Achieving proficiency in financial management tools is essential for anyone looking to advance in the accounting and bookkeeping fields. One of the most important steps in this journey is passing a structured assessment that tests your knowledge and skills in using specialized software. This process not only helps you demonstrate your expertise but also opens up new professional opportunities.

In this section, we will explore the key elements that you need to know to excel in the assessment. From understanding the major concepts to identifying the right resources for preparation, you’ll find all the information you need to approach the challenge with confidence. Preparation is key to mastering the software and showcasing your skills to potential employers or clients.

Whether you are looking to improve your current understanding or you are taking the assessment for the first time, this guide will help you navigate through the process. By focusing on the important areas and learning effective strategies, you can increase your chances of success and gain a valuable credential that will enhance your career in financial services.

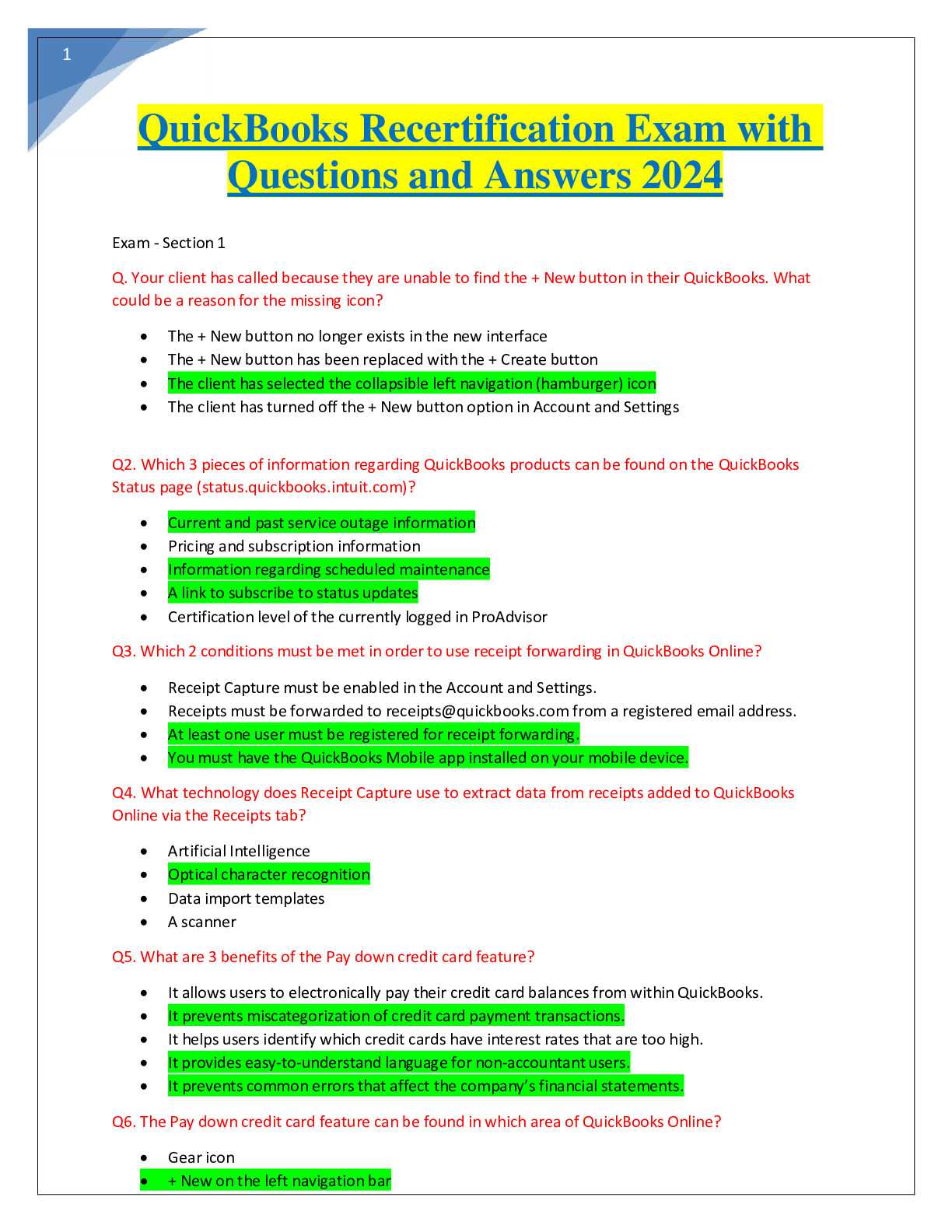

QuickBooks Online Core Certification Exam Overview

The process of becoming proficient in accounting software involves demonstrating your ability to navigate complex financial tools. This structured evaluation is designed to assess your understanding of essential features and processes that businesses rely on for effective financial management. Successfully completing this assessment not only validates your skills but also boosts your professional credibility in the field.

Key Components of the Assessment

The test is structured around various core functionalities that are crucial for managing financial data. The topics covered ensure that you are well-versed in performing tasks that range from basic bookkeeping to more advanced reporting. Key areas include:

- Managing accounts and transactions

- Reconciling financial data

- Creating and managing invoices

- Tracking expenses and generating reports

- Understanding tax-related functions

What to Expect During the Evaluation

The evaluation format typically consists of multiple-choice questions that test both theoretical knowledge and practical skills. It is designed to simulate real-world scenarios where you need to apply your understanding of financial software to solve problems efficiently. While the difficulty may vary, the test is crafted to challenge your ability to work through everyday accounting tasks with precision.

Preparation for the assessment involves familiarizing yourself with the platform’s interface, understanding key features, and practicing common financial workflows. This comprehensive approach ensures that you are ready to demonstrate competence in every aspect of the software, from transaction entry to reporting.

