Preparing for a comprehensive assessment in the field of business decision-making requires a deep understanding of various financial principles. A solid grasp of essential theories and practical tools will not only help you navigate complex scenarios but also improve your ability to make informed judgments under pressure. The process can seem overwhelming, but with the right approach, you can turn challenges into opportunities for learning.

To succeed, it’s crucial to focus on key areas such as evaluating investment opportunities, managing risk, and understanding how to effectively allocate resources. A thorough review of essential topics, combined with strategic study methods, will ensure you’re ready to tackle any problem set before you. Whether dealing with numbers or concepts, confidence in your knowledge will be your greatest asset.

With careful preparation, you can approach this challenge with clarity and precision. Building on your foundational skills and expanding your expertise in financial analysis will position you for success when it’s time to demonstrate your proficiency.

Preparation for Business Assessment Success

To perform well in a comprehensive test on business concepts, it’s essential to develop a strategic study plan that covers all critical areas. Understanding both the theoretical foundations and practical applications of various principles will give you the edge needed for success. By breaking down complex topics into manageable sections, you can ensure that each concept is thoroughly understood and ready to be applied when needed.

Focus Areas for Effective Study

Start by focusing on the core principles that often appear in assessments, such as capital allocation, investment evaluation, and risk management. These areas are fundamental to making sound decisions in business contexts and require a deep understanding of both quantitative and qualitative factors. Additionally, mastering key formulas, understanding financial statements, and practicing problem-solving techniques are crucial steps in preparing for the assessment.

Study Strategies for Maximum Efficiency

Adopting active study techniques will help reinforce your learning. Instead of passively reading through textbooks, engage with the material by solving practice problems, discussing complex topics with peers, and applying the concepts to real-world scenarios. Time management is also critical–ensure that you allocate enough time to each subject while reviewing your weakest areas multiple times for reinforcement.

| Topic | Key Concept | Recommended Resources |

|---|---|---|

| Investment Evaluation | Discounted Cash Flow, NPV, IRR | Textbooks, Online Courses |

| Risk Management | Hedging, Diversification | Case Studies, Practice Problems |

| Financial Ratios | Liquidity, Profitability, Solvency | Study Guides, Interactive Tools |

Incorporating these techniques will make your preparation more structured and effective, giving you the confidence to excel when the time comes to demonstrate your knowledge.

Understanding Key Financial Concepts

Grasping the fundamental principles of business decision-making is essential for mastering complex problems. These core ideas form the foundation of all strategic planning and investment evaluation, and a solid understanding of them is necessary to approach any business challenge effectively. This section explores critical topics that every individual should be familiar with to excel in this field.

Essential Areas to Focus On

To build a strong understanding, it’s important to break down the key financial concepts that frequently appear in assessments. Here are the primary areas to focus on:

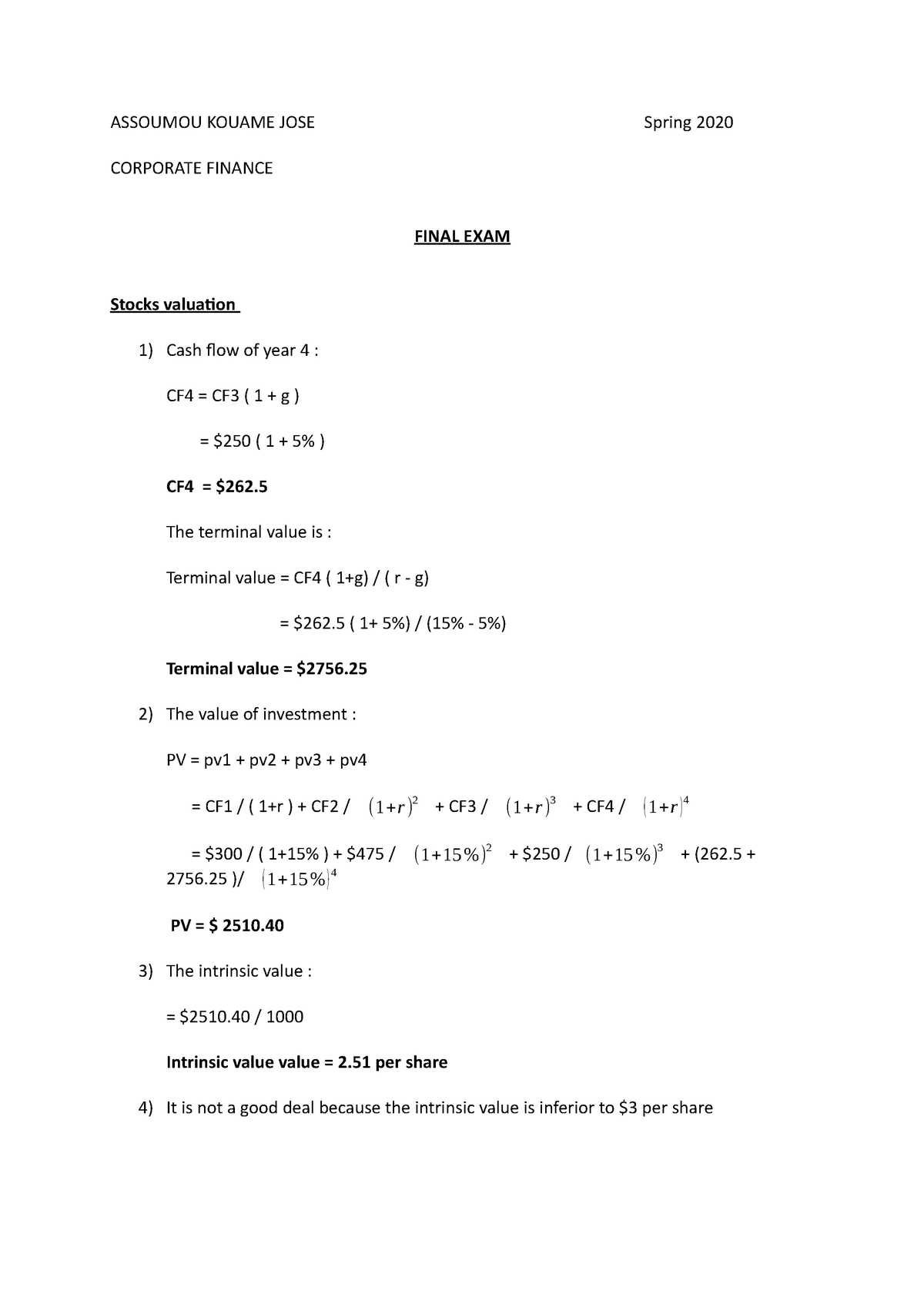

- Time Value of Money: The principle that money today is worth more than the same amount in the future due to its potential earning capacity.

- Risk and Return: The trade-off between potential risks and the expected returns from investments.

- Capital Budgeting: The process of planning and managing a firm’s long-term investments, such as purchasing equipment or expanding operations.

- Cost of Capital: The cost of obtaining funds, which includes both debt and equity, used for investments and operations.

Key Formulas and Tools

Alongside understanding the theoretical concepts, it is crucial to be comfortable with applying key formulas that help in calculating and analyzing different financial metrics:

- Net Present Value (NPV): A method used to evaluate investment opportunities by calculating the present value of expected future cash flows.

- Internal Rate of Return (IRR): The rate at which the net present value of an investment is zero, helping to assess its profitability.

- Return on Investment (ROI): A ratio used to measure the profitability of an investment compared to its cost.

- Debt-to-Equity Ratio: A measure of a company’s financial leverage, calculated by dividing total liabilities by shareholders’ equity.

Mastering these concepts and formulas will significantly enhance your ability to solve practical problems and make sound business decisions. By ensuring you understand the underlying principles, you can approach challenges with confidence and accuracy.

