In this section, students are introduced to essential financial concepts aimed at building a strong foundation for making informed decisions. The content is designed to enhance understanding of key principles that impact personal finance and long-term financial well-being. These lessons are structured to guide learners through a variety of practical situations they may encounter in everyday life.

Comprehension of basic financial literacy is vital for managing money, understanding budgeting, saving, and planning for future goals. As you progress, the exercises will challenge you to apply what you’ve learned to real-world scenarios, improving your problem-solving skills and overall financial knowledge. This approach encourages active learning and provides practical skills for personal development.

The content also includes interactive questions and activities to test your grasp of the material. These assessments are a great opportunity to reinforce your learning and ensure that the information is not only understood but retained. Whether you’re new to these topics or looking to refresh your knowledge, this section offers valuable insights for anyone looking to enhance their financial literacy.

Understanding the Key Concepts in This Section

This section focuses on developing a comprehensive understanding of crucial financial principles that students can apply in real-life scenarios. By exploring various aspects of managing money and making informed decisions, learners are equipped with the knowledge to navigate complex financial situations. The material emphasizes practical skills and encourages critical thinking to help students build a solid foundation for their financial future.

The Importance of Financial Literacy

Financial literacy is the ability to make informed decisions about personal finances. This involves understanding budgeting, saving, investing, and planning for future goals. With these skills, students can develop a more secure financial life and make choices that positively impact their financial well-being. By mastering the core concepts introduced in this section, individuals can take control of their financial journeys.

Real-Life Applications of Financial Knowledge

Throughout the course, learners will encounter interactive challenges that apply these financial concepts to everyday situations. These exercises are designed to simulate real-world scenarios, helping students better understand how the lessons translate into actual decision-making. The ability to apply theoretical knowledge to practical situations is a key takeaway, offering valuable skills that go beyond the classroom.

Overview of Key Learning Points

This section covers the fundamental concepts that will help students understand the essential principles of financial management. By exploring different topics, learners will gain valuable insights into making sound financial decisions, budgeting, saving, and planning for future goals. The aim is to provide a clear understanding of how to apply financial knowledge in real-world situations, ensuring students are prepared to manage their personal finances effectively.

Key Areas Covered

| Topic | Key Takeaways |

|---|---|

| Budgeting | Learn how to create and manage a budget to track income and expenses, ensuring financial stability. |

| Saving | Understand the importance of saving for future goals, including setting up emergency funds and long-term investments. |

| Investing | Discover the basics of investing and how it can help build wealth over time, including types of investments. |

| Debt Management | Learn strategies to manage and reduce debt, focusing on responsible borrowing and repayment plans. |

Practical Applications of Financial Skills

The knowledge gained in this section can be directly applied to managing personal finances. From setting up a simple budget to understanding how to grow savings and handle debt, the practical skills developed here will serve learners well throughout their financial journey. Each lesson builds upon the previous one, ensuring that students are well-equipped to make informed decisions in various financial situations.

Steps to Access the Required Information

Accessing the essential materials for this section is a straightforward process, designed to guide learners through each step efficiently. Whether you’re reviewing key concepts or seeking help with specific tasks, these steps ensure that you can quickly find the resources you need to succeed. By following this process, you can easily navigate the platform and locate the relevant sections for further study or practice.

To begin, ensure that you are logged into the correct platform where the content is hosted. After logging in, locate the course dashboard or content library. From there, select the appropriate section related to financial topics or decision-making processes. Once selected, you will be able to view interactive exercises and review detailed explanations that align with your learning objectives.

Additionally, if you’re seeking to clarify specific points or confirm your understanding, there are options to review past materials and reattempt exercises. These tools help reinforce the knowledge gained and allow you to track progress effectively.

Common Challenges in This Section

While navigating the learning material in this section, students may face several challenges that can hinder their understanding and progress. These obstacles often arise from complex concepts, unfamiliar terminology, or difficulties in applying theoretical knowledge to practical scenarios. However, with focused effort and the right strategies, these challenges can be overcome, enabling learners to gain a deeper understanding of the material.

