In today’s world, understanding how to manage your money effectively is crucial for achieving long-term financial stability. From budgeting to investing, making informed decisions can significantly impact your future. This section is designed to help you navigate the essential principles of money management, providing you with the tools to make sound choices that align with your financial goals.

Financial success isn’t just about earning money–it’s about making that money work for you. By grasping key concepts such as saving, spending wisely, and managing credit, you can avoid common pitfalls and set yourself up for a secure future. Learning how to balance these aspects will give you the confidence to tackle various challenges along your financial journey.

As you go through this material, you will find practical examples and strategies that will make it easier to apply these concepts in real life. The goal is to help you not only understand the theory behind money management but also how to put it into practice for your personal benefit.

Everfi Financial Literacy Module 9 Answers

This section focuses on helping you navigate the key concepts and questions related to managing money effectively. By breaking down the material, you can gain a clearer understanding of essential principles, from budgeting and saving to credit management and investing. The goal is to make these topics more accessible and ensure you can confidently apply them to your own life.

Throughout this guide, we will cover various approaches to handling everyday financial challenges. From practical tips on building a budget to understanding how interest rates affect your savings and loans, this section will provide the necessary insights to improve your financial decision-making. Mastering these elements will set you on the path to financial independence and success.

As you work through these topics, you’ll find specific examples and scenarios designed to reinforce the material. Whether you’re just starting out or looking to improve your knowledge, this section offers the tools needed to better manage your money and achieve your financial goals with confidence.

Understanding Everfi Module 9 Basics

This section introduces the fundamental concepts related to managing money and making smart decisions about spending, saving, and investing. The key focus is on understanding how to handle various aspects of personal finance, including budgeting, understanding credit, and planning for future financial goals. By grasping these core principles, you will be better equipped to navigate the challenges of daily money management.

Key Concepts to Focus On

The foundation of effective money management lies in a few simple yet crucial concepts. These include setting financial goals, controlling spending, and learning how to save and invest for long-term growth. As you delve deeper into the material, you’ll see how these ideas come together to form a comprehensive approach to financial well-being.

Practical Application of Knowledge

Understanding these concepts is one thing, but being able to apply them in real-world scenarios is where the real value lies. Whether it’s building a budget that works for you or understanding the impact of borrowing money, learning how to take control of your finances will put you on the path to greater financial security.

Key Concepts in Financial Literacy

Understanding the core principles of managing money is essential for making informed decisions that lead to long-term financial success. These principles include planning, budgeting, saving, investing, and managing debt. Grasping these ideas is crucial in developing the skills necessary to take control of your economic future and avoid common pitfalls that can derail your financial progress.

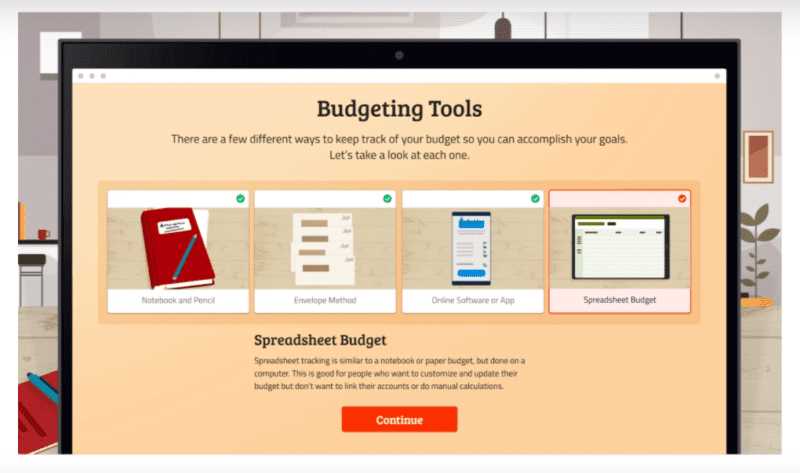

Budgeting is one of the most important concepts to master. It allows individuals to track their income and expenses, ensuring that they can live within their means and save for future goals. Similarly, understanding savings is key to building financial security. Allocating funds for emergencies and future needs helps you stay prepared for unexpected events.

Another vital concept is investing, which involves putting money into assets that can grow over time, such as stocks, bonds, or real estate. This helps you build wealth and achieve financial goals more efficiently. Additionally, managing debt is essential to avoid accumulating high-interest liabilities that can hinder your financial progress. Learning how to use credit responsibly and pay off loans on time is crucial for maintaining good financial health.

