Preparing for the AP exam requires a deep understanding of fundamental concepts that shape the functioning of economies. The focus is on grasping key principles that influence both individual and national financial decisions. This knowledge is essential not only for answering questions but also for applying critical thinking to complex scenarios.

Mastering the core ideas of economic theory can greatly improve performance on the test. From supply and demand to government policies, each concept plays a significant role in shaping market outcomes. Familiarity with these concepts allows students to navigate through the exam with confidence and clarity.

Effective preparation involves understanding the nuances of various models and how they relate to real-world issues. By focusing on essential theories and learning how to apply them, students can approach their studies strategically, ensuring that they are ready for the challenges presented in the AP exam.

Krugman Economics for AP Answers

Understanding key principles that shape financial decision-making is crucial when preparing for the AP exam. The ability to analyze economic situations and apply theoretical models will help students respond to complex questions with accuracy. This section highlights essential topics that frequently appear on the test and provides insights into effectively mastering them.

To succeed, it’s important to familiarize yourself with both micro and macroeconomic theories. Below are several critical areas to focus on:

- Market Structures: Learn how different market types–perfect competition, monopoly, and oligopoly–affect price and output decisions.

- Government Intervention: Understand the role of fiscal and monetary policies in regulating economic stability.

- Externalities: Explore how government policies address unintended side effects in markets, such as pollution or public goods.

Beyond theoretical knowledge, practice applying these concepts to real-world scenarios. Effective exam preparation also involves:

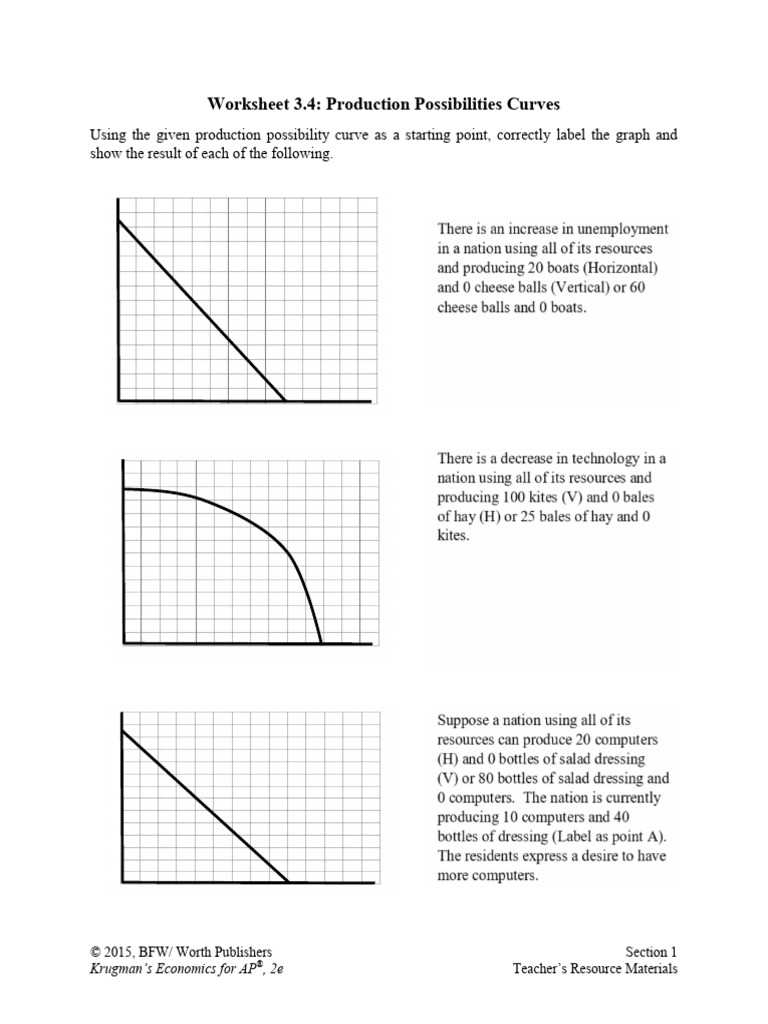

- Mastering Diagrams: Be able to draw and interpret various economic graphs, from supply-demand curves to aggregate demand and supply models.

- Critical Thinking: Question assumptions and think critically about how changes in one factor affect others within the system.

- Time Management: During the exam, allocate your time wisely between multiple-choice questions and essay responses.