Importance of QuickBooks Certification

Becoming proficient in financial management software is essential for anyone looking to enhance their career in accounting or bookkeeping. Obtaining an official qualification that recognizes your expertise in using these tools is a powerful way to stand out in a competitive job market. Not only does it confirm your skills, but it also demonstrates your commitment to professional growth and development.

Boosting Career Opportunities

For individuals working in finance or aspiring to enter the field, holding a recognized qualification significantly increases job prospects. Employers are more likely to trust candidates who have validated their abilities through a structured process, knowing they possess the necessary knowledge and skills to manage financial tasks effectively. This distinction can be particularly valuable for those aiming for roles with higher responsibilities or specialized positions.

Enhancing Professional Credibility

When you earn a recognized qualification, you gain a level of credibility that can enhance your professional reputation. It assures clients and employers that you have the expertise to handle complex financial data with precision and accuracy. Additionally, it can provide you with opportunities for career advancement and higher earning potential, as many businesses prioritize skilled professionals with proven abilities in financial tools.

What to Expect in the Evaluation

Undergoing a structured assessment for financial software proficiency can be both challenging and rewarding. The evaluation is designed to test your grasp of key features and functionalities necessary for managing financial tasks in a professional setting. It will assess your ability to apply your knowledge to real-world scenarios, ensuring that you can effectively use the software to meet business needs.

Structure of the Assessment

The evaluation typically consists of multiple-choice questions that cover a wide range of topics related to managing financial data. These questions are crafted to assess your understanding of common workflows, such as processing transactions, generating reports, and maintaining accurate financial records. The format is designed to simulate practical situations where you must use your knowledge and reasoning skills to solve problems efficiently.

Preparation Tips

To ensure success, it’s important to focus on the key areas that are most likely to appear during the evaluation. Familiarize yourself with the interface of the software and practice performing common tasks, such as creating invoices, reconciling accounts, and tracking expenses. Time management is also crucial, as the evaluation is typically time-bound. Make sure to pace yourself to ensure you can complete all sections within the allotted time.

