Mastering the key concepts in financial management requires a solid understanding of the calculations that drive decision-making in the field. From evaluating investments to assessing risks, having quick access to essential math tools is crucial for both students and professionals. This guide provides a comprehensive overview of the most important equations and methods used in financial analysis.

Whether you’re tackling topics such as capital budgeting, time value, or portfolio management, being familiar with these calculations will streamline your learning process. The right set of techniques can help simplify complex financial scenarios, ensuring you can make informed and efficient choices in real-world applications.

By familiarizing yourself with the essential principles, you will be better prepared to navigate through any challenge in financial management. This resource serves as a quick reference for those looking to enhance their skills and knowledge in the discipline.

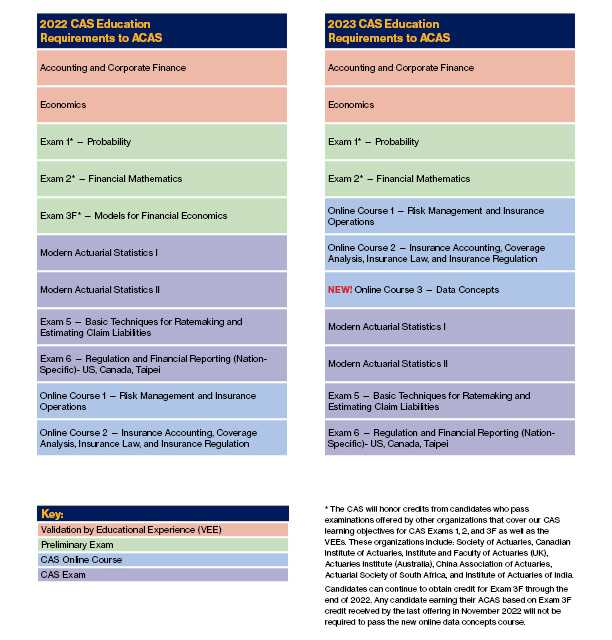

FM Exam Formula Sheet Overview

In financial management, having a reliable collection of essential calculations is vital for making informed decisions. These mathematical tools form the backbone of most financial analyses, helping to assess profitability, risks, and returns. This section introduces a curated set of methods that are commonly used in financial management studies and practices, allowing professionals and students to approach problems with confidence.

Core Concepts and Applications

The primary objective of mastering these calculations is to gain the ability to evaluate various financial scenarios effectively. Whether it’s assessing the value of an investment, calculating the cost of capital, or understanding the implications of debt, each tool serves a specific purpose. These concepts enable users to simplify complex financial challenges, ensuring that decisions are based on solid, quantifiable data.

Importance of Having Quick Access

Efficiency is key when working with financial data. Having quick access to the right calculations can significantly reduce the time spent solving problems and increase overall accuracy. By familiarizing oneself with these essential techniques, anyone can streamline their analysis and move forward with clarity and precision.

Key Formulas for Financial Management

In financial management, a strong grasp of key mathematical concepts is essential for evaluating financial decisions and solving complex problems. Whether you’re assessing investment opportunities or managing risk, understanding the core techniques is critical for making sound judgments. Below are some of the fundamental methods and calculations that are widely used in financial analysis.

Important Calculations for Financial Analysis

These calculations help professionals analyze business performance, investment prospects, and overall financial health. Key areas include time value, profitability, and risk analysis. Familiarity with these techniques can significantly improve your ability to make informed financial decisions.

- Time Value of Money: Understanding the concept of money’s value over time is crucial for evaluating investment returns and financing options.

- Net Present Value (NPV): This technique calculates the value of future cash flows in today’s terms, helping to determine the profitability of projects.

- Internal Rate of Return (IRR): The rate at which a project’s net present value equals zero, useful for comparing investment opportunities.

- Cost of Capital: The required return for an investor to compensate for the risk taken on an investment.

- Debt to Equity Ratio: A measure of a company’s financial leverage, indicating the proportion of debt used to finance assets.

