As you approach your upcoming assessment in economic theory, it’s essential to review the core principles that drive market behavior and decision-making. Understanding the underlying concepts will not only help you answer questions confidently but also allow you to apply these principles in real-world scenarios.

Focus on key topics like supply and demand dynamics, different market structures, and the economic role of firms and consumers. A solid grasp of these subjects will be crucial for navigating the test and ensuring your success.

Studying efficiently and prioritizing the areas with the greatest weight will give you the edge. This guide will highlight the most important concepts and offer useful tips to prepare effectively.

Economics Test Preparation Plan

To succeed in your upcoming assessment, it is important to create a focused and effective study plan. Prioritize the most relevant topics, allocate sufficient time to each, and use a mix of resources to ensure thorough understanding. A strategic approach will help you retain key information and tackle complex questions with confidence.

Start by reviewing foundational concepts like market equilibrium, elasticity, and production functions. Allocate extra time to areas that challenge you the most, whether it’s understanding market structures or analyzing the role of government in economic systems. Break your study sessions into manageable chunks, taking regular breaks to stay fresh and focused.

Utilize practice problems to reinforce your knowledge, and consider discussing difficult topics with peers or professors. Consistent and active engagement with the material will enhance your retention and improve your overall performance on the test.

Key Topics to Review for Test

To ensure you are fully prepared for the upcoming test, it’s crucial to focus on the most significant topics. These core concepts form the foundation of the subject and will be heavily featured in the assessment. Reviewing these areas thoroughly will help you answer a wide range of questions with ease.

Essential Concepts to Master

- Supply and demand principles

- Market structures and their characteristics

- Elasticity and its applications

- Consumer and producer theory

- Costs of production and profit maximization

Key Areas for Focus

- Price determination and market equilibrium

- Role of government in economic systems

- Types of market failures and their solutions

- Monopolies and competition analysis

- Short-run and long-run economic behavior

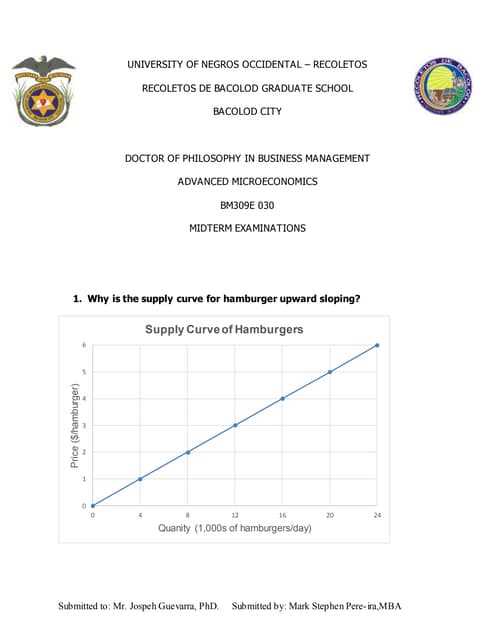

Understanding Supply and Demand Curves

The relationship between the quantity of goods and their price is one of the most fundamental concepts in economics. The interaction between buyers and sellers shapes market outcomes and influences prices. A deep understanding of supply and demand curves helps explain how markets function and how equilibrium is reached.

Key Concepts of Demand Curve

- The demand curve typically slopes downward, reflecting that as prices decrease, the quantity demanded increases.

- Factors affecting demand include consumer income, preferences, and the price of related goods.

- Shifts in the demand curve can occur due to changes in external factors, like trends or economic conditions.

Key Concepts of Supply Curve

- The supply curve generally slopes upward, indicating that as prices rise, producers are willing to supply more of a good.

- Production costs, technological advances, and the number of suppliers affect the supply curve.

- Shifts in the supply curve can happen due to factors like changes in production technology or input prices.

Perfect Competition in Economics

Perfect competition represents an idealized market structure where numerous buyers and sellers participate, and no single entity can influence the market price. In this type of market, goods are homogenous, and all participants have perfect knowledge about prices and availability, leading to an efficient allocation of resources.

In a perfectly competitive market, firms are price takers, meaning they accept the market price as given and cannot set their own. This creates a situation where the forces of supply and demand determine the price, with minimal room for individual firms to affect market outcomes.

Characteristics of Perfect Competition

- Numerous Buyers and Sellers: Many firms and consumers operate in the market, ensuring no one has significant power to set prices.

- Homogeneous Products: All firms sell identical products, meaning consumers have no preference for one seller over another.

- Free Market Entry and Exit: Firms can easily enter or exit the market without barriers, maintaining competition.

