Understanding the fundamentals of economic theory is crucial for analyzing the broader functioning of national economies. This section covers essential principles that help explain the relationships between government policies, market forces, and the overall economic environment. By grasping these concepts, you gain insight into the complex mechanisms that drive economic performance and influence everyday financial decisions.

Monetary and fiscal policies play a central role in shaping the economic landscape. The way these policies interact with factors like inflation, unemployment, and production levels is essential to understanding economic stability and growth. Analyzing such dynamics allows students to appreciate how economies adapt to changing conditions and make informed decisions based on both short-term fluctuations and long-term trends.

As you explore these key topics, it is important to approach the material systematically. The ability to connect theory with real-world applications is what will enable you to navigate the complexities of global economies. Whether it’s interpreting data, understanding policy impacts, or evaluating economic models, developing a strong foundation in these areas is essential for success.

AP Macroeconomics Unit 4 Test Overview

The focus of this section is on the critical economic concepts related to government policies, market regulation, and overall economic health. It emphasizes how various elements, such as inflation, unemployment, and economic growth, interact within a national economy. Understanding these relationships is essential for interpreting economic trends and evaluating the effects of policy changes.

Government spending and monetary control are key drivers in shaping economic stability. How central banks manage the money supply, alongside fiscal strategies implemented by the government, can influence everything from price levels to employment rates. These factors are examined through the lens of economic models designed to predict and explain economic outcomes.

Preparing for this section requires a solid grasp of economic theories and their real-world applications. The ability to analyze data and understand its implications allows for a deeper understanding of how policy decisions impact the broader economy. Whether assessing interest rates or the role of international trade, mastering these concepts will enable you to answer questions with precision and confidence.

Key Concepts in Macroeconomics Unit 4

This section delves into the essential ideas that shape the functioning of national economies, particularly focusing on government intervention, monetary systems, and economic performance indicators. The core concepts explored here help explain the interconnectedness of economic forces and provide a deeper understanding of how policy decisions can influence broader financial conditions.

Government Policies and Economic Impact

Government spending and taxation directly affect the overall economy by influencing both demand and supply. Fiscal policies are used to manage inflation, reduce unemployment, and promote economic stability. By adjusting tax rates or increasing public expenditure, governments can either stimulate or slow down economic activity, depending on the current needs of the economy.

The Role of Money and Inflation

Central banks play a pivotal role in managing the money supply and controlling inflation. By regulating interest rates and intervening in financial markets, they ensure that the economy remains on a stable path. The balance between inflation and growth is crucial for maintaining a healthy economy, and understanding this dynamic is key to answering related questions on how monetary policy affects daily life.

Understanding the Phillips Curve

The Phillips Curve illustrates the inverse relationship between inflation and unemployment within an economy. It suggests that when inflation is low, unemployment tends to be high, and vice versa. This concept helps to explain the trade-off that policymakers face when balancing the two variables in their efforts to maintain economic stability.

The Relationship Between Inflation and Unemployment

In a healthy economy, inflation and unemployment often move in opposite directions. As demand for goods and services increases, businesses may need to hire more workers, leading to lower unemployment. However, this also tends to push prices higher as demand exceeds supply, which in turn raises inflation. The Phillips Curve captures this delicate balance and provides insight into the economic conditions that policymakers must navigate.

Short-Run vs Long-Run Expectations

While the short-term relationship between inflation and unemployment is generally negative, the long-term view complicates this picture. In the long run, expectations of future inflation can shift, making the relationship less predictable. The natural rate of unemployment theory suggests that in the long term, there is a level of unemployment that the economy tends to return to, regardless of inflationary pressures.

Monetary Policy and Its Impact

Monetary policy refers to the actions taken by a nation’s central bank to control the supply of money and influence the overall economy. By adjusting interest rates and using other financial tools, central banks aim to maintain price stability, control inflation, and promote sustainable economic growth. These measures can have a significant effect on employment, investment, and consumer spending.

