Preparing for a crucial test can be overwhelming, but understanding the core principles and strategies will make the process much smoother. Whether it’s analyzing market trends, budgeting effectively, or planning long-term investments, mastering foundational knowledge is the first step to excelling in any assessment related to financial decision-making and resource management.

Effective preparation requires not only understanding theoretical concepts but also knowing how to apply them in real-world scenarios. Having a strong grasp of the essential ideas and formulas is crucial for tackling any challenge that might come your way during the evaluation.

Throughout this guide, we will explore various strategies to help you approach your study sessions with confidence, equipping you with the tools to analyze complex situations and make informed decisions. Success comes from both knowledge and the ability to implement it efficiently when needed.

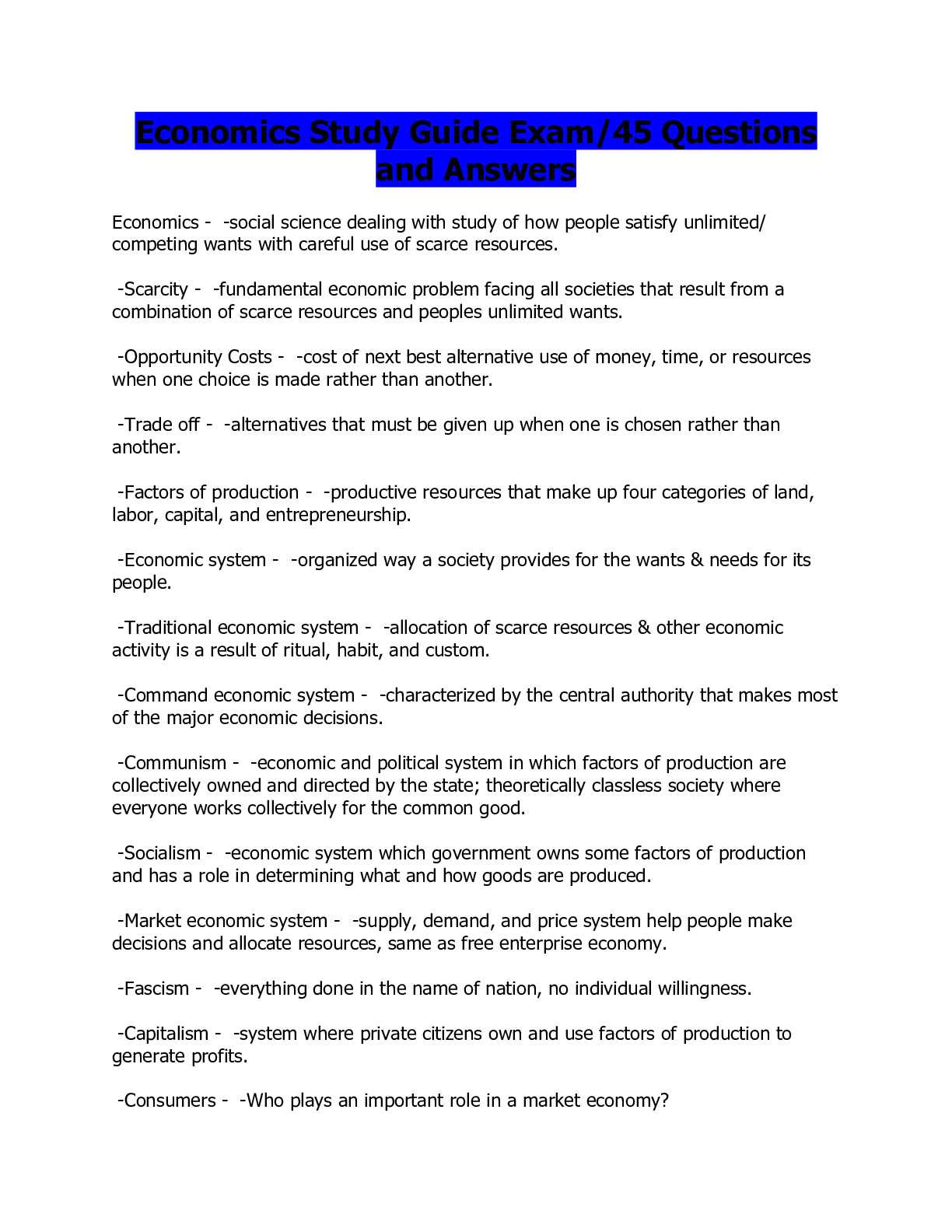

Economics and Personal Finance Final Exam Answers

When preparing for an important assessment on resource management, it’s crucial to focus on both theory and practical applications. Being able to demonstrate a solid understanding of key concepts, like how markets operate, the principles behind budgeting, and the factors influencing investment decisions, is essential for performing well. A comprehensive approach will ensure you can tackle a variety of questions with confidence.