- Perfect Information: All participants have complete knowledge about prices, product quality, and availability.

Impact on Efficiency

- Allocative Efficiency: Resources are allocated to their highest value use, as the price reflects the true cost of production.

- Productive Efficiency: Firms produce at the lowest possible cost, as competition forces them to minimize waste and optimize production.

Market Failures and Externalities Explained

Markets typically function efficiently when supply and demand are in balance. However, there are situations where the market fails to allocate resources in a socially optimal way. These failures often occur due to imperfections or external factors that influence the production or consumption of goods and services.

Externalities, both positive and negative, are a common cause of market failure. These occur when the actions of individuals or firms have side effects on others that are not reflected in the market price. In many cases, these externalities lead to overproduction or underproduction of certain goods, resulting in an inefficient allocation of resources.

Types of Market Failures

- Public Goods: Goods that are non-excludable and non-rivalrous, meaning that one person’s consumption does not reduce availability for others. Examples include clean air and national defense.

- Monopolies: When a single firm dominates the market, limiting competition and potentially leading to higher prices and reduced innovation.

- Asymmetric Information: When one party has more or better information than the other, which can lead to suboptimal decisions and market inefficiencies.

Understanding Externalities

- Negative Externalities: These occur when the social cost of a good or service exceeds the private cost, leading to overproduction. Pollution is a prime example.

- Positive Externalities: These happen when the social benefit of a good or service exceeds the private benefit, often resulting in underproduction. Education and vaccination programs are common examples.

