Preparing for any evaluation in the field of finance requires more than just theoretical knowledge. Success hinges on understanding core principles, applying them effectively, and being able to navigate through complex scenarios with confidence. This section aims to provide you with crucial insights to enhance your preparedness, ensuring you’re ready to tackle various challenges in the field.

By exploring the key concepts and strategies highlighted here, you will gain a clearer perspective on how to approach tests and assessments efficiently. With the right focus, practical tips, and dedicated practice, you can improve your performance and sharpen your skills, making the path to mastering financial evaluations more achievable.

Wall Street Prep Accounting Crash Course Exam Answers

Success in any financial evaluation requires a thorough understanding of fundamental principles and the ability to apply them in various scenarios. This section provides valuable insights and solutions to help you better navigate through the most common questions and challenges you might face during your preparation. Focusing on practical techniques and detailed solutions can significantly improve your ability to manage and solve complex problems with ease.

Key Areas to Focus On

- Financial statement interpretation and analysis

- Application of core principles in real-world scenarios

- Identifying key trends and making informed decisions

- Time management and optimal use of resources

Effective Techniques for Problem Solving

- Break down each question into smaller, manageable components

- Focus on understanding the underlying principles before solving

- Use practice problems to improve speed and accuracy

- Review and double-check your work for consistency

With a focused approach and continuous practice, mastering these essential techniques will not only boost your confidence but also enhance your performance in any related assessments.

Understanding Key Accounting Concepts

Mastering the foundational elements of finance is crucial for navigating through any financial assessment or real-world scenario. A solid understanding of core principles helps you make informed decisions and effectively interpret financial data. This section breaks down essential ideas that every individual must grasp to successfully apply knowledge in practical situations.

Core Principles of Financial Management

- Income and expenses: Understanding how money flows in and out of an entity is essential for accurate financial planning.

- Assets and liabilities: Knowing the balance between what is owned and owed allows for better decision-making and risk assessment.

- Equity and valuation: Grasping the concept of ownership value and asset valuation is key to understanding a company’s financial health.

Key Techniques for Effective Analysis

- Financial ratio analysis: Evaluating performance using key metrics like profitability, liquidity, and solvency ratios.

- Forecasting: Predicting future financial performance based on historical data and trends.

- Cash flow management: Ensuring a business has enough liquidity to cover day-to-day operations while managing long-term investments.

By becoming familiar with these essential principles and tools, you will be better equipped to solve financial challenges, improve decision-making processes, and strengthen your overall understanding of financial systems.

Important Topics Covered in the Course

To fully grasp financial concepts and excel in evaluations, it is essential to understand the primary areas that form the foundation of financial analysis. This section highlights key subjects that are vital for building a comprehensive understanding, offering a clear roadmap for mastering the material and applying it effectively in real-world scenarios.

Essential Financial Foundations

- Income statements: Understanding how revenue and expenses are recorded and analyzed for financial health assessment.

- Balance sheets: Gaining insight into the company’s financial position by evaluating assets, liabilities, and equity.

- Cash flow management: Learning the importance of liquidity and the methods for tracking cash movements within an entity.

Advanced Analysis Techniques

- Financial ratios: Using key metrics such as profitability, liquidity, and solvency ratios to evaluate a company’s performance.

- Valuation methods: Mastering techniques like discounted cash flow (DCF) analysis and market multiples to assess business worth.

- Forecasting and budgeting: Developing skills for predicting future financial performance and creating reliable financial plans.

By covering these fundamental topics, the material prepares individuals to tackle complex financial challenges and make informed decisions in various business contexts.

How to Approach the Exam Effectively

Successfully navigating through any financial assessment requires strategic planning and efficient time management. It’s important to understand how to structure your preparation, focus on key areas, and stay calm during the process. This section outlines effective methods for tackling challenges, improving performance, and mastering the material with confidence.

Steps to Prepare for Success

| Step | Action | Outcome |

|---|---|---|

| 1 | Review key concepts and formulas | Strengthen understanding of core material |

| 2 | Practice with sample problems | Increase speed and accuracy |

| 3 | Prioritize areas of weakness | Address gaps in knowledge |

| 4 | Simulate timed practice sessions | Enhance time management skills |

Effective Time Management During the Assessment

- Read all questions carefully: Ensure a full understanding before beginning your response.

