In the field of accounting, understanding the core principles of professional behavior is essential for success. The ability to navigate complex ethical situations and uphold integrity is crucial for anyone aspiring to work in the industry. This section provides valuable insights into the principles and scenarios that are commonly tested during certification assessments, focusing on real-world applications and decision-making processes.

Comprehensive knowledge of these standards is not only necessary for passing the certification process but also for maintaining trust and professionalism throughout one’s career. Individuals are often faced with difficult choices, and it is important to be well-prepared to identify appropriate actions that align with the profession’s values.

Through careful study and practical examples, you will be equipped with the tools needed to approach these challenges confidently. Mastering the key concepts ensures that candidates are ready to demonstrate their understanding and make informed decisions in any professional setting.

Professional Standards Preparation Guide

In order to successfully navigate the certification process, understanding the core principles that guide professional conduct is essential. This section provides a detailed overview of scenarios commonly assessed during certification, helping candidates prepare for situations that require sound judgment and ethical decision-making. By mastering these principles, you can ensure you’re ready to handle any challenge that arises in the workplace.

Key areas often tested involve understanding the responsibilities professionals hold in their interactions with clients, colleagues, and the public. Here are some important aspects to focus on:

- Integrity and Transparency: The ability to act honestly and openly in all professional matters.

- Confidentiality: Understanding how to handle sensitive information appropriately and securely.

- Independence: The importance of maintaining unbiased judgment and avoiding conflicts of interest.

- Compliance: Adhering to industry regulations and standards that govern professional conduct.

- Professional Responsibility: Taking accountability for one’s actions and decisions in the workplace.

As you prepare, it’s also helpful to familiarize yourself with common scenarios and the ethical dilemmas they present. Practicing with realistic situations will allow you to make well-informed decisions based on the professional code of conduct. In the next section, we will explore some sample cases to help you strengthen your understanding.

Understanding the Importance of Professional Conduct in Certification

In any certification process for accounting professionals, understanding the principles of conduct is crucial. The ability to demonstrate sound judgment, uphold moral values, and adhere to industry standards not only ensures successful certification but also builds the foundation for a trustworthy and reputable career. Professionals in this field are often tasked with making decisions that directly impact clients, stakeholders, and the public, which is why having a strong ethical framework is essential.

Maintaining trust and credibility is central to the role of an accountant. Professionals are regularly faced with situations that test their integrity, confidentiality, and objectivity. Recognizing the importance of these aspects helps individuals navigate complex challenges and respond appropriately, ensuring that their actions reflect the values of the profession.

By integrating strong principles into daily practice, candidates demonstrate not only their technical skills but also their commitment to the highest standards. This focus on professional behavior is a key factor in passing the certification process and advancing in the industry. Professionals who excel in these areas are better equipped to handle ethical dilemmas with confidence and competence.

Common Ethical Dilemmas in Accounting

Accounting professionals frequently encounter situations where their decision-making is challenged by conflicting interests. These dilemmas can arise in various aspects of the job, requiring individuals to balance legal obligations with personal integrity and professional responsibility. It is essential for those in the industry to be prepared for such challenges and understand the proper course of action in each case.

Conflict of Interest

One of the most common challenges in the profession involves managing conflicts of interest. For instance, an accountant may face a situation where personal relationships or financial incentives could influence their impartiality. Navigating these scenarios with transparency and maintaining objectivity is crucial to uphold trust and ensure decisions are made in the best interest of clients and stakeholders.

Confidentiality vs. Disclosure

Another ethical dilemma often arises when accountants are torn between maintaining confidentiality and disclosing information. Accountants are bound by strict rules to protect sensitive data, but there are instances where revealing certain details is necessary, such as when there is evidence of fraud or financial mismanagement. Deciding when to breach confidentiality while adhering to professional standards requires careful consideration of the potential consequences.

Key Topics Covered in Certification Assessments

The certification process for accounting professionals involves assessing a range of core principles and standards that govern the profession. It is essential for candidates to demonstrate a deep understanding of these topics to ensure their ability to navigate real-world scenarios ethically and responsibly. The following areas are critical in evaluating the professional conduct and decision-making skills of candidates.

- Integrity and Objectivity: Understanding how to maintain honesty and impartiality in all professional decisions.