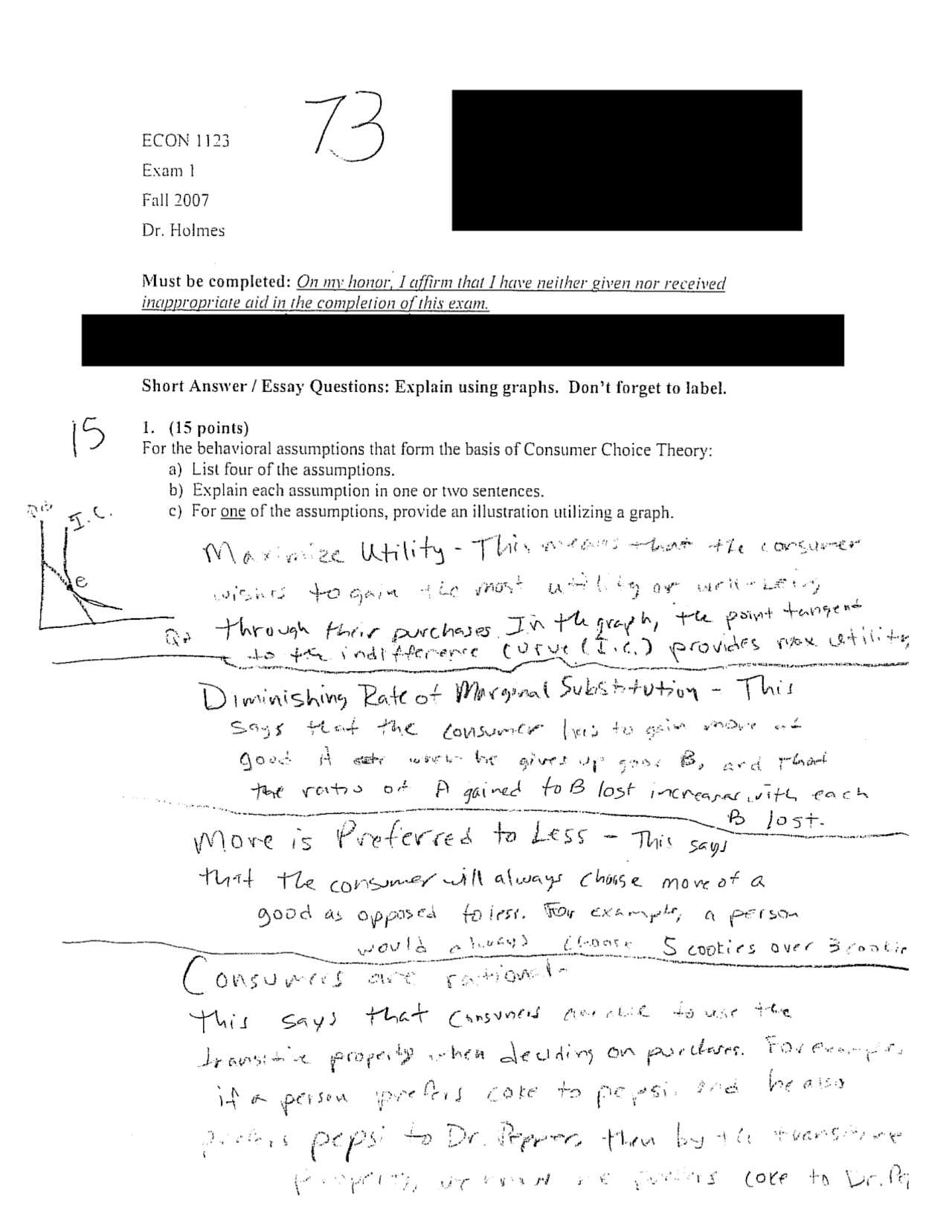

How to Analyze Consumer Behavior

Understanding consumer behavior is essential for analyzing how individuals make purchasing decisions. Various factors influence these choices, including preferences, income, and the prices of related goods. By examining these elements, we can predict how consumers will respond to changes in the market.

To analyze consumer behavior effectively, it’s important to break it down into several key areas. These areas help identify what drives demand and how consumers allocate their resources among different goods and services.

Key Factors Affecting Consumer Decisions

- Income Levels: The amount of income available to consumers plays a crucial role in determining how much they can afford to spend and which products they choose.

- Price Sensitivity: Consumers often respond to price changes, with some goods being more elastic than others. Understanding price elasticity helps predict how demand will change with price fluctuations.

- Preferences and Tastes: Changes in consumer preferences can significantly influence demand. Trends, advertising, and social factors often shape these preferences.

- Substitute and Complementary Goods: The availability and price of substitute goods (products that can replace another) or complementary goods (products often used together) impact consumer choices.

Methods for Analyzing Behavior

- Demand Curve Analysis: By studying how demand changes with variations in price, we can understand consumer sensitivity to price changes.

- Budget Constraints: Analyzing the trade-offs consumers face when deciding how to allocate their limited income across different goods and services.

- Utility Maximization: Consumers aim to maximize their satisfaction or utility from the goods and services they consume, considering their preferences and constraints.

Cost Structures in Different Markets

The cost structure of a firm plays a critical role in determining its pricing strategy, profitability, and market behavior. Depending on the type of market a firm operates in, its costs can vary significantly. These differences are often driven by the level of competition, production processes, and the number of firms in the market.

In some markets, firms experience economies of scale, where the cost per unit decreases as production increases, while in others, costs may remain fixed or even rise with higher output. Understanding the cost structures across different market types helps businesses make informed decisions regarding pricing, production, and long-term strategy.

Cost Structures in Perfect Competition

- Homogeneous Products: Firms produce identical goods, which leads to minimal room for differentiation in pricing.

- Firms as Price Takers: Firms have no control over the market price and must accept the prevailing price set by the market.

- Efficient Cost Management: Firms produce at the lowest possible cost to stay competitive, which ensures productive efficiency.

Cost Structures in Monopoly Markets

- High Barriers to Entry: The dominant firm in the market often has significant control over pricing due to barriers that prevent new competitors from entering.

- Price-Making Behavior: The monopolist can set prices higher than in competitive markets, resulting in higher profit margins.

- Economies of Scale: A monopolist often experiences lower costs per unit as they expand production, leading to potential cost advantages over smaller competitors.

Price Elasticity of Demand and Supply

Price elasticity is a crucial concept in understanding how the quantity of a good or service demanded or supplied changes in response to price fluctuations. It helps determine how sensitive consumers and producers are to price changes, influencing market behavior and decision-making.

When the price of a product changes, both demand and supply can react in different ways depending on their elasticity. If a product is highly elastic, small changes in price can lead to significant changes in the quantity demanded or supplied. Conversely, if the product is inelastic, price changes have little impact on the amount consumers are willing to buy or producers are willing to sell.

Price Elasticity of Demand

- Elastic Demand: When the quantity demanded changes significantly with a small price change, typically for non-essential goods or those with many substitutes.

- Inelastic Demand: When the quantity demanded does not change much with price variations, often seen in necessities or goods with few alternatives.

- Unitary Elastic Demand: When the percentage change in quantity demanded is exactly equal to the percentage change in price.

Price Elasticity of Supply

- Elastic Supply: When producers can increase production easily in response to price increases, typically for goods that are quick and inexpensive to produce.

- Inelastic Supply: When producers cannot easily adjust the quantity supplied in response to price changes, often due to production constraints or limited capacity.

- Unitary Elastic Supply: When the percentage change in quantity supplied is exactly equal to the percentage change in price.