Key Topics Covered in the Test

The assessment focuses on evaluating your competence in various fundamental aspects of financial management. It tests your ability to handle key tasks within the software, such as managing accounts, processing transactions, and generating reports. The topics included are essential for ensuring that you can navigate the system efficiently and apply your knowledge to real-world financial scenarios.

| Topic | Description |

|---|---|

| Managing Accounts | Understanding how to create, modify, and organize different account types for accurate financial tracking. |

| Transaction Processing | Ability to enter, edit, and categorize various financial transactions such as sales, expenses, and payments. |

| Reconciliation | Knowledge of reconciling bank and credit card statements to ensure accurate financial records. |

| Invoicing and Billing | Creating and managing invoices, tracking due payments, and ensuring timely billing processes. |

| Financial Reporting | Generating key financial reports, such as profit and loss statements, balance sheets, and tax-related documents. |

| Tax Management | Understanding tax-related features, including calculating taxes, generating tax reports, and managing tax settings. |

Understanding Core Concepts for Success

Achieving success in any financial management software requires a solid understanding of its fundamental principles. Mastery of key features and processes is crucial, as these are the building blocks that ensure efficient handling of financial tasks. Whether you’re managing accounts, processing transactions, or generating reports, each core concept plays a vital role in ensuring accuracy and consistency in your work.

At the heart of this understanding is the ability to navigate the platform effectively, applying your knowledge to solve real-world financial problems. This includes knowing how to structure accounts, manage cash flow, and create reports that meet both business and compliance needs. By grasping these essential concepts, you lay a foundation for success that will help you work confidently and accurately in any professional environment.

How to Prepare for the Assessment

Preparing for a structured evaluation in financial management software requires a focused approach. To succeed, you must familiarize yourself with the platform’s key features, workflows, and essential functions. Effective preparation involves not only reviewing theoretical concepts but also gaining hands-on experience by practicing common tasks that you will encounter during the evaluation.

Start by studying the main areas of the platform, such as account management, transaction processing, and report generation. Try to simulate real-world tasks, such as creating invoices, reconciling accounts, and generating financial statements. This practical experience will help you become more comfortable with the software and improve your ability to complete tasks quickly and accurately during the evaluation.

Additionally, make use of available study resources, such as practice tests, tutorials, and guides. Time management is also a key factor–ensure that you are not only proficient in using the software but also able to complete the tasks within the allotted time frame. The more familiar you are with the layout and functionality of the platform, the more confident you will feel during the actual assessment.

