willing and able to supply at various price levels. The supply curve typically slopes upward, indicating that higher prices encourage more production. Factors such as labor availability, capital investment, and technological advancements influence this curve.

| Factor | Impact on Aggregate Demand | Impact on Aggregate Supply |

|---|---|---|

| Consumer Confidence | Increase in demand as consumers spend more | Minimal impact |

| Interest Rates | Higher rates reduce demand by making borrowing more expensive | Can affect production costs, reducing supply |

| Government Spending | Increases overall demand | May increase supply by stimulating investment in infrastructure |

Both of these forces, when studied together, provide insight into the balance between total demand and supply, and how shifts in these factors can lead to changes in the overall economic conditions.

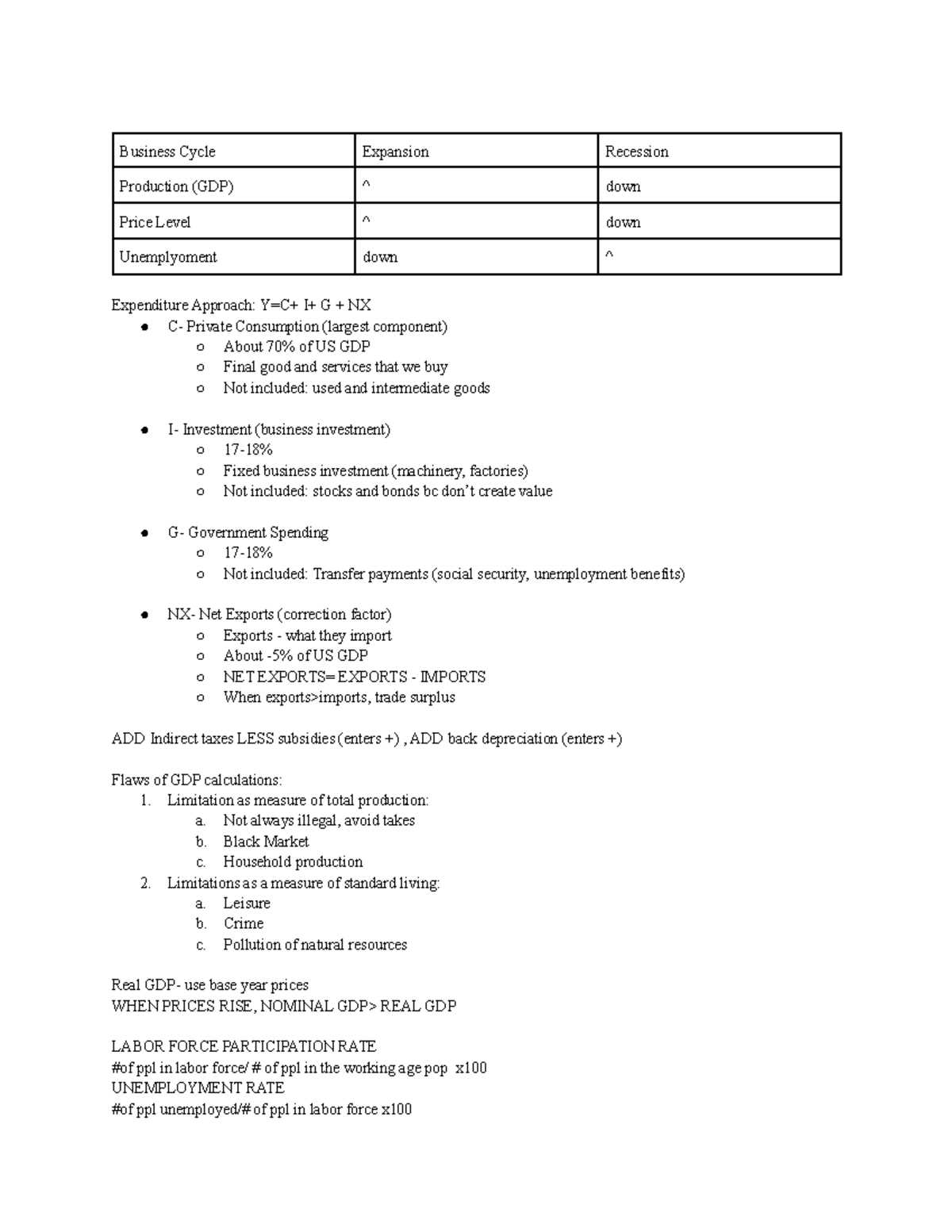

Real vs Nominal GDP Explained

When analyzing the economic performance of a country, one of the most important metrics is the total value of all goods and services produced. However, there are two distinct ways to measure this output, each reflecting different aspects of economic health. Understanding the difference between these two approaches is essential for accurate interpretation and comparison of economic data over time.

Nominal GDP

Nominal GDP refers to the total value of goods and services produced in an economy, measured using current prices during the period in question. This figure does not account for inflation or changes in the price level, meaning it can be influenced by both changes in output and shifts in prices. As a result, nominal GDP can give a distorted view of economic growth if inflation is not considered.