Tools of Monetary Policy

Central banks use various tools to manage the economy, the most prominent of which are:

| Tool | Purpose | Effect on Economy |

|---|---|---|

| Interest Rate Adjustments | Influences borrowing and lending behavior | Lower rates stimulate spending, higher rates control inflation |

| Open Market Operations | Buying or selling government bonds | Injects or withdraws money from circulation, affecting liquidity |

| Reserve Requirements | Determines the amount of money banks must hold in reserve | Higher reserves reduce lending, lower reserves increase liquidity |

Effects of Monetary Policy on the Economy

The primary goal of monetary policy is to influence inflation and employment levels. By lowering interest rates, central banks make borrowing cheaper, which encourages businesses to invest and consumers to spend. However, if inflation rises too quickly, central banks may increase interest rates to cool down the economy and prevent runaway price increases. These actions have a broad impact, affecting everything from home purchases to business expansion, and even international trade.

Aggregate Demand and Supply Review

This section explores the fundamental concepts of total demand and total supply in an economy. The interaction between these two forces determines the overall output and price levels in the market. Understanding how shifts in either demand or supply affect the economy is essential for analyzing economic conditions and predicting future trends.

Aggregate demand represents the total amount of goods and services that households, businesses, and the government are willing to purchase at different price levels. On the other hand, aggregate supply reflects the total quantity of goods and services that producers are willing and able to supply at different price levels. These two forces work together to determine the equilibrium level of production and prices in an economy.

Changes in factors such as consumer confidence, government spending, and production costs can cause shifts in both aggregate demand and supply. For example, an increase in government spending can boost demand, leading to higher output and prices, while a rise in production costs may reduce supply, causing prices to increase and output to decrease. Analyzing these shifts helps to better understand economic fluctuations and guide policymaking decisions.