Typical Obstacles Students Face

| Challenge | Possible Solutions |

|---|---|

| Complex Financial Concepts | Break down each topic into smaller, manageable parts and review definitions regularly. |

| Difficulty in Applying Theory | Use real-world examples and practice exercises to better understand how theory translates into practice. |

| Time Management | Set specific goals for each study session and allocate time for reviewing material consistently. |

| Remembering Key Definitions | Create flashcards or summary notes to regularly test your knowledge and reinforce retention. |

Tips for Overcoming These Challenges

To overcome these common challenges, it is important to stay organized and use the resources available. Consistent practice and reviewing key concepts multiple times can greatly enhance retention. Additionally, seeking clarification when needed–whether through discussion forums, peer groups, or instructor assistance–can provide valuable insights to strengthen your understanding.

How to Navigate the Learning Platform

Successfully navigating the learning platform is essential for accessing the resources and materials needed to complete the course. The platform is designed to be user-friendly, with various sections that allow students to track their progress, access study materials, and complete exercises. Familiarizing yourself with the layout and tools available can significantly improve your learning experience and efficiency.

Basic Steps for Navigation

- Log into the platform using your credentials.

- Access the main dashboard, where you can find an overview of available courses and modules.

- Select the relevant section you want to study.

- Navigate through different lessons using the sidebar or menu options.

- Track your progress and revisit any areas that require further review.

Additional Features and Tools

- Interactive Exercises: Engage with quizzes and activities that help reinforce your understanding of the material.

- Progress Tracker: Monitor your completion status and see how much of the course you’ve covered.

- Discussion Forums: Participate in forums to ask questions or share insights with peers.

- Help Section: Access support resources if you encounter difficulties navigating or understanding content.

By following these steps and utilizing the platform’s features, students can easily move through the lessons and enhance their learning experience. Staying organized and using available tools will help streamline the process and ensure that you get the most out of the course.

Important Tips for Success

Achieving success in this section requires a combination of preparation, focus, and effective strategies. By following key tips and techniques, you can enhance your learning experience, retain essential concepts, and perform well in assessments. The following guidelines will help you stay organized and motivated throughout the course.

Effective Study Techniques

- Stay Consistent: Dedicate regular time each week to study and review materials. Consistency is key to reinforcing your knowledge.

- Break Down Complex Concepts: When faced with challenging topics, divide them into smaller, manageable sections to make understanding easier.

- Practice Regularly: Engage with practice exercises to test your knowledge and improve problem-solving skills.

- Use Study Aids: Leverage additional resources such as flashcards, summaries, and online guides to reinforce learning.

Maximizing Learning Engagement

- Participate Actively: Engage in discussions, ask questions, and collaborate with peers to deepen your understanding of the material.

- Seek Help When Needed: Don’t hesitate to ask for clarification from instructors or use available support resources if you encounter difficulties.

- Review and Reflect: Regularly revisit key points and assess your understanding to ensure long-term retention of the information.

- Stay Organized: Keep track of deadlines, assignments, and your progress to avoid last-minute rushes and ensure steady progress.

By applying these tips, you can navigate the course more efficiently and master the concepts essential for success. Effective preparation and active engagement will not only help you understand the material but also boost your confidence as you move through the course.

Mastering the Financial Literacy Concepts

Understanding key financial principles is essential for making informed decisions that impact both your present and future financial health. This section aims to equip learners with the necessary tools to grasp fundamental concepts such as budgeting, saving, investing, and managing debt. Mastering these concepts not only helps with managing personal finances but also prepares you to make responsible financial choices in various real-life situations.

To truly master these concepts, it is important to approach them with both a theoretical and practical mindset. By learning how to create budgets, set savings goals, and understand investment strategies, students can build a solid foundation in financial literacy. This knowledge empowers individuals to manage money effectively, plan for future financial milestones, and make smart choices that lead to long-term financial stability.

Whether you are new to the topic or looking to refine your knowledge, practicing and applying these principles through exercises and real-world scenarios is key. The more you engage with the material, the more confident you will become in navigating your own financial journey.

