Studying for assessments in the field of economics can be a challenging yet rewarding experience. A thorough understanding of core concepts is essential for tackling complex problems effectively. This section aims to help students focus on crucial topics that often appear in evaluations, offering a structured approach to review important theories, policies, and their implications.

Mastering key topics related to governmental roles in economic processes, taxation methods, and budget management is vital for success. Additionally, understanding the broader effects of economic decisions on society, markets, and inflation can significantly improve your performance in assessments. By breaking down essential themes into manageable sections, students can enhance their grasp of the subject and approach the material with confidence.

Strategic preparation through active review and practice with relevant scenarios will provide the necessary tools for achieving high marks. Whether discussing national debt, redistribution strategies, or government expenditure, focusing on clear, concise explanations will make it easier to recall important information during assessments.

Public Finance Final Exam Questions and Answers

Successfully tackling assessments in economics requires a comprehensive understanding of key concepts. Focus on mastering the essential principles and their real-world applications. By engaging with relevant scenarios and solving complex problems, students can enhance their readiness and boost confidence.

Key areas to concentrate on include:

- The role of government in shaping economic conditions

- Strategies for revenue generation and distribution

- Economic impacts of taxation systems

- Public debt management and its long-term effects

- Evaluating the consequences of fiscal policies on inflation and unemployment

- How government expenditure influences national growth

- International trade’s connection with domestic policy

Focusing on these topics will provide a clear structure for preparation. Review case studies, practice problem-solving techniques, and refine your approach to understanding how economic decisions affect both local and global scales.

To ensure thorough comprehension, consider practicing with hypothetical situations and past scenarios. This will help solidify knowledge and prepare for various types of tasks commonly found in assessments.

Key Topics for Public Finance Exams

Understanding the core principles that govern economic systems is crucial for tackling any assessment in this field. Focus on fundamental areas that explore how governments manage resources, allocate spending, and influence markets through policy. Mastering these areas will ensure strong performance on various tasks and help apply theoretical knowledge to real-world scenarios.

Important subjects to review include:

- Government’s role in economic management

- Tax systems and their impact on markets

- Budget allocation and resource distribution

- Strategies for managing national debt

- Impacts of monetary policy on inflation and employment

- Government spending and its effects on growth

- Global economic connections and their domestic influence

Focusing on these topics will help students understand the complex relationships between governmental actions and economic outcomes. Practicing with case studies and real-life examples will sharpen your ability to analyze the long-term consequences of various economic decisions.

Commonly Asked Public Finance Questions

When preparing for an assessment in the economic field, it’s essential to be aware of the types of topics that are most frequently tested. Understanding the core areas that tend to come up regularly allows for focused studying and better application of knowledge in practical situations. The following topics are often featured in evaluations and require in-depth understanding.

