Preparing for legal assessments in the field of financial regulations and governmental spending requires a thorough understanding of core concepts and their applications. Students often encounter complex scenarios that test their ability to analyze legal texts, interpret guidelines, and apply theoretical knowledge to practical situations. Success in these evaluations depends on one’s ability to grasp both foundational and advanced topics, ensuring a comprehensive approach to answering questions under time constraints.

In this section, we will explore strategies for navigating the essential topics covered in the course, focusing on how to break down questions, identify key issues, and craft well-structured responses. By familiarizing yourself with the key components and their interrelationships, you can improve your ability to address common challenges and avoid common pitfalls. Understanding how to approach these types of assessments will provide you with the confidence needed to perform well and demonstrate your proficiency in this area of study.

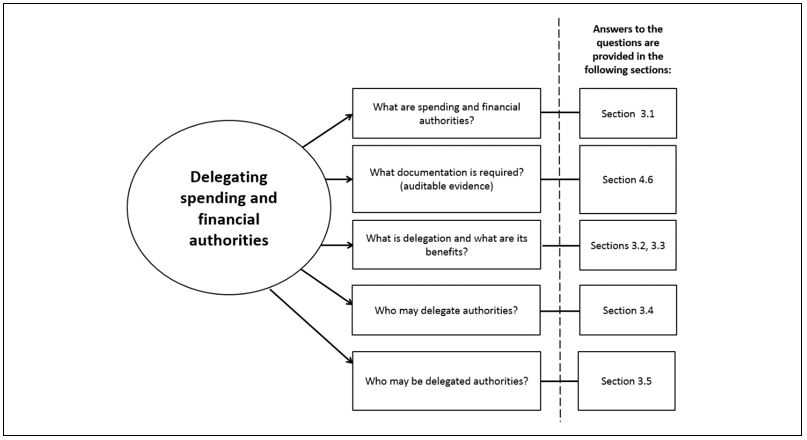

Key Insights for Mastering Government Spending Regulations

Understanding the framework governing government funds and financial decision-making is critical for any student or professional working in public sector administration. This section delves into essential concepts related to the allocation, management, and legal boundaries of public resources. Grasping these areas will enhance one’s ability to navigate complex scenarios often presented in assessments, requiring a keen eye for detail and precision in addressing specific challenges related to fiscal control.

To excel in such evaluations, it is vital to approach each question with a clear methodology. This involves identifying the core issues at play, interpreting the relevant guidelines, and applying legal and administrative precedents to propose effective solutions. Mastering these techniques ensures a solid grasp of the subject matter, improving both comprehension and performance during the review process.

Success in this area relies not only on memorizing rules but also on understanding how these regulations are practically applied. By simulating real-world situations, students can develop the analytical skills needed to craft well-reasoned arguments and provide comprehensive, structured responses under examination conditions.

Key Concepts in Government Funding Regulations

Grasping the foundational concepts that govern the distribution and control of public funds is essential for anyone working in governmental financial management. These concepts form the bedrock of understanding how resources are allocated, monitored, and restricted, ensuring that public finances are used appropriately and responsibly. Whether for academic evaluation or real-world application, these principles guide the decision-making processes within the public sector.

Budget Allocation and Resource Management

At the heart of public sector financial oversight is the proper allocation of funds across various government programs and services. This process involves setting priorities, balancing competing needs, and ensuring that funds are used effectively. Proper management of these resources is crucial for maintaining the integrity and accountability of public spending. Understanding the mechanisms behind these decisions helps ensure that financial allocations align with legislative guidelines and ethical standards.

Legal Constraints and Spending Authority

Every government expenditure is subject to legal constraints designed to prevent misuse or overextension of public funds. These restrictions outline the scope of authority given to public entities in making financial decisions. It is essential to recognize how legal frameworks define the limits of spending power and ensure compliance with relevant regulations. This ensures transparency, preventing misuse of funds while safeguarding public trust in government processes.