- Allocate time wisely: Divide your available time according to the difficulty and length of each section.

- Stay calm under pressure: Take deep breaths if you feel overwhelmed and refocus on the task at hand.

By following these steps and maintaining a focused approach, you’ll be well-equipped to handle even the most challenging financial assessments. Proper preparation, combined with strong time management, will significantly improve your chances of success.

Top Strategies for Accounting Exam Success

Achieving success in any financial evaluation requires more than just basic knowledge. It involves strategic planning, focused practice, and the ability to remain composed under pressure. This section outlines the most effective techniques to help you perform at your best, from structured preparation to stress management during the assessment.

Key Strategies for Effective Preparation

- Active learning: Engage with the material through problem-solving, discussions, and practical applications instead of just passive reading.

- Focused revision: Review important concepts and formulas regularly, with special attention to areas where you are weakest.

- Use of practice materials: Work through sample problems and mock tests to familiarize yourself with the types of questions you will encounter.

- Study groups: Collaborate with peers to discuss difficult topics and share problem-solving techniques.

Maximizing Performance on the Day of the Assessment

- Stay organized: Ensure all materials and documents are prepared in advance to avoid last-minute stress.

- Manage your time: Read through the entire paper first and allocate appropriate time for each section based on its difficulty.

- Keep calm: If you encounter a challenging question, move on and return to it later–staying calm is key to success.

By incorporating these strategies into your preparation and approach, you’ll be better equipped to tackle even the most difficult financial evaluations. The right mindset, combined with efficient study habits, will help you maximize your performance and achieve your desired results.

Common Pitfalls in Accounting Exams

In any financial evaluation, it’s easy to fall into certain traps that can negatively affect performance. Recognizing these common mistakes beforehand allows you to avoid them and approach the task with greater confidence and precision. This section highlights typical errors and offers practical advice on how to prevent them, ensuring a smoother path to success.

Typical Mistakes to Avoid

- Misinterpreting questions: Failing to fully understand the question can lead to irrelevant answers. Always read carefully and ensure clarity before responding.

- Not managing time effectively: Spending too much time on difficult questions can result in unfinished sections. Practice pacing yourself during mock assessments.

- Overlooking important details: Small figures or terms may be easy to miss but can be crucial to answering the question accurately. Double-check your work for any overlooked items.

- Relying too heavily on memorization: While formulas are important, understanding how and when to apply them is equally vital. Focus on conceptual comprehension, not just memorization.

How to Avoid These Pitfalls

- Take your time during the initial reading: Read the question at least twice before beginning to answer, ensuring full understanding of the requirements.

- Prioritize your workload: Tackle easier questions first to build confidence, then move on to the more difficult ones.

- Practice under timed conditions: Simulate the time pressure of a real test to better manage your pace and reduce anxiety.

- Focus on clarity and accuracy: Avoid rushing through calculations or explanations–ensure each response is clear and accurate.

By staying aware of these pitfalls and adopting a more thoughtful approach, you can improve your accuracy and efficiency, ultimately enhancing your performance in any financial assessment.

Mastering Financial Statement Analysis

Effectively analyzing financial reports is a critical skill for anyone involved in evaluating business performance. The ability to interpret key figures and ratios allows for a deeper understanding of a company’s financial health, potential risks, and opportunities. In this section, we will explore the essential techniques for mastering the analysis of financial documents and how to apply these skills in real-world scenarios.

Key Steps for Analyzing Financial Statements

- Reviewing the balance sheet: Examine assets, liabilities, and equity to assess the overall financial position of an organization.

- Analyzing the income statement: Evaluate revenues, costs, and profitability to understand the company’s ability to generate profit.

- Studying cash flow statements: Investigate the movement of cash to determine how well the company manages its liquidity and operational expenses.

Common Ratios Used in Financial Analysis

- Liquidity ratios: Assess short-term financial stability by measuring the company’s ability to cover its immediate obligations.