Real vs Nominal GDP Explained

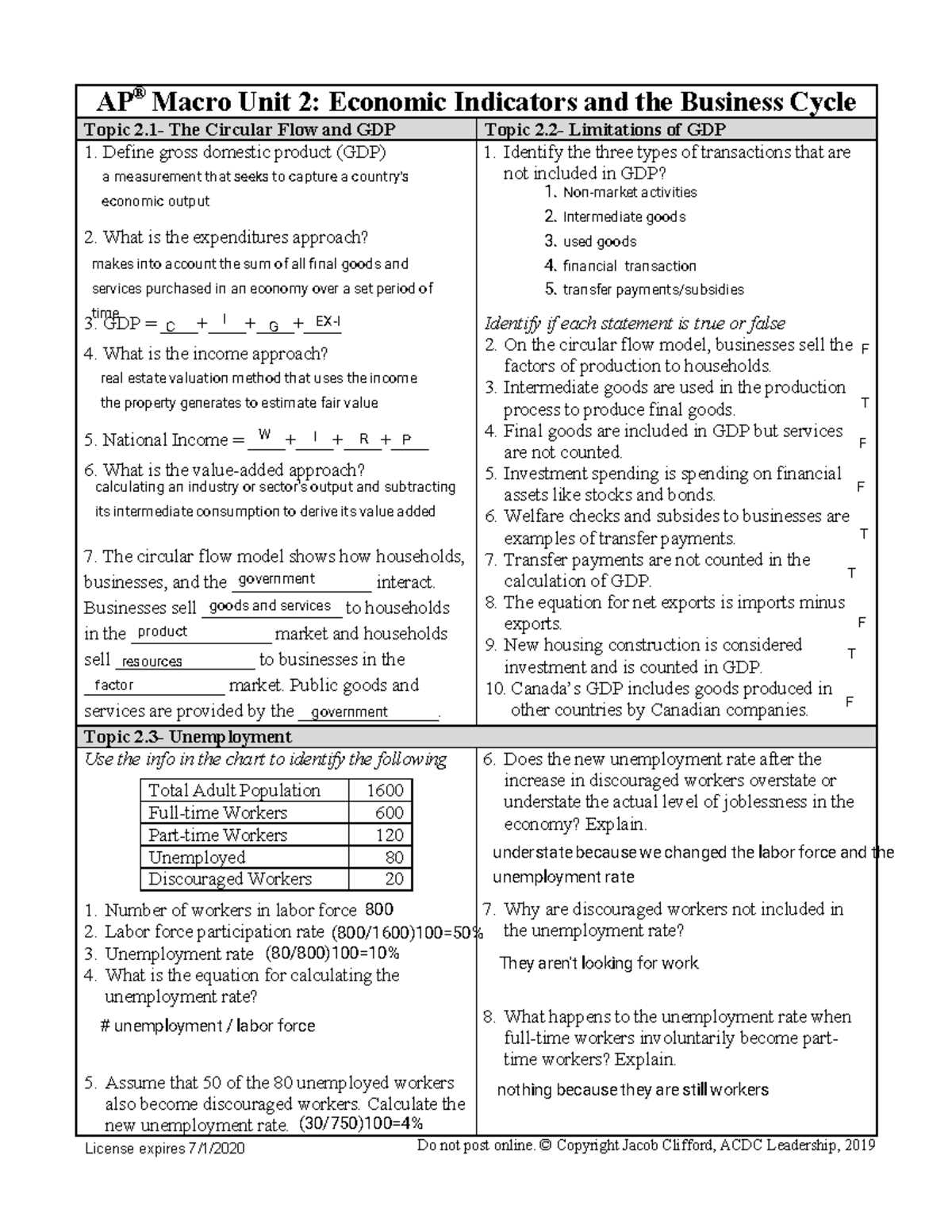

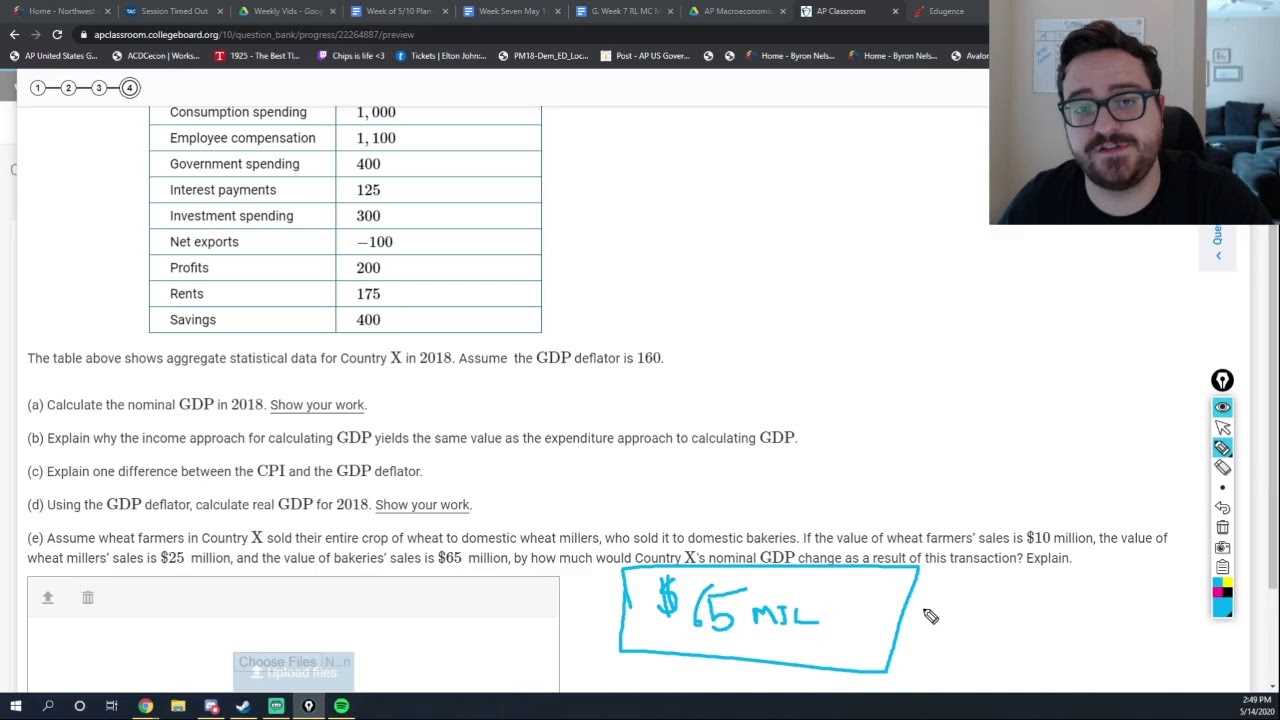

Gross Domestic Product (GDP) is a key indicator of a country’s economic performance, but it’s important to understand that there are different ways to measure it. Two common measures of GDP are real GDP and nominal GDP, each offering a distinct perspective on economic growth. While both are used to assess the value of goods and services produced within a country, the difference lies in how they account for inflation.

Nominal GDP measures the total value of all goods and services produced in a country using current prices during the time of measurement. It reflects the market value without adjusting for changes in price levels over time. On the other hand, real GDP adjusts for inflation, offering a more accurate representation of an economy’s true growth by using constant prices from a base year.

The key distinction between these two measures is that nominal GDP can be influenced by price changes, which may lead to misleading conclusions about the actual growth of an economy. Real GDP, however, removes this effect by factoring in inflation, allowing for a clearer comparison of economic output across different time periods. Understanding both measures is crucial for interpreting economic trends and making informed policy decisions.

Types of Unemployment in Detail

Unemployment is a critical indicator of an economy’s health, and understanding the different types of unemployment helps to evaluate the causes behind joblessness. Each type reflects various aspects of economic conditions, labor market dynamics, and shifts in industry demand. These categories offer insights into why people are out of work and how policy measures can address the issue.

Frictional Unemployment