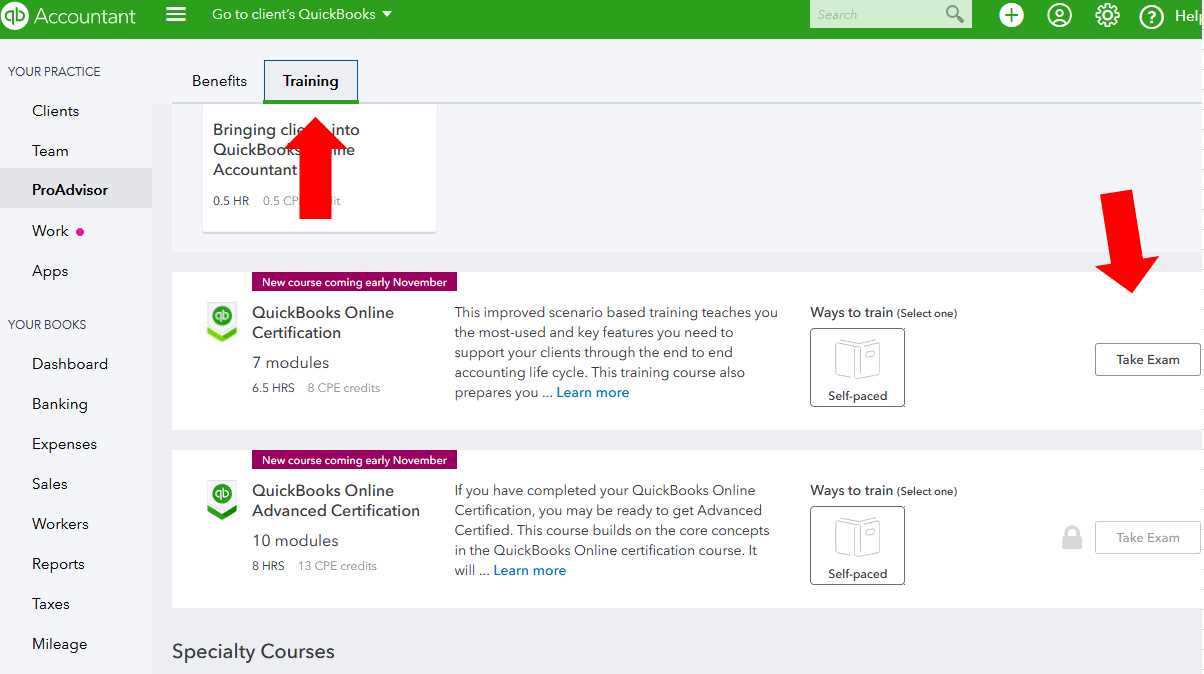

Best Study Resources for Financial Software

When preparing for an evaluation of financial software, choosing the right study materials is essential for success. The most effective resources not only help you understand the software’s features but also provide practical guidance to apply your knowledge in real-world scenarios. With a combination of official documentation, practice exercises, and expert-led tutorials, you can ensure comprehensive preparation.

One of the best starting points is the software’s official learning portal, which often offers free tutorials, user guides, and video lessons. These materials are specifically tailored to cover all key areas, from basic account management to more complex financial reporting features. Additionally, using practice tests or simulation tools can help you familiarize yourself with the platform’s layout and functionality.

Another valuable resource is online forums and communities where users share tips, tricks, and experiences. These platforms often contain discussions about common challenges and how to overcome them, providing insights that might not be found in official guides. Lastly, investing in books or courses created by industry experts can deepen your understanding and provide alternative explanations that may resonate better with your learning style.

Common Mistakes to Avoid During the Test

During a financial software proficiency assessment, it’s easy to make small errors that can have a significant impact on your performance. Recognizing these common mistakes and knowing how to avoid them can make the difference between passing and failing. The key to success is staying focused, managing your time well, and carefully reviewing your work before submitting it.

Rushing Through Questions

One of the most frequent mistakes is rushing through questions in an attempt to finish quickly. While time management is important, it’s essential to take your time and read each question carefully. Skimming over the details can lead to misunderstandings and incorrect answers. Be sure to fully understand the task before attempting to solve it, as misinterpretations can cost valuable points.

Ignoring Platform Features and Shortcuts

Many candidates fail to take full advantage of the platform’s features and shortcuts. For example, using built-in templates, keyboard shortcuts, or automated processes can save time and reduce the chance of errors. Familiarize yourself with the interface before the assessment to ensure you’re making the most of the available tools. These small adjustments can significantly improve your efficiency and accuracy during the test.

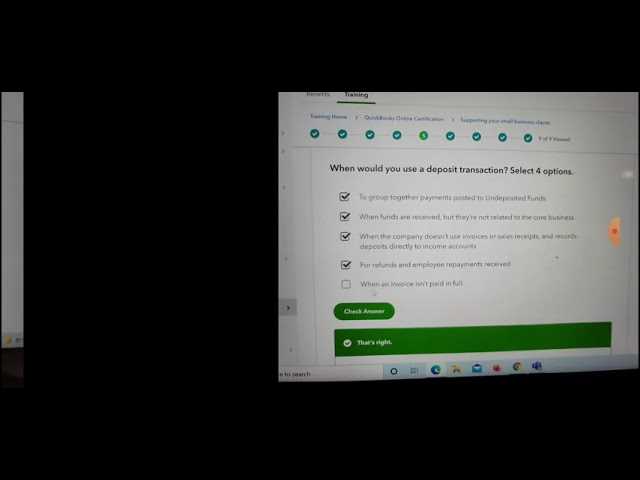

Understanding Test Questions and Format

When preparing for a proficiency assessment in financial management software, it’s crucial to have a clear understanding of the question structure and overall format. Knowing how the questions are framed and what type of responses are expected can significantly enhance your ability to perform well. The test typically involves multiple-choice questions, each designed to evaluate your knowledge of key features and tasks within the software.

