Preparing for an academic challenge in the field of risk management requires a thorough understanding of complex topics. Students must engage with various concepts that cover the relationship between individuals, companies, and their financial protection mechanisms. Through critical thinking and case studies, learners can gain a deeper grasp of how these protective measures are implemented and enforced.

Comprehending the legal aspects of this domain is essential for success. The ability to interpret different scenarios and apply theoretical knowledge to real-world situations is key to mastering this subject. Effective preparation involves focusing on key principles, definitions, and the underlying rules governing financial security structures.

Understanding how rules are applied to specific cases can significantly enhance one’s ability to analyze and solve problems presented in practical settings. With a solid foundation, students can confidently approach challenges, interpret complex material, and ultimately perform better in their assessments.

Insurance Law Exam Questions and Answers

In order to excel in assessments related to risk management and protection mechanisms, it is crucial to understand both theoretical principles and practical applications. The ability to analyze various legal principles and how they interact with financial agreements can set the foundation for solving complex problems. By reviewing key topics and practicing application techniques, students can enhance their comprehension and improve their performance on assessments.

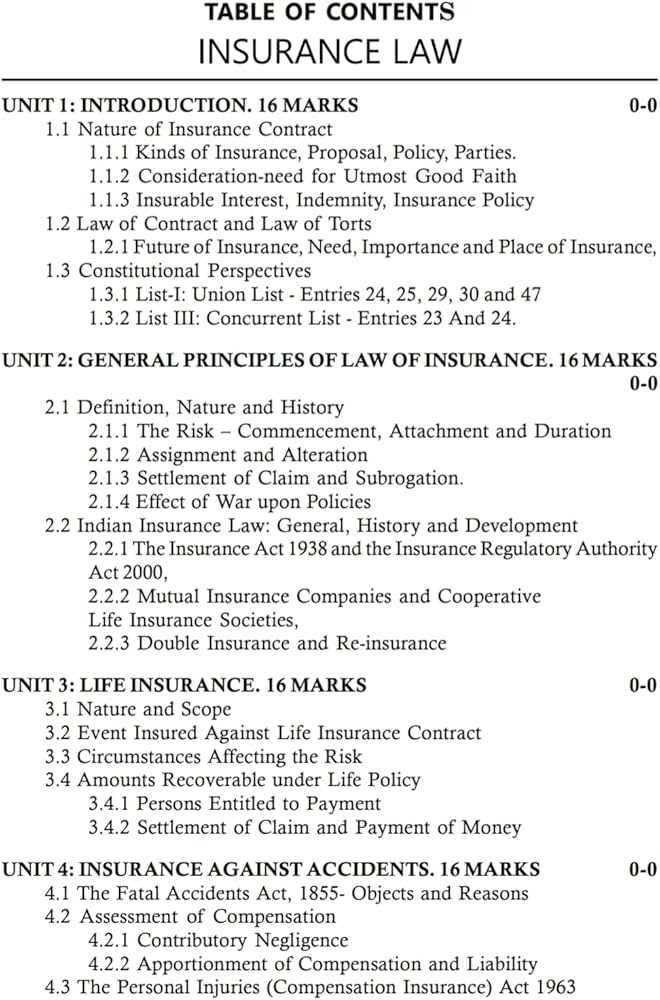

Key Concepts to Focus On

Familiarity with critical concepts allows for a deeper understanding of how protection schemes work. Key terms related to contractual obligations, liability, fraud, and claims processing are fundamental in grasping the full scope of the subject matter. Focus should be placed on the specifics of each term and how it influences practical situations.

Strategies for Mastering the Subject

Effective preparation requires a combination of theoretical knowledge and practical exercises. Reviewing real-life scenarios, analyzing case studies, and engaging with sample assessments can all help reinforce understanding and improve problem-solving skills. It’s important to practice answering complex scenarios and providing well-reasoned explanations to support your answers.

| Topic | Key Points |

|---|---|

| Contractual Obligations | Understanding rights, duties, and enforcement mechanisms in agreements |

| Liability Principles | Identifying responsibility in protection schemes and claims disputes |

| Fraud Prevention | Recognizing fraudulent activities and legal measures for prevention |

| Claims Processing | Steps involved in submitting, reviewing, and resolving claims |

Understanding Key Concepts in Insurance Law

Grasping the foundational principles of risk management mechanisms is essential for navigating this field effectively. These core ideas form the basis of how protection schemes are structured and how different parties interact with them. To excel, one must be well-versed in the terminology and concepts that shape the legal framework surrounding these financial agreements.

