Preparing for an important assessment can often seem overwhelming, but breaking down the material into manageable sections makes it more achievable. By focusing on the essential principles and techniques, you’ll develop the confidence needed to tackle even the most challenging aspects of the subject. Understanding core topics and practicing regularly will set you up for success, ensuring you are well-equipped when the time comes.

Studying effectively involves more than just memorizing facts; it’s about grasping the underlying concepts and knowing how to apply them. Emphasis on real-world scenarios and problem-solving strategies will help deepen your comprehension, making the study process not only easier but also more engaging. Identifying common challenges that arise in tests can also provide valuable insight into areas where more attention may be needed.

Whether you are revising for conceptual questions or practicing problem-solving, the key is consistency. By familiarizing yourself with the structure of typical tests and practicing on example scenarios, you will be able to anticipate the types of content you will face. Focused preparation is the best way to maximize your performance and achieve a strong result.

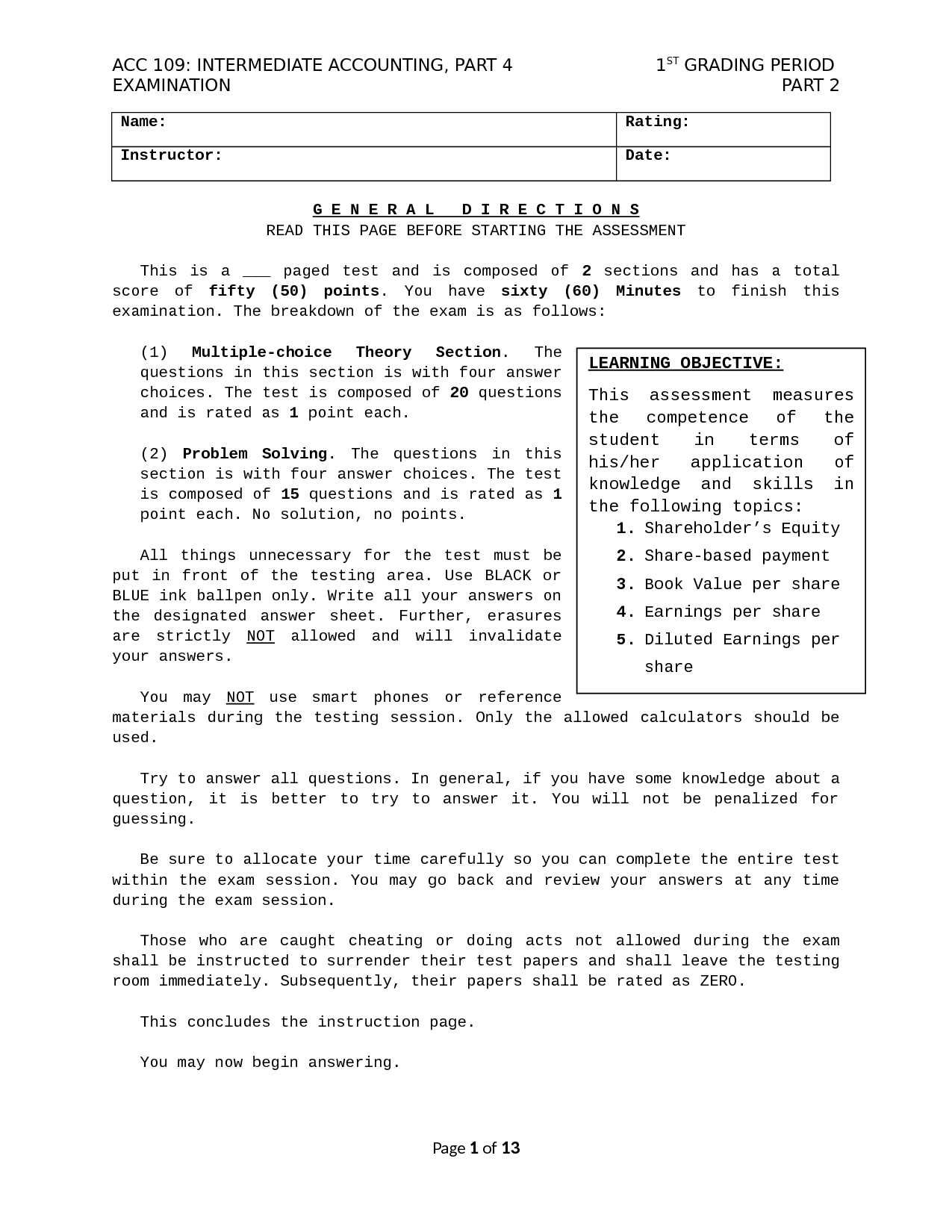

Intermediate Accounting 1 Overview

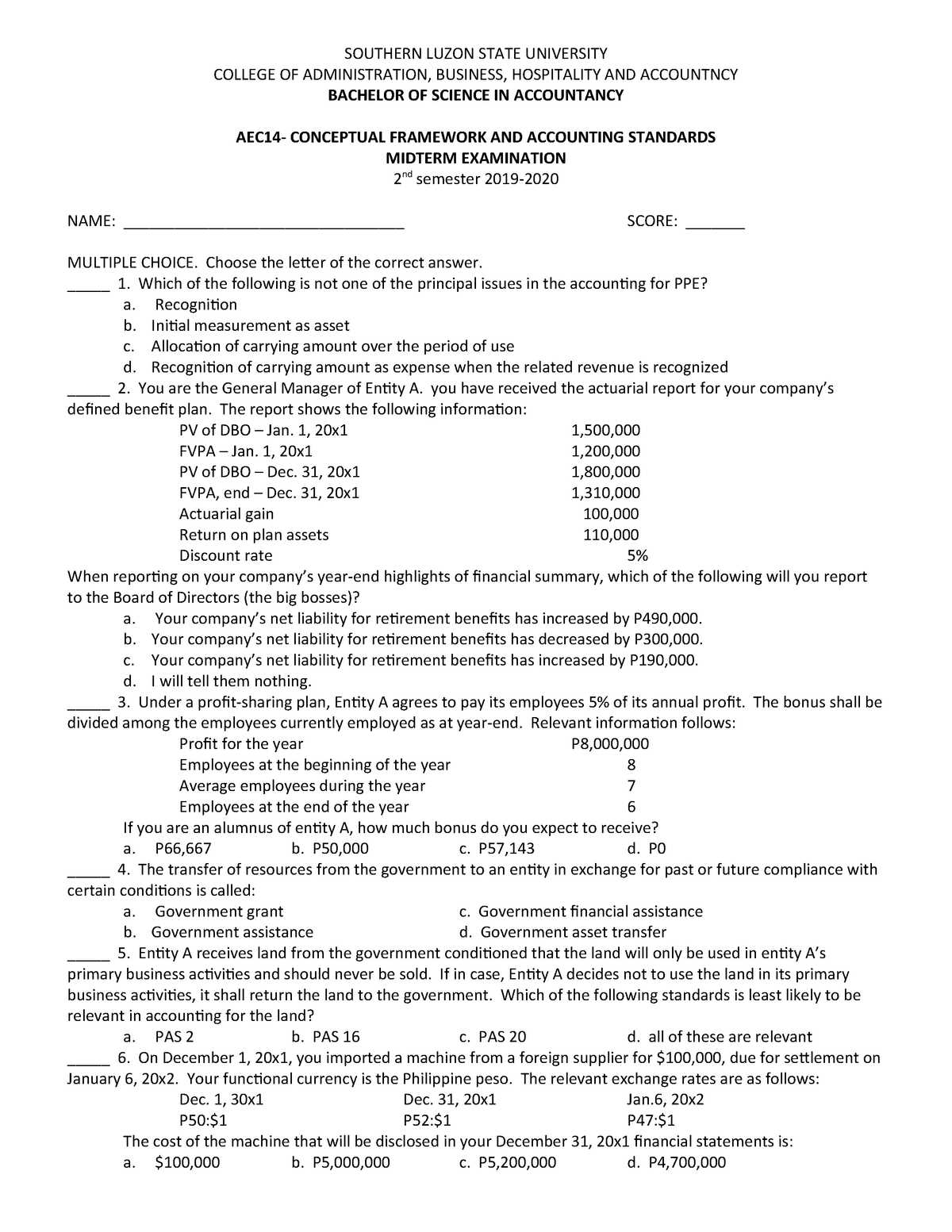

The assessment covers a wide range of topics designed to test your understanding of essential principles and techniques. Success in this challenge depends on how well you can apply your knowledge to real-world scenarios, solve practical problems, and demonstrate your ability to analyze and interpret financial data. The structure typically includes a mix of theoretical questions and practical exercises aimed at assessing both conceptual understanding and technical skills.