Time Value of Money in Business

The concept that money available today is worth more than the same amount in the future is foundational to decision-making in business. This idea is based on the principle that the value of money changes over time due to factors such as inflation, interest rates, and opportunity costs. Understanding how to apply this principle is crucial for assessing investments, managing resources, and making informed financial decisions.

At its core, this principle helps in comparing the value of cash flows received or paid at different times. The key idea is that a dollar today can earn interest, and its value increases with time, whereas a dollar in the future might lose value due to inflation or missed investment opportunities. Recognizing this dynamic allows businesses to evaluate the true worth of future returns and make better choices about where to allocate resources.

By mastering the time value of money, you can confidently assess projects, compare investment options, and determine the best financial strategies for both short-term and long-term goals. This concept is essential for understanding valuation, risk, and the optimal use of capital in various scenarios.

Analyzing Financial Statements Effectively

Evaluating financial reports is essential for making informed decisions regarding business operations and investment opportunities. The ability to interpret and analyze these documents allows you to assess a company’s health, performance, and future potential. Understanding the key components and ratios within these statements can provide valuable insights into profitability, liquidity, and overall stability.

Key Financial Statements to Review

There are three primary reports you need to analyze to gain a comprehensive understanding of a company’s financial position:

- Income Statement: Shows the company’s revenue, expenses, and profits over a specific period, helping to assess profitability.

- Balance Sheet: Provides a snapshot of the company’s assets, liabilities, and equity at a given point in time, indicating financial stability.

- Cash Flow Statement: Tracks the flow of cash into and out of the business, highlighting operational efficiency and liquidity.

Key Ratios for Financial Analysis

Once you have a good understanding of the reports, the next step is to calculate and interpret key financial ratios that offer deeper insights:

- Liquidity Ratios: Measure the company’s ability to meet short-term obligations. Common examples include the current ratio and quick ratio.

- Profitability Ratios: Assess the company’s ability to generate profit relative to its revenue, assets, or equity. Examples are return on assets (ROA) and return on equity (ROE).

- Solvency Ratios: Help to evaluate the long-term financial stability by comparing total debt to equity or assets. The debt-to-equity ratio is an important measure.

- Efficiency Ratios: Indicate how well the company utilizes its assets and liabilities to generate sales. Key ratios include asset turnover and inventory turnover.

By mastering these tools and techniques, you can analyze financial statements with confidence and make better-informed decisions regarding business strategy, investments, and financial management.

Capital Budgeting Techniques Explained

Evaluating and selecting investment opportunities is a critical task for any business looking to grow or maintain long-term profitability. The process involves analyzing potential projects to determine which ones will provide the best return on investment while balancing risk and reward. Several methods are commonly used to assess the financial viability of these opportunities, each offering unique insights into the project’s value and potential success.

Among the most widely used capital budgeting techniques are those that focus on comparing the time value of money, project risks, and the expected cash flows. These approaches help businesses prioritize investments that align with their financial goals and operational strategies, ensuring resources are allocated effectively.

Key Capital Budgeting Methods

There are several techniques used to evaluate investment projects. The most popular methods include:

- Net Present Value (NPV): Measures the difference between the present value of cash inflows and outflows over the life of a project. A positive NPV indicates a worthwhile investment.

- Internal Rate of Return (IRR): The rate at which the net present value of the project becomes zero. A project is generally considered favorable if the IRR exceeds the company’s required rate of return.

- Payback Period: Calculates the time it takes for an investment to recoup its initial cost. A shorter payback period is typically preferred as it indicates faster returns.

- Profitability Index (PI): The ratio of the present value of future cash flows to the initial investment. A PI greater than 1 indicates a potentially profitable project.

By applying these techniques, businesses can evaluate multiple investment opportunities and make more informed decisions about where to direct their capital. These methods not only provide a quantitative measure of potential returns but also help in assessing the risks associated with each project.

