Preparing for a test in business finance requires a deep understanding of various principles and techniques that are crucial for analyzing and making decisions in a corporate setting. This section is designed to help you grasp the most essential topics that commonly appear in evaluations, ensuring you are well-equipped to demonstrate your knowledge and skills.

By focusing on core areas such as budgeting, investment analysis, and financial reporting, students can build a strong foundation for tackling complex problems. Knowing the right approach and methods is essential for effectively solving challenges related to resource allocation, profitability, and risk assessment. In addition, mastering these topics will not only help you during tests but will also serve you well in real-world business scenarios.

Business Finance Assessment Insights

In this section, we explore essential components for preparing and succeeding in evaluations related to business finance. This involves tackling practical scenarios that reflect real-world challenges. By understanding key concepts, you can approach tests with confidence, ensuring that you’re able to solve problems effectively and efficiently. Key areas such as resource distribution, profitability analysis, and investment evaluation are commonly tested and must be well understood.

Core Areas of Focus

It’s crucial to focus on the most frequently covered topics that are designed to test your comprehension and application of theoretical knowledge. These include calculations of return on investment, debt ratios, budgeting techniques, and assessing the impact of various decisions on an organization’s overall financial health. Practicing a wide range of tasks will help develop a solid understanding of the subject matter, making it easier to approach complex questions.

| Topic | Key Concepts | Typical Tasks |

|---|---|---|

| Investment Analysis | Return on investment, Net Present Value, Internal Rate of Return | Calculate ROI, assess investment feasibility |

| Risk Assessment | Risk-adjusted return, volatility, diversification | Evaluate financial risks and returns |

| Cash Flow Management | Operating cash flow, liquidity ratios, working capital | Analyze cash flow statements, determine liquidity |

| Profitability Analysis | Profit margins, return on assets, efficiency ratios | Calculate profit margins, assess financial performance |

Strategies for Success

Mastering these subjects requires a strategic approach to studying. Practice with sample exercises, review past case studies, and refine your ability to interpret financial data quickly. Use a combination of theory and practical scenarios to strengthen your understanding. This comprehensive preparation will enable you to tackle diverse tasks with clarity, ensuring high performance on any evaluation.

Overview of Financial Management Concepts

Understanding the essential principles of resource allocation and business performance evaluation is crucial for navigating the complexities of corporate decision-making. This section covers the foundational ideas that guide various processes aimed at maximizing efficiency, profitability, and sustainability within organizations. Grasping these core concepts is key to both theoretical knowledge and practical application in real-world scenarios.

Key concepts in this field focus on how to efficiently utilize available resources while balancing risk, reward, and long-term growth. These principles influence how businesses allocate capital, measure profitability, manage cash flow, and make strategic choices that affect overall financial stability.

Key Areas to Understand

- Resource Allocation: Determining the optimal use of available capital to generate the highest possible return.

- Risk Management: Identifying, analyzing, and mitigating potential risks that could affect the business’s financial health.

- Investment Strategies: Making informed decisions about where to allocate funds to ensure maximum return on investment.

- Profitability Analysis: Assessing the organization’s ability to generate profits relative to its revenue, costs, and assets.

- Cash Flow Control: Managing the inflows and outflows of cash to ensure the business can meet its financial obligations.

Practical Applications of Key Concepts

- Evaluate the performance of a company by examining key financial ratios and metrics.

- Make informed decisions on whether to expand, cut costs, or invest based on detailed profitability reports.

- Use risk management techniques to hedge against potential market downturns or operational failures.

- Optimize capital structure to ensure long-term financial sustainability.

- Analyze cash flow projections to ensure liquidity and operational efficiency.