Understanding Key Guidelines in Financial Regulations

A deep comprehension of the guidelines that shape the management and distribution of public funds is essential for ensuring compliance and accountability in government operations. These standards help define the boundaries within which financial decisions are made, ensuring that expenditures align with established frameworks and objectives. Understanding these rules is crucial for navigating the complexities of financial management in the public sector.

These guidelines are built on several core concepts that govern public financial processes. Here are some of the most important elements to grasp:

- Resource Allocation – Defining how funds are divided among different government sectors and programs.

- Spending Limits – Setting clear boundaries on how funds can be used, ensuring financial decisions remain within legal parameters.

- Oversight and Accountability – Establishing mechanisms to monitor and evaluate the use of public funds, ensuring transparency and responsible spending.

- Legal Restrictions – Understanding the legal framework that governs the use of government money and the consequences of misuse.

By understanding these key elements, one can approach financial management in the public sector with confidence, ensuring all decisions are legally sound and ethically responsible.

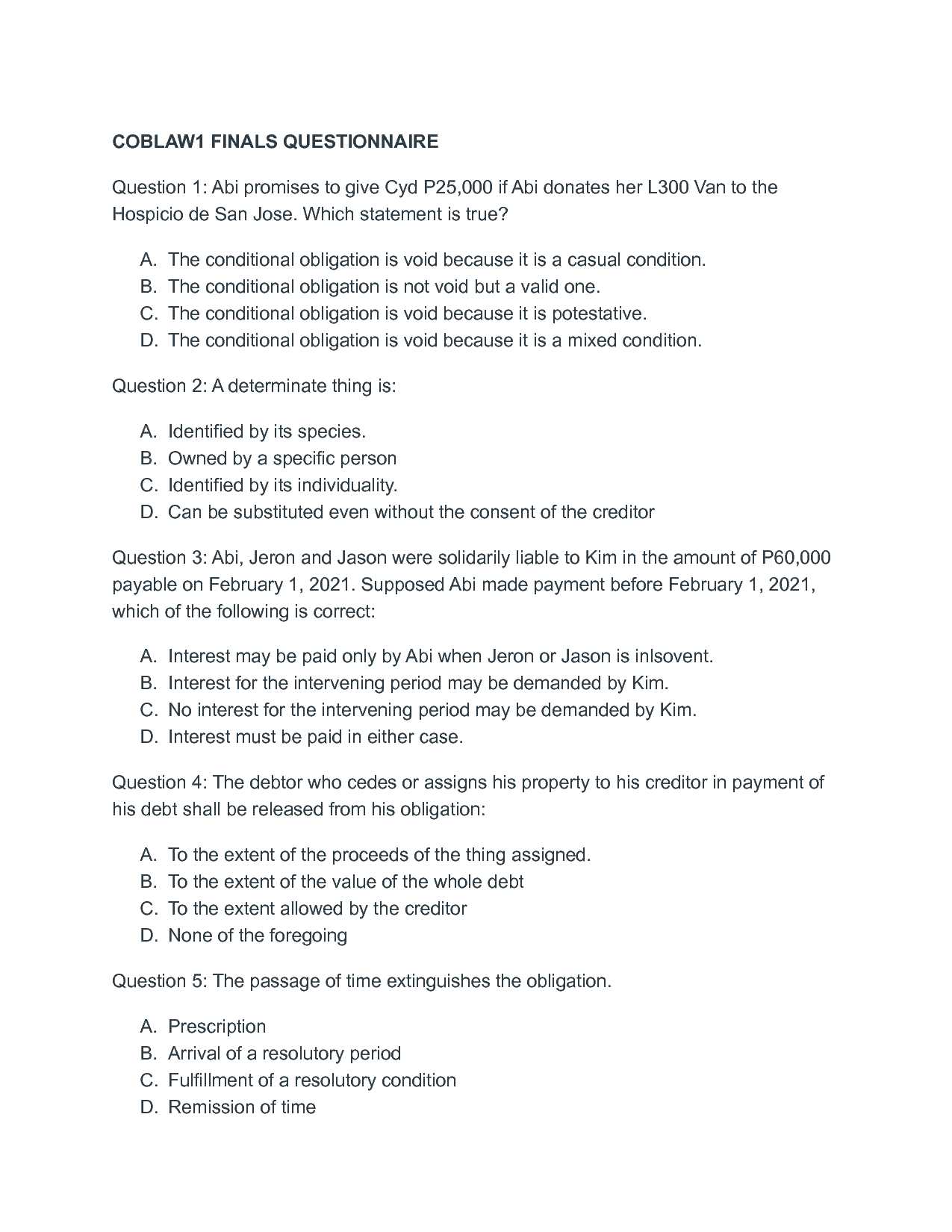

Common Mistakes on the Assessment

When preparing for a financial regulation assessment, students often face challenges that arise from misunderstanding core concepts or misapplying guidelines. These mistakes can hinder their ability to present accurate and well-supported responses. Identifying and avoiding these common errors is key to improving performance and ensuring that each question is addressed with precision.

Below is a table outlining some of the most frequent mistakes made during assessments, along with suggestions for improvement:

| Common Mistake | Suggested Solution |

|---|---|

| Misinterpreting the scope of regulations | Carefully read each question to understand the specific context and limits of financial decision-making being tested. |

| Failure to apply relevant precedents | Review key legal precedents and ensure they are applied to support your arguments in each response. |

| Overlooking the importance of budgeting restrictions | Ensure you clearly understand the rules around financial limits and constraints when making decisions related to public funds. |

| Inadequate analysis of resource distribution | Focus on how resources are allocated and justify your reasoning with proper examples and references. |

| Not addressing accountability mechanisms | Be sure to discuss the mechanisms for overseeing and evaluating public spending when appropriate. |

