Preparing for a financial certification that covers essential industry concepts requires a structured approach. Whether you’re new to the field or looking to solidify your knowledge, understanding the core principles is key to achieving success. The path to proficiency in financial topics involves careful study and practice, ensuring that you can confidently tackle the questions presented during the certification process.

While the material may seem complex at first, breaking it down into manageable sections helps ease the learning process. By focusing on key principles and refining your problem-solving skills, you’ll build the confidence needed to excel. This preparation isn’t just about memorizing facts; it’s about developing a deeper understanding of the underlying concepts and being able to apply them effectively.

Success in this field depends on more than just basic knowledge. It’s about mastering critical thinking and analytical skills, which will serve you well during both the assessment and your professional journey. Focusing on practical application and reviewing past questions will prepare you for the challenges ahead, helping you approach the exam with a calm and clear mindset.

CFA Investment Foundations Exam Answers

When preparing for a financial certification, one of the key elements to focus on is understanding the various types of questions that may arise during the assessment. Gaining proficiency in answering these types of questions requires a well-rounded grasp of fundamental financial principles, along with the ability to apply them effectively in practical scenarios. This section explores methods for enhancing your performance by providing insights into typical questions and practical approaches to mastering them.

Types of Questions You May Encounter

In any certification process, the types of questions asked can vary greatly, requiring different approaches to answer them correctly. Some common formats include:

- Multiple Choice Questions: These are designed to test your recognition and recall of key concepts.

- Scenario-Based Questions: These questions test your ability to apply theoretical knowledge to real-world situations.

- Calculation Problems: Questions that require you to use formulas or perform financial calculations.

- Conceptual Questions: These assess your understanding of broader financial theories and their implications.

Tips for Mastering Financial Questions

Effective preparation goes beyond just reviewing material. To excel in answering questions during the assessment, consider the following strategies:

- Understand Core Concepts: Make sure you have a solid grasp of the basic principles. Without understanding the underlying theories, it’s difficult to apply them correctly.

- Practice with Past Questions: Familiarize yourself with previous assessment questions to get an idea of the question types and the level of difficulty.

- Work on Time Management: Since many assessments are time-constrained, practicing under timed conditions can help you manage your time efficiently.

- Analyze Answer Choices: When tackling multiple-choice questions, carefully evaluate each option before making your final choice. Often, one answer will stand out as the most logically consistent with the principles you’ve studied.

- Focus on Application: In scenario-based and calculation questions, focus on applying your knowledge to the specific case presented. Understanding how to connect theory with practical scenarios is essential.

By following these strategies and actively engaging with the content, you can build confidence and improve your performance on the assessment, ensuring that you are prepared for any challenge that comes your way.

Understanding the CFA Investment Foundations Exam

The process of becoming certified in the field of finance involves mastering a broad range of concepts that form the backbone of the industry. Understanding the structure and content of the assessment is crucial to effectively preparing for it. This section delves into the key components of the certification, highlighting the essential areas you need to focus on in order to succeed.

Core Areas of Focus

The certification covers a wide array of topics, all of which are integral to grasping the principles and practices that drive financial decision-making. Key areas of focus include:

- Ethical and Professional Standards: A deep understanding of ethics in finance and the regulations that guide professional behavior.

- Financial Markets and Instruments: The basics of various markets, including equity, debt, and alternative investments, as well as the instruments traded within them.

- Portfolio Management: Principles of creating and managing investment portfolios, understanding risk, and achieving financial objectives.

- Economics and Financial Reporting: Knowledge of macroeconomic indicators, financial statements, and their relevance to investment strategies.

Preparation Strategies for Success

To excel in the assessment, it’s important to follow a focused preparation plan that targets these core areas. Here are some effective strategies:

- Comprehensive Review: Study all topics comprehensively, ensuring that you understand both theoretical concepts and their real-world applications.

- Active Practice: Work through practice questions to identify your strengths and areas needing improvement.

- Time Management: Focus on managing your study time effectively, balancing between reading, practicing, and revising key concepts.

- Mock Assessments: Take mock assessments under timed conditions to simulate the real experience and help build confidence.

Understanding the structure of the certification process, coupled with targeted study strategies, will prepare you to navigate the complexities of the content and ultimately succeed in the certification journey.

