Mastering essential concepts related to managing money, investments, and planning for the future is crucial for students seeking success in their assessments. Understanding the core principles that guide financial decisions will not only help you answer questions accurately but also provide a solid foundation for real-life situations. This guide focuses on key areas that are often tested, offering helpful insights and strategies for grasping these concepts effectively.

From budgeting and saving to making informed investment choices, every aspect plays a significant role in shaping your understanding. Whether you’re tackling questions about loans, taxes, or retirement planning, being familiar with each topic will improve your ability to analyze and respond to complex scenarios. By reviewing the material from multiple angles, you’ll be better prepared to navigate various challenges and demonstrate your expertise on the subject.

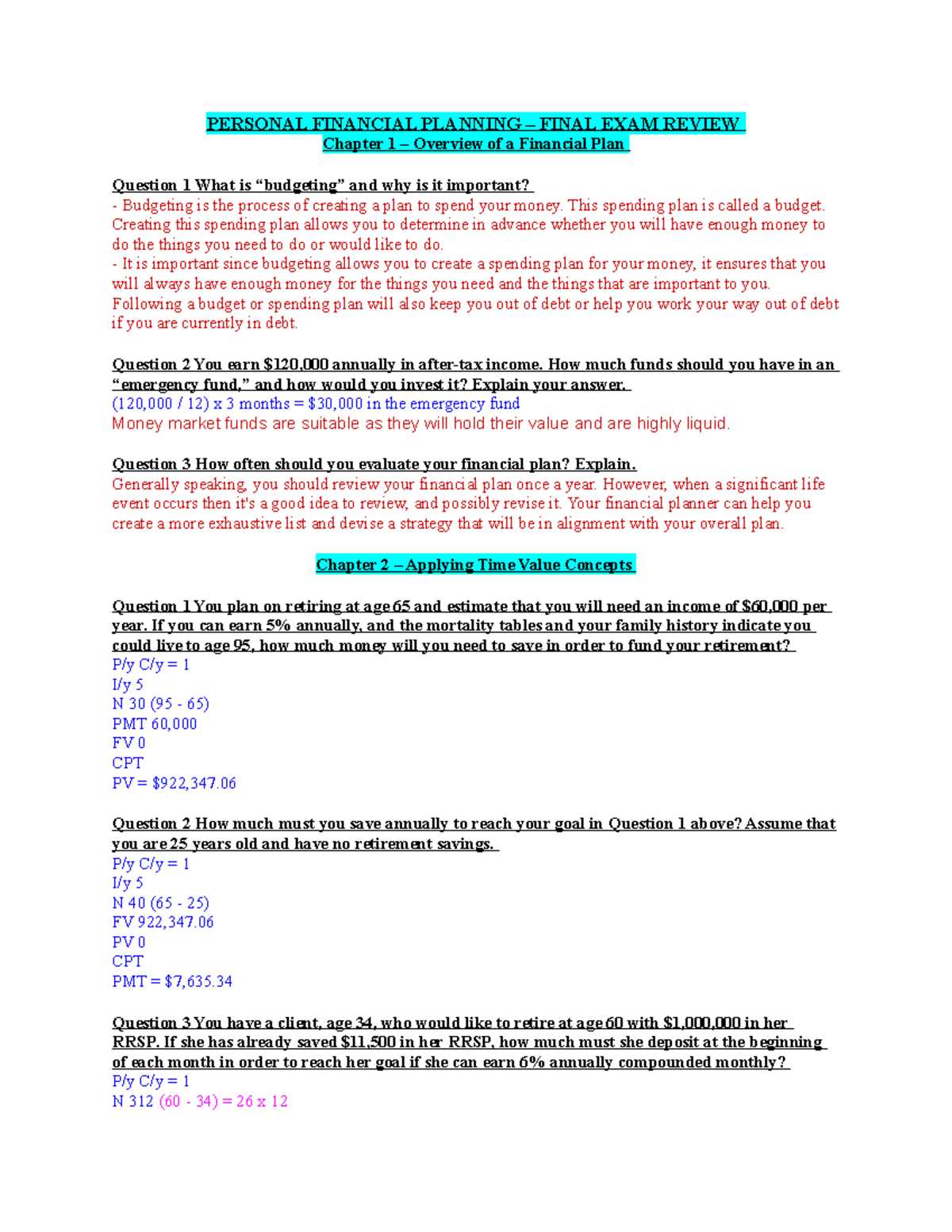

Personal Finance Final Exam Review Answers

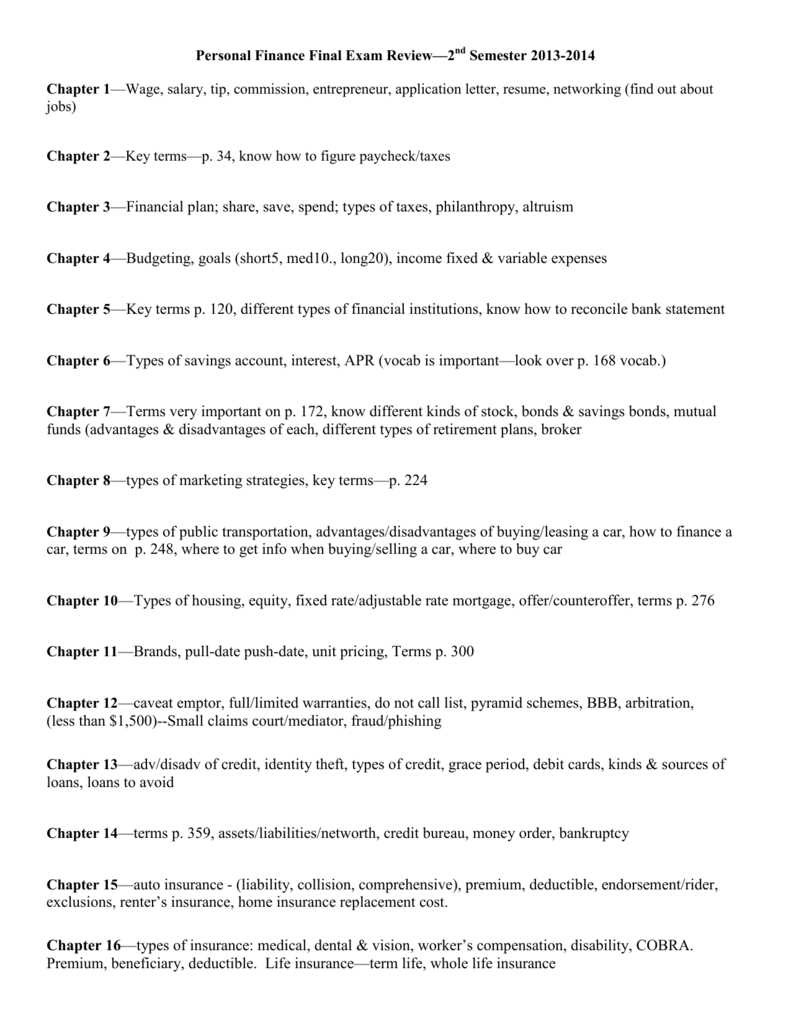

In order to excel in your financial assessment, it’s important to understand a variety of key principles that govern the way we handle money, investments, and long-term planning. Mastery of these concepts will allow you to address complex questions with confidence. This section provides a breakdown of critical topics that are likely to appear, helping you to review essential material and prepare thoroughly for the test.

Key areas include understanding how budgeting, saving, and managing expenses can directly impact one’s financial well-being. Additionally, being able to navigate topics like debt management, taxes, and retirement strategies is fundamental. By reinforcing your knowledge in these subjects, you’ll be able to demonstrate a clear grasp of the material and apply it to real-world situations. Whether you’re asked to evaluate investment options or calculate interest rates, a strong foundation in these concepts is essential for success.

Key Concepts for Personal Finance Exams

To excel in your financial assessment, understanding core concepts is crucial. These principles will help you navigate questions related to managing money, investments, and planning for the future. A deep understanding of these areas will enable you to address a wide range of topics confidently. Below is a summary of the most important concepts that often appear in assessments, providing a solid foundation for your preparation.