By being aware of these common pitfalls, you can refine your approach to assessments and improve the clarity and accuracy of your responses, ultimately achieving better results.

Steps to Prepare for Government Spending Assessment

Preparing for an assessment on government financial management involves a structured approach to mastering key concepts, understanding the application of rules, and developing the ability to analyze complex scenarios. Successful preparation not only relies on memorizing information but also on building a deeper understanding of how principles apply to real-world situations. Below are the essential steps to ensure readiness and increase your chances of success.

1. Review Core Concepts

Start by revisiting the foundational topics that form the core of public resource management. Understand the allocation, distribution, and legal restrictions governing public spending. Familiarize yourself with the key terms and their implications in the context of government budgeting and fiscal responsibility.

2. Analyze Past Cases and Scenarios

Study previous case studies or practice problems that reflect typical situations you might encounter. Analyze how the relevant rules were applied in these examples and what outcomes resulted from different decisions. This exercise helps in honing analytical thinking and improves your ability to apply theoretical knowledge practically.

3. Understand Legal Frameworks

Make sure you are clear on the legal constraints that govern public funds. Review the key restrictions and guidelines that dictate the spending powers of government entities. Understanding the boundaries of financial decisions will help you avoid errors and ensure that your answers remain within the defined limits.

4. Practice Time Management

Time management is crucial during any assessment. Practice answering questions within the time limits to improve efficiency. Focus on structuring your responses clearly and concisely, ensuring that you address each part of the question without rushing.

5. Take Practice Tests

Finally, simulate the test environment by taking practice exams. These tests will help you gauge your understanding, identify areas for improvement, and become more comfortable with the format and timing of the assessment. By regularly testing your knowledge, you can build confidence and refine your approach.

Importance of Budgeting in Government Financial Management

Effective budgeting is crucial for ensuring the proper management of public funds. It serves as the foundation for making informed financial decisions, guiding how money is allocated across various government sectors. Proper budgeting ensures that financial resources are used efficiently and in compliance with regulatory requirements. Without a well-structured budget, the risk of misallocation, waste, or misuse of public funds increases, potentially undermining public trust and the effectiveness of government programs.