Risk Management and Decision Making

In any business, decision-making is often influenced by various uncertainties and potential risks that can affect outcomes. Effectively managing these risks is crucial for making informed choices that maximize potential rewards while minimizing negative consequences. By understanding and mitigating risks, companies can navigate complex environments with greater confidence and stability.

Risk management involves identifying potential threats, analyzing their impact, and developing strategies to either reduce or capitalize on them. This process allows decision-makers to evaluate alternatives based on their risk profiles and make choices that align with the organization’s objectives and risk tolerance.

Key Steps in Risk Management

The risk management process typically follows these steps to ensure a structured and effective approach:

- Risk Identification: The first step is to identify potential risks that could impact the business, whether financial, operational, or external factors.

- Risk Assessment: Once risks are identified, their potential impact and likelihood are evaluated. This helps prioritize which risks require the most attention.

- Risk Mitigation: After assessing risks, strategies are developed to reduce or eliminate them. This can involve creating contingency plans, diversifying investments, or taking out insurance.

- Monitoring and Review: Ongoing monitoring ensures that risk management strategies remain effective, with adjustments made as new risks emerge or existing ones evolve.

Integrating Risk in Decision Making

Incorporating risk management into decision-making involves weighing the potential rewards of a decision against the risks involved. Decision-makers must consider factors such as:

- Risk Tolerance: Understanding the level of risk the organization is willing to accept based on its goals and resources.

- Expected Return: Balancing the potential return on investment against the associated risks.

- Risk Diversification: Spreading investments or resources across different areas to reduce the impact of any single failure.

- Scenario Planning: Analyzing different potential outcomes to better prepare for uncertainties in decision-making.

By combining these strategies, businesses can make decisions that not only consider potential risks but also take advantage of opportunities, ensuring long-term growth and stability.

Financial Ratios for Exam Success

Understanding and applying key financial ratios is essential for evaluating a company’s performance and making informed business decisions. These ratios provide a snapshot of financial health and are often used to analyze profitability, liquidity, efficiency, and solvency. In the context of assessments, mastering these ratios can greatly enhance your ability to interpret financial data and solve complex problems.

When preparing for tests or evaluations in this field, it’s crucial to focus on the most relevant ratios, as they help break down financial statements into manageable and meaningful figures. Knowing how to calculate and interpret these metrics will enable you to assess a company’s strengths and weaknesses, identify trends, and make accurate predictions.

Key Ratios to Focus On

The following ratios are fundamental for exam success and will help you analyze a company’s financial position effectively:

- Current Ratio: Measures a company’s ability to meet short-term obligations with its short-term assets. A ratio above 1 indicates good liquidity.

- Quick Ratio: Similar to the current ratio, but excludes inventory from assets. It provides a more stringent measure of liquidity.

- Return on Equity (ROE): Reflects the profitability relative to shareholders’ equity, indicating how well the company generates profit from investments.

- Return on Assets (ROA): Indicates how efficiently a company uses its assets to generate profit.

- Debt-to-Equity Ratio: Compares the company’s total debt to its equity, providing insight into financial leverage and risk.

Using Ratios in Practical Scenarios

Once you’re familiar with the key ratios, practice applying them to real-world scenarios. This will improve your ability to quickly interpret financial data and answer questions accurately. Try to understand how each ratio impacts the overall financial health of the business and how different ratios are interconnected.

By focusing on these ratios and practicing their calculations, you’ll gain confidence in your ability to tackle financial analysis challenges and perform well in assessments.

Evaluating Investment Opportunities

Assessing investment opportunities is a key step in ensuring that resources are allocated effectively for long-term growth. It involves analyzing potential projects, understanding their risks and returns, and determining how they align with an organization’s overall objectives. A sound investment decision can lead to significant profits, while poor choices can have detrimental effects on financial stability.

The process of evaluating investments requires a combination of quantitative analysis and strategic thinking. Key metrics and techniques are used to assess whether an opportunity is worth pursuing based on its potential for generating value. Understanding the underlying financial data, as well as external factors that may influence the investment, is essential for making informed decisions.