Key areas often emphasized include financial statement preparation, the recognition of revenues, managing various types of liabilities, and understanding methods of asset valuation. Being familiar with the format and types of problems that are likely to appear can make a significant difference in your performance.

| Topic | Key Concepts |

|---|---|

| Financial Reporting | Statement preparation, balance sheets, income statements |

| Liabilities | Current vs non-current, debt recognition |

| Assets | Depreciation, amortization, inventory valuation |

| Revenue Recognition | Timing, conditions, and methods |

| Investments | Equity, bonds, fair value vs cost method |

Key Topics for the Test

When preparing for this assessment, it’s essential to focus on the major areas that are most likely to be covered. These topics are fundamental to understanding the principles that underpin the subject and are crucial for solving both theoretical and practical problems. By mastering these key concepts, you’ll be well-equipped to approach a variety of challenges effectively.

Financial Statements and Their Components

One of the most important areas to focus on is the preparation and interpretation of financial statements. Understanding how to draft a balance sheet, income statement, and cash flow statement is vital. Additionally, knowing the relationships between different financial elements such as assets, liabilities, equity, revenues, and expenses is key to accurately presenting a company’s financial situation.

Valuation and Recognition Techniques

Another crucial area involves understanding how different assets and liabilities are valued and when they should be recognized. Topics such as depreciation methods, amortization schedules, and the timing of revenue recognition will frequently appear. It’s also important to differentiate between the various methods of asset and liability measurement, such as cost, fair value, or net realizable value.

Understanding Financial Statements