Efficient Use in Financial Decisions

By mastering these key calculations, financial managers can quickly assess the viability of projects, forecast future performance, and ensure that capital is allocated efficiently. Whether you are preparing for a major investment decision or evaluating a company’s financial health, these calculations provide the foundation for making data-driven choices.

Understanding Time Value of Money

The concept of time value is fundamental in financial management, emphasizing the idea that money available today is worth more than the same amount in the future. This principle is based on the potential earning capacity of money–essentially, a dollar received now can be invested to generate additional value over time. Understanding this concept is crucial for making informed decisions in both personal and business finance.

Time value of money plays a key role in investment decisions, loan calculations, and valuation processes. It helps individuals and organizations assess whether it’s better to receive a sum of money now or later, taking into account interest rates, inflation, and investment returns.

Key components of this concept include:

- Present Value (PV): The current value of a sum of money to be received in the future, adjusted for interest or discount rates.

- Future Value (FV): The value of a sum of money at a specified point in the future, considering growth over time.

- Discount Rate: The interest rate used to discount future cash flows back to their present value.

By applying the time value principle, financial professionals can assess the real value of money in varying contexts, such as investment planning, loan structuring, and capital budgeting. This understanding allows for more effective decision-making and ensures that financial resources are managed optimally.

Investment Valuation Techniques

Valuing investments accurately is a critical skill in financial management, helping to determine whether an opportunity is worth pursuing. Investment valuation techniques provide the tools needed to assess the potential return on investments, taking into account factors such as risk, time, and expected cash flows. These methods allow investors to make informed decisions about where to allocate capital for the best possible returns.

Key valuation approaches include a variety of models that consider different aspects of an investment’s potential. Some methods focus on future cash flows, while others take a more holistic approach, integrating both market conditions and company performance. Understanding these techniques ensures that investment decisions are based on data-driven insights rather than assumptions or guesses.

Common investment valuation methods include:

- Discounted Cash Flow (DCF): This approach calculates the value of future cash flows, adjusting them for the time value of money to determine their present value.

- Comparable Company Analysis (CCA): This method compares the investment to similar companies or assets in the market to estimate its value.

- Precedent Transactions: This technique looks at past transactions involving similar investments to assess current market value.

- Asset-Based Valuation: This approach determines the value of an investment based on the value of its underlying assets, such as property or equipment.

By applying these valuation techniques, financial professionals can estimate the true worth of an investment, ensuring that resources are allocated wisely and risks are minimized. Whether you’re evaluating a stock, a bond, or a real estate project, using the right methods provides a clear understanding of an asset’s potential in the market.

Risk and Return Calculations

When making financial decisions, understanding the relationship between risk and potential return is essential. Every investment carries a level of uncertainty, and measuring the expected return relative to that risk helps investors make more informed choices. These calculations help evaluate how much risk is acceptable in pursuit of higher returns, and whether the potential reward justifies the associated risks.

Evaluating Investment Risk

Risk can be measured in various ways, depending on the type of investment and the level of analysis required. Common approaches include examining the volatility of returns and assessing the likelihood of loss. By quantifying risk, investors can make better decisions regarding which assets to include in their portfolios, balancing risk with the desired returns.

- Standard Deviation: Measures the variation in returns, indicating the level of volatility and potential risk of an investment.

- Beta Coefficient: Assesses the sensitivity of an investment’s return to the overall market movements, helping to evaluate its systematic risk.

- Value at Risk (VaR): Estimates the potential loss in the value of an investment over a specified period, given normal market conditions.

Assessing Return Potential

While risk quantifies uncertainty, return calculations focus on the potential reward from an investment. The objective is to determine whether the expected returns justify the amount of risk involved. Different methods allow investors to forecast the return on an investment based on historical performance or expected future performance.

- Expected Return: The weighted average of all possible returns, considering their probabilities.

- Capital Asset Pricing Model (CAPM): A model used to calculate the expected return on an asset based on its risk relative to the market.

- Sharpe Ratio: A risk-adjusted measure that calculates the return relative to its volatility, helping investors assess whether an investment provides a reasonable return for its risk level.

