Preparing for a rigorous financial certification can be challenging without access to detailed solutions and explanations. This section provides a thorough breakdown of key topics covered in the examination, helping candidates understand the methodology behind each question. It offers insights that not only aid in passing the test but also deepen your understanding of complex financial concepts.

Through carefully analyzed responses and step-by-step solutions, you can gain clarity on the more intricate aspects of investment strategies, risk management, and quantitative methods. The materials here focus on core areas that are critical for success in professional financial assessments, ensuring that you are well-equipped to approach similar challenges in the future.

Practice and repetition are vital when mastering the content, and these solutions will allow you to reinforce your knowledge in preparation for real-world application. With a focus on accuracy and in-depth explanations, you can refine your approach and boost your confidence before the big day.

2012 CFA Level 3 Exam Answers Overview

This section offers a detailed overview of the solutions and explanations provided for the challenging financial assessment. The focus here is to break down complex topics into manageable components, offering insights into how candidates can approach high-level questions effectively. Through a comprehensive examination of key concepts, the goal is to highlight the essential techniques and strategies that were tested in this particular session.

Understanding the Question Format

The questions are designed to evaluate both theoretical knowledge and practical application. They cover a wide range of financial principles, from portfolio management to asset valuation. By analyzing the provided solutions, candidates can grasp the underlying principles that were tested and learn how to structure their responses to similar questions in future assessments. Understanding the format is key to mastering this type of evaluation.

Strategies for Answering Complex Questions

Effective problem-solving in this context involves more than just memorizing concepts; it requires the ability to apply them in a logical, methodical way. The solutions presented here focus on breaking down each question step by step, showcasing the most efficient approach to reach the correct answer. Emphasis is placed on clear reasoning, time management, and ensuring that each answer aligns with professional standards in financial analysis.