| Concept | Description |

|---|---|

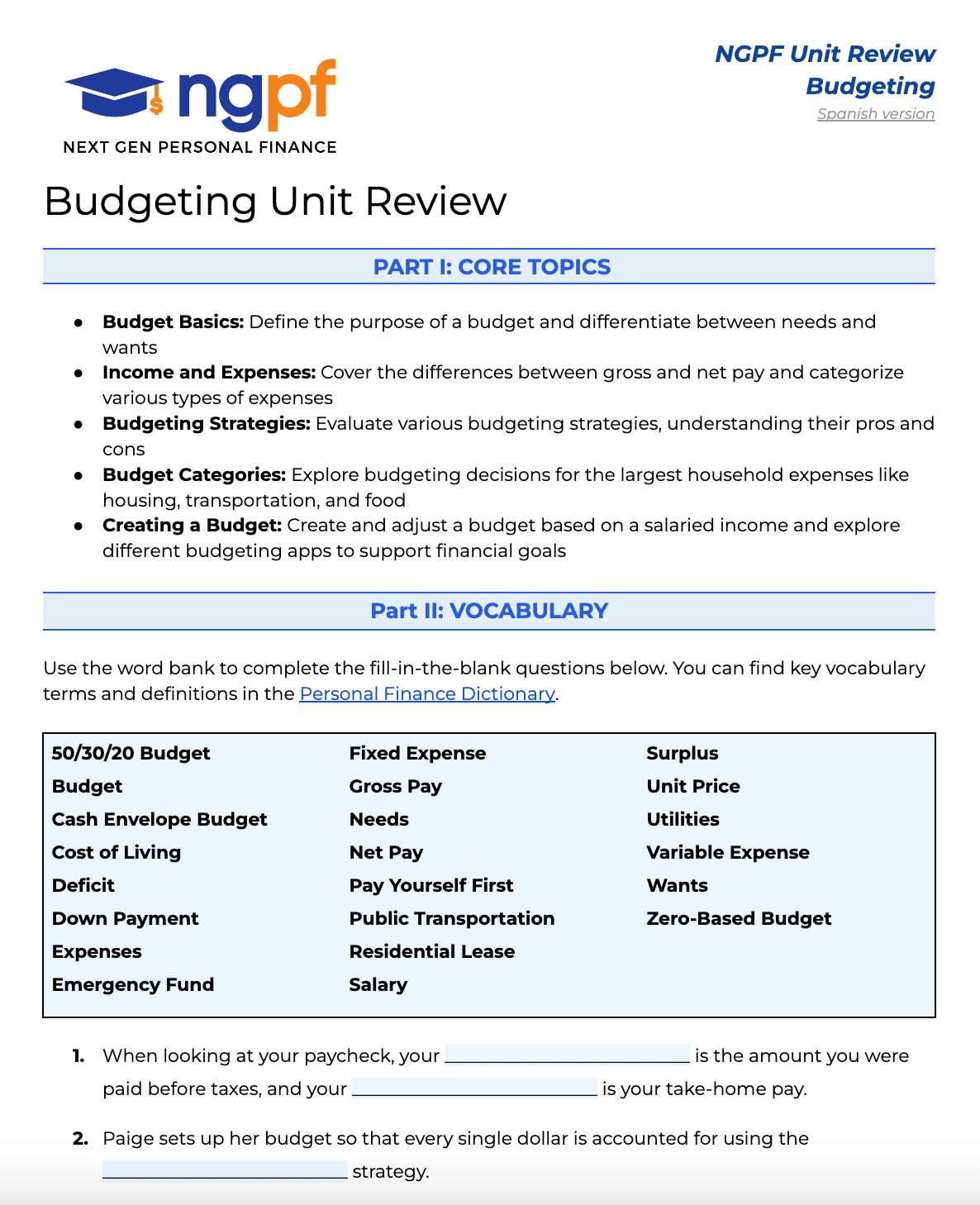

| Budgeting | Learning how to allocate income and control spending to achieve financial goals. |

| Debt Management | Understanding how to manage liabilities and make informed decisions about borrowing. |

| Investments | Grasping the basics of stocks, bonds, and other investment vehicles for wealth-building. |

| Interest Rates | Understanding how interest affects loans, savings, and investments. |

| Taxes | Knowing how taxes influence income, expenses, and investment returns. |

| Retirement Planning | Planning for future financial security through savings and investment strategies. |

Understanding Budgeting for Financial Success

Effective management of resources is a key factor in achieving long-term stability and reaching financial goals. Having a clear plan for tracking income and expenses helps individuals avoid unnecessary debt and ensures that they are working toward their desired outcomes. By mastering the art of budgeting, it becomes easier to prioritize spending, save for the future, and make informed financial decisions.

The Importance of Setting Goals

One of the first steps in creating a successful plan is establishing clear financial goals. Whether saving for a major purchase, building an emergency fund, or planning for retirement, setting specific targets helps guide spending and ensures that resources are allocated efficiently. A well-defined goal provides direction and makes it easier to track progress over time.

Tracking and Managing Expenses

Once goals are established, the next step is to monitor income and spending. By categorizing expenses and identifying areas where savings can be made, individuals can make adjustments to stay on track. Regularly reviewing spending patterns allows for better decision-making and ensures that priorities align with long-term objectives.