Ensuring Accountability and Transparency

A robust budgeting process helps maintain accountability and transparency in government financial operations. By outlining exactly how funds will be spent, governments can provide a clear record of financial decisions. This openness not only strengthens public confidence but also helps ensure that spending aligns with legal and ethical standards. Budgeting is a tool for both the oversight of public funds and the prevention of misuse, making it an indispensable component of government management.

Aligning Financial Resources with Government Priorities

Budgeting also plays a critical role in aligning financial resources with the priorities of a government. Through careful planning and allocation, a government can ensure that funds are directed towards programs and services that are most critical to its citizens. Whether it’s education, healthcare, infrastructure, or social welfare, budgeting helps ensure that the most urgent needs are met first, contributing to the overall well-being of society.

How to Analyze Legal Questions Effectively

Effectively analyzing legal questions requires a systematic approach to breaking down complex scenarios and applying relevant regulations or guidelines. It involves recognizing the key issues at play, understanding the context, and drawing from precedents or rules that can guide your conclusions. By focusing on clarity and structure, you can develop well-supported, logical responses to any legal query.

To begin, carefully read and comprehend the question. Identify the specific problem it presents and any important facts or constraints. Understanding the underlying facts is critical, as they often determine how specific regulations or guidelines apply in each case.

Next, consider the applicable frameworks or guidelines that govern the situation. These could include regulations, statutes, or case law that provide the necessary boundaries for decision-making. Pay attention to how these rules relate to the facts of the case and ensure that they align with the scenario presented.

Finally, construct your answer by outlining your reasoning step by step. Begin with the general legal context, then apply the relevant rules, and finally explain how those rules lead to your conclusion. This clear, methodical approach ensures that your analysis remains focused and logically consistent, addressing each aspect of the question comprehensively.

Real-World Applications of Financial Management Guidelines

The practical application of financial management guidelines plays a crucial role in the day-to-day operations of government organizations. These standards ensure that funds are allocated properly, and help to maintain accountability and transparency in public spending. By adhering to these frameworks, governments can make informed financial decisions that align with societal needs while ensuring compliance with regulations.

Government Budget Allocation

One of the most significant real-world applications of these financial guidelines is in the process of budget allocation. Public sector entities use these standards to determine how resources are distributed across various departments, ensuring that essential services are funded adequately and responsibly. Whether it’s education, healthcare, infrastructure, or defense, these guidelines help ensure that financial resources are spent efficiently and in accordance with legal constraints.

Managing Public Sector Projects

Another key application is the management of public sector projects. From building infrastructure to funding research initiatives, these financial regulations guide how government entities manage expenditures for large-scale projects. By following these principles, governments can prevent overspending, ensure transparency, and make adjustments as needed to stay within budgetary limits.

| Application Area | Real-World Example |

|---|---|

| Budget Allocation | Distributing funds for national healthcare programs |

| Project Management | Funding the construction of public infrastructure such as roads and bridges |

| Resource Oversight | Monitoring government spending on defense and security operations |

These applications showcase how crucial it is to apply these financial frameworks in real-world settings. They help to ensure that public funds are used in a manner that serves the best interests of the public while remaining accountable to the law.

Strategy for Analyzing Legal Case Studies

When tackling legal case studies, a clear and methodical approach is essential for effectively addressing the issues presented. The key to success lies in understanding the facts of the case, identifying the core legal questions, and applying relevant rules and precedents to form a well-reasoned argument. By following a structured strategy, you can ensure that your responses are coherent, well-supported, and demonstrate a comprehensive understanding of the subject matter.

The first step is to thoroughly read the case study, paying close attention to the facts and circumstances surrounding the legal dispute. Identify the key players, the issues at hand, and any potential conflicts. This will allow you to frame your response within the context of the case.

Next, focus on identifying the relevant regulations, rules, or precedents that apply to the situation. This requires understanding how specific guidelines are meant to be interpreted and applied in various scenarios. Consider how the facts of the case align with these rules, and where conflicts or ambiguities might arise.

Finally, structure your response logically by breaking it down into clear sections: start with an introduction that summarizes the case, followed by a detailed analysis of the legal issues, and conclude with a well-reasoned resolution. This step-by-step approach not only helps to clarify your thinking but also ensures that you address every aspect of the case methodically.