- Profitability ratios: Evaluate the company’s ability to generate earnings relative to revenue, assets, or equity.

- Solvency ratios: Measure long-term financial viability by comparing debt levels to equity and assets.

By mastering these analysis techniques and understanding the key ratios, you will be able to draw meaningful conclusions about a company’s financial health, predict future performance, and make informed decisions. Developing this skillset is crucial for anyone looking to gain a competitive edge in the financial world.

Essential Formulas and Their Applications

Understanding key mathematical formulas is vital for successfully navigating any financial analysis. These formulas serve as the foundation for making precise calculations and drawing insightful conclusions about a company’s financial performance. In this section, we will review some of the most essential formulas, their practical applications, and how to use them effectively in various financial scenarios.

Key Formulas for Financial Analysis

- Current Ratio: Current Assets / Current Liabilities – Measures the company’s ability to pay short-term obligations with its short-term assets.

- Return on Assets (ROA): Net Income / Average Total Assets – Indicates how effectively a company uses its assets to generate profit.

- Debt-to-Equity Ratio: Total Debt / Shareholder Equity – Assesses the financial leverage of the company and its reliance on debt financing.

- Gross Profit Margin: (Revenue – Cost of Goods Sold) / Revenue – Measures the percentage of revenue that exceeds the cost of goods sold.

Applications of Key Financial Formulas

- Liquidity Assessment: Use the current ratio to evaluate whether the company can meet its short-term liabilities without facing liquidity issues.

- Profitability Evaluation: Apply the return on assets formula to understand how efficiently the company is generating profits from its assets.

- Financial Risk Analysis: The debt-to-equity ratio helps assess how much risk a company is taking on by using debt to finance its operations.

- Operational Efficiency: Gross profit margin can indicate how well a company controls its production costs relative to its sales.

Mastering these essential formulas and knowing when and how to apply them will significantly enhance your ability to evaluate financial data, make informed decisions, and interpret the underlying health of a business.

Time Management Tips for Accounting Exams

Effective time management is one of the most important skills you can develop to ensure success in any financial assessment. With numerous topics to cover and limited time to demonstrate your understanding, it’s essential to approach the task strategically. In this section, we will explore practical tips to help you manage your time efficiently during the evaluation process, ensuring that you can complete each section with accuracy and confidence.

One key to managing time effectively is to prioritize tasks based on difficulty and familiarity. Start with the questions you find easiest to gain momentum, and then tackle more complex sections with a clearer mind. Additionally, setting time limits for each question or section can prevent spending too much time on one part of the assessment, leaving you enough time to address everything in a balanced way.

Another useful strategy is to practice time-bound mock assessments. By simulating real conditions, you can improve your pacing and identify areas where you may need to adjust your approach. Regular practice also helps you develop the mental stamina required for longer evaluations and boosts your confidence in handling time pressure.

Lastly, remember to leave some time at the end to review your work. Double-checking your answers and calculations can help catch any mistakes or overlooked details that may affect your performance. With these time management strategies, you can approach any financial evaluation with greater efficiency and a stronger chance of success.

Commonly Asked Questions and Solutions

During any financial assessment, certain questions and challenges tend to appear repeatedly. Understanding these common inquiries and knowing how to approach them is crucial for efficient problem-solving. This section addresses frequently encountered issues and provides practical solutions, helping you navigate through your tasks with confidence and accuracy.

Frequently Encountered Challenges

| Problem | Solution |

|---|---|

| Difficulty in understanding financial ratios | Break down each ratio into its components and understand what it measures. Practice interpreting ratios in the context of real business scenarios. |

| Confusion between direct and indirect methods of cash flow | Remember, the direct method lists cash inflows and outflows, while the indirect method starts with net income and adjusts for non-cash items. |

| Struggling with time constraints | Prioritize questions based on familiarity and difficulty. Set time limits for each section to ensure a balanced approach throughout. |

Clarifying Complex Concepts

- Depreciation vs. Amortization: Depreciation applies to tangible assets, while amortization pertains to intangible assets. Both represent the allocation of an asset’s cost over time.