Mastering Investment Strategies for Beginners

Investing is a powerful tool for building wealth over time, but it requires knowledge and strategy to make informed decisions. Beginners often face the challenge of choosing the right options and understanding how different investments work. By grasping the fundamental principles behind various investment vehicles, individuals can develop a strategy that aligns with their financial goals and risk tolerance.

Starting with the basics, it’s essential to learn about different types of investments, such as stocks, bonds, and mutual funds. Each carries its own set of risks and rewards, making it important to assess your goals before committing to any one option. Diversification is another key principle, as spreading investments across various assets can help mitigate risks and ensure more stable returns.

For those just beginning, it’s recommended to start with simpler, lower-risk investments while gradually learning more about advanced strategies. By staying informed and making decisions based on careful research, you can increase your chances of success in the world of investing.

Understanding Credit and Debt Management

Managing credit and debt is a crucial aspect of achieving financial stability. Knowing how to use credit wisely and how to manage existing debt can significantly impact long-term financial health. By understanding the basics of borrowing, repayment strategies, and the consequences of mismanagement, individuals can avoid common pitfalls and make better financial decisions.

Credit allows you to access funds for purchases or investments, but it comes with responsibilities. Misusing credit or accumulating too much debt can lead to high interest payments, fees, and damage to your credit score. To avoid this, it’s important to follow sound principles when borrowing and repaying money.

- Borrowing Responsibly: Always assess your ability to repay before taking on new debt. Borrow only what you need and ensure that monthly payments are manageable within your budget.

- Paying on Time: Late payments can lead to penalties and negatively affect your credit score. Setting reminders or automating payments can help ensure timely repayments.

- Reducing Debt: Prioritize paying off high-interest debts first, such as credit cards, and consider consolidating loans to reduce overall interest costs.

- Monitoring Credit: Regularly check your credit report to ensure there are no errors or fraudulent activities. Maintaining a healthy credit score helps secure better loan terms in the future.

By following these principles and making informed choices, you can successfully manage your credit and debt, ultimately supporting your financial goals.

Taxes and How They Affect Your Finances

Understanding the impact of taxes is essential for anyone managing their money and planning for the future. Taxes are an unavoidable part of life, but by understanding how they work, you can make better decisions regarding income, savings, and investments. Whether you’re an employee or a business owner, taxes can significantly affect your overall financial situation.

How Taxes Influence Your Income

Taxes reduce the amount of income you take home, affecting your disposable income and overall budget. The amount deducted depends on factors such as your income level, filing status, and any deductions or credits you’re eligible for. Being aware of these factors helps you plan for the net income you’ll receive after taxes, ensuring that you’re budgeting accurately and saving accordingly.

Investments and Tax Implications

Investment returns are also subject to taxation, which can influence the growth of your wealth over time. Understanding how different types of investments–such as stocks, bonds, and retirement accounts–are taxed can help you optimize your investment strategy. For example, tax-deferred accounts allow you to postpone taxes on earnings until retirement, potentially allowing your investments to grow faster.

By staying informed and planning for taxes, you can make more strategic decisions and minimize their impact on your financial goals.

The Role of Insurance in Financial Planning

Incorporating insurance into your financial strategy is crucial for protecting your assets and securing your future. Insurance provides a safety net that helps manage risk by covering unexpected events such as illness, accidents, or property damage. Having the right types of coverage in place ensures that you’re financially protected in case of emergencies, allowing you to focus on achieving long-term goals without the fear of unforeseen setbacks.

Types of Insurance to Consider

Several types of insurance can play a key role in financial protection. Health insurance safeguards against medical expenses, while life insurance offers financial security for loved ones in the event of an untimely death. Property insurance, including home and auto policies, protects against loss or damage to valuable assets. Disability insurance can replace lost income if you’re unable to work due to illness or injury.

How Insurance Fits into Your Budget

Incorporating insurance premiums into your budget is an important step in ensuring adequate protection without overspending. While it may seem like an additional expense, the peace of mind insurance provides is invaluable. By carefully assessing your coverage needs and comparing options, you can find affordable plans that align with your financial goals.

Retirement Planning Essentials for Students

Planning for the future is important, even at the start of your career journey. While retirement may seem far off, starting early can significantly impact your long-term financial stability. By establishing good saving habits and making informed decisions early on, students can set the foundation for a comfortable and secure retirement.

One of the key advantages of starting retirement planning early is the power of compound interest. The earlier you start saving, the more time your money has to grow. This allows even small contributions to accumulate over time, creating a substantial nest egg by the time retirement arrives. Additionally, understanding different retirement savings accounts and investment options available can help students make smart decisions that align with their goals and risk tolerance.