Understanding the balance between risk and return is fundamental to successful investment management. By using these calculations, investors can optimize their portfolios to achieve desired outcomes while minimizing exposure to excessive risk.

Capital Budgeting Formulas Explained

Capital budgeting is a crucial process in financial management, allowing businesses to evaluate and prioritize long-term investments. By using specific calculations, companies can assess whether a project is worth pursuing based on its potential returns and risks. These methods help determine the financial viability of a project and its alignment with the company’s strategic goals.

The most commonly used tools in capital budgeting involve calculating the profitability and risk of investment projects over time. The following table outlines some of the essential methods used to assess the feasibility of long-term projects:

| Method | Description | Key Formula |

|---|---|---|

| Net Present Value (NPV) | Evaluates the profitability of a project by comparing the present value of expected cash inflows to the initial investment. | NPV = Σ (Cash Flow / (1 + r)^t) – Initial Investment |

| Internal Rate of Return (IRR) | Identifies the discount rate that makes the net present value of the project equal to zero, helping to assess its profitability. | 0 = Σ (Cash Flow / (1 + IRR)^t) – Initial Investment |

| Payback Period | Calculates the amount of time it takes to recover the initial investment from the project’s cash inflows. | Payback Period = Initial Investment / Annual Cash Inflow |

| Profitability Index (PI) | Measures the ratio of the present value of future cash flows to the initial investment, indicating the potential profitability of the project. | PI = Present Value of Cash Inflows / Initial Investment |

These methods allow decision-makers to determine which projects will likely provide the highest return on investment and which may pose excessive risk. By incorporating these calculations, businesses can make better-informed decisions about where to allocate capital for future growth.