Key Topics Covered in Exams

In assessments focused on business finance, various critical areas are tested to evaluate one’s ability to apply theoretical knowledge in practical situations. These topics often cover essential aspects of how businesses handle resources, measure performance, and make decisions that impact profitability and long-term growth. Understanding these areas is crucial for success in such evaluations.

| Topic | Key Concepts | Common Tasks |

|---|---|---|

| Resource Allocation | Capital budgeting, cost of capital, funding options | Analyze investment opportunities, determine optimal capital mix |

| Risk Assessment | Risk vs return, volatility, diversification | Evaluate financial risks, apply hedging strategies |

| Profitability Analysis | Margins, return on assets, operating efficiency | Calculate profitability ratios, assess financial performance |

| Cash Flow Management | Liquidity ratios, working capital, operating cash flow | Examine cash flow statements, ensure liquidity |

| Investment Evaluation | Net present value, internal rate of return, payback period | Assess investment viability, calculate ROI |

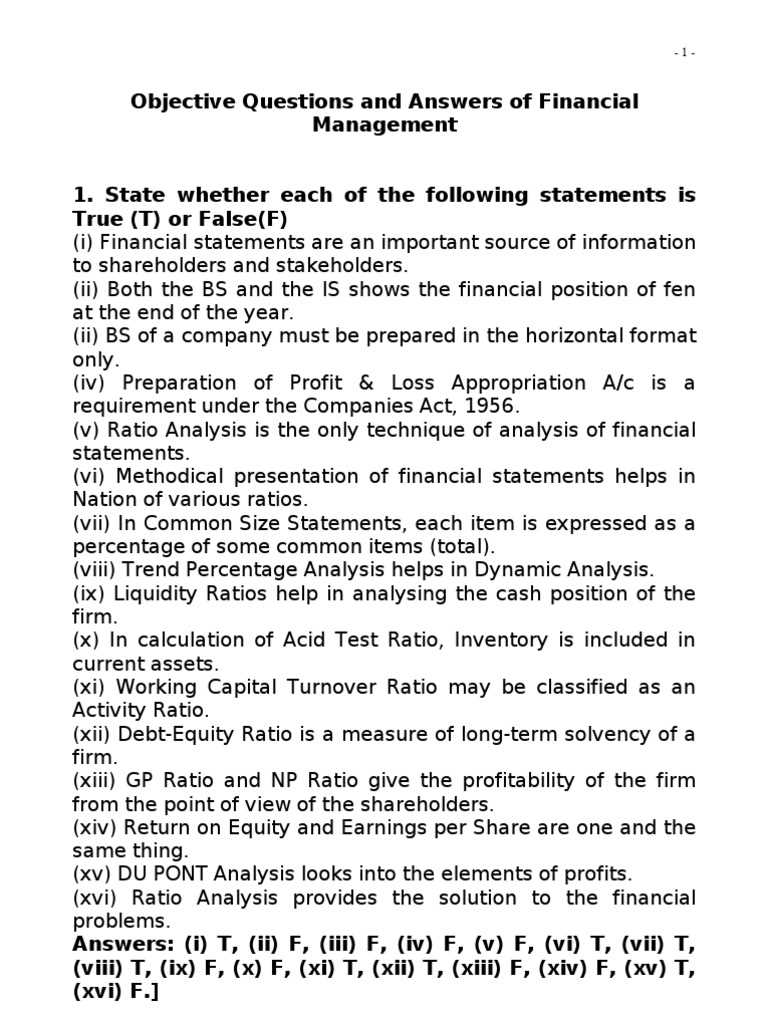

Understanding Financial Ratios and Analysis

Analyzing key metrics is essential for evaluating the overall health of a business. Ratios provide a systematic way to interpret financial data, offering insights into profitability, efficiency, liquidity, and solvency. By understanding these ratios, one can better assess an organization’s ability to meet its obligations, manage assets, and generate returns.

Types of Financial Ratios

There are several types of ratios that serve different purposes, each focusing on a specific aspect of a company’s performance. These include:

- Liquidity Ratios: Measure the ability to meet short-term obligations, such as the current ratio and quick ratio.

- Profitability Ratios: Indicate how efficiently a company generates profit, including gross margin and return on equity.

- Efficiency Ratios: Assess how well a company utilizes its assets, such as asset turnover and inventory turnover.

