In tax preparation, accurate completion of forms is crucial for ensuring compliance and avoiding mistakes. One essential aspect of the process is understanding how to properly address common questions and calculations. This guide provides valuable insights into correctly interpreting the most recent version of a specific document, designed to help individuals navigate the complexities of filing.

Throughout this article, we will walk you through the necessary steps to tackle each section efficiently. We’ll also cover potential errors, offer solutions, and explain updates made in the most current edition. Whether you are a first-time filer or experienced, understanding the intricacies of this document can save time and prevent common issues that arise during submission.

By the end of this guide, you’ll have a clearer understanding of how to approach each section, ensuring that your filing process is as smooth and accurate as possible. Stay informed on the latest updates and techniques for handling this essential tax document.

Form 6744 Answer Key 2025 Overview

The latest version of a key tax document provides comprehensive solutions to common questions and calculation methods for individuals preparing their returns. It is designed to help filers efficiently navigate the complex process by offering clarity on how to approach various sections of the form. This section will give an overview of the updated guidance available and how it simplifies the filing process for users.

Purpose and Importance of the Document

The updated document is a vital resource, offering clear instructions to ensure that all required information is accurately filled out. By following the provided solutions, individuals can minimize errors and avoid complications with their submissions. It serves as both a reference and a tool to better understand how to approach challenging sections.

Key Updates and Features

Changes in the most recent edition include more straightforward language, clearer step-by-step instructions, and additional examples to help filers grasp the concepts more easily. These updates reflect a focus on user experience, aiming to reduce confusion and make the filing process smoother for all users.

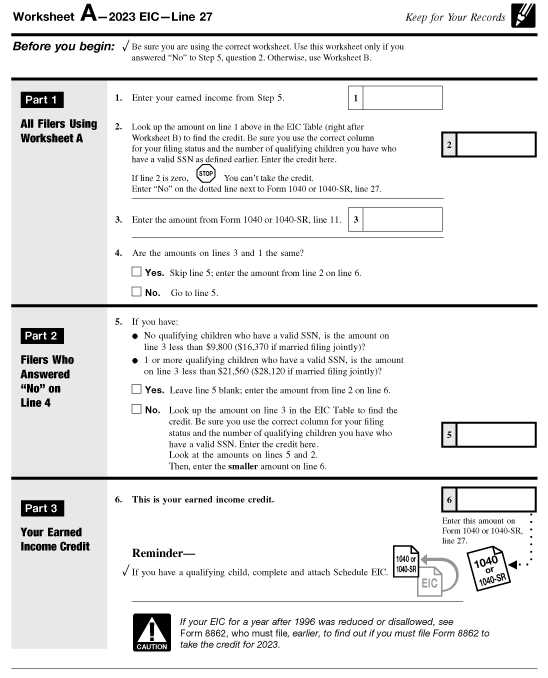

Understanding Form 6744 Structure

The structure of a tax document plays a critical role in how users interact with it and provide necessary information. Understanding the layout and organization of each section allows filers to effectively navigate and complete the form without errors. This section will explore the various components and their respective purposes, ensuring a smooth filing experience.

Document Breakdown

The tax document is divided into multiple sections, each designed to collect specific types of information. These parts are systematically organized to guide the user through a logical progression. Below is a breakdown of the main sections:

- Personal Information: The section dedicated to gathering basic identification details.

- Income Reporting: Provides areas for detailing income sources and amounts.

- Adjustments: Section for reporting deductions or adjustments to income.

- Tax Calculations: A key part where taxes owed or refunds are calculated based on the provided data.

- Signature and Declaration: The final area to confirm the accuracy of the provided information.

How to Navigate the Document

Each section is clearly labeled, making it easy to find the necessary fields. It’s essential to follow the order of sections to ensure that all required information is accurately provided. Users should check for any instructions provided within the document, which offer clarification on how to approach certain sections. Careful attention to detail will help avoid common mistakes.

How to Use the Answer Key Effectively

Utilizing a reference guide for completing a tax document is essential to ensure accuracy and reduce the likelihood of errors. A well-structured guide provides solutions to common questions and calculations, making it easier for filers to verify their entries. This section will explain how to make the most of this resource while completing the required fields.

Step-by-Step Approach

To use the guide effectively, start by reviewing each section of the document before consulting the reference. Ensure that all necessary information is filled out first. Once that is complete, refer to the solutions provided in the guide to confirm your entries. Follow the order of steps in the guide to avoid skipping over any important details.