Techniques for Assessing Investments

There are several methods used to evaluate investment opportunities. Some of the most common techniques include:

- Net Present Value (NPV): NPV calculates the difference between the present value of cash inflows and outflows, helping to determine whether the investment will generate a positive return over time.

- Internal Rate of Return (IRR): IRR calculates the rate at which an investment breaks even. A higher IRR indicates a more attractive investment, as it shows greater potential for profitability.

- Payback Period: This method measures how long it takes for an investment to recover its initial cost. A shorter payback period is typically preferred, as it indicates a faster return on investment.

Qualitative Factors in Investment Decisions

In addition to financial metrics, it’s also important to consider qualitative factors when evaluating an investment. These can include:

- Market Trends: The economic environment and industry trends play a significant role in determining the success of an investment opportunity.

- Management Expertise: The skills and experience of the management team can heavily influence the success of a project or venture.

- Competitive Advantage: An investment opportunity with a clear competitive edge in the market is more likely to succeed in the long term.

By using both quantitative analysis and considering qualitative factors, businesses can make more informed decisions and increase their chances of achieving positive financial outcomes.

Working with Cost of Capital

Understanding the cost of capital is essential for making informed investment decisions and evaluating financial projects. It represents the cost of obtaining the funds necessary to finance a business or project, whether through debt, equity, or a combination of both. This concept plays a crucial role in determining the minimum return an investment must generate to satisfy the expectations of investors and lenders.

To effectively manage and optimize the cost of capital, companies must carefully assess their sources of funding and their impact on overall financial performance. A lower cost of capital can result in more profitable investment opportunities, while a higher cost can limit potential returns. Understanding how different financing options affect the cost of capital is key for any financial strategy.

Components of Cost of Capital

The cost of capital is typically calculated as a weighted average of the costs of debt and equity. Below is a summary of the main components:

| Component | Description | Example |

|---|---|---|

| Cost of Debt | The effective rate a company pays on its borrowed funds, adjusted for taxes. | Interest rate on a loan or bond. |

| Cost of Equity | The return required by equity investors, considering the risk associated with owning the company’s stock. | Dividend yield or expected capital gains. |

| Weighted Average Cost of Capital (WACC) | The average rate of return a company is expected to pay to finance its assets, weighted by the proportion of debt and equity. | WACC calculation includes both debt and equity costs. |

Impact of Cost of Capital on Investment Decisions

When evaluating potential investments, the cost of capital serves as a benchmark against which the returns of a project are measured. If the expected return on an investment exceeds the cost of capital, the project can generate value for the company and its shareholders. However, if the return is lower than the cost, it could indicate that the investment will not be profitable in the long run.

Minimizing the cost of capital involves optimizing the mix of debt and equity to achieve the most favorable financing conditions. This balance will depend on factors such as market conditions, company risk profile, and the cost of different financing sources.

Maximizing Firm Value in Finance

Increasing the value of a business is a fundamental goal in strategic decision-making. This involves identifying opportunities to generate higher returns, reduce risks, and enhance operational efficiency. The value of a company is not just determined by its financial statements but also by its ability to create sustainable growth and maintain a competitive edge in the market.

To achieve this goal, businesses must align their resources, investments, and strategies in a way that maximizes profitability while maintaining financial stability. This requires careful analysis of market conditions, investment opportunities, and long-term objectives. By optimizing these elements, firms can increase their overall value and drive long-term success.