Key topics often include understanding market forces, managing household expenses, and identifying the impact of interest rates. Recognizing patterns and trends in these areas allows for more accurate decision-making, which is a key aspect of demonstrating competence in this field. Knowing how to apply these ideas in different scenarios will be critical to your success.

In addition to grasping theoretical knowledge, focusing on how these concepts influence everyday decisions will help bridge the gap between learning and practical application. The ability to analyze case studies or hypothetical situations and provide well-thought-out responses is a valuable skill in this context.

Understanding Key Economic Concepts

Mastering essential principles is the foundation for tackling any assessment in this field. A solid grasp of fundamental ideas will help you analyze situations and make informed choices. These concepts provide the framework needed to understand how resources are allocated, how people and organizations interact within markets, and how decisions are made based on available information.

Some of the key concepts you should focus on include:

- Supply and Demand: The relationship between the availability of goods and services and the desire for them.

- Scarcity: The concept that resources are limited, requiring choices to be made about their allocation.

- Opportunity Cost: The cost of forgoing the next best alternative when making a decision.

- Marginal Utility: The additional satisfaction or benefit gained from consuming one more unit of a good or service.

- Market Structures: Different organizational forms in which markets operate, such as perfect competition, monopolies, and oligopolies.

Understanding these core ideas allows you to think critically about how individuals, businesses, and governments interact within the economy. It’s not just about memorizing definitions; it’s about applying them to real-world scenarios and being able to explain their impact on various decisions.

Mastering Personal Finance Principles

Achieving financial success involves understanding key strategies that help individuals manage their income, savings, and investments effectively. Mastering these concepts is essential for making informed choices about how to allocate resources, plan for the future, and secure financial stability. By focusing on the fundamental principles, one can build a strong foundation for making sound financial decisions.

Some core principles to focus on include:

- Budgeting: Developing a system to track income and expenses to ensure money is allocated efficiently.

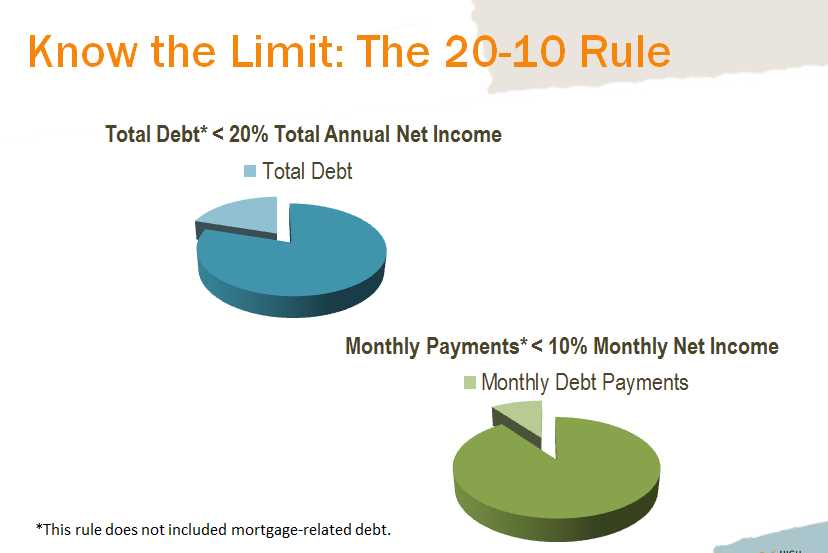

- Debt Management: Understanding how to handle borrowed money, prioritize payments, and avoid excessive interest rates.

- Saving for Emergencies: Setting aside funds to cover unexpected expenses and protect against financial uncertainty.

- Investment Strategies: Making informed decisions about where to place money for long-term growth, such as stocks, bonds, and mutual funds.

- Retirement Planning: Setting goals and creating a strategy for securing financial independence in later years through savings and investments.

