When it comes to managing personal finances, understanding how different forms of protection and obligations work is essential. Knowing the principles behind securing your belongings and income can help you make smarter financial choices. Whether it’s safeguarding against unforeseen events or complying with government regulations, having a solid grasp of these topics is crucial for long-term stability.

Everyone encounters the need for financial safeguards at some point, but the complexities of how they function can be confusing. From determining the right coverage to understanding your obligations, there are key factors that influence these decisions. It’s important to know not only what protection is available but also how various factors, like income and personal circumstances, can affect your options.

By breaking down complex concepts into easy-to-understand explanations, this guide aims to simplify the critical aspects of personal financial management. Whether you’re just starting out or seeking to deepen your knowledge, it’s important to know how to navigate these areas confidently and effectively.

Insurance and Taxes Everfi Answers

Understanding the systems that protect your assets and manage your financial responsibilities is crucial for anyone looking to secure their financial future. These systems are designed to help individuals mitigate risks and ensure they meet their obligations. It is essential to have clear insights into how these mechanisms work to make informed decisions that align with your long-term goals.

When navigating the world of financial management, two key areas that require attention are personal protection plans and the duties you owe to regulatory bodies. Both of these factors play a significant role in shaping your financial stability, and it’s important to understand the structure and benefits of each. Here’s a look at some of the most commonly asked questions related to these systems and how they function.

| Topic | Key Details |

|---|---|

| Financial Safeguards | Provides protection for unexpected events, like accidents, health issues, or property damage. |

| Risk Management | Involves strategies to limit financial loss and ensure preparedness for uncertain situations. |

| Government Regulations | Defines your obligations related to earnings and ensures compliance with local or national laws. |

| Benefits of Proper Coverage | Helps minimize out-of-pocket expenses and offers financial security during difficult times. |

| Filing Obligations | Involves timely reporting of income and related data to the appropriate authorities. |

By understanding the dynamics of these systems, individuals can better prepare for life’s uncertainties while ensuring they remain compliant with their financial obligations. The key to mastering these concepts lies in becoming familiar with their rules and how they influence both personal and financial well-being.

Understanding the Basics of Insurance

In financial management, safeguarding your assets and reducing potential risks plays a pivotal role in securing peace of mind. Many people rely on various systems to protect their belongings, health, or income in case of unexpected events. The principle behind these systems is to help you avoid significant financial burdens by pooling risk across many individuals or entities.

Grasping the fundamental concepts of these protection plans is crucial for anyone looking to make informed decisions about their financial well-being. It’s not just about purchasing coverage but also understanding how it works, what it covers, and how it can be tailored to your unique needs. Below, we’ll explore the core aspects of these protective systems that can help you navigate your options effectively.

| Key Concept | Explanation |

|---|---|

| Risk Pooling | Distributes the financial risk across a large group to reduce the burden on individuals. |

| Premiums | Regular payments made to maintain coverage and protect against financial losses. |

| Coverage Limits | Defines the maximum amount that can be claimed for a particular event or circumstance. |

| Deductibles | The amount you must pay out of pocket before certain benefits or claims are covered. |

| Exclusions | Specific situations or circumstances that are not covered under the protective plans. |

By learning these basic components, individuals can make better decisions when choosing the right type of coverage. Understanding these fundamentals not only helps in selecting an appropriate plan but also empowers you to use these systems effectively in case of unforeseen events.

How Taxes Affect Your Income

When you receive earnings from your job or business, a portion of that income is often allocated to meet legal obligations. These deductions can impact the amount you take home each period, affecting your overall financial planning. It’s important to understand how these obligations are calculated and how they influence your budget and spending.

These obligations are based on several factors, including your earnings level, the type of income you receive, and any applicable exemptions or deductions. The system is designed to ensure that individuals contribute a fair share towards public services, but the amount deducted can vary significantly depending on personal circumstances.

- Progressive Systems: Higher earners may pay a larger percentage of their income compared to those with lower earnings.

- Withholding: A portion of your income is automatically deducted by your employer or payer before you even receive it.

- Benefits of Deductions: Certain deductions, such as for dependents or retirement savings, can reduce the amount subject to deduction, thus affecting the final amount you pay.