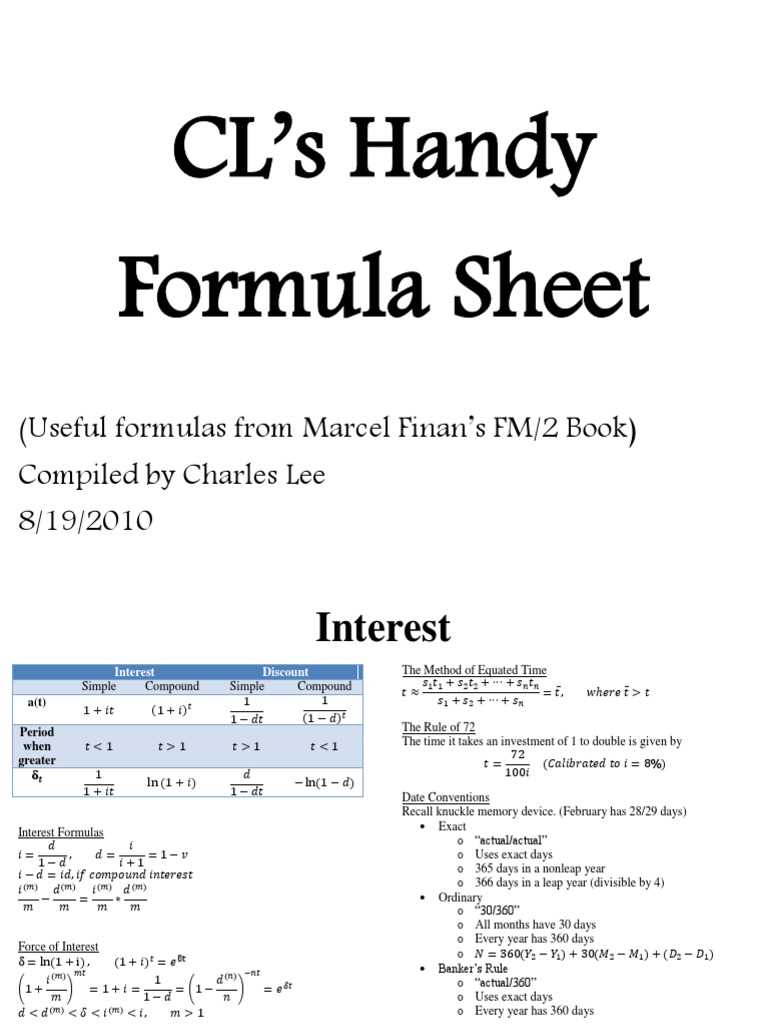

Interest Rate Calculations Simplified

Understanding interest rate calculations is fundamental for evaluating loans, investments, and financial products. Whether you’re dealing with simple or compound interest, these calculations help determine how much you’ll earn or owe over time. Mastering these methods allows individuals and businesses to make more informed financial decisions by understanding the cost or return on capital.

Simple Interest Calculation

Simple interest is one of the most basic methods for calculating interest. It is typically used for short-term loans or investments, where the interest is calculated on the initial principal amount for the entire duration of the investment or loan period. This method is straightforward and helps estimate the cost or return without accounting for the effects of compounding.

The calculation for simple interest is:

- Formula: Interest = Principal × Rate × Time

- Where:

- Principal is the initial amount invested or borrowed.

- Rate is the annual interest rate (in decimal form).

- Time is the time period for which the money is invested or borrowed, usually in years.

Compound Interest Calculation

Unlike simple interest, compound interest takes into account the interest that accumulates on both the initial principal and the accumulated interest from previous periods. This compounding effect makes it a more accurate reflection of how investments or loans grow or accrue over time. Compound interest is commonly used for savings accounts, loans, and investments where the interest is reinvested or added back into the principal.

The calculation for compound interest is:

- Formula: A = P (1 + r/n)^(nt)

- Where:

- A is the amount of money accumulated after interest (including principal).

- P is the principal amount (the initial investment).

- r is the annual interest rate (decimal).

- n is the number of times the interest is compounded per year.

- t is the number of years the money is invested or borrowed for.

By understanding both simple and compound interest calculations, individuals and businesses can accurately assess the impact of interest on loans and investments, helping them make smarter financial decisions.

Working with Cash Flow Analysis

Cash flow analysis is an essential tool for assessing the financial health of a business or investment. By tracking the movement of cash in and out of a company, this analysis helps identify whether the entity is generating enough revenue to cover its expenses, invest in growth, and meet financial obligations. Understanding cash flow is crucial for making strategic decisions that ensure long-term sustainability and profitability.

In cash flow analysis, the focus is on the timing and amount of cash inflows and outflows, which can vary depending on business cycles, industry norms, and investment strategies. A well-conducted analysis allows businesses to forecast future cash positions and avoid potential liquidity problems that might arise from operational inefficiencies or unforeseen expenses.

Key components of cash flow analysis typically include:

- Operating Activities: This section tracks the cash generated from a company’s core business operations, such as sales revenue, payments to suppliers, and employee wages.

- Investing Activities: This category focuses on cash inflows and outflows from the purchase or sale of assets, investments, or property.

- Financing Activities: It includes the cash flow from borrowing or repaying debts, issuing or repurchasing stock, and other financial strategies.

Accurate cash flow management ensures that a business has sufficient liquidity to fund operations and avoid financial distress. By regularly reviewing cash flow reports, businesses can make timely adjustments to their financial strategies, ensuring they remain on track for growth and profitability.

Cost of Capital Formulas

Understanding the cost of capital is critical for businesses when making investment decisions. It represents the required return that investors expect for providing capital to the company, whether through equity, debt, or other financial instruments. This cost is used as a benchmark to evaluate potential projects and investments, ensuring that they generate returns above the cost of acquiring capital.

The cost of capital can be broken down into different components depending on the sources of funding, each with its own calculation method. Typically, the total cost of capital is the weighted average of the costs associated with debt and equity financing, adjusted for the risk involved. Below is an overview of the key formulas and components used in calculating the cost of capital.

Cost of Debt

The cost of debt is the effective rate that a company pays on its borrowed funds. It is usually calculated after tax adjustments, since interest expenses are tax-deductible. This formula helps determine how much the company is paying for its loans or bonds.