Monopolies and Their Economic Impact

Monopolies occur when a single firm dominates an entire market, controlling the production and pricing of a specific good or service. This market structure has significant implications for both consumers and producers, often leading to inefficiencies and a reduction in consumer welfare. In contrast to competitive markets, monopolies can influence prices, output levels, and innovation, with consequences that vary depending on how the monopoly is regulated or controlled.

The economic impact of monopolies extends beyond price manipulation. While they can benefit from economies of scale and enjoy high profits, monopolistic behavior often results in higher prices, reduced choice, and stifled innovation. Additionally, monopolists may not have the same incentives to improve product quality or customer service compared to firms in competitive markets.

Positive and Negative Impacts of Monopolies

- Positive Aspects: Monopolies can lead to lower costs per unit of production due to economies of scale, making it possible to invest in research and development.

- Negative Aspects: Consumers often face higher prices, less variety, and limited access to alternatives. Market efficiency is often reduced, leading to deadweight loss.

Comparing Monopoly and Perfect Competition

| Aspect | Monopoly | Perfect Competition |

|---|---|---|

| Market Power | High control over prices | None, price takers |

| Price Level | Typically higher | Determined by supply and demand |

| Consumer Choice | Limited variety | Numerous alternatives |

| Efficiency | Lower, due to lack of competition | Higher, driven by competition |

Profit Maximization Strategies for Firms

Maximizing profits is the primary goal for most businesses. To achieve this, firms must carefully manage both costs and revenues while adjusting their strategies according to market conditions. By optimizing production, pricing, and operational efficiency, businesses can increase their profit margins and sustain long-term growth.

Profit maximization can be approached in several ways, depending on the market structure, competitive landscape, and the resources available to the firm. The strategies typically involve finding the optimal balance between output levels and the cost of production while also considering consumer demand and competitive pressures. Below are some key strategies that firms often use to maximize their profits.

Key Strategies for Maximizing Profits

- Cost Reduction: Minimizing operational costs through efficient production techniques, outsourcing, and supply chain optimization.

- Pricing Strategy: Setting prices at a level that maximizes revenue while considering demand elasticity, competition, and consumer willingness to pay.

- Product Differentiation: Offering unique features or services that make the product more attractive to consumers, allowing the firm to charge higher prices.

- Market Segmentation: Identifying specific market segments and targeting them with tailored products or services, optimizing revenue per segment.

- Capacity Utilization: Ensuring that production facilities and resources are used efficiently to maximize output without overextending resources.

Long-Term Profit Maximization Approaches

- Innovation and Research: Investing in research and development to create new products, improve existing ones, or enhance operational efficiency.

- Economies of Scale: Expanding production to lower average costs and increase profitability as the business grows.

- Strategic Partnerships: Collaborating with other firms to share resources, technology, or market access to increase competitiveness and profitability.

Production Functions and Marginal Returns

In any production process, firms must understand how inputs translate into outputs. The relationship between the resources used in production and the resulting output is captured through production functions. These functions help businesses determine how efficiently they are using their resources, and they are fundamental for making decisions about resource allocation, cost management, and scaling operations.

One of the key concepts related to production functions is the idea of marginal returns. Marginal returns refer to the additional output produced when an extra unit of input is added, keeping all other inputs constant. Initially, adding more of a resource might lead to greater output, but as more units are added, the additional output tends to decrease. This is known as diminishing marginal returns, a principle that helps firms understand the optimal level of resource use in the production process.

Understanding the Law of Diminishing Returns

- Initial Gains: When a firm begins increasing one factor of production, such as labor, the output typically increases at an increasing rate due to more efficient resource use.

- Decreasing Returns: After reaching a certain point, adding more of one input results in less efficient output increases, leading to diminishing returns.

- Negative Returns: If too much of one input is added while others remain fixed, output may actually decrease, resulting in negative returns.

Applications of Production Functions

- Cost Management: Understanding production functions helps firms optimize their costs by determining the point at which adding more inputs no longer contributes to higher output.

- Optimal Resource Allocation: Firms can determine the most efficient combination of inputs to maximize output without over-investing in one area.

- Scaling Decisions: The production function assists firms in deciding when and how to scale their operations based on expected returns from additional inputs.

Market Structures: Oligopoly vs Monopoly

Market structures define the characteristics of the competitive environment in which firms operate. Understanding these structures is crucial for evaluating how companies interact, set prices, and achieve market power. Two common types of market structures are oligopoly and monopoly, each with distinct features that impact competition, pricing, and consumer choice.

