Preparing for a professional tax assessment can be a crucial step in advancing your career in the financial services industry. This process involves mastering various concepts related to tax preparation, laws, and guidelines, ultimately demonstrating your proficiency in handling complex tax situations. The journey towards certification requires not only theoretical knowledge but also practical problem-solving skills.

In this section, we will explore key insights into passing the assessment for aspiring tax preparers. We’ll dive into essential study materials, exam structure, and techniques to tackle challenging scenarios. Whether you are preparing for your first certification or seeking to enhance your skills, understanding the core principles will help you succeed.

Tax Preparation Certification Insights

Successfully completing the certification process for tax professionals requires a thorough understanding of tax laws, deductions, and client scenarios. The final stage of the evaluation tests your ability to apply learned concepts to practical situations. As the certification process is both rigorous and comprehensive, it is essential to focus on developing problem-solving skills and attention to detail.

The key to performing well lies in understanding the structure of the assessment, including the types of questions you may encounter. These tests often feature practical scenarios that assess your ability to navigate tax software, calculate deductions, and apply the latest tax regulations. Preparation should include reviewing past cases, practicing with sample tasks, and ensuring you are familiar with the materials provided during the assessment.

Understanding tax scenarios is one of the most critical components of preparation. Being able to break down each question and interpret it based on real-world tax situations will give you an edge. Focusing on common mistakes and frequently tested topics will allow you to target the areas that matter most, increasing your chances of success.

Understanding Tax Assessment Structure

To succeed in a professional tax certification process, it’s crucial to understand how the evaluation is organized. The structure of the assessment is designed to test both theoretical knowledge and practical skills required for handling tax preparation tasks. This includes understanding key topics such as tax laws, deductions, credits, and client-specific scenarios. The questions are structured to assess your ability to apply learned concepts to real-world situations.

Typically, the evaluation is divided into sections, each focusing on different aspects of tax preparation. Some sections may test your ability to solve specific problems, while others will require a broader understanding of tax regulations. The format often includes multiple-choice questions, practical exercises, and sometimes, scenario-based problems that require detailed explanations or calculations.

Being familiar with the exam format and the types of questions you may encounter can significantly improve your preparation. It’s essential to allocate time for each section and understand the weight each part carries in determining your overall score. This awareness will help you prioritize your study efforts and approach the certification process with confidence.

Key Topics Covered in Tax Certification Evaluation

During the certification assessment, several core areas of tax preparation are evaluated to ensure a comprehensive understanding of the field. These topics are designed to test your knowledge of current tax laws, the application of various tax deductions and credits, and the ability to handle different financial scenarios that clients may encounter. Mastery of these subjects is essential for successfully completing the certification process.

Among the critical areas covered are individual income tax preparation, business tax filings, and understanding of tax software tools. The assessment will also explore your familiarity with recent changes to tax regulations and your ability to apply them effectively. In addition, issues such as itemized deductions, tax credits, and the preparation of accurate returns for various tax situations are frequently tested to ensure you can navigate all aspects of tax preparation efficiently.

Focusing on these key subjects and ensuring a clear understanding of how they relate to real-world scenarios will help you tackle the evaluation with confidence and improve your chances of success in the certification process.

Study Tips for Tax Certification Preparation

Effective study strategies are essential to mastering the material and succeeding in the certification process. With a structured approach, you can ensure that you are well-prepared to tackle various topics, from tax laws to practical filing procedures. Adopting a focused and organized study plan will help you retain important concepts and boost your confidence when taking the assessment.

One key tip is to break the material into smaller, manageable sections. Focus on one area at a time, whether it’s tax deductions, credits, or specific filing methods. Create a study schedule that allows you to cover all necessary topics without feeling overwhelmed. Practicing with sample questions and case studies will also help reinforce your understanding and improve your problem-solving skills.

Additionally, make use of available resources, such as online practice tests, textbooks, and instructional videos. These can provide valuable insight into the structure of the assessment and the types of questions you are likely to encounter. Regular review of your notes and practicing calculations will ensure you are fully prepared to demonstrate your knowledge and skills.