Several key concepts play a vital role in understanding how these systems operate. Familiarity with the following terms is crucial for any student or professional aiming to master the subject:

- Risk Assessment: The process of identifying, evaluating, and prioritizing potential risks.

- Contractual Agreement: The legally binding arrangement between involved parties defining the terms of protection.

- Premium Calculation: The determination of the payment amount based on various factors like risk level and coverage type.

- Coverage Scope: The extent to which a plan protects against different types of losses or damages.

In addition to these basic concepts, understanding how they interact with one another is equally important. For example, how risk assessments influence the terms of the agreement or how premiums are adjusted based on the scope of coverage. These connections form a cohesive system that requires careful analysis and application in practical scenarios.

Developing a solid understanding of these key principles is the first step toward mastering the material and tackling more complex problems in this field.

Common Questions on Insurance Contracts

Understanding the core principles of financial protection agreements is crucial for anyone navigating this field. These contracts often raise specific inquiries about their structure, enforceability, and the obligations they impose on both parties. Addressing these common concerns is essential for a clearer understanding of how these agreements function in practice.

Some of the most frequent points of confusion involve the terms and conditions outlined in the contract. Key topics often include:

- Coverage Limitations: What specific risks or damages are covered by the agreement, and which are excluded?

- Obligations of the Parties: What are the responsibilities of the individual or company entering the agreement?

- Policy Renewal: How and when should the contract be renewed to maintain continuous protection?

- Claims Process: What steps must be taken when a claim is made, and how is it assessed?

These topics often spark debate or confusion, but gaining clarity on each point ensures that both parties know their rights and responsibilities. Examining the nuances of these aspects helps to prevent misunderstandings and ensures proper application in real-world scenarios.

Liability in Insurance Law: What to Know

Understanding the principles of accountability and responsibility is crucial when dealing with protection agreements. These principles define who is responsible in the event of a claim and what factors determine the financial obligations of each party. Recognizing how liability is structured within such agreements helps in both evaluating risks and resolving disputes effectively.

Key aspects to consider when examining liability include:

- Policyholder’s Responsibility: The extent to which the individual or business must ensure compliance with terms and conditions.

- Insurer’s Duty: Understanding the obligations of the insurer, including handling claims and providing coverage as promised.

- Exclusions and Limitations: Identifying the situations where coverage may not apply, reducing the insurer’s liability.

- Negligence and Fault: How the actions or inactions of either party affect the assignment of responsibility in a claim.

Clarifying these components ensures both parties involved in the agreement understand their potential liabilities and the limits of their coverage. By addressing these factors, individuals and businesses can better navigate the intricacies of these protective mechanisms.

Essential Insurance Terminology for Exams

Mastering the key terms and concepts in risk management is critical for success in assessments related to this field. A solid grasp of these terms allows for clear understanding and accurate application of complex material. Familiarity with the language used in this domain ensures that you can interpret scenarios and answer questions with confidence.

Some of the most important terms to know include:

- Premium: The amount paid regularly by an individual or business to maintain protection coverage.

- Policyholder: The person or entity that holds the contract and receives the benefits of the coverage.

- Claim: A formal request for compensation made under the terms of a protection agreement.

- Deductible: The amount the policyholder must pay out-of-pocket before coverage kicks in for certain claims.

- Exclusion: A provision that limits or eliminates coverage for specific risks or damages.

Understanding these terms is essential not only for assessments but also for practical application in real-world scenarios. Being able to define and correctly apply these concepts will significantly enhance performance in any situation involving risk management agreements.