How to Read and Interpret Financial Statements

Understanding financial statements is a vital skill for making informed decisions about investments, business operations, or personal budgeting. These documents provide a snapshot of a company’s or individual’s financial health, revealing key details about income, expenses, assets, and liabilities. By learning how to read and interpret these reports, you can gain valuable insights into performance, profitability, and overall financial stability.

The Income Statement

The income statement shows how much money is earned and spent over a specific period. It highlights key figures such as revenue, expenses, and net income. By reviewing this statement, you can assess whether an entity is operating profitably and identify areas where costs can be reduced or revenues increased.

The Balance Sheet

The balance sheet offers a detailed view of assets, liabilities, and equity at a given moment in time. It helps determine whether the entity’s assets outweigh its liabilities, providing a clear picture of its financial stability. A healthy balance sheet indicates that the organization is in a strong position to meet its obligations and grow in the future.

The Impact of Inflation on Personal Wealth

Inflation can significantly affect the purchasing power of your money, eroding the value of savings and investments over time. As prices rise, the same amount of money buys fewer goods and services, which can be particularly harmful for individuals who rely on fixed incomes or savings. Understanding how inflation impacts your financial situation is essential for making smart decisions about saving, investing, and managing debt.

How Inflation Affects Different Assets

Inflation influences various types of assets in different ways. While some investments may grow in value to keep pace with inflation, others may lose their purchasing power. Here’s how inflation can affect different asset classes:

- Cash Savings: Savings held in cash or low-interest accounts lose value as inflation increases, as the returns do not keep up with rising costs.

- Stocks: While stocks may offer a hedge against inflation over the long term, some sectors may struggle as higher costs impact company profits.

- Bonds: Fixed-rate bonds are vulnerable to inflation, as the interest payments may not outpace rising prices.

- Real Estate: Property values tend to rise with inflation, but it depends on market conditions and location.

Strategies to Mitigate Inflation’s Impact

There are several strategies you can adopt to protect your wealth from inflation’s negative effects:

- Diversify Investments: Spread your investments across various asset classes to help protect against inflation risks.

- Invest in Inflation-Protected Securities: Consider Treasury Inflation-Protected Securities (TIPS) or other bonds that are designed to adjust with inflation.

- Focus on Growth Assets: Invest in assets with potential for high returns, such as stocks or real estate, that may outpace inflation over time.

- Increase Income Streams: Look for opportunities to increase your income through side businesses, investments, or higher-paying job opportunities to offset rising costs.

By understanding the effects of inflation and taking proactive steps, you can safeguard your wealth and ensure long-term financial security.

Building an Emergency Fund for Financial Stability

Creating an emergency fund is a fundamental aspect of maintaining financial security. Life is unpredictable, and unforeseen expenses can arise at any time. Having a dedicated reserve of funds can help you handle unexpected situations, such as medical emergencies, car repairs, or job loss, without derailing your financial plans.

Why an Emergency Fund is Essential

Having a safety net allows you to manage life’s challenges without going into debt or making drastic financial sacrifices. An emergency fund acts as a buffer, giving you the confidence to face difficult situations without stress. Here’s why it’s crucial:

- Prevents Debt Accumulation: Without an emergency fund, you might rely on credit cards or loans when unexpected costs arise, leading to increased debt.

- Provides Peace of Mind: Knowing you have funds set aside can reduce anxiety about potential financial setbacks.

- Helps Maintain Financial Goals: An emergency fund ensures you don’t need to dip into savings meant for long-term goals like buying a home or retirement.

Steps to Build an Emergency Fund

Building a sufficient emergency fund requires discipline and consistent effort. Follow these steps to create a robust financial cushion:

- Set a Target Amount: Aim to save at least three to six months’ worth of living expenses. This will provide enough support in case of job loss or a major emergency.

- Start Small: Begin with a manageable amount, even if it’s just $500 or $1,000, and gradually increase it over time.

- Automate Contributions: Set up automatic transfers to a separate savings account each month, ensuring you consistently add to the fund without effort.

- Cut Unnecessary Expenses: Review your monthly spending and reduce non-essential purchases to allocate more towards your emergency fund.

By taking these steps, you can build a reliable emergency fund that provides a cushion in times of need and contributes to long-term financial stability.