- Professional Responsibility: The obligation to act with accountability, ensuring decisions align with both legal requirements and industry standards.

- Confidentiality: The importance of protecting sensitive client information and knowing when it is necessary to disclose certain data.

- Independence: Maintaining unbiased judgment, especially when working with clients or stakeholders who may have conflicting interests.

- Compliance with Regulations: Familiarity with the rules and regulations governing the accounting profession, ensuring all actions are in line with legal expectations.

- Professional Behavior: Demonstrating respect, fairness, and transparency in all professional interactions.

These topics form the foundation for evaluating candidates’ ability to uphold the highest standards of conduct and responsibility in their careers. Mastering these principles is key to achieving success in certification assessments and in practice.

How to Prepare for the Professional Conduct Section

Preparing for the section focused on professional conduct is essential for anyone looking to succeed in the certification process. This part of the assessment tests your understanding of the values and principles that guide behavior in the field. To perform well, candidates must be well-versed in key concepts and ready to apply them to real-world situations.

Study the Core Principles

Familiarizing yourself with the foundational values of the profession is the first step in preparation. These principles guide decision-making and help ensure that actions align with the highest standards. Focus on the following key areas:

- Integrity: Acting honestly and with transparency in all professional matters.

- Confidentiality: Protecting sensitive information while understanding when it may be necessary to disclose it.

- Independence: Avoiding conflicts of interest and maintaining objectivity in all professional dealings.

- Accountability: Taking responsibility for your actions and ensuring compliance with all applicable rules and regulations.

Practice with Real-World Scenarios

To deepen your understanding, practice applying these principles to various professional scenarios. Use case studies and sample situations to test your decision-making skills. This will help you recognize how to approach challenges and navigate complex issues that may arise in your career.

By focusing on these key areas and practicing with realistic examples, you’ll be better prepared to demonstrate your knowledge and make informed decisions when it matters most.

Ethical Standards for Certified Public Accountants

Professional accountants are held to rigorous standards of conduct, which ensure that their work is carried out with the highest level of integrity and responsibility. These standards are designed to protect public trust, maintain transparency, and ensure that decisions are made in accordance with both legal and professional guidelines. Adhering to these principles is essential for anyone in the field to succeed and maintain credibility throughout their career.

Some of the core standards that accountants must follow include maintaining honesty, ensuring confidentiality, and avoiding conflicts of interest. They are expected to act with fairness, uphold the public’s confidence, and make decisions that reflect both ethical considerations and professional judgment. These guidelines help shape the behavior of accountants in a way that promotes trust and accountability in all their dealings, whether with clients, colleagues, or the public.

Common Mistakes in Certification Assessments

When preparing for the certification assessment, candidates often make certain mistakes that can impact their performance. These errors can stem from a misunderstanding of key principles, misapplication of concepts, or lack of thorough preparation. Identifying and addressing these common pitfalls is essential for success in the process.

| Mistake | Description |

|---|---|

| Overlooking Core Principles | Failing to properly study and understand the fundamental guidelines that govern professional conduct can lead to incorrect decisions in real-world scenarios. |

| Misinterpreting Scenarios | Not fully analyzing the context of a situation before choosing an answer may result in applying the wrong ethical standard or guideline. |

| Ignoring Conflicts of Interest | Not recognizing potential conflicts of interest or bias in decision-making can lead to unethical or unprofessional choices. |

| Underestimating the Importance of Confidentiality | Failing to appreciate the significance of confidentiality in certain situations can lead to breaches of trust and violation of professional standards. |

| Overconfidence in Technical Skills | Relying too heavily on technical knowledge without considering the ethical implications of decisions can be detrimental in the assessment. |

To avoid these mistakes, it is important to review all materials thoroughly, practice applying principles to case studies, and focus on developing a clear understanding of the professional values that guide decision-making. By being aware of these common errors, candidates can improve their ability to make informed and ethical choices when it matters most.