- Refunds: If more is withheld than necessary, you may be eligible for a refund after filing your annual returns.

It’s essential to keep track of these deductions to avoid surprises and adjust your financial strategies accordingly. Understanding how the allocation of your earnings works allows you to budget more effectively and plan for future expenses.

Key Types of Insurance You Should Know

When it comes to safeguarding your financial future, understanding the different types of protective plans available is essential. These plans are designed to provide coverage in case of unexpected events that could cause significant financial strain. Knowing which types are most relevant to your life helps ensure you are adequately protected and can make informed decisions about your personal finances.

There are various types of coverage to consider, each serving a unique purpose. Some protect your property, while others focus on your health, income, or even your loved ones. Below are the key categories of protection that everyone should be familiar with to help minimize risks and ensure stability in challenging times.

- Health Protection: Covers medical expenses, including doctor visits, surgeries, and prescription medications.

- Life Protection: Provides financial support to your dependents in the event of your death, ensuring their well-being.

- Property Coverage: Safeguards your home, car, or personal belongings against loss or damage caused by accidents, theft, or natural disasters.

- Income Protection: Ensures that you receive a steady stream of income if you’re unable to work due to illness, injury, or other unforeseen circumstances.

- Liability Coverage: Protects you financially if you are held responsible for injuries or damages to others or their property.

Understanding the purpose and scope of each type of coverage will allow you to tailor your protective plans to your personal needs and risk factors. By securing the right protections, you can have peace of mind knowing that you’re prepared for life’s uncertainties.

What Is Tax Withholding and How It Works

When you earn income, a portion of it is often automatically deducted before you even receive it. This process is designed to ensure that you meet your legal obligations without needing to set aside money yourself. Understanding how these deductions work is essential for managing your finances and ensuring that you don’t face unexpected liabilities later on.

Withholding refers to the practice of deducting a certain percentage of your earnings directly from your paycheck or other sources of income. This money is then sent to the government or relevant authorities on your behalf. By doing so, the process helps distribute the financial responsibility across the year, reducing the need for large lump-sum payments at the end of a fiscal period.

How Withholding Is Calculated

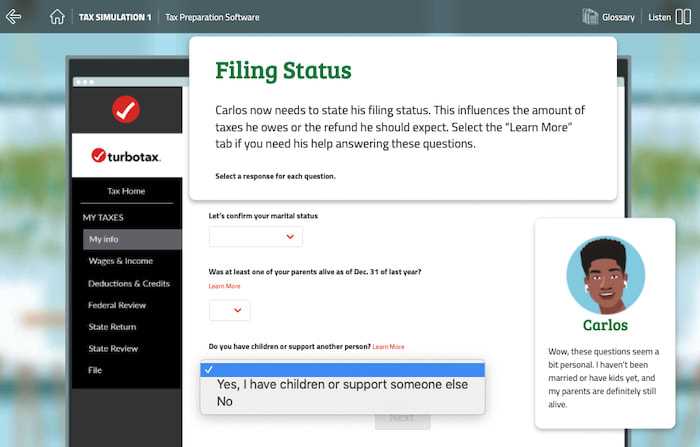

The amount withheld depends on several factors, such as your income level, your filing status, and any exemptions or deductions you qualify for. Employers typically use a set formula to determine the right amount to withhold based on these variables.

- Income Level: Higher earners typically have more withheld compared to those with lower earnings.

- Filing Status: Whether you’re single, married, or have dependents can affect how much is deducted.

- Exemptions and Deductions: Certain deductions, like those for dependents or retirement savings, can lower the amount withheld.

Why Withholding Matters

Proper withholding helps ensure that you’re not caught off guard by a large tax bill at the end of the year. It also helps maintain cash flow throughout the year by spreading out your payments. However, it’s important to review your withholding periodically, especially if your financial situation changes, to avoid overpaying or underpaying.

- Overpaying: If too much is withheld, you could receive a refund, but your cash flow throughout the year will be affected.

- Underpaying: If too little is withheld, you may owe additional money when you file your return, possibly with penalties.

By staying informed about withholding and adjusting it as necessary, you can better manage your finances and ensure that you’re not overburdened with unexpected expenses.