Real GDP

In contrast, real GDP adjusts for inflation by using constant prices from a base year, providing a more accurate reflection of an economy’s true growth over time. By removing the effects of price changes, real GDP allows for better comparisons across different years, showing whether the increase in output is due to actual growth or just higher prices.

While nominal GDP can give an immediate snapshot of the economy, real GDP provides a clearer picture of economic progress by showing changes in production levels without the distortion caused by inflation. Understanding both metrics is crucial for making informed decisions regarding economic policy and investment strategies.

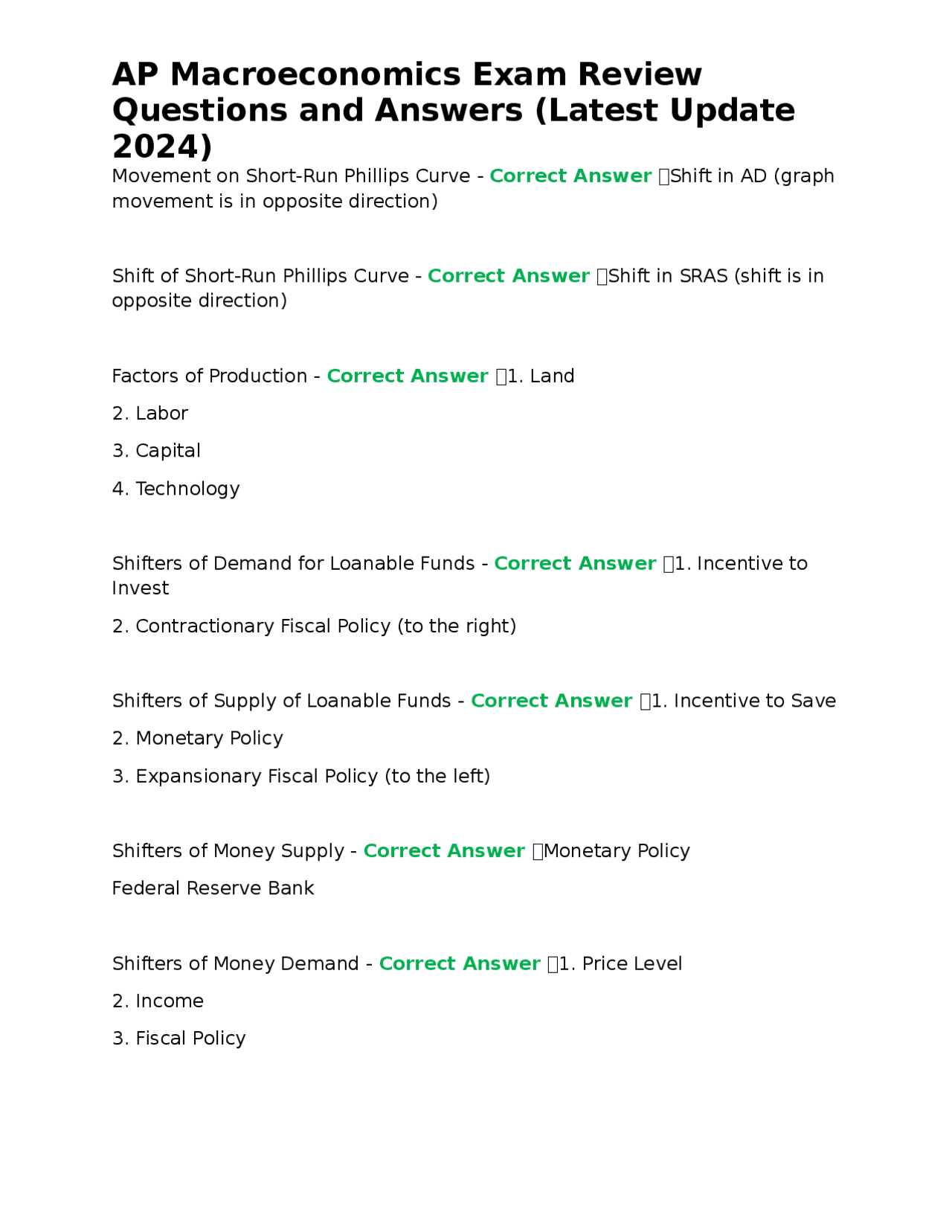

Monetary Policy and Its Impact

One of the primary tools used by governments to manage an economy is the regulation of the money supply. This approach aims to influence inflation, unemployment, and overall economic growth. Through strategic adjustments to interest rates and the money supply, monetary authorities can stimulate or cool down an economy, making it a powerful tool for maintaining economic stability.

Key Instruments of Monetary Policy

The central bank typically uses a few main instruments to implement monetary policy effectively:

- Interest Rates: By adjusting the rate at which banks borrow money, the central bank can encourage or discourage borrowing and spending throughout the economy.

- Open Market Operations: This involves buying and selling government securities to influence the amount of money circulating in the economy.

- Reserve Requirements: The central bank may change the amount of reserves that banks are required to hold, which directly affects their lending capacity.

Impact of Monetary Policy on the Economy

The effects of monetary policy are far-reaching and influence various economic factors:

- Inflation Control: By raising interest rates, the central bank can reduce borrowing and spending, which helps to control rising prices.