Common Legal Terms in Government Financial Management

Understanding key terminology is crucial when navigating the complex realm of government financial regulations. Certain terms are frequently used to define the rules and procedures governing public funds, and a clear grasp of these concepts ensures that one can interpret and apply them effectively in real-world scenarios. Below, we explore some of the most common terms encountered in the context of managing government finances.

| Term | Definition |

|---|---|

| Budget Authority | The legal authority granted to an entity to incur obligations and make expenditures for a specified purpose. |

| Obligation | A legal commitment that requires payment, such as a contract or a purchase order, resulting in the expenditure of government funds. |

| Fiscal Year | A twelve-month period used for budgeting, accounting, and reporting, typically beginning on October 1 and ending on September 30 in many government agencies. |

| Sequestration | A process through which specific budgetary funds are automatically reduced to enforce spending limits set by legislation. |

| Appropriation | The authorization by a legislative body to allocate funds for specific government spending or activities. |

| Reprogramming | The process of reallocating funds within an approved budget to cover unanticipated needs or priorities. |

These terms represent just a small selection of the vocabulary critical for understanding how government entities manage public resources. By familiarizing yourself with these key concepts, you can better navigate the intricacies of public sector financial management and ensure compliance with regulations governing public expenditures.

How to Interpret Legal Texts Correctly

Interpreting legal texts requires precision and a clear understanding of both the language used and the context in which the text is applied. Legal documents, whether statutes, regulations, or contractual agreements, are written with specific meanings in mind, and it’s essential to approach them systematically to ensure accurate interpretation. A careful analysis helps avoid misapplication and ensures that decisions are made in accordance with the intended legal framework.

Here are some key steps to correctly interpret legal texts:

- Read Carefully and Thoroughly: Begin by reading the text multiple times to grasp its full meaning. Pay attention to every word, as legal language often uses precise terms that may differ from everyday language.

- Consider the Context: Understanding the context in which the document was created is crucial. Look at the surrounding provisions, related regulations, and the purpose of the law or agreement. This will help clarify the intent behind specific clauses.

- Identify Key Terms: Legal texts often contain specialized vocabulary. Make sure to research or consult a legal dictionary for terms that might have a specific legal definition.

- Follow the Hierarchy: In case of conflicting statements within a document or across different documents, identify the hierarchy of laws or provisions. Higher-level regulations typically override lower-level ones.

- Use Precedents: When available, consider relevant case law or previous interpretations of similar texts. Court decisions can provide valuable insights into how particular terms or provisions should be applied.

- Seek Expert Opinion: In more complex cases, consulting with a legal professional can help clarify ambiguities and provide an expert interpretation tailored to the specific situation.

By following these steps, one can ensure a well-rounded and accurate interpretation of legal documents, which is essential for effective decision-making and compliance.

Best Resources for Studying Government Financial Regulations

When preparing for a deep understanding of government funding rules and financial guidelines, it is essential to use high-quality study materials. These resources provide comprehensive coverage of the rules, procedures, and applications of government spending practices. Below is a list of some of the most valuable tools and resources that can help enhance your knowledge and support your studies in this complex field.

| Resource | Description |

|---|---|

| Official Government Websites | Websites such as usa.gov provide direct access to federal regulations, budgetary guidelines, and official documents that explain government financial procedures. |

| Federal Budget Manual | A comprehensive guide that outlines the procedures for budgeting within the U.S. federal government. It includes critical processes for funding allocation, execution, and control. |

| Online Legal Databases | Platforms like LexisNexis and Westlaw offer access to statutes, regulations, and case law that explain the financial frameworks guiding public sector funding. |

| Textbooks on Government Spending | Books dedicated to government finance and fiscal management provide foundational knowledge and practical examples of financial regulations in action. |

| Academic Journals | Articles in journals like Public Administration Review offer insights into the current trends, issues, and case studies related to public sector budgeting and financial laws. |

| Professional Seminars and Workshops | Attending seminars and workshops led by legal and financial experts can provide real-time case studies and opportunities to ask questions about specific regulations and applications. |

By using these diverse and credible resources, you can ensure a thorough and informed approach to mastering government financial regulations. Each of these materials provides a unique perspective, helping you develop a well-rounded understanding of the subject matter.