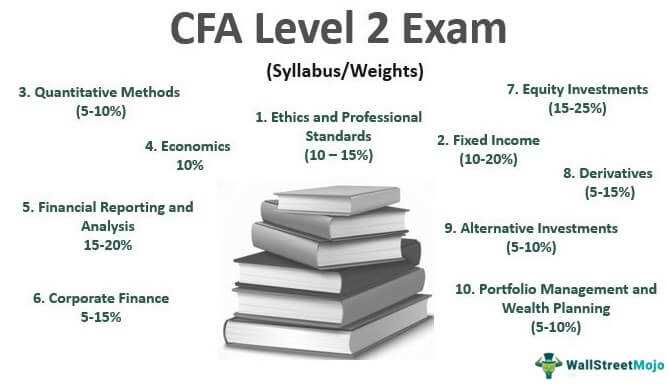

Key Topics Covered in the CFA Exam

The certification process in the financial industry requires candidates to master a wide range of critical subjects. These topics serve as the foundation for understanding the key concepts that drive financial markets and decision-making. Each area provides the essential knowledge needed to navigate the complexities of finance, from basic theory to practical applications. Below are the major topics typically covered in the certification assessment.

Ethical and Professional Standards

One of the most important areas focuses on the ethical guidelines that govern the financial profession. Understanding the standards of conduct, integrity, and professional behavior is essential for anyone working in finance. Key concepts include:

- Ethical decision-making frameworks

- Global regulatory standards

- Professional conduct and fiduciary responsibility

Financial Markets and Instruments

This topic covers the different types of financial markets and the instruments traded within them. It includes a thorough understanding of:

- Equity and debt securities

- Derivatives and alternative investments

- Market efficiency and pricing mechanisms

Portfolio Management

Managing investment portfolios is a crucial skill for finance professionals. This area includes principles related to:

- Risk management techniques

- Asset allocation and diversification

- Performance evaluation and optimization strategies

Economics and Financial Reporting

A solid grasp of economics and financial reporting is essential for making informed investment decisions. Topics within this area include:

- Macroeconomic indicators and their impact on markets

- Financial statement analysis and interpretation

- Key ratios used in financial analysis

These topics represent the core areas that form the backbone of financial knowledge, and mastering them is key to excelling in the certification process. By understanding these critical subjects, candidates are better prepared to apply their knowledge in real-world financial settings.

How to Approach CFA Investment Questions

Successfully answering financial questions during a certification requires more than just memorization of facts. It demands a strategic approach that combines knowledge of key concepts with practical problem-solving techniques. To excel in this process, it’s important to break down each question carefully and apply structured methods for finding the best solutions. Below are strategies that can help improve your performance when tackling complex financial questions.

Understand the Question’s Objective

Before diving into any calculations or solutions, take a moment to carefully read the question. Understand what is being asked and identify the key components that will guide your answer. Often, the question will include specific details such as timeframes, financial figures, or theoretical concepts that should influence your response. Pay attention to:

- Keywords that signal important aspects (e.g., “calculate,” “assess,” “determine”)

- Context or scenarios that provide clues about how to approach the problem

- Any limitations or assumptions that should be considered

Break Down the Problem

Once you understand the question, break it down into manageable parts. Complex questions may involve multiple steps, and addressing each one systematically will help avoid confusion. Organize your approach by:

- Identifying relevant formulas or concepts

- Setting up the problem logically before solving it

- Ensuring that each step is justified and leads toward the correct answer

Manage Your Time Efficiently

Time management is critical when working through a series of questions. Practice answering questions under timed conditions to simulate the actual experience. Ensure that you allocate enough time for each question based on its complexity, and avoid spending too much time on a single problem if you’re unsure of the solution. If a question is taking too long, move on and revisit it later if time allows.

Check Your Work

After completing a question, take a moment to review your answer. Double-check calculations, ensure that all components of the question have been addressed, and verify that your answer aligns with the problem’s requirements. Reviewing your work can help catch errors and improve your accuracy.

By applying these strategies, you will be better equipped to tackle financial questions with confidence and clarity, increasing your chances of success in the certification process.