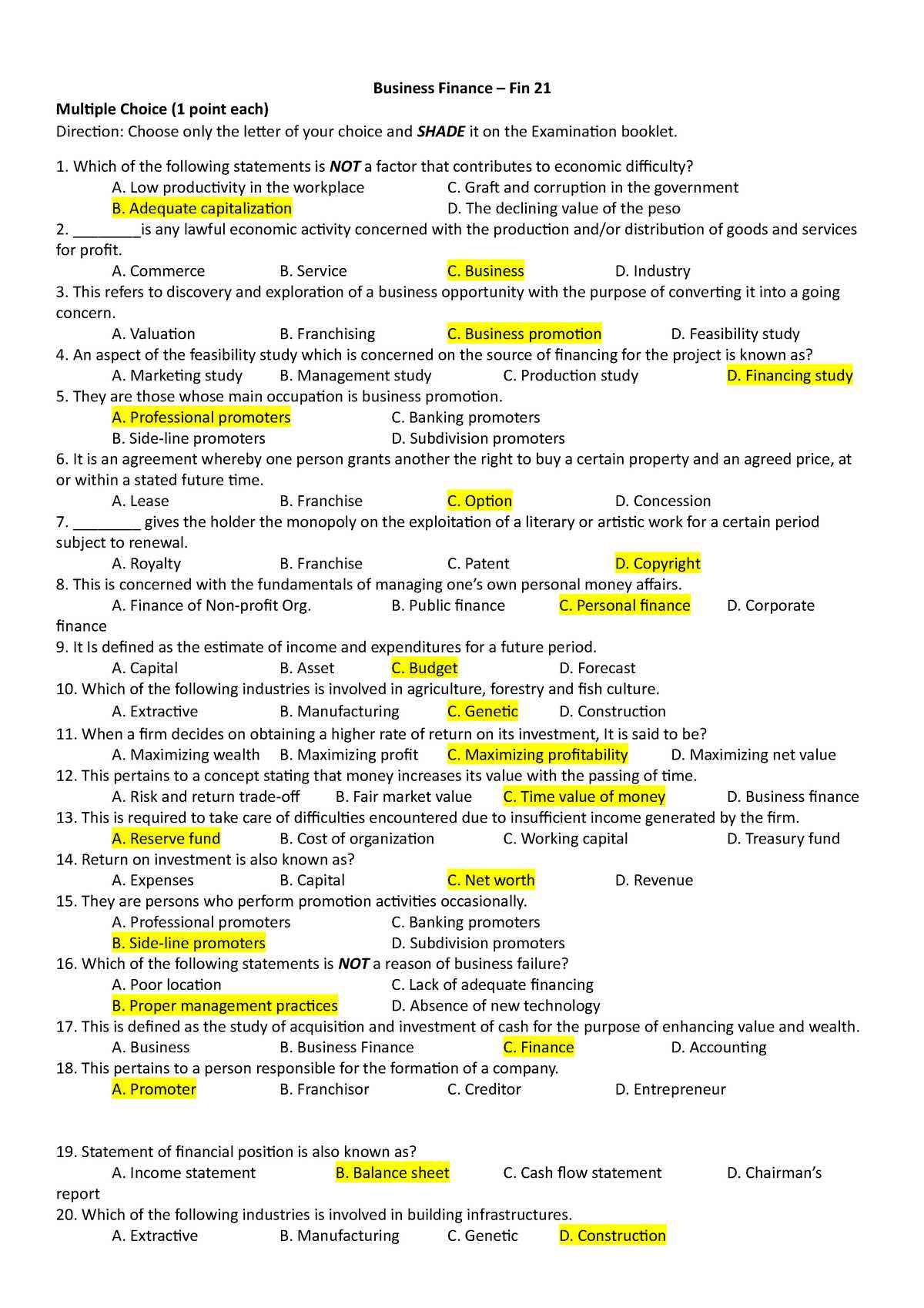

Revenue Generation and Taxation Systems

One key area that frequently appears is the government’s methods for generating income, particularly through various taxation systems. Students should be able to analyze the effects of different tax structures on the economy, businesses, and individuals.

Government Spending and Budget Allocation

Another commonly addressed topic is how governments allocate funds and decide on spending priorities. This area explores the impact of budgetary decisions on economic growth, public services, and long-term development.