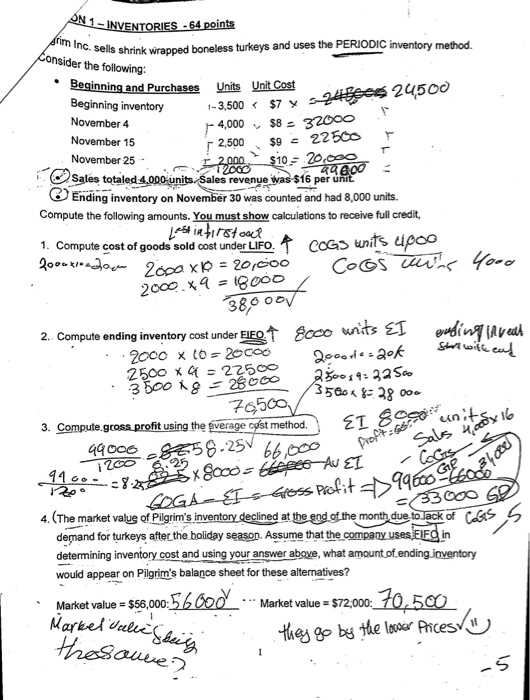

Loans and Interest Rates Explained Simply

Understanding how loans work and the role of interest rates is essential for making informed decisions about borrowing money. Whether you are considering a mortgage, car loan, or personal credit, it’s important to know how interest affects the total cost of the loan. Interest is the fee lenders charge for providing the loan, and it can significantly impact how much you end up paying over time.

How Loans Work

When you borrow money, the lender agrees to give you a certain amount for a specified period, with the condition that you will repay the loan in installments, including interest. The total amount you repay is higher than the amount borrowed due to interest. Here are the key elements of a loan:

- Principal: The original amount borrowed.

- Interest: The additional amount you pay to the lender as a percentage of the principal.

- Term: The length of time you have to repay the loan, typically months or years.

- Monthly Payment: The amount you pay each month towards the loan, which includes both principal and interest.

Understanding Interest Rates

The interest rate is a key factor in determining the cost of a loan. It can be fixed or variable, and it is usually expressed as an annual percentage rate (APR). The APR represents the cost of borrowing on a yearly basis, including interest and other fees. Here’s what to know:

- Fixed Interest Rate: The interest rate remains the same throughout the loan term, offering predictable payments.

- Variable Interest Rate: The rate can change over time, often based on market conditions, which may lead to fluctuations in your payments.

- APR: This includes both the interest rate and any additional fees that may be charged, giving you a clearer picture of the overall cost.

By understanding how loans and interest rates work, you can make more informed borrowing decisions and better manage your debt. Knowing the total cost of borrowing, including interest, allows you to plan your finances more effectively.