Common Mistakes to Avoid During the Assessment

While preparing for and taking a professional certification test, it’s easy to fall into certain traps that can undermine your performance. Avoiding common errors during the assessment process is crucial for ensuring that your knowledge and skills are accurately reflected. Being mindful of these pitfalls will help you stay focused and improve your chances of success.

Overlooking Important Instructions

One of the most frequent mistakes candidates make is failing to read instructions carefully. Each question or task typically comes with specific guidelines on how to approach it, and ignoring these can lead to unnecessary errors. Always take a moment to review the instructions before diving into the problem to ensure you’re following the correct procedure.

Rushing Through the Questions

Another common mistake is rushing through the questions in an attempt to finish quickly. While time management is essential, it’s equally important to read each question thoroughly and avoid making assumptions. Taking the time to think through your answers will reduce the likelihood of mistakes, especially in complex tax scenarios.

| Mistake | Tip to Avoid It |

|---|---|

| Skipping important instructions | Carefully read all provided guidelines before answering. |

| Rushing through tasks | Pace yourself and review your work before submitting. |

| Ignoring time limits | Manage your time effectively to allocate enough to each section. |

| Overcomplicating simple questions | Stay calm and apply basic principles first. |

By staying attentive and avoiding these common pitfalls, you will significantly improve your performance and ensure a smoother testing experience.

How to Prepare for the Certification Test

Preparing for a professional assessment requires a focused approach and strategic planning. It’s important to not only review key concepts but also to engage with the materials in a way that enhances your practical understanding. By systematically organizing your study time and utilizing available resources, you can ensure you are well-equipped to face the challenges of the certification process.

Develop a Study Plan

One of the most effective ways to prepare is by creating a study plan. This plan should outline specific topics to focus on each week and allow time for reviewing key areas. Prioritize complex subjects and areas you may feel less confident in, while ensuring you have enough time to revisit all necessary material. A structured schedule will keep you on track and make your study sessions more productive.

Use Practice Tests and Mock Scenarios

Taking practice tests is essential for familiarizing yourself with the format and types of questions you may encounter. These tests not only help reinforce your knowledge but also improve your ability to manage time during the actual assessment. In addition to written tests, engage with mock scenarios that simulate real-world tasks you might face in tax preparation. This combination of theory and practical application will enhance your readiness.

Essential Resources for Tax Certification Preparation

To succeed in a professional tax certification, having access to the right resources is key. These materials will not only help you understand the core concepts but also give you practical tools to apply your knowledge effectively. Whether it’s textbooks, online platforms, or hands-on practice, utilizing these resources will support your preparation and boost your confidence.

Books and Study Guides

Start by reviewing comprehensive study guides and textbooks that cover the full range of tax topics. These resources provide in-depth explanations and examples, helping you solidify your understanding. Be sure to choose updated materials that reflect the most current tax laws and regulations.

- Comprehensive tax preparation textbooks

- Specialized guides for certification preparation

- Study materials from tax preparation courses

Online Tools and Practice Tests

Online tools and practice tests are invaluable for improving your problem-solving abilities. These platforms often simulate real-world scenarios, helping you understand how to apply your knowledge in practical settings. Many offer interactive quizzes and mock assessments that mirror the structure of the actual certification.

- Online tax calculators and software demos

- Practice quizzes and mock exams

- Interactive case studies and scenario-based exercises

By making use of these essential resources, you can ensure a well-rounded preparation strategy and feel confident heading into the certification process.

Certification Requirements Explained

Before pursuing a tax professional certification, it is important to understand the requirements and steps involved in the process. Meeting these qualifications ensures that you are adequately prepared to handle various client needs, from individual tax returns to business filings. This section outlines the essential criteria and the necessary steps to complete your certification successfully.

| Requirement | Details |

|---|---|

| Educational Background | A basic understanding of tax preparation and accounting is recommended. Some programs may require specific courses or prior experience in the field. |

| Training Courses | Completion of accredited tax preparation courses is often mandatory. These courses cover key tax concepts, rules, and the software used in filing returns. |

| Practical Experience | Many certification programs require a certain amount of hands-on experience in tax preparation. This can include supervised work with clients or completing mock returns. |

| Pass the Assessment | After meeting educational and experience requirements, passing the final assessment is necessary to earn certification. This tests your knowledge of tax laws and filing procedures. |

By understanding and fulfilling these requirements, you will be on your way to becoming a certified tax professional, ready to help clients navigate their tax obligations effectively.