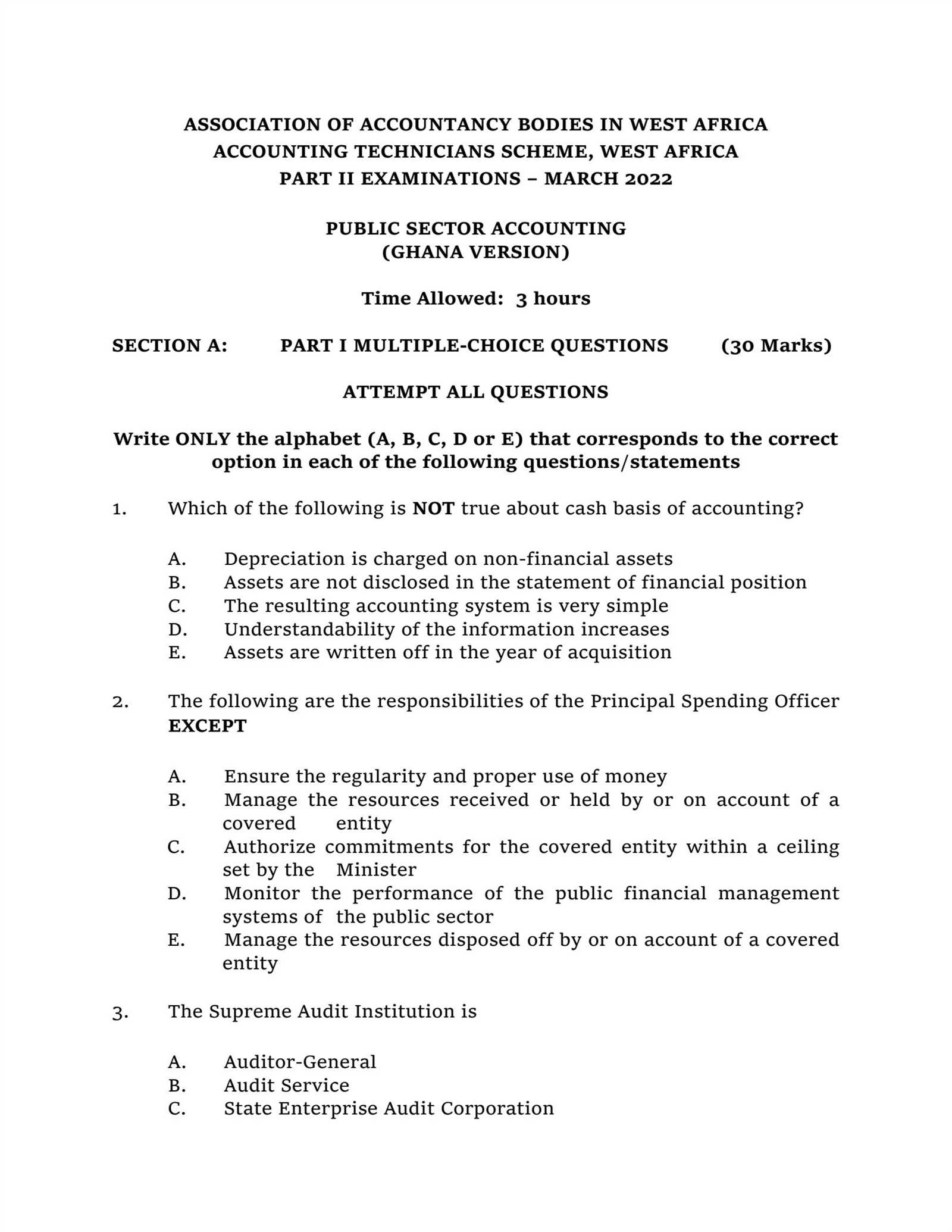

Understanding Government Budgeting Processes

The process through which governments plan and allocate their financial resources is a critical aspect of economic governance. Understanding how funds are distributed across various sectors helps clarify the impact of such decisions on national development and stability. This area covers the procedures used to determine priorities, balance income, and control spending.

Key elements of the budgeting process include:

- Setting national priorities and identifying key areas for investment

- Estimating government income and revenue sources

- Allocating resources for public services, infrastructure, and social programs

- Ensuring fiscal discipline through monitoring and adjustments

- Addressing deficits and managing debt

Comprehending these steps provides insights into how economic policies are shaped and how governments strive to balance economic growth with social well-being. It also highlights the long-term effects of financial decisions made at the state level on a country’s overall economy.

Taxation Policies in Public Finance

Taxation is a fundamental tool used by governments to generate revenue and shape economic outcomes. The design and implementation of tax policies influence various aspects of a nation’s economy, from income distribution to investment decisions. Understanding how different tax systems function and their broader effects is essential for analyzing the role of taxes in economic development and stability.

Key components of tax policies include:

- Progressive, regressive, and proportional tax systems

- Income, corporate, and consumption taxes

- Tax incentives and their role in encouraging investment

- Strategies for combating tax evasion and ensuring compliance

- The balance between tax rates and economic growth

Tax policies directly impact government revenue and are a critical element in shaping social welfare programs, infrastructure projects, and other public investments. Understanding the relationship between taxation and economic performance is vital for making informed decisions about national economic strategies.