By focusing on these key concepts and refining your application skills, you’ll be well-equipped to tackle the exam and showcase your understanding of economic systems.

Overview of Krugman’s Economic Theories

Paul Krugman is widely recognized for his contributions to the understanding of global economic systems, particularly through his analysis of market behavior, trade, and government interventions. His theories emphasize the importance of policy in shaping economic outcomes, especially in times of crisis. By examining how nations interact in a global market, Krugman sheds light on key dynamics that influence economic stability and growth.

Global Trade and Market Integration

Krugman’s analysis of international trade focuses on the benefits of open markets and global economic integration. He argues that free trade leads to increased efficiency, lower prices, and greater innovation. His work challenges the traditional views of protectionism and highlights the potential gains that countries experience through comparative advantage. Understanding his perspective on trade is essential for answering questions related to global economic interaction.

Role of Government in Economic Stability

Another core aspect of Krugman’s thought is his view on government intervention. He strongly advocates for active fiscal and monetary policies to combat economic recessions and ensure long-term growth. His work in this area has become increasingly relevant, especially in addressing economic downturns and financial crises.

| Key Concepts | Description | Impact on Economic Stability |

|---|---|---|

| Free Trade | Promotes global market integration and specialization based on comparative advantage. | Enhances efficiency, drives innovation, and reduces consumer prices. |

| Government Intervention | Focuses on fiscal policies such as stimulus spending and monetary measures to manage the economy. | Helps mitigate recessions, stabilize markets, and boost recovery. |

| Market Failures | Addresses situations where markets alone cannot allocate resources efficiently, such as in the case of externalities or public goods. | Government intervention is necessary to correct inefficiencies and ensure fair outcomes. |

Krugman’s theories provide a comprehensive framework for understanding how global markets operate and the essential role of government in maintaining economic stability. Mastering these concepts will be invaluable for those preparing for the AP exam.

Key Concepts in AP Economics Exam

To succeed in the AP exam, it is essential to grasp a variety of fundamental concepts that form the foundation of economic theory. These ideas are crucial for understanding how markets function, how government policies impact economies, and how various economic factors are interrelated. Mastering these concepts will help students navigate both multiple-choice questions and essay-based scenarios effectively.

Here are some of the most important topics that students should focus on:

- Supply and Demand: Understanding the laws of supply and demand is key to analyzing market behavior, determining prices, and predicting changes in equilibrium.

- Market Structures: Different market types–perfect competition, monopolies, and oligopolies–affect pricing, output, and efficiency in unique ways.

- Elasticity: Knowing how sensitive the demand for a good is to changes in its price or other factors is essential for analyzing consumer behavior.

In addition to these core topics, students should also familiarize themselves with the following areas:

- Fiscal Policy: Learn how government spending and taxation influence national economic performance, including issues like budget deficits and surpluses.

- Monetary Policy: Understand the role of central banks in controlling the money supply and influencing interest rates to maintain economic stability.

- International Trade: Study the impact of trade policies, tariffs, and exchange rates on global markets and national economies.

By thoroughly understanding these key concepts, students can approach the AP exam with confidence and a well-rounded knowledge of how economies function and react to various internal and external factors.

Understanding Market Structures for AP

In the study of how markets operate, it’s essential to understand the different types of market structures. These structures determine how goods and services are produced, priced, and distributed within an economy. Each type has distinct characteristics that influence the behavior of businesses and consumers, as well as the level of competition and market efficiency.

There are four primary market structures that students must be familiar with:

- Perfect Competition: This structure is characterized by many firms producing identical products, with no single firm able to influence the market price. It represents an idealized form of competition where consumers have many choices and prices are determined by supply and demand.

- Monopolistic Competition: In this structure, many firms sell similar but not identical products. Businesses differentiate their products through branding and advertising, leading to some degree of market power and price-setting ability.

- Oligopoly: A small number of large firms dominate the market in an oligopoly. These firms have significant control over prices and output, but they must consider the actions of their competitors when making decisions.

- Monopoly: A single firm controls the entire market for a particular good or service. This structure often results from barriers to entry, allowing the monopoly to set prices without competition.

Each market structure has its own implications for pricing, output, and the overall efficiency of the economy. Understanding the distinctions between them is crucial for answering questions on the AP exam, as they often appear in both theoretical and real-world context scenarios. By mastering these structures, students will be better equipped to analyze how different market environments affect economic outcomes.