- Formula: Cost of Debt = Interest Rate × (1 – Tax Rate)

Cost of Equity

The cost of equity is the return that equity investors expect on their investment in the company. This can be estimated using various models, but the most commonly used method is the Capital Asset Pricing Model (CAPM), which considers the risk-free rate, the expected market return, and the company’s beta (a measure of volatility relative to the market).

- Formula: Cost of Equity = Risk-Free Rate + Beta × (Market Return – Risk-Free Rate)

Weighted Average Cost of Capital (WACC)

The WACC represents the overall required return for a company, considering both debt and equity. It is the weighted average of the costs of debt and equity, where each is weighted according to its proportion in the company’s capital structure.

| Component | Formula |

|---|---|

| WACC | WACC = (E/V × Re) + (D/V × Rd × (1 – Tc)) |

| E | Market value of equity |

| D | Market value of debt |

| V | Total market value (E + D) |

| Re | Cost of equity |

| Rd | Cost of debt |

| Tc | Corporate tax rate |

By accurately calculating the cost of capital, companies can determine whether their projects are likely to create value and meet investor expectations. The cost of capital serves as a critical metric for assessing the financial feasibility of new investments, guiding business leaders in making decisions that will enhance long-term growth and profitability.

Leveraging Financial Ratios

Financial ratios are essential tools for analyzing a company’s performance and financial health. By comparing different financial metrics, these ratios provide insights into various aspects of a business, such as profitability, liquidity, efficiency, and solvency. Investors, analysts, and business managers use these ratios to make informed decisions about investments, creditworthiness, and overall business strategy.

These ratios allow stakeholders to evaluate how well a company is managing its resources, generating profits, and meeting its obligations. By assessing trends in these ratios over time or comparing them to industry benchmarks, businesses can identify areas of improvement and set performance targets.

Key Financial Ratios

Here are some of the most important financial ratios used to evaluate business performance:

- Liquidity Ratios: Measure the company’s ability to meet short-term obligations. The most common liquidity ratio is the Current Ratio, which compares current assets to current liabilities.

- Profitability Ratios: Assess a company’s ability to generate profit relative to its revenue, assets, or equity. Examples include the Gross Profit Margin and Return on Assets (ROA).

- Efficiency Ratios: Evaluate how well a company utilizes its assets and liabilities to generate sales and maximize profits. Ratios like the Asset Turnover Ratio help measure operational efficiency.

- Solvency Ratios: Analyze a company’s long-term debt obligations and its ability to repay them. The Debt to Equity Ratio is a common solvency ratio that indicates the proportion of debt used in financing.

Using Ratios for Business Decisions

By carefully monitoring these ratios, businesses can make more effective financial and operational decisions. For example, a company with strong liquidity ratios may be able to negotiate better terms with creditors or suppliers, while a business with a high profitability ratio may attract more investors. Additionally, comparing a company’s ratios to industry averages helps benchmark performance and identify areas where it may be falling short or excelling.

Financial ratios are not only valuable for internal analysis but also for communicating financial health to external stakeholders, such as investors, creditors, and analysts. Regularly reviewing these ratios enables businesses to adjust strategies, mitigate risks, and seize opportunities for growth.

Stock and Bond Valuation Basics

Valuing stocks and bonds is a fundamental aspect of investment analysis, providing investors with a way to determine the intrinsic worth of these financial instruments. Understanding how to assess their value helps investors make informed decisions about buying, holding, or selling securities. The valuation of stocks and bonds relies on different approaches, reflecting the distinct nature of these two types of investments.

For stocks, the value is typically based on the company’s ability to generate future cash flows, such as dividends or earnings. For bonds, valuation focuses on the present value of future interest payments and the repayment of the principal amount at maturity. Both methods require a deep understanding of the time value of money and the required rate of return.

Stock Valuation Methods

There are several methods used to assess the value of a stock, each based on different assumptions and approaches:

- Dividend Discount Model (DDM): This method calculates the present value of a company’s expected future dividends, assuming they will grow at a constant rate.