By gaining proficiency in these areas, individuals can develop a comprehensive approach to managing their finances, helping them make smarter choices today while planning for a more secure future.

Study Tips for Exam Success

Effective preparation is key to excelling in any assessment. By organizing your study time, focusing on core concepts, and applying practical strategies, you can maximize your chances of performing well. Understanding how to study efficiently and avoid distractions will make the process smoother and less stressful.

Create a Study Plan

One of the most important steps in preparing for any evaluation is to create a detailed study plan. Break down the material into manageable sections and allocate specific time slots for each topic. This will help you stay organized and ensure you cover everything you need to know without feeling overwhelmed. Remember to include short breaks to keep your mind fresh and focused.

Practice with Mock Scenarios

Practice is essential for reinforcing your understanding of key principles. Work through practice questions or case studies similar to what you may encounter in the test. This will not only help you familiarize yourself with the format but also improve your ability to apply concepts in real-world scenarios. The more you practice, the more confident you’ll feel when it’s time to take the test.

Common Exam Pitfalls to Avoid

When preparing for an important assessment, it’s easy to fall into certain traps that can negatively impact your performance. Avoiding these common mistakes will help you stay focused and ensure that you make the most of your study time. By being aware of potential pitfalls, you can navigate the process with greater confidence and efficiency.

Overloading Information

Trying to learn everything at once can lead to burnout and confusion. Instead, focus on understanding key concepts and build your knowledge step by step. Avoid cramming the night before the test, as this can leave you feeling unprepared and stressed.

- Prioritize essential topics over minor details.

- Use active learning methods like practice questions and self-quizzing.

- Take regular breaks to avoid mental fatigue.

Mismanaging Time

Effective time management is crucial during both the preparation phase and the test itself. Many individuals make the mistake of spending too much time on one area while neglecting others. It’s important to allocate study time wisely and stick to your plan.

- Set a specific amount of time for each topic.

- Avoid getting stuck on a single question or concept for too long.

- Review all materials before the test to reinforce understanding.

By staying organized and mindful of these common mistakes, you can ensure a more effective study routine and increase your chances of success.

How to Manage Your Time Effectively

Effective time management is one of the most important skills for achieving success in any evaluation. By organizing your schedule, prioritizing tasks, and staying focused, you can ensure that you cover all the necessary material without feeling rushed or overwhelmed. Good planning allows you to make the most of your study time and approach the challenge with confidence.

Start by breaking down the material into smaller sections. Create a detailed study plan that allocates time for each topic based on its importance and your familiarity with it. This approach helps you stay on track and avoid spending too much time on any one area. Be sure to set aside time for regular breaks to maintain focus and avoid burnout.

As the test date approaches, shift your focus toward revision and practicing with sample questions. This will help reinforce key concepts and improve your problem-solving skills. Make sure to leave time for a final review to go over any areas where you feel less confident.