How to Approach Krugman’s Models

When studying economic models, it is essential to approach them with a structured mindset, focusing on their underlying principles and how they apply to real-world situations. By understanding the assumptions, variables, and relationships in these models, students can better analyze and interpret their outcomes. This method not only helps in answering exam questions but also in grasping the broader concepts at play.

Start by identifying key assumptions within the model. These assumptions often simplify complex economic systems, allowing for clearer analysis. Recognizing these assumptions is critical as they set the boundaries within which the model is valid.

Next, focus on the relationships between different variables. Whether it’s the interaction between supply and demand, the effects of monetary policy, or the role of government intervention, understanding how changes in one variable affect others is central to applying the model effectively.

Don’t overlook the real-world applications. Theoretical models are built to represent idealized situations, but the real world often deviates from these ideal conditions. Be prepared to analyze how these models apply to current events or historical examples. By relating the theory to practical scenarios, you can better understand the model’s implications and answer exam questions more effectively.

By breaking down models in this way and practicing their application to various questions, students will gain a stronger grasp of the material and improve their ability to tackle complex exam scenarios with confidence.

Demand and Supply Principles Explained

Understanding the basic principles of demand and supply is essential for analyzing how markets function. These concepts form the foundation for much of economic theory, explaining how prices are determined and how resources are allocated in different types of markets. Both demand and supply are influenced by various factors, and their interaction ultimately dictates the price and quantity of goods in the market.

Law of Demand

The law of demand states that, all else being equal, as the price of a good or service decreases, the quantity demanded by consumers increases. This relationship is driven by the fact that consumers are more willing to purchase a good when it is less expensive. Additionally, lower prices allow consumers to buy more with the same budget, leading to higher demand.

Law of Supply

In contrast, the law of supply suggests that as the price of a good or service increases, producers are willing to supply more of it to the market. Higher prices create an incentive for producers to increase production, as they can earn greater revenue. This relationship between price and supply reflects the desire for producers to maximize profits.

Equilibrium occurs when the quantity demanded equals the quantity supplied at a particular price. This price is known as the equilibrium price, and the corresponding quantity is the equilibrium quantity. When the market price is above or below the equilibrium, it creates either a surplus or a shortage, respectively, leading to market adjustments over time.

Shifts in Demand and Supply can occur due to changes in external factors such as income levels, consumer preferences, production technology, and input prices. Understanding how these factors affect the curves can help predict market movements and guide decision-making in both theoretical and real-world contexts.

Monetary Policy and AP Preparation

Monetary policy plays a crucial role in shaping the stability and growth of an economy. It involves the management of a country’s money supply and interest rates, typically by a central bank, to control inflation, stabilize the currency, and achieve sustainable economic growth. Understanding how monetary policy works and its impact on various economic factors is key to doing well in the AP exam.

The central bank uses several tools to influence the economy, the most important being open market operations, the discount rate, and reserve requirements. By adjusting these tools, the central bank can either stimulate the economy by lowering interest rates or slow it down by raising them. This, in turn, affects everything from consumer spending to business investment and even international trade.

It is important to focus on the effects of both expansionary and contractionary monetary policies. Expansionary policy, aimed at stimulating economic activity, lowers interest rates and increases the money supply. On the other hand, contractionary policy works to slow down inflation by increasing interest rates and reducing the money supply.

Understanding the connection between monetary policy and inflation is also critical. The central bank’s goal is to maintain price stability by controlling inflation, which can erode purchasing power and cause instability. Questions in the AP exam often test students’ ability to understand the implications of policy decisions on inflation rates and broader economic health.

By reviewing the key concepts of monetary policy, its tools, and its effects on the economy, students can prepare themselves to answer questions effectively on the AP exam. Understanding how changes in money supply and interest rates influence economic conditions will give students a deeper insight into macroeconomic stability and growth.

Fiscal Policy and Economic Stabilization

Government spending and taxation policies are essential tools for managing the overall health of an economy. These fiscal measures are used to influence economic activity, stabilize fluctuations, and promote long-term growth. By adjusting spending levels and tax rates, the government can either stimulate the economy during periods of recession or slow it down when inflation is rising too quickly.

Expansionary fiscal policy is used when an economy is in a downturn or facing low growth. This approach typically involves increasing government spending or cutting taxes to boost demand. Higher government spending can stimulate job creation and increase consumption, while tax cuts put more money in the hands of individuals and businesses, encouraging spending and investment.