Strategies to Maximize Value

Several strategies can be employed to enhance the value of a business. Below are key approaches that are commonly used:

| Strategy | Description | Example |

|---|---|---|

| Cost Optimization | Reducing unnecessary expenses to improve profitability without sacrificing product quality or customer satisfaction. | Implementing process improvements to lower operational costs. |

| Revenue Growth | Expanding sales and market share through new products, services, or geographic regions. | Launching a new product line or entering untapped markets. |

| Capital Allocation | Investing resources into high-return opportunities while managing risks and maintaining liquidity. | Focusing on projects with high net present value (NPV) or strong internal rates of return (IRR). |

Evaluating and Measuring Firm Value

To effectively measure and track improvements in a company’s value, certain metrics are used. Key performance indicators (KPIs) such as earnings before interest and taxes (EBIT), return on equity (ROE), and market capitalization provide insights into financial health and growth potential. A strong focus on both short-term profitability and long-term value creation ensures that a company is moving in the right direction.

By combining these strategies and continuously assessing the performance, businesses can position themselves for sustainable growth and greater value creation over time.

Key Formulas for Financial Assessments

Understanding essential formulas is crucial for mastering financial analysis and making accurate calculations in various business contexts. These formulas provide the foundation for assessing investments, determining profitability, and evaluating risk. A solid grasp of these calculations can help in making informed decisions and solving complex financial problems efficiently.

To succeed in financial assessments, it is important to familiarize oneself with key equations that measure value, return, and risk. These formulas are frequently used in scenarios like project evaluation, capital budgeting, and performance analysis. Knowing when and how to apply them can significantly improve accuracy and decision-making processes.

Important Formulas

Below are some of the most widely used formulas that are essential for performing financial calculations:

| Formula | Purpose | Example |

|---|---|---|

| Net Present Value (NPV) | Evaluates the profitability of an investment by comparing the present value of cash inflows and outflows. | NPV = ∑(Cash Flow / (1 + r)^t) – Initial Investment |

| Internal Rate of Return (IRR) | Determines the rate at which the NPV of an investment becomes zero, indicating the expected return on the investment. | IRR is the discount rate where NPV = 0 |

| Return on Investment (ROI) | Measures the profitability relative to the cost of the investment. | ROI = (Net Profit / Cost of Investment) × 100 |

| Debt-to-Equity Ratio | Indicates the proportion of debt used to finance a company’s assets relative to equity. | Debt-to-Equity Ratio = Total Debt / Total Equity |

How to Use These Formulas

Each of these formulas serves a specific purpose in evaluating different aspects of financial health. For example, the NPV is most useful when assessing investment opportunities, as it helps determine whether an investment will generate sufficient returns to justify the initial outlay. The IRR is often used to compare multiple investment options with different cash flow patterns. Meanwhile, ROI provides a quick overview of an investment’s efficiency, while the debt-to-equity ratio helps assess the company’s financial leverage and risk.

Mastering these formulas and understanding their applications will significantly enhance your ability to analyze financial data and make more effective business decisions.

Important Topics in Governance

Effective management and oversight of an organization are critical for its long-term success. Key principles and practices in governance ensure that a company operates transparently, ethically, and in the best interest of its stakeholders. These elements form the foundation for decision-making processes that drive business strategies, financial performance, and risk management.

Understanding the key areas of governance is essential for anyone looking to grasp the complexities of organizational leadership. This includes roles and responsibilities, accountability, compliance, and the relationship between management and shareholders. A strong governance framework not only promotes efficiency but also protects the integrity and reputation of the company.

Key Aspects of Governance

The following topics are central to effective governance practices:

| Topic | Description | Example |

|---|---|---|

| Board Structure | Defines the composition, responsibilities, and authority of the governing board. | A board with independent directors ensures unbiased decision-making. |

| Shareholder Rights | Ensures that the interests of shareholders are protected through voting rights and transparency. | Providing shareholders with access to relevant financial reports. |

| Executive Compensation | Involves aligning executive pay with company performance and shareholder interests. | Bonuses tied to long-term growth rather than short-term profits. |

| Risk Management | Addresses the identification and mitigation of potential risks that could impact the business. | Creating a risk management committee to oversee potential threats. |

Best Practices for Strong Governance

Organizations can implement best practices to strengthen their governance structures. This includes establishing clear policies for ethical behavior, promoting diversity within the board, and ensuring that executives are held accountable for their actions. Additionally, effective communication with shareholders and maintaining rigorous financial reporting standards are key to ensuring that the organization remains transparent and trustworthy.