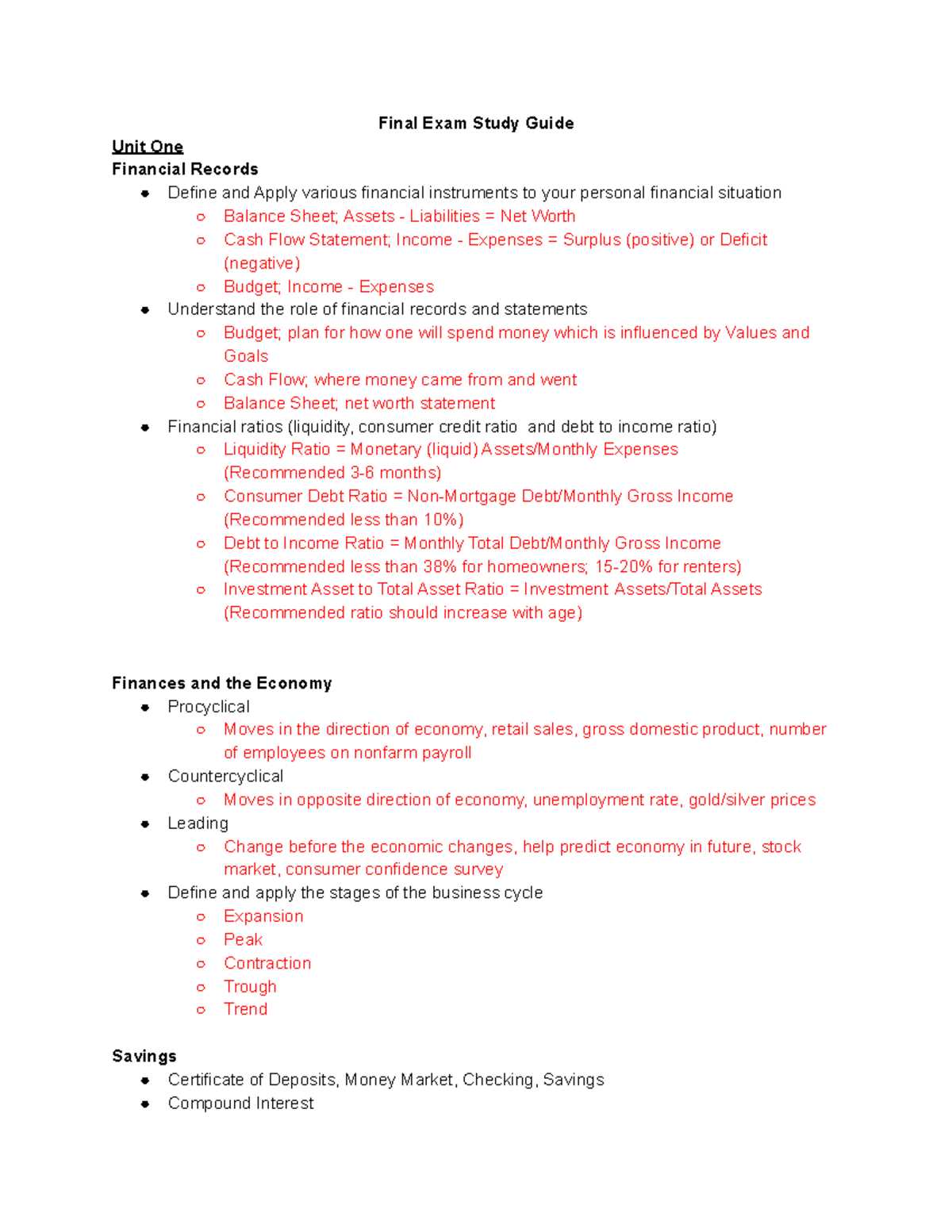

Important Formulas to Memorize

Mastering key mathematical formulas is essential for solving problems efficiently during any assessment. These equations provide the tools to make quick and accurate calculations, helping you apply theoretical knowledge to practical situations. Familiarity with these formulas allows you to focus on the logic behind the questions, rather than spending time recalling the necessary equations.

Key Financial Formulas

In many cases, understanding how money grows over time, or how to calculate interest and returns, is essential. Here are a few formulas to keep in mind:

- Simple Interest: Interest = Principal × Rate × Time

- Compound Interest: A = P (1 + r/n)^(nt) (where A is the amount, P is the principal, r is the interest rate, n is the number of times interest is compounded, and t is the time in years)

- Net Worth: Assets – Liabilities = Net Worth

Budgeting and Investment Formulas

Effective budgeting and investment strategies also rely on simple mathematical concepts. Here are some formulas that can be particularly useful:

- Debt-to-Income Ratio: Debt Payments ÷ Income = Debt-to-Income Ratio

- Return on Investment (ROI): ROI = (Gain from Investment – Cost of Investment) ÷ Cost of Investment

- Annual Percentage Rate (APR): APR = (Total Interest / Loan Amount) × 100

By committing these formulas to memory, you can quickly solve problems and approach your evaluation with confidence, knowing you have the necessary tools at your disposal.