- Operating vs. Non-Operating Income: Operating income relates to core business activities, whereas non-operating income arises from secondary activities like investments or sales of assets.

- Working Capital Management: Efficient management of short-term assets and liabilities is essential to ensure liquidity without sacrificing profitability.

By familiarizing yourself with these common challenges and solutions, you will be better prepared to tackle any questions you face during financial assessments, enabling you to apply the right techniques and achieve the best possible results.

Exam Tips from Accounting Professionals

Insights from experienced professionals can significantly enhance your approach to any financial evaluation. Their practical advice, rooted in years of expertise, can help you avoid common mistakes and improve your performance. This section shares valuable tips from industry experts that can guide you in preparing for and excelling during your assessment.

Key Strategies for Success

- Stay Organized: Begin by reviewing the key concepts and creating a clear study schedule. Break down topics into manageable sections to avoid feeling overwhelmed.

- Practice, Practice, Practice: The more you practice solving problems, the better you will understand the material and improve your speed. Utilize mock tests to replicate real conditions.

- Understand the Theory: While memorizing formulas and definitions is important, understanding the underlying principles behind them is essential for applying the knowledge effectively in various scenarios.

- Work Efficiently: During the evaluation, avoid spending too much time on one question. If a question is difficult, move on and come back to it later with a fresh perspective.

Additional Advice from the Pros

- Manage Your Time: Allocate specific amounts of time for each section. Ensure you leave enough time to review your answers before the assessment concludes.

- Be Mindful of Common Pitfalls: Double-check your work for simple mistakes like calculation errors or overlooking key information that could affect your answers.

- Stay Calm Under Pressure: Maintaining focus and a calm mindset can help you think clearly and make better decisions during the test.

By applying these professional tips, you will be better equipped to tackle financial assessments confidently, ensuring that you maximize your performance and achieve your goals.

How to Handle Complex Accounting Problems

Dealing with intricate financial scenarios requires both methodical thinking and a strong grasp of core principles. Complex issues often involve multiple steps and calculations, which can be overwhelming if not approached in an organized way. This section will guide you through strategies to effectively manage these types of problems, ensuring clarity and accuracy in your solutions.

Steps to Tackle Challenging Problems

- Break It Down: Start by simplifying the problem into smaller, more manageable parts. Identify the key components and address them one at a time.

- Identify the Core Issues: Focus on the main question or concept being asked. Sometimes, complex problems involve extraneous information meant to distract you.

- Use a Systematic Approach: Follow a logical sequence of steps to solve the problem. Whether it’s applying a formula or setting up an equation, having a step-by-step method can keep you on track.

- Check Your Work: After reaching a solution, review each step to ensure no errors were made. Recalculate and verify key figures to confirm accuracy.

Common Techniques to Simplify Complex Calculations

- Use of Templates and Frameworks: Having a structured template can help you approach recurring problems in a consistent manner, reducing time spent on each task.

- Draw Diagrams or Charts: Visual representations of data can often make complex calculations easier to follow and interpret, especially when dealing with large amounts of information.

- Seek Patterns: Many complex issues share common patterns. Recognizing these can significantly speed up the process of finding the correct solution.

By following these steps and techniques, you can confidently tackle complicated financial problems, turning them into more straightforward tasks that are easier to solve with accuracy and efficiency.

Practice Questions and Answer Explanations

Reinforcing your understanding of key concepts through practice is essential to mastering any subject. Working through sample questions not only helps to test your knowledge but also gives you a clearer insight into the logic and processes involved in solving complex problems. In this section, we will explore several practice questions and break down their solutions to provide a deeper understanding of each step.

Sample Problem 1: Financial Statement Analysis

Question: Given a set of financial data, determine the liquidity ratio and interpret its meaning in the context of the business’s performance.

Solution Breakdown: The liquidity ratio is calculated by dividing the current assets by the current liabilities. A ratio of 1 or above typically indicates that the company has sufficient assets to cover its short-term liabilities. Here’s how you calculate it:

- Identify the current assets (e.g., cash, receivables, inventory).

- Identify the current liabilities (e.g., short-term debt, accounts payable).

