The federal procurement process plays a critical role in ensuring that government operations run smoothly and efficiently. Understanding the structure and regulations governing these financial tools is essential for those involved in managing or using them. This section aims to provide a comprehensive look at the various systems used by the federal government to facilitate purchasing and financial management, along with key requirements and best practices.

For individuals tasked with overseeing or using these financial systems, it is important to grasp not only the technical aspects but also the ethical guidelines and compliance requirements. The resources and knowledge provided will help navigate the complexities of managing federal expenditures, making it easier to handle transactions with accountability and transparency.

Learning how to effectively operate within these systems ensures that all involved parties can meet their objectives while maintaining the integrity of the process. By understanding the responsibilities and obligations attached to these tools, users can avoid common pitfalls and contribute to the overall success of government spending efforts.

Understanding the DOD Purchase Card Program

The federal government relies on a structured system to streamline its procurement processes, enabling authorized personnel to acquire goods and services efficiently. This program serves as a key mechanism for smaller transactions, designed to simplify purchasing while adhering to strict rules and regulations. By offering a direct method for acquiring necessary resources, it helps reduce administrative workload and ensures accountability at all levels.

Program Structure and Usage Guidelines

The system operates through specific guidelines that govern who can utilize it and under what circumstances. Authorized personnel must comply with detailed procedures to ensure purchases align with federal policies. This helps to maintain transparency and integrity throughout the entire procurement process. While it provides flexibility, it also places responsibility on users to follow proper protocols, especially when making transactions related to government activities.

Ethical and Compliance Standards

Adherence to ethical standards and compliance is paramount in ensuring the proper use of this procurement tool. Cardholders must be well-versed in the relevant regulations that govern their actions, from avoiding conflicts of interest to ensuring that purchases are legitimate and necessary. Failure to follow these standards can result in significant consequences, both for the individuals involved and the broader integrity of government spending.

Key Objectives of the DOD Card System

The primary aim of this financial tool is to simplify and expedite the procurement process for government personnel, ensuring that necessary resources can be acquired quickly and efficiently. By streamlining transactions, it reduces administrative burdens and accelerates decision-making, allowing for faster responses to operational needs. This system is designed to promote efficiency while maintaining a high level of accountability and oversight in government spending.

Another key objective is to enhance compliance with federal guidelines and regulations. The system ensures that each transaction is carefully monitored to prevent misuse and ensure that purchases are legitimate and align with the organization’s budgetary and operational goals. This structure provides both flexibility and control, ensuring that users can meet their purchasing needs while remaining within the bounds of legal and ethical standards.

Who Can Use the Governmentwide Card

The ability to access and utilize this procurement tool is strictly limited to authorized personnel within the federal system. It is essential that users meet specific qualifications and are trained to handle transactions properly. This ensures that those granted access understand the system’s rules and can make purchases responsibly while adhering to government standards and regulations.

Eligibility Criteria for Authorized Users

Only individuals with proper clearance and roles within government organizations can be granted the authority to use this tool. Typically, these individuals include government employees responsible for day-to-day operations or specific procurement tasks. They must demonstrate a clear understanding of procurement guidelines, as well as complete the necessary training programs to manage these resources effectively.

Responsibilities of Approved Users

Approved users have a significant responsibility in ensuring the correct use of this resource. This includes abiding by all relevant regulations and ensuring that each transaction serves a legitimate government purpose. Additionally, cardholders must maintain records and report any discrepancies to avoid misuse and uphold transparency in financial processes.

Types of Purchases Allowed with the Card

This financial tool is designed to facilitate a wide range of acquisitions necessary for government operations. However, there are clear guidelines on what can and cannot be bought using this method. The primary focus is on ensuring that purchases are legitimate, relevant to government functions, and within the established budgetary constraints.