By focusing on these core topics, companies can foster a governance environment that promotes both accountability and sustainability in the long run.

Leverage and Capital Structure Insights

Understanding the balance between debt and equity is crucial for managing the financial health of a company. This balance determines how a business funds its operations and growth, and influences both risk and return. The mix of debt and equity in a company’s capital structure plays a significant role in shaping its overall value and financial stability.

Leverage refers to the use of borrowed funds to increase the potential return on investment. However, excessive use of leverage can introduce significant risks, especially if the business faces cash flow challenges. On the other hand, an optimal capital structure can enhance shareholder value and minimize financial risk by strategically combining debt and equity financing.

Understanding Leverage

Leverage allows a company to amplify returns by using borrowed capital. Here are some key considerations when evaluating leverage:

- Debt-to-Equity Ratio: This ratio measures the proportion of debt and equity used to finance a company’s assets. A high ratio indicates higher financial risk, but also the potential for higher returns.

- Fixed Costs: Leverage increases exposure to fixed costs. If a company takes on too much debt, it may struggle to meet interest payments during economic downturns.

- Tax Benefits: Debt financing offers tax advantages, as interest expenses are tax-deductible. This can be beneficial in reducing a company’s overall tax burden.

Capital Structure Considerations

The optimal capital structure depends on several factors, including the company’s risk tolerance, industry norms, and growth prospects. Companies must carefully assess both internal and external factors when deciding how to structure their capital:

- Business Risk: Companies with stable and predictable cash flows may benefit from higher levels of debt, as they can reliably meet debt obligations.

- Cost of Capital: A well-balanced capital structure minimizes the overall cost of capital, which is vital for maximizing returns and enhancing market valuation.

- Market Conditions: In times of low interest rates, borrowing may be more attractive, while high rates may make equity financing a more favorable option.

Ultimately, finding the right mix of debt and equity is a complex decision that requires balancing potential returns with financial stability. Properly managing leverage and capital structure can greatly enhance a company’s ability to grow and thrive in competitive markets.

Short-Term vs Long-Term Financing

Choosing the right type of funding is essential for a business to meet its operational needs and growth objectives. Companies often face the decision of whether to rely on short-term or long-term borrowing, each of which offers distinct advantages and challenges. The choice between these two financing options can significantly impact a company’s liquidity, risk profile, and overall strategy.

Short-term financing typically provides immediate capital to cover daily operational needs or unexpected expenses. However, these funds need to be repaid relatively quickly, often within a year. Long-term financing, on the other hand, is designed for larger investments and can provide stability over extended periods, often lasting several years. Understanding the nuances of both financing types is crucial for effective financial management.

Benefits of Short-Term Financing

Short-term funding is often used to address temporary cash flow gaps or to finance working capital needs. Here are some key benefits:

- Quick Access to Funds: Short-term loans are often easier and faster to secure, making them ideal for businesses with urgent financial requirements.

- Flexibility: These financing options typically have less stringent requirements, offering flexibility for businesses to adjust their financial strategies.

- Lower Costs: Interest rates for short-term financing are often lower than long-term options, especially for businesses with good credit ratings.

Advantages of Long-Term Financing

Long-term financing is typically used for capital expenditures, such as purchasing equipment, acquiring property, or funding large-scale projects. Some of its key benefits include:

- Lower Repayment Pressure: With longer repayment terms, businesses can manage their debt obligations more comfortably, reducing immediate financial strain.

- Stability: Long-term financing can provide stability and predictability, which is essential for large-scale investments or business expansion.

- Tax Advantages: Depending on the structure, long-term debt financing may offer tax-deductible interest payments, lowering the effective cost of borrowing.

Ultimately, the decision between short-term and long-term financing depends on a company’s specific needs, financial situation, and strategic goals. While short-term financing offers immediate relief, long-term funding provides the stability required for sustainable growth and development.