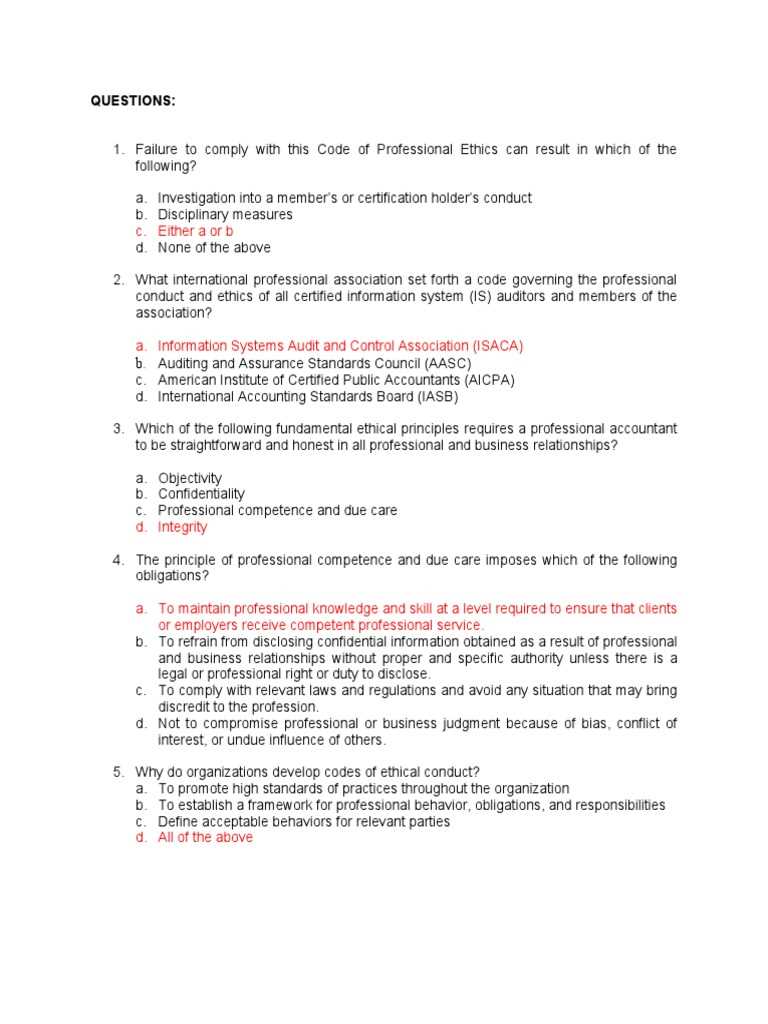

Sample Questions for Certification Assessment

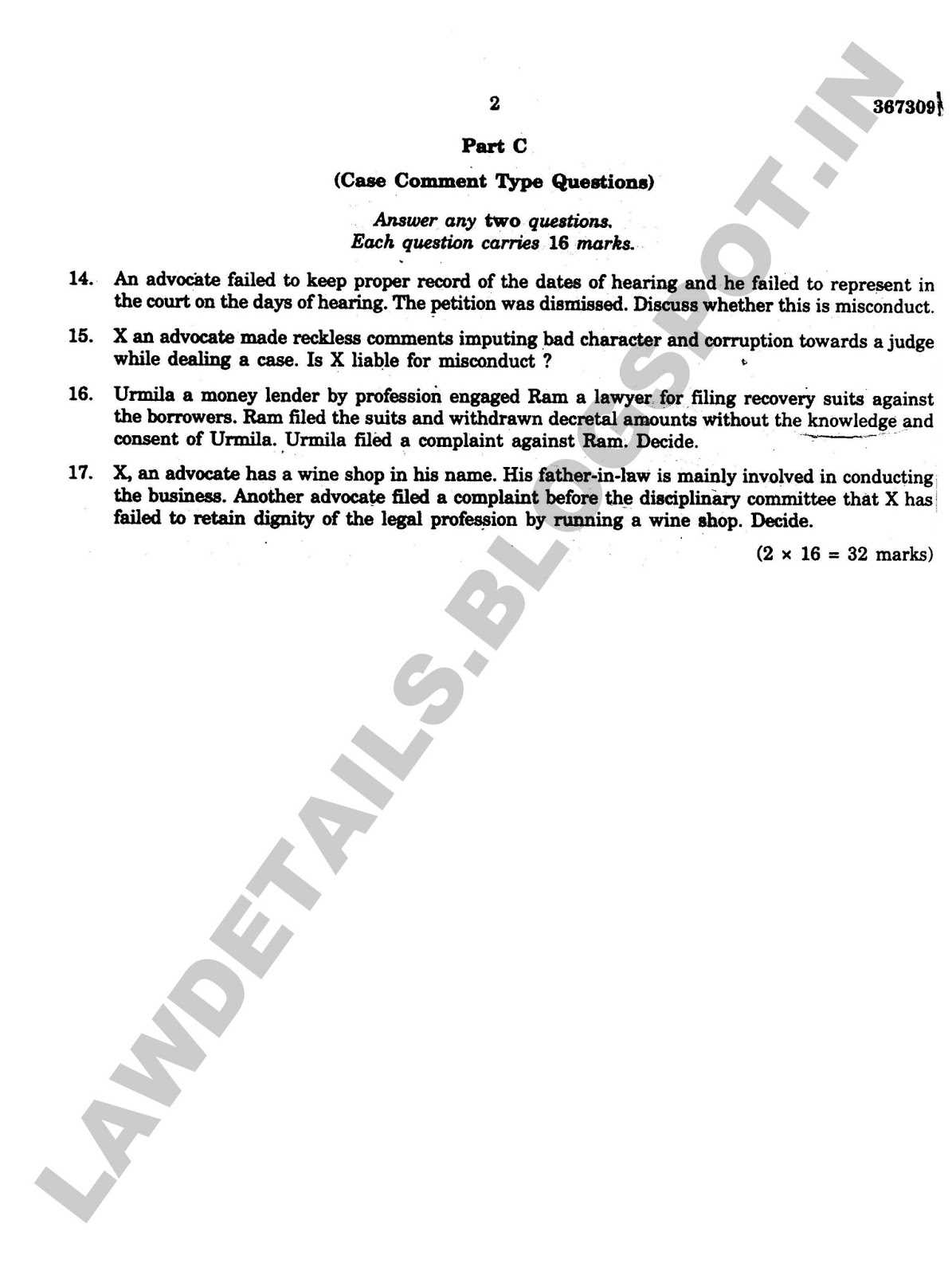

Understanding the types of scenarios presented in a certification assessment is key to effective preparation. These situations typically require candidates to apply core principles of professional conduct and make decisions that align with industry standards. Below are some sample scenarios to help you practice thinking critically and responding in accordance with the highest standards of the profession.

Scenario 1: A colleague asks you to overlook a minor error in a client’s financial statement in exchange for future business opportunities. How would you handle this situation?

Answer: Uphold integrity and objectivity by refusing to overlook the error. Professional standards require that all financial statements be accurate and truthful, regardless of external pressures.

Scenario 2: You come across confidential information about a client that could be damaging if released to the public. What actions would you take?

Answer: Protect the confidentiality of the information unless there is a legal obligation or requirement to disclose it. The duty to maintain client privacy outweighs personal interests or potential gain.