Financial statements are crucial tools for assessing the health and performance of any organization. They provide an organized snapshot of a company’s financial activities, allowing stakeholders to make informed decisions. Grasping the structure and components of these reports is essential, as it helps to interpret the financial data presented in a meaningful way.

Key Components of Financial Statements

The main financial statements include the balance sheet, income statement, and cash flow statement. Each of these plays a distinct role in portraying the financial status of a business. The balance sheet gives a detailed view of assets, liabilities, and equity, while the income statement outlines profitability over a given period. The cash flow statement shows how cash moves in and out of the company.

| Statement | Purpose | Key Elements |

|---|---|---|

| Balance Sheet | Shows the company’s financial position at a point in time | Assets, Liabilities, Shareholder’s Equity |

| Income Statement | Displays performance over a period | Revenue, Expenses, Net Income |

| Cash Flow Statement | Tracks cash movements during a specific period | Operating, Investing, Financing Activities |

Interpreting Financial Data

To analyze these statements, it is essential to understand the relationships between the different elements. For instance, the balance sheet’s liabilities and equity should match the total value of assets. Analyzing the income statement helps assess a company’s ability to generate profit, while the cash flow statement provides insight into the company’s liquidity and cash management. Mastering these concepts ensures a comprehensive understanding of an organization’s financial standing.

Common Ratios to Know

Ratios are vital tools for evaluating a company’s financial performance. These metrics provide insight into various aspects of a business, from profitability to liquidity and operational efficiency. By understanding and calculating key ratios, you can assess the strengths and weaknesses of a company more effectively.