Fiscal Policies and Economic Growth

Government policies related to taxation, spending, and borrowing play a crucial role in shaping economic performance. The way governments manage their budgets and adjust economic policies influences national growth, stability, and the overall welfare of citizens. By balancing government expenditure with revenue, fiscal decisions can stimulate or slow down the economy depending on the situation.

Impact of Government Spending

Increased public investment in infrastructure, education, and healthcare can boost productivity and long-term growth. Well-targeted government spending helps create jobs, improve living standards, and develop critical sectors of the economy. However, excessive or poorly planned expenditure can lead to inefficiencies and inflationary pressures.

Role of Taxation in Economic Development

Tax policies affect business investment and consumer behavior. Lower taxes can encourage spending and investment, stimulating economic activity. Conversely, higher taxes may reduce disposable income, affecting consumption levels but can also provide funding for essential public services. The challenge lies in finding the right balance that promotes growth without overburdening citizens and businesses.

Public Debt Management Explained

Managing a nation’s borrowing is a crucial aspect of economic governance. The process involves determining how to finance deficits while ensuring that the government’s debt remains sustainable in the long term. Effective management of liabilities is essential for maintaining fiscal health and avoiding excessive reliance on external creditors.

Key elements of debt management include deciding between domestic and foreign borrowing, setting interest rates, and determining repayment schedules. These decisions can influence a country’s credit rating, affect investor confidence, and determine the overall cost of borrowing. Proper debt management ensures that a government can meet its obligations without stifling economic growth or placing an undue burden on future generations.

Public Goods and Externalities Overview

Certain resources or services are provided in such a way that they benefit all individuals in society, regardless of their participation or contribution. These goods are typically underfunded or misallocated in a purely market-driven economy, requiring government intervention to ensure that society as a whole can access them. Additionally, economic activities can have side effects that impact people outside of the original transaction, both positively and negatively.

Characteristics of Public Goods

Public goods are non-excludable and non-rivalrous, meaning that no one can be excluded from their use, and one person’s use does not reduce their availability for others. Examples include clean air, national defense, and public parks. Since these goods cannot be sold in the traditional market, governments typically provide them to ensure widespread access and avoid inefficiencies.

Understanding Externalities

Externalities occur when the actions of individuals or businesses have unintended side effects on others. These effects can either be positive, such as the benefits of a well-educated population, or negative, such as pollution from industrial activities. Addressing externalities often requires policy measures to correct market outcomes and align private incentives with social welfare.

Social Welfare and Redistribution Policies

The role of governments in promoting the well-being of their citizens is central to modern economic systems. To address inequalities and ensure a minimum standard of living, various programs are put in place to support individuals and families facing financial hardships. These efforts often involve transferring resources from wealthier individuals to those in need, with the goal of reducing economic disparities.

Redistribution policies are designed to adjust the distribution of wealth across society. These policies typically include mechanisms such as taxes, social security benefits, unemployment assistance, and healthcare subsidies. The primary aim is to balance wealth inequality and provide essential services to those who may otherwise lack access.

Social welfare programs focus on improving quality of life for disadvantaged groups. By providing direct support such as cash transfers or food assistance, these programs aim to reduce poverty, increase access to education and healthcare, and promote general economic stability. Effective welfare systems contribute to long-term economic growth by ensuring that all members of society have opportunities to improve their circumstances.

Impact of Public Finance on Inflation

The relationship between government spending, taxation, and the overall economic environment plays a crucial role in shaping inflation levels. When governments allocate resources and manage the economy, their policies can either exacerbate or mitigate the pressures that contribute to price increases across the market.

Government spending is one of the key factors influencing inflation. Excessive expenditure, especially in times of economic overheating, can lead to an increase in aggregate demand, which often results in higher prices. When demand outpaces supply, the economy experiences upward pressure on the cost of goods and services.

Monetary Policies and Inflation

Monetary policy is another vital tool for managing inflation. Central banks play a significant role in controlling money supply through interest rates and reserve requirements. Lower interest rates can encourage borrowing and spending, potentially driving up inflation if not carefully managed. Conversely, raising interest rates can dampen spending and help control inflationary pressures.

Taxation and Inflation Control

Adjusting tax rates is another method governments use to influence inflation. By increasing taxes, especially on high-income earners or luxury goods, a government can reduce disposable income and curb demand, helping to lower inflation. On the other hand, tax cuts may boost consumer spending but could contribute to inflationary pressures if the economy is already operating at full capacity.