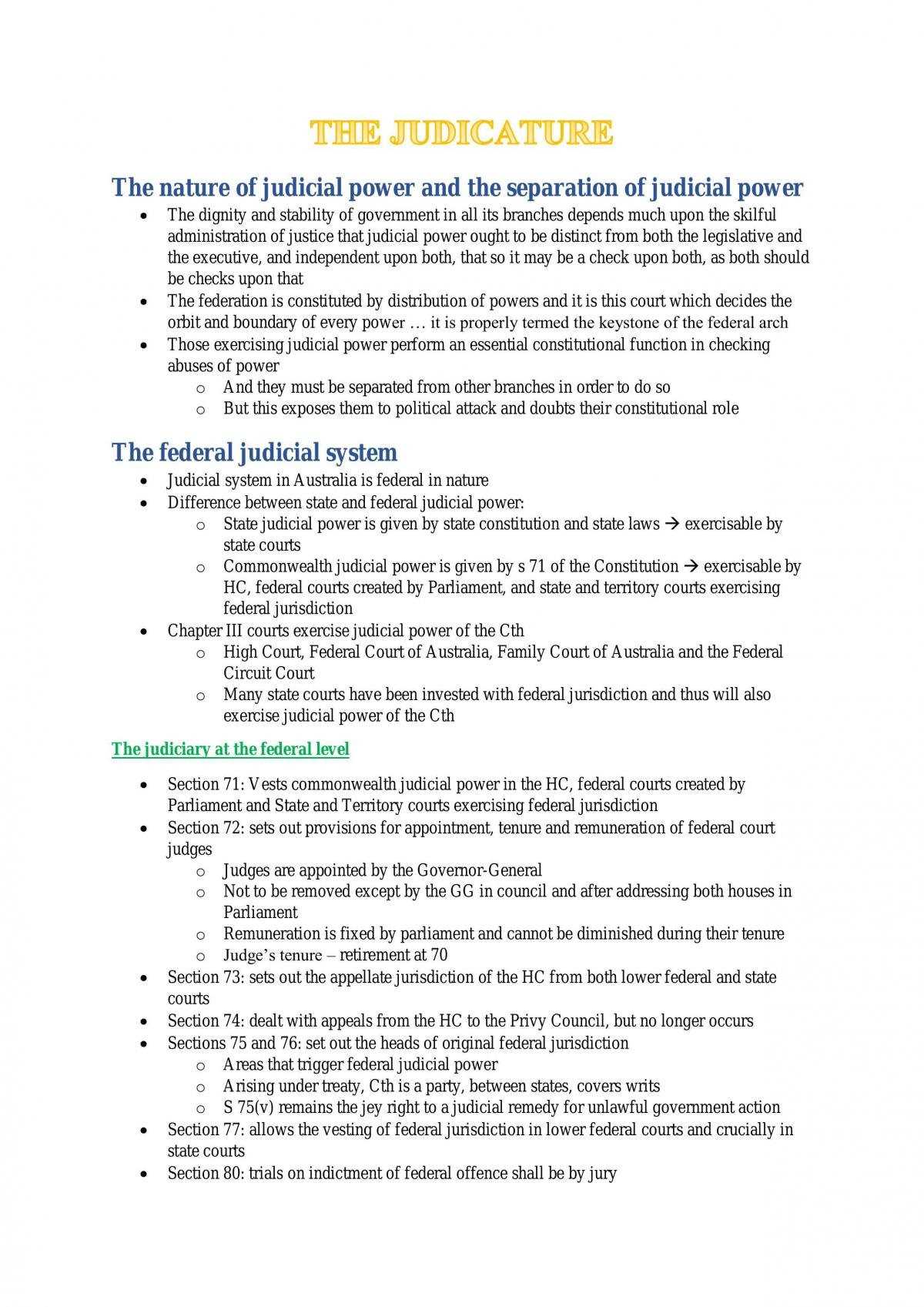

Understanding Legal Precedents in Exam Context

In preparing for assessments that deal with legal concepts, it is crucial to understand how previous court decisions shape the interpretation and application of current rules. Legal precedents, or past rulings, often serve as a guide for analyzing new cases, offering insights into how certain legal principles are applied in various situations. Grasping the relevance of these precedents is vital for effectively responding to questions that require detailed legal analysis.