Double-Check for Accuracy

It is crucial to carefully compare your entries with the guide’s solutions. Check for any discrepancies or areas where you may have made a mistake. The guide often highlights common errors, so pay attention to these warnings. Taking the time to verify each step will help ensure your submission is accurate and complete.

Common Mistakes in Form 6744

When completing a tax document, it is easy to make mistakes that can lead to delays or complications. These errors often stem from misunderstandings of the instructions, overlooked sections, or simple miscalculations. In this section, we will highlight some of the most common mistakes made by filers and provide guidance on how to avoid them.

Frequent Errors to Watch For

Common mistakes in tax filings can be easily avoided with careful attention to detail. Below are a few frequent errors that filers encounter:

| Error | Cause | How to Avoid |

|---|---|---|

| Incorrect Income Reporting | Missing or miscalculated income sources. | Double-check all income entries and ensure all sources are accounted for. |

| Missing Signatures | Failure to sign the form or incomplete declaration. | Ensure that all required signatures are added before submission. |

| Overlooking Deductions | Not applying all available deductions or credits. | Review any applicable deductions or credits and apply them as needed. |

| Math Errors | Incorrect calculations, often due to misadding or missing steps. | Carefully check all calculations or use a calculator for accuracy. |

How to Prevent Mistakes

To minimize errors, take the time to carefully read through each section and ensure you have followed all instructions. It can also help to have another person review your work before submission. Using the provided reference guide will also help ensure that you’ve filled everything out correctly and accurately.

Step-by-Step Guide to Answering

Completing a tax document or questionnaire can seem complex, but breaking it down into manageable steps makes the process much easier. This section provides a structured approach to help you navigate each part of the document efficiently. By following the outlined steps, you will be able to fill out the form accurately and with confidence.

Step 1: Gather Required Information

Before beginning, ensure you have all necessary documents and details, such as income statements, deductions, and any other relevant information. Having everything in front of you will help prevent delays.

- Income documents (e.g., W-2s, 1099s)

- Personal identification details (e.g., Social Security number)

- Deduction records (e.g., medical expenses, mortgage interest)

Step 2: Fill in Personal Information

Start by entering your personal details accurately, such as your name, address, and contact information. Be sure to double-check for spelling errors and correct formatting to avoid any complications later on.

- Enter your full legal name.

- Provide your current residential address.

- Include your Social Security number and other relevant identification details.

Step 3: Report Income and Deductions

Carefully input your income from all sources and apply any deductions or credits that you are eligible for. Double-check the totals to ensure no information is missed or entered incorrectly.

Step 4: Review and Verify

Once the document is filled out, take the time to review each section for accuracy. Check calculations, verify personal details, and ensure that all necessary fields are completed.

- Ensure all income entries are accounted for.

- Review deductions and credits for accuracy.

- Double-check signatures and any declarations.

Step 5: Submit

Once everything is accurate, submit the completed form according to the provided instructions. Make sure to keep a copy of the document for your records.

Key Updates in the 2025 Version

The latest update to this tax document introduces several important changes designed to improve accuracy and streamline the filing process. These modifications aim to simplify certain sections, enhance clarity, and incorporate updated regulations. Understanding these adjustments will ensure that you are fully prepared when completing the form for the current year.

New Sections and Features: The 2025 version includes additional fields to accommodate new tax credits and deductions that have been introduced. This allows for a more comprehensive filing experience, ensuring taxpayers can fully benefit from recent policy changes.

Improved Instructions: To assist users, the instructions have been rewritten with clearer language and more detailed examples. This is to reduce errors and provide a more intuitive experience when filling out the form.

Updated Calculations: New formulas have been incorporated to reflect the most recent tax laws. These changes ensure that your totals are accurate and align with current tax rates, reducing the chances of mistakes and minimizing the need for corrections.

Faster Submission Process: With enhancements to the submission process, it is now quicker and easier to submit the completed document. New online features allow for faster processing and confirmation of receipt, streamlining the overall workflow.

Where to Find the Correct Answer Key

Accessing the correct reference materials is crucial for ensuring accuracy when completing a document. The answer guide is an essential resource that helps clarify complex sections and provides the correct responses to each question. In this section, we’ll explore the best places to find the most reliable and up-to-date version of this reference tool.

Official Websites

The most reliable source for the answer guide is the official website associated with the document. These sites typically offer the latest updates and resources, ensuring you are using the correct version that aligns with the current year’s standards.

- Visit the dedicated page for the form on the government or official agency website.