How to File Your Taxes Properly

Filing your financial obligations correctly is a critical part of staying compliant with the law. Ensuring that all necessary information is submitted accurately and on time helps avoid penalties and ensures that you meet your responsibilities. The process may seem complex, but breaking it down into manageable steps can make it easier to navigate.

Proper filing involves gathering all required documents, choosing the right forms, and calculating the appropriate amounts owed or refundable. Understanding the process and staying organized is key to ensuring everything is completed without error. Below are the essential steps to help guide you through the filing process.

Step-by-Step Process for Filing

- Gather Your Documents: Collect your income statements, deduction records, and any other relevant financial documents.

- Choose the Correct Forms: Depending on your income type and filing status, select the appropriate forms. Common forms include individual filing forms and business-related submissions.

- Claim Deductions and Credits: Make sure to apply any deductions or credits you’re eligible for, such as for dependents, education, or home ownership.

- Accurately Calculate Amounts: Use reliable tools or consult with a professional to ensure your calculations are correct. Mistakes in this step can lead to overpayments or legal issues.

- Submit Your Return: File your return on time, either online or by mail, according to the specific deadline for your situation.

Important Considerations

- Timeliness: Be sure to file by the deadline to avoid penalties and interest charges.

- Accuracy: Double-check all forms and calculations to avoid mistakes that could lead to fines or audits.

- Professional Help: If you’re unsure about any part of the process, consider hiring a tax professional to ensure that everything is handled correctly.

By following these steps and ensuring accuracy in your filing, you can stay on top of your responsibilities and avoid any unnecessary complications. Regularly reviewing your financial situation and understanding your obligations will help you maintain peace of mind throughout the year.

Insurance Premiums Explained Simply

When you sign up for a financial protection plan, one of the key elements to understand is the cost you’ll need to pay periodically to keep that coverage active. This payment, often required on a regular basis, ensures that you are protected against unexpected events or losses. It’s a commitment you make to secure your financial future and reduce risks associated with unforeseen circumstances.

These payments, known as premiums, are calculated based on several factors. The amount can vary significantly depending on the type of protection you need, the level of coverage you select, and your individual risk profile. Understanding how premiums are set and what influences them can help you make more informed decisions about the types of coverage that best fit your needs.

Factors That Affect Premiums

- Coverage Level: The more extensive the protection, the higher the cost of the premiums. If you choose higher coverage limits, expect to pay more.

- Personal Risk Profile: Factors like age, health, occupation, or driving history can influence your premium rates. The higher the perceived risk, the higher the premiums.

- Deductibles: A higher deductible generally leads to lower premiums. If you are willing to pay more out of pocket in the event of a claim, your monthly or annual premium may be reduced.

- Location: Your geographical area can also affect premiums, especially when it comes to property or vehicle coverage. Areas with higher risks of natural disasters or theft might see higher premiums.

- Claims History: If you’ve made many claims in the past, your premiums may be higher as the provider considers you a higher risk.

Why Understanding Premiums Is Important

Knowing how premiums are calculated can help you better plan for your finances and avoid surprises. It also allows you to adjust your coverage to fit your budget while ensuring you’re not overpaying for protection you don’t need. By reviewing your premiums regularly, you can ensure that your coverage aligns with your needs and circumstances.

What Is Taxable Income and Deductions

When it comes to managing your financial obligations, understanding how your earnings are assessed is crucial. Certain portions of your income are subject to regular assessments, while others may be excluded or reduced through specific adjustments. Knowing the difference between what counts as taxable earnings and what can be deducted helps you better plan your finances and potentially reduce your financial burden.

Taxable income refers to the portion of your earnings that is subject to regular assessments. This amount is determined after various exemptions or deductions have been applied. Deductions, on the other hand, are expenses or allowances that reduce your total taxable income, thereby lowering the overall amount you owe. Here’s an overview of how these concepts work.

Common Types of Taxable Income

- Salary and Wages: The most common type of taxable earnings, typically based on your regular employment income.

- Interest and Dividends: Earnings from savings, investments, and dividends from stocks or bonds.

- Rental Income: Income from property rental or lease agreements.

- Self-Employment Income: Earnings from freelance work or running your own business.

