For students pursuing a career in accounting, the final assessment can feel like the ultimate challenge. This critical evaluation tests not only your knowledge but also your ability to apply complex principles and concepts to real-world scenarios. Success in this evaluation requires both a deep understanding of the material and strategic study techniques.

Effective preparation is key to performing well. From mastering the foundational concepts to understanding the more advanced topics, every step matters. Organizing your study time, focusing on the most important areas, and practicing with mock assessments can make a significant difference in your results.

In this guide, we will explore essential study strategies, common pitfalls to avoid, and practical tips for approaching the test with confidence. Whether you are a first-time test-taker or looking to improve your score, these insights will help you navigate the process more effectively.

Mastering Accounting Test Preparation

Success in any major assessment depends on a solid plan and disciplined execution. The key to excelling in this challenging evaluation is developing a comprehensive study approach that allows you to grasp core concepts, apply them effectively, and manage your time wisely. Preparing well is not about cramming, but about building a deep understanding and reinforcing your knowledge through strategic revision.

Start by identifying key topics that are often emphasized in the test. Focus on the foundational principles and build from there, ensuring you understand both the theory and practical application of accounting rules. Make use of study guides, textbooks, and practice problems to strengthen areas that you find more challenging.

Practice is another essential element of preparation. Working through past assessments or mock questions will give you insight into the types of problems you will face. It also helps familiarize you with the test format, reducing anxiety and improving your confidence on the day of the assessment. Stay organized, track your progress, and make adjustments as needed to ensure you’re covering all relevant material.

Understanding Key Accounting Concepts

To perform well in any accounting assessment, it’s crucial to have a solid grasp of the fundamental concepts that form the backbone of the subject. These core principles not only guide your theoretical understanding but also help you apply your knowledge to real-world scenarios. Mastering these concepts will allow you to approach complex problems with confidence and clarity.

Core Principles to Focus On

Focus on the following key concepts, as they are foundational to understanding the broader scope of accounting practices:

- Internal Controls: These procedures ensure the integrity of financial reporting and safeguard against fraud.

- Risk Assessment: Identifying potential risks and their impact on financial accuracy is crucial for maintaining reliable reporting.

- Materiality: Understanding the importance of certain figures or transactions in the context of overall financial statements.

- Evidence Collection: Learning how to gather and evaluate evidence that supports the accuracy of financial statements.

Application of Key Concepts

It’s essential to not just memorize definitions but to practice applying these concepts in different scenarios. Here are some practical tips:

- Work on case studies that require the identification of key concepts in action.

- Review how each principle ties into financial reporting and decision-making processes.

- Engage in mock assessments to practice your ability to apply these principles under exam conditions.

By mastering these essential ideas, you’ll be well-equipped to tackle a variety of questions and scenarios, demonstrating a deep understanding of accounting practices.

Essential Study Materials for Accounting Assessments

Having the right study materials is essential for effective preparation. A variety of resources can enhance your understanding of key concepts, provide practice opportunities, and improve your ability to apply theoretical knowledge. Selecting and utilizing high-quality materials will help you focus on the most important areas and ensure you are fully prepared for the test.

Recommended Resources

Here are some essential study materials that can aid in your preparation:

| Resource Type | Description | Benefits |

|---|---|---|

| Textbooks | Comprehensive guides that cover all major concepts and principles. | Provides in-depth explanations and examples for understanding core topics. |

| Study Guides | Condensed versions of key topics, often with practice questions. | Helps in quick review and reinforcement of important concepts. |

| Practice Questions | Sets of questions or past assessments designed to test your knowledge. | Improves problem-solving skills and familiarity with the test format. |

| Online Resources | Websites, forums, and video lectures for learning and discussion. | Offers flexible learning and access to a range of different explanations. |

How to Make the Most of These Materials

While having the right resources is crucial, how you use them is equally important. Focus on areas where you need improvement and prioritize materials that align with your weak points. Be sure to practice regularly and track your progress to identify areas requiring further attention.

Common Mistakes in Accounting Assessments

When preparing for a major accounting assessment, it’s easy to make errors that could affect your performance. Many students overlook certain aspects of their preparation or fall into traps during the assessment itself. Recognizing these common pitfalls can help you avoid them and improve your chances of success.

Preparation Mistakes

There are several mistakes that can occur during the preparation phase that may leave you unprepared on the day of the test:

- Ignoring Key Concepts: Focusing too much on less important topics and neglecting core principles can lead to gaps in knowledge.