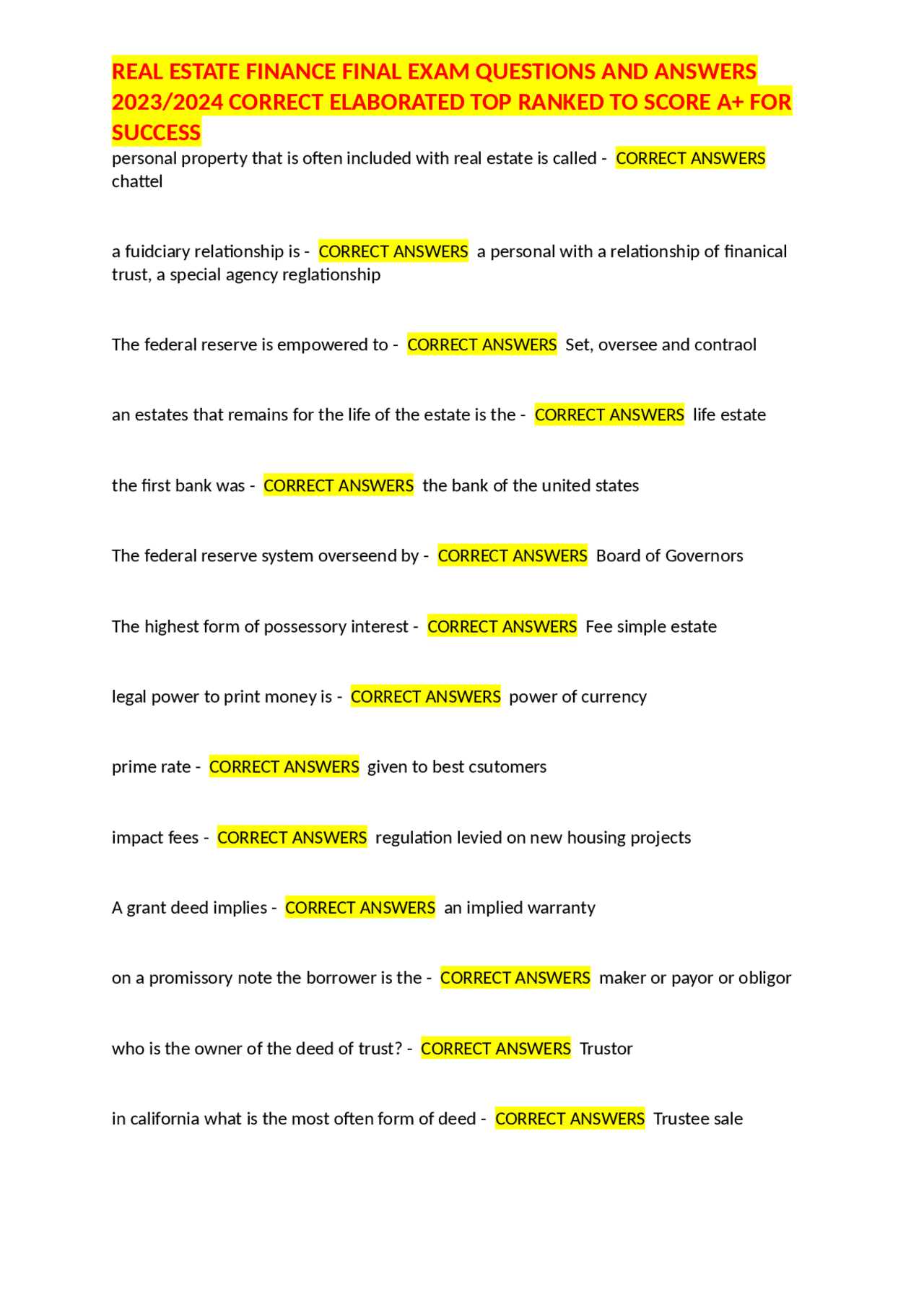

The Basics of Real Estate Investment

Investing in property offers the potential for both income generation and long-term wealth accumulation. It involves purchasing, owning, managing, renting, or selling properties for profit. Real estate investment can take many forms, from residential properties to commercial spaces, and even land. Understanding the fundamentals is essential for anyone considering this avenue for building financial security.

Types of Real Estate Investments

There are several types of real estate investments, each with its own set of advantages and risks. Here’s a brief overview:

| Investment Type | Description | Pros | Cons |

|---|---|---|---|

| Residential Properties | Investing in single-family homes or multi-family units. | Steady rental income, potential property value appreciation. | Property management can be time-consuming, tenant issues. |

| Commercial Properties | Investing in office buildings, shopping centers, or warehouses. | Longer-term leases, often higher returns. | Requires more capital, higher maintenance costs. |

| Real Estate Investment Trusts (REITs) | Pooled investments in property markets without owning physical assets. | Liquidity, diversification, lower entry costs. | Market fluctuations, less control over investments. |

| Land Investment | Buying undeveloped land for future development or resale. | Potential for high returns if land values increase. | Limited income generation, property taxes. |

Key Considerations for Investing in Property

Before jumping into real estate investments, it’s important to consider the following factors:

- Location: The location of a property greatly influences its value and rental income potential.

- Financing: Most real estate investments require substantial capital. Explore options like mortgages, private loans, or partnerships.

- Risk Management: Market fluctuations, tenant risks, and property maintenance costs should all be accounted for when making an investment.

- Property Management: Owning and managing properties can be demanding, so consider whether you will manage them yourself or hire a property manager.

Real estate investment offers the potential for both steady income and asset appreciation. However, it requires a thoughtful approach and careful planning to ensure success. By understanding the types of real estate investments and key factors to consider, you can make informed decisions and build a strong investment portfolio.

Financial Goal Setting and Tracking Progress

Setting clear, achievable financial objectives is crucial for building long-term wealth and achieving financial independence. A well-defined plan helps in prioritizing expenses, saving effectively, and making smart investment choices. Tracking progress towards these goals ensures that individuals stay on track and make necessary adjustments along the way. Without proper tracking, it’s easy to lose sight of one’s financial aspirations.

Steps to Set Effective Financial Goals

To successfully set and achieve financial goals, consider the following steps:

- Define Your Goals: Specify what you want to achieve, such as saving for a home, building an emergency fund, or retiring early.

- Set Realistic Timelines: Determine when you aim to reach each goal, keeping in mind your current financial situation and resources.