An oligopoly occurs when a market is dominated by a small number of large firms, leading to limited competition. In this environment, firms are interdependent, meaning their decisions regarding pricing, production, and market entry are influenced by the actions of their competitors. A monopoly, on the other hand, exists when a single firm dominates the entire market, often due to barriers to entry that prevent other competitors from entering the space. This lack of competition gives the monopolist significant control over prices and output.

Key Differences Between Oligopoly and Monopoly

- Number of Firms: In an oligopoly, there are a few dominant firms, while a monopoly is characterized by a single firm controlling the entire market.

- Market Control: Firms in an oligopoly have limited control over prices because of the competition between them, whereas a monopolist has full control over the price and output of the product or service.

- Barriers to Entry: Barriers to entry are relatively high in both market structures, but they are more significant in monopolies, which often result from government regulation, patents, or control over a critical resource.

- Product Differentiation: Oligopolies may have differentiated products, but monopolies typically offer a unique product with no close substitutes, giving them a stronger market position.

Impact on Consumers and the Economy

- Price Levels: In a monopoly, prices are usually higher because the monopolist is the only provider, while in an oligopoly, firms may engage in competitive pricing strategies to gain market share.

- Consumer Choice: A monopoly limits consumer choice to one product or service, while an oligopoly offers more options, but often with less differentiation.

- Market Efficiency: Monopolies are often less efficient due to the lack of competition, leading to potential consumer welfare loss, while oligopolies may result in more competitive practices, but still face inefficiencies due to collusion risks.

The Role of Government in Markets

The government plays a crucial role in shaping the functioning of markets by regulating and intervening in various ways to ensure fairness, efficiency, and stability. While markets are primarily driven by supply and demand forces, government involvement can address market failures, protect consumers, and promote economic welfare. Understanding the government’s role is essential for comprehending how economies operate and how policies can impact business activities and consumer choices.

Governments typically intervene in markets through regulations, subsidies, taxes, and the provision of public goods. These actions aim to correct imbalances, protect the environment, and ensure equitable access to essential resources. Without proper regulation, markets can often lead to monopolistic behavior, resource misallocation, and negative externalities, which could undermine public welfare.

Key Government Functions in Markets

| Government Action | Purpose | Example |

|---|---|---|

| Regulation | Ensures fair competition and prevents monopolistic behavior | Antitrust laws preventing price-fixing |

| Subsidies | Encourages production or consumption of certain goods | Subsidies for renewable energy production |

| Taxation | Discourages harmful consumption and raises government revenue | Excise tax on tobacco products |

| Public Goods | Provides essential services that are not profitable for private firms | National defense, public education |

By balancing market forces with appropriate interventions, the government can ensure that markets function in ways that benefit society at large. These actions help reduce inequality, encourage innovation, and protect consumers from harmful practices. Ultimately, government involvement is critical in maintaining a stable and equitable market environment.

Understanding Elasticities in Real Life

Elasticity refers to the responsiveness of demand or supply to changes in price or other economic factors. In everyday life, understanding how products and services respond to price changes can help consumers and businesses make informed decisions. Elasticities offer insights into how much the quantity demanded or supplied will change when prices fluctuate, which can have a significant impact on markets and individual behaviors.

In the real world, elasticities affect everything from how businesses set prices to how governments tax goods and services. For example, when the price of a product increases, consumers may buy less of it if the product is considered elastic, while for inelastic goods, price hikes may have little impact on demand. Recognizing the elasticity of products in different sectors helps businesses and policymakers make more effective strategies.

Types of Elasticities

- Price Elasticity of Demand (PED): Measures how much the quantity demanded changes when the price of a product changes. If demand is highly responsive, the product is considered elastic.

- Price Elasticity of Supply (PES): Measures how much the quantity supplied changes when the price of a product changes. It is useful for businesses in determining how quickly they can adjust production levels.

- Income Elasticity of Demand (YED): Refers to how the quantity demanded of a product changes as consumer income levels change. Luxury goods tend to have high income elasticity, while necessity goods are typically less elastic.

- Cross-Price Elasticity of Demand (XED): This refers to how the quantity demanded of one product changes when the price of another related product changes. For example, if the price of coffee rises, the demand for tea may increase if they are substitutes.

Real-Life Examples of Elasticities

- Luxury Goods: Expensive cars and designer clothing often exhibit high elasticity. A small increase in price can lead to a significant decrease in demand as consumers look for more affordable options.

- Necessities: Basic goods like bread or medicine tend to have inelastic demand. Even if prices rise, consumers will continue to purchase these items because they are essential.