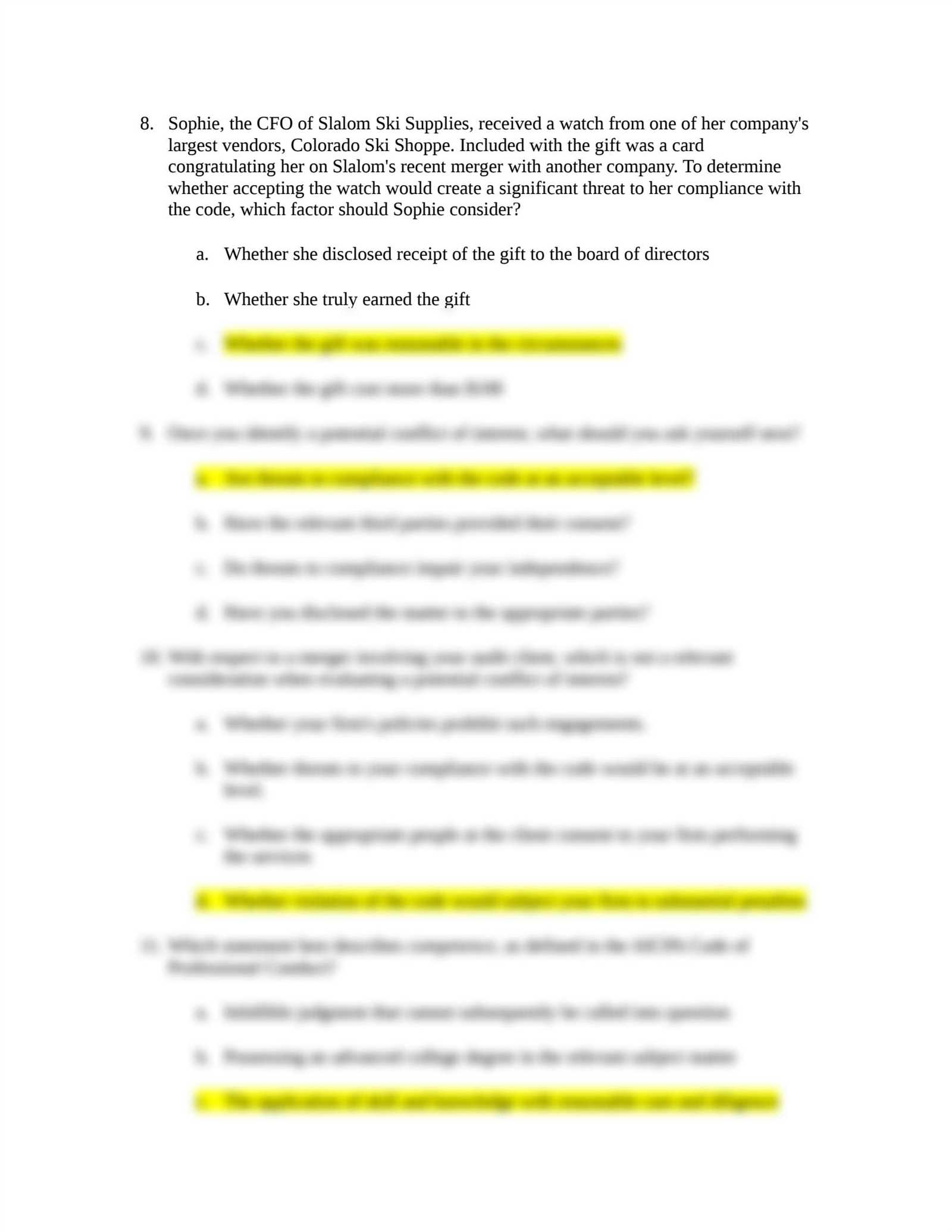

Scenario 3: You are offered a gift from a client as a token of appreciation for your work. How should you respond?

Answer: Reject the gift to maintain independence and avoid any perception of bias. Accepting gifts may create a conflict of interest or undermine your objectivity in future dealings.

These sample situations illustrate the types of ethical challenges you may face. By practicing how to respond to similar scenarios, you can develop a strong understanding of the key principles that govern professional behavior and decision-making.

Tips for Answering Ethics Questions Correctly

Successfully responding to questions on professional conduct requires a deep understanding of core principles and the ability to apply them to real-world scenarios. The key to answering these questions effectively lies in evaluating each situation carefully and choosing the response that aligns with industry standards. Below are some helpful tips to guide you in providing accurate responses.

Focus on Core Principles

Before answering, remind yourself of the fundamental values that guide professional behavior. These include integrity, confidentiality, objectivity, and accountability. Always prioritize these principles when considering the best course of action in a given scenario. Evaluate whether the decision respects these values and aligns with the professional conduct expected in the field.

Consider All Perspectives

Ethical challenges often involve multiple stakeholders with conflicting interests. Take a moment to think about the potential consequences for each party involved in the situation. Weighing these perspectives will help ensure that you choose the response that maintains fairness, transparency, and compliance with professional standards.

By following these tips, you can improve your ability to navigate complex ethical situations, making informed choices that align with both legal requirements and the ethical guidelines of the profession.

Time Management Strategies for Certification Assessments

Effectively managing your time during the certification assessment is crucial to ensure that you can thoroughly address each scenario without feeling rushed. Time management allows you to stay calm, focused, and ensures that you give thoughtful answers to each question. Developing strategies for organizing your time is essential for performing well in this part of the assessment.

Prioritize Key Topics

Before the assessment, familiarize yourself with the most common areas that are typically tested. By understanding these topics, you can allocate your time more effectively during preparation and focus on areas that are likely to appear in the assessment. During the actual test, prioritize questions related to these key themes to ensure you have enough time to address them fully.

Set Time Limits for Each Question

While taking the assessment, set a specific time limit for each question. This ensures that you don’t spend too much time on any one scenario, leaving enough time for others. A good rule of thumb is to allocate equal time for each question and move on if you feel stuck, allowing you to come back to difficult questions later if needed.