How to Approach Module 9 Questions

When tackling the questions in this section, it’s important to take a strategic approach. Focus on understanding the key concepts before attempting the questions, as this will help you think critically and apply your knowledge effectively. Start by carefully reading each question to ensure you fully grasp what is being asked, and take your time to consider all available options before selecting an answer.

Break down complex questions into smaller parts if necessary. Identify the main points and look for clues that can guide you toward the correct solution. If a question involves calculations or comparing different scenarios, make sure to organize your thoughts clearly and use simple steps to arrive at the answer. Don’t rush through the process–accuracy is more important than speed.

Review your understanding regularly. If you find yourself uncertain about a particular concept, revisit the related material to strengthen your grasp on the topic. Over time, practicing this method will help you approach similar questions with confidence and improve your overall ability to apply these principles in real-world situations.

Importance of Budgeting in Module 9

Creating and maintaining a budget is one of the most effective tools for taking control of your finances. By carefully tracking your income and expenses, you can make informed decisions that help you live within your means and save for future goals. Without a clear plan for managing money, it can be easy to overspend or neglect saving, which can lead to financial instability.

In this section, budgeting serves as a foundation for making thoughtful choices. Whether you are planning for short-term expenses or long-term goals, a well-structured budget ensures that you allocate funds appropriately. By understanding where your money goes each month, you can identify areas for improvement and take actionable steps toward better financial management.

| Category | Budgeted Amount | Actual Amount |

|---|---|---|

| Income | $3,000 | $3,000 |

| Housing | $1,200 | $1,250 |

| Groceries | $400 | $350 |

| Transportation | $200 | $180 |

| Entertainment | $150 | $120 |

| Savings | $500 | $500 |

By regularly reviewing and adjusting your budget, you can ensure that your spending aligns with your priorities and that you stay on track to meet your financial goals. A solid budget provides clarity and control, helping you make smarter financial decisions and avoid unnecessary debt.

Saving for the Future Explained

Planning ahead and setting aside money for future needs is a crucial aspect of achieving financial security. Whether it’s for emergencies, retirement, or long-term goals like buying a home, saving consistently can provide peace of mind and ensure you’re prepared for the unexpected. By adopting smart saving habits early on, you can create a strong foundation that supports your financial well-being in the years to come.

Starting early is key to building a robust savings plan. The sooner you begin saving, the more time your money has to grow, thanks to compound interest. Even small contributions can add up over time, making it easier to reach your future goals without feeling overwhelmed by large, last-minute expenses.

Setting specific goals for your savings helps keep you motivated and focused. Whether you’re saving for an emergency fund, a big purchase, or retirement, having a clear target ensures that you stay on track and can make adjustments as necessary. Creating a budget that includes savings as a regular expense is an effective way to prioritize your future financial needs while managing current responsibilities.