- Solvency Ratios: Evaluate a company’s long-term financial stability, such as the debt-to-equity ratio.

Interpreting Financial Ratios

Interpreting these ratios involves comparing them to industry benchmarks or historical data to draw meaningful conclusions. A higher current ratio indicates better liquidity, while a higher return on equity suggests better profitability. It’s also important to analyze trends over time to determine whether a company’s financial situation is improving or deteriorating. These insights can help guide business decisions, from investment choices to operational adjustments.

Common Questions on Cash Flow Management

Effectively monitoring cash flow is crucial for a business’s survival and growth. Without sufficient cash on hand, even the most profitable companies can face difficulties meeting their obligations. Understanding how to properly assess and manage cash inflows and outflows is key to ensuring liquidity and operational stability. In this section, we address some of the most common inquiries related to cash flow and its optimization.

How to Improve Cash Flow Efficiency?

Improving cash flow efficiency involves several strategies, including streamlining the collection of receivables, extending payment terms with suppliers, and closely monitoring inventory levels. By reducing the time between when sales are made and when payments are received, businesses can free up more cash for daily operations. Additionally, managing overhead costs and delaying non-essential expenditures can help balance cash flow during slower periods.

What Are the Key Indicators of Cash Flow Health?

Several key indicators can provide insights into a company’s cash flow health. Among the most critical are the operating cash flow ratio, which measures how well current operations generate cash, and the cash conversion cycle, which indicates how long it takes to turn investments in inventory and other resources into cash. Monitoring these ratios allows businesses to identify potential liquidity problems before they become critical.

Exam Tips for Budgeting and Forecasting

Creating accurate projections and managing budgets effectively are critical skills for any professional working with resources and planning. Understanding how to estimate future costs, revenues, and other financial variables is essential for making informed decisions. This section offers practical tips to help you excel when tackling tasks related to preparing budgets and forecasts in evaluations.

To perform well in these areas, focus on the key components of a budget, such as income, fixed costs, variable costs, and profit margins. When it comes to forecasting, make sure to use historical data as a basis and adjust for any anticipated changes in the market or business environment. Being able to explain the assumptions behind your projections is just as important as the numbers themselves.

Practice working with different types of forecasting models, from simple linear projections to more complex methods that take into account seasonality or economic conditions. The more familiar you are with these techniques, the better prepared you will be to handle any scenario that may appear in an assessment.

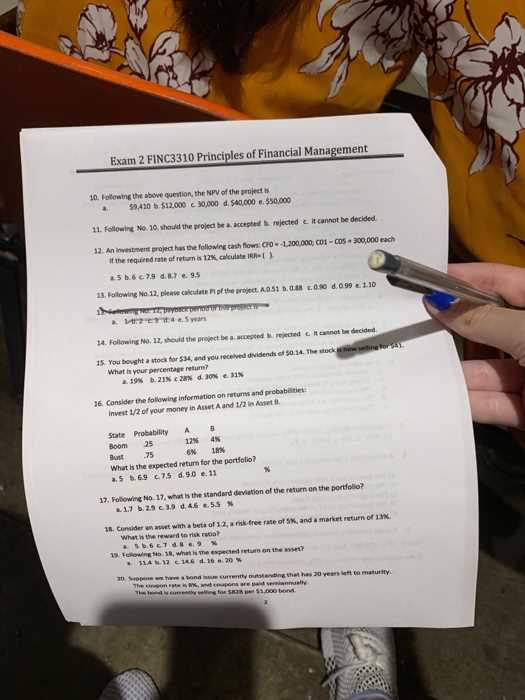

Capital Budgeting and Investment Decisions

Making informed decisions about how to allocate resources for long-term projects is essential for any business aiming for growth and profitability. This process involves evaluating potential investments to determine which projects will deliver the best returns. By carefully assessing various options, companies can prioritize opportunities that align with their strategic objectives while managing risk.