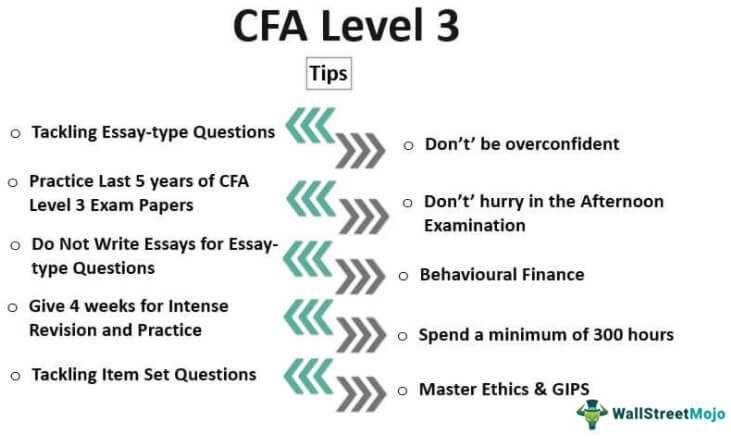

Study Techniques for CFA Success

Achieving success in any certification process requires a focused and efficient study plan. The key to mastering financial concepts and performing well in assessments lies in adopting effective study techniques. The following strategies will help you approach your preparation in a way that maximizes retention, understanding, and application of key principles.

Develop a Structured Study Plan

A well-organized study plan serves as the foundation for your preparation. It allows you to manage your time effectively and ensures that all important topics are covered. Key components of a strong study plan include:

- Set Clear Goals: Break down your study goals into manageable sections and set deadlines for each one.

- Prioritize Key Areas: Focus on the areas that carry the most weight or are more difficult for you.

- Review Regularly: Consistent review of previously studied material helps reinforce learning and prevent forgetting.

Active Learning Methods

Active learning techniques encourage deeper engagement with the material, making it easier to retain and apply what you’ve learned. Some effective methods include:

- Practice Questions: Regularly working through practice problems will help reinforce key concepts and improve problem-solving skills.

- Teach What You Learn: Explaining concepts to others can deepen your understanding and identify areas where you need further clarification.

- Group Study: Collaborating with peers allows for discussion and clarification of difficult topics, offering multiple perspectives on the material.

Use Varied Learning Resources

Relying on just one source of material can limit your understanding. To gain a comprehensive grasp of the subject, use a variety of learning resources:

- Study Guides and Textbooks: Use comprehensive study guides and textbooks to cover the core concepts thoroughly.

- Online Courses and Videos: Visual learning through videos or online courses can be an excellent way to understand complex theories.

- Flashcards: Use flashcards for quick recall of definitions, formulas, and key concepts.

Stay Consistent and Track Progress

Consistency is key to long-term success. Set aside dedicated study time each day and track your progress to ensure you’re staying on track. Periodically assess your progress and adjust your plan as needed. By maintaining a steady pace, you will avoid last-minute cramming and improve retention.

By integrating these techniques into your study routine, you’ll enhance your understanding, build confidence, and increase your chances of success in your certification journey.

Common Mistakes to Avoid in the Exam

During any certification assessment, there are several common pitfalls that candidates often fall into. These mistakes can undermine your performance, regardless of how well you’ve prepared. Being aware of these issues beforehand allows you to avoid them and approach the test with more confidence and focus. Below are some key mistakes to watch out for and strategies to ensure success.

Neglecting to Read Questions Carefully

One of the most frequent errors is rushing through the questions without fully understanding what is being asked. Many questions are designed to test your ability to analyze and apply knowledge, rather than simply recall facts. Always read each question thoroughly, paying close attention to the specifics such as timeframes, conditions, or instructions. Taking a few extra seconds to understand the question can save you time and prevent costly mistakes.

Overlooking the Importance of Time Management

Time pressure is one of the most challenging aspects of an assessment. Failing to manage time effectively can result in incomplete answers or rushed responses. To avoid this, allocate time to each section according to its complexity. If you encounter a particularly difficult question, move on and return to it later rather than wasting precious minutes. Practice under timed conditions before the test to build your ability to pace yourself.

Ignoring the Fundamentals

While it may be tempting to focus solely on advanced topics, neglecting the foundational concepts can hinder your performance. Basic principles are often the key to solving more complex problems. Make sure you have a solid understanding of the core material, as it will support your ability to tackle a wide variety of questions effectively.

Not Reviewing Your Work

In the rush to finish, many candidates fail to review their answers before submitting. This oversight can lead to simple errors such as miscalculations or overlooked details. If time permits, always double-check your work. Look for any obvious mistakes, such as incorrect formulas or missing information, to ensure your answers are as accurate as possible.