Understanding the Exam Structure

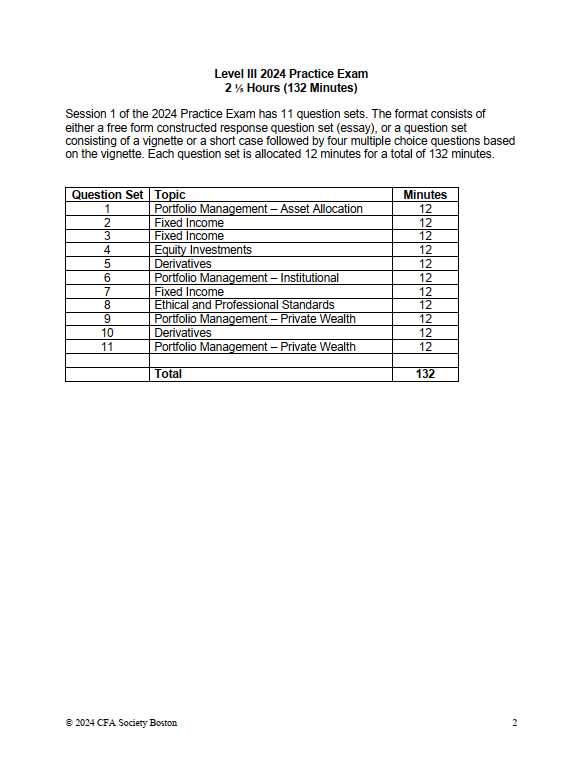

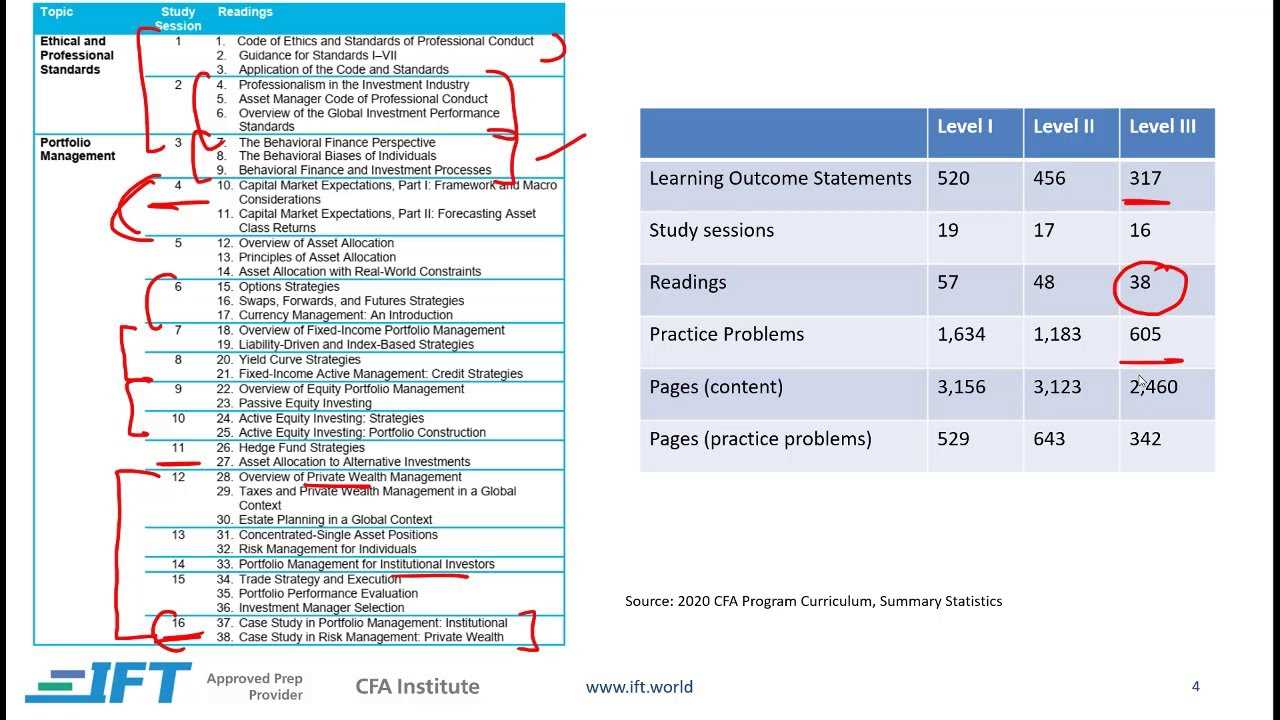

The structure of this comprehensive assessment is designed to test both theoretical knowledge and practical problem-solving skills in the field of finance. It consists of two primary sections: one focused on multiple-choice questions and the other on detailed, scenario-based queries. Each part challenges candidates to apply concepts to real-world situations, ensuring that they are not only familiar with the material but also capable of making sound financial decisions under pressure.

The first section typically emphasizes broad concepts, requiring quick recall and accurate application of fundamental principles. The second section is more in-depth, often requiring analytical thinking and the ability to construct well-reasoned arguments. Understanding the flow and format of these two components is essential for effective preparation, as it allows candidates to strategize their approach and manage their time wisely during the assessment.

Key Topics in the 2012 Exam

This section covers the essential subjects tested in the comprehensive financial assessment. The focus is on areas that require a deep understanding of investment strategies, risk management, and quantitative analysis. These core topics were chosen to evaluate candidates’ ability to navigate complex financial scenarios and apply their knowledge in practical settings.

Portfolio Management and Asset Allocation

One of the primary areas of focus was portfolio management, which involves strategic decision-making for asset allocation. Candidates were tested on their ability to build and manage diversified portfolios, optimizing risk and return. Understanding the principles of modern portfolio theory and the role of alternative investments was crucial for success in this section.

Risk Management and Financial Analysis

The assessment also emphasized risk management techniques and financial analysis tools. Candidates needed to demonstrate their ability to assess market risks and evaluate the financial health of companies. Key concepts such as Value at Risk (VaR), scenario analysis, and stress testing were central to the analysis of potential financial threats.

Detailed Solutions for Morning Session

The morning section of the assessment typically consists of open-ended questions designed to test candidates’ ability to apply financial principles to complex, real-world scenarios. These questions require a detailed, step-by-step approach to problem-solving, focusing on areas such as portfolio management, financial analysis, and risk assessment. In this section, each solution is broken down into its core components, providing a clear understanding of the reasoning behind the correct answers.