- Overloading on Cramming: Last-minute studying may help in the short term but doesn’t promote long-term understanding or retention.

- Lack of Practice: Skipping practice questions or not reviewing past assessments can leave you unprepared for the types of questions you will face.

- Not Reviewing Mistakes: Failing to learn from errors made in practice tests can result in repeating the same mistakes during the real assessment.

On-the-Day Mistakes

During the actual test, there are several behaviors that can reduce your performance:

- Panic and Time Mismanagement: Losing control of your time due to stress or starting with difficult questions can waste valuable minutes.

- Overthinking Questions: Trying to find overly complex answers when the solution is simpler can lead to unnecessary confusion.

- Neglecting to Review Answers: Not double-checking your responses can result in avoidable mistakes, especially with numerical or detail-oriented questions.

Time Management During Test Preparation

Effective time management is one of the most critical skills when preparing for any major academic assessment. Properly allocating your study time allows you to cover all necessary material, avoid last-minute cramming, and ensure that you have enough time to review key concepts before the test. Developing a strategic plan will help you stay focused and make the most of each study session.

How to Plan Your Study Time

To make the best use of your time, break down your study sessions into manageable blocks and prioritize tasks based on difficulty and importance. Here’s a simple breakdown for organizing your preparation:

| Task | Suggested Time Allocation | Focus |

|---|---|---|

| Review Core Concepts | 30% of total study time | Understand the foundational principles and theories. |

| Practice with Sample Problems | 40% of total study time | Apply knowledge to real-world scenarios and past tests. |

| Revise Mistakes | 20% of total study time | Identify weaknesses and focus on areas of improvement. |

| Take Breaks | 10% of total study time | Rest and recharge to avoid burnout. |

Effective Study Scheduling Tips

In addition to time allocation, creating a detailed study schedule can significantly enhance your productivity. Consider these tips:

- Start Early: Begin your preparation well in advance to avoid feeling rushed and overwhelmed.

- Set Realistic Goals: Break down large tasks into smaller, achievable goals to stay motivated.

- Stick to a Routine: Establish a consistent study routine and stick to it, even when distractions arise.

- Use Tools: Utilize planners or apps to track progress and stay on top of deadlines.

By organizing your study time effectively, you can reduce stress, improve retention, and feel fully prepared when the day of the assessment arrives.

How to Approach Accounting Case Studies

Case studies are an integral part of any accounting assessment, as they challenge you to apply your theoretical knowledge to real-world scenarios. The ability to effectively analyze and solve case studies requires both critical thinking and a structured approach. Knowing how to break down the problem, identify key issues, and present solutions can make a significant difference in your performance.

Steps to Effectively Solve Case Studies

To tackle a case study efficiently, follow these steps:

- Read the Case Thoroughly: Understand the context, background, and key issues before diving into the details. This will give you a clear sense of the problem you’re trying to solve.

- Identify Key Issues: Look for financial discrepancies, risks, or other factors that are central to the case. Pinpointing the main issues early on will help you stay focused.

- Analyze the Data: Carefully examine the financial statements, reports, and other data provided. Look for patterns, anomalies, or trends that might influence your analysis.

- Apply Relevant Theories: Use the accounting principles you’ve learned to interpret the information. Make sure to back up your conclusions with evidence from the case.

- Develop a Structured Solution: Organize your response logically. Present your findings, followed by recommendations, and clearly explain your reasoning behind each decision.

Tips for Improving Case Study Performance

While the steps above will guide you through the process, there are additional strategies that can help you improve your case study responses:

- Practice Regularly: The more case studies you solve, the more comfortable you will become with identifying key issues and applying solutions effectively.

- Manage Your Time: Allocate specific time limits for each section of the case study to avoid rushing through or spending too much time on any one part.

- Focus on Clarity: Your analysis should be clear and concise. Avoid unnecessary jargon and focus on delivering your points logically and succinctly.

- Review Your Work: Always take a few minutes to go back and review your analysis, ensuring that you haven’t missed anything important and that your solution is sound.

By following a structured approach and practicing regularly, you will increase your confidence and improve your ability to solve case studies under pressure.