- Economic Growth: Lower interest rates can stimulate investment and consumption, leading to higher economic activity and growth.

- Unemployment Rates: Adjusting the money supply can indirectly affect the labor market, with lower rates encouraging business expansion and job creation.

In summary, monetary policy is a critical lever that central banks use to influence the broader economy. By carefully managing the supply of money and credit, they can help stabilize prices, encourage growth, and reduce unemployment, all while aiming to prevent the economy from overheating or falling into recession.

Fiscal Policy and Government Spending

Government spending plays a vital role in influencing the overall economic performance of a nation. By adjusting its expenditure and taxing strategies, the government can affect the level of demand within the economy, drive economic growth, and manage inflation. Understanding how fiscal decisions impact public services, infrastructure, and the broader economic environment is crucial for analyzing national economic health.

Fiscal policy primarily focuses on two main actions: government spending and taxation. Both are used to influence aggregate demand, employment, and overall economic activity. These tools are often employed in response to economic conditions such as recessions or periods of inflation, with the aim of stabilizing or stimulating the economy.

| Government Action | Effect on the Economy |

|---|---|

| Increased Government Spending | Stimulates demand, boosts economic growth, and reduces unemployment. |

| Tax Cuts | Increases disposable income, encourages consumption and investment. |

| Increased Taxes | Reduces disposable income, slows down consumption, and can help control inflation. |

Through careful management of spending and tax policies, the government can guide the economy toward its desired objectives, such as full employment or price stability. However, excessive reliance on fiscal policy without proper planning can lead to budget deficits or higher public debt, which can have long-term negative effects on the economy.

Inflation and Unemployment Relationship

The relationship between inflation and unemployment is a crucial concept in economic theory. These two factors are often seen as interconnected, with changes in one influencing the other. Economists and policymakers study this relationship to understand how fluctuations in the job market affect price levels, and vice versa. A balance between these two variables is vital for maintaining economic stability and ensuring sustainable growth.

Trade-Off Between Inflation and Unemployment

Traditionally, there is a trade-off between inflation and unemployment, often illustrated by the Phillips Curve. The basic idea is that when unemployment is low, inflation tends to rise due to increased demand for goods and services, which puts upward pressure on prices. Conversely, during times of high unemployment, demand tends to fall, leading to lower inflation rates.

Factors Influencing the Relationship

Several factors can affect the balance between inflation and unemployment:

- Demand Shocks: Sudden increases or decreases in demand for goods and services can lead to changes in both price levels and employment rates.

- Supply Shocks: Events such as natural disasters or increases in the cost of raw materials can disrupt production, leading to inflationary pressures while also affecting employment.

- Monetary Policy: Central banks influence both inflation and unemployment through interest rate adjustments and money supply changes, aiming to stabilize the economy.

While the relationship between these two factors is complex and dynamic, understanding how they interact helps policymakers design strategies to manage inflation and promote job creation effectively. By monitoring these variables closely, economies can strive for a balance that supports both price stability and low unemployment.

The Role of Central Banks in Economy

Central banks play a fundamental role in shaping the economic landscape of a country. These institutions have significant influence over monetary policy, ensuring financial stability and supporting the broader economic environment. By managing the money supply, regulating interest rates, and overseeing financial systems, central banks help steer the economy toward sustainable growth and mitigate financial crises.

Monetary Policy and Economic Stability

Central banks are primarily responsible for implementing monetary policy, which involves controlling inflation and promoting economic growth. Through actions like adjusting interest rates and influencing the money supply, they can either stimulate the economy during periods of slow growth or cool it down when inflation becomes too high. These tools are crucial in maintaining price stability and ensuring that the economy operates within optimal parameters.

Regulation and Oversight of Financial Systems

In addition to managing monetary policy, central banks oversee and regulate the banking sector, ensuring that financial institutions operate within safe and sound guidelines. This regulatory role helps prevent excessive risk-taking and maintains trust in the financial system, which is essential for overall economic health. By acting as a lender of last resort during times of crisis, central banks also help prevent systemic collapses that could lead to widespread economic downturns.

Ultimately, central banks are vital for the long-term stability and prosperity of a nation’s economy. Their ability to influence key economic indicators, such as inflation, employment, and currency value, ensures they remain a cornerstone of modern economic policy.

Examining Economic Growth Factors

Economic growth is influenced by a range of factors that contribute to a nation’s overall output and living standards. Understanding the key drivers of growth helps policymakers and analysts identify the strengths and weaknesses of an economy, as well as develop strategies to promote long-term prosperity. These factors span from the availability of resources to technological advancements and the effectiveness of government policies.

One of the primary contributors to economic growth is the accumulation of capital, both physical and human. Investments in infrastructure, machinery, and technology enhance productivity, while improvements in education and workforce skills create a more efficient labor market. Additionally, sound fiscal and monetary policies can create a stable environment that encourages investment and innovation, further boosting growth.

Global factors, such as trade relationships and the flow of capital across borders, also play a significant role in shaping the economic trajectory of nations. A country’s ability to engage in international trade, attract foreign investment, and maintain competitive industries can provide a substantial boost to growth rates.