The questions are often scenario-based, requiring you to apply your understanding of financial workflows to solve practical problems. Some may present common situations that a business might encounter, asking you to select the best course of action or identify the most efficient solution. Others may test your familiarity with specific features or tasks, such as generating reports or processing transactions. Being comfortable with the structure of these questions can help you think more critically and manage your time effectively during the assessment.

Time Management Tips for the Assessment

Effective time management is key to performing well in a financial software proficiency test. With a limited amount of time to complete all the tasks, it’s essential to approach the test strategically. Proper planning and prioritization can help ensure that you can answer all the questions without feeling rushed. Below are some time management tips to help you optimize your performance.

| Tip | Description |

|---|---|

| Read Questions Carefully | Take a few moments to read each question thoroughly before answering to avoid unnecessary mistakes. Skipping over important details can cost you valuable time later. |

| Start with Easy Questions | Begin with the questions you find easiest to answer. This will build confidence and help you accumulate points quickly, leaving more time for the challenging questions. |

| Allocate Time for Each Section | Divide your time based on the sections and the number of questions. Ensure you spend an appropriate amount of time on each section, so no part of the assessment is left unfinished. |

| Don’t Get Stuck on One Question | If you encounter a particularly difficult question, move on and return to it later. This will prevent you from wasting time and ensure that you complete the assessment on time. |

| Use Timed Practice Tests | Take practice tests with time limits to simulate the test environment. This will help you improve your speed and become more accustomed to managing time effectively. |

Passing Rate and Difficulty Level

The success rate and difficulty level of a financial management software assessment can vary based on your preparation and familiarity with the platform. While many candidates pass the test, others may struggle with the complexity of the tasks presented. The difficulty level is generally moderate, but it requires a deep understanding of both the platform’s features and the tasks you are expected to complete.

Generally, individuals who are well-prepared with hands-on experience and a strong grasp of essential functions tend to perform better. It’s important to remember that while the assessment can be challenging, it is designed to test your practical knowledge of the software, so focusing on real-world applications and workflows will help you succeed. Keeping track of your progress through practice tests can give you an indication of your readiness and help you identify areas where you may need further study.