- Divide current assets by current liabilities to find the liquidity ratio.

Interpretation: A ratio of 2, for example, means the company has twice the assets it needs to cover its current liabilities, suggesting good short-term financial health.

Sample Problem 2: Cost-Volume-Profit Analysis

Question: A business produces widgets that cost $5 each in variable costs. Fixed costs are $50,000, and each widget sells for $20. How many units must the company sell to break even?

Solution Breakdown: To find the break-even point, we use the formula: Break-even volume = Fixed costs / (Selling price per unit – Variable cost per unit).

- Fixed costs = $50,000

- Selling price per unit = $20

- Variable cost per unit = $5

Now plug these values into the formula:

Break-even volume = $50,000 / ($20 – $5) = $50,000 / $15 = 3,333 units

Interpretation: The company needs to sell 3,333 widgets to cover all of its fixed and variable costs. Any sales beyond this number will result in profit.

By working through practice questions and carefully analyzing the solutions, you can build a stronger grasp of key financial principles and better prepare yourself for solving similar problems in real-world scenarios.

Reviewing and Retaining Accounting Knowledge

Maintaining and reinforcing your understanding of key principles is critical for long-term success. Simply completing tasks or passing tests is not enough if the knowledge does not stay with you. Regular review sessions, coupled with effective techniques for retention, can help solidify the concepts and ensure that the information remains accessible when you need it most. In this section, we explore strategies for reviewing material and improving memory retention in the field of financial analysis and management.

Active Recall and Spaced Repetition: One of the most effective techniques for retaining information is active recall, where you test yourself regularly on the material instead of just rereading it. This method strengthens your memory and helps you retrieve information more efficiently. Combining active recall with spaced repetition, which involves reviewing information at increasing intervals, can significantly improve retention. For example, reviewing a topic after one day, then after one week, and then after one month, helps to reinforce the information in your long-term memory.

Practical Application: Applying the knowledge you have learned in real-life scenarios or through mock problems enhances retention. For instance, using financial statements to analyze hypothetical business cases or solving practical problems related to cost analysis helps solidify concepts and gives you a deeper understanding of how to apply them in various situations.

Review Techniques for Mastery

In addition to active recall and spaced repetition, there are other methods you can use to reinforce your learning:

- Summarization: Summarizing key concepts in your own words can help you better internalize the material and recognize the core principles.

- Mind Mapping: Creating visual diagrams or mind maps can help you see the relationships between concepts and organize complex information more effectively.

- Peer Teaching: Teaching the concepts to a peer or even explaining them aloud to yourself can reinforce your understanding and highlight areas that need further review.

Effective Memory Retention Strategies

While regular review is essential, the way you approach your study sessions also impacts how well you retain information. Here are some memory techniques to try:

- Chunking: Break large amounts of information into smaller, more manageable chunks. This makes it easier to process and remember the material.

- Visualization: Associating abstract concepts with images or scenarios can help strengthen memory and make complex ideas easier to recall.

- Mnemonics: Creating mnemonic devices, such as acronyms or rhymes, is a useful way to memorize lists or specific sequences of information.

By implementing these strategies, you can improve not only your ability to review and retain knowledge but also your overall performance when applying this knowledge in practice. Consistent review and practical application will ensure that the material stays fresh in your mind, allowing you to recall it effortlessly when needed.

Key Resources for Further Study

Continuing education and expanding your knowledge base are essential for mastering complex concepts and staying up-to-date in any field. While initial learning might provide a strong foundation, further exploration of resources is crucial to deepen your understanding and refine your skills. In this section, we will highlight valuable tools and materials that can support your ongoing study, from textbooks to online platforms, offering a variety of options to suit different learning styles and needs.

Textbooks and Reference Guides: Comprehensive textbooks remain a reliable source for structured learning. They often present theories in a step-by-step format, providing in-depth explanations and examples. Classic books focused on financial analysis, budgeting, and financial modeling are excellent references for both beginners and advanced learners. Many textbooks also come with accompanying problem sets, offering opportunities to practice and test your skills.