Liquidity ratios are used to measure a company’s ability to cover short-term obligations with its available assets. Current ratio and quick ratio are two common examples that help determine whether a business has enough resources to meet its immediate liabilities.

| Ratio | Purpose | Formula |

|---|---|---|

| Current Ratio | Measures ability to cover short-term liabilities | Current Assets / Current Liabilities |

| Quick Ratio | Assesses liquidity excluding inventory | (Current Assets – Inventory) / Current Liabilities |

Profitability ratios focus on evaluating a company’s ability to generate profit relative to its sales, assets, or equity. Common profitability ratios include the net profit margin and return on assets (ROA).

| Ratio | Purpose | Formula |

|---|---|---|

| Net Profit Margin | Shows percentage of profit from revenue | Net Income / Revenue |

| Return on Assets (ROA) | Measures how efficiently assets generate profit | Net Income / Total Assets |

These ratios provide a strong foundation for analyzing financial health, offering valuable perspectives on both operational efficiency and overall stability.

Tips for Studying Effectively

Effective preparation requires more than just reading through notes; it involves active engagement with the material and strategic planning. By organizing your study sessions and focusing on the key areas, you can improve your understanding and retention. Consistency and variety in your approach are essential for mastering the content.

Establish a Study Plan

Creating a structured study plan is crucial for staying on track. Organize your time by setting specific goals for each session. Here are some helpful tips:

- Break down your study sessions into manageable chunks.

- Allocate time for both review and practice problems.

- Prioritize challenging topics that need more attention.

- Include regular breaks to avoid burnout.

Practice Regularly

One of the most effective ways to reinforce what you’ve learned is by practicing regularly. Solving problems and working through examples helps you apply theoretical knowledge to real-life situations. Consider these strategies:

- Work on past practice problems and mock exercises.

- Review incorrect answers and understand where mistakes were made.

- Use flashcards or quizzes to test your recall and understanding.

- Study in groups to discuss difficult concepts and share insights.

By focusing on these strategies, you’ll build a solid foundation and feel more confident when faced with the actual assessment.

How to Analyze Trial Balances

Analyzing a trial balance is an essential step in ensuring that financial records are accurate and that all transactions are properly recorded. It serves as a tool for identifying discrepancies, errors, or omissions in the general ledger before moving on to the preparation of financial statements. Understanding how to properly interpret a trial balance allows you to spot inconsistencies and make necessary adjustments.

To effectively analyze a trial balance, start by ensuring that the total of all debit balances matches the total of all credit balances. This is a key indication of whether the books are in balance. Any imbalance may suggest that an error occurred during the journal entries or posting process. If the totals don’t match, the next step is to systematically check each account to identify any potential mistakes.

In addition to checking for mathematical accuracy, it’s important to review the individual account balances for reasonableness. Ensure that the amounts in each account make sense based on the business operations. For example, if a company’s cash balance is unusually low while accounts payable is unusually high, this could signal an issue with cash flow management or the recording of payments.

Accrual vs. Cash Accounting

When managing finances, businesses can choose between two main methods for recording transactions: one that recognizes income and expenses when they occur, and another that records them only when cash is actually exchanged. These two approaches offer different advantages and drawbacks depending on the business’s needs and the level of accuracy required in financial reporting.

Accrual-based accounting provides a more comprehensive view of a company’s financial position. It records revenues when earned and expenses when incurred, regardless of when cash changes hands. This method is generally preferred for businesses that need to track long-term performance, as it aligns with the matching principle, ensuring that income is matched with the expenses incurred to generate that income.

Cash-based accounting, on the other hand, is simpler and more immediate. It only records transactions when money is actually received or paid. This method is often used by smaller businesses or those with simpler financial transactions, as it provides a more straightforward way of tracking cash flow without the complexity of managing accruals.