Eligible Purchases

Approved users can make purchases for a variety of needs that directly support the mission and operations of their agency. Some common items include:

- Office supplies and equipment

- Software and licenses required for government projects

- Training materials for personnel development

- Minor maintenance services for equipment

- Travel-related expenses such as lodging and transportation

Restricted Purchases

While the system provides flexibility, there are specific items and services that cannot be acquired through this mechanism. These restrictions are in place to prevent misuse and ensure that public funds are spent appropriately. Some restricted purchases include:

- Personal or non-business-related items

- Goods or services that exceed certain dollar limits

- Items requiring extensive contractual agreements

- Products from unauthorized vendors

Eligibility Requirements for Cardholders

Not everyone within a government organization is authorized to utilize this financial tool. To ensure responsible usage and compliance with regulations, certain eligibility criteria must be met. These criteria ensure that only qualified individuals with the proper training and understanding of procurement guidelines are entrusted with managing government funds.

Qualification Criteria for Authorized Users

In order to be considered eligible, individuals must hold specific roles within their organization and be tasked with responsibilities that require access to this financial tool. This typically includes personnel involved in operational or procurement activities. Additionally, prospective users must undergo thorough training to ensure they are familiar with the policies and procedures that govern the use of these resources.

Ongoing Responsibilities and Compliance

Once authorized, cardholders are expected to maintain a high standard of accountability. This includes adhering to all relevant rules, reporting any issues promptly, and ensuring that all transactions align with established guidelines. Regular reviews and audits are often conducted to ensure continued compliance and to prevent misuse of resources.

Common Mistakes During the Exam

When taking a test related to financial systems and procurement regulations, it’s easy to make simple mistakes that can impact your performance. Many individuals overlook important details or misunderstand key concepts, which can lead to errors. By recognizing common pitfalls and preparing for them in advance, you can improve your chances of success.

Overlooking Key Guidelines

One of the most frequent errors is failing to fully grasp the rules and regulations governing the use of government financial tools. This can result in answering questions incorrectly due to a lack of understanding of critical policies. Common mistakes include:

- Misinterpreting eligibility criteria for users

- Not understanding restricted purchases

- Failing to recognize compliance standards

Rushing Through the Test

Another common mistake is rushing through the test without carefully reading each question. It’s important to take your time to ensure you fully understand what is being asked. This can help avoid careless errors and improve the accuracy of your responses. Some common rushing-related mistakes include:

- Skipping questions that seem complicated

- Misunderstanding multi-part questions

- Overlooking the context of the scenario presented

Exam Preparation Tips for Success

Successfully preparing for a test focused on procurement practices and financial guidelines requires a strategic approach. Knowing the key concepts and understanding the regulations in depth are essential for performing well. By organizing your study materials and using the right techniques, you can increase your chances of mastering the content and performing confidently on the test.

Organize Your Study Materials

One of the most effective ways to prepare is to organize all relevant study materials. This includes reviewing official guidelines, past test papers, and notes. Make sure to focus on areas that are often emphasized in the test, such as the rules for using financial resources and ethical standards. Break down the material into manageable sections and prioritize the most important topics.

Practice with Sample Questions

Another powerful preparation method is practicing with sample questions or mock tests. This helps familiarize you with the format and style of questions that may appear. It also allows you to assess your strengths and identify areas where you need more review. Be sure to time yourself during these practice sessions to improve your ability to manage time during the actual test.