Importance of Precedents in Legal Analysis

Legal precedents offer a structured approach to understanding complex issues. They are critical in the process of legal reasoning, as they allow for consistency and predictability in the application of rules. When answering questions in an academic context, consider the following:

- Consistency: Precedents provide a stable framework for interpreting new cases based on prior judgments.

- Guidance: They offer insights into how courts have previously ruled on similar issues, helping to predict likely outcomes.

- Argumentation: Citing relevant precedents strengthens your arguments and demonstrates a deep understanding of the material.

How to Utilize Precedents in Assessments

When approaching a case study or a theoretical question, remember the following steps to incorporate precedents effectively:

- Identify Relevant Precedents: Before beginning your answer, scan for past rulings that closely align with the issues at hand.

- Analyze the Ruling: Understand how the precedent was applied and why it was significant in shaping legal reasoning.

- Apply Precedents Thoughtfully: Use them to justify your analysis, showing how similar principles can be applied to the current scenario.

By understanding and using legal precedents correctly, you will be able to craft well-supported, coherent responses that demonstrate your ability to apply established principles to new contexts.

Time Management Tips for Final Exam

Effective time management is essential when preparing for and completing assessments, especially those that require deep understanding and careful analysis. Balancing the time spent on reading, planning, and writing your responses is critical to achieving success. By managing your time wisely, you can ensure that you approach each task strategically, maximizing your ability to demonstrate your knowledge and reasoning skills.

Strategies to Manage Your Time During Assessments

Adopting time management techniques will help you stay focused and organized throughout your assessment. Below are some practical tips:

- Prioritize Tasks: Identify the most complex questions and allocate more time to them, while leaving easier questions for later.

- Set Time Limits: Assign a specific amount of time for each section or question to ensure you don’t get stuck on one task.

- Plan Breaks: Schedule short breaks during long assessments to refresh your mind and avoid mental fatigue.

Preparation Tips for Better Time Management

Proper preparation is key to efficient time use during an assessment. Implement the following steps to enhance your time management skills:

- Review Past Materials: Spend time revising key topics and concepts ahead of the assessment, so you can answer questions confidently without needing excessive time for recall.

- Practice with Timed Mock Tests: Familiarize yourself with answering questions under time constraints to build confidence and improve your pacing.

- Outline Your Responses: Before diving into writing, quickly outline your main points to stay organized and focused during the assessment.

By following these time management strategies, you can ensure that you utilize every minute of your assessment efficiently, reducing stress and improving the quality of your responses.

Commonly Asked Questions on Don Principles

In any complex field, there are common queries that often arise, particularly when the subject matter involves intricate rules and regulations. Understanding the most frequently asked questions can provide clarity and enhance comprehension, making it easier to apply these concepts in various contexts. Below are some of the most common questions that individuals may have when exploring this area.

Frequently Asked Questions

Here are some of the key questions that are often asked regarding the subject matter, along with concise answers:

- What is the main purpose behind these concepts? These ideas aim to establish clear guidelines for managing resources effectively, ensuring that funds and processes are handled properly within a defined framework.

- How do these rules impact decision-making? Understanding the guidelines allows for more informed and compliant decision-making, ensuring that actions are taken within the boundaries of set regulations.

- Are there any key steps to follow in applying these rules? Yes, there are several steps to follow, including thorough understanding, careful planning, and consistent application to ensure correct outcomes.