Failing to Stay Calm Under Pressure

Stress and anxiety can cloud your thinking and lead to impulsive decisions. Staying calm and focused is critical to performing well. If you feel overwhelmed, take a deep breath and reset your mind. Trust in your preparation and approach the questions with a clear and logical mindset. Maintaining composure will help you think more clearly and work through challenging questions with confidence.

By recognizing and avoiding these common mistakes, you can improve your chances of success and navigate the assessment process more effectively.

Important Resources for CFA Exam Prep

Preparing for a financial certification assessment requires a range of study materials to ensure comprehensive knowledge of the subject matter. The right resources can help you master critical concepts, practice applying them, and ultimately enhance your performance. Below are some of the most valuable resources available for candidates to use during their preparation.

Study Materials and Books

Comprehensive study guides and textbooks are fundamental for building a strong foundation in the key concepts covered in the certification process. These resources often include detailed explanations, practice questions, and real-world applications to help reinforce your learning. Key materials include:

- Official Curriculum: The official study material often provided by the certifying body, which includes all essential concepts, practice questions, and detailed explanations.

- Study Guides: Condensed resources that highlight the most important topics and provide structured outlines for review.

- Practice Question Banks: Access to a collection of practice questions that simulate real-world assessment conditions, allowing you to test your knowledge and improve problem-solving skills.

Online Courses and Webinars

Online platforms offer interactive courses that allow for a more flexible learning experience. These courses typically include video lectures, quizzes, and virtual study groups to enhance engagement and deepen understanding. Some popular resources include:

- Online Courses: Platforms like Coursera and Udemy offer comprehensive courses taught by experts in the field.

- Webinars and Workshops: Live or recorded webinars hosted by professionals provide insights and tips for tackling complex topics.

Practice Tests and Mock Assessments

Taking practice tests under timed conditions is one of the best ways to prepare for the certification assessment. These tests help you familiarize yourself with the format, manage time efficiently, and identify areas that need improvement. Many prep providers offer mock assessments that simulate the real test experience, allowing you to practice in a high-pressure environment.

Study Group and Peer Support

Joining a study group can be a highly effective way to stay motivated and clarify doubts. Collaborating with peers allows for mutual learning, discussion of difficult concepts, and sharing of useful resources. Online study forums and local groups offer platforms for interaction and support throughout your preparation journey.

Comparison of Key Resources

| Resource | Description | Advantages |

|---|---|---|

| Official Curriculum | Comprehensive study material provided by the certifying body | Authoritative, covers all topics in-depth |

| Study Guides | Condensed versions of the core material | Time-saving, highlights key concepts |

| Online Courses | Interactive video lectures and quizzes | Flexibility, visual and interactive learning |

| Practice Tests | Mock assessments to simulate the real exam | Improves time management and problem-solving |

| Study Groups | Collaborative learning with peers | Peer support, mutual learning |

Using a combination of these resources will give you a comprehensive approach to studying and increase your chances of success in the certification process. Each resource offers unique benefits, and leveraging them together will help you better understand the material and perform at your best.

Time Management Tips for the CFA Exam

Efficient time management is crucial when preparing for and taking any financial certification assessment. The ability to allocate time wisely can significantly impact your performance. Proper planning ensures that you can address each section of the test without feeling rushed or overwhelmed. Below are some valuable tips for managing your time effectively during your preparation and on the test day itself.

Creating a Study Plan

Establishing a study schedule well in advance allows you to cover all essential topics and avoid last-minute cramming. Break down your study sessions into manageable chunks, focusing on specific subjects each day. Prioritize areas where you feel least confident and ensure that you consistently review all material leading up to the test. A detailed plan will keep you on track and prevent you from wasting time on unnecessary tasks.

Practice Time Allocation

Simulating real test conditions during your preparation is one of the best ways to manage your time effectively. When practicing with mock assessments or sample questions, set a time limit for each section. This will help you gauge how long you should spend on different types of questions. During your study sessions, practice managing your time per question so that you’re not rushing through the material on test day.

Time Management on Test Day

When sitting for the certification assessment, time can quickly slip away, especially with complex questions. The key to staying on track is pacing yourself. Start by reading through the instructions carefully and allocating time for each section based on its difficulty. Avoid spending too much time on any one question–if you’re stuck, move on and return to it later. Aim to leave a few minutes at the end to review your answers.

Stay Calm and Focused

During the test, remaining calm is essential to managing your time effectively. Anxiety can cloud your judgment, causing you to rush through questions or misinterpret them. Take deep breaths and focus on one question at a time. If you find yourself losing focus, pause for a moment and refocus your mind. Staying composed allows you to maintain a steady pace throughout the assessment.