Common Deductions That Reduce Taxable Income

Deductions are designed to reduce the amount of income that is taxed, and can come in many forms. Here are some of the most common types:

- Standard Deduction: A fixed amount that can be deducted from your taxable income, regardless of your actual expenses.

- Itemized Deductions: These may include expenses like mortgage interest, medical bills, and charitable donations that exceed a certain threshold.

- Retirement Contributions: Contributions to retirement plans such as 401(k) or IRA accounts may be deducted, reducing taxable income.

- Education Expenses: Certain costs related to education, including tuition or student loan interest, may qualify for deductions.

How Deductions Impact Your Financial Obligations

By reducing your taxable income, deductions can lower the total amount you need to pay. Understanding which deductions you qualify for can have a significant impact on your overall financial picture, helping you keep more of your earnings and potentially increasing your refund.

Below is a simple table summarizing taxable income and common deductions:

| Type | Description |

|---|---|

| Taxable Income | Income that is subject to assessments, such as salary, rental income, and dividends. |

| Standard Deduction | A fixed reduction applied to your income to lower your taxable amount. |

| Itemized Deductions | Specific expenses that can reduce taxable income, like medical costs and mortgage interest. |

| Retirement Contributions | Contributions to retirement accounts that lower your taxable earnings. |

Health Coverage vs Life Protection

When it comes to safeguarding your well-being and that of your loved ones, there are two essential types of financial protection plans to consider. Each type serves a different purpose and addresses different aspects of life’s uncertainties. One is designed to cover your health-related needs, while the other ensures financial security for your family in the event of your passing. Understanding the differences between these two types of coverage is crucial in making informed decisions about your future.

Health coverage typically focuses on providing financial support for medical expenses, from routine check-ups to emergency care. It helps reduce the burden of healthcare costs and ensures that you have access to necessary treatments. On the other hand, life protection is aimed at providing your family with financial stability if you’re no longer around. This type of plan ensures that your dependents have a financial safety net to cover living expenses, debts, or other needs in your absence.

Key Differences

- Purpose: Health coverage is primarily for managing medical costs, while life protection is meant to provide financial support to your family after your death.

- Coverage Period: Health coverage is typically renewed annually or as needed, while life protection is often a long-term plan that lasts for a set period or for the rest of your life.

- Benefits: Health coverage pays for doctor visits, hospital stays, and medications. Life protection pays out a lump sum to beneficiaries upon your passing.

- Cost: Health plans often have monthly premiums, co-pays, and deductibles based on your health needs. Life protection premiums depend on factors like age, health, and the amount of coverage you choose.

Why You Might Need Both

Many individuals choose to have both types of coverage, as they address different risks and needs. While health coverage ensures that you can manage your healthcare costs throughout your life, life protection provides peace of mind that your loved ones will have financial support in the event of your death. By having both, you ensure that both your health and your family’s future are protected.

Understanding Income Tax Brackets

When it comes to determining how much of your earnings will be subject to a financial levy, the system is designed to divide income into segments, or “brackets,” each of which is taxed at a different rate. These divisions ensure that those with higher earnings contribute more, while those with lower incomes are taxed at a lower percentage. It’s essential to grasp how these brackets work, as they directly impact the amount of money you take home after financial obligations are deducted.

The concept behind income brackets is fairly straightforward. Each bracket represents a range of income, and the rate applied increases as your income rises. However, it’s important to note that the higher rate only applies to the income that falls within the specific bracket, not to your entire earnings. This system is designed to be progressive, meaning that higher earners pay a higher rate on the portion of their income that exceeds certain thresholds.

How the Brackets Work

Income brackets typically start at a low rate and increase as your income climbs. Here’s an example of how it could look:

- First portion of your income may be taxed at 10%

- The next portion falls into a 12% rate

- Additional income could be taxed at higher rates such as 22%, 24%, and so on

It’s important to remember that only the income that falls within each bracket is taxed at that rate, meaning your overall rate is a blend of all the applicable rates based on the different segments of your income.

Why Brackets Matter

Understanding these divisions can help you plan your finances better. Knowing where your income falls within the brackets allows you to estimate your financial obligations more accurately and find potential opportunities to reduce your taxable income through various deductions or credits. It’s an essential part of making informed decisions about your income and budgeting for the future.