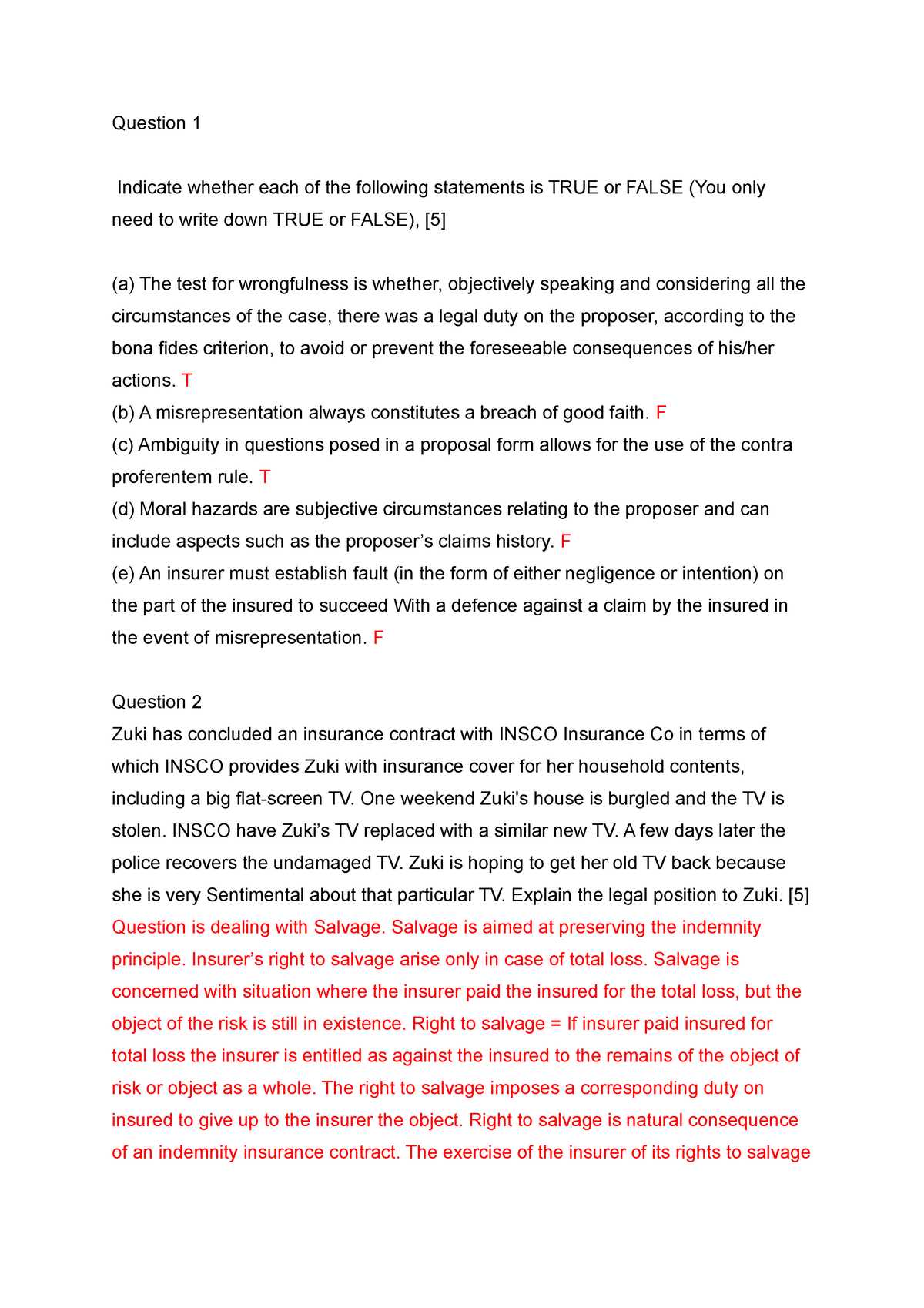

Case Studies in Insurance Law Exams

Practical scenarios are an essential part of mastering risk protection agreements. These real-life examples help students apply theoretical knowledge to resolve complex situations. By analyzing case studies, learners can better understand how principles are implemented and what considerations must be taken when making decisions in this field.

Case studies often present a variety of challenges, from contract disputes to claims issues, allowing students to practice identifying key factors that influence outcomes. These exercises not only improve analytical skills but also prepare individuals to handle similar situations in their professional careers.

Key aspects to focus on when reviewing case studies include:

- Identifying the central issue: Determine what specific problem or dispute needs to be resolved.

- Applying relevant principles: Use knowledge of rights, obligations, and exclusions to address the issue.

- Evaluating outcomes: Consider how different legal concepts or conditions would impact the final resolution.