By applying these time management strategies, you can ensure that you approach the certification assessment in a systematic and efficient manner, allowing for the best possible outcomes.

Reviewing the AICPA Code of Professional Conduct

The AICPA Code of Professional Conduct serves as the cornerstone for ensuring integrity, responsibility, and accountability in the accounting profession. Familiarizing yourself with its provisions is essential for understanding the standards that guide professional behavior. By reviewing the code, individuals can better navigate complex situations and maintain the trust of clients, colleagues, and the public.

The code is structured around a series of principles designed to help professionals make ethical decisions. These principles cover a broad range of topics, from maintaining independence to safeguarding client confidentiality. Understanding each section in depth will prepare you to handle ethical dilemmas effectively.

Key Areas of the AICPA Code

Below are some key areas covered by the AICPA Code of Professional Conduct that are crucial for professional behavior:

- Integrity and Objectivity: Accountants must maintain honesty and impartiality in all professional relationships.

- Confidentiality: Professionals are required to protect client information and disclose it only under specific conditions.

- Professional Competence: Accountants should continue to improve their skills and provide competent services.

- Due Care: Professionals must act diligently and in accordance with applicable standards and regulations.

- Independence: Maintaining objectivity and independence is key to avoid conflicts of interest.

How to Use the Code in Practice

To effectively apply the code, professionals should regularly review its provisions and use it as a guide when facing ethical challenges. It is not just a set of rules to follow but a framework for making thoughtful decisions in the face of difficult situations. Whether in daily tasks or in more complex ethical dilemmas, the AICPA Code serves as a constant reference point.

By thoroughly understanding the code, you can ensure that your decisions and actions align with the highest standards of the profession, fostering trust and confidence among clients and peers alike.

Understanding Conflicts of Interest in Accounting

Conflicts of interest arise when an individual’s personal interests or relationships interfere with their professional duties and obligations. In the accounting profession, these situations can lead to biased decision-making, compromising the quality of service provided to clients or the public. Recognizing and managing conflicts of interest is essential to maintaining the integrity and objectivity of the profession.

Types of Conflicts of Interest

There are various scenarios in which conflicts of interest can occur. Some common examples include:

- Financial Interests: When an accountant has a financial stake in a client’s business, it may influence their objectivity in providing services.

- Personal Relationships: Close personal ties with a client or business associate may create bias in the decision-making process.

- Multiple Roles: Serving in multiple capacities for the same client, such as being both an auditor and a consultant, can lead to conflicting interests.

Managing Conflicts of Interest

To prevent conflicts of interest from affecting professional judgment, accountants should take proactive measures:

- Full Disclosure: It is crucial to disclose any potential conflicts to clients, employers, or other stakeholders to ensure transparency.

- Recusal: In some cases, it may be necessary to recuse oneself from certain decisions or tasks to avoid undue influence.

- Clear Policies: Organizations should have clear policies in place to identify, manage, and resolve conflicts of interest effectively.

By being vigilant and managing conflicts of interest appropriately, accounting professionals can maintain the trust of their clients and the integrity of the profession.

How to Handle Ethical Violations in Practice

When ethical violations occur in the workplace, it is crucial to address them promptly and effectively. Ignoring or mishandling such issues can lead to serious consequences, including loss of trust, legal repercussions, and damage to professional reputation. Handling violations requires a clear understanding of the situation, adherence to guidelines, and a commitment to maintaining the integrity of the profession.

Here are the essential steps to take when faced with an ethical violation:

| Step | Action |

|---|---|

| 1. Identify the Violation | Carefully assess the situation to determine whether the actions in question violate professional standards or regulations. |

| 2. Gather Facts | Collect relevant information and evidence to understand the full scope of the issue before taking any action. |

| 3. Report the Issue | If the violation is significant, it should be reported to the appropriate authority or body within the organization or profession. |

| 4. Seek Guidance | Consult with supervisors, legal advisors, or professional bodies for advice on how to handle the violation. |

| 5. Take Corrective Action | Depending on the severity of the violation, corrective measures may include disciplinary action, training, or process improvements. |

| 6. Prevent Future Violations | Implement procedures or policies to reduce the likelihood of similar ethical issues occurring in the future. |

Addressing violations in a timely and responsible manner not only ensures compliance with professional standards but also fosters a culture of accountability and trust within the workplace. It is essential that all professionals take responsibility for maintaining the highest standards of conduct in their practice.