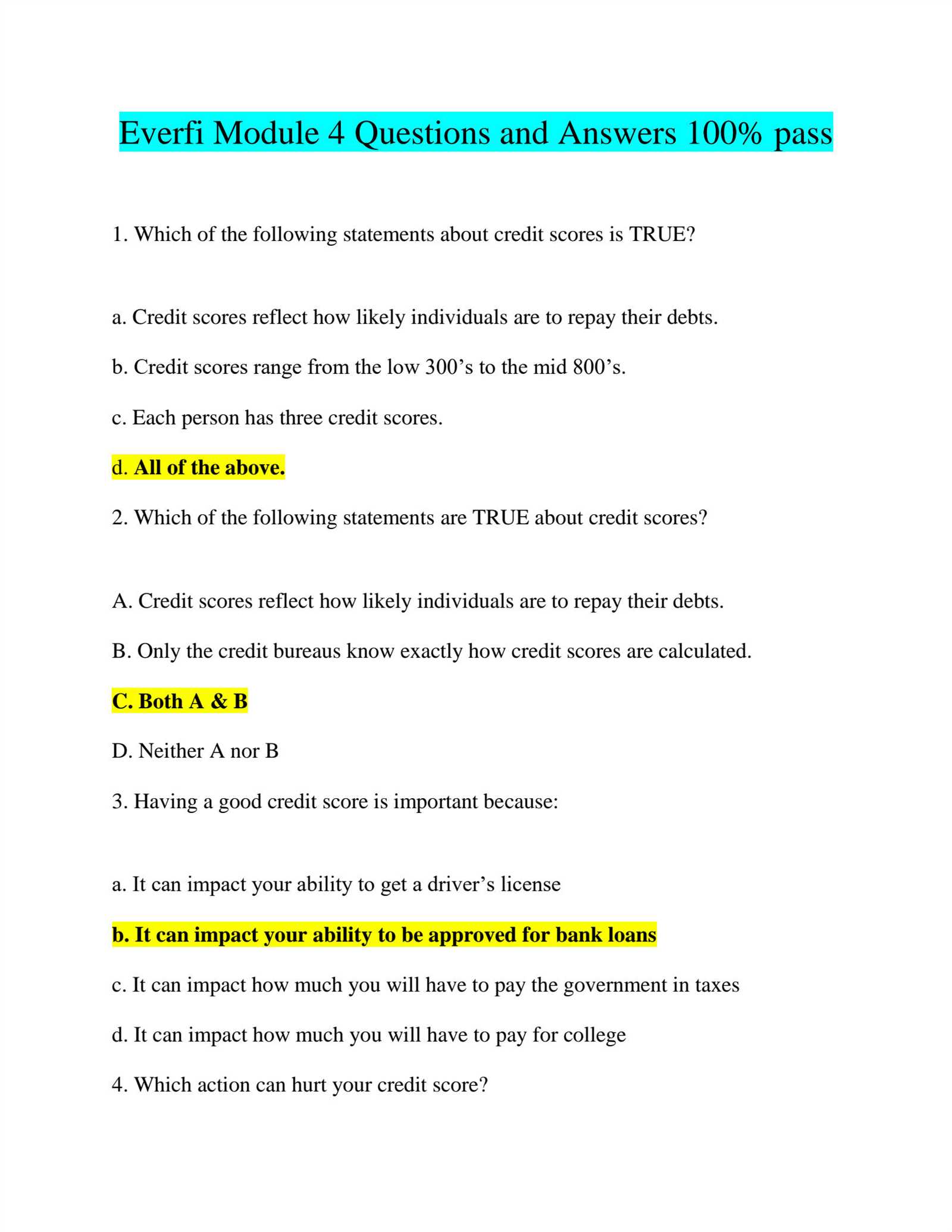

Understanding Credit and Debt Management

Managing credit and debt is a fundamental skill for maintaining financial health. Understanding how credit works and how to handle debt responsibly can prevent financial struggles and help you build a strong credit history. By using credit wisely and keeping debt under control, you can make smarter financial choices that support your long-term goals.

Credit is essentially borrowed money that you agree to pay back, often with interest. It is used in many aspects of life, from taking out loans for big purchases to using credit cards for everyday expenses. However, it’s crucial to manage credit carefully, as mismanaging it can lead to debt accumulation and a poor credit score, which affects your ability to borrow in the future.

Debt management involves making timely payments and avoiding unnecessary borrowing. Keeping debt levels manageable is essential for maintaining financial stability. One effective way to handle debt is by creating a plan to pay off high-interest debts first, which can reduce the total amount you owe over time.

| Type of Debt | Interest Rate | Monthly Payment |

|---|---|---|

| Credit Card | 18% | $200 |

| Personal Loan | 7% | $150 |

| Student Loan | 4% | $100 |

| Mortgage | 3.5% | $800 |

Effective debt management also includes setting up automatic payments to avoid missed due dates and reducing expenses to free up more funds for debt repayment. By taking proactive steps to manage credit and debt, you can maintain financial freedom and build a secure future.

Smart Spending Habits to Practice

Developing smart spending habits is essential for maintaining financial health and reaching long-term goals. By making conscious decisions about where and how you spend your money, you can reduce unnecessary expenses, save more, and avoid falling into debt. Practicing mindful spending helps ensure that your financial resources are used in the most effective way possible.

Track Your Expenses

One of the first steps in smart spending is keeping track of where your money goes. Regularly reviewing your spending allows you to identify patterns, pinpoint areas where you can cut back, and ensure you’re staying within your budget. By categorizing your expenses, such as groceries, entertainment, and transportation, you can make more informed choices and adjust accordingly.

Prioritize Needs Over Wants

Before making a purchase, take a moment to consider whether it’s something you truly need or simply a want. Distinguishing between the two helps prevent impulse buying and keeps you focused on your financial priorities. By focusing on essential purchases first and delaying or forgoing non-essential items, you can save more and avoid unnecessary debt.

Shop Smart by comparing prices, looking for sales, and using coupons. Small adjustments like these can add up over time and help you stretch your budget further. Additionally, buying in bulk for items you regularly use can provide savings in the long run, especially when discounts are available for larger quantities.