Choosing between these methods depends on the nature of the business and its reporting requirements. While accrual accounting gives a more accurate picture of a company’s financial health over time, cash accounting can be beneficial for smaller businesses with fewer financial activities and a focus on cash flow management.

Understanding Depreciation Methods

Depreciation is a method used to allocate the cost of tangible assets over their useful life. This concept is essential for businesses that invest in long-term assets, as it allows them to spread out the cost of these assets over time rather than expensing the full amount upfront. There are various approaches to calculating depreciation, each of which can affect a company’s financial statements and tax obligations in different ways.

Straight-Line Depreciation

The most commonly used method is the straight-line approach, which divides the initial cost of the asset evenly over its estimated useful life. This method results in the same depreciation expense each year, making it simple and predictable for financial planning. It is best suited for assets that lose value at a steady rate over time, such as buildings or office furniture.

Accelerated Depreciation

Accelerated depreciation methods allow businesses to expense a larger portion of an asset’s cost in the earlier years of its life. Two popular methods within this category are the double-declining balance method and the sum-of-the-years’-digits method. These methods are often used for assets that quickly lose value or become obsolete, such as technology or vehicles.

Understanding the various depreciation methods helps businesses make informed decisions about asset management and financial reporting. The choice of method can impact both the reported profits and tax liabilities of a company, making it an important consideration in overall financial strategy.

Revenue Recognition Principles

Recognizing revenue is one of the core aspects of financial reporting. It determines when and how a business records income from its activities, ensuring that the recognition aligns with the actual performance of the company. Proper revenue recognition is essential for accurately reflecting a company’s financial health and ensuring compliance with regulatory standards.

Core Principle of Revenue Recognition

The core principle behind revenue recognition is that income should be recorded when it is earned, not necessarily when cash is received. This principle ensures that revenue is matched with the corresponding expenses during the period in which the transaction occurs. For example, if a company delivers goods to a customer but has not yet received payment, it would still recognize the revenue once the goods have been transferred, provided all conditions for payment are met.

Common Revenue Recognition Models

There are several methods businesses use to recognize revenue, depending on the nature of the transaction:

- Point of Sale Recognition: This method records revenue when the sale occurs, typically when the product or service is delivered to the customer.

- Percentage of Completion: Often used in long-term contracts, revenue is recognized progressively as work is completed.

- Installment Method: This method is used when payments are made over time, recognizing revenue as cash is received.

Each model has specific criteria and guidelines to follow, ensuring that revenue is recognized in a way that accurately reflects the business’s activities and financial situation.

Handling Current and Non-Current Liabilities

Liabilities are obligations that a business must settle, typically by transferring assets or providing services in the future. These obligations are classified based on the time frame in which they need to be settled. Understanding the distinction between short-term and long-term liabilities is crucial for accurate financial reporting and effective cash flow management.

Current liabilities are debts that must be paid within one year or within the company’s operating cycle, whichever is longer. These typically include obligations that are expected to be settled with current assets, such as cash or inventory.

Non-current liabilities, on the other hand, represent obligations that extend beyond one year. These debts are often related to long-term financing, such as loans or bonds payable, and are not expected to be settled in the short term.

Types of Current Liabilities

Common examples of short-term liabilities include:

- Accounts payable

- Short-term loans

- Accrued expenses

- Taxes payable

- Unearned revenue

Types of Non-Current Liabilities

Long-term obligations include the following:

- Long-term loans

- Bonds payable

- Pension liabilities

- Lease obligations

Correctly classifying liabilities helps businesses better understand their financial obligations and manage their resources accordingly. It also provides investors and stakeholders with a clearer picture of a company’s financial stability and its ability to meet future commitments.