- Critical thinking: Develop well-reasoned solutions based on facts, not assumptions.

By approaching case studies with a structured mindset, students can sharpen their ability to analyze real-world scenarios, making them more prepared for professional challenges.

Legal Principles Behind Insurance Claims

The foundation of any claim in risk protection schemes is built upon key principles that determine how claims are processed, evaluated, and resolved. These principles ensure that the process remains fair and consistent, providing both parties with a clear understanding of their rights and obligations. A strong grasp of these underlying concepts is essential for anyone involved in the management or settlement of such claims.

Some of the core principles that govern claims include:

| Principle | Description |

|---|---|

| Good Faith | Both parties must act honestly and disclose all relevant information during the agreement and claims process. |

| Indemnity | The goal is to restore the claimant to the financial position they were in before the loss, without allowing for profit. |

| Subrogation | Allows the provider to seek compensation from third parties responsible for the loss after paying the claim. |

| Utmost Good Faith | Both parties must share full transparency regarding all material facts to avoid any misrepresentation or fraud. |

Understanding these principles not only clarifies how claims should be managed but also helps in resolving disputes that may arise during the claims process. It ensures a structured approach, balancing the interests of all parties involved.

How to Analyze Insurance Law Scenarios

Effectively analyzing situations involving risk protection agreements requires a methodical approach. These scenarios often involve complex details that need careful evaluation to determine the rights, responsibilities, and potential outcomes for all parties involved. A structured analysis helps in identifying the most relevant factors, applying the right principles, and reaching a fair resolution.

Steps for Analyzing Risk Protection Scenarios

To properly assess such cases, follow these key steps:

- Identify the Issue: Determine what specific problem needs to be addressed–whether it’s a dispute over coverage, liability, or a claim denial.

- Review the Terms: Examine the terms of the agreement to understand the provisions that apply to the situation. Look for relevant exclusions, limits, or clauses that could impact the outcome.

- Gather Facts: Collect all the facts related to the incident, such as the nature of the loss, the actions of each party, and any documentation involved.

- Apply Legal Principles: Use the foundational principles of risk management to guide your analysis, such as good faith, indemnity, and negligence.

Key Considerations

When analyzing a scenario, pay attention to the following:

- Contractual Obligations: What are the primary duties of each party as defined by the contract?

- Exclusions: Are there any exclusions or limits that could prevent or reduce coverage?

- Precedents: Are there any previous legal rulings or precedents that could influence the decision?

By systematically working through these steps and considerations, you can gain a deeper understanding of the situation and provide a well-supported conclusion based on the facts and principles at hand.

Defining Insurance Policyholder Rights

The rights of individuals or entities holding risk protection contracts are fundamental in ensuring a fair and transparent relationship with the provider. These rights not only secure the policyholder’s ability to receive the benefits promised but also protect them from unfair treatment or breach of contract. Understanding these rights is essential for anyone involved in risk management agreements.

Policyholders are entitled to several key protections, which include:

- Right to Information: Policyholders have the right to receive clear, understandable details about their coverage, including exclusions, limits, and terms.

- Right to Fair Treatment: They are entitled to fair handling of claims, with no undue delays or arbitrary denials, provided the claim is within the terms of the agreement.

- Right to Privacy: Policyholders’ personal and financial information must be kept confidential, with access only granted in situations authorized by law or consent.

- Right to Appeal: If claims are denied or disputes arise, policyholders have the right to appeal the decision or seek external resolution through legal or regulatory channels.

- Right to Cancel: In certain circumstances, policyholders may cancel the agreement, subject to any applicable terms or penalties outlined in the contract.

These rights ensure that policyholders are not left vulnerable and can rely on their protection agreements to provide the intended security and financial support. Properly understanding and exercising these rights enables policyholders to navigate any challenges that may arise throughout the term of their contract.

Insurance Fraud: Legal Implications and Cases

Fraudulent activities within risk protection contracts undermine trust between providers and policyholders, leading to serious consequences for both parties. These deceptive practices can take many forms, ranging from exaggerated claims to deliberate falsification of information. Understanding the legal repercussions and real-world examples of fraud is crucial for both professionals in the field and policyholders who may encounter such issues.