Approach to Portfolio Management Questions

Portfolio management questions often require candidates to demonstrate their ability to allocate assets effectively while managing risk. Solutions to these questions involve:

- Identifying key objectives, such as return maximization or risk minimization

- Determining the appropriate asset classes and their allocation based on risk tolerance

- Applying optimization techniques to balance the portfolio

Risk Assessment and Financial Analysis Solutions

Risk management and financial analysis questions assess how well candidates can identify and mitigate potential risks within investment strategies. Solutions typically involve:

- Calculating risk metrics such as standard deviation, correlation, and beta

- Performing stress testing and scenario analysis to evaluate the impact of adverse market conditions

- Evaluating financial statements to assess the health of investment opportunities

Exam Focus: Portfolio Management Strategies

This section emphasizes the importance of developing and implementing effective strategies for managing investment portfolios. A key aspect of this focus is understanding how to balance risk and return while tailoring investments to meet specific objectives. The ability to make informed decisions based on market conditions, asset allocation, and the client’s financial goals is crucial for success in this area.

Strategic Asset Allocation

Strategic asset allocation is fundamental to constructing a diversified portfolio. It involves determining the ideal mix of asset classes based on long-term investment goals and risk tolerance. Solutions to questions on this topic typically include:

- Assessing the investor’s risk profile and financial objectives

- Choosing appropriate asset classes, such as equities, bonds, and alternatives

- Adjusting the allocation over time to reflect changing market conditions

Active vs. Passive Management

Another key area of focus is the debate between active and passive portfolio management. Both approaches have their advantages and challenges, and candidates are often asked to evaluate their effectiveness. Important considerations include:

- Comparing the costs, risks, and potential returns of active management strategies

- Understanding the benefits of passive strategies, such as lower fees and market tracking

- Determining when each approach is most suitable based on market conditions and investor goals

Ethics and Professional Standards Breakdown

Ethics and professional conduct are foundational to the financial industry, and a deep understanding of these principles is essential for success. This section highlights the core ethical standards that professionals must uphold, focusing on integrity, transparency, and responsibility. It covers the critical areas where ethical dilemmas often arise, providing candidates with the tools to navigate these situations effectively and make decisions that align with industry standards.

Key Principles of Professional Conduct

In financial decision-making, the following principles guide professionals in maintaining high ethical standards:

| Principle | Description |

|---|---|

| Integrity | Acting honestly and with transparency in all professional activities. |

| Objectivity | Avoiding conflicts of interest and maintaining impartiality in decision-making. |

| Confidentiality | Protecting client information and using it only for appropriate purposes. |

| Professional Competence | Maintaining and improving skills and knowledge to serve clients effectively. |

Handling Ethical Dilemmas

Financial professionals are often faced with ethical dilemmas that require careful consideration and judgment. Key strategies to resolve these challenges include:

- Assessing the situation from multiple perspectives to ensure fairness

- Referring to the professional code of conduct to guide decisions

- Seeking guidance from colleagues or mentors when necessary

Insights into Quantitative Methods Section

The Quantitative Methods section assesses candidates’ ability to apply mathematical and statistical techniques to real-world financial problems. This area is essential for understanding complex market behavior, analyzing financial data, and making informed investment decisions. Mastery of these methods is vital for solving problems related to risk, return, and valuation across various asset classes.

Key Topics in Quantitative Analysis

Several core topics are frequently covered in this section. Understanding these concepts allows candidates to approach numerical problems with confidence and accuracy. These include:

- Time value of money and discounted cash flow analysis

- Probability theory and its application in financial modeling

- Statistical measures such as mean, variance, and correlation

- Hypothesis testing and regression analysis for forecasting

Techniques for Effective Problem-Solving

To tackle questions in this section efficiently, it is essential to approach problems systematically. Here are some helpful strategies:

- Break down complex problems into smaller, manageable steps

- Use appropriate formulas and methodologies for calculations

- Double-check assumptions and data inputs for accuracy

- Ensure clear interpretation of results and their implications for financial decisions

Fixed Income Questions and Solutions

The fixed income section tests candidates’ understanding of debt securities, their pricing, and risk assessment. It focuses on key concepts such as bond valuation, interest rate risk, and the impact of economic changes on bond prices. Solving questions related to fixed income requires a solid grasp of how bonds behave under different market conditions and how to apply quantitative techniques to assess their value and yield.