Government Spending and Its Effects

Government expenditure plays a fundamental role in the overall health and stability of an economy. It influences various sectors, from infrastructure to social programs, and affects the broader economic landscape through both direct and indirect channels. The way resources are allocated can either stimulate growth or lead to imbalances, depending on the level and focus of spending.

When the government increases its spending, it often stimulates economic activity by creating jobs, encouraging consumption, and boosting demand for goods and services. This can lead to faster growth, especially during periods of economic downturns or stagnation. However, excessive or inefficient allocation of funds can result in inflationary pressures or inefficiencies within the market.

On the other hand, when spending is reduced, it can slow down the economy, particularly if cuts affect vital areas like public health, education, or infrastructure. While fiscal tightening may help control inflation or reduce debt, it can also lead to decreased aggregate demand, higher unemployment, and slower economic expansion in the short term.

Role of Central Banks in Finance

Central banks hold a pivotal role in managing a nation’s monetary system and ensuring the stability of its economy. These institutions oversee the creation and regulation of currency, interest rates, and monetary policies that directly impact national and global financial conditions. Their actions can influence inflation, employment levels, and economic growth, making them essential in guiding overall economic health.

One of the primary functions of central banks is to control money supply and regulate interest rates. By adjusting these rates, they can either stimulate the economy by making borrowing more affordable or cool it down by making credit more expensive. In times of economic crisis, central banks may intervene by providing liquidity to financial institutions or implementing quantitative easing to encourage lending and investment.

Monetary Policy and Economic Stability

Central banks are responsible for shaping monetary policy, which is crucial for achieving long-term economic stability. Through policy tools such as open market operations, discount rates, and reserve requirements, central banks influence inflation and stabilize the currency. By carefully managing these aspects, they help avoid extreme fluctuations in prices and safeguard the purchasing power of the currency.

Regulating Financial Institutions

Another vital role of central banks is to regulate financial institutions to ensure their solvency and stability. By enforcing banking regulations and overseeing financial markets, they help prevent excessive risk-taking and ensure that institutions can withstand economic shocks. This regulatory framework is crucial in maintaining public confidence in the financial system.

International Trade and Public Finance

The relationship between global commerce and economic systems is complex and vital for national growth and development. The flow of goods, services, and capital across borders plays a key role in shaping the economic policies of countries. This interaction influences the fiscal strategies adopted by governments and how they manage resources, taxes, and spending to align with international market dynamics.

International trade significantly impacts the economic health of nations by affecting the balance of payments, exchange rates, and the availability of foreign investments. Countries that engage in open trade can benefit from increased access to resources, lower production costs, and expanded markets. However, it also requires careful management of tariffs, subsidies, and trade agreements to ensure that domestic industries remain competitive while fostering positive relations with trade partners.

Government policies regarding taxation, subsidies, and public spending are often shaped by the need to support or regulate international trade. The challenge lies in balancing the benefits of global commerce with the necessity of maintaining fiscal stability and equitable wealth distribution within the country. By understanding the interplay between trade and economic governance, nations can better position themselves in the global marketplace while supporting sustainable domestic growth.

Budget Deficits and Their Consequences

When government spending exceeds its revenue, it results in an imbalance that can have significant effects on the economy. These imbalances are typically referred to as budget deficits, which can influence both short-term financial stability and long-term economic growth. Understanding the causes, implications, and potential solutions to these deficits is essential for maintaining a healthy economic environment.

Budget deficits are not inherently harmful; in some cases, they may be necessary to stimulate economic growth, particularly during recessions. However, persistent deficits can lead to rising national debt, higher interest rates, and reduced investor confidence. The broader effects on inflation, employment, and public services must be carefully managed to avoid negative outcomes.

| Consequences of Persistent Deficits | Potential Solutions |

|---|---|

| Increased national debt and interest burden | Reducing government spending and increasing efficiency |

| Higher interest rates, limiting private investment | Raising taxes to increase revenue |

| Potential inflationary pressures | Implementing fiscal consolidation measures |

| Reduced public services and social spending | Encouraging private sector growth and investment |

While addressing budget deficits, policymakers must strike a balance between stimulating economic growth and maintaining long-term fiscal sustainability. Through effective management, it is possible to reduce deficits while fostering a stable and prosperous economy for future generations.