- Gasoline Prices: Gasoline typically has inelastic demand, especially in the short term. People still need to drive, even if prices increase, though demand may decrease in the long term as consumers switch to more fuel-efficient vehicles.

Understanding elasticities is essential for both businesses and consumers to navigate fluctuating markets. By analyzing how demand and supply react to changes, firms can optimize pricing strategies, and policymakers can make informed decisions on taxation and subsidies.

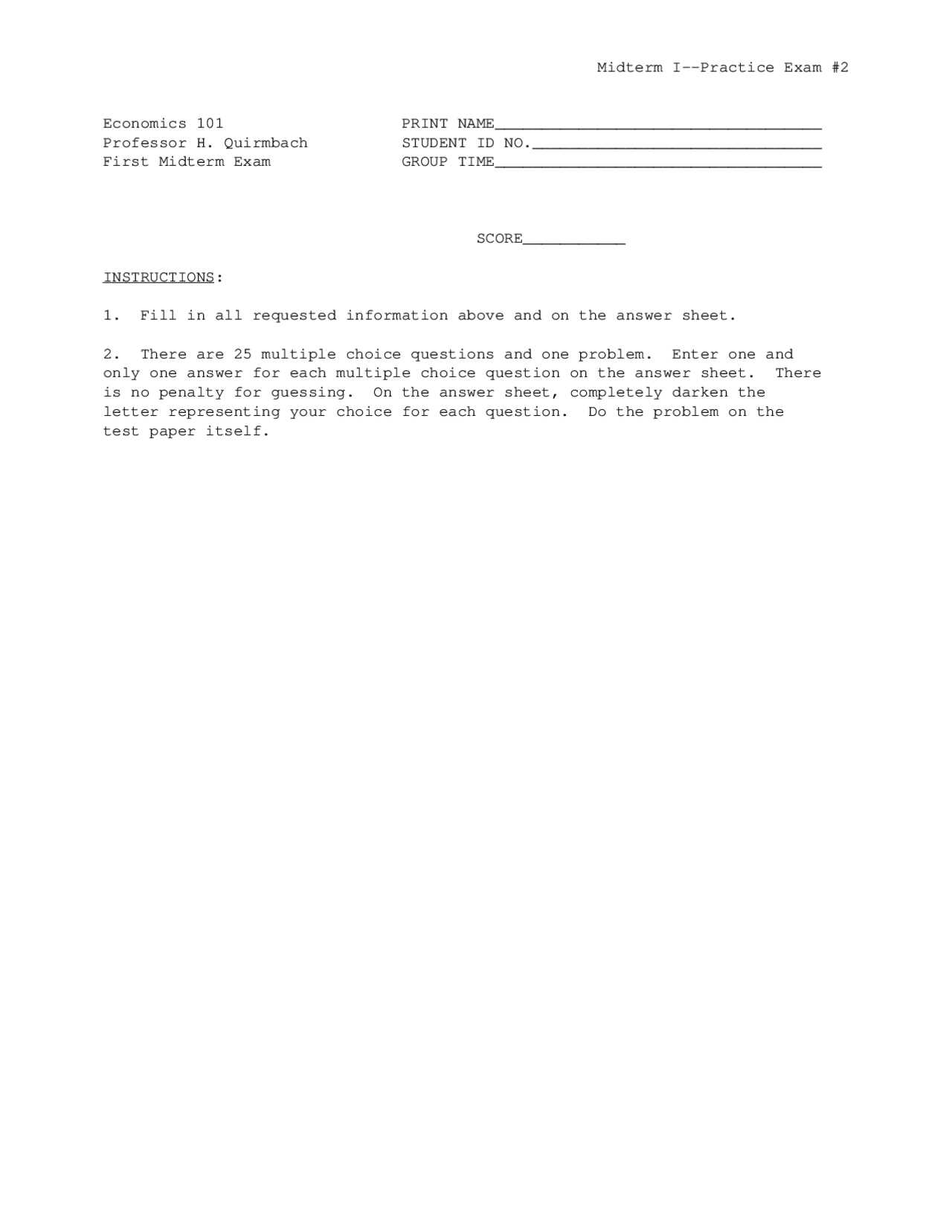