In sum, economic growth is a complex process driven by a variety of internal and external factors. By understanding these drivers, economies can work toward sustainable development that benefits both businesses and citizens alike.

Short-Run vs Long-Run Equilibrium

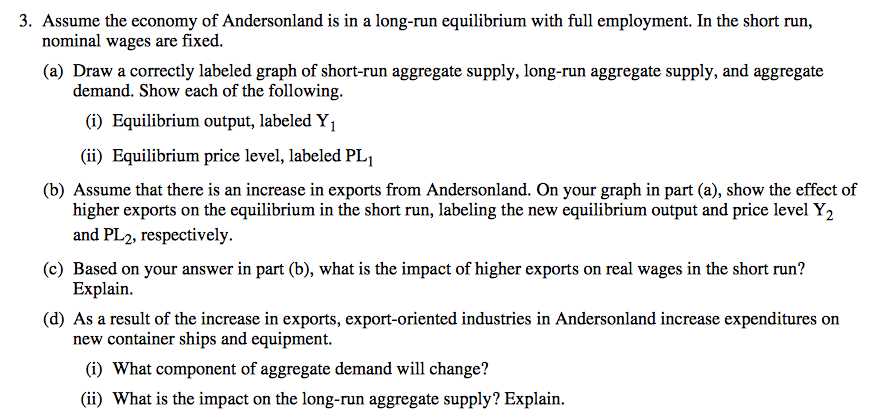

The concepts of short-run and long-run equilibrium are essential for understanding how an economy adjusts over time. In the short run, various factors may cause the economy to temporarily deviate from its ideal state, while in the long run, the economy tends to reach a more stable and sustainable condition. Understanding the differences between these two periods helps clarify how markets, production, and employment respond to changes in economic conditions.

Short-Run Equilibrium

In the short run, the economy is subject to fluctuations driven by factors such as changes in demand, supply shocks, or policy interventions. During this period, prices and wages are often sticky, meaning they do not adjust immediately to market conditions. As a result, the economy may experience periods of inflation, unemployment, or output gaps. Short-run equilibrium occurs when aggregate demand matches the aggregate supply at existing prices, but this balance may not be sustainable in the long term.

Long-Run Equilibrium

In contrast, long-run equilibrium refers to a state where the economy has fully adjusted to all changes and market forces operate efficiently. Over time, prices and wages are flexible, allowing the economy to reach a natural level of output where resources are fully employed. In the long run, any short-run fluctuations are corrected, and the economy stabilizes at its potential output, which is determined by factors like technology, capital, and labor force growth. At this point, the economy operates at full employment, and inflation remains under control.

While short-run and long-run equilibria may look very different, they are both vital for understanding how economic systems work. Policymakers and economists analyze these dynamics to forecast future trends and implement effective strategies for growth and stability.

Exchange Rates and International Trade

The value of a country’s currency relative to others plays a significant role in shaping global trade. Exchange rates influence the cost of imports and exports, affecting the balance of trade, business competitiveness, and overall economic growth. A fluctuating exchange rate can make a country’s products more affordable or expensive for foreign buyers, thus impacting international demand and supply.

How Exchange Rates Affect Trade

Exchange rates directly impact the prices of goods and services in the global market. A stronger currency makes imports cheaper and exports more expensive, potentially reducing demand for locally produced goods abroad. On the other hand, a weaker currency can make a country’s exports more attractive, boosting sales to foreign markets while raising the cost of imports.

- Strong Currency: Increases import purchasing power, but can reduce export competitiveness.

- Weak Currency: Enhances export demand, but raises costs for importing goods and services.