Time Management Strategies for the Assessment

Effective time management is essential for performing well in any professional assessment. When faced with a large amount of material or multiple tasks, managing your time wisely can help reduce stress and increase efficiency. By developing a strategic approach to time allocation, you can ensure that you address each section thoroughly while avoiding the rush at the end.

Prioritize High-Value Sections

Start by identifying the sections that carry the most weight or are the most complex. Allocate more time to these areas during your preparation so you can handle them with confidence. When working through the test, ensure you spend extra time on the topics that are more challenging or require complex problem-solving. This approach will prevent you from getting stuck on less critical sections.

Use a Time Allocation System

Break the assessment into smaller, manageable segments, and assign a specific time limit for each section or question. Use a timer to keep track of the time you spend on each part and stick to the allocated time. If a question is taking longer than expected, move on and return to it later. This method ensures that no section is left incomplete and helps you stay focused on your overall progress.

Tip: Stay calm and keep track of time throughout the assessment to avoid rushing through your answers at the last minute. Prioritizing and managing your time effectively will give you the best chance for success.

Breaking Down the Tax Preparation Syllabus

Understanding the structure of the curriculum is crucial for effective preparation. The syllabus outlines the key topics and learning objectives that will be tested, allowing you to focus on the most relevant areas. By breaking down each section, you can organize your study plan to cover all necessary material and ensure that no topic is overlooked.

Core Concepts of Tax Filing

The syllabus begins with foundational concepts related to tax filing. This includes understanding different types of tax returns, the relevant tax laws, and the various forms required for filing. Mastery of these core concepts will be essential as they form the basis for more complex tasks.

Advanced Tax Scenarios and Solutions

As you progress, the curriculum will introduce more complex tax scenarios, such as handling deductions, credits, and business taxes. These topics often require a deeper understanding and the ability to apply rules to real-world situations. Familiarity with these advanced scenarios will help you approach the more challenging sections of the certification.

By methodically working through the syllabus and focusing on key areas, you can ensure comprehensive preparation and improve your chances of success in the certification process.

How to Tackle Complex Tax Scenarios

When faced with complicated tax situations, it is essential to approach them systematically. These scenarios often require a solid understanding of tax laws and the ability to apply them to real-world situations. By breaking down the problem into manageable steps and focusing on key details, you can effectively navigate these challenges.

Step-by-Step Approach

To handle complex tax scenarios with confidence, follow this structured process:

- Identify the Key Elements: Start by determining the specific tax issues involved in the scenario, such as deductions, credits, or income sources.

- Gather Relevant Information: Make sure you have all the necessary documents, such as receipts, income statements, and previous tax returns, to help you make informed decisions.

- Apply the Correct Tax Laws: Review the relevant tax laws or guidelines that pertain to the situation. This may involve specific rules for deductions, tax brackets, or other tax treatment.

- Double-Check Calculations: After applying the rules, recheck all calculations to ensure accuracy. Even small errors can lead to significant discrepancies.

Seek Additional Resources When Needed

If you encounter challenges while working through a complex tax scenario, don’t hesitate to consult additional resources. Tax software, reference guides, or consulting with colleagues can provide helpful insights and clarification.

By breaking down complex situations and staying organized, you’ll be better equipped to solve intricate tax problems effectively.