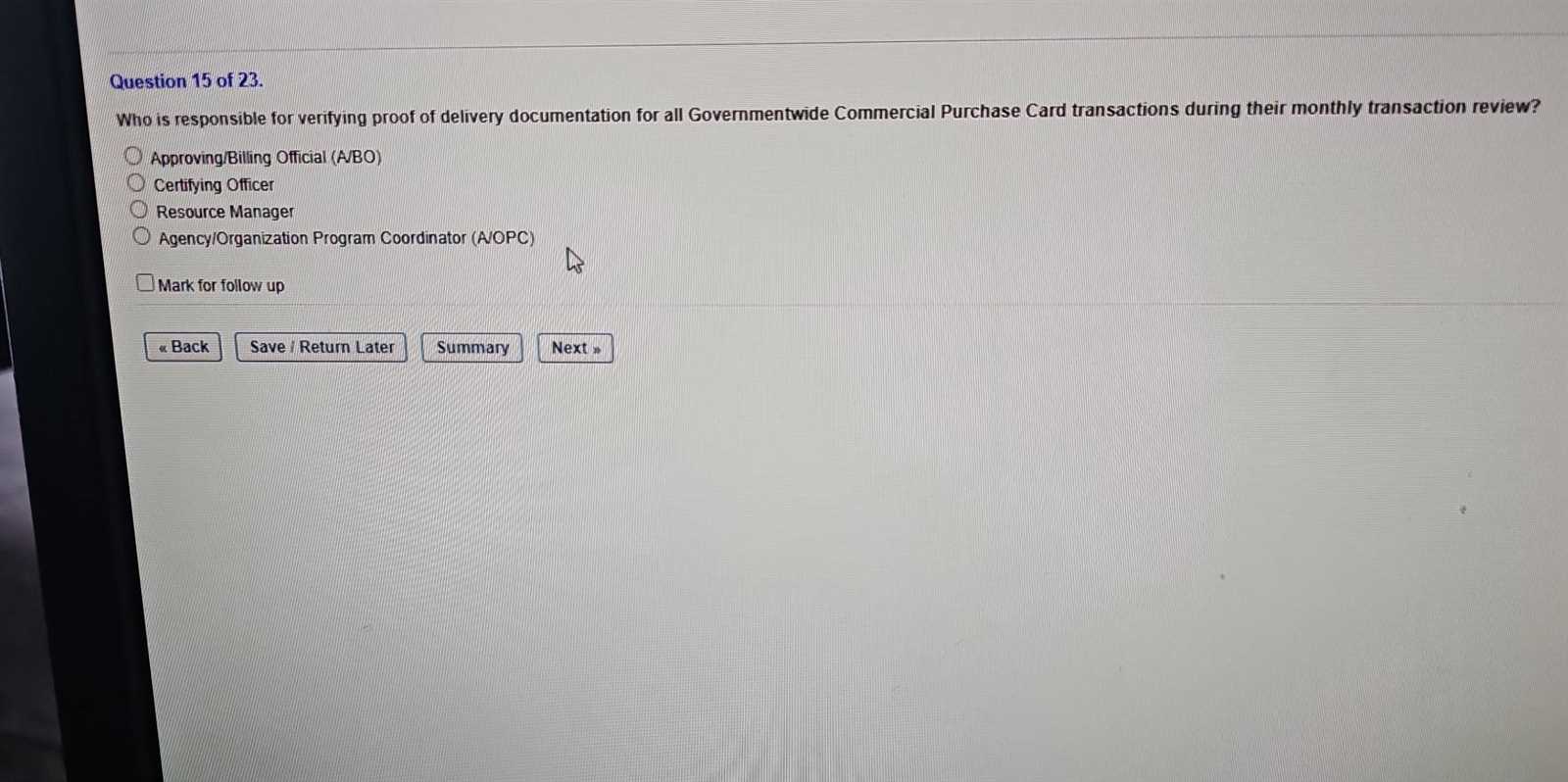

Understanding the Cardholder Responsibilities

Individuals authorized to use government-issued financial tools carry significant responsibilities. These responsibilities ensure that all transactions are handled ethically and in accordance with established rules. Cardholders are expected to exercise due diligence and follow strict guidelines to maintain transparency, accountability, and proper use of public funds.