How to Read Your Coverage Policy

When you receive a document outlining your coverage plan, it can seem overwhelming at first glance. However, understanding the key sections of this document is crucial for knowing what is covered, what is excluded, and how to navigate any claims. By breaking down the document into manageable parts, you can make sure you are fully aware of the terms, conditions, and limitations that apply to your specific situation.

The policy document typically starts with basic information, such as the type of plan, the coverage period, and the parties involved. This is followed by details about what is included in your coverage, as well as any exclusions or conditions that might limit the scope of protection. It’s essential to pay close attention to these elements to avoid surprises in the future.

Key Sections to Understand

- Policy Summary: This section provides an overview of the main aspects of your plan, including coverage limits and premium costs.

- Coverage Details: Here, you’ll find a description of what is included under your policy, such as specific scenarios or services that are covered.

- Exclusions: This section highlights what is not covered, such as specific situations or conditions that are outside the scope of the policy.

- Claim Process: Information on how to file a claim, including any necessary documentation and the steps involved in getting compensation or reimbursement.

Important Terms to Look For

- Premium: The amount you pay periodically for your coverage.

- Deductible: The amount you must pay out-of-pocket before the coverage begins to take effect.

- Limitations: Restrictions on the maximum amount that can be claimed under the policy.

- Excess: The portion of a claim you must pay, often before receiving full reimbursement.

By carefully reviewing each of these sections, you can ensure that you fully understand the terms of your coverage, and are aware of your rights and obligations. If anything is unclear, don’t hesitate to contact the provider for further clarification. Being informed about your policy helps you make better decisions about your protection and financial security.

What Are Tax Credits and Exemptions

When managing your financial obligations, it’s important to understand the tools available to reduce the amount you owe. Two common ways to lower your liability are through credits and exemptions, which provide different forms of relief. These mechanisms are designed to lessen the overall burden, whether by directly reducing the amount owed or by lowering the income subject to charges. Each type has specific rules, and knowing how to apply them can make a significant difference in your financial planning.

Tax credits are essentially direct reductions in the amount you owe. They are typically subtracted from your total liability, lowering the final amount due. On the other hand, exemptions reduce the income that is subject to a levy in the first place, meaning that they decrease the total amount of earnings on which you’ll be assessed. Both can help individuals save money, but the method of benefit varies.

Types of Credits

There are different types of credits that can be applied depending on your circumstances. Here are a few of the most common:

- Nonrefundable Credits: These credits can reduce your obligation to zero, but they do not provide a refund beyond that.

- Refundable Credits: These credits can reduce your liability below zero, often resulting in a refund if your credits exceed your obligation.

- Adjustable Credits: Some credits may vary based on your income level or personal situation, like education or child-related credits.

Types of Exemptions

Exemptions typically come in two main forms, each offering a different way to reduce the taxable income:

- Personal Exemption: This applies to individuals and can often reduce the amount of income that is subject to charges.

- Dependent Exemption: Available if you have dependents, this exemption reduces your overall taxable income based on the number of qualifying individuals in your household.

By understanding the difference between credits and exemptions, and how each applies to your financial situation, you can better plan for your obligations and make use of the opportunities for reducing the amount you owe. It’s advisable to consult with a professional if you’re unsure how to best take advantage of these benefits.

How Protection Plans Safeguard Your Assets

When it comes to securing your financial future, one of the most effective strategies is protecting your valuable possessions and wealth. A well-structured protection plan serves as a safety net, offering financial relief in the event of unexpected circumstances. Whether it’s the loss of property, damage, or liability issues, such a plan ensures that you won’t face a complete financial setback. It’s designed to absorb the costs that would otherwise fall on you, allowing you to manage risk and safeguard your hard-earned assets.

These protective measures are essential for mitigating the financial impact of accidents, unforeseen events, or liability claims. Depending on the type of coverage you choose, these plans can help cover repair costs, medical bills, or legal expenses. They essentially act as a buffer, preventing you from losing everything in the face of a significant financial setback.