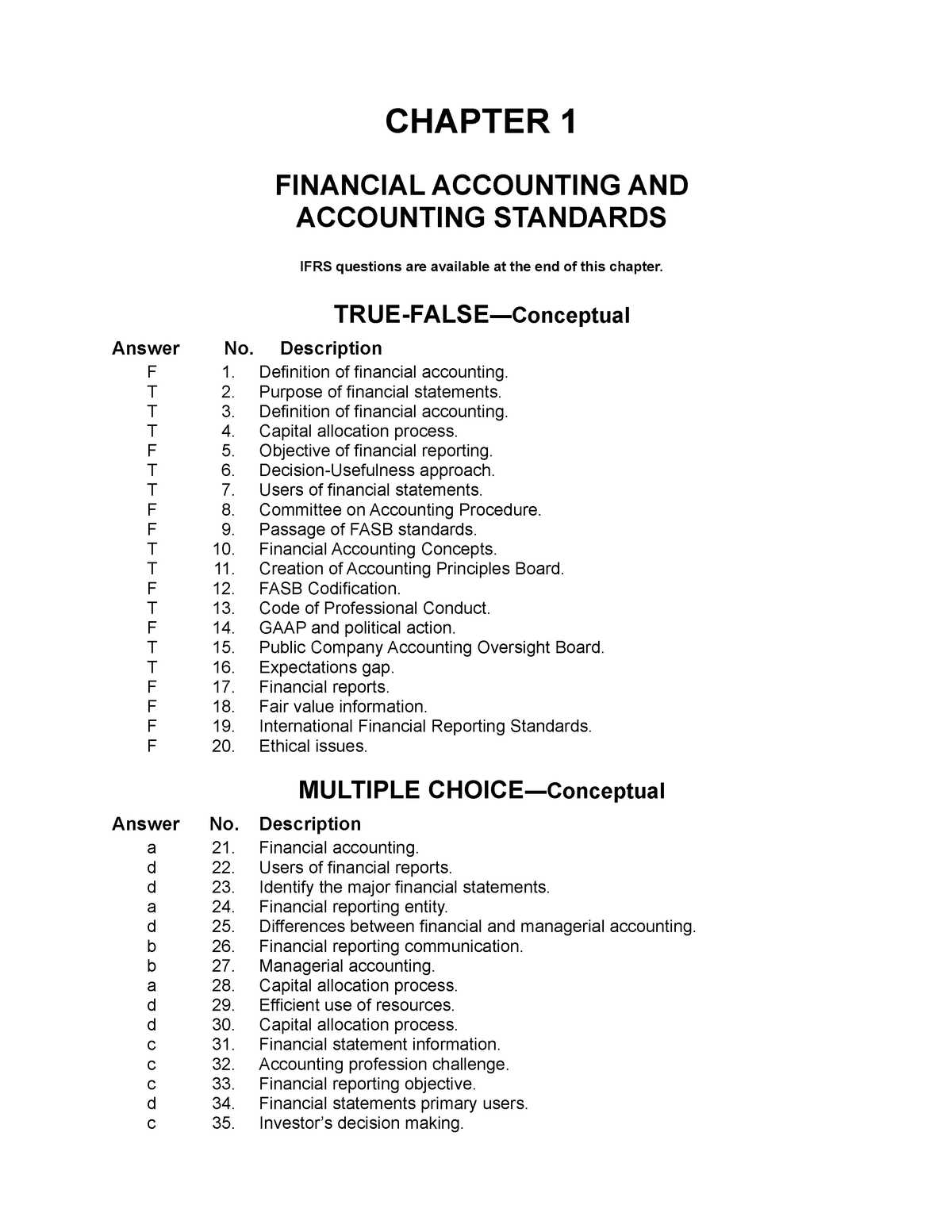

Preparing for Multiple Choice Questions

Multiple choice assessments are designed to test a wide range of knowledge in a focused and efficient manner. Preparing for such assessments requires a solid understanding of key concepts, as well as the ability to quickly analyze the options presented and select the most accurate response. Effective preparation goes beyond simply memorizing information; it involves strategic approaches to help you recognize the correct answers and avoid common pitfalls.