Frictional unemployment occurs when individuals are temporarily without work while transitioning between jobs or entering the workforce for the first time. This type is generally short-term and is often seen as a natural part of a dynamic economy. Factors contributing to frictional unemployment include:

- Voluntary job changes

- New entrants to the labor force, such as graduates

- Relocation or changes in personal circumstances

Structural Unemployment

Structural unemployment arises when there is a mismatch between the skills of the workforce and the demands of the job market. Technological advancements, changes in consumer preferences, or the decline of certain industries can lead to job losses in specific sectors. This type of unemployment is typically longer-term and requires workers to acquire new skills or relocate to areas with more job opportunities. Key causes of structural unemployment include:

- Automation and technological advancements

- Outsourcing of jobs to other countries

- Decline in certain industries (e.g., coal mining, manufacturing)

Cyclical Unemployment

Cyclical unemployment is directly related to the overall economic cycle. During periods of economic downturn, businesses reduce production, leading to job cuts. As the economy recovers, unemployment typically falls. Cyclical unemployment is highly dependent on the health of the economy and can be addressed through government intervention, such as stimulus programs or monetary policy adjustments.

Fiscal Policy and Government Spending

Government spending plays a crucial role in shaping the overall economy. Through targeted financial actions, the government can influence economic growth, reduce unemployment, and stabilize inflation. By adjusting expenditure and taxation levels, policymakers aim to manage the economy’s performance, especially during times of economic downturns or growth surges.