The Role of Integrity in Accounting Exams

In the field of accounting, maintaining integrity is paramount, particularly when it comes to assessments. The accuracy and transparency of financial reporting directly impact businesses, investors, and the broader economy. During evaluations, whether theoretical or practical, honesty ensures that professionals uphold the trust placed in them by clients, employers, and regulatory bodies. A commitment to ethical standards during these assessments reflects a candidate’s ability to make responsible and reliable decisions in real-world scenarios.

Understanding the importance of integrity is not only vital for passing assessments but for building a solid foundation in one’s professional career. Here’s why integrity plays a critical role in these evaluations:

| Aspect | Importance |

|---|---|

| Trustworthiness | Maintaining honesty ensures that assessments reflect true understanding, fostering trust in one’s skills and decision-making abilities. |

| Accountability | Demonstrating integrity means taking full responsibility for one’s work and actions, which is essential in professional practice. |

| Professional Reputation | Consistency in upholding high ethical standards strengthens a professional’s reputation, making them more credible in the field. |

| Long-Term Success | Adherence to integrity ensures that professionals are prepared for ethical challenges throughout their careers, leading to sustained success and growth. |

By upholding integrity during assessments, individuals demonstrate their readiness to handle the ethical complexities of the accounting profession, ultimately benefiting both themselves and the wider business community. Ethical conduct is a cornerstone that supports long-term professional development, and it should be embraced as an essential element throughout one’s career journey.

Using Case Studies to Improve Exam Results

Case studies are an excellent tool for deepening understanding and improving performance in assessments. By analyzing real-life scenarios, candidates can apply theoretical knowledge to practical situations, enhancing their critical thinking and problem-solving skills. This approach helps bridge the gap between academic concepts and their real-world applications, making it easier to grasp complex material and perform better in assessments.

Integrating case studies into preparation can provide several benefits, such as:

- Practical Application: Case studies allow individuals to test their knowledge in realistic contexts, which is vital for understanding how principles are used in day-to-day practice.

- Critical Thinking: Analyzing case studies encourages the development of analytical thinking, helping candidates assess issues from multiple perspectives and make informed decisions.

- Enhanced Retention: Applying theoretical concepts to case scenarios aids in better retention and recall of information during evaluations.

- Preparation for Complex Situations: Case studies expose individuals to a variety of scenarios, preparing them for the variety of challenges they may face in professional practice.

By practicing with case studies, individuals can simulate the types of situations that may arise in real-world practice, boosting their confidence and readiness for assessments. This strategy fosters a deeper understanding of the material, helping to ensure that students and professionals are equipped with the tools needed for success.

Resources for CPA Ethics Exam Preparation

Effective preparation for assessments that test professional integrity and standards requires access to the right resources. A combination of books, online courses, practice materials, and guidance from experts can greatly enhance understanding and increase the likelihood of success. In this section, we explore a variety of tools that can help individuals prepare thoroughly and confidently for these critical assessments.

Study Materials

Comprehensive study materials provide a structured approach to learning key principles. Some of the most useful resources include:

- Textbooks: Books that cover the fundamental topics of professional conduct and standards are essential for building a strong foundation. Popular texts include those authored by reputable institutions and professionals.

- Study Guides: Focused guides that distill complex topics into clear, concise summaries can help clarify difficult concepts and improve retention.

- Online Articles: Articles from trusted industry sources offer insights into real-world applications of standards and common dilemmas faced in the profession.

Practice and Mock Tests

Simulating the assessment experience can significantly boost confidence and familiarity with the format. Key practice resources include:

- Practice Tests: Mock exams allow individuals to gauge their knowledge and identify areas where further review is necessary. Many online platforms offer free and paid practice tests designed to mimic actual assessment formats.

- Question Banks: Question banks containing a wide variety of practice questions provide opportunities for repeated testing and review.

- Interactive Quizzes: Online quizzes with immediate feedback can help reinforce learning and encourage active engagement with the material.

By utilizing a combination of these resources, individuals can enhance their preparation, improve their problem-solving skills, and ensure they are fully ready for the assessment.