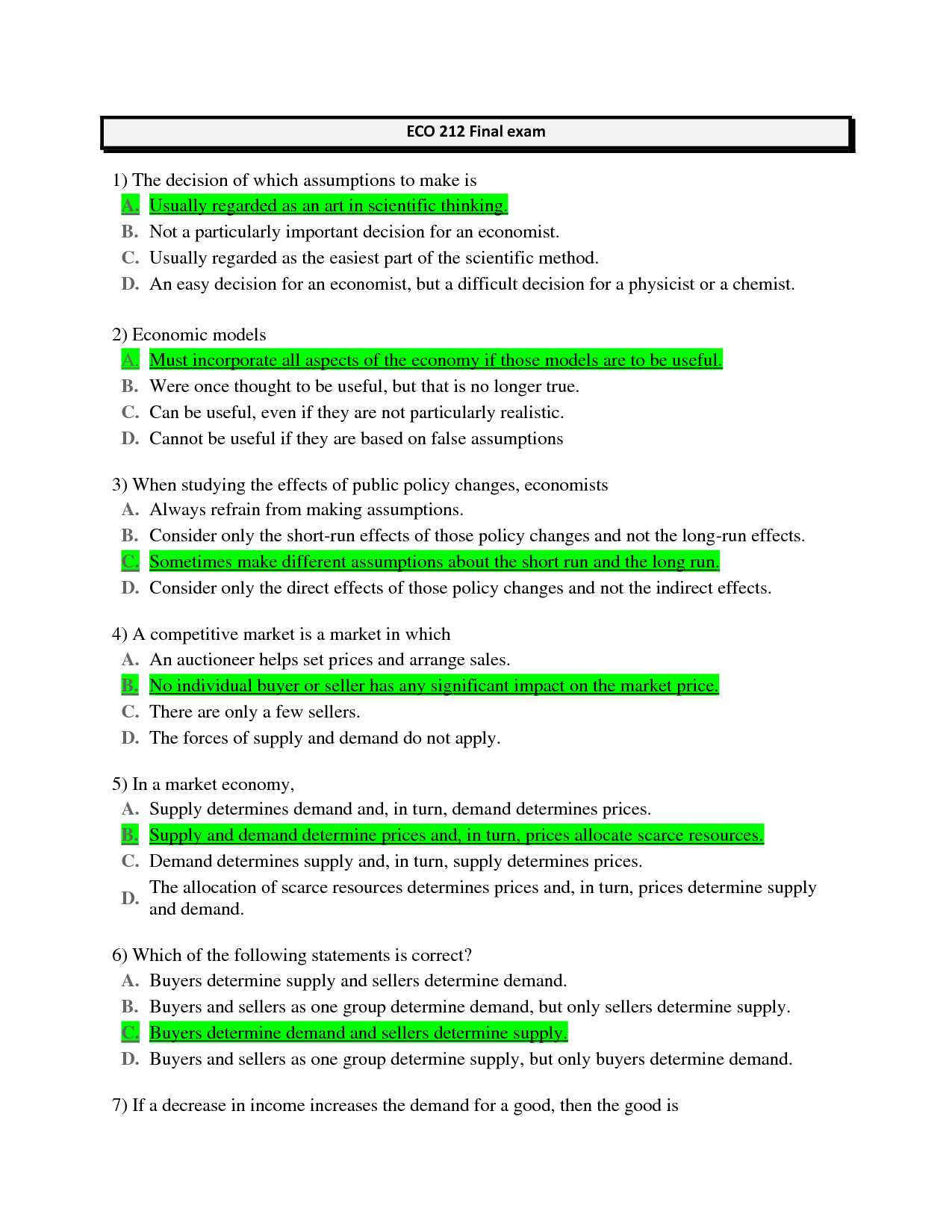

Breaking Down Supply and Demand

The relationship between availability of goods or services and consumer desire is one of the core concepts that drives markets. Understanding how supply and demand interact is essential for analyzing how prices are determined, and how changes in either factor can impact the overall market. Whether looking at individual products or broader market trends, this dynamic is at the heart of many decisions made by both producers and consumers.

When supply exceeds demand, prices typically fall as sellers compete to attract buyers. Conversely, when demand exceeds supply, prices rise due to the competition among consumers. This balance or imbalance helps establish the equilibrium price at which buyers are willing to purchase and sellers are willing to sell.

Key elements that affect supply include production costs, technology, and availability of resources. Demand, on the other hand, is influenced by factors such as consumer income, preferences, and the prices of related goods. By understanding these forces, you can predict how markets will react to various changes, helping to make more informed decisions in both business and personal contexts.

Understanding Budgeting and Saving Strategies

Effective management of income and expenses is essential for long-term financial security. By setting clear spending limits and prioritizing savings, individuals can achieve their financial goals and prepare for future needs. Budgeting allows you to allocate funds wisely, while saving strategies ensure you have reserves for emergencies or major purchases. Together, these practices form the foundation of good financial habits.