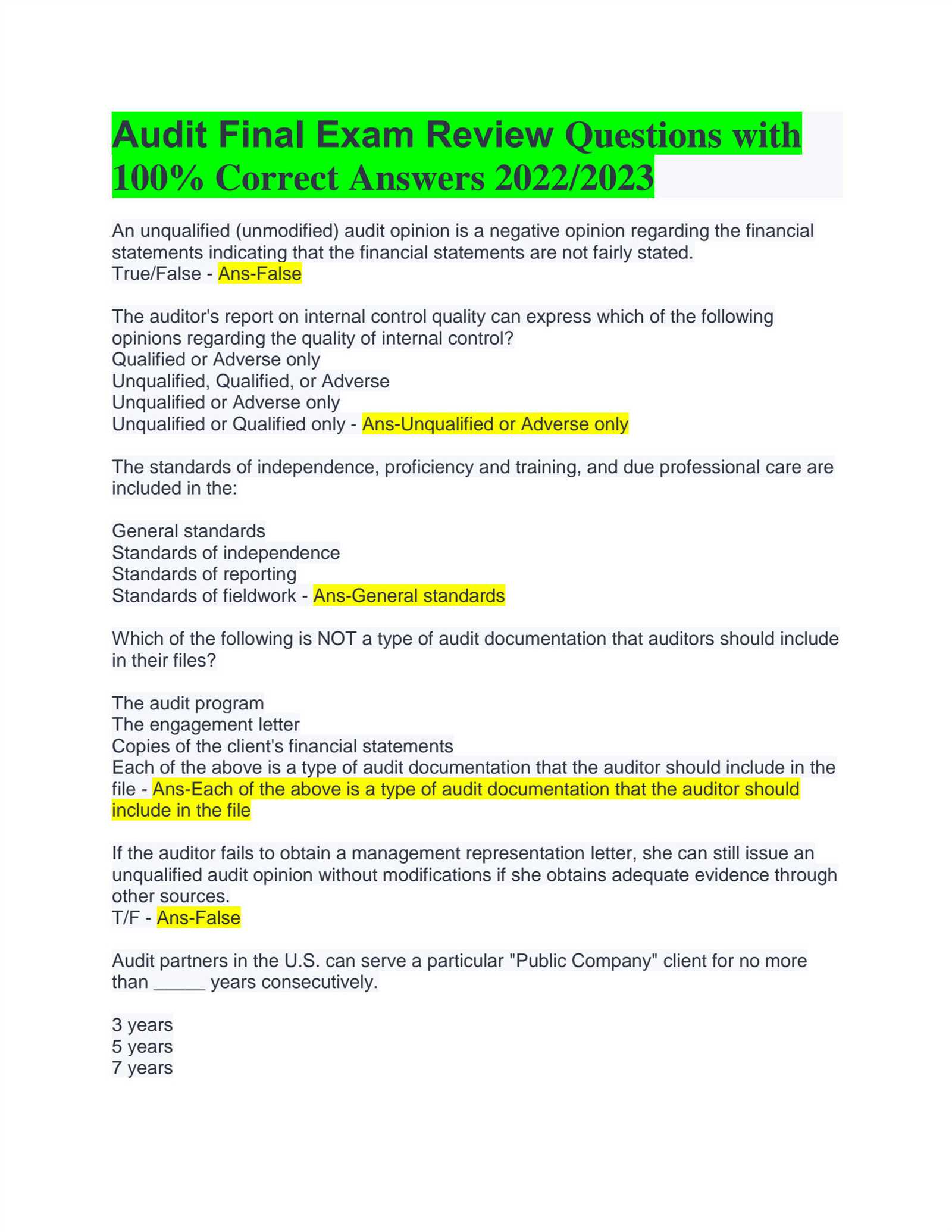

Best Practices for Multiple Choice Questions

Multiple choice questions (MCQs) are a common format in many assessments, testing both your recall and ability to apply knowledge under time pressure. Success in these questions requires more than just memorization; it requires a strategic approach to reading, analyzing, and selecting the correct answer. Knowing how to tackle these questions effectively can significantly improve your performance.

Effective Strategies for Answering MCQs

To maximize your chances of answering multiple choice questions correctly, consider the following strategies:

- Read the Question Carefully: Ensure you fully understand what the question is asking before looking at the options. Pay attention to keywords such as “always,” “never,” or “most likely” that can guide your decision.

- Eliminate Wrong Answers: Narrow down your choices by eliminating obviously incorrect options. This increases your chances of selecting the correct answer, even if you’re unsure.