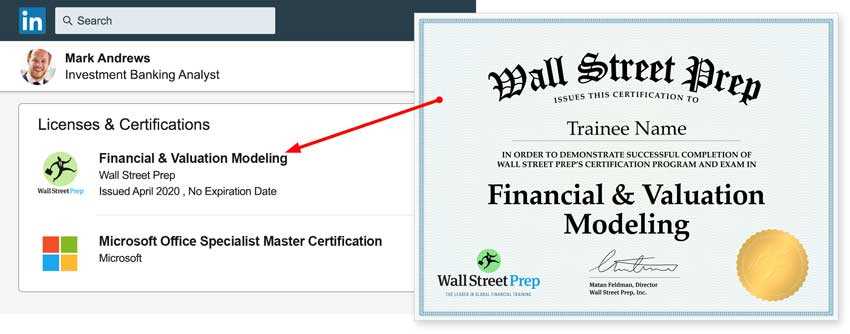

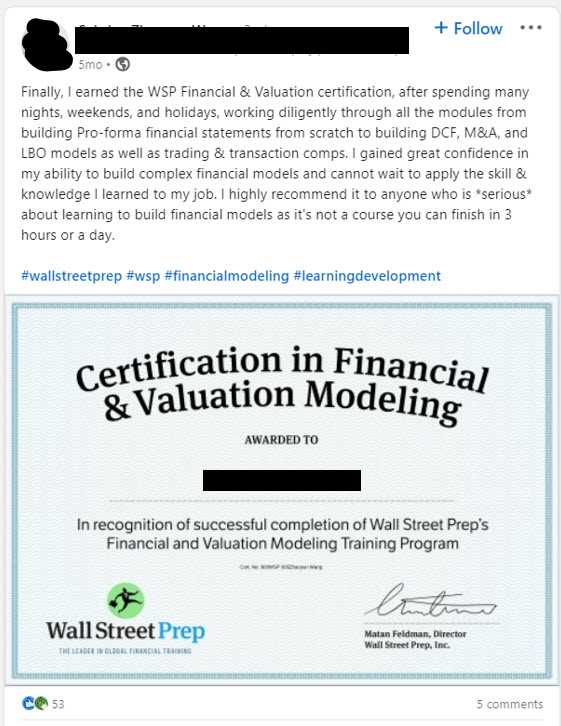

Online Platforms and Courses: The digital age has made learning more accessible through online platforms that provide courses, tutorials, and interactive lessons. Websites such as Coursera, edX, and LinkedIn Learning offer various programs and video lectures tailored to specific subjects, including financial management and analysis. These resources allow you to learn at your own pace and revisit difficult topics as needed, with many courses featuring certifications upon completion.

Additional Learning Tools

In addition to books and online platforms, several other tools can enhance your study and understanding of complex concepts:

- Interactive Simulations: Websites like Investopedia and Khan Academy offer interactive simulations and exercises to practice real-world scenarios. These exercises help solidify your understanding by allowing you to apply theory to practical problems.

- Study Groups and Forums: Joining study groups or online forums such as Reddit’s finance communities or specialized financial management groups can help you discuss difficult topics, exchange ideas, and learn from others’ experiences.

- Financial Software: Tools like Excel and financial modeling software provide hands-on experience with data analysis, budgeting, and reporting. Mastery of these tools is often crucial for anyone involved in financial management, helping you practice applying your knowledge in real-world contexts.

Professional Certifications and Organizations

For those looking to further their careers or gain recognition in the field, pursuing professional certifications can be highly beneficial. Organizations such as the CFA Institute or the Financial Planning Association offer courses and certifications that enhance expertise and increase career opportunities. Additionally, these certifications often provide access to exclusive resources, including industry reports and networking events.

By leveraging these resources and committing to continuous learning, you can advance your knowledge and skills in financial analysis, modeling, and management. Whether you prefer traditional books, digital courses, or hands-on practice, there are numerous avenues available to deepen your expertise and stay current in this dynamic field.