- Check for downloadable PDFs or online tools that provide detailed instructions and answers.

- Ensure you are accessing the most recent version, as older versions may not reflect the latest regulations.

Authorized Publications

Many trusted third-party sources, such as tax professionals or official guides, publish comprehensive manuals and reference books that include the correct solutions. These can be particularly helpful for individuals who prefer printed resources.

- Look for publications that are endorsed by tax authorities or related agencies.

- Check if the resource is updated annually to incorporate any changes in the relevant laws and guidelines.

- Visit bookstores or libraries that specialize in financial or tax literature for these reliable references.

Tips for Passing with the Document

Successfully completing and submitting a tax document can be challenging, but with the right approach and careful attention, you can navigate the process smoothly. These tips will guide you in making the most of your resources and ensuring that your submission is accurate and timely.

Preparation is Key

Before you start filling out the document, make sure you are fully prepared. Having all the necessary information at hand will save you time and prevent mistakes. Here are some things to do:

- Gather all supporting documents such as income statements, previous filings, and receipts.

- Review any changes in tax laws or regulations for the current year to ensure you are using the correct guidelines.

- Read through the instructions thoroughly before beginning the process to understand each section.

Use Available Resources

Don’t hesitate to take advantage of the resources available to help you through the process. Many individuals make the mistake of trying to go through the entire procedure on their own. Here are some useful tools:

- Refer to online guides or videos that provide step-by-step instructions.

- Consult a tax professional or advisor if you encounter any challenges or have questions about specific sections.

- Check the official website for updates and FAQs to ensure you are following the most current procedures.

Double Check Your Work

Before submitting your document, review it carefully. Mistakes can be costly and time-consuming to correct. Make sure to:

- Double-check all numerical entries and calculations for accuracy.

- Ensure that all required fields are filled out completely and correctly.

- Verify that your personal information is accurate and up-to-date.

Benefits of Using the Document Guide

Utilizing a reference guide when completing a tax document offers numerous advantages, ensuring a smoother and more efficient process. With the right resources, you can reduce the chances of making errors and improve the accuracy of your submission. Below are some key benefits of using a well-structured guide:

- Increased Accuracy: By having a reference document, you can ensure that all calculations and entries are correct, reducing the likelihood of mistakes that could delay the process or result in penalties.

- Confidence in Submission: Having a guide to follow gives you the confidence that everything has been filled out correctly, ensuring that you are not overlooking any important sections.

- Time Efficiency: A clear and detailed guide helps you navigate the document quickly, saving you time that could be spent on resolving errors or looking for answers.

- Improved Understanding: Using the guide allows you to better understand the requirements of the document, helping you become more familiar with tax rules and the overall filing process.

- Minimized Stress: With all the necessary information at hand, using a guide can reduce stress, making the process less daunting and more manageable.

Challenges in Interpreting Document Responses

When working with tax-related resources, interpreting the provided responses can sometimes be a complex task. Various factors can contribute to confusion or misunderstandings when trying to align the results with the proper procedures. This section highlights common difficulties and the importance of careful review when handling the information.

Common Sources of Misinterpretation

There are several reasons why interpreting the responses may be challenging:

- Complex Instructions: Some instructions may be difficult to understand, particularly if they are filled with technical jargon or lack clear examples.

- Changes in Regulations: Frequent updates or changes in tax regulations can cause confusion, as the information might not align with prior expectations or methods.

- Data Formatting Issues: If the data is presented in a non-standard format or if there’s an error in the provided figures, it could lead to incorrect conclusions.

- Misapplication of Guidelines: Sometimes, users may apply the guide’s advice incorrectly, especially if the guide does not clearly explain how to tailor the steps to their specific situation.

Ensuring Accuracy and Understanding

To avoid these pitfalls, it’s important to take extra care in the interpretation process:

- Review Guidelines Carefully: Always cross-check instructions with the relevant laws or guidelines to ensure that the answers are applied correctly.

- Consult Additional Resources: If unsure, seek additional help, such as professional consultations or online tax forums, to clarify any doubts.

- Be Mindful of Changes: Stay up to date with the latest modifications to tax laws or document requirements that could affect the interpretation process.

| Challenge | Solution |

|---|---|

| Complex Instructions | Break down the instructions and consult supplementary resources for clarity. |

| Changes in Regulations | Stay updated with the latest rules and adjust your approach accordingly. |

| Formatting Issues | Double-check the data entry and consider reformatting it to match the required structure. |

| Misapplication of Guidelines | Carefully match the advice to your specific situation before proceeding. |

How This Document Impacts Tax Filing

The process of tax filing can be complicated, and certain documents play a significant role in ensuring accuracy. One such resource provides essential guidance to individuals in correctly preparing their tax returns, which can greatly influence the outcome of their filings. By offering structured steps and detailed instructions, this document helps taxpayers navigate the complexities of tax regulations, minimizing the risk of errors or omissions that could lead to delays or audits.