Investing and Growing Your Money

Building wealth over time requires more than just saving–it involves making your money work for you. Investing allows you to grow your savings by putting them into assets that have the potential to increase in value. While it comes with risks, investing wisely can offer significant rewards, allowing you to achieve long-term financial goals such as retirement, purchasing a home, or funding education.

Types of Investments to Consider

When it comes to investing, there are several options available. Each type of investment carries its own risk level and potential for growth. Here are some common investment vehicles:

- Stocks: Owning shares in a company gives you a stake in its growth. Stocks can offer high returns, but they also come with greater risk due to market fluctuations.

- Bonds: These are loans you make to companies or governments in exchange for interest payments. Bonds are generally considered less risky than stocks, but their returns are also typically lower.

- Mutual Funds: These pools of money are managed by professionals and invested in a variety of assets like stocks and bonds, providing diversification to reduce risk.

- Real Estate: Purchasing property can provide both long-term appreciation and rental income, though it requires a larger initial investment and ongoing maintenance costs.

- Index Funds: These funds track the performance of a market index, offering a way to invest in a broad range of stocks or bonds at a lower cost.

Strategies for Growing Your Investments

To make the most of your investments, it’s important to have a clear strategy. Here are a few approaches that can help:

- Diversify: Spread your investments across different asset classes to reduce the risk of losing money if one sector underperforms.

- Start Early: The earlier you begin investing, the more time your money has to grow through compound interest.

- Stay Consistent: Regularly contributing to your investment accounts, even in small amounts, helps build wealth over time.

- Reinvest Earnings: Reinvesting dividends or interest payments can accelerate the growth of your portfolio.

- Focus on Long-Term Goals: Avoid the temptation to make impulsive decisions based on short-term market fluctuations. Focus on your long-term objectives to reduce emotional decision-making.

By choosing the right investment options and following a thoughtful strategy, you can increase your chances of growing your wealth and achieving financial independence. While no investment is without risk, informed decisions and consistent efforts will put you on the path to success.

Calculating Interest and Loans Effectively

Understanding how interest works and how loans are structured is essential for managing debt and making informed financial decisions. Whether you’re taking out a loan, using a credit card, or saving in an interest-bearing account, knowing how to calculate interest can help you assess the true cost of borrowing and the potential benefits of saving. Accurate calculations ensure you understand how your money grows or how much you’ll need to repay over time.

Interest is essentially the cost of borrowing money or the reward for saving. It is usually expressed as a percentage of the principal amount, which is the original sum of money. Interest can be calculated in two common ways: simple interest and compound interest.

Simple Interest is calculated on the principal amount only, meaning the interest doesn’t change over time. The formula for simple interest is:

Simple Interest = Principal x Rate x Time

Where:

- Principal: The initial amount of money borrowed or invested.

- Rate: The interest rate, usually expressed as a percentage.

- Time: The length of time the money is borrowed or invested for, typically in years.

Compound Interest, on the other hand, is calculated on both the principal and the interest that has already been added to the balance. This means the amount of interest can grow exponentially over time. The formula for compound interest is:

Compound Interest = Principal x (1 + Rate)^Time – Principal

Where:

- Principal: The initial amount.

- Rate: The interest rate.

- Time: The time period, typically in years.

When taking out loans, it’s crucial to understand how much you will pay in total over the life of the loan, including both the principal and the interest. This helps you make informed decisions about how much you can afford to borrow and what the long-term costs will be. Similarly, when saving money, knowing how interest compounds helps you predict how much your savings will grow.

By learning to calculate and compare interest rates effectively, you can make smarter borrowing and saving decisions, helping you manage debt more effectively and increase your financial stability.

Insurance Basics and Its Importance

Insurance is a tool that helps protect individuals and families from financial loss due to unexpected events. It provides a safety net, offering compensation or coverage in case of accidents, illness, damage, or other risks. By paying a relatively small amount regularly, policyholders can safeguard themselves against large, potentially devastating costs. Understanding the basics of insurance can help individuals make informed decisions and choose the right plans to meet their needs.

Types of Insurance

There are various types of insurance, each designed to protect against different risks. The main categories include:

- Health Insurance: Covers medical expenses such as doctor visits, hospital stays, and prescription medications. This is essential for managing the cost of healthcare services.

- Life Insurance: Provides a financial benefit to beneficiaries upon the death of the policyholder. It ensures that dependents are financially supported after the loss of a loved one.