By implementing these time management strategies, you can optimize your preparation and perform at your best during the certification process. Proper planning, regular practice, and staying calm on test day will help you navigate the process smoothly and effectively.

How to Review CFA Investment Materials

Effective review is key to mastering the core concepts necessary for a financial certification. The review process ensures that you retain critical information, strengthen your understanding, and identify areas needing further attention. Below are strategies to help you efficiently go through study materials and maximize your retention.

Focus on Key Topics

Start by identifying the core concepts that are most frequently tested. Focus your review on these topics, as they are likely to make up the bulk of the assessment. Use your study guides and practice questions to prioritize these areas and make sure you are confident in your understanding of them. Narrowing your review to key topics helps ensure you’re not overwhelmed with excessive material.

Use Active Recall and Spaced Repetition

Active recall is an excellent technique for reinforcing your understanding. Instead of passively rereading notes, try to recall the information from memory. This forces your brain to engage with the material in a deeper way, strengthening long-term retention. Spaced repetition is another powerful method–review material at increasing intervals over time to combat forgetting and reinforce key concepts.

Practice with Mock Questions

One of the best ways to review is by practicing with mock questions that simulate the real assessment conditions. This allows you to test your knowledge, improve your speed, and get comfortable with the types of questions that may appear. Focus not only on correct answers but also on understanding why certain answers are incorrect to avoid making the same mistakes in the future.

Track Your Progress

Keep track of your progress during the review process. Regularly assess your performance in practice tests and identify weak areas. Focus on reviewing these sections in more depth and retest yourself periodically. This helps you ensure continuous improvement and prevents you from neglecting important topics.

Review Strategy Comparison

| Method | Description | Benefits |

|---|---|---|

| Active Recall | Attempting to remember information without looking at notes | Enhances retention and strengthens memory connections |

| Spaced Repetition | Reviewing material at increasing intervals | Helps combat forgetting and reinforces long-term memory |

| Mock Questions | Practicing with simulated questions | Improves problem-solving skills and prepares for real conditions |

| Progress Tracking | Assessing and tracking performance over time | Helps identify weak areas and measure improvement |

By using these techniques, you can systematically review the material, reinforcing your knowledge and improving your ability to recall and apply key concepts. Regular, focused review combined with active recall and spaced repetition will ensure you’re fully prepared for the certification process.

What to Expect on the Exam Day

The day of the assessment can be both exciting and stressful. Knowing what to expect can help you manage your time effectively, stay calm, and approach the test with confidence. Proper preparation goes beyond studying the material–it’s also about being mentally and physically prepared for the day itself. Here’s what you should keep in mind as you head into the test center.

Arriving at the Test Center

Make sure to arrive early to give yourself enough time to settle in and avoid any last-minute stress. Most test centers will require you to check in, go through security protocols, and verify your identification. Be prepared to follow all instructions provided by the test center staff. Bring all required documents, such as your admission ticket and a valid ID. Checking your test materials the night before can prevent any delays on the day of the assessment.

Understanding the Test Structure

The assessment will likely consist of multiple-choice questions, designed to test your knowledge across different topics. Knowing the format will help you manage your time effectively. Plan on spending a set amount of time on each section, and avoid dwelling too long on difficult questions. If you don’t know an answer right away, move on and return to it later if needed. Stay calm and remember that you can always guess if you’re running out of time.

During the test, you may be allowed to bring certain materials such as a calculator, but make sure to check the guidelines ahead of time. It’s also important to follow the rules set by the testing organization, as failure to do so may result in penalties or disqualification. With the right mindset and preparation, you can approach the test day with confidence and perform at your best.

Understanding CFA Investment Terminology

Mastering the terminology used in finance and related fields is crucial for anyone pursuing certification or building a career in this industry. A strong grasp of the key terms and concepts ensures that you can interpret questions correctly, understand complex topics, and communicate effectively within the financial sector. Here’s a guide to some of the most important terminology you should familiarize yourself with to increase your chances of success.

Key Financial Terms

- Asset Class: A category of assets, such as stocks, bonds, or real estate, that share similar characteristics and behave in similar ways.

- Risk Premium: The extra return expected from an investment compared to the risk-free rate, compensating for the potential risk involved.

- Diversification: The practice of spreading investments across various asset types or sectors to reduce risk.