Commonly, questions in this area revolve around calculating bond prices, yields, and durations. Candidates are also asked to assess the impact of interest rate movements on the value of debt instruments. The solutions to these problems involve a mix of formula-based calculations and conceptual understanding to ensure accurate financial decision-making.

Bond Pricing and Yield Calculations

To solve pricing and yield-related questions, candidates must be familiar with the following key concepts:

- Present value calculations for bond cash flows

- Yield to maturity (YTM) and yield to call (YTC) calculations

- Accrued interest and its impact on pricing

Risk and Duration Management

Understanding the risks associated with fixed income securities is essential. Key concepts include:

- Duration and its role in measuring interest rate sensitivity

- Convexity and its effect on bond price changes

- Strategies to manage interest rate risk, such as immunization

Equity Investments and Answer Analysis

The equity investments section evaluates one’s ability to analyze and make decisions based on stock performance, valuation metrics, and market trends. It requires a deep understanding of how to assess a company’s financial health, the factors affecting stock prices, and the methods used to value different equity securities. By mastering these techniques, professionals can better understand the dynamics of equity markets and make informed investment choices.

Questions in this area often focus on evaluating a company’s fundamentals, analyzing its growth prospects, and determining the appropriate valuation methods. The solutions typically involve a combination of ratio analysis, discounted cash flow models, and comparison to industry benchmarks. These tools help assess whether a stock is overvalued, undervalued, or fairly priced based on its financial and market performance.

Key Concepts in Equity Valuation

In order to effectively tackle equity investment-related questions, it’s essential to understand the following valuation concepts:

- Price-to-earnings (P/E) ratio and its implications for growth

- Discounted cash flow (DCF) method and its application in estimating intrinsic value

- Price-to-book (P/B) ratio and its use in evaluating company assets

Understanding Market Dynamics

Market conditions significantly impact the performance of equity investments. Important factors include:

- Economic cycles and their influence on stock prices

- Interest rate changes and their effect on equity valuations

- Market sentiment and its role in short-term stock price movements

Alternative Investments: Key Insights

Alternative investments offer diversification opportunities beyond traditional asset classes like stocks and bonds. These investments encompass a wide range of options such as real estate, private equity, hedge funds, and commodities. Their appeal lies in the potential for higher returns and reduced correlation to traditional markets, making them a valuable component of a well-rounded portfolio.

Investors interested in alternative assets must understand the unique characteristics, risks, and potential rewards associated with each type of investment. These assets often require more in-depth analysis and long-term commitment, but they can provide significant growth and hedging opportunities when managed correctly. Below are some of the key aspects to consider when evaluating alternative investments.

Types of Alternative Investments

Alternative assets can take many forms, each with its distinct features and investment strategies. The most common types include:

- Private Equity: Investments in private companies, offering opportunities for high returns through business growth or acquisition.

- Real Estate: Direct ownership or investment in real estate properties or real estate investment trusts (REITs), providing income through rental yields or appreciation.

- Hedge Funds: Pooled investment funds that employ a variety of strategies, such as short selling, leverage, and derivatives, to achieve high returns.

- Commodities: Investments in physical assets like oil, gold, or agricultural products, used for hedging or speculation purposes.

Evaluating Risks and Rewards

Alternative investments come with their own set of risks that must be carefully evaluated. Key factors to assess include:

- Liquidity Risk: Many alternative assets are less liquid than traditional stocks and bonds, meaning it may be harder to sell them quickly.

- Volatility: Some alternatives, like commodities, can experience extreme price swings, making them more volatile than traditional investments.

- Management Risk: Private equity and hedge funds rely heavily on skilled management, and poor decision-making can significantly affect returns.

Understanding the Derivatives Section

The derivatives section focuses on the use of financial instruments whose value is derived from the performance of an underlying asset. These instruments, including options, futures, forwards, and swaps, allow investors to hedge risks or speculate on price movements in various markets. A solid understanding of these instruments and their applications is crucial for making informed financial decisions.

In this section, candidates are tested on their ability to apply the principles of derivatives to real-world scenarios. This includes understanding how derivatives can be used for risk management, pricing strategies, and assessing their impact on portfolios. The focus is not only on the technical aspects of derivative instruments but also on the strategies used to manage risk and enhance returns.