Key concepts in this area include understanding how to evaluate cash flows, calculate profitability, and assess the risks involved in each investment. Properly applying tools like net present value (NPV) and internal rate of return (IRR) is crucial for making well-informed choices about which projects to fund.

Techniques Used in Investment Evaluation

- Net Present Value (NPV): Calculates the difference between the present value of cash inflows and outflows over time, helping to determine if an investment is worthwhile.

- Internal Rate of Return (IRR): Identifies the rate of return at which the present value of inflows equals the outflows, used to compare the attractiveness of investments.

- Payback Period: Measures how long it takes for an investment to recover its initial cost, offering a simple way to assess liquidity risk.

- Profitability Index (PI): Compares the present value of future cash inflows to the initial investment, helping to rank projects by their relative profitability.

Evaluating Investment Risks

It’s also important to consider the risks associated with each investment. Factors such as market volatility, project execution challenges, and economic conditions must be taken into account. The goal is to balance risk with reward, ensuring that the projects undertaken provide sufficient returns to justify the risks involved.

Financial Statements and Their Interpretation

Understanding how to read and analyze key documents that report a company’s economic performance is crucial for making informed decisions. These records provide valuable insights into the business’s health, revealing its ability to generate profits, manage expenses, and handle obligations. Proper interpretation of these documents is essential for both internal management and external stakeholders, such as investors and creditors.

Types of Financial Statements

The primary documents used to assess a company’s financial health include:

- Income Statement: Shows the company’s profitability over a specific period by summarizing revenues, costs, and expenses.

- Balance Sheet: Provides a snapshot of a company’s assets, liabilities, and equity at a given point in time.

- Cash Flow Statement: Tracks the flow of cash into and out of the business, offering insights into liquidity and operational efficiency.

Interpreting the Key Metrics

When reviewing these statements, focus on key metrics such as:

- Profit Margins: Indicate the percentage of revenue that translates into profit, reflecting the company’s efficiency in generating earnings.

- Return on Assets (ROA): Measures how effectively a company uses its assets to generate profit.

- Debt-to-Equity Ratio: Assesses the proportion of debt used to finance the business compared to shareholders’ equity, revealing the company’s financial risk.

By analyzing these ratios and trends over time, one can gain a clearer understanding of the company’s overall financial position and its ability to meet future challenges.

Working Capital Management Essentials

Efficiently managing day-to-day operations is crucial for maintaining a company’s liquidity and ensuring its ability to meet short-term obligations. A well-managed balance between assets and liabilities can help a business avoid cash shortages, improve operational flexibility, and maximize profitability. Understanding the key components that influence this balance is essential for long-term stability.

One of the primary focuses in this area is the effective handling of current assets such as inventory, accounts receivable, and cash, while ensuring that short-term liabilities, such as accounts payable and short-term debt, are managed efficiently. Proper planning and control over these elements allow businesses to maintain a positive cash flow while minimizing financial risks.

Key Components of Working Capital

| Component | Description |

|---|---|

| Inventory | Refers to goods or raw materials held for sale or production. Efficient inventory management helps reduce costs and avoid overstocking. |

| Accounts Receivable | Represents money owed by customers. Faster collection cycles can improve cash flow and reduce the risk of bad debts. |

| Cash | The liquid funds available for immediate use. Ensuring adequate cash reserves are maintained is essential for handling unforeseen expenses. |

| Accounts Payable | Money owed to suppliers. Managing payables effectively can help maintain strong supplier relationships while conserving cash. |

Effective management of these components requires careful planning, monitoring, and decision-making. By ensuring that cash is efficiently allocated across these areas, a business can operate smoothly without the risk of liquidity issues. A good strategy helps optimize working capital, allowing for investment in growth opportunities without compromising financial health.

Risk and Return in Financial Management

In any investment decision, the balance between potential gains and possible losses plays a crucial role. Understanding how various factors influence the potential for profit and the risks involved is essential for making informed choices. Investors and businesses must carefully assess how to maximize rewards while minimizing exposure to adverse outcomes.