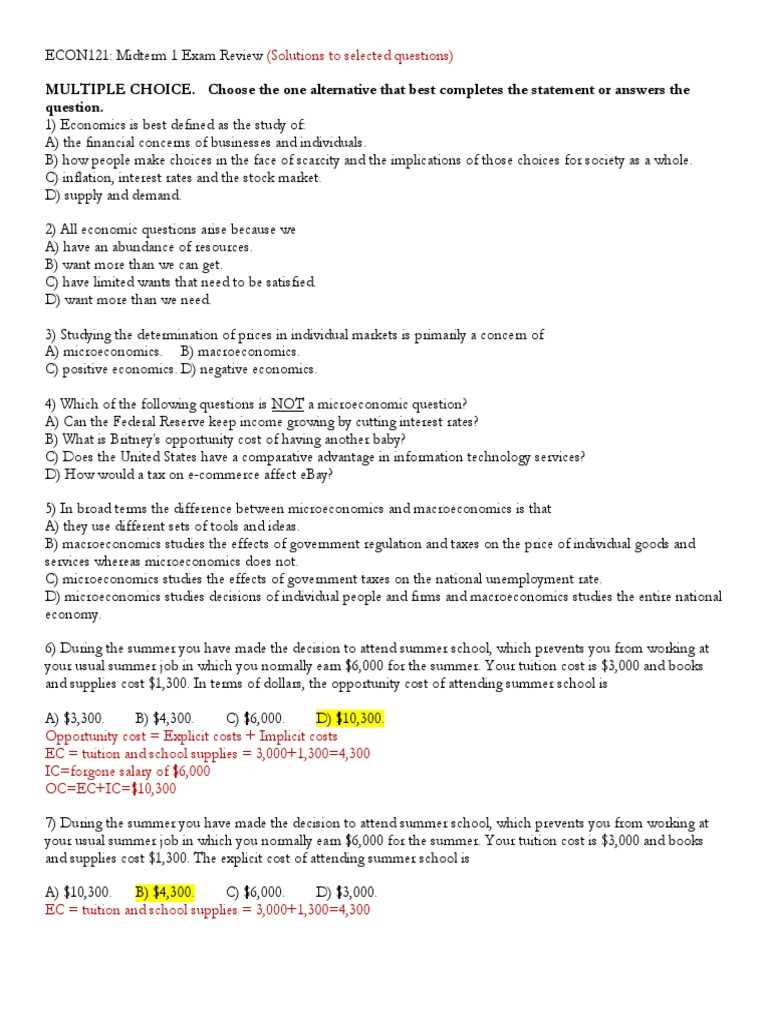

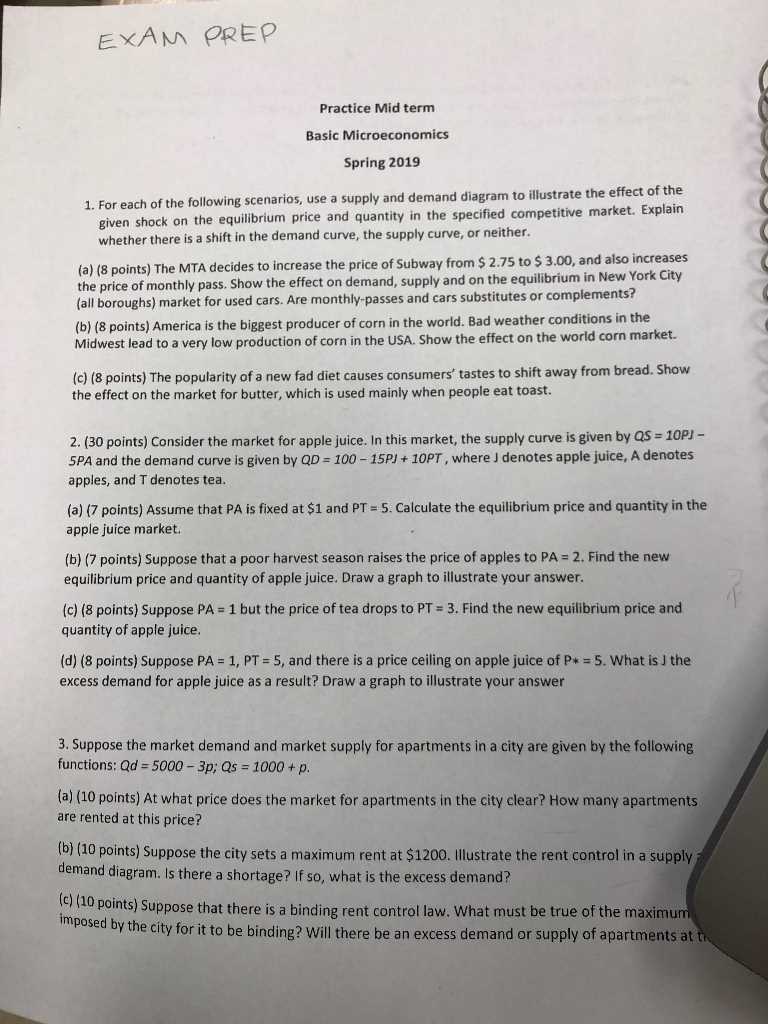

What to Expect on the Economic Assessment

When preparing for an upcoming evaluation in economics, it’s important to understand the key areas that will be tested. This type of evaluation typically covers a wide range of topics related to how markets operate, consumer behavior, and the principles that drive supply and demand. You can expect to encounter both theoretical questions and practical applications that require you to analyze various scenarios and concepts.