Key Derivatives Instruments

The primary derivative instruments covered in this section include:

- Options: Contracts that give the holder the right, but not the obligation, to buy or sell an asset at a predetermined price before a specified expiration date.

- Futures: Standardized contracts to buy or sell an asset at a specified future date for a price agreed upon today.

- Forwards: Customizable contracts similar to futures, but typically traded over-the-counter (OTC), allowing more flexibility in terms of delivery and contract specifications.

- Swaps: Agreements between two parties to exchange cash flows based on underlying assets, such as interest rate swaps or currency swaps.

Applications of Derivatives

Derivatives serve multiple functions in finance, and their applications vary depending on the investor’s goals:

- Hedging: Derivatives are often used to offset potential losses in underlying assets, providing a form of insurance against adverse price movements.

- Speculation: Investors use derivatives to speculate on price movements of assets without actually owning the underlying asset.

- Arbitrage: Derivatives can be used to exploit price differences between markets, generating risk-free profits under specific conditions.

Economics Concepts in the Exam

The study of economics plays a critical role in understanding financial markets and decision-making processes. In the context of the assessment, economic theories, principles, and applications are tested to evaluate a candidate’s ability to analyze and interpret real-world economic situations. A solid grasp of key economic concepts helps in forming the foundation for making informed investment decisions, managing risk, and understanding market behavior.

This section emphasizes the importance of both microeconomic and macroeconomic frameworks, focusing on how they impact financial markets, asset pricing, and economic policies. Key topics cover the functioning of economies, market structures, inflation, monetary and fiscal policies, and international trade. A well-rounded understanding of these concepts is essential for addressing the complexities of investment management and economic analysis.

Key Economic Concepts

The following core topics are often covered in assessments related to economics:

- Market Structures: Understanding the characteristics of different market types such as perfect competition, monopolies, and oligopolies.

- Inflation and Deflation: Analyzing the causes and effects of inflationary and deflationary pressures on economies, including their impact on asset prices.

- Fiscal and Monetary Policy: Examining the role of government spending, taxation, and central bank policies in shaping economic conditions.

- International Trade: Assessing the implications of trade policies, exchange rates, and globalization on the financial markets and economic growth.

Applying Economic Theories

The application of economic theories in practical scenarios is key to this section. Candidates are expected to apply economic models to solve problems related to:

- Cost-Benefit Analysis: Evaluating investment decisions based on economic efficiency and market outcomes.

- Supply and Demand: Understanding how changes in supply or demand affect prices and market equilibrium.

- Risk and Return: Assessing the relationship between economic factors and financial risks, including the impact on portfolio management strategies.

Risk Management Questions and Solutions

Effective risk management is crucial in the field of investment and finance. It involves identifying, assessing, and mitigating various financial risks that can affect portfolio performance. This section focuses on common risk-related problems that are typically encountered and the strategies to address them. By applying the right tools and methodologies, risk can be quantified and controlled, ensuring that financial goals are achieved within acceptable risk parameters.

In the following sections, we will delve into risk management concepts, including types of risks, risk measures, and their application in financial decision-making. Solutions to risk-related questions will be presented, offering practical approaches that can be used to tackle real-world financial challenges.

Types of Financial Risks

Risk management involves the identification of several types of financial risks, each of which requires a tailored approach. Below are some of the key risks that professionals encounter:

- Market Risk: The potential for losses due to changes in market prices, including stock prices, interest rates, and commodity prices.

- Credit Risk: The risk that a borrower will default on their obligations, resulting in financial losses for lenders or investors.

- Liquidity Risk: The risk that an asset cannot be sold quickly enough without incurring a significant loss.

- Operational Risk: Risks arising from inadequate internal processes, systems, or external events that can disrupt operations.