Addressing Common Misunderstandings

Many individuals have misconceptions about certain aspects of these guidelines. Below are a few of the most common misunderstandings and their clarifications:

- Misunderstanding: The rules are too rigid to allow flexibility. Clarification: While the guidelines are structured, there is room for flexibility within the framework, provided the core objectives are met.

- Misunderstanding: Compliance is difficult to achieve. Clarification: With proper training and attention to detail, compliance can be achieved more easily, and is essential for long-term success.

- Misunderstanding: The process is time-consuming and burdensome. Clarification: When approached systematically, the process can be streamlined, making it much more efficient.

By addressing these common questions and misconceptions, individuals can gain a deeper understanding of the rules and confidently apply them in practical scenarios.

Overview of Key Legal Precedents

In any area of regulation or governance, previous rulings and decisions serve as foundational points for understanding current practices. These precedents help define boundaries and set expectations for future cases, ensuring consistency in decision-making. This section provides an overview of some of the most significant precedents that shape the current landscape.

Important Precedents and Their Impact

Throughout history, there have been key decisions that influenced the framework of rules. These rulings are often cited in legal discussions and have a lasting impact on how current issues are addressed. Some of the most important precedents include:

- Ruling 1: Early Landmark Case – This case established the basic principles regarding how funds should be allocated, setting the stage for future regulatory frameworks.

- Ruling 2: Mid-Century Court Decision – This ruling reinforced the application of specific provisions, clarifying how they should be interpreted in the context of contemporary situations.

- Ruling 3: Recent Court Interpretation – More recent rulings continue to refine the guidelines, offering updated interpretations and solutions to emerging issues.

Application of Precedents in Practice

Understanding how legal precedents are applied can significantly improve the comprehension of the rules in practice. Here are a few examples of how they are used:

- Precedent 1: Direct Application in Policy – Legal precedents often serve as the foundation for new policies, guiding lawmakers in making informed decisions based on past rulings.

- Precedent 2: Resolving Conflicts – When new disputes arise, these precedents can be referenced to ensure that decisions align with established principles.

- Precedent 3: Shaping Future Legislation – Precedents are frequently cited in legislative sessions, influencing future laws and regulations that reflect ongoing societal needs.

By reviewing key precedents, individuals can gain a deeper understanding of how past decisions shape current practices, ultimately leading to more informed actions and decisions in the future.

How to Structure Your Final Exam Responses

When faced with complex questions, organizing your responses in a clear and logical manner is essential. A well-structured answer not only helps convey your understanding effectively but also allows you to demonstrate your ability to think critically and logically. Here’s how you can structure your responses to maximize clarity and impact.

1. Read the Question Carefully

Before writing anything, take a moment to thoroughly understand the question. Identify the key components and determine what is being asked. This step ensures that your response stays focused and relevant to the topic.

2. Start with a Clear Introduction

Begin your response with a concise introduction that sets the stage for your argument. Provide a brief overview of the main points you will cover, giving the reader a roadmap of what to expect. Avoid going into too much detail here; the introduction should simply outline the approach you plan to take.

3. Organize the Body Logically

The body of your response should be organized into coherent sections that address each part of the question. Use subheadings or bullet points to break down complex concepts and make it easier for the reader to follow your reasoning. Each section should flow naturally from one to the next, and you should provide evidence or examples to support your points.

- Start with the most important points to capture the main ideas first.

- Use clear and specific examples to demonstrate your understanding and application of the topic.

- Explain your reasoning to show how you arrived at your conclusions.

4. Conclude with a Strong Summary

End your response with a concise conclusion that summarizes the key points you’ve made. Reaffirm your main argument or insight and provide a final reflection on the topic. Avoid introducing new information in the conclusion; it should simply wrap up your discussion.

5. Review Your Response

Once you have completed your answer, take the time to review it. Check for clarity, coherence, and accuracy. Ensure that you have answered all aspects of the question and that your writing is free of errors. Revising your response can help improve its overall quality and effectiveness.

By following these steps, you can present your knowledge in a clear, organized, and well-supported manner, increasing your chances of success in any assessment.