Legal Consequences of Fraudulent Claims

Fraudulent actions in the realm of risk protection agreements often lead to significant legal penalties, including:

- Civil Penalties: Individuals found guilty of fraud may be required to pay restitution, return any ill-gotten gains, or compensate the affected party.

- Criminal Charges: In severe cases, fraud can lead to criminal charges, resulting in fines or imprisonment, depending on the scale of the deceit.

- Contract Voidance: If fraud is detected, the contract may be rendered null and void, meaning the policyholder is no longer entitled to any benefits under the agreement.

- Reputational Damage: Both the individual involved in the fraud and the provider can suffer long-lasting damage to their reputations, which can affect future dealings and business relationships.

Notable Fraud Cases in the Field

Real-world examples of fraud highlight the importance of vigilance and thorough investigation. Some notable cases include:

- Claim Inflation: A policyholder falsely inflates the value of a loss or damages in an attempt to receive a higher payout, often leading to a lengthy investigation and potential charges.

- Fake Injuries: An individual may falsely claim an injury to secure compensation for medical expenses, lost wages, or disability benefits, despite having no actual harm.

- Arson for Profit: A case where a property owner sets fire to their own building to claim insurance payouts, a crime that often involves elaborate schemes and falsified reports.

These cases underscore the importance of protecting the integrity of risk management agreements, ensuring that both providers and policyholders act ethically and within the bounds of the contract. By understanding the potential consequences of fraudulent activity, individuals can better navigate the complexities of these agreements and help reduce the risk of fraud in the industry.

Examination of Insurance Coverage Disputes

Disputes regarding the extent of coverage are a common challenge in the realm of risk protection contracts. When policyholders seek compensation or benefits, disagreements may arise over the scope of protection provided, exclusions, or the interpretation of terms. Understanding how these conflicts are addressed and resolved is essential for both providers and insured parties to ensure fair and just outcomes.

Common Causes of Coverage Disputes

Several factors can lead to disagreements over the extent of coverage, including:

- Ambiguities in Policy Language: Vague or unclear wording can lead to differing interpretations, creating confusion about the coverage’s application.

- Exclusions and Limitations: Some claims may be denied based on exclusions or limits outlined in the policy, such as specific types of damages or incidents not covered.

- Failure to Disclose Information: If the policyholder fails to disclose relevant details or misrepresents facts, coverage may be reduced or denied.

- Failure to Meet Conditions: Many contracts have specific conditions that must be met for coverage to apply, such as timely reporting of a loss or filing a claim within a specified period.

Methods for Resolving Coverage Disputes

To resolve coverage disputes, several approaches are typically employed:

- Negotiation: In many cases, policyholders and providers attempt to settle disagreements through direct negotiation, aiming to find a mutually acceptable solution.

- Mediation: A neutral third party may be involved to facilitate a compromise between both sides, helping to reach an amicable resolution.

- Arbitration: In more formal proceedings, both parties may agree to submit the dispute to arbitration, where an impartial decision-maker will make a binding determination.

- Litigation: If other methods fail, legal action may be taken, with the case being decided by a court based on the terms of the contract and applicable laws.

By understanding the root causes of coverage disputes and the resolution options available, policyholders and providers can better navigate these challenges and minimize the impact of conflicts. A thorough review of policy language, clear communication, and adherence to terms are essential in preventing and resolving such disagreements.