How to Tackle Quiz Questions Effectively

Successfully answering quiz questions requires a strategic approach that balances knowledge with time management. By understanding the format of questions and applying effective techniques, you can improve your chances of getting the correct answers. This section provides practical steps to help you tackle each question with confidence and efficiency, ensuring you perform at your best.

Preparation Before the Quiz

- Review Key Concepts: Prior to the quiz, go over essential materials and focus on areas that are frequently tested.

- Understand the Question Format: Familiarize yourself with the types of questions (multiple choice, true/false, etc.) to strategize your approach.

- Time Management: Allocate specific amounts of time to each question to avoid spending too long on any one item.

During the Quiz

- Read Carefully: Take your time to read each question and all answer choices thoroughly before making a selection.

- Eliminate Incorrect Options: If you’re unsure about an answer, rule out clearly incorrect options to improve your odds of choosing the right one.

- Answer What You Know First: Quickly tackle the questions you are confident about and come back to the difficult ones later.

- Don’t Overthink: Trust your initial instincts, as they are often more accurate than second-guessing.

By following these strategies, you can approach quiz questions more effectively, reduce stress, and increase your chances of achieving a higher score. The key is to be prepared, stay focused, and manage your time wisely during the test.

Breaking Down Complex Scenarios

When faced with complex situations, it’s easy to feel overwhelmed by the amount of information and decisions involved. However, breaking these scenarios down into smaller, manageable steps can help simplify the process and make it easier to understand. This section provides strategies for tackling complicated problems by analyzing key components and approaching them one at a time.

Steps to Simplify Complex Scenarios

- Identify the Core Issue: Focus on what the problem is really asking. Remove any irrelevant details that could cause confusion.

- Break it Into Smaller Parts: Divide the scenario into distinct steps or elements to make it easier to address each one individually.

- Analyze Each Component: Look at each piece of the situation carefully to understand how it contributes to the overall problem.

- Consider Possible Solutions: For each part, brainstorm potential solutions and weigh their pros and cons.

Practical Example of Problem Breakdown

- Scenario: A person needs to budget for a trip, but they are unsure how to prioritize their spending.

- Breakdown:

- Step 1: Identify fixed costs (e.g., flights, accommodation).

- Step 2: List variable expenses (e.g., meals, activities).

- Step 3: Allocate a portion of the budget for each category.

- Step 4: Identify potential areas to reduce spending, such as cutting back on unnecessary activities.

- Solution: Create a detailed budget plan by addressing each category and adjusting priorities as needed.

By breaking down complex scenarios into smaller tasks, you can gain clarity and approach each problem with a more organized and effective strategy. This method not only makes decision-making easier but also leads to better solutions in less time.

Top Resources for Students

To succeed in any learning program, it’s crucial to have access to the right resources. These tools not only provide additional insights but also enhance your understanding of the material. In this section, we’ll explore some of the best resources available to help students navigate their coursework, reinforce learning, and perform better in assessments.

Online Study Tools

- Khan Academy: Offers free educational content that covers a wide range of topics, including finance and budgeting, making it a great supplement for students looking to deepen their understanding.

- Quizlet: Provides study sets, flashcards, and practice quizzes tailored to specific subjects, helping students test their knowledge effectively.

- Edmodo: A platform for students and educators to share resources, assignments, and feedback, creating a collaborative learning environment.

- Coursera: Features courses from top universities and institutions, allowing students to expand their knowledge in a structured format.

Interactive Tools for Practice

- Mint: A budgeting tool that helps students practice managing personal finances, providing real-life application to the concepts they are learning.

- Financial Literacy Apps: Apps like You Need a Budget (YNAB) or PocketGuard give students hands-on experience with managing finances, offering valuable practice outside of the classroom.

- Google Sheets: Students can use spreadsheet tools to create budgets and track expenses, practicing essential financial skills in a real-world setting.

By utilizing these resources, students can access a wealth of information and practical tools to reinforce their learning, ensuring they are well-prepared to apply what they’ve learned and succeed in their studies.