How Protection Plans Help with Property Loss

For physical assets such as homes, cars, or valuable personal property, protection plans can provide reimbursement or financial support if they are damaged, lost, or destroyed. In the event of theft, fire, natural disasters, or accidents, these plans often cover the repair or replacement costs, ensuring that you don’t have to bear the entire financial burden.

- Home and Property Protection: Coverage may include damage to your house or possessions due to a range of disasters, from fires to severe weather events.

- Automobile Protection: In case of an accident or damage to your vehicle, these plans can help cover repair costs, replacement, and any related liabilities.

How Protection Plans Safeguard Against Liability

In addition to property protection, many plans also offer coverage for liability situations. For example, if you are held responsible for injuring someone or causing damage to their property, your protection plan can cover the legal expenses or compensation fees. This helps prevent a costly legal battle or settlement from draining your finances.

- Personal Liability Protection: This can cover legal costs and damages if you are found liable for injuries or property damage caused to others.

- Business Liability Protection: If you own a business, certain plans can shield you from financial fallout due to claims from employees, customers, or third parties.

By having these protective measures in place, you ensure that you have a financial safety net in place, preventing unexpected losses from derailing your financial stability. It’s important to choose the right coverage based on your needs, ensuring that your assets remain protected regardless of the circumstances.

The Importance of Filing Tax Returns

Filing your annual financial statements is a crucial task that can significantly impact your financial well-being. This process ensures that your income is properly reported and that you meet any obligations set by the governing authorities. It also opens doors to various benefits, including potential refunds or adjustments to your financial standing. Without this formal filing, you could miss out on valuable opportunities or even face legal penalties.

Properly submitting your financial information is more than just a legal requirement. It provides an accurate record of your earnings, deductions, and credits, which could ultimately reduce the amount you owe or even lead to a refund. Beyond the immediate benefits, filing can also be a step toward achieving long-term financial stability, allowing you to build a reliable financial record.

Benefits of Timely Submission

- Tax Refunds: One of the primary reasons individuals file is to claim any potential refunds. By submitting the required forms, you may be eligible to receive money back if you have overpaid throughout the year.

- Eligibility for Government Programs: Filing is often required for accessing certain government benefits, such as social security or housing assistance programs.

- Credit and Loan Applications: A filed financial statement may be requested when applying for loans, mortgages, or credit. It serves as proof of your financial standing and ensures that you qualify for these services.

Consequences of Failing to File

- Legal Penalties: Not submitting your financial statement can lead to fines or even legal action, depending on the severity of the situation.

- Loss of Refunds: If you fail to file, you forfeit the chance to claim any refunds or deductions you may be entitled to.

- Difficulty in Financial Planning: Not filing regularly makes it harder to track your finances and make informed decisions about savings, investments, and spending.

Filing your financial reports on time is an important practice that protects your rights, maximizes benefits, and ensures compliance with applicable regulations. It’s not just about following the rules–it’s about securing your financial future.

What Is Liability Coverage

Liability protection is designed to help individuals and businesses manage the financial consequences of causing harm to others or damaging their property. This type of coverage serves as a safeguard, ensuring that if you are held responsible for an accident or injury, the financial burden of compensation does not fall solely on your shoulders. Whether for personal or business-related incidents, it provides essential peace of mind and legal protection.

Types of Liability Protection

- Personal Liability: This form covers situations where an individual is found responsible for injuries or damages that occur on their property or as a result of their actions. It can be crucial in everyday scenarios, such as accidents that happen in your home or while driving.

- Professional Liability: Often referred to as errors and omissions coverage, this type is particularly important for professionals who provide services or advice. It protects against claims of negligence or mistakes made while performing work.

- Product Liability: This is essential for businesses that manufacture, distribute, or sell goods. It covers damages caused by a faulty product that injures or damages someone or something.

Why You Need Liability Protection

- Financial Protection: Without liability coverage, the cost of legal defense, settlements, and judgments can be overwhelming. This protection helps cover those costs and prevents financial ruin.

- Peace of Mind: Knowing that you are financially protected in case of an accident or mistake can alleviate stress and allow you to focus on your personal or professional responsibilities.

- Legal Compliance: In some industries, having liability coverage is not just a precaution–it’s a legal requirement. Having the proper protection ensures that you comply with regulatory requirements.