- Auto Insurance: Protects against financial loss in case of accidents, theft, or damage to a vehicle. It may also cover injuries to the driver or others involved in an accident.

- Homeowners or Renters Insurance: Protects your home and belongings from damage due to natural disasters, theft, or accidents. It can also cover liability if someone is injured on your property.

- Disability Insurance: Provides income replacement if you are unable to work due to illness or injury. This type of insurance is crucial for maintaining financial stability in case of unforeseen health issues.

How Insurance Works

Insurance works by pooling risks from many individuals or entities. Policyholders pay premiums, which are typically regular payments made to the insurance company. In return, the insurer agrees to cover certain financial losses as outlined in the policy. The amount paid out by the insurance company depends on the terms of the policy, including the deductible (the amount the policyholder must pay before the insurance kicks in) and coverage limits (the maximum amount the insurer will pay). If an event occurs that is covered by the policy, the insurance company will reimburse the policyholder or directly pay for the related costs.

Why Insurance is Important

Having the right insurance is crucial for protecting yourself and your loved ones from the financial burden of unexpected events. It ensures that you won’t face overwhelming costs in the event of an emergency, allowing you to focus on recovery rather than worrying about how to pay for services or repairs. Insurance can also provide peace of mind, knowing that you are financially covered in situations beyond your control.

- Financial Protection: Helps you manage potential losses by covering expenses you may not be able to afford on your own.

- Risk Management: Transfers the financial burden of unexpected events from the individual to the insurance company.

- Peace of Mind: Knowing that you have a safety net can reduce stress and allow you to focus on other important aspects of life.

- Support for Dependents: Life insurance, in particular, provides financial support for family members and dependents in the event of the policyholder’s death.

In summary, understanding the basics of insurance is an important step in securing your financial future. It ensures that you are prepared for life’s uncertainties and can protect yourself, your family, and your assets when the unexpected happens.