- Look for Clues in the Question: Sometimes, the question itself contains hints that can help you identify the right answer. Look for context or specific details mentioned that could match with one of the options.

- Don’t Overthink: Trust your first instinct. If you are unsure about an answer, don’t spend too much time doubting yourself. Move on and come back to it later if needed.

Time Management for Multiple Choice Questions

Effective time management is essential when answering MCQs, as you don’t want to spend too much time on any one question. Here are some tips:

- Set Time Limits: Allocate a set amount of time for each question. If you find yourself stuck, move on and return to it later.

- Answer Easy Questions First: Start with the questions you find easiest to answer. This builds confidence and ensures you don’t waste time on questions you’re unsure about.

- Review Your Answers: If time allows, go back and review your responses. Double-check your answers, especially for questions you had to guess.

By applying these techniques, you can approach multiple choice questions with confidence and improve your chances of success in the assessment.

Effective Note-taking for Accounting Courses

Taking clear and organized notes is a vital skill for mastering complex concepts in accounting. Effective note-taking helps you retain information, identify key ideas, and serve as a reference for revision. By developing a structured approach to note-taking, you can make studying more efficient and improve your understanding of challenging topics.

Key Principles for Effective Notes

When taking notes, focus on clarity and organization. Here are some key principles to follow:

- Stay Organized: Use headings, subheadings, and bullet points to separate different topics. This will help you easily locate specific information later.

- Focus on Key Concepts: Avoid writing down everything the instructor says. Instead, focus on important theories, principles, and examples that are likely to appear on the test.

- Use Abbreviations: Develop your own shorthand to write faster without sacrificing clarity. For example, abbreviate terms like “transaction” to “txn” or “financial statement” to “FS.”

- Highlight Critical Information: Use underlining, asterisks, or color coding to highlight key points or concepts that require extra attention.

Strategies for Reviewing and Organizing Notes

Taking notes is just the first step. You need a strategy for reviewing and organizing them effectively:

- Review Notes Regularly: Don’t wait until the last minute to review your notes. Set aside time weekly to go over what you’ve written to reinforce your learning.

- Summarize Key Ideas: After each class, take a few minutes to write a brief summary of the main points covered. This will help consolidate your understanding.

- Create Visual Aids: Where possible, create diagrams, flowcharts, or mind maps to visualize complex relationships between concepts.

- Group Study: Share and compare notes with classmates to ensure you’ve captured all essential information and gain different perspectives on difficult topics.

By following these strategies, you’ll be able to take more effective notes that will serve as a valuable resource throughout your studies and help you retain key concepts for any upcoming assessments.

Using Practice Tests for Assessment Success

Practice tests are one of the most effective ways to prepare for any academic assessment. They simulate the real test environment, helping you familiarize yourself with the format, timing, and types of questions you will face. Regularly using practice tests not only boosts your confidence but also helps reinforce your knowledge and improve problem-solving skills.

Engaging with practice tests allows you to assess your current level of understanding, pinpoint areas for improvement, and track your progress over time. By regularly testing yourself, you can identify gaps in your knowledge before it’s too late, giving you more time to focus on weak spots. Additionally, practicing under timed conditions helps you develop the ability to manage time effectively during the actual test.

To make the most of practice tests, it’s important to approach them strategically. Rather than just taking them passively, you should use them as a tool for active learning. After completing each practice test, review your answers carefully, especially the ones you got wrong. Understanding why a particular answer is correct or incorrect will deepen your comprehension of the material.

How to Memorize Accounting Standards

Memorizing complex standards and regulations can be one of the more challenging aspects of accounting courses. These guidelines are essential for ensuring consistency and accuracy in financial reporting and must be understood thoroughly. However, with the right techniques, memorization can be more manageable and even become second nature.

One effective approach is to break down the standards into smaller, more digestible parts. Rather than trying to memorize large sections at once, focus on understanding and remembering one concept or rule at a time. Use mnemonic devices, acronyms, or visualization techniques to make the standards more memorable. Associating each standard with a real-world example or case can also help reinforce your understanding and recall.

Another key strategy is active repetition. Regularly testing yourself on the standards through quizzes or flashcards will reinforce the material and help you commit it to memory. Pairing this with consistent review will strengthen your retention and make it easier to recall the information when needed.