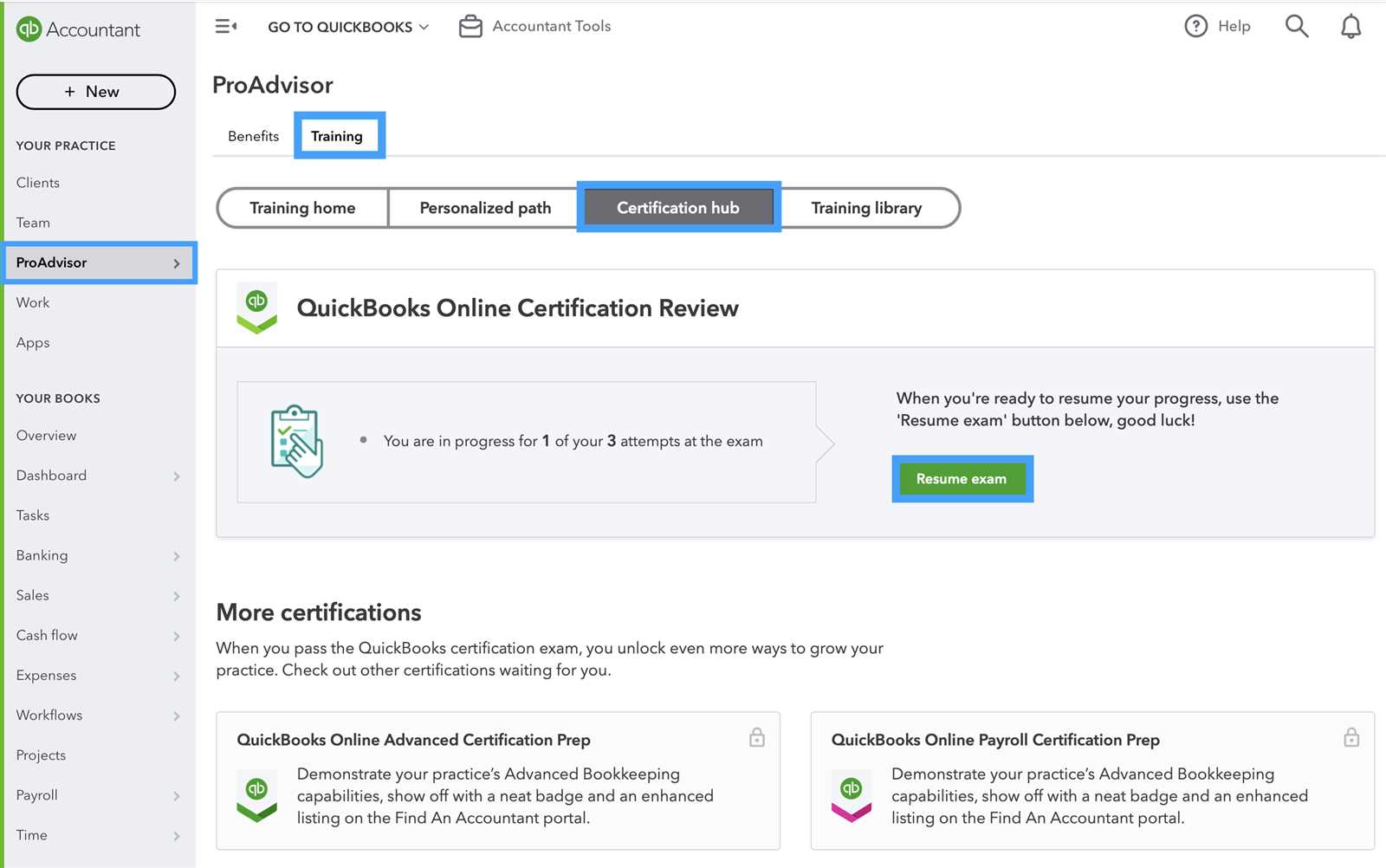

How to Take the Online Assessment

Taking a proficiency test remotely requires careful preparation and a clear understanding of the process. It’s important to ensure that you are ready technically and mentally before starting the test. The online format allows you to take the assessment from the comfort of your own space, but it also comes with its own set of challenges that you should be aware of to ensure a smooth experience.

Step-by-Step Process

- Check System Requirements: Before you begin, make sure your computer meets the necessary system requirements, such as a stable internet connection, a compatible browser, and any specific software or plugins needed for the test.

- Set Up a Quiet Environment: Choose a location where you can work without interruptions. A quiet space with good lighting and a comfortable chair will help you focus during the assessment.

- Log In Early: Log into the platform at least 10–15 minutes before the scheduled start time. This will give you time to address any technical issues and familiarize yourself with the interface.

- Follow Instructions Carefully: Pay close attention to the instructions provided at the beginning of the test. This includes guidelines on how to navigate the platform, how to submit answers, and what to do in case of technical difficulties.

During the Test

- Stay Focused: Avoid distractions while you take the test. Turn off notifications on your computer or phone and focus solely on the questions.

- Monitor Your Time: Keep an eye on the time to ensure you’re progressing at a steady pace. Most platforms will show a countdown, but it’s also helpful to set your own timer to manage time for each section.

- Use the Tools Provided: Many assessments offer tools like a calculator, notepad, or a feature to mark questions for review. Utilize these tools to enhance your efficiency.

Key Features to Master for Success

To excel in any financial management software assessment, it is essential to have a strong command of the platform’s key features. Mastering these functions will not only help you complete tasks efficiently but also ensure that you are able to handle real-world scenarios with ease. Below are some of the most important features to focus on when preparing for the test.

Essential Features to Focus On

- Transaction Management: Understand how to create, edit, and track different types of transactions, such as invoices, expenses, and payments. This is a core skill that will appear frequently in the test.

- Reporting Tools: Master the process of generating various financial reports. Being able to quickly create balance sheets, profit and loss statements, and other financial summaries is crucial for success.

- Bank Reconciliation: Knowing how to match transactions with bank statements and reconcile accounts is an essential skill for any test on financial platforms.

- Inventory Management: Many assessments will test your ability to manage product listings, track inventory levels, and update stock quantities in real-time.