- Price-to-Earnings (P/E) Ratio: A simple approach that compares a company’s current share price to its earnings per share. A high P/E ratio may indicate overvaluation, while a low ratio might suggest undervaluation.

- Discounted Cash Flow (DCF) Analysis: This method calculates the present value of all future cash flows that a company is expected to generate, discounted at an appropriate rate.

Bond Valuation Methods

Bond valuation, on the other hand, involves assessing the present value of future payments, which include interest and the principal amount to be repaid at maturity. The key components of bond valuation include:

- Present Value of Coupon Payments: The sum of the present values of all future coupon payments, discounted by the bond’s yield or required return.

- Present Value of Principal: The present value of the principal amount that will be repaid to the bondholder at maturity, discounted at the same required return rate.

- Yield to Maturity (YTM): This represents the total return an investor can expect if the bond is held until maturity, taking into account both the coupon payments and the difference between the purchase price and the face value.

By applying these valuation methods, investors can determine whether a stock or bond is priced appropriately in the market, providing insights into potential investment opportunities. Understanding the nuances of these approaches is crucial for building a successful investment portfolio that aligns with individual financial goals and risk tolerance.

Understanding Net Present Value

Net Present Value (NPV) is a core concept in financial decision-making that helps evaluate the profitability of an investment or project. It involves calculating the difference between the present value of expected cash inflows and the present value of cash outflows. The basic principle behind NPV is that money received in the future is worth less than money received today, due to factors like inflation and opportunity cost.

By calculating the NPV, investors and businesses can determine whether an investment will generate more value than its cost. A positive NPV indicates that the projected returns exceed the initial investment, while a negative NPV suggests the opposite. This measure is essential for making sound financial decisions, as it accounts for both the timing and scale of future cash flows.

NPV is widely used in capital budgeting and investment analysis to compare different projects or investment opportunities. It helps decision-makers prioritize investments that will maximize value and align with strategic objectives. While NPV is a powerful tool, it’s important to note that it relies on accurate forecasts of future cash flows and an appropriate discount rate, which can introduce some level of uncertainty into the analysis.

Effective Use of Depreciation Methods

Depreciation is a key concept in financial management, helping businesses allocate the cost of tangible assets over their useful life. This process allows companies to match the expense of using an asset with the revenue it generates, offering a more accurate picture of financial performance. The choice of depreciation method can have significant implications on a company’s financial statements, tax liabilities, and cash flow management.

Different methods of depreciation are suited to various types of assets and business needs. The selection of the appropriate method depends on factors such as the asset’s usage pattern, tax strategy, and industry practices. Understanding these methods allows businesses to optimize their financial reporting and tax planning while ensuring that their financial projections align with real-world asset wear and tear.

Common Depreciation Methods

There are several widely used depreciation techniques, each with its own advantages and applications:

- Straight-Line Depreciation: This method evenly distributes the cost of the asset over its useful life. It is the simplest approach and works best for assets that lose value gradually and consistently.

- Declining Balance Method: This approach applies a higher depreciation expense in the earlier years of an asset’s life, reflecting the accelerated wear and tear. It is suitable for assets that lose value more quickly.

- Units of Production Method: This method ties depreciation directly to the asset’s usage or production output. It is ideal for machinery or equipment whose value declines based on usage rather than time.

Choosing the Right Depreciation Method

Choosing the correct depreciation method depends on several factors:

- Asset Usage: If an asset is used more heavily in its early years, an accelerated method may be more appropriate.

- Tax Implications: Certain methods, like the declining balance method, can result in higher depreciation expenses early on, reducing taxable income and providing short-term tax benefits.

- Industry Standards: Some industries have established depreciation practices, which may influence the decision on which method to use.

By understanding and applying the right depreciation method, businesses can more accurately reflect the value of their assets and manage their financial health effectively. The key is to select a method that aligns with the asset’s usage and the company’s long-term financial goals.