The relationship between risk and return is fundamental to investment strategies. Higher returns typically come with higher risks, and vice versa. By measuring potential outcomes, businesses can develop strategies that align with their risk tolerance and financial objectives. Key to this process is the ability to evaluate market conditions, asset volatility, and the overall economic environment.

One way to evaluate this balance is through various performance metrics and models, such as the risk-adjusted return, which helps to determine whether the expected return justifies the level of risk taken. This approach assists in comparing different investments or business ventures based on their relative risk and reward profiles.

Time Value of Money in Exams

The concept that money today is worth more than the same amount in the future is critical in making sound financial decisions. This principle is often tested in assessments where candidates are required to apply mathematical formulas and models to assess the impact of time on value. Understanding this idea is key to evaluating investment opportunities, loans, and savings plans.

Core Concepts to Remember

To tackle problems related to the time value of money, it’s important to focus on the following concepts:

- Present Value (PV): The current value of a future sum of money, discounted to reflect its worth in today’s terms.

- Future Value (FV): The value of a sum of money at a specific point in the future, accounting for interest or growth over time.

- Discounting: The process of determining the present value of a future sum by applying a discount rate, which reflects the time value of money.

- Compounding: The process of determining the future value of an investment by applying interest or growth at regular intervals.

Common Formulas Used

When preparing for assessments, it’s essential to familiarize yourself with the key formulas that involve these concepts:

- Present Value Formula: PV = FV / (1 + r)^n, where r is the interest rate and n is the number of periods.

- Future Value Formula: FV = PV × (1 + r)^n, where r is the interest rate and n is the number of periods.

By mastering these calculations and concepts, you will be better equipped to solve problems involving investments, loans, and other financial decisions in assessments.

Corporate Finance and Financing Decisions

In any business, the ability to effectively raise capital and allocate resources is essential for long-term success. Companies must make strategic choices about how to fund their operations and growth, weighing the costs and benefits of different financing options. These decisions have a significant impact on a company’s risk profile, profitability, and overall financial health.

The decisions regarding funding sources typically fall into two main categories: equity and debt. While equity involves raising funds by selling ownership stakes in the company, debt involves borrowing money that must be repaid with interest. The challenge lies in determining the optimal balance between these options, as well as managing the financial risks associated with each.

Key Factors in Financing Decisions

- Cost of Capital: The cost of raising funds through either equity or debt. Companies aim to minimize this cost to maximize shareholder value.

- Risk Tolerance: The degree to which a company is willing to take on risk when choosing its financing methods.

- Capital Structure: The mix of debt and equity financing used by a company. An optimal capital structure helps balance risk and return.

- Market Conditions: Economic factors, such as interest rates and investor sentiment, which can influence financing decisions.

Strategies for Raising Capital

Companies use a variety of methods to raise funds, including:

- Issuing Stocks: Raising funds by offering shares of the company to investors.

- Taking on Loans: Borrowing funds from banks or other financial institutions, often secured by company assets.

- Private Equity: Raising capital from private investors in exchange for ownership stakes or debt agreements.

By carefully analyzing these options and understanding the associated risks, businesses can make informed decisions that support growth and sustainability. Effective financing strategies are critical to maintaining a competitive edge and achieving long-term financial goals.

Analyzing Profitability and Efficiency

Assessing a company’s ability to generate profit and use resources effectively is crucial in determining its overall performance. Profitability reflects how well a business can generate earnings relative to its revenue, assets, or equity. Efficiency, on the other hand, measures how well a company utilizes its resources to achieve its goals. Both aspects play a vital role in evaluating the sustainability and growth potential of an organization.

By examining key metrics, businesses can gain insights into their operational effectiveness and identify areas for improvement. This analysis involves evaluating how resources are allocated and how effectively the company converts those resources into profit.

Key Profitability Ratios

- Gross Profit Margin: This ratio measures the percentage of revenue remaining after subtracting the cost of goods sold. It indicates how efficiently a company produces goods or services.