Key Budgeting Techniques

When it comes to managing expenses, there are several strategies that can help create a sustainable financial plan. Below are common budgeting techniques that can help you stay on track:

| Technique | Description |

|---|---|

| 50/30/20 Rule | Divide your income into three categories: 50% for needs, 30% for wants, and 20% for savings or debt repayment. |

| Zero-Based Budgeting | Every dollar of income is assigned a specific purpose, ensuring that income minus expenses equals zero. |

| Envelope System | Use physical envelopes or digital apps to allocate specific amounts for categories like groceries, entertainment, and bills. |

Effective Saving Methods

Once you have a budget in place, implementing a consistent savings plan is crucial for building financial stability. Consider these strategies for effective saving:

- Emergency Fund: Set aside a specific amount of money for unexpected expenses, typically aiming for 3 to 6 months of living expenses.

- Automate Savings: Set up automatic transfers from checking to savings accounts to ensure consistent contributions without effort.

- High-Interest Accounts: Place savings in high-yield accounts or investment vehicles that offer better returns over time.

By combining these budgeting techniques with strong saving practices, you can manage your finances more effectively, reduce financial stress, and achieve long-term goals.

Key Theories in Macroeconomics

The study of broad economic factors that influence national and global markets helps explain how economies function as a whole. Several key concepts shape how governments, businesses, and individuals respond to changes in economic conditions, such as employment, inflation, and overall economic output. Understanding these theories is essential for interpreting large-scale economic trends and for formulating policies that can guide long-term economic growth.

Theory of Aggregate Demand and Aggregate Supply

This theory explains the total demand for goods and services in an economy at different price levels. It highlights how shifts in either aggregate demand or supply can lead to changes in production, employment, and prices. For example, an increase in government spending can raise demand, while improvements in technology can increase supply, each influencing economic performance in distinct ways.

Monetarism and the Quantity Theory of Money

Monetarism emphasizes the role of money supply in determining inflation and economic stability. According to the quantity theory of money, the amount of money circulating in an economy directly affects the price level and inflation. Advocates of this theory argue that controlling the money supply is key to controlling inflation and ensuring stable economic conditions.

By understanding these fundamental theories, policymakers and business leaders can make informed decisions that influence national economic performance.

The Role of Interest Rates Explained

Interest rates play a crucial part in shaping the financial landscape. They determine the cost of borrowing and the return on savings, influencing both individual decisions and broader economic activity. By adjusting interest rates, central banks can regulate economic growth, control inflation, and stabilize markets. The dynamics between borrowing costs and savings returns affect everything from consumer spending to investment strategies, making interest rates a powerful tool in managing an economy.

When interest rates are high, borrowing becomes more expensive, which tends to slow down consumer spending and business investment. On the other hand, low interest rates reduce the cost of loans, encouraging borrowing and stimulating economic activity. The balance struck by central banks in setting these rates can have far-reaching effects on inflation, employment, and overall economic stability.

For individuals, understanding the impact of interest rates is key to making informed financial decisions, whether it involves taking out loans, saving for the future, or investing in assets. By monitoring interest rate trends, one can gain valuable insights into the broader economic environment and adjust personal strategies accordingly.

Financial Planning and Investment Basics

Effective management of resources is essential for achieving long-term goals. By setting clear objectives and carefully allocating funds, individuals can secure their financial future. Investment strategies, when aligned with personal goals, can help build wealth over time. A solid plan encompasses both short-term needs and long-term aspirations, balancing risk with potential returns to optimize outcomes.

To start, it’s important to establish clear financial goals. This includes saving for retirement, purchasing a home, or building an emergency fund. Once goals are identified, the next step is to choose appropriate investment options that suit your risk tolerance and time horizon. For instance, stocks may offer higher returns but come with greater risk, while bonds tend to be more stable but provide lower returns. A diversified portfolio that includes a mix of assets can reduce overall risk while aiming for steady growth.

In addition to choosing investments, regularly reviewing your strategy is essential. Market conditions, personal circumstances, and life events all play a role in shaping financial needs. As such, ongoing adjustments to your plan ensure that you stay on track to achieve your financial goals.

Understanding Inflation and Its Impact

Inflation is a key factor that affects the purchasing power of money over time. When inflation occurs, the value of currency decreases, which means that individuals can purchase fewer goods and services with the same amount of money. This phenomenon can impact both individuals and businesses, influencing everything from everyday spending to long-term savings and investments.