Public Finance and Income Inequality

Income disparity between different groups within a society often results from various economic factors, including wealth distribution, education, and employment opportunities. The role of governmental policy in addressing or exacerbating such gaps is crucial, as certain strategies can either promote greater equality or widen the existing divide. These policies influence wealth distribution through taxation, transfers, and public services, making their implementation vital in shaping a more balanced economic landscape.

Government interventions play a key role in reducing income disparity. Progressive tax systems, social safety nets, and public investments in education and healthcare are just a few examples of tools used to support lower-income households. However, the effectiveness of these measures often depends on the political climate, administrative efficiency, and the overall economic structure of a nation.

Monetary Policy and Public Finance

Monetary strategies implemented by central authorities are crucial for influencing economic stability, growth, and overall financial health. By regulating money supply, interest rates, and credit conditions, these policies directly impact the economic environment, including employment, inflation, and the overall economic balance. The interplay between monetary actions and governmental budgetary decisions shapes a nation’s economic trajectory and affects how resources are allocated across various sectors.

In particular, the approach taken by central banks can influence national debt levels, fiscal spending, and the effectiveness of economic policies. Decisions regarding interest rates and liquidity can either facilitate or constrain governmental expenditures, affecting the ability to implement large-scale projects or services. Coordination between monetary measures and budgetary strategies is key to ensuring that both sectors work harmoniously to maintain a balanced and sustainable economy.

Financial Crisis and Public Sector Responses

The onset of a financial crisis can have wide-ranging effects on the economy, leading to instability, loss of confidence, and disruptions in financial markets. In such times, the public sector plays a critical role in providing stability and support to the economy through various policy measures. Governments and central banks often work in tandem to implement fiscal and monetary policies aimed at addressing the immediate impacts of the crisis, restoring confidence, and promoting economic recovery.

Responses from Governments

When a financial crisis occurs, governments may take various steps to stabilize the situation. These measures might include increasing public spending on infrastructure, offering financial assistance to struggling businesses and households, providing liquidity support to banks, and implementing social welfare programs to support vulnerable populations. These actions are designed to stimulate economic activity, preserve jobs, and maintain social stability during periods of economic distress.

Central Bank Interventions

Central banks are also crucial in responding to financial crises. They may lower interest rates, increase the money supply, and provide emergency funding to banks in order to prevent a credit freeze. These monetary interventions are often complemented by fiscal measures from the government to ensure a coordinated effort in stabilizing the economy. Through a combination of these tools, central banks aim to restore normal economic conditions and bring about recovery.

| Response Measures | Description |

|---|---|

| Fiscal Stimulus | Government spending programs designed to boost economic activity during a crisis. |

| Monetary Easing | Reduction of interest rates and increased money supply to encourage borrowing and investment. |

| Support for Financial Institutions | Providing liquidity and capital to banks and other financial institutions to ensure stability. |

| Social Safety Nets | Programs and measures to protect individuals and families from economic hardship during crises. |

Effective Study Strategies for Exams

Preparing for academic assessments requires careful planning, focus, and disciplined effort. Effective study techniques not only help students retain information but also improve their ability to recall and apply knowledge under pressure. By employing the right strategies, individuals can optimize their preparation time, reduce anxiety, and enhance overall performance during assessments.

Active Learning Techniques

One of the most powerful ways to enhance retention is through active learning methods. Instead of passively reading through notes or textbooks, engaging with the material by summarizing key points, teaching others, or solving problems can significantly boost comprehension. Active recall, where learners try to retrieve information from memory rather than just reviewing it, has proven to be highly effective in strengthening long-term retention.

Time Management and Consistency

Developing a structured study schedule and sticking to it is crucial for successful preparation. Breaking study sessions into manageable blocks and incorporating regular breaks ensures sustained focus and prevents burnout. Consistency in study habits also builds momentum, allowing students to progressively master the material and avoid last-minute cramming.