- Operating Profit Margin: This ratio reflects the profitability of the company from its core operations, excluding non-operating items like interest or taxes.

- Net Profit Margin: It shows the percentage of revenue left after all expenses, including taxes and interest, have been deducted.

- Return on Assets (ROA): This ratio shows how efficiently a company uses its assets to generate profit.

- Return on Equity (ROE): A measure of the profitability relative to shareholders’ equity, indicating how effectively the company uses equity capital to generate profits.

Key Efficiency Ratios

- Asset Turnover: This ratio measures how effectively a company uses its assets to generate sales. A higher turnover rate suggests better asset utilization.

- Inventory Turnover: It indicates how often a company sells and replaces its inventory during a period. A high inventory turnover rate suggests effective inventory management.

- Receivables Turnover: This ratio measures how efficiently a company collects its accounts receivable. A higher rate means quicker collection of owed money.

Analyzing these ratios helps businesses understand where they stand in terms of profitability and efficiency, offering insights into potential areas for operational improvement and cost reduction.

Debt Management and Its Implications

Effective handling of borrowed funds plays a pivotal role in the overall health and sustainability of a business. When a company takes on debt, it can provide the capital necessary for growth, expansion, or day-to-day operations. However, the manner in which debt is managed can significantly impact the long-term financial stability of the organization. Properly balancing debt levels, ensuring timely repayments, and assessing the cost of borrowing are essential components of a sound borrowing strategy.

Understanding the risks associated with high levels of debt and its effect on profitability is critical for decision-makers. Uncontrolled debt can lead to liquidity problems, affect credit ratings, and limit future financing options. On the other hand, when debt is managed wisely, it can contribute to business growth and higher returns.

Key Factors in Debt Management

- Debt-to-Equity Ratio: This ratio measures the proportion of a company’s debt relative to its equity. A higher ratio indicates higher financial leverage, which may signal greater risk.

- Interest Coverage Ratio: This ratio assesses a company’s ability to pay interest on its outstanding debt. A higher ratio indicates a stronger ability to cover interest payments from operating income.

- Debt Service Coverage Ratio (DSCR): This ratio compares a company’s cash available to the debt servicing requirements, highlighting the ability to meet long-term debt obligations.

- Leverage Ratio: The leverage ratio shows the extent of a company’s financial leverage, helping to assess its exposure to debt-related risk.

Implications of Debt Levels on Business Operations

Debt levels can have significant consequences on business operations. When debt becomes too burdensome, companies may face cash flow difficulties, making it harder to meet daily operational needs. Additionally, a company with excessive debt may be forced to cut back on investment opportunities, as much of its cash flow is directed towards servicing the debt.

On the other hand, moderate and well-structured debt can provide the necessary liquidity to pursue growth opportunities, such as new projects, acquisitions, or capital expenditures. It can also offer tax advantages, as interest payments on debt are often tax-deductible.

Debt Management Strategies

- Refinancing: Replacing high-interest debt with lower-interest options can help reduce overall financial costs and improve liquidity.

- Debt Restructuring: This strategy involves negotiating with creditors to adjust repayment terms, interest rates, or principal amounts to make debt more manageable.

- Debt Reduction: A proactive approach to reducing debt by using excess cash flow to pay down high-interest loans can help lower financial risk.

- Diversifying Financing Sources: Relying on a variety of financing options, such as equity, debt, and other forms of capital, can reduce the risk associated with over-dependence on debt.

Ultimately, the goal of debt management is to ensure that borrowing supports business objectives without jeopardizing financial stability. A strategic approach to handling debt can lead to increased profitability, improved cash flow, and enhanced growth prospects.

Exam Strategies for Financial Modelling

Creating accurate models that reflect a company’s financial health requires a solid understanding of both theory and practical application. These models are essential tools for evaluating various business scenarios, and the ability to build them effectively is crucial during assessments. Whether working with budgets, forecasts, or long-term planning tools, the goal is to display how different financial variables interact with each other.