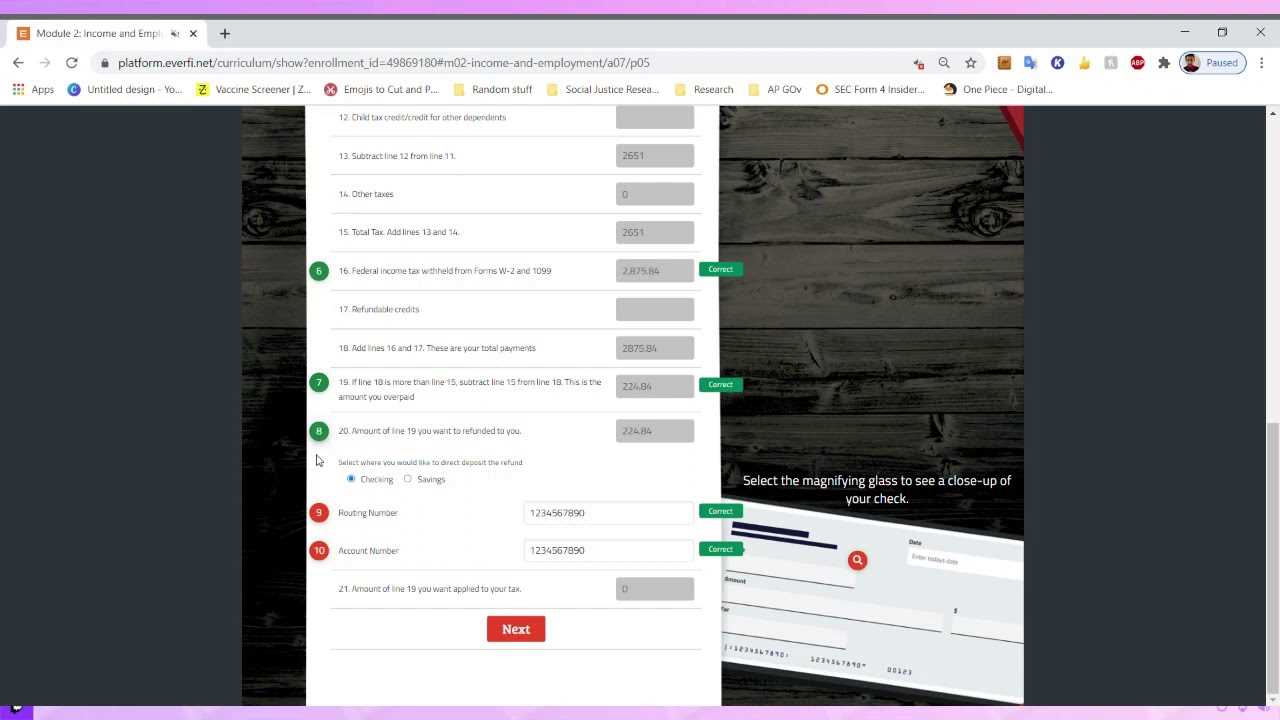

How Taxes Affect Your Financial Life

Taxes play a significant role in your overall financial well-being and influence how much of your income you get to keep. They can impact your disposable income, savings potential, and long-term financial goals. Understanding how taxes work, and how they affect your spending and saving decisions, is crucial for managing your money effectively. From income tax to property tax, the amount you pay in taxes can either help or hinder your ability to achieve financial stability and security.

Types of Taxes and Their Impact

There are various taxes that individuals face throughout their lives. Each of these can influence your finances in different ways. The most common types of taxes include:

| Tax Type | Impact on Finances |

|---|---|

| Income Tax | Reduces the amount of income you take home, affecting your daily budget, savings, and investment decisions. |

| Sales Tax | Increases the cost of goods and services, affecting your purchasing power and overall spending habits. |

| Property Tax | Can increase your homeownership costs, potentially limiting how much you can save or invest in other areas. |

| Capital Gains Tax | Affects the profit you make from selling investments, such as stocks or property, reducing your potential return on investment. |

Strategies for Managing Taxes

Managing your tax obligations effectively is essential to minimizing their impact on your finances. Here are a few strategies to consider:

- Tax Planning: Anticipating taxes throughout the year can help you make informed decisions about income, investments, and deductions to reduce your overall tax liability.

- Utilize Tax-Advantaged Accounts: Contributing to retirement accounts or health savings accounts (HSAs) can lower your taxable income and grow your savings tax-deferred.

- Claim Deductions and Credits: Take advantage of deductions (e.g., mortgage interest) and tax credits (e.g., education credits) that can reduce your taxable income or directly reduce the amount of tax owed.

- Tax-Efficient Investments: Some investment options, such as municipal bonds, offer tax advantages, helping you retain more of your investment returns.

In summary, understanding how taxes affect your financial life can help you make smarter decisions regarding your income, savings, and investments. By adopting strategies to manage taxes efficiently, you can minimize their impact and enhance your financial future.

Understanding Financial Goals and Planning

Setting clear goals and creating a detailed plan are essential steps toward achieving long-term success in managing your money. Without a roadmap, it can be difficult to navigate financial decisions effectively. By identifying what you want to achieve, whether it’s saving for retirement, buying a home, or paying off debt, you can create a strategy that guides your spending, saving, and investing decisions. This approach not only helps you stay focused, but it also ensures that your financial actions align with your broader life objectives.

Types of Financial Goals

Goals come in many forms, and they can vary depending on your current situation and future aspirations. Here are some common types of objectives that people set:

- Short-Term Goals: These are goals you aim to accomplish within a year or two, such as building an emergency fund or paying off credit card debt.

- Medium-Term Goals: These are usually achieved within a 3-5 year timeframe, like saving for a down payment on a house or buying a car.

- Long-Term Goals: These goals extend beyond 5 years, such as saving for retirement or funding your children’s college education.

Creating an Effective Plan

Once you have identified your goals, the next step is to create a plan that will help you reach them. A well-structured plan provides direction and outlines the specific steps you need to take. Here are some key steps to building an effective financial plan:

- Assess Your Current Situation: Understand where you stand financially by evaluating your income, expenses, debts, and savings. This helps you determine how much you can allocate toward achieving your goals.

- Set SMART Goals: Make sure your goals are Specific, Measurable, Achievable, Relevant, and Time-bound. This makes it easier to track your progress and stay motivated.

- Create a Budget: A budget helps you control your spending and ensure that you’re putting enough money toward your goals. Be sure to include both fixed and variable expenses in your budget.

- Build an Emergency Fund: Having a safety net for unexpected expenses ensures that you won’t have to dip into your long-term savings if something unexpected happens.

- Monitor and Adjust: Periodically review your financial plan to ensure you’re staying on track. Life circumstances and financial markets can change, so it’s important to be flexible and adjust your goals and strategies as needed.

In conclusion, establishing and planning for clear financial goals is a critical part of taking control of your money. By setting objectives and creating actionable steps to achieve them, you put yourself on the path toward financial security and success.