Factors Influencing Exchange Rates

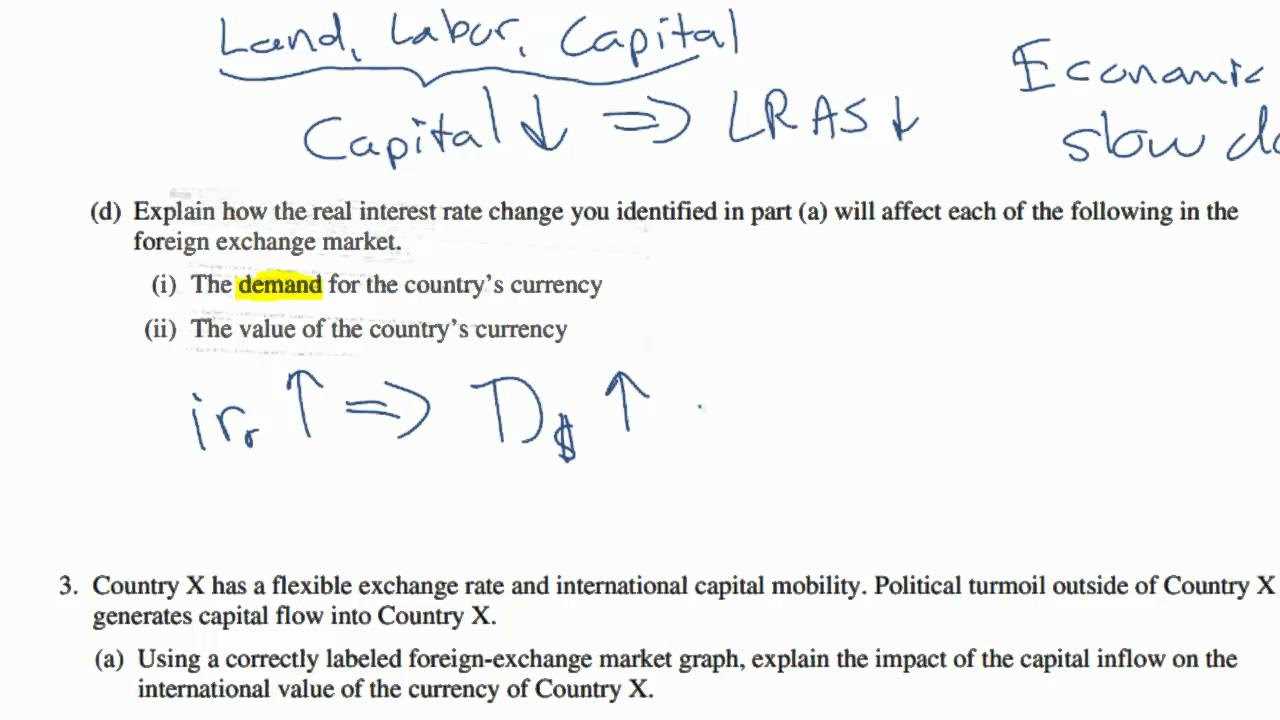

Several factors contribute to the fluctuations in exchange rates, including economic performance, inflation rates, interest rates, and market speculation. Countries with higher inflation rates often see a depreciation in their currency, while those with stronger economies or higher interest rates may experience an appreciation in their currency.

- Economic Stability: Countries with stable economies often have stronger currencies.

- Inflation: Higher inflation can lead to currency depreciation.

- Interest Rates: Higher interest rates can attract foreign investment, boosting the currency’s value.

In conclusion, exchange rates have a profound impact on international trade by influencing the relative prices of goods and services. As businesses and governments respond to changes in exchange rates, they must carefully monitor and adapt their strategies to maintain a competitive edge in global markets.

Macroeconomic Models You Should Know

Understanding the key frameworks that guide the analysis of economic activity is crucial for anyone studying economic dynamics. These models provide a structured way to examine the complex interactions between various factors, such as output, inflation, employment, and monetary policy. Each model serves a different purpose, helping economists and policymakers make predictions, evaluate strategies, and understand the broader economy.

There are several prominent models that are essential to grasp, as they highlight different aspects of economic behavior. From the analysis of short-term fluctuations to long-term growth trends, these models offer valuable insights into how economies operate. By studying these models, one can better understand the tools and mechanisms used to manage economic stability and growth.

Familiarity with these frameworks can enhance your ability to analyze economic conditions, anticipate trends, and evaluate the effects of policy decisions on the broader economic landscape. Whether you are examining the role of fiscal policy, the dynamics of supply and demand, or the impact of monetary interventions, these models serve as foundational tools for understanding economic behavior.