Answer Strategies for Module 9 Questions

When approaching questions in an educational program, having a solid strategy can significantly improve your ability to answer them accurately. By understanding common question formats and applying effective techniques, students can navigate complex queries with ease. This section focuses on actionable strategies that can help enhance performance in assessments and boost confidence during test-taking.

Effective Reading and Interpretation

- Focus on Keywords: Carefully read each question and highlight important terms. These will often guide you toward the correct response.

- Understand the Question Type: Determine if the question is asking for a fact, an opinion, or a comparison, as this will influence your approach to the answer.

- Break Down the Question: If the question feels complex, break it into smaller parts. Address each component separately to avoid confusion.

Time Management and Decision Making

- Prioritize Easy Questions: Begin with questions you are confident about. This will save time and build momentum as you move through the test.

- Don’t Overthink: Trust your initial instinct, especially on multiple-choice questions. Often, your first choice is the right one.

- Use Process of Elimination: If unsure, rule out obviously incorrect options to increase your chances of choosing the correct one.

By employing these strategies, students can approach each question more effectively, manage their time better, and reduce anxiety during assessments. The key is to remain focused, break down complex questions, and trust the preparation you’ve done leading up to the test.

Why Practice is Crucial for Mastery

Achieving mastery in any subject requires more than just initial understanding; it demands consistent effort and repetition. Practice is the bridge between theoretical knowledge and real-world application. By engaging with concepts repeatedly, students not only reinforce their learning but also improve their ability to recall and apply information when needed. In this section, we’ll explore why regular practice is essential for mastering any skill or topic.

When students practice frequently, they build confidence and deepen their understanding. This process helps identify areas of weakness and allows for targeted improvement. Moreover, the more often you engage with the material, the more automatic your responses become, making it easier to solve problems efficiently and effectively in future scenarios.

Additionally, practice encourages critical thinking and problem-solving skills. As students encounter different variations of problems, they learn how to approach unfamiliar situations with a structured method. This kind of active engagement leads to better retention and a higher likelihood of success when faced with challenging tasks.

In short, regular practice is not just about repetition; it’s about refining skills, enhancing recall, and building the confidence needed to master complex material over time.

Improving Your Scores

Achieving higher scores in any online learning platform requires more than just passing assessments. It involves actively improving your understanding, refining your skills, and applying strategic approaches to each test or exercise. In this section, we’ll discuss practical methods to boost performance and maximize your learning outcomes.

Effective Study Techniques

- Review Key Concepts Regularly: Instead of cramming, revisit the important topics frequently. This reinforces your understanding and ensures the material sticks in your memory.

- Active Recall: Test yourself on the material without looking at notes or textbooks. This active engagement strengthens your ability to retain information.

- Teach What You Learn: Explaining concepts to someone else helps you internalize the material. Teaching forces you to organize your thoughts and clarify your understanding.

Test-Taking Strategies

- Read Questions Carefully: Take the time to fully understand what the question is asking. Look for keywords or specific instructions that might help guide your response.

- Eliminate Incorrect Choices: If the test is multiple choice, eliminate any obviously wrong answers first. This increases your chances of selecting the correct option.

- Time Management: Don’t spend too much time on any one question. If you’re stuck, move on and come back to it later if you have time.

By incorporating these strategies into your study routine, you’ll be able to enhance your performance and increase your chances of achieving higher scores. Consistency and careful preparation are key to mastering the material and excelling in assessments.

Key Definitions Explained

Understanding key terminology is crucial to mastering any subject. In this section, we’ll break down the most important terms and concepts, providing clear explanations to help you gain a deeper understanding of the material. Having a strong grasp of these definitions will not only aid in your learning process but also enhance your ability to apply the knowledge in real-world scenarios.

Important Terms You Should Know

- Financial Literacy: The ability to understand and effectively use various financial skills, including personal finance management, budgeting, saving, and investing.

- Budgeting: The process of planning and managing how to allocate your income or resources to different expenses over a set period of time.