Using Probability in Financial Models

Incorporating probability into financial models is essential for assessing risk and uncertainty in decision-making processes. It allows analysts to estimate the likelihood of different outcomes, helping businesses and investors make informed choices under uncertain conditions. By applying probability concepts, financial models can more accurately reflect the real-world risks associated with investments, market fluctuations, and economic conditions.

Probability models enable the quantification of risks, providing a statistical framework for making predictions about future events. This approach is commonly used in various areas such as portfolio management, pricing of financial derivatives, and capital budgeting, where uncertain variables play a significant role. Using probability techniques, financial professionals can estimate expected returns, assess the distribution of potential outcomes, and adjust strategies accordingly.

Common Applications of Probability in Finance

- Risk Assessment: Financial professionals use probability to measure the risk of different investment opportunities and assess how likely a loss or gain is under various scenarios.

- Option Pricing: In derivative markets, probability helps calculate the fair value of options and other complex financial instruments by factoring in various possible future price movements.

- Portfolio Management: Probability distributions are used to optimize asset allocation and manage the risk-return profile of a portfolio.

Key Probability Techniques in Financial Modeling

- Monte Carlo Simulation: This method uses random sampling and statistical modeling to simulate a range of possible outcomes, providing a probability distribution of potential results for complex financial systems.

- Binomial Model: Often applied in options pricing, the binomial model calculates the potential future values of assets by considering multiple possible price paths.

- Value at Risk (VaR): VaR quantifies the maximum potential loss over a given time period with a certain level of confidence, helping firms understand the worst-case scenario.

By integrating probability into financial models, professionals can more effectively manage risk and enhance decision-making. The key is not to eliminate uncertainty but to quantify and account for it, allowing for more informed and strategic financial decisions.

Capital Structure and Leverage

The way a company finances its operations and growth plays a crucial role in determining its financial health and risk profile. The mix of debt and equity used to fund a business is known as capital structure, and understanding its impact is vital for making informed financial decisions. A well-balanced capital structure can maximize a company’s value and minimize the cost of capital, while a poor mix can increase the cost of financing and financial instability.

Leverage refers to the use of borrowed funds to amplify returns on investment. While leveraging can increase potential gains, it also magnifies risks. The relationship between leverage and capital structure is essential for companies to understand, as it directly influences profitability, risk, and the overall financial strategy.

Types of Leverage

- Operating Leverage: This type of leverage arises from a company’s fixed costs. High operating leverage means that small changes in sales can lead to significant changes in profits.

- Financial Leverage: This refers to the use of debt to finance investments. A company with high financial leverage uses more debt in its capital structure, which can increase returns but also raises financial risk.

Impact of Leverage on Risk and Return

- Increased Return on Equity: When a company successfully uses debt to finance profitable ventures, it can generate higher returns on equity. However, this comes at the cost of increased risk.

- Higher Financial Risk: The greater the amount of debt in the capital structure, the higher the risk of financial distress. In case of poor performance, debt obligations must still be met, which could lead to insolvency.

By carefully balancing debt and equity, companies can optimize their capital structure to achieve the desired level of profitability while managing risk. Leverage, when used wisely, can create value, but without proper risk management, it can lead to significant financial challenges.

Understanding Portfolio Management

Portfolio management involves the strategic allocation of financial assets to achieve specific investment goals while managing risk. It is a process that requires a comprehensive understanding of market dynamics, investor preferences, and asset types. The objective is to construct a mix of investments that balances the potential for return with an acceptable level of risk, based on an individual’s or institution’s financial objectives.

A well-managed portfolio takes into account various factors such as market trends, economic conditions, and risk tolerance. The goal is to optimize returns over time while minimizing the likelihood of significant losses. This process requires ongoing monitoring and adjustment to respond to changing market conditions and the investor’s evolving needs.

Types of Portfolio Strategies

- Active Management: In this approach, portfolio managers actively make decisions about asset allocation, seeking to outperform the market. This strategy involves frequent adjustments based on market analysis and trends.

- Passive Management: Passive management involves creating a portfolio that mirrors a market index, with minimal adjustments. The goal is to replicate the performance of the market rather than outperform it.