Understanding Dividend Policies and Valuation

One of the key decisions a company makes is determining how much profit to return to its shareholders versus reinvesting in the business. This decision is influenced by several factors including financial health, growth opportunities, and market conditions. A company’s approach to distributing earnings can have a significant impact on its stock price, investor perceptions, and long-term success.

Dividend policies play a critical role in this process, as they dictate how and when earnings are distributed. Companies typically adopt one of several strategies, ranging from paying regular dividends to reinvesting all profits. The valuation of a company is often directly affected by its dividend approach, as investors generally favor predictable and sustainable payouts, especially when seeking long-term income. Understanding the relationship between dividend policies and valuation helps in assessing the financial health of a business and its potential for growth.

Types of Dividend Policies

There are different approaches to paying dividends, and each has its own implications for a company’s financial strategy:

- Stable Dividend Policy: Companies paying stable dividends aim to maintain a consistent payout, often with slight adjustments based on earnings. This policy fosters investor confidence, as it signals financial reliability.

- Residual Dividend Policy: This approach suggests that dividends are only paid out after all profitable investments have been made. The focus is on retaining earnings to fund future growth opportunities, making the dividend payouts less predictable.

- Irregular Dividend Policy: Some companies pay dividends on an ad-hoc basis, based on available profits or one-time events. This type of policy is common in businesses with fluctuating earnings or those in growth stages.

Impact on Valuation

Dividend payouts can affect a company’s market value in several ways. Investors often use dividends to estimate the intrinsic value of a company, with high, stable dividends often leading to higher valuations due to the appeal of steady income streams. Below are some key considerations:

- Dividend Discount Model (DDM): This model helps estimate the value of a company based on the present value of expected future dividends. The model assumes that dividends will continue to grow at a constant rate, providing a clear picture of the company’s long-term value.

- Market Perception: Companies that consistently meet or exceed their dividend expectations are often seen as more stable and reliable, boosting investor confidence and stock price.

Understanding dividend policies and their influence on valuation allows investors and company managers to make informed decisions about how to balance reinvestment and shareholder returns. It also provides insights into a company’s financial priorities and its outlook for the future.

Strategies for Efficient Exam Time Management

Effective time management is crucial for success during any rigorous testing scenario. With limited time available and a broad range of topics to cover, students must develop a strategic approach to maximize their efficiency and ensure they perform at their best. Proper planning allows individuals to allocate time wisely, reduce stress, and enhance the likelihood of covering all necessary material.

By prioritizing tasks, breaking them into manageable sections, and focusing on high-value content, students can improve their chances of doing well while maintaining a calm and composed mindset throughout the process.

Prioritizing Key Areas

- Identify High-Impact Topics: Focus on the subjects that carry the most weight in the assessment or have historically been emphasized. Understanding which topics are most likely to appear will help direct your study efforts effectively.

- Review Past Assessments: Look at previous exams or sample questions to recognize patterns in the types of questions asked. This can give you a better idea of where to direct your attention.

- Allocate Time According to Difficulty: Spend more time on complex topics or areas where you feel less confident. For easier subjects, a quick review may be sufficient.

Time Allocation During the Test

- Read Instructions Carefully: Before jumping into solving problems, take a moment to thoroughly read the instructions. Misunderstanding a question can waste valuable time.

- Start with Easy Questions: Begin with the questions you feel most confident about. This not only boosts your morale but also ensures that you accumulate marks early in the process.

- Keep Track of Time: Set periodic reminders or glance at the clock to monitor how much time you’ve spent on each section. This helps prevent spending too long on a single question.

- Leave Room for Review: Set aside a few minutes at the end to go over your answers. This final check can help catch any careless mistakes and refine your responses.

By using these strategies, you can manage your time more effectively, reduce last-minute panic, and approach the assessment with a clear, focused mindset. Time management is not just about working harder, but about working smarter to achieve the best results possible.