- Tax Calculations: Ensure that you are comfortable using the software to calculate taxes and apply them correctly to transactions and reports.

Advanced Tools and Features

- Automation: Learn how to set up automatic workflows for recurring invoices, bill payments, and reminders to reduce manual work and improve efficiency.

- Multi-Currency Support: For those working with international clients or transactions, mastering multi-currency handling and exchange rates is essential.

- User Management: Know how to assign roles, set permissions, and manage users within the software, especially if you are handling a business’s team accounts.

- Integration with Other Software: Get familiar with integrating the platform with other tools like payroll systems, e-commerce platforms, and third-party financial apps to streamline operations.

How to Review Your Results

After completing an assessment, reviewing your performance is an essential step in the learning process. It allows you to identify areas where you excelled and pinpoint areas that may need further improvement. By thoroughly analyzing your results, you can better prepare for future assessments or real-world applications. Below are key steps to help you effectively review and learn from your results.

Steps to Analyze Your Performance

- Examine Correct Answers: Start by reviewing the questions you answered correctly. This will help reinforce your understanding of the topics and ensure that you can confidently apply them in real-world scenarios.

- Identify Mistakes: Carefully go through the questions you got wrong. Pay attention to patterns in your mistakes–whether they were due to misinterpretation, a lack of knowledge, or time constraints. Understanding why you made a mistake will guide you in improving those areas.

- Look for Feedback: Some assessments offer feedback on incorrect answers. Take note of these explanations as they can provide valuable insights into your areas of weakness and help clarify concepts you may not have fully grasped.

Using the Results to Improve

- Target Weak Areas: Focus on the sections or topics where you struggled the most. Use additional study materials, tutorials, or practice questions to reinforce these areas.

- Revisit Practice Tests: Retake practice tests to track your improvement. This will also help you become more comfortable with the format and question types.

- Seek Guidance: If you continue to struggle with certain topics, consider seeking guidance from a mentor, tutor, or online forum to clarify any doubts.

Reviewing your results with a critical yet constructive approach is key to turning your assessment experience into a valuable learning opportunity.

Benefits of Becoming a Certified Professional

Achieving professional recognition through a formal qualification offers numerous advantages, both in terms of career growth and personal development. Certification demonstrates a high level of expertise and competence in your field, boosting your credibility and providing tangible benefits for your professional journey. Below are some key reasons why becoming certified can be a valuable asset to your career.

Key Advantages of Professional Certification

- Enhanced Career Opportunities: Holding a recognized qualification can significantly increase your chances of securing a job or promotion. Employers are more likely to hire or promote individuals who have demonstrated a strong understanding of industry practices.

- Increased Earning Potential: Certified professionals often earn higher salaries than their non-certified counterparts. Certification serves as proof of your skills and expertise, making you more valuable to employers and clients.

- Industry Recognition: A certification can distinguish you from other professionals in your field. It shows that you are committed to maintaining and enhancing your knowledge and skills, earning you the respect of peers and supervisors alike.

- Improved Job Security: Certified individuals tend to be more resilient in the face of economic downturns and organizational changes. Employers are more likely to retain workers who have proven their qualifications and expertise.

- Access to a Professional Network: Becoming certified often opens doors to exclusive professional groups, forums, and events, where you can network with other experts, share knowledge, and grow your career.

Personal Growth and Development

- Boosted Confidence: Gaining certification helps you feel more confident in your skills and knowledge. This confidence can enhance your performance in both professional and personal tasks.

- Continuous Learning: The process of preparing for and maintaining certification encourages lifelong learning, keeping you up-to-date with the latest trends, technologies, and best practices in your field.

- Sense of Accomplishment: Earning certification provides a sense of achievement, knowing that you’ve reached a high standard of competence. This recognition can increase job satisfaction and personal pride in your work.

Overall, becoming a certified professional can be a transformative step in your career, offering both tangible and intangible benefits that help you succeed and thrive in a competitive industry.