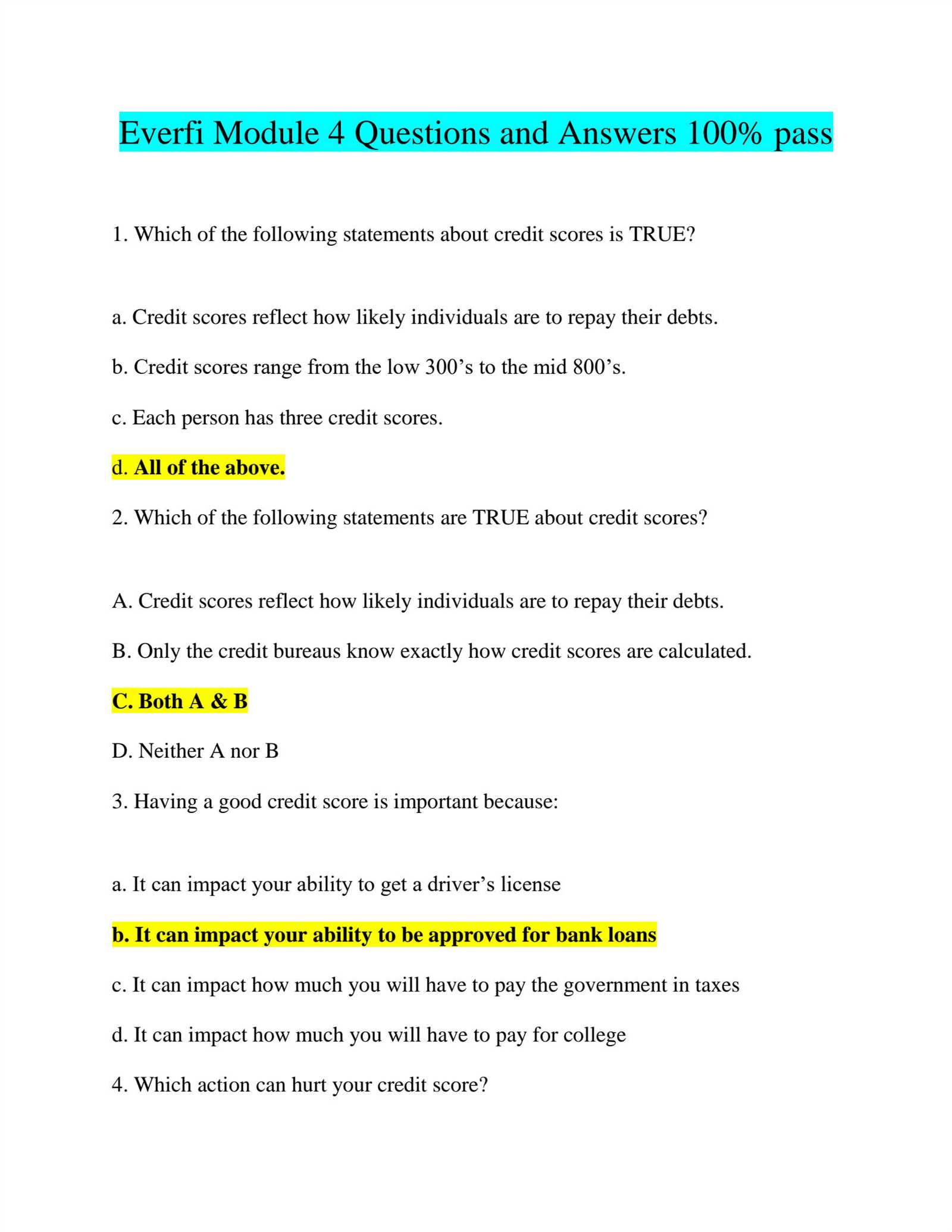

- Credit Score: A numerical representation of a person’s creditworthiness based on their credit history. A higher score indicates a better ability to repay debts.

Concepts to Keep in Mind

- Interest Rates: The cost of borrowing money, usually expressed as a percentage. Understanding how interest works can help you make better financial decisions.