Managing Risks in Personal Finance

In any financial journey, managing risk is essential to ensure long-term stability and protect your wealth. Risks come in many forms, from unexpected emergencies to fluctuations in investments or market conditions. While it’s impossible to eliminate all risks, understanding them and taking proactive steps can greatly reduce their impact. By assessing potential threats and preparing for them, you can make informed decisions that safeguard your assets and maintain financial security.

Types of Financial Risks

Understanding the various types of risks that can affect your personal finances is the first step in managing them. Here are some common types of financial risks to consider:

- Market Risk: This refers to the risk that the value of investments may fluctuate due to changes in market conditions, such as stock price movements or interest rate changes.

- Credit Risk: The possibility that a borrower will default on a loan or credit obligation, which can affect your ability to access future credit.

- Inflation Risk: The risk that inflation will erode the purchasing power of your money over time, making it more expensive to live and save.

- Liquidity Risk: The challenge of accessing cash or selling assets quickly without significant loss of value, particularly in the case of non-liquid investments like real estate.

- Personal Risk: These risks involve unexpected life events such as job loss, illness, or disability, which can disrupt your income and financial stability.

Strategies for Mitigating Risks

Once you understand the types of risks, it’s important to implement strategies to protect yourself. Here are some ways to manage and reduce financial risks:

- Insurance: Having the right insurance coverage, such as health, life, home, and auto insurance, helps protect you from unexpected financial setbacks. It acts as a safety net during emergencies.

- Diversification: Diversifying your investments across different asset classes (stocks, bonds, real estate, etc.) can help reduce the risk of significant losses in any one area. This strategy spreads the potential risk and can provide more stability.

- Emergency Fund: Building an emergency fund allows you to cover unexpected expenses, such as medical bills or job loss, without needing to rely on credit or loans. Ideally, this fund should cover 3-6 months of living expenses.

- Debt Management: Reducing and managing debt, especially high-interest debt like credit card balances, lowers your financial risk. Consider paying off high-interest loans as soon as possible and avoid taking on unnecessary debt.

- Financial Planning: Developing a solid financial plan that includes goals, budgeting, and retirement planning helps you stay on track and prepare for long-term risks. Planning ahead allows you to make informed decisions based on your overall financial picture.

By identifying and mitigating risks, you can protect your financial well-being, adapt to unexpected challenges, and ensure greater stability throughout your life. Proper risk management is a key component of sound financial planning and achieving long-term goals.

Building Good Financial Habits Early

Establishing strong financial habits from a young age is a crucial step toward achieving long-term stability and success. The earlier you start managing your money effectively, the better equipped you will be to handle future financial challenges and reach your goals. Building these habits can lead to greater savings, less debt, and a healthier financial outlook overall. By learning the fundamentals of budgeting, saving, and investing early, you set yourself up for a lifetime of financial confidence and security.

Key Habits to Develop Early

Creating sound financial habits doesn’t happen overnight, but small steps taken consistently can make a significant impact. Here are some essential habits to focus on:

- Creating a Budget: Tracking your income and expenses is the foundation of good financial management. A budget helps you see where your money is going and allows you to make intentional decisions about spending and saving.

- Saving Regularly: Setting aside a portion of your income for savings, even in small amounts, can accumulate over time. This habit ensures that you have a financial cushion for emergencies and helps you prepare for future needs.

- Avoiding Impulse Purchases: Impulse buying can quickly derail a budget. By practicing mindfulness and sticking to your spending plan, you can reduce unnecessary expenses and focus on long-term financial goals.

- Building Credit Wisely: Establishing and maintaining good credit is essential for larger financial milestones like buying a house or securing loans at favorable rates. Start by using credit responsibly, paying bills on time, and avoiding carrying high balances.

- Understanding Needs vs. Wants: Differentiating between what is essential and what is not can help you avoid overspending. Focus on your priorities and be selective with your purchases.

Long-Term Benefits of Healthy Financial Habits

Building good habits early doesn’t just impact your immediate finances–it lays the foundation for a secure future. Here are some key advantages of developing strong money management practices:

- Financial Independence: Managing your money well can lead to financial independence, where you’re not reliant on debt or loans for everyday expenses or large purchases.

- Less Stress: A well-balanced budget and savings plan can reduce financial stress and allow you to handle unexpected expenses with ease.

- Better Preparedness for the Future: By saving and investing early, you’re preparing for big life events such as buying a home, retirement, or your children’s education without financial strain.