What to Expect in an Accounting Assessment

When preparing for an assessment in accounting, it’s important to understand the structure and the types of questions that will be presented. The test will likely cover a wide range of topics, from fundamental principles to more complex scenarios. Being familiar with the format can help reduce anxiety and ensure you’re fully prepared for what lies ahead.

Typically, you can expect to encounter a combination of question types designed to test both your theoretical knowledge and practical application. Here’s what to anticipate:

- Multiple Choice Questions: These questions are designed to assess your understanding of key concepts and facts. Expect questions that require you to select the best answer based on your knowledge of accounting standards and principles.

- Short-Answer Questions: These questions require more detailed responses, where you must explain concepts, principles, or provide definitions. They test your ability to articulate and apply what you have learned.

- Case Studies or Scenarios: In these sections, you will be presented with real-world situations requiring you to analyze information, apply theories, and propose solutions. This is where critical thinking is most important.

- Practical Calculations: You may need to perform calculations based on given data, such as balancing accounts, determining financial ratios, or assessing compliance with specific standards.

It’s also important to manage your time effectively during the assessment. Ensure you understand the weight of each section and allocate your time accordingly. The questions may range in difficulty, with some requiring deeper analysis and others testing your ability to recall key facts quickly.

By understanding the structure and content of the assessment, you’ll be better equipped to approach each section confidently and perform at your best.

Techniques for Managing Assessment Stress

Stress during a major academic assessment is a common experience for many students, but it doesn’t have to hinder your performance. Managing stress effectively can help you maintain focus, stay organized, and improve your overall well-being during intense study periods. By incorporating certain strategies into your preparation, you can minimize anxiety and increase your chances of success.

One key aspect of stress management is learning how to control your mindset and maintain a positive outlook. This can be achieved through practices that promote relaxation, time management, and self-care. Below are some techniques that can help you manage stress before and during an assessment:

| Technique | Benefit | How to Implement |

|---|---|---|

| Mindful Breathing | Reduces anxiety and clears your mind | Take deep, slow breaths in a quiet space to calm your nerves. |

| Regular Exercise | Boosts energy and helps release tension | Incorporate a 20-30 minute walk or workout into your daily routine. |

| Time Management | Prevents last-minute panic | Create a study schedule, breaking tasks into smaller, manageable chunks. |

| Sleep Hygiene | Improves focus and cognitive function | Prioritize 7-9 hours of sleep each night to ensure optimal performance. |

| Positive Affirmations | Helps boost self-confidence | Repeat affirmations such as “I am well-prepared and capable” daily. |

Incorporating these techniques into your routine not only reduces stress but also helps you stay focused, calm, and mentally sharp during the assessment. Remember, taking care of your physical and emotional health is just as important as academic preparation. By managing stress, you can improve both your well-being and your performance.

How to Organize Your Study Schedule

Effective time management is key to academic success, especially when preparing for a rigorous assessment. A well-structured study schedule helps you stay focused, reduces anxiety, and ensures you cover all necessary material. By planning ahead and allocating your time wisely, you can balance study with rest, maximizing your productivity and retention.

To create a study schedule that works for you, start by setting clear goals and breaking down your tasks into smaller, manageable chunks. Prioritize areas where you feel less confident and balance your workload to avoid burnout. Below are some steps to guide you in organizing your study routine:

- Set Clear Goals: Define what you want to achieve each day, whether it’s completing a specific chapter, mastering a concept, or practicing certain problems.

- Break It Down: Instead of planning long, uninterrupted study sessions, divide your study time into focused blocks (e.g., 45-60 minutes of study with a 10-15 minute break in between).

- Prioritize Tasks: Identify the most important or difficult topics and allocate more time for them. Tackle challenging areas first when you’re freshest.

- Include Regular Breaks: Schedule short breaks throughout your study sessions to prevent fatigue. Use this time to stretch, walk, or relax your mind.

- Be Realistic: Set achievable goals for each study session and don’t over-schedule yourself. It’s better to complete fewer tasks thoroughly than to rush through many.

- Track Your Progress: At the end of each study day, reflect on what you’ve accomplished and adjust your schedule if needed to ensure you’re staying on track.

By following these steps and creating a balanced, realistic schedule, you’ll be able to manage your study time effectively, reduce stress, and improve your chances of success.