Contractionary fiscal policy is applied when the economy is overheating, leading to high inflation. In this case, the government may reduce spending or increase taxes to cool down the economy and prevent runaway price increases. These measures help to maintain price stability and ensure that economic growth remains sustainable in the long term.

The role of fiscal policy in economic stabilization is to mitigate the effects of economic fluctuations. During periods of recession, expansionary policies can reduce the severity of downturns, while contractionary measures help prevent the economy from growing too quickly, which could lead to inflation. Understanding these tools and their impacts is essential for analyzing how governments manage economic cycles and maintain balance in the economy.

By mastering the principles of fiscal policy and understanding how these tools affect economic stabilization, students will be better equipped to answer questions on the AP exam and apply their knowledge to real-world economic scenarios.

Inflation and Unemployment in Economics

Inflation and unemployment are two critical economic indicators that reflect the overall health and stability of an economy. These two factors are often interrelated, with changes in one frequently influencing the other. Understanding the causes and consequences of both inflation and unemployment is essential for analyzing the broader economic environment and for making informed policy decisions.

Inflation occurs when the overall price level of goods and services in an economy rises over time. This decrease in the purchasing power of money can be caused by several factors, such as increased demand for goods and services (demand-pull inflation) or rising production costs (cost-push inflation). On the other hand, unemployment occurs when individuals who are actively seeking work are unable to find employment. It is a key indicator of an economy’s ability to create jobs and provide opportunities for its workforce.

| Type of Inflation | Cause | Impact |

|---|---|---|

| Demand-Pull Inflation | Increased consumer spending and investment | Higher prices due to excessive demand in the economy |

| Cost-Push Inflation | Higher production costs (e.g., wages, raw materials) | Rising prices due to increased cost of production |

Unemployment can be divided into different categories, including frictional, structural, and cyclical unemployment. Frictional unemployment occurs when workers are temporarily between jobs or entering the workforce for the first time. Structural unemployment happens when there is a mismatch between the skills workers have and the skills needed by employers. Cyclical unemployment is tied to economic downturns and occurs when demand for goods and services decreases, leading to job losses.

These two factors–inflation and unemployment–often move in opposite directions. For example, during periods of high inflation, the central bank may raise interest rates to reduce inflation, which can lead to higher unemployment. Conversely, policies aimed at reducing unemployment, such as increasing government spending, can lead to higher inflation. Understanding this trade-off is crucial for evaluating economic policy decisions and their potential impact on the broader economy.

International Trade and Comparative Advantage

Global trade allows countries to specialize in the production of goods and services in which they are most efficient, leading to a more efficient allocation of resources and greater economic benefits. By focusing on what each nation does best, countries can engage in trade to obtain products they cannot produce as efficiently, improving overall wealth and access to diverse goods. The concept of comparative advantage lies at the heart of this process, illustrating how trade can benefit all parties involved, even if one country is less efficient than another in producing all goods.

Understanding Comparative Advantage

Comparative advantage occurs when a country has a lower opportunity cost in producing a particular good compared to another country. Opportunity cost refers to what is sacrificed in order to produce one good over another. By specializing in the production of goods where they have the lowest opportunity cost, countries can produce more efficiently and trade for other goods that they produce less effectively.

- Opportunity Cost: The cost of forgoing the next best alternative when making a decision.

- Efficiency: Specializing in the production of goods that can be produced most efficiently, leading to better resource utilization.

- Mutual Benefit: Both trading countries can benefit from increased consumption possibilities through trade.

Benefits of International Trade

International trade opens up many economic opportunities. Through specialization and trade, countries can:

- Access a wider variety of goods: Trade allows nations to obtain products they cannot efficiently produce themselves.

- Lower production costs: By focusing on specific goods, nations can reduce costs and pass on savings to consumers.

- Enhance economic growth: Trade promotes innovation, efficiency, and investment, leading to long-term economic development.

Ultimately, the principle of comparative advantage shows how global trade fosters economic interdependence, leading to increased prosperity for all countries involved. Understanding this concept is crucial for analyzing the dynamics of international trade and its impact on global economies.

Krugman’s View on Economic Growth

Economic growth is a fundamental aspect of a nation’s long-term prosperity, and many theories explore the best ways to achieve sustainable progress. A prominent perspective on this issue highlights the role of technological advancements, policy decisions, and global interconnectivity. Economic growth, according to this view, is not solely driven by capital accumulation or labor expansion, but by a combination of factors that enable efficiency improvements and innovation. The focus is on the dynamics that promote stability and long-term advancement, making it essential to understand the underlying forces behind growth strategies.