- Improved Credit Score: Building good credit habits from a young age helps you maintain a positive credit score, which can lead to better loan terms, lower interest rates, and more favorable financial opportunities.

By making smart financial choices now, you can ensure a solid financial foundation that will support you throughout your life. The key is to start early, stay consistent, and keep learning as your financial journey evolves.

Real-World Applications of Module 9 Concepts

The concepts learned in this section can be directly applied to everyday life, helping individuals make better decisions about managing money, building wealth, and planning for the future. These lessons provide practical tools that can be used in various financial situations, from setting a budget to navigating larger financial goals such as buying a home or saving for retirement. Understanding how to manage your finances with these strategies can lead to more informed choices, increased financial security, and the ability to adapt to changing circumstances.

Here are some real-world scenarios where the knowledge gained can make a significant difference:

- Budgeting for Monthly Expenses: Creating a clear budget helps you track income and expenses, ensuring that you live within your means. By applying budgeting techniques, you can avoid overspending and set aside funds for savings or emergencies.

- Saving for Large Purchases: Whether you’re saving for a new car, a vacation, or a down payment on a house, the ability to plan and save for big expenses can prevent you from taking on unnecessary debt.

- Managing Debt Responsibly: Understanding how loans work, including interest rates and repayment terms, can help you make smarter decisions when taking out credit. By managing debt carefully, you can avoid high-interest loans and reduce financial stress over time.

- Planning for Retirement: The importance of starting early when saving for retirement cannot be overstated. Knowing how to invest wisely and take advantage of retirement accounts ensures you’re on track to meet long-term financial goals.

- Building an Emergency Fund: Learning how to save consistently for unexpected events, such as medical emergencies or car repairs, helps create financial stability and prevents reliance on credit cards or loans during tough times.

By applying the concepts of budgeting, saving, and investing in real-life scenarios, you can make proactive financial decisions that improve your quality of life and prepare you for the future. These practical applications empower individuals to navigate both expected and unforeseen financial challenges with confidence and control.

How to Use Module 9 Answers for Success

Successfully applying the lessons learned in this section requires more than just memorizing concepts. It involves understanding how these principles can guide your decisions and improve your overall approach to managing resources. Whether you’re preparing for an assessment or looking to implement the strategies in your day-to-day life, knowing how to use the information effectively is key to achieving long-term goals and ensuring financial stability.

Here are some ways to leverage the insights gained from this section for success:

- Master the Fundamentals: Focus on understanding the core concepts, such as budgeting, saving, and debt management. This knowledge will form the foundation for more advanced financial decision-making, helping you avoid mistakes and make informed choices.

- Apply Lessons to Real-Life Scenarios: Practice what you’ve learned by applying these strategies in your personal life. Whether it’s setting a savings goal, reducing spending, or evaluating credit offers, applying these principles can have immediate positive effects.

- Review and Reflect: Regularly revisit the material to reinforce your understanding. Reviewing the key ideas periodically helps you internalize the information and adapt to changing circumstances.

- Set Achievable Financial Goals: Use the insights from this section to set clear, realistic goals that align with your priorities. Break larger objectives into smaller, actionable steps to stay motivated and track your progress.

- Seek Advice and Continue Learning: Don’t hesitate to reach out for additional guidance from experts or mentors. Whether through books, courses, or online resources, continuous learning helps you stay ahead in financial planning and decision-making.

By using these principles strategically, you can enhance your understanding, build confidence in your decision-making, and ultimately set yourself up for success in both short-term achievements and long-term financial well-being.

Final Thoughts on Financial Literacy

Understanding the core principles of managing money is essential for building a strong foundation in life. It’s not just about earning; it’s about making informed choices that will have lasting impacts on your future. From budgeting to saving, and from understanding debt to planning for long-term goals, these skills help individuals navigate everyday challenges and seize opportunities with confidence.

As you move forward, remember that knowledge alone isn’t enough–it’s the application of these concepts that leads to tangible results. Developing smart habits and continuously refining your strategies will empower you to make better decisions, reduce financial stress, and create a path toward long-term stability. The journey to mastering money management is ongoing, but with each step, you build the tools necessary for financial independence and security.

Ultimately, learning about money management is a lifelong process. Staying informed, adapting to new financial tools, and being open to learning will allow you to make the best decisions possible, no matter where you are on your journey. The more you practice, the more equipped you’ll be to navigate financial landscapes with ease and confidence.