Success in constructing these models during an assessment can often be influenced by preparation and strategic thinking. Understanding the structure of the model, being familiar with common formulas, and knowing how to interpret data are key elements that contribute to building robust financial representations.

Key Steps for Successful Financial Modelling

- Understand the Objective: Before diving into the model, it’s essential to grasp the purpose behind the model. Whether it’s for evaluating profitability, liquidity, or risk, understanding the focus will guide your approach and decisions.

- Organize Data Properly: Organizing your input data into clear categories and sections, such as assumptions, income statements, and balance sheets, will help keep the model structured and easy to follow.

- Use Consistent Assumptions: For a model to be reliable, the assumptions used must be logical and consistent across the analysis. These assumptions affect all aspects of the model, so clarity is crucial.

- Focus on Accuracy: Ensure that all calculations, formulas, and assumptions are correct. A small mistake can skew the results and lead to inaccurate conclusions, so precision is key.

Common Pitfalls to Avoid

- Overcomplicating the Model: While it’s important to include relevant factors, making the model too complex can create confusion and increase the likelihood of errors. Stick to essential variables that directly influence outcomes.

- Neglecting Sensitivity Analysis: Testing how sensitive the results are to changes in key assumptions can provide valuable insights. Always ensure that variations in data inputs are considered to understand the model’s flexibility.

- Ignoring Documentation: Clear documentation of assumptions, formulas, and steps taken throughout the modelling process is vital. It helps reviewers follow the logic and ensures that the model can be updated or replicated if needed.

By focusing on these strategies, individuals can improve their ability to build accurate, clear, and insightful models during assessments. Solid preparation, attention to detail, and a structured approach can make all the difference in mastering this important aspect of financial analysis.

Understanding Dividend Policy and Payouts

Companies often face the decision of how to distribute profits to their shareholders, balancing between reinvesting earnings for future growth and rewarding investors. The approach to this decision can vary, but it typically revolves around determining the appropriate level of payouts that aligns with the company’s overall goals and financial health. The payout strategy reflects a company’s priorities, whether it leans towards maintaining reinvestment opportunities or offering attractive returns to its investors.

A well-defined payout policy provides clarity to investors about the company’s approach to returning profits. It also allows for the evaluation of long-term sustainability and growth potential. Factors such as profitability, cash flow, and the stability of earnings all play a significant role in shaping the choices a company makes in terms of payouts.

Types of Payout Policies

- Stable Dividend Policy: In this approach, the company aims to pay a consistent dividend over time, irrespective of short-term earnings fluctuations. This provides predictability for investors, especially those relying on regular income.

- Residual Dividend Policy: Under this method, dividends are paid after all profitable investment opportunities are funded. The payout is a function of the remaining earnings, often leading to variable dividend amounts.

- Constant Payout Ratio: Companies using this strategy distribute a fixed percentage of earnings as dividends. While the payout amount fluctuates with profitability, the ratio remains constant.

Factors Influencing Dividend Decisions

- Profitability: Companies that consistently generate profits are more likely to provide higher payouts, while those with lower earnings may limit their distributions.

- Cash Flow Position: Cash flow is essential for sustaining dividend payments. Companies must have sufficient liquidity to cover dividends, even if their reported earnings are strong.

- Tax Considerations: The tax treatment of dividends can influence how much a company chooses to distribute. In some cases, companies may retain more earnings to avoid higher tax rates on payouts.

- Investment Opportunities: If a company has attractive investment opportunities, it may choose to retain earnings for expansion, reducing the amount available for distribution.

By understanding these policies and the factors that influence dividend decisions, investors can better assess the long-term sustainability of a company’s payout practices. Clear and consistent payout strategies often signal to the market that the company is in a strong financial position, while erratic or inadequate payouts may raise concerns about the business’s financial health or future prospects.

Managing Financial Crises in Business

When a company faces a severe disruption in its operations or cash flow, it must respond quickly and effectively to restore stability. These challenges can arise from various factors such as economic downturns, operational inefficiencies, or unexpected market changes. The key to navigating such difficult situations lies in a combination of strategic foresight, sound decision-making, and effective communication with stakeholders.