The Role of Technology and Innovation

One of the core elements in fostering economic expansion is technological progress. By continually developing new technologies and improving existing ones, economies can enhance productivity and efficiency across all sectors. This leads to a rise in output without proportionally increasing resource usage. Investments in research, education, and infrastructure are crucial to fostering innovation, as they provide the foundation for technological breakthroughs and long-term development.

- Productivity Growth: Increased efficiency from new technologies can result in higher output and lower costs.

- Innovation-driven economy: Encouraging creativity in all sectors can boost competitiveness and raise living standards.

The Importance of Policy and Global Integration

Effective policy decisions are essential in guiding economies toward sustainable growth. Government actions that prioritize education, infrastructure, and financial stability create the conditions necessary for businesses to thrive. Additionally, the global market plays an increasingly important role, as nations become more interconnected. Through international trade and cooperation, economies can capitalize on comparative advantages, leading to faster development and improved economic outcomes.

- Government Investment: Policies that promote research and development can accelerate growth by fostering innovation.

- Global Cooperation: Open trade policies and international partnerships expand markets and create growth opportunities.

Overall, sustainable growth depends on a balanced approach that includes both technological advancements and supportive policies. By nurturing innovation and maintaining a global perspective, economies can achieve long-term prosperity and stability.

Microeconomic Principles in AP Exam

The AP exam tests students’ understanding of the fundamental concepts that drive the functioning of individual markets and the behavior of consumers and firms. By examining these principles, students can demonstrate their ability to analyze economic decisions and the resulting outcomes in a variety of settings. This section focuses on key microeconomic ideas that play a significant role in shaping market dynamics and the allocation of resources within an economy. A strong grasp of these concepts is essential for success in the AP exam and for understanding the complexities of real-world economic interactions.

Key Concepts in Microeconomics

Microeconomics explores the decision-making processes of individuals and firms, focusing on how resources are allocated, goods are produced, and services are distributed. Understanding these principles is crucial for analyzing how markets work and the factors influencing supply and demand. Below are some key areas covered in the AP exam:

- Supply and Demand: The relationship between the availability of goods and consumer desire for them.

- Elasticity: The responsiveness of demand or supply to changes in price or income.

- Market Equilibrium: The point at which the quantity demanded equals the quantity supplied, determining the price of a good or service.

Commonly Tested Topics in AP Exam

The AP exam evaluates students’ understanding of how these concepts apply to different market structures, from perfect competition to monopolies. The exam also tests knowledge of the effects of government interventions, such as taxes, subsidies, and price controls. Below are the primary topics that frequently appear:

| Topic | Description |

|---|---|

| Market Structures | Different types of market environments, including perfect competition, monopolistic competition, oligopoly, and monopoly. |

| Externalities | How third-party effects, such as pollution, can result from market activities and require government intervention. |

| Cost and Production | Understanding the relationship between the quantity of output produced and the costs incurred by firms in the production process. |

| Market Failures | Situations where the free market does not allocate resources efficiently, often requiring government intervention to correct the outcome. |

Mastering these principles is key to performing well on the AP exam. Students should be prepared to apply these concepts to real-world scenarios and demonstrate their understanding through clear, concise explanations and problem-solving techniques.

Macroeconomic Tools for Test Success

Understanding the broader economy is essential for excelling in any exam focused on economic principles. The tools used to analyze national income, employment levels, inflation, and fiscal policies are critical to answering questions effectively. Mastering these instruments helps students break down complex scenarios and predict economic outcomes accurately. This section highlights the core macroeconomic tools that are crucial for performing well on the test, providing both conceptual understanding and practical application techniques.

Key Macroeconomic Tools

The exam assesses students’ ability to use various macroeconomic models and frameworks to analyze economic conditions. Key tools include:

- Aggregate Demand and Supply: A model that helps explain total spending and total production in an economy, crucial for understanding price levels and output.

- GDP Calculation: Understanding how gross domestic product (GDP) is calculated and its role in measuring a nation’s economic performance.

- Fiscal Policy: The use of government spending and taxation to influence economic activity and stabilize the economy.

How to Apply Macroeconomic Tools in the Exam

Knowing how to apply these tools under exam conditions is vital for success. Below are strategies for using macroeconomic models effectively:

- Practice Graphs: Be prepared to draw and interpret supply-demand curves, and aggregate demand and supply graphs, to demonstrate shifts and the impact of policy changes.