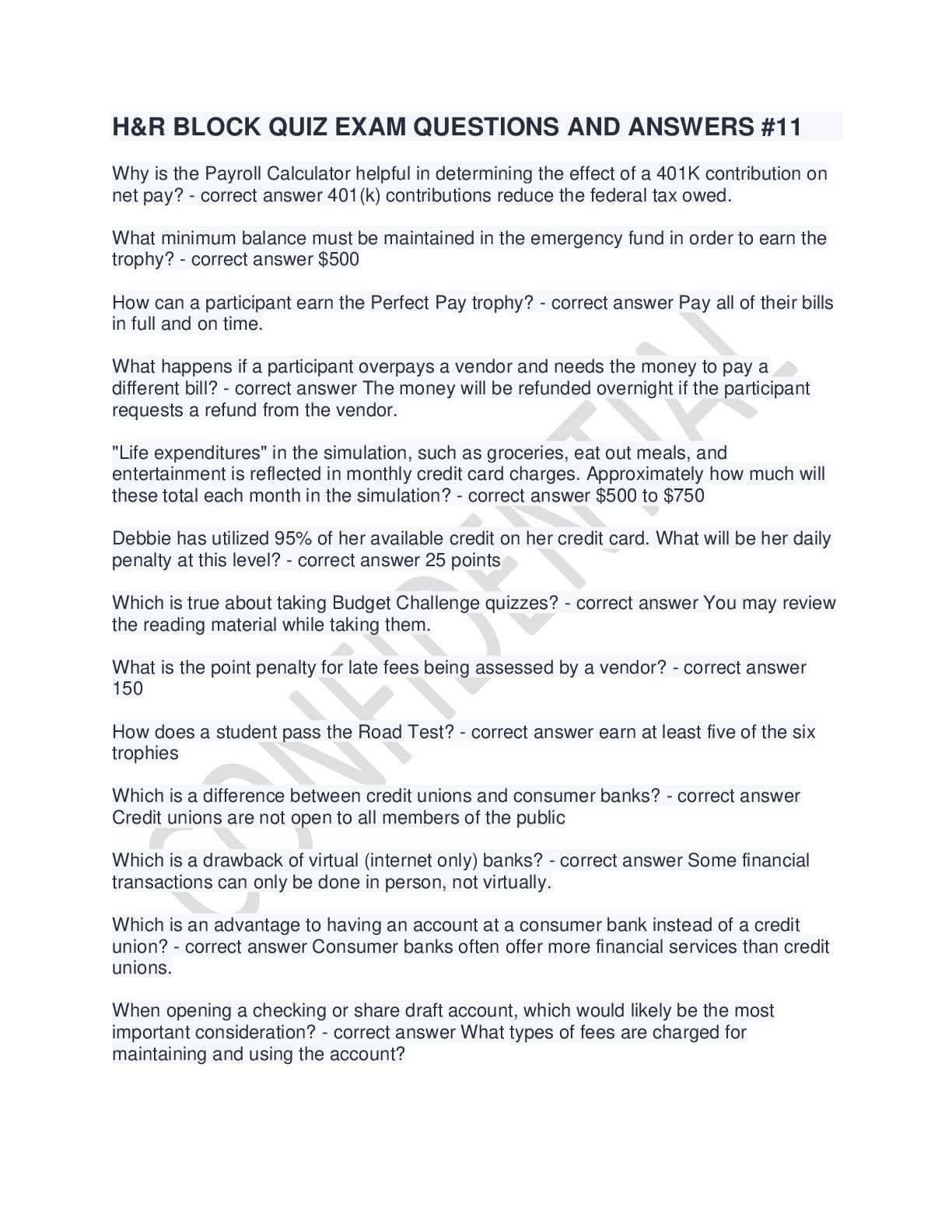

Sample Questions for the Certification Assessment

Practice is one of the most effective ways to prepare for any certification process. Reviewing sample questions allows you to familiarize yourself with the format, difficulty level, and key topics that may appear on the actual assessment. By testing your knowledge with realistic questions, you can identify areas where additional study is needed and boost your confidence.

Sample Question 1: A taxpayer is eligible for a standard deduction but has several additional deductions related to healthcare and home improvements. How should these deductions be handled in the calculation?