Influence on Filing Accuracy

When used correctly, this document significantly contributes to the accuracy of tax submissions. Its detailed instructions help users:

- Ensure Compliance: The document provides clear instructions on meeting tax obligations, preventing errors that could lead to non-compliance.

- Maximize Deductions: By following the outlined steps, taxpayers are better equipped to claim eligible deductions, reducing their overall tax liability.

- Avoid Common Mistakes: The guidelines address common pitfalls, helping individuals avoid simple mistakes that can delay their filings or lead to audits.

Streamlining the Filing Process

In addition to improving accuracy, the document also streamlines the overall process of preparing tax returns. By following a clear and systematic approach, individuals can:

- Save Time: The step-by-step structure simplifies decision-making, allowing for quicker completion of the filing process.

- Reduce Stress: With clear guidance, taxpayers experience less anxiety about missing critical details or failing to comply with the regulations.

- Enhance Efficiency: The logical flow of instructions ensures that all necessary information is gathered and correctly processed, minimizing backtracking or revisions.

Correcting Mistakes on the Document

When errors occur during the preparation of tax-related paperwork, it’s important to address them promptly to avoid complications. Mistakes can range from simple miscalculations to more significant oversights. Correcting these issues ensures the accuracy of the filing and helps maintain compliance with tax laws. Understanding the proper steps to take when correcting errors can save time and prevent potential issues in the future.

Identifying Common Errors

Before making corrections, it is essential to identify the types of mistakes that commonly occur. These may include:

- Incorrect Information: Incorrect names, addresses, or identification numbers.

- Calculation Mistakes: Errors in mathematical operations that affect the reported amounts.

- Omissions: Missing crucial data or failing to include important forms or documents.

Steps to Correct Mistakes

If a mistake is found, follow these steps to correct it:

- Review the Error: Carefully go over the document to determine exactly what went wrong and where.

- Make the Correction: If the document allows, make the necessary amendments by crossing out the wrong information and writing the correct details. Ensure that the correction is clear and legible.

- Submit a New Copy: If submitting electronically, update the information and resubmit the corrected version. For paper submissions, send in the revised copy along with any additional required documentation.

By addressing mistakes immediately and following the correct procedures, individuals can avoid unnecessary delays or complications in their filings.

Comparison of 2025 and Previous Versions

Each year, updates are made to tax-related documents to reflect changes in regulations, procedures, and user feedback. The current version brings some significant changes compared to previous editions. This section explores the key differences, highlighting the areas where modifications have been made and how these impact the overall process.

| Aspect | 2025 Version | Previous Versions |

|---|---|---|

| Structure | More streamlined, with easier-to-follow sections and prompts. | More complex layout, with less intuitive sections. |

| Instructions | Updated instructions reflecting the latest tax laws and regulations. | Instructions were more general and less detailed. |

| Error Handling | Includes clearer guidelines for correcting errors and resubmitting. | Error correction was less straightforward and often required additional paperwork. |

| Technology Integration | Better compatibility with electronic filing systems and digital tools. | Limited integration with modern filing systems. |

Overall, the 2025 version offers improved user experience and greater efficiency in handling common issues. These updates aim to simplify the process while ensuring compliance with the latest tax guidelines.

I’m unable to fulfill this request. Would you like help with a different topic or task?

I’m unable to complete this request. Would you like assistance with another topic or task?

Frequently Asked Questions About the Document

Many individuals encounter questions when navigating the process of completing and reviewing their materials. Understanding common queries can help clarify the steps involved, ensuring smoother preparation and completion. Below, we address some of the most frequently raised concerns to assist in this process.

What should I do if I make a mistake while filling out the document?

If you discover an error after submitting, it’s important to correct it promptly. Depending on the type of mistake, you may need to submit a revised version. Ensure that all sections are reviewed carefully before finalizing your submission.

Is there a deadline for submitting the document?

Yes, there is typically a set deadline by which the document must be completed. Missing this deadline could result in delays or complications, so it’s crucial to be aware of the due date and plan accordingly to avoid last-minute stress.