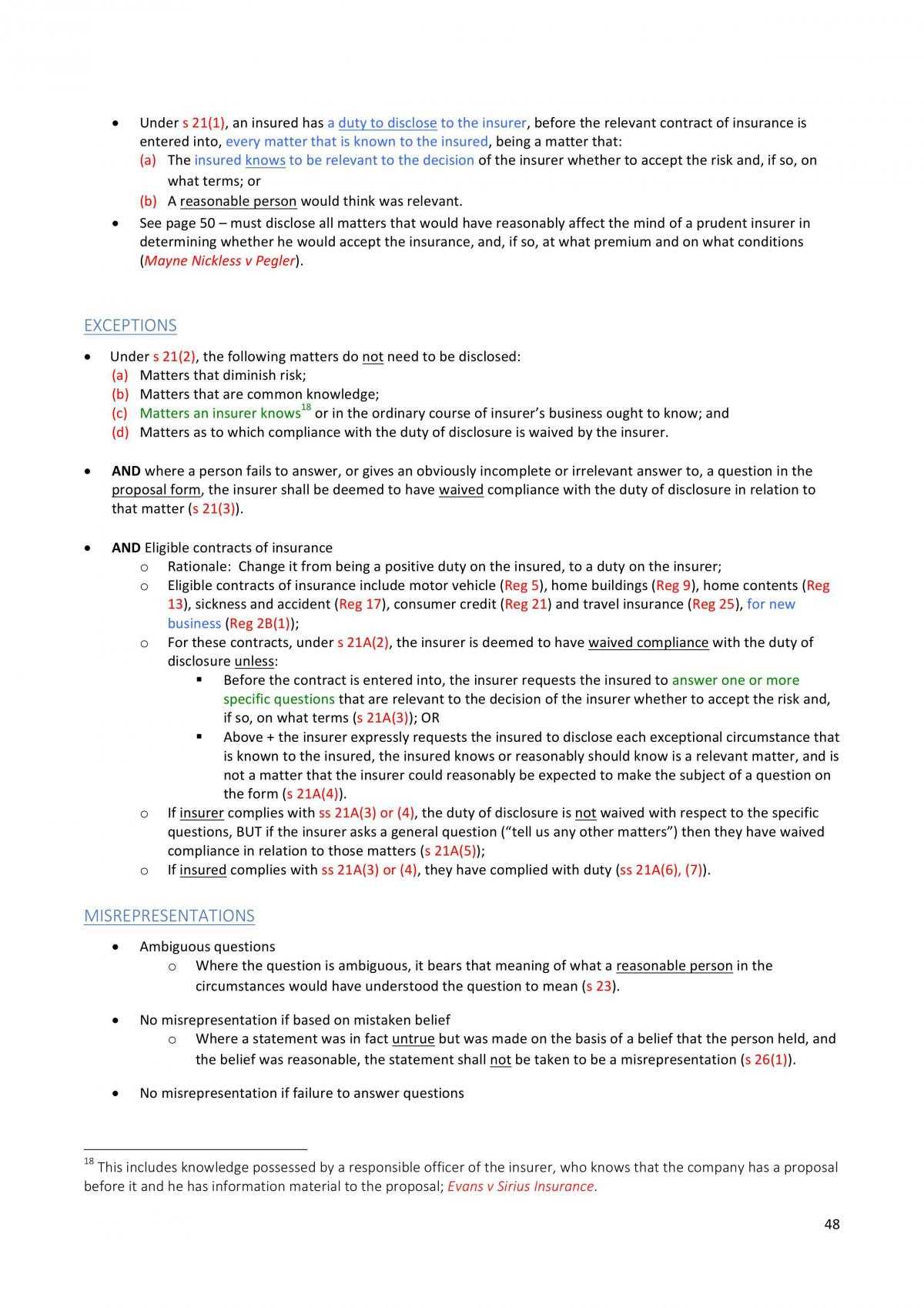

Examining Insurance Law Statutory Provisions

Statutory provisions play a crucial role in shaping the framework for risk protection agreements and determining the rights and obligations of parties involved. These legal statutes are designed to offer clarity, prevent fraud, and ensure fairness within the industry. Understanding the key provisions that govern these contracts helps in interpreting and enforcing the terms effectively.

Such provisions outline specific requirements for how contracts should be written, the responsibilities of both parties, and the procedures for resolving disputes. They also provide guidelines for the duties of the provider and the protections available to the policyholder. By adhering to these provisions, both parties can ensure that their interactions comply with the established standards, minimizing risks of conflict or legal issues.

Some of the core areas covered by statutory provisions include:

- Disclosure Requirements: Both the provider and the policyholder are required to disclose material facts relevant to the agreement. Failure to do so may result in penalties or voiding of the contract.

- Claims Process: Statutory guidelines often establish how claims should be processed, including time limits for reporting and submitting claims, and the documentation required to support them.

- Consumer Protection: Laws often include provisions designed to protect consumers from unfair practices, such as misrepresentation or unfair denial of claims.

- Regulation of Premiums: Statutory provisions may regulate how premiums are calculated and ensure they are fair and based on the actual risk involved.