Sample Question 2: In the case of a small business owner who claims depreciation on assets, what are the rules for calculating and reporting depreciation expenses for tax purposes?

Sample Question 3: A client has a significant capital gain from the sale of property. What tax implications should be considered, and how can the taxpayer minimize their liability?

Sample Question 4: What is the difference between tax credits and tax deductions, and how do they impact a taxpayer’s total liability?

These sample questions cover a range of topics, from deductions and credits to business-related tax rules. Reviewing them, along with the associated solutions, will help you develop a deeper understanding of the material and prepare more effectively for the assessment.

Online Tools to Aid in Preparation

In today’s digital age, there are numerous online tools available that can significantly enhance your preparation for any professional assessment. These tools provide interactive features, study materials, and practice questions that make learning more efficient and focused. By utilizing these resources, you can identify weak areas and ensure that you’re fully prepared for the certification process.

Interactive Practice Platforms

Many websites offer interactive practice tests that simulate real-world scenarios. These platforms help you familiarize yourself with the format of the assessment while testing your knowledge on key topics. Some features include:

- Timed mock exams to improve time management skills

- Instant feedback on correct and incorrect answers

- Detailed explanations for each question to deepen your understanding

Study Guides and Resource Libraries

Online study guides provide a wealth of materials, from step-by-step breakdowns of important concepts to comprehensive reference books. Some of these guides are tailored to the specific areas you may need to focus on, allowing for a more personalized learning experience. Additional resources include:

- Interactive eBooks with embedded quizzes

- Video tutorials that explain complex topics

- Forums and communities for collaborative learning and problem-solving

By incorporating these online tools into your study routine, you can maximize your preparation and build the confidence needed to succeed.

Understanding Exam Scoring

Grasping the scoring system is essential for understanding how well you performed during a professional assessment. This process ensures that you can evaluate your strengths and weaknesses, allowing you to identify areas for improvement. The scoring criteria are based on multiple factors, such as accuracy, time management, and the complexity of tasks completed.

How Scoring Works

The assessment is typically divided into different sections, each of which is assigned a specific weight. Scoring is based on your ability to answer questions correctly within a given time frame. Here are the key components that determine your overall score:

- Correct answers: Each correct response adds to your total score.

- Partial credit: Some answers may receive partial credit depending on the level of accuracy.

- Time efficiency: Timely completion of sections may impact your score, demonstrating your ability to manage time effectively.

- Complexity of tasks: More difficult questions may carry higher point values.

Tips for Improving Your Score

To achieve the best possible results, consider the following strategies:

- Practice with timed mock tests to get used to the pace and pressure.

- Review areas where you consistently struggle and seek additional resources.

- Stay calm during the assessment to avoid mistakes caused by stress.

By understanding the scoring methodology, you can tailor your study approach to ensure the best outcome and track your progress effectively.

Exam Day Tips for Success

The day of the assessment is crucial for ensuring that all your preparation pays off. Properly managing your time, staying calm, and focusing on key strategies can significantly improve your performance. With the right mindset and a few practical steps, you can approach the day with confidence and maximize your chances of success.

Here are some essential tips to help you perform your best:

- Get a Good Night’s Sleep: Rest is vital for cognitive function. Ensure you get enough sleep the night before to stay sharp and focused during the assessment.

- Arrive Early: Give yourself plenty of time to settle in and avoid unnecessary stress. Arriving early allows you to familiarize yourself with the testing environment.

- Bring Necessary Materials: Double-check that you have all required items, such as identification, pens, or any specific tools needed for the assessment.

- Stay Calm and Focused: It’s easy to feel overwhelmed, but staying calm can help you think more clearly. Take deep breaths if you feel anxious.

- Read Each Question Carefully: Rushing through questions can lead to careless mistakes. Take the time to understand each question fully before answering.

By preparing yourself mentally and physically, you can reduce anxiety and improve your chances of success. Keep these tips in mind to stay on track and perform to the best of your ability on the big day.