Group Study vs. Solo Study for Assessments

When it comes to preparing for a challenging academic assessment, students often face the decision of whether to study alone or with a group. Both approaches have their advantages and disadvantages, and the right choice depends on individual preferences, study habits, and the nature of the material being studied. Understanding the strengths of each method can help you make an informed decision that suits your learning style and goals.

Advantages of Group Study

Studying with others can provide a collaborative learning environment where students share knowledge, discuss difficult concepts, and solve problems together. Here are some benefits of group study:

- Active Learning: Group study encourages active participation, allowing students to engage in discussions and debates, which can deepen understanding.

- Multiple Perspectives: Collaborating with peers provides exposure to different viewpoints and interpretations of the material.

- Motivation and Accountability: Group study fosters a sense of responsibility. You’re less likely to procrastinate when others are relying on you to contribute.

- Clarification of Difficult Concepts: Peers may explain topics in a simpler or more relatable way, helping you grasp challenging ideas more easily.

Benefits of Solo Study

While group study has its advantages, solo study offers a more personalized, distraction-free approach. Some benefits of studying alone include:

- Focused Attention: Studying alone allows you to create an environment tailored to your needs, free from distractions and interruptions.

- Personalized Pace: You can progress through the material at your own pace without feeling pressured to keep up or slow down to accommodate others.

- Better for Self-Reflection: Solo study offers more time for individual reflection and understanding. You can rework problems or review concepts until they make sense.

- Flexible Schedule: When studying alone, you have complete control over when and how long you study, allowing you to adjust to your personal rhythm and energy levels.

Ultimately, the decision between group study and solo study depends on your personal learning style and the subjects you’re tackling. Some students may find a balance between both methods, using group sessions for brainstorming and discussing complex concepts while relying on solo study for deep, focused revision.

Key Accounting Principles to Focus On

When preparing for a rigorous assessment in accounting, it’s crucial to focus on the core principles that underpin the subject. These foundational concepts not only guide the analysis of financial data but also provide the framework for decision-making and problem-solving. Understanding these principles thoroughly will help you navigate complex questions and scenarios with confidence.

Among the many important principles, some stand out for their frequency of application and relevance to real-world situations. These are the principles that you should prioritize during your study sessions:

- Integrity and Objectivity: These principles emphasize the need for unbiased, accurate reporting and the ethical standards that govern financial practices.

- Materiality: Materiality refers to the significance of an item or transaction in the context of financial statements. Understanding what is considered material is key to making accurate judgments.

- Consistency: This principle ensures that accounting methods and standards are applied consistently over time, providing comparability across financial periods.

- Conservatism: The conservative approach encourages caution when making financial estimates, ensuring that liabilities and losses are not understated.

- Accrual Basis: Understanding when and how revenues and expenses are recognized is essential for ensuring accurate and timely financial reporting.

- Substance Over Form: This principle focuses on the true economic reality of transactions, rather than their legal form, to ensure accurate financial representation.

Mastering these key principles will enhance your ability to approach both theoretical questions and practical case studies. By solidifying your understanding of these concepts, you will be better prepared for any challenges that arise during the assessment.

Reviewing Past Papers Effectively

One of the most effective ways to prepare for an assessment is by reviewing past papers. This strategy helps you familiarize yourself with the types of questions that may appear, understand the format, and identify recurring topics. By studying previous assessments, you can gain insight into how to approach different question styles, manage time effectively, and highlight areas where further study is needed.

However, simply reviewing past papers is not enough; it’s important to do so strategically. Here are some steps to ensure you are getting the most out of your past paper review:

Steps for Effective Review

- Start Early: Begin your review well in advance of the assessment. The earlier you start, the more time you have to review multiple papers and identify patterns.

- Focus on Patterns: Look for recurring themes and frequently asked topics. These often indicate key areas of focus that are more likely to appear again.

- Simulate Real Conditions: When reviewing, try to replicate exam conditions by timing yourself and answering questions without reference materials. This will help you manage your time and work under pressure.

- Analyze Mistakes: After completing a past paper, thoroughly review any mistakes you made. Understanding why you got an answer wrong is crucial for improving your understanding of the material.