By understanding these statutory frameworks, both policyholders and providers can navigate the complex terrain of risk management agreements with confidence. Ensuring compliance with these provisions not only protects the parties involved but also promotes transparency and fairness in the industry.

Legal Procedures for Insurance Claim Handling

The process of handling claims involves a series of structured steps designed to ensure fair treatment of both the claimant and the provider. These procedures are crucial in determining whether a claim is valid, the extent of coverage, and how the resolution is reached. The systematic approach helps both parties understand their rights, responsibilities, and the proper course of action when disputes arise.

Initial Steps in Claim Filing

When a claim is made, it triggers a series of actions that must be followed carefully. The primary steps include:

- Claim Submission: The claimant must provide all necessary documentation, such as forms, evidence, and reports, to initiate the claim process.

- Verification of Information: The provider must verify the details provided to ensure they are accurate and complete before moving forward with the evaluation.

- Notification of Coverage: Once the claim is processed, the claimant is informed whether their claim is accepted, partially accepted, or denied based on the terms outlined in the contract.

Resolution and Dispute Handling

In some cases, disagreements may arise regarding the validity or amount of the claim. Legal procedures guide the handling of these situations through:

- Negotiation: Both parties may attempt to reach a settlement through direct discussions, with the aim of avoiding further disputes.

- Mediation: If negotiation fails, a third-party mediator may be involved to help facilitate a resolution.

- Litigation: If an agreement cannot be reached, the case may proceed to court, where a judge or arbitrator will make a final decision based on the contract and applicable regulations.

Adhering to these procedures ensures a transparent, efficient process that protects the rights of both the claimant and the provider. By understanding these steps, all parties involved can navigate the claims process with greater confidence and clarity.

Insurance Law Examination Strategy Tips

Success in legal assessments, particularly those related to the intricacies of contractual obligations and regulatory principles, hinges on clear understanding and effective strategies. Grasping the underlying concepts and applying them efficiently can significantly improve performance. With the right preparation and approach, candidates can tackle even the most complex scenarios with confidence.

Preparation Tips

Proper preparation is the foundation of success in any legal assessment. Focus on the following key elements:

- Understand Core Concepts: Focus on mastering fundamental terms and principles. A solid grasp of the primary concepts is essential for solving case scenarios effectively.

- Review Case Studies: Analyze real-world cases to understand how theoretical principles are applied in practical settings. This helps build a practical understanding of the subject matter.

- Practice Writing Skills: Articulate your understanding clearly in writing. Practice drafting concise, well-structured responses that address the key elements of the problem.

During the Assessment

When faced with an assessment, the following strategies will help you manage your time and responses:

- Read Carefully: Thoroughly read each scenario and identify key facts. Pay attention to the details, as minor aspects can often be crucial to solving the problem.

- Outline Your Response: Before writing, take a few moments to outline your response. Structuring your answer ensures you cover all relevant points and avoids missing critical elements.

- Stay Focused: Keep your answers clear and focused on the specific issue presented. Avoid deviating into unrelated topics or overcomplicating the response.

By following these strategies, candidates can enhance their ability to effectively navigate the complexities of legal assessments, ensuring they are well-prepared to address any challenge that arises during the evaluation process.

Common Pitfalls in Insurance Law Exams

When navigating legal assessments, particularly those that involve intricate contractual principles and regulatory requirements, candidates often encounter several common challenges. Understanding these typical pitfalls can help prevent missteps and improve performance. Awareness of these potential issues allows for better preparation and ensures more accurate responses during the evaluation process.

Frequent Mistakes to Avoid

The following are common errors students make in legal assessments:

- Overlooking Key Facts: It’s easy to miss crucial details when reading a scenario quickly. Careful analysis of every fact is necessary, as small pieces of information often make a significant impact on the outcome.

- Misinterpreting Terminology: Confusing or misapplying technical terms can undermine an answer. Clear understanding and correct usage of specific terminology are essential for accurate analysis.

- Failure to Address All Aspects: Sometimes, responses focus only on one element of the issue, neglecting other important components. Ensure all parts of the question are fully addressed.

Strategies for Overcoming Pitfalls

To avoid these common pitfalls, consider the following strategies:

- Read Questions Thoroughly: Before answering, take the time to read the prompt carefully, identifying all the details and any specific points that must be covered in the response.