Successfully handling a financial crisis often requires reevaluating priorities, cutting non-essential costs, and finding ways to optimize cash flow. In some cases, it may involve securing additional capital or restructuring debt to ensure the company can continue to operate. The response plan should be adaptable and consider both short-term survival and long-term recovery.

Steps for Addressing a Crisis

- Assess the Situation: The first step is to accurately diagnose the problem. This requires a thorough analysis of the company’s financial health, identifying the root causes of the crisis.

- Cut Unnecessary Expenditures: Reducing overhead costs and halting non-essential spending can provide immediate relief, freeing up cash flow for more critical operations.

- Restructure Debt: Negotiating with creditors to extend payment terms or reduce outstanding obligations can alleviate financial pressure and provide more time to recover.

- Secure Additional Capital: In some cases, obtaining new funding through loans or investor capital is necessary to ensure business continuity. However, this should be done carefully to avoid further financial strain.

- Improve Cash Flow: Improving the efficiency of accounts receivable and managing inventory more effectively can help generate the cash needed to cover immediate expenses.

Key Strategies for Long-Term Stability

- Diversify Revenue Streams: Companies that rely too heavily on a single source of income are more vulnerable during a crisis. Diversifying revenue streams can help mitigate risks and ensure financial stability.

- Strengthen Financial Controls: Ensuring that robust financial systems are in place helps companies make better decisions and avoid unnecessary risks during challenging times.

- Enhance Crisis Management Planning: Having a proactive crisis management plan can make it easier to respond quickly in future disruptions, reducing the negative impact on the business.

In summary, while financial crises are an inevitable part of doing business, their impact can be minimized through quick action, effective resource allocation, and long-term planning. By staying agile and focusing on core priorities, a company can emerge stronger after a crisis and be better prepared for future challenges.

How to Approach Financial Management Exams

Approaching any assessment focused on key business principles requires careful preparation, a solid understanding of core concepts, and the ability to apply theoretical knowledge to real-world scenarios. When faced with tests that assess your knowledge on budgeting, analysis, and strategic decision-making, it is essential to adopt a structured approach to maximize your performance.

Begin by reviewing all the topics covered in the course. Focus on understanding the key principles and their applications, rather than memorizing formulas or definitions. Real-world examples help to contextualize the material, making it easier to recall under pressure. Additionally, practicing problem-solving and case studies can enhance your ability to work through complex scenarios quickly and efficiently.

Key Preparation Tips

- Master Core Concepts: Understand the basic principles thoroughly. Whether it’s cost analysis, risk assessment, or capital budgeting, having a solid foundation will help you tackle any problem posed during the test.

- Use Practice Materials: Go through past assignments, case studies, and sample problems. This will give you a feel for the types of questions you may encounter and help you improve your problem-solving skills.

- Organize Study Time: Set aside dedicated time to review and practice. Break your study sessions into manageable chunks, and focus on one topic at a time to avoid overwhelming yourself.

- Learn to Interpret Data: Often, assessments will provide you with financial reports, graphs, and tables. Being able to interpret and analyze this data quickly is crucial for answering application-based questions.

Approach During the Test

- Read Instructions Carefully: Make sure you fully understand each question before diving into calculations or explanations. Misinterpreting the prompt can lead to wasted time and incorrect answers.

- Start with What You Know: Begin with the questions that seem easiest or most familiar. This will build confidence and ensure you don’t waste time on difficult problems early on.

- Show Your Work: In quantitative questions, make sure to show all your calculations. This not only demonstrates your thought process but also helps to earn partial credit if your final answer is wrong.

- Manage Time Wisely: Allocate your time based on the difficulty and weight of each section. Keep track of time to ensure that you can address every question, giving more time to complex problems.

In conclusion, a well-planned approach to studying and tackling these assessments will significantly improve your ability to perform under pressure. Consistent preparation, clear understanding of the material, and an organized approach to the test itself are the keys to success.