Government Spending as a Tool

Government spending affects various sectors, such as infrastructure, healthcare, education, and defense. The objective is to stimulate demand, create jobs, and encourage investment in essential public services. The effectiveness of government spending in achieving economic goals largely depends on the timing and scale of these actions. The key areas impacted by government expenditure include:

| Area of Spending | Purpose | Economic Impact |

|---|---|---|

| Public Infrastructure | Investment in roads, bridges, and utilities | Boosts employment, stimulates business growth |

| Education | Funding for schools, colleges, and training programs | Enhances workforce skills, promotes long-term growth |

| Healthcare | Spending on hospitals, medical research, and healthcare services | Improves population health, reduces healthcare costs |

Fiscal Policy and Economic Cycles

Fiscal policy refers to how the government adjusts its spending and tax policies to manage the economy. During periods of economic slowdown, the government may increase spending to stimulate demand and reduce unemployment. Conversely, in times of economic expansion, the government may reduce spending or raise taxes to prevent the economy from overheating. These adjustments help to smooth out the business cycle, ensuring a balanced and sustainable economic growth trajectory.

Inflation and Its Economic Effects

Inflation represents a sustained increase in the overall price level of goods and services within an economy. It erodes purchasing power, as consumers are able to buy less with the same amount of money. While moderate inflation can signal a growing economy, excessive inflation can lead to economic instability, affecting everything from consumer behavior to business investments.

There are various factors that contribute to inflation, including rising demand for goods and services, increased production costs, and changes in the supply of money. Understanding the underlying causes of inflation is crucial for policymakers as they try to maintain price stability and avoid inflationary or deflationary pressures that can disrupt the economy.

The impact of inflation is felt by both consumers and producers. For consumers, inflation reduces the real value of income, making everyday purchases more expensive. For businesses, it can lead to higher production costs, which may be passed on to consumers in the form of higher prices. If inflation becomes too high, it can lead to decreased confidence in the economy, lower investment, and potential economic downturns.

Money Supply and Central Banks

The supply of money in an economy is a critical factor that influences inflation, interest rates, and overall economic activity. Central banks are responsible for managing the money supply through various tools to ensure economic stability. By adjusting the amount of money circulating in the economy, central banks aim to promote healthy growth, control inflation, and support financial stability.

How Central Banks Control the Money Supply

Central banks control the money supply through a variety of mechanisms, such as setting interest rates, conducting open market operations, and setting reserve requirements for commercial banks. When the central bank lowers interest rates, it encourages borrowing and increases the money circulating in the economy. Conversely, raising interest rates tends to reduce borrowing and slows the growth of money supply. Other tools include:

- Open Market Operations: Buying and selling government securities to increase or decrease the money supply.

- Reserve Requirements: Adjusting the amount of money that banks must hold in reserve, which impacts how much they can lend.

- Discount Rate: Setting the interest rate at which commercial banks borrow from the central bank, influencing lending practices.

The Role of Central Banks in Economic Stability

Central banks play a vital role in maintaining economic stability by carefully managing the money supply. During periods of economic downturn, they may inject more money into the economy to stimulate growth. In contrast, during periods of rapid economic growth, they may take steps to reduce the money supply to prevent inflation. Through these actions, central banks help to stabilize the financial system, prevent excessive inflation, and encourage sustainable economic development.

How Interest Rates Influence the Economy

Interest rates play a pivotal role in determining the cost of borrowing money, influencing consumer behavior, business investment, and overall economic activity. When interest rates are low, borrowing becomes more affordable, encouraging individuals and businesses to take out loans, invest, and spend more. Conversely, higher interest rates raise the cost of borrowing, which can slow down spending and investment, leading to a more cautious economic environment.

Changes in interest rates can affect several key areas of the economy, including consumer spending, business expansion, and housing markets. For example, when rates are lowered, consumers are more likely to finance large purchases like homes or cars, and businesses may find it easier to obtain capital for new projects. On the other hand, higher rates typically lead to reduced borrowing, which can dampen demand for goods and services, potentially slowing down economic growth.

Interest Rates and Inflation

Interest rates are also used as a tool to control inflation. Central banks may raise rates to reduce excessive spending and cool down an overheated economy. This helps to maintain price stability by curbing inflationary pressures. However, if interest rates are set too high for extended periods, it can lead to reduced investment and slower economic growth.