To excel in multiple choice tests, it’s important to practice with various question formats, familiarize yourself with the types of topics that are typically tested, and learn how to eliminate incorrect choices. The following strategies can significantly enhance your performance:

Key Strategies for Success

- Review Key Concepts: Focus on understanding the underlying principles rather than just memorizing facts. Pay attention to definitions, formulas, and important procedures.

- Practice with Sample Questions: Work through past tests or sample problems to get a feel for the types of questions that may be asked.

- Identify Patterns: Recognize recurring themes or topics that are frequently covered in tests. This will help you anticipate what might come up.

- Use Process of Elimination: When unsure, eliminate the obviously incorrect answers first, narrowing down your choices and increasing the odds of selecting the correct one.

- Manage Your Time: Pace yourself to ensure you have enough time to review all questions. Avoid getting stuck on difficult questions–move on and return to them if needed.

By incorporating these strategies into your preparation, you can approach each question with greater confidence and improve your chances of selecting the right answer in a multiple choice format.

Common Mistakes to Avoid

When tackling assessments, there are several pitfalls that can lead to errors and missed opportunities for success. These mistakes often arise from rushing through the material, misunderstanding key concepts, or failing to apply effective strategies during preparation. By recognizing these common mistakes, you can better position yourself for success and avoid unnecessary setbacks.

Common Pitfalls to Watch Out For

- Rushing Through Questions: Hurrying can cause you to overlook important details or misinterpret questions. Take the time to read each question carefully and ensure you understand it before answering.

- Skipping Over Difficult Topics: It’s tempting to focus on areas you feel more confident in, but ignoring challenging topics can lead to gaps in your knowledge. Make sure to dedicate time to all key areas, even the tough ones.

- Misinterpreting Instructions: Failing to fully grasp the instructions can result in incorrect responses. Always read the directions for each section thoroughly before proceeding.

- Neglecting Time Management: Spending too much time on one question can leave you with insufficient time to answer others. Set a pace that allows you to answer all questions and review your responses at the end.

- Overlooking the Process of Elimination: If you’re unsure about an answer, don’t be afraid to eliminate clearly incorrect choices. This will increase your chances of selecting the correct one from the remaining options.

- Not Reviewing Your Work: A final review of your responses is crucial for spotting mistakes or overlooked details. Always leave time to go back and check your answers.

Avoiding these common mistakes will help you approach your assessments with greater focus and improve your overall performance. With proper preparation and careful attention to detail, you can ensure a more successful outcome.

How to Approach Essay Questions

Written responses require a different set of skills compared to multiple-choice tasks. They test your ability to articulate and organize your thoughts clearly while demonstrating a thorough understanding of the material. Effectively answering essay prompts involves more than simply recalling information; it requires presenting a well-reasoned argument, supported by relevant examples and concepts. By developing a structured approach, you can approach each question with confidence and precision.

Steps for Crafting a Strong Response

- Understand the Prompt: Carefully read the essay prompt to ensure you understand exactly what is being asked. Break it down into key components and identify the main focus.

- Plan Your Response: Organize your thoughts before you start writing. Create an outline that includes the main points you intend to address, as well as any supporting examples or explanations.

- Develop a Clear Thesis: Your response should have a central argument or point. Clearly state your thesis in the introduction to guide the rest of your response.

- Support Your Argument: Provide evidence, examples, or logical explanations that reinforce your thesis. Show how the information you present connects to the prompt and supports your position.

- Maintain a Structured Format: Write in paragraphs that flow logically from one to the next. Each paragraph should focus on a single point that contributes to your overall argument.

- Review and Revise: Once you’ve finished writing, take time to review your response for clarity, accuracy, and completeness. Check for any errors in grammar, spelling, or punctuation that could detract from your answer.

Tips for Effective Time Management

- Allocate Time Wisely: Divide your available time between planning, writing, and reviewing. Avoid spending too much time on one section at the expense of others.

- Keep It Concise: While it’s important to provide detailed responses, avoid unnecessary elaboration. Be direct and to the point, focusing on what’s most important to the prompt.