Causes of Inflation

Inflation can be caused by various factors, including increased demand for goods and services, rising production costs, or changes in the money supply. These factors can lead to higher prices across the economy, affecting both consumers and producers. A balance between supply and demand plays a crucial role in keeping inflation under control, while excessive demand or supply chain disruptions can push prices higher.

Effects of Inflation on the Economy

The consequences of inflation can be both positive and negative, depending on its level and stability. While moderate inflation may signal economic growth, excessive inflation can erode savings, decrease the value of wages, and destabilize the economy. It’s important for governments and central banks to monitor inflation levels and take corrective measures when necessary.

| Impact | Description |

|---|---|

| Purchasing Power | Inflation reduces the value of money, leading to higher costs for goods and services. |

| Interest Rates | Inflation influences the cost of borrowing. Central banks often raise rates to combat rising prices. |

| Savings | High inflation can erode the value of savings, making it more challenging for individuals to build wealth. |

Understanding inflation is essential for making informed financial decisions. By recognizing how it affects prices, interest rates, and savings, individuals can adjust their strategies to protect their purchasing power and ensure long-term financial security.

Types of Taxes and Their Effects

Taxes play a significant role in shaping both the economy and individuals’ financial situations. They are essential for generating government revenue, but different types of taxes can have varied impacts on behavior, income distribution, and business operations. Understanding these effects is crucial for making informed decisions about both personal finances and public policy.

One of the most common forms of taxation is the income tax, where individuals or businesses are taxed based on their earnings. This type of tax is progressive, meaning that higher earners pay a higher percentage. Income taxes help fund essential services like healthcare, education, and infrastructure. However, they can also influence work incentives, savings behavior, and investment decisions.

Another widely used tax is the sales tax, which is levied on goods and services purchased by consumers. Unlike income taxes, sales taxes are generally regressive, meaning they take a larger proportion of income from lower earners than higher earners. While they are straightforward to collect, they can lead to increased costs for consumers, especially those in lower income brackets.

Property Tax

Property taxes are assessed on the value of property owned, such as real estate. These taxes are typically used to fund local government services like schools, police, and fire departments. While property taxes are relatively stable and predictable, they can place a financial burden on homeowners, especially in areas with rapidly increasing property values.

Corporate Tax

Corporate taxes are imposed on businesses based on their profits. These taxes impact companies’ profitability, investment strategies, and ability to hire workers. While corporate taxes provide essential funding for government programs, they can also influence business decisions, including where to operate, how much to invest in growth, and how to allocate profits.

Each type of tax has distinct effects, influencing everything from consumer spending and saving habits to business investments and economic growth. By understanding how different taxes function, individuals and policymakers can make more effective decisions about budgeting, spending, and investing.

The Basics of Risk and Insurance

Understanding risk is fundamental to managing one’s financial well-being. Every individual and business faces uncertainties, whether from accidents, illness, or unexpected events that could lead to financial losses. Insurance serves as a tool to mitigate these risks by transferring potential losses to a third party in exchange for regular payments, known as premiums. This approach allows individuals and organizations to safeguard their assets and ensure financial stability in case of unforeseen events.

Types of Risks

There are various types of risks that people and businesses encounter, including:

- Health Risk: The possibility of incurring medical expenses due to illness or injury.

- Property Risk: The threat of losing or damaging personal or real property, such as a home or vehicle.

- Liability Risk: The potential for being held financially responsible for injury or damage to others.

- Income Risk: The uncertainty of income due to job loss, disability, or other financial disruptions.

How Insurance Works

Insurance is designed to help individuals or organizations manage these risks. By paying regular premiums, policyholders transfer the financial burden of specific risks to the insurance company. In return, the insurance provider agrees to cover certain costs or damages, depending on the terms of the policy. The amount of coverage and the cost of premiums are influenced by several factors, including the type of insurance, the level of coverage, and the policyholder’s risk profile.

Insurance plays a crucial role in promoting financial security by providing peace of mind, knowing that risks are shared with a reliable partner. While it may not eliminate the possibility of loss, it helps reduce the financial impact of such events. Properly understanding the types of risks and available insurance options can help individuals make informed decisions about protecting their financial future.