The Broader Economic Impact

Overall, interest rates serve as a key lever for controlling economic conditions, impacting everything from consumer credit to corporate profits. By adjusting interest rates, policymakers aim to balance economic growth with inflation control, striving to maintain stability and avoid extreme fluctuations in economic activity.

International Trade and Exchange Rates

International trade and exchange rates are closely intertwined and play a crucial role in shaping global economic dynamics. The ability to trade goods and services across borders is affected by the value of one currency in relation to another. This relationship, known as exchange rates, influences everything from the prices of imported goods to the competitiveness of exports in foreign markets. A change in exchange rates can either benefit or harm a country’s economy depending on its position in the global market.

The Role of Exchange Rates in Global Trade

Exchange rates represent the price of one currency in terms of another. When a country’s currency appreciates, its goods and services become more expensive for foreign buyers, potentially leading to a decline in exports. Conversely, when a currency depreciates, its goods and services become cheaper for foreign buyers, which may lead to an increase in exports. Several factors affect exchange rates, including:

- Interest Rates: Higher interest rates tend to attract foreign investment, which increases demand for the currency and causes it to appreciate.

- Economic Stability: Countries with stable economies tend to have stronger currencies, while political or economic instability can lead to depreciation.

- Inflation Rates: Countries with lower inflation rates generally see their currency appreciate over time, making their exports more competitive.

Impact of Exchange Rate Fluctuations on Trade

Fluctuations in exchange rates can have significant consequences for both importers and exporters. A sharp decline in the value of a currency can make imported goods more expensive, leading to inflationary pressures. On the other hand, it can also boost exports by making them cheaper for foreign buyers. For businesses engaged in international trade, understanding exchange rate trends is essential to managing risks and taking advantage of favorable market conditions.

In sum, exchange rates are an essential component of international trade. Changes in the value of a nation’s currency can have broad implications for its trade balance, influencing the cost of imports and exports and ultimately shaping its economic trajectory in the global marketplace.

Examining the Loanable Funds Market

The loanable funds market plays a central role in the allocation of capital within an economy. It is where savers and borrowers come together, with savings providing the funds that are borrowed for investments, consumption, or government spending. The supply of loanable funds is driven by the amount of savings in the economy, while the demand for funds comes from those seeking to borrow for various purposes such as business expansion or home purchases. The equilibrium in this market is determined by the interest rate, which balances the amount of funds supplied and demanded.

Factors Affecting the Supply and Demand for Loanable Funds

Several factors influence both the supply of and demand for loanable funds. On the supply side, the availability of savings plays a significant role. Higher savings rates, for example, lead to an increase in the funds available for lending. On the demand side, businesses and individuals borrowing for investments or consumption needs determine the overall demand for funds. Key elements influencing these dynamics include:

- Interest Rates: As interest rates rise, the cost of borrowing increases, which typically reduces the demand for funds. However, it also makes saving more attractive, thus increasing the supply.

- Economic Growth: In times of economic expansion, businesses are more likely to invest, driving up the demand for loanable funds.

- Government Borrowing: When the government increases its borrowing, it can reduce the availability of funds for private borrowers, pushing interest rates higher.

- Consumer Confidence: Higher consumer confidence often leads to increased borrowing, as individuals are more willing to take loans for purchases such as homes and cars.

Equilibrium in the Loanable Funds Market

The interest rate acts as the price in the loanable funds market, ensuring that the quantity of funds supplied equals the quantity of funds demanded. When the interest rate is too high, the supply of funds exceeds demand, leading to an excess of savings. On the other hand, when interest rates are too low, the demand for funds exceeds the supply, leading to a shortage of funds. The equilibrium interest rate ensures a balance between the two, facilitating efficient capital allocation in the economy.

In conclusion, the loanable funds market is a crucial mechanism in the broader economic system, allowing savings to be transformed into investments that drive growth. Understanding how interest rates, supply, and demand interact within this market is essential for comprehending broader economic trends and financial stability.