Key Duties of Authorized Users

Cardholders must adhere to a range of duties designed to ensure compliance and prevent misuse. These include:

- Understanding and following procurement policies

- Ensuring purchases are for legitimate government purposes

- Monitoring transaction limits and adhering to budget constraints

- Maintaining accurate records of all expenditures

Ensuring Ethical Standards

In addition to procedural duties, cardholders must also uphold high ethical standards. This involves avoiding conflicts of interest, ensuring fairness in vendor selection, and preventing fraudulent activities. Ethical behavior is crucial in maintaining public trust and ensuring that all resources are used appropriately.

Reviewing Purchase Card Policies

Familiarizing oneself with the established policies governing the use of financial tools is crucial for ensuring compliance and preventing errors. These policies outline the proper procedures, limitations, and expectations for authorized individuals. Regularly reviewing these guidelines helps maintain integrity in financial transactions and ensures that all acquisitions align with government objectives and regulations.

Key Policy Guidelines to Follow

Understanding the main components of the policy is essential for all cardholders. The following key points are typically addressed in the guidelines:

- Eligibility requirements for authorized users

- Allowed and restricted types of purchases

- Spending limits and transaction approvals

- Reporting and documentation requirements for each purchase

Compliance and Accountability

To avoid misuse and potential violations, cardholders must comply with both internal and external oversight mechanisms. Regular audits, proper documentation, and timely reporting ensure that all financial activities are transparent and in line with regulations. Being accountable for each transaction is essential in safeguarding public funds and maintaining the integrity of the system.