Reviewing Personal Finance Case Studies

Case studies are a powerful tool for gaining practical insights into financial decision-making. By examining real-life situations, individuals can understand how others approach managing resources, investments, budgeting, and planning. These examples provide valuable lessons on the complexities of everyday money management, highlighting both successful strategies and common mistakes to avoid. Reviewing such cases allows one to apply theoretical knowledge to practical scenarios, improving decision-making skills and preparing for future financial challenges.

Each case study typically involves a specific individual or household facing financial dilemmas, such as paying off debt, saving for retirement, or purchasing a home. Through careful analysis of these situations, we can identify the strategies that were used to address challenges, the mistakes that were made, and the outcomes of those decisions. These studies serve as excellent learning tools, enabling individuals to reflect on their own financial practices and make better-informed choices moving forward.

By examining a variety of case studies, you can gain a broader understanding of different approaches to financial well-being. This not only helps in building a personal financial strategy but also fosters critical thinking about how to adapt those strategies to your unique circumstances.

Effective Strategies for Exam Revision

Effective preparation is key to success when facing assessments. Approaching your review strategically can significantly enhance retention and comprehension. The process involves not just reading through materials, but actively engaging with the content to ensure a deep understanding. Focusing on high-priority topics, practicing problem-solving, and reviewing past scenarios all contribute to a more efficient revision experience.

Active Learning Techniques

One of the most effective ways to prepare is through active learning. This involves testing yourself on the material, discussing key concepts with peers, or teaching the content to someone else. Active engagement solidifies information in your memory and helps identify areas that need further focus. Techniques such as creating flashcards, summarizing key points, or forming mind maps can also enhance understanding.

Time Management and Study Plans

Creating a structured study plan is crucial to managing your time effectively. Allocate specific periods for each topic, ensuring you have enough time to cover both strengths and weaknesses. Prioritize areas that require more effort or have been difficult to understand in the past. Break down large sections into manageable chunks to avoid feeling overwhelmed, and take regular breaks to maintain focus and productivity.

By using these strategies, you can approach your preparation with confidence, improving both efficiency and effectiveness. Combining active learning with disciplined time management ensures a more organized and successful revision period, helping you feel fully prepared when it’s time to take the test.

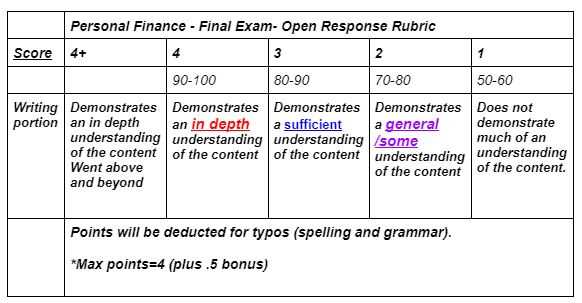

How to Tackle Essay-Based Questions

Essay-based questions require a thoughtful approach that goes beyond memorization. They demand critical thinking, structured arguments, and clear writing. Whether you’re addressing theoretical concepts or applying knowledge to real-life scenarios, the key is to craft a well-organized response that directly addresses the prompt while showcasing your understanding. Below are some steps to guide you through this process.

Breaking Down the Question

Before diving into writing, it is essential to thoroughly understand the question. Here’s how you can approach it:

- Identify Key Terms: Highlight important phrases or directives (e.g., “analyze,” “compare,” “evaluate”) to understand what the question is asking.

- Determine the Focus: Break down the question to recognize its central theme. Ask yourself what the core issue is and what aspects need to be discussed.

- Clarify Scope: Be mindful of the scope – whether the question is asking for a broad overview or a detailed response on a specific aspect.

Structuring Your Response

Once you’ve analyzed the question, organize your response logically. A clear structure is vital for presenting a cohesive argument. Here are some tips:

- Introduction: Briefly outline your approach, introducing the key themes and your thesis. This sets the stage for your argument.

- Body Paragraphs: Each paragraph should focus on one main point. Start with a clear topic sentence, followed by supporting evidence or examples. Make sure your argument flows logically from one point to the next.

- Conclusion: Summarize your argument and restate your thesis in light of the points you’ve made. Avoid introducing new ideas in the conclusion.

By following these steps, you can tackle essay-based questions effectively, ensuring your response is clear, well-organized, and demonstrates a deep understanding of the subject matter. Practicing this method will help you feel confident in your ability to write strong essays under timed conditions.