- Understand Economic Indicators: Familiarize yourself with key economic indicators like unemployment rates, inflation, and real GDP, and know how to apply them to specific situations.

- Analyze Policy Impacts: Learn how different fiscal and monetary policies affect the economy and how to assess their effectiveness in various scenarios.

By mastering these tools, students will be equipped to analyze questions more effectively and demonstrate a deeper understanding of macroeconomic principles, ultimately increasing their chances of success on the test.

Government Intervention in Economic Markets

Government involvement in market dynamics is a key concept that shapes the outcomes of economic systems. The state can influence the allocation of resources, ensure market stability, and promote fairness through various policies and actions. This section delves into the different ways governments intervene in markets to correct inefficiencies, address imbalances, and protect public welfare. Understanding these interventions is critical for analyzing their impact on economic behavior and the broader society.

Governments take several approaches to manage and regulate economic activity. Some interventions are direct, such as setting regulations or controlling prices, while others are indirect, such as through monetary policies or tax incentives. These measures are designed to address market failures, stimulate economic growth, or curb negative externalities that might harm the public.

Types of Government Intervention

Various tools are at the disposal of policymakers to intervene in economic markets, each serving different purposes:

- Price Controls: Governments may set maximum or minimum prices to prevent extreme fluctuations and ensure fairness in essential goods like healthcare, housing, or fuel.

- Subsidies and Tax Breaks: By offering financial support to industries or households, governments encourage specific behaviors, such as investment in green energy or affordable housing.

- Regulation and Oversight: Enforcing rules that govern business practices, environmental standards, and consumer protection to reduce exploitation and ensure ethical market operations.

Impacts of Government Actions

The effects of government intervention can vary depending on the policy measures implemented. Positive outcomes can include greater economic stability, lower inequality, and enhanced public welfare. However, interventions can also lead to unintended consequences, such as market distortions, inefficiencies, or reduced competition. It is essential to assess both the benefits and drawbacks of each action to understand its overall effectiveness.

In summary, while government intervention is a powerful tool for guiding economic markets, it requires careful consideration of its long-term effects and the specific context in which it is applied.

Understanding Externalities and Public Goods

In any economic system, activities often have effects that extend beyond the immediate parties involved. These effects can either benefit or harm individuals who are not directly part of the transaction. This concept, along with the notion of public goods, is crucial in understanding how markets function and where government intervention may be necessary. By examining the effects of externalities and the characteristics of public goods, we can better comprehend the challenges that arise in creating an efficient and fair economy.

Externalities refer to the unintended side effects of economic activities that affect others outside of the transaction. Public goods, on the other hand, are goods that are non-excludable and non-rivalrous, meaning that one person’s use does not reduce the availability for others, and it is difficult to exclude anyone from using them. These concepts are essential in analyzing situations where markets fail to provide optimal outcomes for society as a whole.

Types of Externalities

Externalities can be categorized into two broad types, each with distinct implications for policy and market behavior:

- Positive Externalities: These occur when an economic activity benefits others who are not directly involved in the transaction. For example, education improves society by increasing productivity and reducing crime, yet individuals may not be fully compensated for these benefits.

- Negative Externalities: These arise when an activity imposes costs on others, such as pollution from factories affecting nearby residents. In such cases, the social cost is greater than the private cost, leading to inefficiency in market outcomes.

Public Goods and Their Challenges

Public goods present a unique challenge because their non-excludable and non-rivalrous nature makes them difficult to sell in traditional markets. Examples include clean air, national defense, and public parks. Since no one can be excluded from using these goods, and one person’s use doesn’t diminish its availability to others, there is little incentive for private individuals or firms to provide them.

- Non-Excludability: No one can be prevented from consuming the good, even if they do not contribute to its production or maintenance. This often leads to the “free rider” problem, where people benefit without paying.

- Non-Rivalry: The consumption of the good by one individual does not reduce its availability to others, meaning that the good can be enjoyed by many without depletion.

Due to these characteristics, public goods are often provided by the government to ensure that society receives the benefits, such as the maintenance of infrastructure or public healthcare. Without government intervention, these goods might be underprovided, leading to inefficiency and inequality.