By following these steps and using time efficiently, you can approach essay tasks methodically and produce clear, persuasive, and well-supported responses.

Practice Problems for Success

One of the most effective ways to prepare for any evaluation is by engaging with practice exercises. These problems not only help reinforce theoretical concepts but also provide valuable insight into the types of scenarios you may encounter. Working through various examples allows you to become more comfortable with the material, increases retention, and builds the confidence needed to tackle challenges during the actual assessment. By regularly practicing, you also refine your problem-solving skills and learn to identify patterns or common techniques used in different tasks.

Why Practice Matters

Repetition is key to mastering any subject. When you solve practice problems, you are actively applying your knowledge and learning from each step. It’s an interactive way to identify areas where you may need more focus and provides the opportunity to apply theories in practical situations. In addition, practicing under timed conditions can help you improve your speed, ensuring that you can complete tasks efficiently when it matters most.

How to Approach Practice Problems

- Start Simple: Begin with basic exercises to build a strong foundation before progressing to more complex scenarios.

- Work Methodically: Approach each problem step-by-step. Write down key information, break it into smaller parts, and tackle each one logically.

- Review Solutions: After solving problems, review the correct solutions carefully. Understand why a particular approach works and how different methods can lead to the same result.

- Challenge Yourself: Once you feel comfortable with easier problems, move on to more difficult ones. Pushing yourself beyond your comfort zone will ensure you’re fully prepared.

Regularly engaging with practice problems will significantly improve your understanding and performance. The more problems you solve, the better prepared you’ll be for tackling similar challenges in an actual test environment.

Mastering Adjusting Entries

Adjusting entries are an essential part of financial record-keeping, ensuring that all transactions are accurately reflected at the end of a reporting period. These adjustments account for revenues and expenses that have been earned or incurred but not yet recorded. By properly making these adjustments, businesses can present a true and fair view of their financial position. Mastering the process of adjustments is crucial for accurate reporting and maintaining the integrity of financial statements.

The Importance of Adjustments

Without proper adjustments, financial reports would be incomplete and misleading, potentially resulting in inaccurate assessments of a company’s performance. Adjusting entries are typically necessary for items such as accrued expenses, prepaid expenses, unearned revenue, and depreciation. They ensure that financial records comply with the matching principle and revenue recognition standards, which are fundamental to accurate financial reporting.

Types of Adjusting Entries

- Accruals: These entries account for revenues earned or expenses incurred that have not yet been recorded.

- Deferrals: Deferrals involve adjusting entries for revenues or expenses that were recorded before the related event actually occurred.

- Estimates: Some adjusting entries are based on estimates, such as depreciation or bad debt expense.

By regularly practicing adjusting entries, individuals can ensure that their financial data is both accurate and compliant with accounting standards, leading to more reliable financial analysis and decision-making.

Time Management During the Exam

Effective time management is a critical skill for success in any test or assessment. It allows you to allocate the right amount of time to each section, ensuring that you have enough time to thoroughly complete every task without rushing or leaving questions unfinished. Properly managing your time during the evaluation not only helps you stay calm and organized but also maximizes your chances of performing well under pressure.

The key to managing your time efficiently is to stay aware of how much time you have and pace yourself. Start by quickly reviewing the entire test at the beginning. This will help you get an overview of what to expect and allow you to strategize how to approach each section. Prioritize the sections that are easier or shorter, tackling more difficult tasks later when you have time to think through the answers carefully.

Another useful strategy is to set time limits for each section. For instance, if you know the test is divided into multiple parts, allocate a fixed amount of time for each section based on its difficulty level and length. Remember to keep an eye on the clock regularly to ensure you’re sticking to your plan. Adjust your pace if necessary, but don’t dwell too long on any one section, as this could cost you precious time elsewhere.

Lastly, practice under timed conditions ahead of time. This will help you get comfortable with the time constraints and improve your ability to think quickly and efficiently. The more you practice managing your time, the more naturally it will come during the actual assessment, leaving you free to focus on showcasing your knowledge.