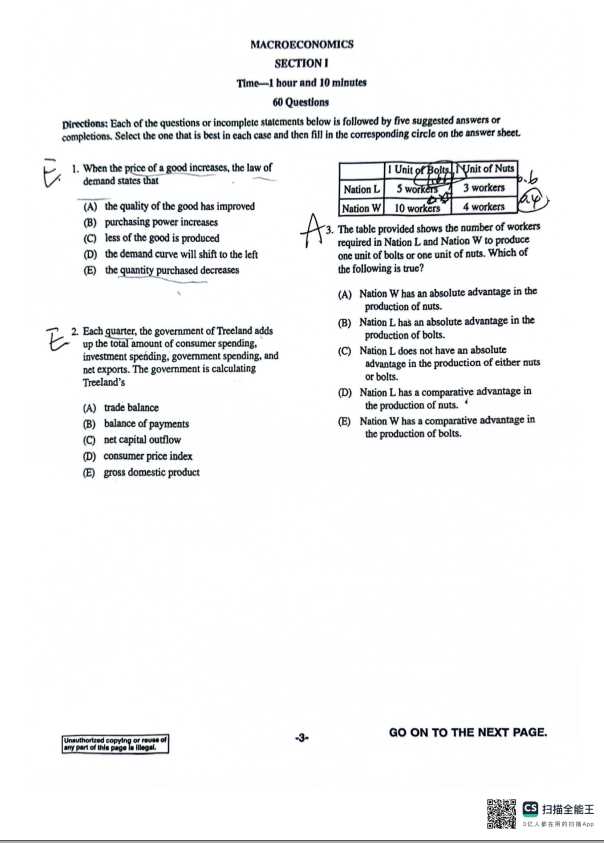

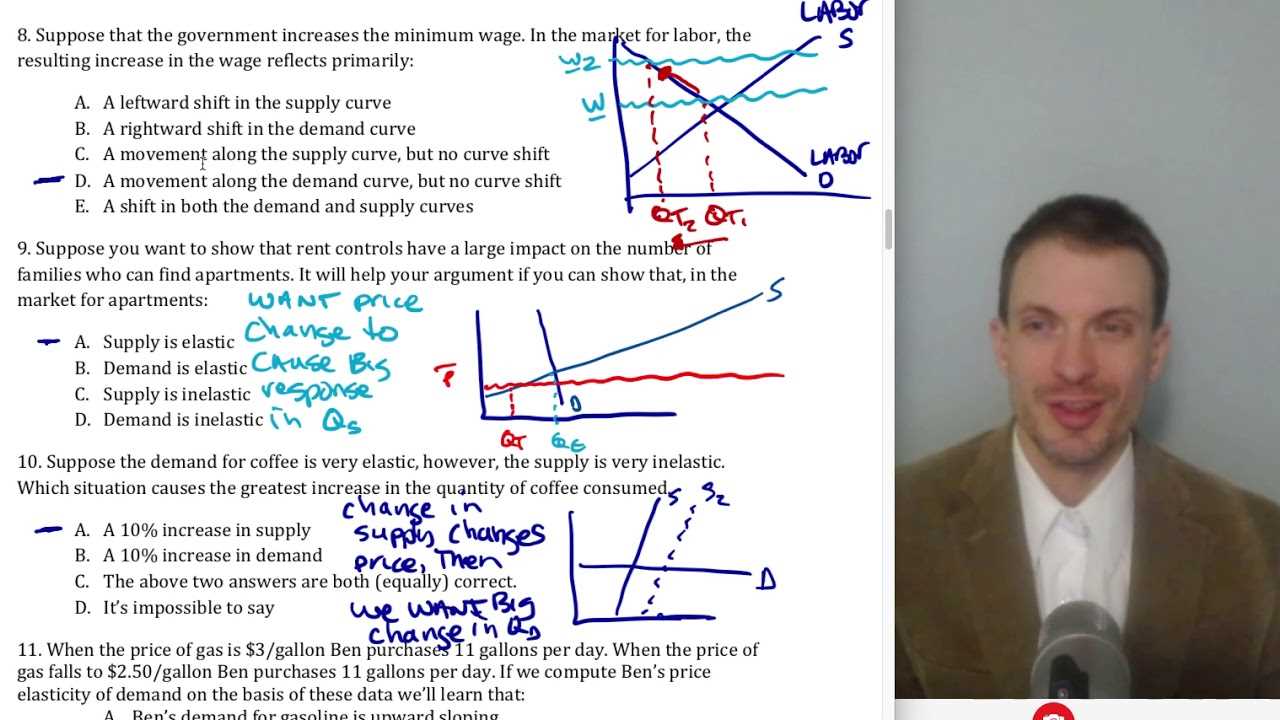

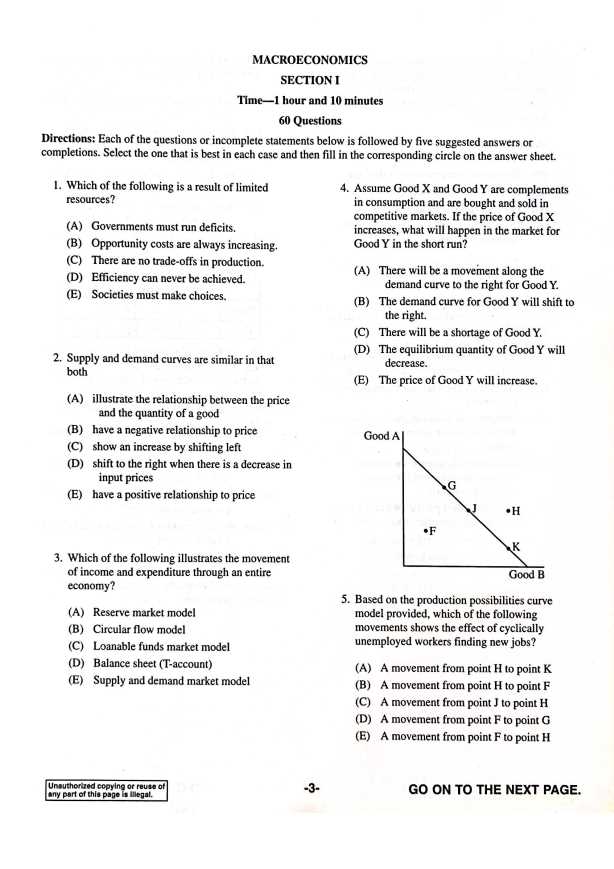

How to Approach Multiple-Choice Questions

When facing multiple-choice questions, it’s essential to develop a strategic approach that maximizes accuracy and efficiency. These types of questions often test your understanding of key concepts, requiring both knowledge and the ability to apply that knowledge quickly. By following a systematic method, you can improve your chances of selecting the correct answer, even when you are uncertain about some options.

Read Each Question Carefully: Start by carefully reading the question and all the answer choices. This ensures that you fully understand what is being asked. Often, multiple-choice questions contain subtle clues or qualifiers that can guide you toward the correct answer. Don’t rush–take your time to absorb the details.