- Debt Management: The strategies used to reduce or manage debts, which may include consolidation, refinancing, or budgeting to pay off outstanding amounts over time.

- Investment Diversification: The strategy of spreading investments across different assets or sectors to reduce risk and improve the potential for returns.

By becoming familiar with these key definitions, you will be better equipped to understand complex financial concepts and apply them to everyday situations. Mastering these terms will also lay a strong foundation for your continued learning and growth in the subject.

Understanding Learning Goals

Each section of a curriculum is designed with specific learning objectives that guide students toward gaining practical knowledge and skills. In this part, we will explore the core learning goals intended to help you achieve a deeper understanding of key concepts and apply them effectively. By recognizing these goals, you can focus on the essential ideas and strategies that will make your learning process more efficient and rewarding.

Core Learning Objectives

- Financial Decision-Making: Learn how to make informed decisions about money, including budgeting, saving, and managing expenses.

- Understanding Financial Tools: Gain insight into different financial instruments such as savings accounts, credit cards, and loans, and how they impact personal finances.

- Long-Term Planning: Understand the importance of long-term financial planning, including saving for future goals like retirement or education.

Skills to Develop

- Critical Thinking: Enhance your ability to analyze financial situations and make well-reasoned decisions based on available information.

- Money Management: Learn the practical skills needed to handle finances responsibly and avoid common pitfalls such as excessive debt or poor investment choices.

- Understanding Risks and Rewards: Understand the balance between risk and reward in financial planning and how to evaluate potential opportunities.

By achieving these learning goals, you will be better equipped to manage your finances, plan for the future, and make decisions that align with your personal and financial objectives.

How This Section Relates to Real Life

Understanding financial concepts and personal decision-making is crucial for navigating the complexities of everyday life. The lessons explored in this section provide practical knowledge that can be directly applied to daily situations, such as budgeting, saving, and making informed financial decisions. By learning about these core principles, individuals are better prepared to handle real-life financial challenges and work toward their long-term goals.

The concepts introduced here have immediate relevance in a variety of real-world scenarios. Whether managing personal finances, planning for future investments, or understanding the implications of financial choices, the knowledge gained will equip you with the tools to succeed. These skills not only help in personal budgeting but also extend to business and investment environments, making the content universally applicable.

Real-Life Applications

| Scenario | Application of Financial Concepts |

|---|---|

| Setting up a budget | Understanding how to track income, expenses, and set realistic financial goals. |

| Saving for future goals | Learning the importance of creating long-term savings plans for education, retirement, or major purchases. |

| Managing debt | Gaining insight into how debt works and developing strategies to pay it off effectively. |

As you continue to develop these skills, they will serve as a solid foundation for making smarter financial choices in various aspects of life. From budgeting for day-to-day expenses to planning for significant life events, the lessons learned here will enhance your ability to manage and grow your financial resources responsibly.

Final Thoughts on This Learning Section

As we conclude this section, it is important to reflect on the key concepts learned and how they can be applied in real-world scenarios. Mastering the material not only helps in understanding theoretical principles but also enhances practical skills in managing personal finances, decision-making, and long-term planning. These lessons are valuable tools that can be leveraged to build a more secure financial future.

While this section provides foundational knowledge, its true value comes from how you choose to apply what you’ve learned. The ability to navigate various financial decisions with confidence, set achievable goals, and manage resources effectively will continue to benefit you beyond this course. The skills gained here can make a significant difference in day-to-day life, preparing you for more complex challenges ahead.

Key Takeaways

| Concept | Application |

|---|---|

| Financial Planning | Learn how to set realistic budgets and savings goals to achieve financial security. |

| Debt Management | Develop strategies to manage and pay off debt efficiently, reducing financial stress. |

| Investing Basics | Understand the principles of investing and how to make informed decisions about your future. |

Ultimately, the insights gained here will serve as a strong foundation for building a successful financial strategy, whether it’s for personal use or broader economic goals. Continue to revisit these concepts and apply them as you progress in your financial journey.