- Liquidity: The ability to quickly convert an asset into cash without significantly affecting its price.

- Capital Market: A financial market where long-term debt or equity-backed securities are bought and sold.

Understanding Market Indicators

- Volatility: The degree of variation in the price of an asset over time, often indicating the level of market uncertainty.

- Yield: The income return on an investment, typically expressed as a percentage of the investment’s cost or market value.

- Return on Investment (ROI): A measure of the profitability of an investment, calculated by dividing the net profit by the original investment amount.

- Bear Market: A market condition where asset prices are falling or are expected to fall.

- Bull Market: A market condition where asset prices are rising or are expected to rise.

By becoming familiar with these and other key terms, you will be better prepared to navigate the complexities of financial assessments and discussions. Understanding the language of finance is an essential part of developing expertise in the field, helping you build the knowledge necessary for success.

Mastering Investment Foundations Concepts

Building a strong understanding of basic financial concepts is essential for anyone aiming to succeed in the world of finance. These fundamental principles lay the groundwork for more complex topics and help ensure that you can make informed decisions. In this section, we’ll explore several core concepts that every aspiring professional should grasp to navigate the financial landscape with confidence.

Core Principles to Understand

- Risk and Return: The fundamental relationship between the level of risk associated with an investment and the potential return it offers. Understanding this balance is key to evaluating various opportunities.

- Asset Allocation: The process of distributing investments among different asset classes, such as stocks, bonds, and real estate, to manage risk and optimize returns.

- Time Value of Money: The principle that money available today is worth more than the same amount in the future due to its potential earning capacity.

- Compounding: The process by which the value of an investment grows over time as earnings are reinvested, generating additional earnings.

- Market Efficiency: The theory that financial markets reflect all available information at any given time, making it impossible to consistently outperform the market without taking on additional risk.

Building a Strong Financial Strategy

- Long-Term Planning: Developing a strategy for future financial goals, ensuring that investments grow steadily and are aligned with personal or organizational objectives.

- Diversification: Spreading investments across different asset types to reduce exposure to any single risk, thereby increasing the overall stability of a portfolio.

- Liquidity Management: Ensuring that there is enough accessible capital to meet immediate financial needs without compromising long-term investment goals.

- Risk Mitigation: Identifying and implementing strategies to limit exposure to potential losses while optimizing investment returns.

Mastering these concepts forms the backbone of any successful financial strategy. With a firm grasp of these core ideas, you will be well-prepared to approach more advanced topics with confidence and clarity. Understanding these foundational principles is not just about passing a test–it’s about developing a mindset that allows for informed, strategic decision-making in the complex world of finance.

Practical Tips for Answering CFA Questions

Approaching a set of questions designed to test your knowledge requires a thoughtful and strategic method. Whether you’re answering multiple-choice or open-ended questions, applying specific techniques can help ensure clarity, accuracy, and efficiency in your responses. This section provides actionable tips that will enable you to tackle questions with confidence and enhance your overall performance.

Strategies for Effective Question Handling

- Read Questions Carefully: Always read each question thoroughly before attempting to answer. Understanding what is being asked is essential to providing the correct response.

- Identify Key Information: Highlight or underline important details within the question to ensure you don’t miss any critical components that could impact your answer.

- Eliminate Obvious Wrong Answers: In multiple-choice questions, immediately rule out options that are clearly incorrect. This increases your chances of selecting the right answer from the remaining choices.

- Use Process of Elimination: When you’re uncertain, carefully evaluate each remaining option. Consider what each choice implies and use logical reasoning to eliminate less likely options.

- Stay Focused on the Question’s Objective: Keep the goal of the question in mind. Avoid overthinking or introducing irrelevant information that could distract you from providing a concise, accurate response.

Managing Time and Improving Efficiency

- Time Allocation: Set a time limit for each question to avoid spending too much time on any single item. Practice with timed mock questions to improve your pacing.

- Don’t Rush: While managing time is crucial, don’t sacrifice accuracy for speed. If a question is particularly difficult, move on and return to it later if time permits.

- Track Progress: Keep an eye on your progress throughout the test. If you find yourself stuck on a question, make a note of it and keep moving to ensure you complete all sections within the allotted time.