Eliminate Clearly Wrong Answers: One of the most effective techniques is to immediately rule out any options that are clearly incorrect. This narrows down your choices and increases your likelihood of guessing correctly if you need to. By focusing only on the remaining choices, you make a more informed decision.

Consider All Options: Don’t settle on an answer too quickly. Even if one choice seems right, take a moment to check if any other option is more precise or complete. Sometimes, multiple answers can appear correct, but only one may fully answer the question in the context provided.

Use Logic and Context: If you’re uncertain, use logic to guide your decision. Think about the broader context of the question–how does the concept you’re being asked about relate to the other material you’ve studied? This can help you rule out implausible answers and focus on the most likely one.

By applying these strategies, you can approach multiple-choice questions with confidence and improve your performance on assessments. The key is staying calm, focused, and methodical as you work through each question.

Common Pitfalls in Macroeconomics Assessments

When preparing for assessments in economics, many students encounter recurring challenges that can hinder their performance. These obstacles often arise from misunderstandings of key concepts, poor time management, or simple misinterpretation of questions. Recognizing and addressing these pitfalls ahead of time can significantly improve results and reduce unnecessary stress during the assessment.

Common Mistakes to Avoid

Here are some frequent pitfalls that students should watch out for:

- Misinterpreting Key Terms: Pay close attention to specific terminology in the questions. Words like “inflation,” “supply,” or “growth” can have different meanings in different contexts. Misunderstanding these terms can lead to choosing the wrong answer.

- Rushing Through the Questions: It’s easy to feel pressured to finish quickly, but rushing can cause mistakes, especially in questions requiring careful analysis. Take your time to ensure you’re selecting the most accurate response.

- Not Reviewing Answer Choices Thoroughly: Sometimes, multiple answers can seem correct. Make sure to read all options before making your choice. Relying on the first one that seems right can lead to mistakes.

- Overlooking Important Details: Small details often make a big difference. Be sure to pay attention to qualifiers like “always,” “never,” or “mostly,” which can change the meaning of a statement.

- Skipping Difficult Questions: While it’s tempting to skip tough questions and come back later, this can lead to leaving important answers unfinished. If you’re unsure, try to narrow down the options before moving on.

How to Overcome These Pitfalls

To avoid falling into these traps, here are a few tips:

- Review Your Notes Regularly: Familiarize yourself with the key concepts and definitions so that you can confidently recognize them during the assessment.

- Practice Past Questions: Working through previous assessments helps you become familiar with the question format and how to approach different types of problems.

- Stay Calm and Focused: Stress can impair your ability to think clearly. Stay calm, breathe, and focus on each question individually.

- Read Carefully and Plan Your Time: Allocate your time wisely during the test, and ensure you read each question carefully to avoid missing important details.

By being aware of these common mistakes and taking proactive steps to avoid them, you can approach your assessments with greater confidence and improve your performance. Effective preparation and attention to detail are key to mastering economic concepts and excelling in evaluations.

Time Management Tips During the Assessment

Effective time management is crucial when it comes to taking any test. Without a clear strategy, it’s easy to run out of time before completing all questions or, conversely, to rush through the entire test and make avoidable errors. In order to maximize your performance, it’s important to organize your time wisely during the test, allowing sufficient focus on each section while ensuring that you don’t leave anything incomplete.

Essential Time Management Strategies

Here are some key time management tips to help you stay on track during your assessment:

- Familiarize Yourself with the Test Structure: Before beginning, take a few moments to scan through the entire test. This will give you a sense of its structure, allowing you to identify the more challenging sections and allocate time accordingly.

- Set a Time Limit for Each Section: Divide the total time by the number of sections or questions to set an appropriate time limit for each. This will help you avoid spending too much time on any one section.

- Prioritize Easier Questions: Start with questions that you find easier or quicker to answer. This will help you build momentum and leave more time for the more complex ones later.

- Keep Track of Time: Use a watch or a timer to monitor your progress. Make sure to glance at the clock periodically to avoid losing track of time.

- Don’t Get Stuck on One Question: If you come across a particularly difficult question, move on to the next one and come back to it later if you have time. Dwelling too long on one item can eat up valuable time.

Sample Time Allocation Table

Here’s an example of how you can allocate time for each section of the test:

| Section | Number of Questions | Time to Spend (Minutes) |

|---|---|---|

| Section 1: Easy Questions | 10 | 15 |

| Section 2: Medium Difficulty | 8 | 20 |

| Section 3: Difficult Questions | 5 | 20 |

| Review & Check | N/A | 10 |

By applying these strategies, you can ensure that you stay focused, calm, and organized throughout your assessment. With good planning, you’ll be able to make the most of your time and complete the test efficiently without feeling rushed or overwhelmed.

How to Analyze Economic Graphs

Understanding and interpreting economic graphs is a critical skill that helps in visualizing complex relationships between different variables. These graphical representations are used to illustrate various concepts, such as supply and demand, growth trends, inflation, and other economic phenomena. Being able to accurately analyze these graphs allows you to draw meaningful conclusions and make informed decisions based on the data presented.