- Plan Before Writing: Outline your response before diving into the full answer. This ensures that your thoughts are structured logically and that you address all aspects of the question.

- Clarify Ambiguous Points: If any part of the prompt seems unclear, don’t hesitate to ask for clarification or make reasonable assumptions based on your knowledge.

By recognizing and avoiding these pitfalls, candidates can approach assessments with greater confidence, ensuring their responses are both thorough and precise.

Important Precedents in Insurance Law

Legal precedents play a crucial role in shaping the principles and interpretations that govern various contractual obligations. In particular, key rulings serve as foundations for resolving disputes and clarifying the boundaries of obligations between involved parties. Understanding these precedents is essential for navigating the complexities of the field and for ensuring informed decision-making when addressing related issues.

Notable Cases to Consider

Here are some landmark decisions that have significantly impacted the way legal relationships in this domain are understood:

- Case 1: The Coverage Interpretation – This case clarified the extent to which policyholders are entitled to compensation under certain conditions, setting a standard for interpreting ambiguous clauses.

- Case 2: The Duty of Disclosure – In this ruling, the court emphasized the importance of full disclosure by the policyholder, outlining the consequences of withholding information during the application process.

- Case 3: The Liability Limitation – This precedent examined the scope of the insurer’s responsibility, determining limits to the amount that could be claimed in specific circumstances.

Significance of These Rulings

These cases have not only shaped how terms are applied in future agreements but also influence legal reasoning when disputes arise. They help define the expectations of both insurers and policyholders, ensuring clarity in the contractual relationship. Familiarity with such precedents can guide practitioners in assessing claims, drafting policies, and handling disputes with confidence.

Understanding Insurance Law Case Law

Case law plays a fundamental role in shaping the framework that governs contractual relationships in this field. By examining how courts have ruled on disputes and interpreting terms, we gain valuable insights into the application of principles and guidelines. These rulings help clarify the rights and obligations of the parties involved and establish precedents for handling similar situations in the future.

Key Principles Derived from Case Law

The following principles have emerged from landmark rulings, which provide clear interpretations of how policies are enforced and what is expected from both parties:

- Burden of Proof – Courts often establish the burden of proof, determining who is responsible for demonstrating the validity of claims or defenses in a dispute.

- Contractual Interpretation – Legal decisions often provide clarity on how terms within a contract should be interpreted, especially in cases of ambiguity.

- Exclusion Clauses – Several cases have clarified the enforceability of exclusion clauses, explaining when and how they can limit or exclude coverage.

The Importance of Precedent in the Industry

Understanding case law is essential for navigating the intricate aspects of this area. Precedents set by previous rulings influence how current cases are resolved, providing a consistent framework for resolving disputes. By studying these decisions, practitioners can develop a deeper understanding of how courts balance the interests of all parties involved, and how they interpret both explicit and implied terms within a contract.

Preparing for Complex Insurance Law Topics

When studying intricate subjects within this field, a structured and strategic approach is essential to mastering the material. These topics often involve detailed analysis of contracts, principles, and the relationship between various stakeholders. Success depends on understanding not only the rules but also how they are applied in different contexts. A solid grasp of the underlying concepts is crucial, as is familiarity with case studies and judicial decisions that influence interpretations.

Key Areas to Focus On

When tackling advanced topics, it is important to break them down into manageable segments. Focusing on specific areas ensures a deeper understanding of the material and helps identify critical issues. Here are some areas to prioritize:

| Topic | Key Focus | Resources |

|---|---|---|

| Contract Formation | Understanding terms, conditions, and enforceability | Textbooks, case studies, lectures |

| Claims Handling | Analyzing procedures, dispute resolution methods | Guides, practice tests, articles |

| Exclusions & Limitations | Studying common exclusions in policies and their legal effects | Case law, online resources, expert blogs |

Approach for Complex Topics

For particularly complex areas, it is helpful to use a combination of resources. Begin by reviewing theoretical material, such as textbooks and online articles, and then focus on applying that knowledge through practice. Work with case studies to see how principles are applied in real-world situations. Additionally, discussing topics with peers or instructors can provide new perspectives and deepen understanding. Regular review and self-testing also reinforce key concepts, ensuring retention over time.