Career Opportunities with Certification

Obtaining a formal qualification in accounting or financial software systems can significantly enhance your career prospects. With a recognized certification, professionals open doors to a variety of career opportunities in industries ranging from finance and accounting to consulting and small business management. Whether you are looking to grow in your current role or transition to a new career path, a specialized qualification can help you stand out in a competitive job market.

Job Roles and Industries for Certified Professionals

- Financial Analyst: Certified individuals are well-positioned for roles as financial analysts, where they assess financial data, help with budgeting, and make strategic recommendations to businesses and organizations.

- Bookkeeper: Bookkeepers manage and maintain financial records for businesses. Certification can make you a preferred candidate for positions that require a deeper understanding of financial software and accounting principles.

- Accountant: As a certified professional, you can pursue accounting roles in both large firms and smaller businesses. Your expertise will be valued in preparing financial statements, ensuring compliance, and managing tax processes.

- Payroll Specialist: Payroll specialists handle employee compensation, including wages, benefits, and tax deductions. Certification can increase your chances of securing positions in this field by demonstrating your proficiency in managing payroll systems.

- Business Consultant: Many consultants use their expertise to help businesses improve their financial processes, optimize resource allocation, and implement efficient systems. A recognized qualification enhances your credibility in consulting roles.

- Small Business Owner: Entrepreneurs and small business owners can also benefit from certification, as it equips them with the skills necessary to manage their own finances, track expenditures, and ensure proper tax filing.

Industries That Value This Qualification

- Accounting Firms: Accounting firms often prefer professionals with relevant qualifications to help manage client accounts, tax filings, and audits.

- Financial Services: Banks, credit unions, and investment firms look for certified professionals to assist with financial planning, asset management, and regulatory compliance.

- Consulting Firms: Consultants who specialize in business systems, financial processes, or operations often benefit from certification to enhance their expertise and client trust.

- Small and Medium Enterprises (SMEs): SMEs often need professionals to help with bookkeeping, financial reporting, and tax management, and certification can increase your appeal to these businesses.

- Government and Nonprofit Organizations: Many government and nonprofit roles require certified professionals to ensure financial transparency and accountability.

Overall, having a recognized qualification in financial software systems can lead to a wide range of career opportunities. Whether you are advancing in your current job or seeking new challenges, this qualification can serve as a stepping stone to success in many industries.

Maintaining Certification and Ongoing Education

Achieving a professional qualification is just the beginning of a successful career path in financial software management. To remain competitive and effective in your role, it is essential to keep your skills up-to-date and continue learning. Ongoing education and the maintenance of professional credentials ensure that you stay informed about new tools, regulations, and industry trends. By dedicating time to professional development, you can improve your expertise and enhance your career opportunities.

Importance of Continuing Education

- Adapting to New Software Features: Financial software is constantly evolving with new features and updates. Ongoing education helps you stay ahead by mastering these advancements and integrating them into your work practices.

- Keeping Up with Regulatory Changes: Financial regulations and tax laws are subject to change. Regular learning ensures that you remain compliant and informed about the latest developments that affect your industry.

- Enhancing Job Performance: Continuing education allows you to refine your skills, discover more efficient ways to handle tasks, and ultimately improve your job performance.

- Expanding Career Opportunities: By continually enhancing your knowledge and skill set, you position yourself for new job roles, promotions, and professional growth.

How to Maintain Your Qualifications

- Complete Required Continuing Education: Many organizations and professional bodies require individuals to complete specific courses or training to maintain their qualifications. This might include workshops, webinars, or online modules.

- Stay Informed with Industry News: Reading industry journals, following thought leaders, and subscribing to relevant newsletters can help you stay up-to-date with trends and best practices in financial software management.

- Attend Professional Conferences: Participating in conferences, seminars, and networking events can offer you opportunities to learn from experts, exchange ideas with peers, and expand your professional network.

- Seek Feedback and Mentorship: Engaging with mentors or seeking feedback from colleagues can provide valuable insights into areas where you can improve and further develop your skills.

Maintaining a professional qualification requires ongoing commitment to personal and professional growth. By continually updating your knowledge and skills, you demonstrate your dedication to excellence and position yourself as a leader in your field.