Risk and Diversification

- Diversification: This is a key concept in portfolio management. By spreading investments across different asset classes, sectors, or geographic regions, investors reduce the risk of significant losses from any single investment.

- Risk Tolerance: Understanding risk tolerance is crucial in designing a portfolio. It involves assessing how much risk an investor is willing to take to achieve their financial goals, considering factors like age, income, and investment horizon.

Effective portfolio management is an ongoing process that involves regular assessment and adjustment. By combining different asset types and applying strategies tailored to the investor’s objectives, it is possible to create a robust portfolio capable of achieving long-term financial success.

Optimal Asset Allocation Strategies

Optimal asset allocation is a fundamental aspect of investment strategy, aimed at balancing risk and return by distributing investments across different asset classes. The goal is to achieve the best possible financial returns while minimizing exposure to risk. This process requires a clear understanding of the investor’s financial goals, risk tolerance, and time horizon, along with a strategic approach to diversifying investments.

By selecting the right mix of asset classes–such as stocks, bonds, real estate, and alternative investments–investors can create a portfolio that maximizes potential returns in alignment with their risk preferences. The challenge lies in finding the appropriate balance that aligns with both short-term and long-term objectives, ensuring a well-rounded strategy that responds to market changes effectively.

Types of Allocation Strategies

- Strategic Asset Allocation: This long-term approach involves setting a fixed allocation for each asset class based on an investor’s risk profile and investment goals. It requires periodic rebalancing to maintain the desired distribution over time.

- Tactical Asset Allocation: This strategy allows for short-term adjustments to the asset mix based on market conditions and economic forecasts. It offers flexibility to capitalize on potential market opportunities but involves higher risk due to frequent changes.

Considerations for Effective Allocation

- Risk Tolerance: Understanding how much volatility an investor is willing to accept is critical in determining the right balance between high-risk and low-risk assets.

- Time Horizon: The length of time an investor plans to hold their investments plays a crucial role in shaping the asset mix. Longer time horizons often allow for more aggressive strategies, while shorter horizons may require a more conservative approach.

Ultimately, optimal asset allocation requires a thoughtful and dynamic approach, adjusting strategies as personal circumstances or market conditions change. By continually assessing and refining the mix of assets, investors can improve the likelihood of achieving their financial goals while maintaining a level of risk they are comfortable with.

Financial Modeling Best Practices

Creating reliable and accurate financial models is an essential skill for professionals in finance and investment. A well-constructed model provides valuable insights into a company’s financial performance and assists in making informed decisions. To ensure the model is both effective and efficient, it’s important to follow a set of best practices that enhance clarity, accuracy, and adaptability.

Financial models are used to forecast future financial performance, evaluate investment opportunities, and support strategic decisions. A strong model is structured, transparent, and easy to update when necessary. By following best practices, financial professionals can build models that stand up to scrutiny and provide actionable insights.

Key Practices for Building Effective Models

- Maintain Simplicity: Avoid overcomplicating the model. The simpler and more streamlined the structure, the easier it is to understand and maintain. Focus on key variables and avoid excessive assumptions that can obscure the analysis.

- Consistency in Formatting: Standardize the layout and formatting to make the model easy to follow. Use consistent color coding for different categories of information, clearly labeled headings, and well-organized data sheets.

- Use Clear Assumptions: Document and explain all key assumptions used in the model. This ensures transparency and helps others understand the reasoning behind the numbers, making the model more robust and credible.

Common Mistakes to Avoid

- Excessive Complexity: While some models may require detailed analysis, too many variables or intricate calculations can create confusion and reduce the reliability of the model.

- Overreliance on Past Data: Historical data is useful, but a model should be adaptable and account for future changes, such as market fluctuations or new business strategies.

- Lack of Flexibility: Models should be designed with flexibility in mind to allow for updates and adjustments based on new information, rather than being rigid and static.

By following these practices, financial analysts can create more accurate, transparent, and useful models. Consistency, simplicity, and adaptability are key to ensuring the model is reliable and can evolve with changing business conditions.