The Role of the Federal Reserve

The Federal Reserve, often referred to as the central bank of the United States, plays a critical role in shaping the economy by managing the country’s money supply, regulating financial institutions, and implementing monetary policies aimed at achieving economic stability. It serves as a key player in maintaining price stability, controlling inflation, and fostering maximum sustainable employment. Its actions directly influence interest rates, the availability of credit, and overall economic conditions.

The Federal Reserve’s core functions revolve around several key areas that support economic growth and financial stability. These functions include:

- Monetary Policy Implementation: The Federal Reserve adjusts the money supply through tools like open market operations, the discount rate, and reserve requirements to influence interest rates and liquidity in the economy.

- Regulation of Financial Institutions: It ensures the stability and soundness of banks and other financial entities by overseeing their operations and setting regulations to prevent risky practices that could destabilize the financial system.

- Ensuring Payment System Efficiency: The Federal Reserve also operates and oversees the country’s payment systems, facilitating secure and efficient transactions between individuals, businesses, and governments.

- Financial Crisis Management: During economic downturns or financial crises, the Federal Reserve acts as a lender of last resort, providing liquidity to prevent a collapse of the banking system and stabilizing financial markets.

One of the most influential tools at the Federal Reserve’s disposal is its ability to manipulate interest rates. By raising or lowering interest rates, the Federal Reserve can influence borrowing costs, which in turn affects consumer spending, business investment, and overall economic activity. Additionally, its actions in controlling inflation and managing unemployment help stabilize the broader economy.

In summary, the Federal Reserve plays a fundamental role in steering the U.S. economy toward long-term growth by implementing monetary policies, regulating financial institutions, and ensuring the stability of the financial system. Its decisions ripple through various sectors of the economy, influencing everything from consumer loans to the cost of housing and the overall business environment.

Macroeconomic Models and Their Use

Economic models serve as simplified representations of the real world, helping economists and policymakers understand the complex interactions within an economy. These models allow for predictions and analysis of economic trends, providing insights into how various factors such as government policies, consumer behavior, and global events influence economic outcomes. By using mathematical equations, graphs, and assumptions, these models distill complicated economic processes into manageable frameworks.

One of the primary purposes of economic models is to analyze the relationships between key variables, such as inflation, employment, output, and investment. They also help in testing the effects of different policy decisions, such as changes in interest rates or fiscal spending. Here are some common uses of these models:

Analyzing Economic Fluctuations

Economic models are particularly useful in examining short-term fluctuations in economic activity. They help explain how factors like changes in aggregate demand or supply can lead to periods of growth or contraction. By using these models, economists can predict the potential impact of external shocks or domestic changes on key economic indicators, such as GDP growth and unemployment rates.

Guiding Policy Decisions

Governments and central banks use economic models to guide their policy decisions, especially in areas such as fiscal policy and monetary policy. These models allow for the simulation of various policy scenarios, helping to determine the best course of action to achieve goals like price stability, full employment, and sustainable growth. For example, they can predict the effects of increasing government spending or adjusting interest rates on inflation and economic output.

In conclusion, economic models are vital tools in understanding the functioning of an economy. They allow for the analysis of complex relationships and provide valuable insights that assist in policymaking and forecasting future economic conditions. While these models are based on assumptions and simplifications, they offer a structured way to evaluate the potential outcomes of different economic scenarios.

Understanding Economic Growth Factors

Economic growth is driven by a variety of interconnected factors that influence the productivity and output of an economy. These factors range from technological advancements to the quality of human capital, and they determine the long-term expansion of a nation’s economic capacity. Understanding these elements is crucial for developing strategies that promote sustainable growth and improve living standards over time.

One of the primary drivers of economic growth is technological innovation. The development of new technologies allows for more efficient production processes, reducing costs and increasing output. As industries adopt advanced machinery, automation, and digital systems, productivity rises, fueling economic expansion. Additionally, investments in research and development (R&D) are essential for fostering continued innovation.