Risk Management Solutions

To address these risks effectively, various strategies and tools can be applied. The solutions provided in this section highlight practical methods used by financial professionals to manage risk:

| Risk Type | Management Solution | Tools Used |

|---|---|---|

| Market Risk | Diversification, hedging with derivatives | Options, futures, and swaps |

| Credit Risk | Credit analysis, portfolio diversification | Credit default swaps (CDS), bonds ratings |

| Liquidity Risk | Maintaining cash reserves, liquidity ratios | Cash flow projections, liquidity stress testing |

| Operational Risk | Process optimization, disaster recovery plans | Risk audits, contingency planning |

By applying these solutions, risk can be effectively managed, ensuring that potential threats are minimized while maximizing returns. Understanding how to address each type of risk is essential for professionals looking to navigate the complex world of finance and investment.

Performance Evaluation: Detailed Answers

Performance evaluation is a critical aspect of financial management and investment analysis. It involves assessing the returns on investment in relation to the risks taken, as well as evaluating the effectiveness of strategies and decision-making processes. This section provides an in-depth look at various performance measurement techniques, their applications, and detailed solutions to common problems encountered in performance analysis.

To evaluate performance accurately, it is essential to consider multiple factors such as risk-adjusted returns, benchmarks, and the time horizon of the investment. Several methods and tools are used to gauge the success of investment portfolios and compare them to appropriate market indices or peer groups. In the following sections, we will break down these techniques and provide solutions that help to interpret and apply them effectively in real-world scenarios.

Common Performance Evaluation Metrics

Several key metrics are widely used in the industry to assess the performance of portfolios and investments. These include:

- Sharpe Ratio: Measures the risk-adjusted return of a portfolio by comparing its excess return over the risk-free rate to its volatility. A higher Sharpe ratio indicates better performance relative to risk.

- Treynor Ratio: Similar to the Sharpe ratio but focuses on systematic risk (beta) instead of total volatility. It helps evaluate how well a portfolio has performed in relation to market risk.

- Jensen’s Alpha: Assesses the excess return of a portfolio over its expected return, based on the Capital Asset Pricing Model (CAPM). A positive alpha suggests the portfolio has outperformed the expected return given its level of risk.

- Information Ratio: Measures the consistency of a portfolio’s returns relative to a benchmark, indicating how much return is generated for each unit of active risk taken.

Detailed Solutions for Performance Evaluation

To understand how to apply these metrics effectively, let’s consider the following scenario:

| Metric | Formula | Interpretation |

|---|---|---|

| Sharpe Ratio | (Rp – Rf) / σp | Measures the risk-adjusted return. A higher value indicates better performance relative to risk. |

| Treynor Ratio | (Rp – Rf) / βp | Assesses return per unit of systematic risk. Higher values indicate superior market-adjusted performance. |

| Jensen’s Alpha | Rp – [Rf + βp * (Rm – Rf)] | Measures the portfolio’s excess return beyond the expected return based on market risk. Positive alpha indicates outperformance. |

| Information Ratio | (Rp – Rb) / σ(Rp – Rb) | Evaluates consistency of active returns. A higher ratio signifies consistent outperformance over the benchmark. |

These metrics provide valuable insights into the risk-return profile of an investment portfolio, allowing investors to make informed decisions and refine their strategies. By understanding how to calculate and interpret each metric, investors can effectively monitor performance and identify areas for improvement.