Self-Assessment Tools for Preparation

Effective preparation involves not only understanding the material but also evaluating your own progress. Self-assessment tools play a crucial role in this process, allowing learners to measure their knowledge, identify strengths and weaknesses, and focus their efforts on areas that need improvement. In this section, we will explore various tools and techniques that can help you assess your readiness and optimize your study approach.

Practice Tests: One of the most effective self-assessment methods is taking practice tests. These tests simulate the real situation, helping you gauge your understanding of key topics, time management skills, and test-taking strategies. Practice exams also give you insight into the question format, allowing you to become familiar with the structure and reduce anxiety on the actual day. Many practice tests also provide detailed explanations of the correct answers, enhancing your learning experience.

Quizzes and Flashcards: Quizzes and flashcards are another excellent way to assess your grasp of specific concepts. These tools help reinforce important details and formulas, ensuring that you remember essential information. Flashcards, in particular, can be used for quick recall exercises, allowing you to review key points repeatedly and efficiently. Many digital platforms offer customizable quizzes and flashcards, enabling you to tailor your study sessions to your personal needs.

Additional Assessment Methods

In addition to practice tests and quizzes, there are other self-assessment tools that can provide valuable insights into your progress:

- Self-Reflection Journals: Keeping a journal of your study sessions allows you to track your thoughts, challenges, and areas where you feel less confident. By reflecting on your learning experiences, you can adjust your study techniques and focus on areas that need further attention.

- Peer Review and Group Study: Studying with peers and discussing topics with others can help you assess your own understanding. Explaining concepts to others often reveals gaps in your knowledge, and receiving feedback from peers can help refine your grasp of difficult material.

- Performance Analytics on Digital Platforms: Many online learning platforms provide performance analytics that track your progress over time. These analytics can highlight which topics you’ve mastered and which ones require more attention. Some platforms even offer personalized recommendations based on your performance data.

Using Assessment Results Effectively

After using these self-assessment tools, it is important to review the results critically. Identify patterns in the areas where you struggle the most and prioritize those topics in your study plan. Don’t hesitate to revisit materials that were particularly challenging. By regularly testing your knowledge and analyzing your performance, you ensure that you’re always on the right track and ready to succeed.

Improving Your Performance Over Time

Achieving continuous improvement in your academic performance requires dedication, consistent effort, and the ability to adapt your study habits. Over time, small adjustments in your approach can lead to significant progress. In this section, we’ll explore strategies that can help you refine your skills, overcome challenges, and maximize your potential in any assessment.

Reflect and Analyze Your Mistakes: One of the most powerful ways to enhance your performance is to learn from your mistakes. After each practice session or test, take the time to review the questions you got wrong. Understand why you made those errors, whether it was due to lack of understanding, time pressure, or misinterpretation of the question. This reflection helps identify recurring problems and allows you to target specific areas for improvement.

Track Your Progress: Regularly monitoring your progress is key to understanding where you stand and how much you’ve grown. Use performance tracking tools or simple spreadsheets to record your results over time. By comparing your performance from one practice session to the next, you’ll be able to see how far you’ve come and which areas need more attention. This process keeps you motivated and provides valuable insights into your strengths and weaknesses.

Adapting Your Study Strategies

As you progress in your studies, it’s important to adapt your approach based on your experience and evolving needs. Consider the following adjustments:

- Change Study Techniques: If certain methods aren’t yielding results, don’t hesitate to try new ones. Switching between active learning techniques like summarization, self-testing, and group discussions can help reinforce your understanding and keep you engaged.

- Increase Time Commitment: As assessments become more challenging, you may need to dedicate more time to review and preparation. Focus on creating a balanced schedule that allows for both deep study sessions and sufficient rest.

- Seek Feedback: Getting feedback from peers, mentors, or instructors can help you gain valuable perspectives on how to improve. They may offer tips on how to refine your approach and clarify concepts that you’re struggling with.

Staying Consistent and Motivated

Consistency is key when it comes to long-term improvement. Set aside regular study time and stick to your schedule. Avoid cramming or leaving everything to the last minute. Additionally, staying motivated through small, achievable goals can keep you on track. Whether it’s mastering a difficult topic or completing a certain number of practice questions, celebrate each milestone along the way to maintain momentum.