In conclusion, understanding externalities and public goods is fundamental in addressing market failures and ensuring that resources are allocated in a way that benefits society as a whole. Effective government intervention can help mitigate the negative effects of externalities and provide public goods that are essential for the well-being of the population.

Effective Study Tips for AP Economics

Successfully preparing for a challenging exam requires not only hard work but also strategic approaches to studying. When tackling the complexities of economic concepts, it’s essential to organize your study time effectively and focus on the areas that will yield the highest return. Understanding key principles, practicing problem-solving, and staying consistent in your review can make a significant difference in your performance. Here are some practical study tips to guide you through the preparation process.

Key Strategies for Success

- Master Core Concepts: Focus on understanding the fundamental principles of microeconomics and macroeconomics. Ensure you are comfortable with topics such as supply and demand, market structures, fiscal policies, and the role of government. A deep understanding of these core ideas is vital for solving both multiple-choice questions and essays.

- Use Practice Exams: Take practice tests to familiarize yourself with the exam format and timing. This helps you develop time management skills and identify areas where you need further review. The more practice questions you do, the more confident you’ll become in applying your knowledge to real exam scenarios.

- Study Regularly: Instead of cramming the night before, create a study schedule that allows you to review material consistently. Break your study sessions into manageable chunks to avoid feeling overwhelmed and to retain information better over time.

Additional Resources and Techniques

- Study Groups: Consider joining or forming a study group where you can discuss and debate economic concepts with peers. Explaining topics to others can reinforce your own understanding, and it may help clarify difficult areas you may be struggling with.

- Use Flashcards: Create flashcards for key terms, definitions, and economic models. These quick, repetitive reviews can be especially helpful in memorizing important vocabulary and formulas.

- Focus on Application: Try to relate economic theory to real-world situations. This will not only improve your understanding but also help you better tackle essay questions where application of knowledge is essential. Watch economic news, read articles, and think critically about how concepts apply to current events.

By using these study strategies and staying consistent in your preparation, you’ll be better equipped to succeed in your exam. A mix of conceptual understanding, practical exercises, and application will ensure that you are fully prepared when it’s time to test your knowledge.

Common Mistakes in AP Economics Answers

During the preparation and execution of an exam, it’s easy to overlook key details that may lead to common errors in responses. Understanding the most frequent pitfalls can help students avoid them and improve their performance. These mistakes often arise from misunderstandings, misapplications, or simply rushing through questions. Recognizing these missteps ahead of time allows for more careful and precise work during the test.

Frequent Errors in Test Responses

- Misinterpreting Graphs and Diagrams: A frequent issue is incorrectly interpreting graphs or diagrams, especially in questions that require drawing or analyzing shifts in supply and demand. Students may fail to accurately label axes or misread shifts in curves, leading to incorrect conclusions.

- Confusing Short-Term and Long-Term Effects: Many students mistakenly mix up the short-term and long-term impacts of economic policies or changes. This is particularly important when addressing topics like inflation, unemployment, or fiscal policies.

- Overgeneralizing Economic Concepts: It’s easy to make broad statements that are not entirely accurate or applicable in all scenarios. It’s crucial to remember that economic principles are often context-dependent, and answers should reflect specific conditions or assumptions provided in the question.

How to Avoid These Mistakes

- Review Key Terms: Make sure you are familiar with all relevant economic terminology and the specific nuances of each concept. Knowing when to apply different models or theories correctly can help avoid confusion.

- Take Your Time with Questions: Don’t rush through the test. Read each question carefully, especially those involving graphs, scenarios, or complex explanations. Double-check your answers to ensure they match the question’s context.

- Practice with Past Papers: Practicing previous exams can help you become more familiar with common question formats and reduce the likelihood of making similar mistakes on test day.

Common Mistakes by Question Type

| Type of Mistake | Example Scenario | How to Avoid |

|---|---|---|

| Graph Misinterpretation | Incorrectly labeling supply and demand shifts. | Carefully read all graph instructions and label axes and curves accurately. Practice with different graph types before the test. |

| Overgeneralization | Making broad statements about fiscal policy without context. | Ensure each answer directly ties to the specific scenario given in the question. Avoid generic responses. |

| Failure to Differentiate Between Time Frames | Confusing the immediate impact of policy with its long-term effects. | Clearly distinguish between short-run and long-run impacts in your responses, especially when discussing policies or economic variables. |

By being mindful of these common errors and taking the time to avoid them, you can ensure your responses are both accurate and comprehensive, ultimately boosting your score on the exam.