Ultimately, liability protection is a vital aspect of risk management, offering financial safeguards in case of unforeseen events. It is an essential tool for both individuals and businesses to mitigate potential legal and financial challenges.

Common Financial Mistakes to Avoid

When managing your financial obligations, there are several common errors that people often make, which can lead to unnecessary complications and potential penalties. These mistakes can range from incorrect calculations to overlooking crucial details when filing. Avoiding these errors is essential to ensuring compliance, maximizing refunds, and minimizing the risk of legal trouble.

Frequent Errors to Be Aware Of

- Incorrect Reporting of Income: Failing to report all sources of income, including freelance work, interest, or side businesses, can lead to serious issues. Be sure to include all forms of income on your documentation to avoid discrepancies.

- Neglecting to Keep Proper Records: Insufficient documentation of expenses or earnings can lead to inaccurate filings. Keep organized records of all financial transactions, receipts, and tax-related documents throughout the year.

- Filing with Inaccurate Deductions: Claiming deductions you are not eligible for, or forgetting to include those you are entitled to, can result in fines or even legal action. Double-check all deductions before submitting your forms.

- Failing to Meet Deadlines: Missing submission deadlines is one of the most avoidable mistakes. Late filings can lead to fines and interest on overdue amounts. Always stay on top of filing dates and submit your documents ahead of time.

How to Prevent These Mistakes

- Double-Check Information: Always review your forms carefully before submission. Ensure that all figures are accurate and up to date, and verify that all required fields are completed.

- Stay Organized: Keep all financial documents organized and accessible. Use software tools or spreadsheets to track your income and expenses, making it easier to complete your filings correctly.

- Consult a Professional: If you’re unsure about any aspect of the process, consider seeking advice from a financial expert or accountant to help guide you through the process and avoid costly mistakes.

By understanding these common pitfalls and taking proactive steps to avoid them, you can ensure a smoother and more efficient filing experience, and protect yourself from potential financial setbacks.

How to Choose the Right Coverage

When selecting the right coverage to protect your assets, health, or loved ones, it is essential to carefully consider several factors that align with your personal needs and financial situation. The process can seem overwhelming due to the variety of options available, but understanding the key aspects can help you make an informed decision.

The first step is to assess your specific needs. Consider the risks you face, such as health-related concerns, vehicle use, or property ownership. Identify areas where you may need protection the most, and prioritize those in your search for coverage. Some policies are designed for individuals, while others may cater to families or businesses, so understanding the scope of coverage is important.

Next, examine the terms and conditions of each option. Pay attention to the types of coverage offered, such as liability, compensation for damages, or loss prevention. It’s crucial to know exactly what is covered and what isn’t to avoid unpleasant surprises when filing a claim. Make sure to compare different plans and see what works best for your budget and goals.

Don’t forget to evaluate the reputation of the provider. A company with a solid track record of customer service and claims processing can make a significant difference when you need assistance. Research online reviews and consult with others who have experience with various providers to find a trustworthy partner for your needs.

Finally, consider working with a professional advisor who can help you navigate through different options, explain the finer details, and ensure you’re selecting the best coverage for your circumstances. Taking the time to research and select the right coverage will give you peace of mind and financial security when you need it most.

Understanding Refunds and Payments

When it comes to managing your financial obligations, understanding how refunds and payments work is crucial. These processes can significantly impact your budget, whether you’re receiving money back or need to settle outstanding amounts. Knowing the details can help you plan ahead and avoid surprises.

What Is a Refund?

A refund occurs when you’ve paid more than what you owe, and the excess is returned to you. This often happens when your estimated payments throughout the year exceed the actual amount due. It can also arise from credits or deductions that reduce your total obligation. Understanding the calculation behind a refund can help you adjust future payments to avoid overpayment and maximize your funds.

Making Payments

If your payments fall short of what is required, you will be asked to pay the remaining amount. This could happen if your withholdings were too low or if you missed certain deductions. In some cases, you may be required to make payments in installments or in full by a set deadline. It’s important to plan for these payments to avoid penalties or interest.

Both refunds and payments are part of the ongoing process of balancing what you owe with what you’ve already paid. By keeping track of your finances and understanding how these processes work, you can avoid common mistakes and manage your funds more effectively.