Tips for Maximizing Review Efficiency

| Review Strategy | Benefit | How to Apply |

|---|---|---|

| Practice Under Time Constraints | Improves time management skills and exam readiness | Set a timer and complete the past paper within the time limit. |

| Mark and Evaluate Your Answers | Helps identify weak areas and avoid repeating mistakes | Check answers with a solution guide and note down errors. |

| Group Study of Past Papers | Provides diverse perspectives and clarifies concepts | Discuss questions and answers with study partners to enhance understanding. |

| Use Multiple Resources | Offers additional practice and broadens understanding | Review other related practice papers or online resources. |

By using these strategies, reviewing past papers becomes a more active and productive part of your preparation process. This method not only boosts confidence but also equips you with the tools to tackle unfamiliar questions with ease.

How to Stay Motivated During Study

Staying motivated during long periods of study can be challenging, especially when preparing for an intense academic assessment. Maintaining focus and enthusiasm throughout the preparation process requires a combination of strategies that keep you engaged and driven. Whether you’re tackling complex concepts or revising for an upcoming challenge, staying motivated is key to making consistent progress.

To help you stay on track and push through difficult moments, here are some proven techniques to keep your energy and motivation high throughout your study sessions:

Effective Strategies for Motivation

- Set Clear, Achievable Goals: Break your study material into smaller, manageable tasks. Set daily or weekly goals to measure progress and celebrate small victories along the way.

- Use a Reward System: Reward yourself after completing study sessions. A treat, a break, or an enjoyable activity can serve as motivation to finish your work efficiently.

- Create a Positive Study Environment: Organize your study space in a way that fosters focus. A clutter-free, quiet environment with minimal distractions can significantly boost your productivity.

- Visualize Success: Imagine the sense of accomplishment and relief after completing your preparation. Visualization techniques can create a strong mental connection to your end goal, reinforcing motivation.

- Track Your Progress: Keep a study journal or checklist where you mark off completed tasks. Seeing your progress visually can provide a sense of achievement and encourage you to keep going.

Maintaining Energy and Focus

- Take Regular Breaks: Avoid burnout by scheduling short, frequent breaks. A quick walk, stretching, or a few minutes of relaxation can refresh your mind and body.

- Stay Physically Active: Physical exercise can boost brain function and mood. Incorporate movement into your day, whether it’s a workout, yoga, or even a brisk walk.

- Stay Social: Don’t isolate yourself completely during intense study periods. Talk to friends or family for encouragement, or consider joining a study group for accountability and support.

By implementing these techniques, you can maintain high levels of motivation throughout your study process. With a clear purpose, structured breaks, and a positive mindset, you’ll find that staying motivated is not only possible but also enjoyable.

Post-Assessment Tips for Students

Once the pressure of an academic assessment has passed, it’s important to focus on the next steps to ensure you make the most of your preparation and learn from the experience. The period following an assessment is an opportunity to reflect, recharge, and plan your next academic moves. Properly managing this time can enhance your long-term success and set you up for future challenges.

Here are some helpful tips for making the most out of the time after completing your assessment:

Reflection and Learning

- Review Your Performance: Once the results are available, take time to go over your performance. Identify areas where you struggled and figure out how you can improve for next time.

- Analyze Mistakes: If possible, review any questions you got wrong. Understanding your errors helps prevent repeating them in the future.

- Seek Feedback: Don’t hesitate to ask your instructors or peers for feedback. Understanding their perspectives can provide valuable insights into how to approach similar tasks or questions in the future.

- Reflect on Study Methods: Think about your study strategies. Did they work well, or do you need to adjust your approach? Reflecting on your study habits can help refine your technique for the future.

Self-Care and Recharging

- Relax and Unwind: After the stress of studying and sitting for the assessment, it’s important to take time to relax. Engage in activities you enjoy to recharge your mental and emotional batteries.

- Celebrate Small Wins: Even if you didn’t achieve everything you hoped for, recognize the effort you put into your preparation. Celebrating progress, no matter how small, helps maintain a positive mindset.

- Stay Physically Active: Physical activity helps reduce stress and boosts mood. A light workout or even a walk outside can help clear your mind and refresh your body.

Planning Ahead

- Set New Goals: Whether it’s for the next semester or a future assessment, setting new academic goals can help you stay motivated and focused.

- Keep Learning: Don’t stop learning just because the assessment is over. Take the time to deepen your understanding of the material, or even start reviewing for the next challenge.

- Organize Your Next Steps: Use the post-assessment period to plan your upcoming tasks, assignments, and study sessions. Being organized will make future preparations easier and less stressful.

By following these tips, you can make the most out of the time after an assessment. Reflection, self-care, and proper planning will ensure that you continue progressing in your academic journey with confidence and purpose.