- Break Down Goals into Actionable Steps: Divide larger goals into smaller, manageable milestones that can be tracked over time.

- Set Specific Amounts: Assign clear dollar amounts to your goals to measure success easily, whether it’s saving $500 a month or paying off debt by a specific date.

How to Track Your Financial Progress

Monitoring progress regularly helps ensure you are moving closer to your financial objectives. Here are some tools and methods to stay on track:

- Monthly Budgeting: Use budgeting tools or apps to compare your actual spending against your planned budget and assess savings progress.

- Financial Dashboard: Create a visual dashboard with charts or graphs to track savings, investments, and debt reduction.

- Regular Financial Check-ins: Set monthly or quarterly reviews to assess your goals, celebrate milestones, and make adjustments as needed.

- Accountability Partners: Share your goals with a trusted friend or family member to keep yourself accountable and motivated.

Financial goal setting is a powerful tool that can bring clarity to your financial journey. By breaking goals into actionable steps and regularly tracking progress, you will be better positioned to reach your objectives and make adjustments when necessary. Achieving financial success becomes easier when you stay focused, monitor your progress, and remain adaptable to changes.

Risk Management in Personal Finance

Managing risks effectively is a fundamental aspect of achieving long-term financial security. Life is full of uncertainties, and understanding how to mitigate potential financial setbacks is crucial. By identifying and evaluating risks, individuals can implement strategies to reduce their exposure to adverse events, whether they involve sudden expenses, loss of income, or unexpected market fluctuations. Proper risk management provides peace of mind and helps protect wealth from unforeseen events.

Types of Financial Risks

There are various risks that can impact an individual’s financial health. Recognizing these risks is the first step in creating a comprehensive risk management plan. Below are some common types of financial risks:

- Market Risk: The risk of financial loss due to fluctuations in the market, such as stock price volatility or changes in interest rates.

- Credit Risk: The possibility of default on loans or credit obligations, either by the borrower or the lending institution.

- Liquidity Risk: The risk that an individual may not be able to access cash or liquid assets when needed due to market conditions or personal circumstances.

- Life Event Risk: Unpredictable events like job loss, medical emergencies, or accidents that can disrupt financial stability.

Effective Strategies for Risk Mitigation

Once risks are identified, several strategies can be employed to reduce or eliminate potential financial harm:

- Diversification: Spreading investments across different asset classes (stocks, bonds, real estate) to minimize the impact of a poor-performing sector.

- Insurance: Purchasing health, life, property, and disability insurance can help protect against financial losses from unexpected events.

- Emergency Fund: Building an emergency savings fund provides a financial cushion to cover sudden expenses or temporary income loss.

- Debt Management: Keeping debt levels manageable and having a solid plan for repayment can help reduce financial stress during periods of uncertainty.

By proactively identifying risks and implementing strategies to mitigate them, individuals can safeguard their financial future. Effective risk management not only protects wealth but also provides the foundation for making confident, informed decisions in the face of uncertainty.

Final Exam Tips for Personal Finance Students

Preparing for a key assessment in any subject requires a well-thought-out approach, and financial topics are no exception. To perform well, it’s essential to understand core concepts, be familiar with key terms, and practice applying your knowledge to different scenarios. This section provides valuable insights into how to approach studying for the exam effectively, boost retention, and improve your ability to answer questions with confidence.

Here are some tips that can help you excel:

- Review Key Concepts: Make sure you have a clear understanding of the fundamental ideas covered in the course. Focus on essential topics such as budgeting, investments, debt management, taxes, and retirement planning. Understanding these concepts will give you a strong foundation for solving problems.

- Practice with Sample Questions: Test yourself with past papers, practice problems, or sample questions. This will help you become familiar with the question format and improve your problem-solving speed.

- Organize Study Sessions: Break down your study time into manageable blocks, focusing on one topic at a time. Use active recall and spaced repetition to retain information more effectively.

- Understand Formulas: Many financial concepts rely on specific calculations, such as interest rates, savings, and loan repayment schedules. Be sure you’re comfortable with the formulas and know when and how to apply them.

- Clarify Doubts Early: Don’t wait until the last minute to ask about topics you’re unsure about. Reach out to your professor or study group early so that you have time to work through difficult concepts.

- Stay Calm and Focused: On the day of the test, stay calm and read each question carefully. Manage your time effectively during the exam to ensure you have ample time to review your answers before submission.

By following these strategies, you will be able to approach the assessment with confidence and increase your chances of achieving a strong performance. Consistent preparation and a clear understanding of the material will allow you to tackle questions effectively and showcase your knowledge.