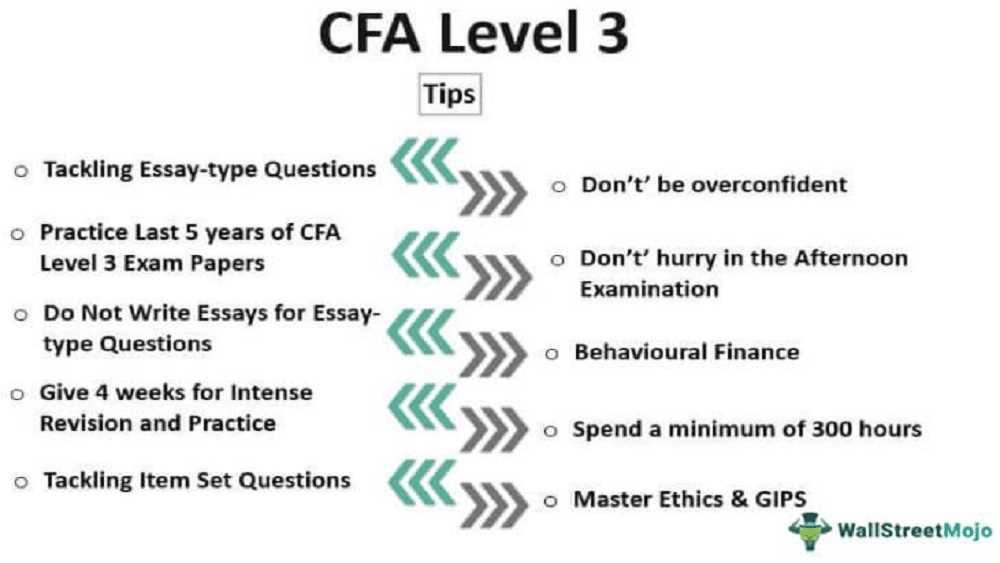

Exam Preparation Tips for Level 3

Preparing for advanced professional qualifications requires a disciplined and structured approach. The key to success is not only understanding complex concepts but also mastering the ability to apply them in real-world situations. To help ensure success, it is essential to focus on strategic planning, active practice, and efficient time management throughout the preparation process.

Effective preparation goes beyond memorization. It involves developing a deep understanding of core principles and learning how to apply them through problem-solving and case studies. In this section, we will explore valuable strategies that will guide you through the preparation process and enhance your performance on test day.

Key Preparation Strategies

- Start Early: Begin your study plan well in advance. Early preparation helps you understand the material thoroughly, allowing ample time to tackle complex topics and review key concepts.

- Focus on Core Topics: Identify the most important topics and ensure you have a solid grasp of them. Focus on areas like portfolio management, ethics, and fixed income, which often carry significant weight in the assessment.

- Practice Regularly: Practice solving problems from past papers and mock tests. This helps familiarize you with the question formats and improves your time management skills.

- Understand the Exam Format: Familiarize yourself with the structure of the test. Understanding how questions are framed and what is expected in each section allows you to prepare efficiently.

Time Management Techniques

- Allocate Study Time Wisely: Divide your study hours based on the importance of topics and your own comfort level with each subject. Prioritize areas that require more focus.

- Simulate Exam Conditions: Set time limits when practicing to simulate real exam conditions. This helps build confidence and improves your ability to handle time pressure.

- Take Breaks: Regular breaks during study sessions are crucial for maintaining focus and mental clarity. Follow a structured schedule with breaks to avoid burnout.

By adhering to these strategies and maintaining a consistent study routine, you can increase your chances of success. Preparation for such a rigorous assessment is not only about hard work, but also about smart planning and applying the right techniques to ensure that you are well-equipped for the challenge ahead.