Another key factor is the accumulation of human capital, which refers to the skills, knowledge, and abilities of the workforce. A well-educated and trained population can contribute more effectively to the economy, driving both productivity and growth. Governments and businesses alike invest in education and workforce development programs to enhance human capital and prepare workers for the demands of a modern economy.

Capital accumulation also plays a vital role in economic growth. This involves the investment in physical infrastructure, machinery, and equipment that supports production activities. As businesses and governments invest in capital goods, the economy becomes more efficient and capable of handling larger scales of production, which in turn drives growth.

In addition to these domestic factors, external elements such as trade and foreign investment can significantly impact a nation’s economic expansion. Open markets and international trade allow for the exchange of goods, services, and technology, creating opportunities for growth in both emerging and developed economies. Foreign investment provides additional capital that can be used to expand industries and improve infrastructure.

Ultimately, economic growth is the result of a complex interaction between technological progress, human capital development, capital accumulation, and external factors. By understanding these drivers, policymakers can craft informed strategies to foster long-term economic prosperity and ensure a stable future for their economies.

Practice Questions for Unit 4 Test

Preparing for an exam requires a comprehensive understanding of key concepts, and practicing with targeted questions can significantly enhance your knowledge. The following set of practice questions covers various topics, designed to test your understanding of economic principles and their application in real-world scenarios. These questions will help reinforce essential concepts and provide valuable insight into the types of challenges you might encounter.

- Question 1: What impact does an increase in government spending have on the overall demand within an economy? Explain how it can affect inflation and employment levels.

- Question 2: Discuss the relationship between interest rates and the overall economic activity. How do central banks use monetary policy to influence this relationship?

- Question 3: Compare and contrast the effects of nominal GDP and real GDP. How do changes in prices influence each of these measurements?

- Question 4: Define and explain the concept of aggregate demand. How do factors like consumer confidence and government policy influence it?

- Question 5: How do exchange rates affect a country’s international trade? Describe the influence of a stronger versus a weaker currency on imports and exports.

- Question 6: Explain the role of central banks in managing the money supply. How do their actions impact inflation and economic growth?

- Question 7: What are the main factors that contribute to economic growth? How do technological advancements and human capital play a role in this process?

By answering these practice questions, you’ll gain a deeper understanding of economic dynamics and be better equipped to tackle more complex problems. Make sure to review your answers carefully, and if you’re uncertain about any concept, take the time to revisit the material for clarification.

Effective Test-Taking Strategies

When approaching any exam, having a clear and structured strategy can make a significant difference in performance. It’s not only about knowing the material, but also about applying the right techniques to manage time, reduce stress, and maximize accuracy. Below are several strategies that can help improve your approach and increase your chances of success.

Preparation is Key

Thorough review is essential. Start by going over key concepts, important formulas, and definitions. Use active recall, where you test yourself on the material without looking at notes. This can be particularly effective for reinforcing memory and identifying areas that require more attention.

Another important aspect is practice testing. Engage with sample questions, past exams, or online quizzes to familiarize yourself with the format and structure of the questions. This can help reduce any surprises on the day of the exam.

During the Exam

Once you’re in the exam, managing your time efficiently is crucial. Divide the available time by the number of questions, making sure to leave time at the end for review. Start by answering the questions you know well to build confidence, then return to the more challenging ones.

Read each question carefully before answering. Ensure that you understand what is being asked before you begin. If you’re unsure, eliminate obviously incorrect options first (for multiple-choice questions), and then make an educated guess.

Stay Calm and Focused

Maintain a calm and focused mindset throughout the exam. If you feel stuck on a question, move on and come back to it later. Avoid the trap of spending too much time on one question, as it can eat into the time available for others.

Remember to stay hydrated and take short mental breaks when needed. A quick pause can help refresh your mind and improve concentration for the remaining questions.

By following these strategies, you’ll be better prepared to handle the challenges of the exam, improve your efficiency, and increase your overall performance. Success comes not only from knowledge but also from the ability to approach the exam with the right mindset and tools.