The content may include questions that test your understanding of economic models, the implications of different market structures, and the factors that influence the decisions of consumers and firms. Additionally, you will likely need to demonstrate how to apply these concepts to real-world situations. The format might include multiple-choice questions, short-answer questions, and problem-solving exercises that require a clear explanation of your reasoning.

Common Topics Covered

- Supply and Demand Analysis: Expect to answer questions about shifts in the curves, price determination, and market equilibrium.

- Elasticity: Be prepared to calculate and interpret the price elasticity of demand and supply, along with other forms of elasticity.

- Market Structures: Questions may cover the characteristics and outcomes of different market structures such as perfect competition, monopoly, and oligopoly.

- Consumer Behavior: You might be asked to explain how consumers make choices and allocate their resources.

- Cost Structures: Understanding how costs behave in different industries and how firms optimize production will be key in solving related problems.

Tips for Success

- Review Key Concepts: Make sure you understand the fundamental principles that drive the economy, such as how supply and demand interact, or how different market structures function.

- Practice Problem Solving: Work through past questions and practice problems to ensure you can apply theoretical knowledge to real-world situations.

- Understand Graphs and Models: Many questions will require you to interpret graphs or economic models, so be sure you can accurately draw and analyze them.

- Focus on Definitions: Be clear on key terms and their definitions, as many questions will require you to explain concepts accurately.

By focusing on these areas and preparing strategically, you will be well-equipped to approach the assessment with confidence. Stay organized, practice regularly, and approach each question methodically to ensure your success.

Top Study Tips for Midterm Success

Preparing for a major assessment in economics requires effective study strategies and disciplined time management. Success doesn’t only depend on how much you study but on how you approach the material. To maximize your performance, it’s important to develop a study plan, focus on understanding core concepts, and practice problem-solving skills. This guide outlines some essential tips to help you prepare for your upcoming evaluation.

Study Tips for Success

- Start Early: Begin your preparation well ahead of the deadline. Cramming at the last minute can lead to stress and poor retention of information.

- Understand Key Concepts: Rather than memorizing, focus on understanding the underlying principles. Know the definitions, but also understand how they apply in different scenarios.

- Practice with Past Questions: Working through previous questions will familiarize you with the format and types of problems you may encounter.

- Teach Someone Else: One of the best ways to reinforce your understanding is to explain concepts to others. Teaching forces you to clarify your own understanding.

- Group Study Sessions: Study groups can be useful for discussing difficult topics. Make sure to stay focused on the material and use group time effectively.

Time Management Strategies

- Create a Study Schedule: Break your study sessions into manageable chunks. Allocate more time to areas where you feel least confident.

- Prioritize Difficult Topics: Identify the areas where you need the most improvement and spend extra time on them. Don’t neglect the easier topics, but focus on strengthening your weaknesses.

- Take Breaks: Study for no more than 90 minutes at a time without a break. Taking short breaks will help you stay focused and avoid burnout.

Additional Tips for Success

- Stay Organized: Keep all your study materials in one place, and organize your notes by topic to make reviewing easier.

- Stay Healthy: Never underestimate the power of a good night’s sleep, proper nutrition, and exercise in keeping your mind sharp.

- Stay Calm and Confident: Confidence comes from preparation. Stay calm, take deep breaths, and trust in your ability to perform well.

Study Schedule Example

| Time | Activity |

|---|---|

| 9:00 AM – 10:30 AM | Review key concepts (supply & demand, elasticity) |

| 10:30 AM – 10:45 AM | Take a 15-minute break |

| 10:45 AM – 12:00 PM | Practice with past questions |

| 12:00 PM – 1:00 PM | Lunch break |

| 1:00 PM – 2:30 PM | Review graphs and market structures |

| 2:30 PM – 2:45 PM | Take a 15-minute break |

| 2:45 PM – 4:00 PM | Group study session or teaching someone else |

By following these tips and creating a structured plan, you can effectively prepare for your assessment and boost your chances of success. Remember, consistent and focused study sessions are key to mastering the material and performing well on the test.