Useful Tips for Practice

| Tip | Benefit |

|---|---|

| Review Past Questions | Familiarizes you with the question formats and common topics. |

| Practice Under Timed Conditions | Helps improve time management skills and reduces exam-day anxiety. |

| Analyze Mistakes | Identifies areas of weakness and allows for targeted improvement. |

By following these strategies, you’ll be better equipped to approach the questions with confidence and precision. With consistent practice and careful attention to detail, answering questions will become a smoother, more streamlined process, increasing your chances of success.

Common Question Formats on the CFA Exam

Understanding the various types of questions you might encounter is crucial to effectively preparing for any testing environment. Different formats are designed to assess your knowledge and ability to apply core principles in practical scenarios. In this section, we will explore the most common formats and how to approach them with precision and clarity.

Multiple Choice Questions

Multiple choice questions (MCQs) are one of the most common formats you will face. They consist of a question or statement followed by a set of possible answers, usually four options. Your task is to identify the most accurate answer from the given choices. To excel at these questions:

- Eliminate obvious wrong answers: Quickly rule out any options that are clearly incorrect, which increases your chances of selecting the right one.

- Look for keywords: Pay attention to qualifying terms such as “always,” “never,” or “generally,” as they can provide clues about the correct answer.

- Guess strategically: If you’re unsure, use the process of elimination to narrow down your options and make an educated guess.

True or False Questions

True or false questions present statements where you must determine whether the information provided is correct. These questions test your ability to discern factual accuracy, often requiring attention to detail. To handle these questions effectively:

- Read carefully: Ensure you fully understand the statement before deciding on its truthfulness.

- Spot absolutes: Statements with absolute terms like “always” or “never” are often false, unless they are universally true in the context provided.

- Think critically: Even if a statement seems generally true, check for exceptions that could make it false.

Case Study Questions

Case study questions present a scenario or problem that you must analyze and respond to based on the information provided. These questions often involve longer text and may include financial statements or other supporting data. To succeed in these questions:

- Break down the information: Identify key details in the case and organize your thoughts logically to form a structured response.

- Apply concepts: Use your knowledge of theoretical concepts to address practical issues raised in the scenario.

- Consider multiple perspectives: Be prepared to explore different approaches and solutions, as real-world situations often require a nuanced understanding.

Fill-in-the-Blank Questions

Fill-in-the-blank questions require you to complete a sentence or statement with the correct term or number. These questions often test specific knowledge of definitions, formulas, or numerical concepts. To tackle them effectively:

- Memorize key terms: Focus on critical terms, formulas, or definitions that are frequently tested.

- Understand the context: Even if you’re unsure of the exact answer, understanding the broader context of the question can help you deduce the correct response.

- Use logic: If you know the general concept being tested, logically think through the possible answers to find the one that fits.

By familiarizing yourself with these common question formats, you can approach the test with greater confidence. Practicing with a variety of question types will enhance your readiness and ensure you are well-prepared for any format you encounter.

How to Improve Your Score

Achieving a high score on any assessment requires a combination of effective strategies, focused study, and consistent practice. Whether you are looking to enhance your understanding of key concepts or sharpen your test-taking skills, there are several steps you can take to maximize your performance. This section provides actionable tips to help you improve your score and boost your confidence before the test.

Develop a Structured Study Plan

A well-organized study plan is critical for mastering the material and ensuring that you cover all necessary topics. Instead of cramming at the last minute, break down your study schedule into manageable chunks and allocate time to review each subject. Here are a few strategies to consider:

- Set clear goals: Define specific objectives for each study session, such as mastering a particular concept or completing practice problems.

- Prioritize difficult topics: Identify areas where you struggle the most and dedicate more time to reviewing them. This focused attention will help you improve faster.

- Use a variety of resources: Diversify your study materials, including textbooks, online resources, and practice tests, to reinforce your learning from different angles.

Practice with Realistic Simulations

One of the most effective ways to improve your test-taking abilities is through simulated practice. By practicing under conditions that closely mimic the actual test, you will familiarize yourself with the types of questions and time constraints you will face. Here are a few methods to incorporate into your preparation:

- Timed practice tests: Complete practice questions or full-length tests within the allotted time frame to simulate the pressure of the real situation.

- Analyze your results: After completing practice tests, review your mistakes and understand why you chose the wrong answers. This reflective process will help you avoid similar errors in the future.

- Track your progress: Regularly assess your improvement by tracking your practice test scores and focusing on areas where you are still weak.

By consistently following these tips and maintaining a disciplined approach to your study habits, you can significantly improve your score. Remember, success is built on consistent effort and the willingness to learn from your mistakes.