To effectively analyze economic graphs, you need to follow a systematic approach. Start by carefully reviewing the axes, as they typically represent the variables under examination. Next, examine the overall shape and direction of the graph to determine trends and relationships. Whether you are looking at a curve or a line, understanding its slope and the direction it takes will give you valuable insight into the dynamics being represented.

Key Steps in Graph Analysis

Here are the essential steps to analyze an economic graph:

- Identify the Axes: Understand what each axis represents. The horizontal axis (x-axis) typically shows the independent variable, while the vertical axis (y-axis) shows the dependent variable.

- Examine the Trend: Look for patterns or trends in the graph. Is the curve moving upwards, downwards, or remaining constant? These trends can indicate positive or negative relationships between the variables.

- Consider the Scale: Pay attention to the scale of the graph. A small change on the graph might indicate a significant change in real-world terms, depending on the scale used.

- Look for Intersections: Intersections or points where curves meet often represent equilibrium or turning points in the data. Understanding these can help you identify key shifts in the economy.

- Interpret the Slope: The steepness of a curve or line reveals the rate of change. A steeper slope indicates a rapid change, while a flatter one suggests a slower rate.

Example of Economic Graph Interpretation

Let’s consider a basic supply and demand graph. The intersection point where the supply curve meets the demand curve represents the equilibrium price and quantity. If the demand increases, the demand curve shifts to the right, leading to a higher equilibrium price. Conversely, if supply increases, the supply curve shifts to the right, resulting in a lower price.

By following these steps and practicing your graph analysis skills, you can become more adept at interpreting economic data and drawing conclusions that are essential for understanding economic phenomena.

Reviewing Key Formulas for the Exam

Mastering essential mathematical formulas is crucial when preparing for assessments that involve economic concepts. These formulas serve as tools for solving problems related to growth, inflation, productivity, and other vital aspects of economic theory. Knowing when and how to apply these equations can greatly enhance your ability to analyze and interpret various economic situations efficiently.

By familiarizing yourself with the most commonly used formulas, you can ensure that you’re well-equipped to tackle different types of questions that may arise during the assessment. These formulas can help in determining key economic indicators, such as GDP, inflation rates, or the relationship between various variables like price levels and output. Additionally, understanding the underlying principles behind each formula will enable you to approach problems with greater confidence and accuracy.

Below are some key formulas often used in economic assessments:

- Gross Domestic Product (GDP): GDP = C + I + G + (X – M)

This formula calculates the total value of goods and services produced within a country, where C is consumption, I is investment, G is government spending, and (X – M) is net exports (exports minus imports).

- Inflation Rate: Inflation Rate = (New CPI – Old CPI) / Old CPI * 100

This formula calculates the rate at which prices for goods and services increase over a specified period. CPI stands for Consumer Price Index, which measures price changes.

- Unemployment Rate: Unemployment Rate = (Number of Unemployed / Labor Force) * 100

This equation calculates the percentage of the workforce that is actively seeking but unable to find employment.

- Real GDP: Real GDP = Nominal GDP / (1 + Inflation Rate)

Real GDP adjusts the nominal GDP for inflation, providing a more accurate measure of a country’s output by accounting for changes in price levels.

- Labor Force Participation Rate: LFPR = (Labor Force / Working-Age Population) * 100

This formula measures the percentage of the working-age population that is actively employed or seeking employment.

As you review these formulas, it’s important to not only memorize them but also understand their significance in economic analysis. Knowing how and when to apply each formula allows you to break down complex scenarios and arrive at meaningful conclusions that are vital for assessment success.

Effective Study Strategies for Success

Achieving success in any assessment requires more than just reviewing materials; it involves adopting the right techniques to enhance understanding and retention. Effective study strategies help you not only grasp key concepts but also apply them efficiently when needed. By following a structured approach and using proven methods, you can improve your focus and maximize your potential.

Here are some practical study strategies to help you succeed:

- Active Recall: Instead of passively reviewing notes, try to recall key concepts from memory. This strengthens neural connections and enhances long-term retention.

- Spaced Repetition: Spread out your study sessions over time rather than cramming all at once. This method helps reinforce learning and ensures that you retain information for longer periods.

- Practice Problems: Apply what you’ve learned by solving practice problems. This not only helps solidify your understanding but also helps you become familiar with the format and types of questions that may arise.

- Group Study: Collaborate with peers to discuss difficult concepts. Explaining material to others is an effective way to deepen your understanding and address any gaps in your knowledge.

- Prioritize Weak Areas: Focus more on topics you find challenging. Allocate more time to areas where you struggle the most, while reviewing stronger areas with less intensity.

- Use Visual Aids: Diagrams, charts, and mind maps can help you visualize complex relationships and make abstract concepts more tangible.

- Time Management: Break your study sessions into focused intervals with short breaks in between. This maintains your energy levels and prevents burnout.

Incorporating these strategies into your study routine can help build a strong foundation for success. By staying organized, managing time wisely, and regularly assessing your progress, you’ll be better prepared for any academic challenge.