How to Retake the Exam if Needed

If you did not achieve the desired results on your first attempt, it’s important to know that retaking the test is a possibility. Understanding the process and requirements for re-taking the assessment can help you approach the situation with clarity and confidence. With the right preparation and attitude, a second attempt can be an opportunity to improve your performance.

Here are the key steps to follow if you need to retake the test:

- Review the Test Guidelines: Before deciding to retake the assessment, familiarize yourself with the retake policy. This includes the number of attempts allowed, any waiting periods, and any additional fees that may apply.

- Analyze Your First Attempt: Take time to review your previous performance. Identify areas where you struggled or made mistakes, and focus on improving your understanding in those areas.

- Prepare More Effectively: Make sure you take the time to study thoroughly before your next attempt. Use practice tests, study guides, and any additional resources available to enhance your knowledge.

- Register for the Retake: Once you’re prepared, ensure you follow the proper steps for re-registering for the assessment. This may include selecting a date, paying any necessary fees, and confirming your registration.

- Stay Positive: It’s normal to feel disappointed, but maintaining a positive attitude is crucial. Use the opportunity as a learning experience to better yourself and approach the retake with renewed determination.

By taking the necessary steps and staying focused, a second attempt can provide the chance for success. Make the most of your preparation and ensure that you’re ready for the next opportunity.

Why the Certification Matters

Achieving certification in the tax preparation field can significantly enhance one’s career prospects, offering both personal and professional advantages. Earning this credential not only demonstrates expertise in a specific area but also validates a commitment to ongoing education and skill development. In a competitive job market, this certification sets individuals apart by proving their proficiency and reliability to employers and clients alike.

Key Benefits of Certification

- Increased Credibility: Certified professionals are often viewed as more knowledgeable and trustworthy. Clients tend to prefer working with individuals who have demonstrated their capabilities through certification, leading to greater job opportunities and client trust.

- Career Advancement: With certification, individuals can unlock higher-paying roles, promotions, and increased responsibilities within their organizations. It opens the door to a variety of tax-related positions, enhancing job security.

- Comprehensive Knowledge: The process of obtaining certification equips candidates with a deep understanding of tax laws, regulations, and effective practices. This ensures that professionals are well-prepared to handle complex cases and provide sound advice.

- Professional Growth: Continuing education is often required to maintain certification, promoting ongoing professional development and keeping practitioners up-to-date with the latest industry trends.

Why Employers Value Certified Professionals

Employers highly value certification because it represents a verified level of expertise and competence. It also indicates that an individual is proactive and committed to maintaining their qualifications. This, in turn, reduces the training time required for new hires and ensures that employees are equipped with the skills needed to meet the demands of the job.

Overall, certification is not just a credential but a step toward building a successful, sustainable career in the field, offering both personal fulfillment and professional recognition.

After the Test: Next Steps

Once the assessment is completed, it’s important to focus on what comes next to ensure continued growth and success. Whether you passed or need to retake the test, there are strategic steps to follow in order to advance in your career and skill development. Taking the time to evaluate your performance and plan for future goals is essential for long-term success in the field.

Review Your Results

After the test, review your performance carefully. If the results are positive, take a moment to acknowledge your hard work and the knowledge you’ve gained. If the outcome wasn’t as expected, don’t be discouraged. Analyze the areas where you may have struggled, and consider how you can improve next time. It’s crucial to understand where mistakes were made so that you can target those weaknesses for future improvement.

Consider Additional Training

If you feel there are gaps in your understanding or areas where you need more practice, consider additional training or study resources. There are plenty of online materials, workshops, and courses available that can help you refine your skills and prepare for any future challenges in your field.

Apply Your Knowledge

Once you’ve passed and received your certification, put your knowledge into action. Start by taking on real-world tasks that allow you to apply what you’ve learned. Gaining hands-on experience will not only reinforce your learning but also build your confidence and competence in handling various situations.

Plan for Further Advancement

As you move forward, think about your next career steps. Whether it’s pursuing additional certifications, seeking higher-level roles, or exploring new areas of expertise, planning your next move will help you stay focused on your long-term professional goals. Keep setting new objectives and continue your education to stay competitive and grow in your field.