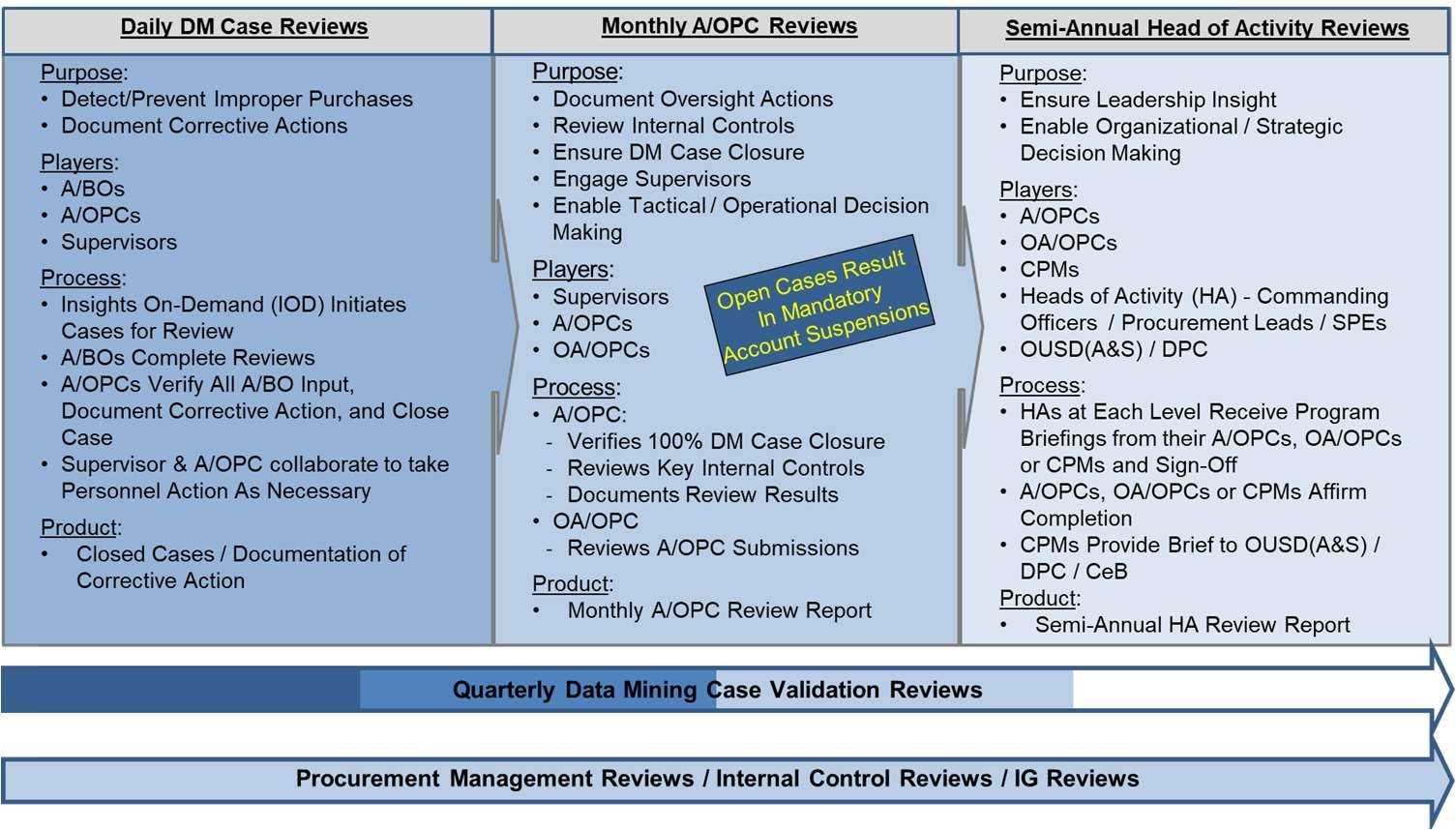

Monitoring and Managing Government Cards

Effectively tracking and overseeing the use of government-issued financial tools is essential for ensuring that funds are used responsibly and in compliance with relevant regulations. Proper management involves both real-time monitoring and ongoing evaluations to ensure that all transactions are legitimate and aligned with official policies.

Tracking Transactions and Spending

One of the primary responsibilities in managing these financial instruments is closely monitoring expenditures. This includes:

- Tracking all purchases to ensure they are within approved limits

- Reviewing receipts and documentation for accuracy

- Monitoring ongoing spending to avoid exceeding allocated budgets

Implementing Oversight and Audits

Regular audits and oversight procedures are essential for maintaining accountability. By conducting periodic reviews and audits of transactions, organizations can identify any potential misuse or discrepancies. This proactive approach ensures that all transactions adhere to guidelines and that any irregularities are promptly addressed. Strong internal control systems are key to preventing fraud and ensuring financial integrity.

Essential Compliance and Ethics Guidelines

Adhering to compliance and ethics standards is crucial when managing government-funded financial tools. These guidelines ensure that individuals and organizations operate with integrity, transparency, and accountability. By following these principles, cardholders can protect public trust and prevent misuse of resources.

Key Compliance Requirements

Compliance involves following legal and regulatory standards that govern the use of financial resources. Some essential compliance requirements include:

- Ensuring all transactions align with official procurement policies

- Adhering to spending limits and restrictions

- Maintaining accurate and up-to-date records for each transaction

Ethical Standards for Responsible Use

In addition to compliance, ethical behavior is vital for maintaining public confidence. Cardholders are expected to:

- Avoid conflicts of interest and ensure fairness in decision-making

- Ensure purchases are made only for legitimate government purposes

- Report any suspicious activity or misuse of resources

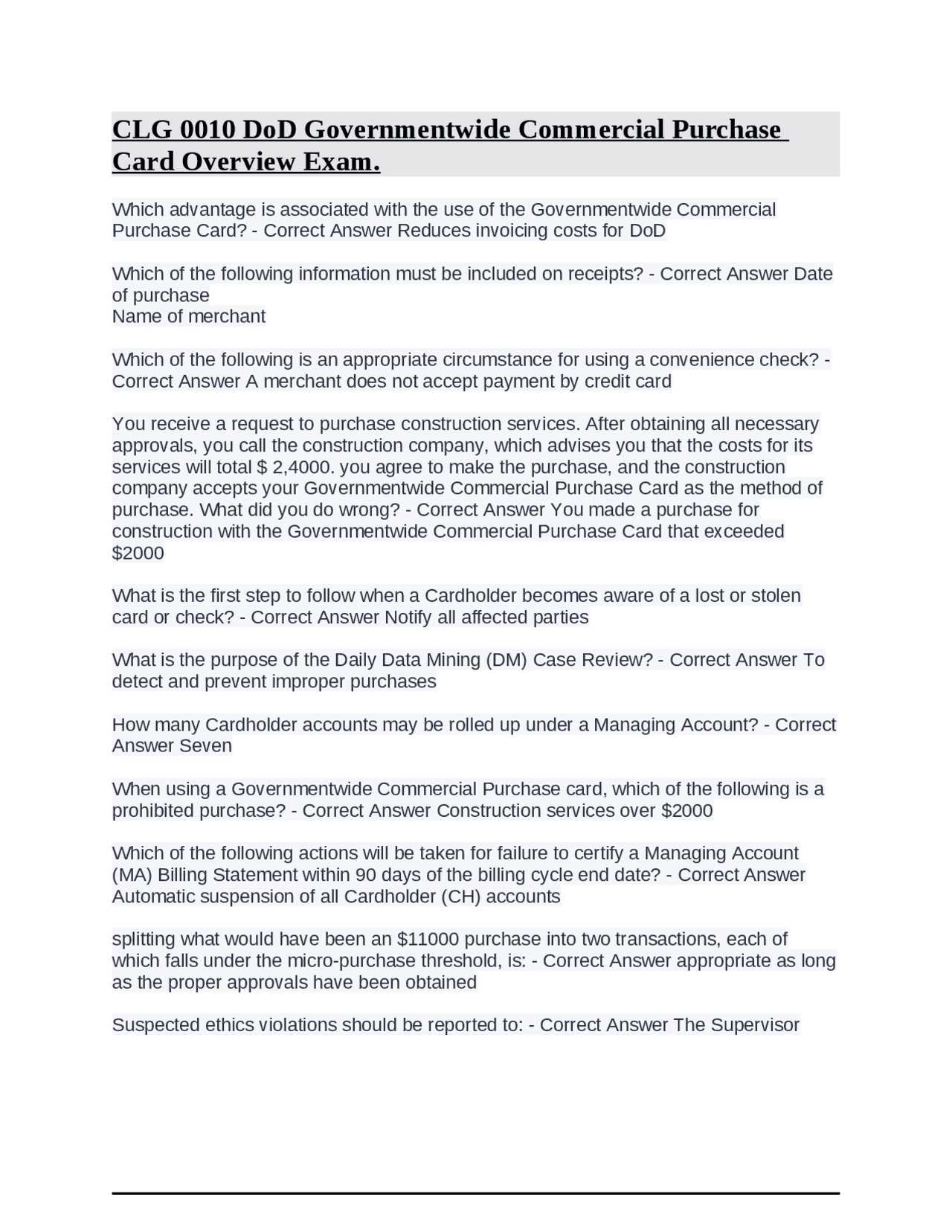

Commonly Asked Questions in the Exam

When preparing for assessments related to government financial tools, certain questions tend to arise more frequently. These questions often focus on the proper use, rules, and policies surrounding the management of these resources. Understanding the common themes in these inquiries can help candidates effectively navigate the testing process.

Frequently Encountered Topics

Some of the most common topics covered in the assessments include:

- Eligibility criteria for authorized users

- Appropriate types of purchases and restrictions

- Spending limits and approval processes

- Documentation and reporting requirements for transactions

- Ethical considerations and compliance rules

Sample Questions

To better prepare, candidates can anticipate questions such as:

- What actions must be taken if a transaction exceeds the approved spending limit?

- How should records be maintained for auditing purposes?

- What are the key ethical guidelines for using government-funded financial tools?

- Who is authorized to make purchases using these financial instruments?