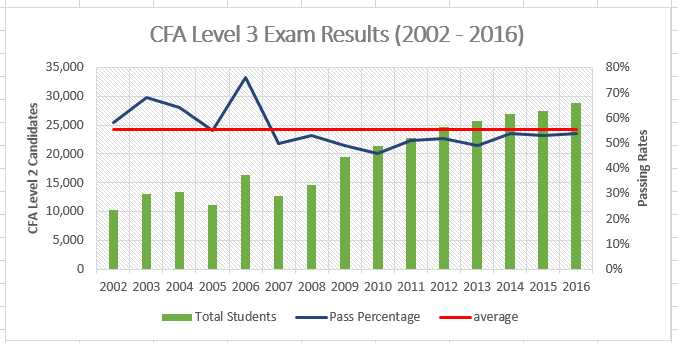

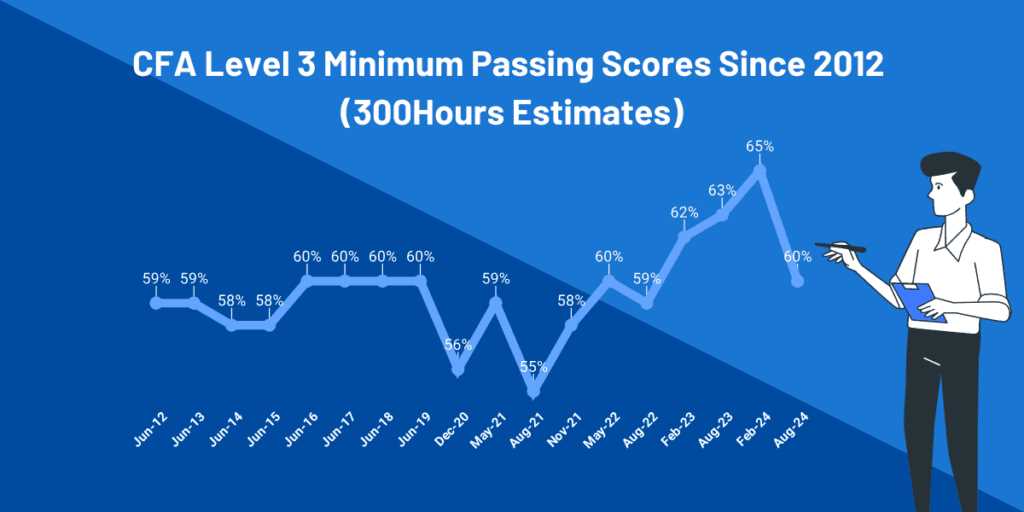

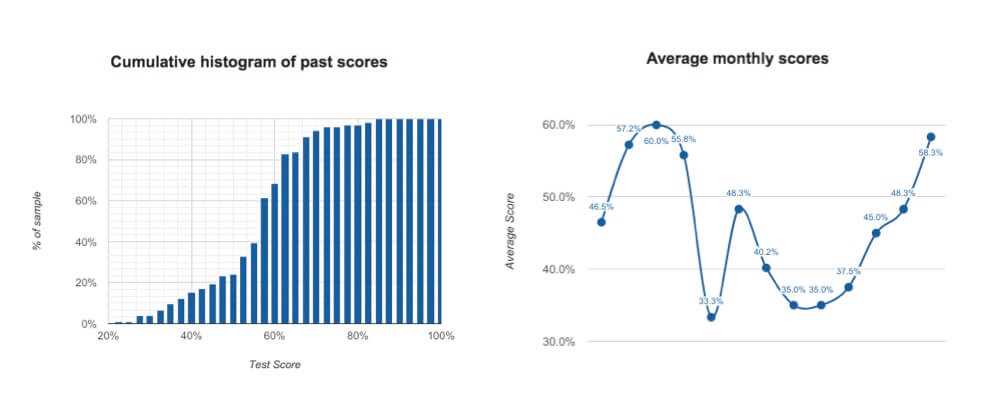

Reviewing the CFA Level 3 Scoring System

Understanding the scoring system for advanced professional assessments is crucial for effective preparation. The grading method plays a significant role in how performance is evaluated, which can ultimately influence your approach to the study material and how you allocate time during the exam. This section will break down the scoring system, providing clarity on how points are awarded and how the different sections of the test contribute to the final result.

The assessment is typically divided into multiple sections, each with its own scoring criteria. A clear understanding of these components can help guide your focus on the areas that impact your final score the most. Both multiple-choice and written-response sections carry different weight, and each component is designed to test specific skills and knowledge.

Scoring Breakdown

The scoring system is divided into two main categories: the multiple-choice section and the written-response section. Here’s how the points are generally allocated:

| Section | Weight | Description |

|---|---|---|

| Multiple Choice | 70% | This section tests knowledge across several key areas, with questions that require detailed understanding and the ability to apply concepts. |

| Written Response | 30% | Focusing on more complex and detailed questions, this section assesses your ability to synthesize information and formulate comprehensive solutions. |

Understanding the Scoring Process

- Correct Responses: Points are awarded for each correct answer, while no points are deducted for incorrect responses. This encourages educated guessing when unsure of an answer.

- Partial Credit: In the written-response section, partial credit is often given for demonstrating understanding and logical reasoning, even if the final answer is not entirely correct.

- Weighted Scoring: Different sections carry varying levels of importance. For example, the multiple-choice section typically has a larger impact on your overall score compared to the written-response section.

- Minimum Passing Score: The final score is based on a scaled scoring system, with a minimum passing score that varies slightly each year, depending on overall performance.

By familiarizing yourself with this scoring system, you can approach your preparation strategically, focusing on areas that maximize your score. Understanding how each section impacts your final result allows you to allocate time effectively and adopt a more tailored study plan to improve your chances of success.